Every year, the world holds its breath for Apple’s latest earnings report, and for good reason. Apple isn’t just a company; it’s a cultural benchmark for innovation and consumer trends. Picture this: a teenager in California unboxes the latest iPhone while, halfway across the globe, an entrepreneur in India makes their first pitch on a new MacBook Air. Apple’s global influence is unparalleled, and its sales performance tells the story of how technology continues to weave into daily life.

In 2025, Apple faces both enormous opportunity and growing complexity. With new product lines, evolving global markets, and an increasingly competitive tech ecosystem, Apple’s sales statistics offer more than revenue, they reveal the future of consumer electronics.

Editor’s Choice

- Apple’s total revenue for Q1 2025 hit $127.8 billion, showing a modest increase of 3.2% year-over-year.

- The iPhone 15 series, now including the Pro Max Ultra, accounted for 53% of total quarterly revenue.

- In Q1 2025, Mac sales bounced back with a 7% increase following the M3 chip rollout.

- iPad revenue declined slightly by 2.1%, continuing a trend from 2024 amid increased tablet competition.

- Apple’s Wearables, Home, and Accessories segment crossed the $15 billion mark for the first time in a single quarter.

- iPhone sales in India grew 18% YoY, marking it the fastest-growing iPhone market globally.

- Apple’s services revenue, including iCloud, Apple Music, and App Store, reached a record $25.6 billion, now contributing nearly 20% of total revenue.

Apple Revenue by Region

- The Americas remained Apple’s top revenue contributor, accounting for 46.3% of the total revenue.

- Europe followed with a significant share of 26.3%, highlighting strong performance across key EU markets.

- China generated 20.0% of Apple’s global revenue, maintaining its position as a critical market.

- The Asia Pacific region contributed 7.4%, reflecting steady growth in emerging markets across the region.

iPhone Sales Performance by Quarter

- In Q1 2025, Apple shipped approximately 79.2 million iPhones.

- Q2 2025 iPhone revenue stood at $51.3 billion, driven by strong demand for Pro models in the US and Japan.

- iPhone 15 Pro Max Ultra accounted for 41% of iPhone units sold in Q2 2025.

- Sales in China showed signs of recovery in Q1 and Q2 2025, with a 5.5% YoY increase, reversing last year’s decline.

- The average selling price (ASP) of iPhones rose to $988, due to higher-end model adoption.

- In Europe, iPhone revenue grew 6.8% in the first half of 2025, aided by trade-in incentives.

- iPhones with satellite emergency SOS saw a 22% surge in unit sales in regions with limited connectivity.

- Carrier promotions across North America contributed to 20% of all iPhone upgrades in H1 2025.

- Apple’s trade-in program usage grew 13%, reducing upgrade costs and boosting retention.

- Refurbished iPhone sales increased by 11%, particularly in Latin America and Southeast Asia.

Mac and iPad Sales Trends

- Mac revenue in Q1 2025 reached $11.2 billion, a 9% increase YoY, driven by the M3-powered MacBook Pro and iMac.

- Apple reported 6.7 million Mac units shipped in Q1, the highest since 2022.

- The MacBook Air M3 became the best-selling laptop in the US education market in early 2025.

- Enterprise adoption of Mac grew 17% YoY, with increased demand in software development and media sectors.

- iPad shipments declined to 11.5 million units in Q1 2025, a 3.5% drop YoY.

- iPad Pro with M2 chip accounted for over 45% of iPad revenue, despite lower overall volume.

- iPads maintained dominance in the US education market with a 52% share of school-issued tablets.

- Apple’s keyboard and pencil accessories for iPads generated over $1.2 billion in revenue in H1 2025.

- iPad penetration grew in Germany and South Korea, contributing to a 7% rise in ASP globally.

- Despite the unit drop, iPad revenue stayed stable due to increased premium model purchases.

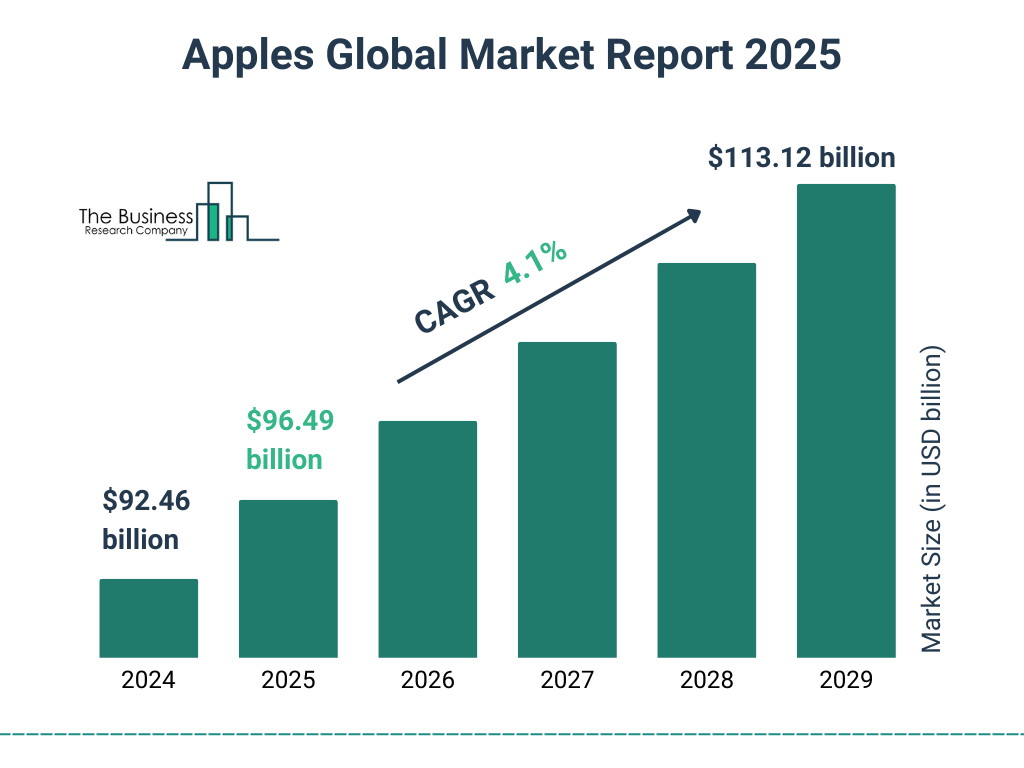

Apple’s Global Market Growth Forecast

- In 2024, Apple’s global market size was valued at $92.46 billion.

- By 2025, it is projected to reach $96.49 billion, showing steady year-over-year growth.

- The market is expected to grow at a CAGR of 4.1% through 2029.

- Forecasts show continued expansion, culminating in a market size of $113.12 billion by 2029.

This growth underscores Apple’s consistent market dominance and increasing global demand.

Regional Breakdown of Apple Product Sales

- In the United States, Apple’s largest market, revenue topped $46.3 billion in Q1 2025, a 2.9% increase YoY.

- Greater China posted a rebound with $24.1 billion in sales in Q1 2025, reversing a dip in late 2024.

- India emerged as Apple’s fastest-growing market, with sales rising 18.2% YoY, driven by local manufacturing and aggressive pricing.

- Europe generated $29.7 billion in revenue in H1 2025, with the UK, Germany, and France leading.

- Apple’s revenue in Japan declined by 2.3%, largely due to currency fluctuations and inflationary pressure.

- Latin America showed strong double-digit growth, with iPhone and wearables revenue growing 11.6% YoY in the region.

- Sales in Canada held steady, with a 0.8% increase YoY, though iPad sales declined slightly.

- The Middle East and Africa saw a 9.5% YoY growth in Q1 and Q2 2025, with Dubai and South Africa leading demand.

- Vietnam and the Philippines showed a combined 14% YoY increase, fueled by expanding e-commerce and digital finance ecosystems.

- Australia and New Zealand reported stable growth, with a 6.2% increase in Mac sales fueled by university and government purchases.

Apple Sales Comparison with Competitors

- In smartphone shipments, Apple held 22.8% of global market share in Q1 2025, trailing slightly behind Samsung at 24.1%.

- Apple overtook Dell as the #1 US laptop seller in Q1 2025, driven by MacBook Air M3 demand.

- In tablets, Apple maintained a 36% global market share, ahead of Samsung (19%) and Huawei (12%).

- Apple’s services revenue growth (up 9.1% YoY) outpaced Google Play’s revenue growth in the same timeframe.

- Compared to Xiaomi and Oppo, Apple’s ASP remains more than double, at $988 vs $410 on average.

- Wearables market leadership continues, with Apple Watch holding 31% global share, ahead of Garmin and Fitbit.

- Apple TV+ subscriber base hit 42 million in early 2025, though it still lags behind Netflix (252 million) and Disney+ (153 million).

- Apple Pay usage outpaced Google Pay in the US, with 54% of iPhone users regularly using it for in-store payments.

- Samsung’s Galaxy S25 launch created pressure in Asia, but Apple held firm with a 3.5% sales uptick in the region post-launch.

- In global PC rankings, Apple ranked #4 in Q1 2025, behind Lenovo, HP, and Dell, but with the highest YoY growth rate among the top 5.

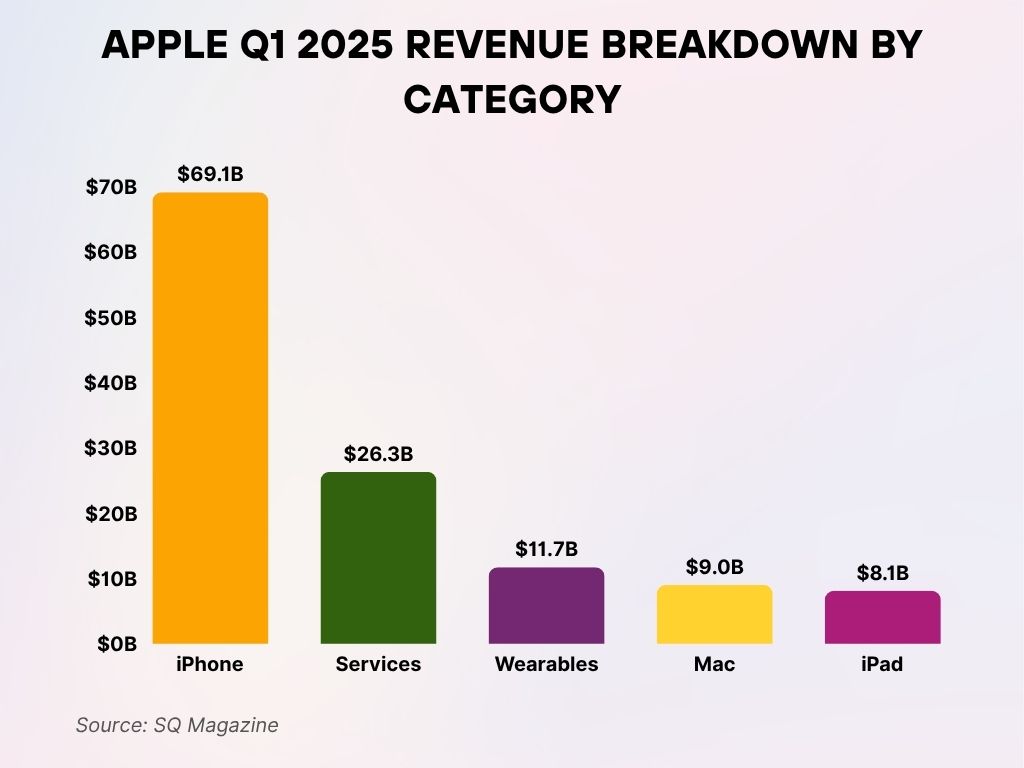

Apple Q1 2025 Revenue Breakdown by Category

- iPhone remained Apple’s top revenue generator at $69.1 billion, though it saw a slight decline of 0.8%.

- Services revenue grew impressively to $26.3 billion, marking a +14% increase, driven by subscriptions and digital content.

- Wearables brought in $11.7 billion, but experienced a -2% dip, suggesting a minor slowdown in this segment.

- Mac sales reached $9.0 billion, showing a robust +16% growth, likely fueled by demand for M-series chips.

- iPad revenue hit $8.1 billion, rising +15% year-over-year, indicating strong interest in tablet upgrades.

E-commerce vs Retail Apple Sales

- In 2025, 65% of Apple’s total product sales in the US came from e-commerce channels.

- The Apple Online Store saw a 14% YoY growth in global revenue, driven by enhanced personalization and delivery options.

- Retail store traffic declined by 3.8% globally in Q1, although conversion rates in flagship locations increased.

- In China, Apple’s online Tmall store experienced a 21% YoY surge, especially around the Lunar New Year sale.

- Apple’s Buy Online, Pick Up In Store (BOPIS) program accounted for 27% of US online orders, offering convenience for time-sensitive buyers.

- Third-party retailers like Best Buy and Amazon now make up over 32% of iPhone sales in North America.

- Apple’s apparel and accessories segment performed better online, with 78% of AirPods Max sales occurring through digital storefronts.

- Physical stores still drive premium experience purchases, 74% of Mac Studio units were bought in-store, often after a demo.

- Apple Store app usage rose 12.6% in H1 2025, with increased interest in AR try-ons for Apple Watch bands and accessories.

- In emerging markets, offline retail still dominates, but Apple is investing in localized e-commerce platforms in Southeast Asia and Latin America.

Impact of Product Launches on Sales

- The iPhone 15 Pro Max Ultra, launched in late 2024, significantly lifted H1 2025 sales, contributing over $38 billion to iPhone revenue.

- MacBook Air M3 launch in January 2025 led to a 23% increase in unit sales YoY in Q1 alone.

- The Apple Vision Pro, Apple’s first spatial computing headset, has created $3.4 billion in sales since its release in early 2025.

- Apple Watch Series X, introduced in March 2025, included major health tracking upgrades and generated 9% higher pre-orders than Series 9.

- New iPad Pro with OLED display saw a 6% ASP increase, though unit growth remained modest.

- AirPods Pro 3, launched in April 2025, boosted accessory revenue by $1.1 billion in Q2 alone.

- Product launches accounted for 46% of all Apple-related search traffic in Q1 2025, reflecting continued brand excitement.

- Early reviews and YouTube unboxings of the new devices influenced 32% of online purchase decisions, according to internal analytics.

- Apple’s trade-in incentives during product launches helped drive iPhone 15 series upgrades up by 19% vs Q1 2024.

- Apple’s Launch Week sales events added an estimated $4.7 billion in global revenue during the first 10 days of each major product drop.

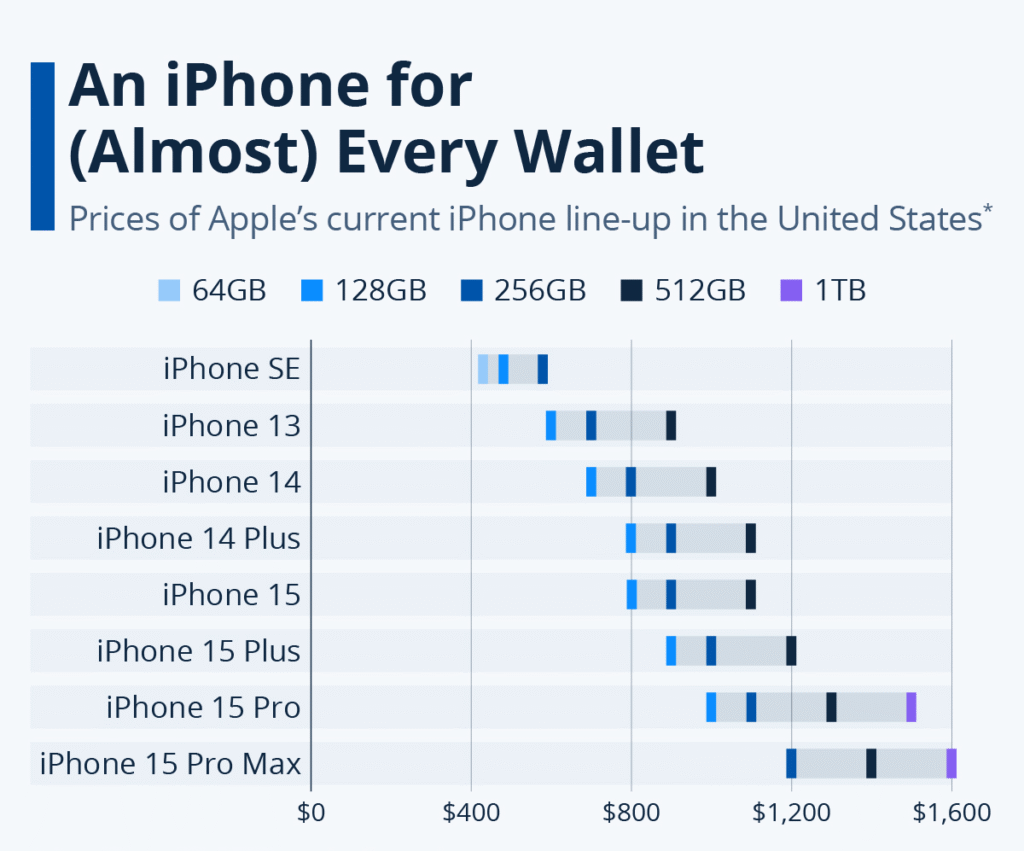

iPhone Price Range in the US

- Apple offers iPhones for various budgets, starting from under $500 to nearly $1,600.

- The iPhone SE is the most affordable, with prices ranging from $430 to $580, depending on storage (64GB to 256GB).

- iPhone 13 ranges from $600 to $930, available in 128GB to 512GB options.

- iPhone 14 and 14 Plus are priced between $700 and $1,100, with storage up to 512GB.

- The iPhone 15 and 15 Plus have a wider spread, starting at $800 and reaching $1,200, offering up to 512GB.

- Premium models, iPhone 15 Pro and 15 Pro Max range from $1,000 to $1,600, offering storage options up to 1TB.

- Higher storage tiers (512GB and 1TB) significantly raise the price, especially in Pro models.

Apple’s pricing strategy ensures options for budget-conscious buyers and premium users alike, aligning price with storage capacity.

Apple Sales in Emerging Markets

- India became Apple’s fastest-growing large market, with overall sales up 18.2% year-over-year in H1 2025.

- Apple opened three new retail stores in India in early 2025, which contributed to a 12% uplift in foot traffic and conversions.

- In Brazil, Apple sales grew by 7.6% YoY, with iPhone SE and older models driving volume in Tier 2 cities.

- Vietnam’s iPhone shipments increased by 13%, aided by government incentives on tech imports and Apple-authorized resellers.

- In Indonesia, Apple’s educational partnerships led to a 26% rise in iPad sales, primarily in private schools and institutions.

- Nigeria and Kenya saw a combined growth of 9.3% in Apple product sales, despite infrastructural and pricing challenges.

- In Mexico, Apple’s market share crossed 17%, thanks to expanded retail presence and telecom bundle offers.

- Thailand reported a 14% increase in Apple Watch sales, largely from Gen Z consumers entering the wearables market.

- Apple’s mid-range product strategy (e.g., iPhone 13 and SE) accounted for 35% of its emerging market unit sales.

- Localization, such as Hindi and Vietnamese language UI enhancements, helped Apple strengthen user engagement in Asia-Pacific.

Environmental and Sustainability Impact on Sales

- By Q2 2025, over 78% of Apple’s global operations were powered by renewable energy.

- Apple’s carbon-neutral pledge for all products by 2030 remains on track, with 45% of the product lineup now meeting these standards.

- The Apple Watch Series X is the company’s first carbon-neutral product, using 100% recycled aluminum and rare earths.

- Apple recycled over 44,000 metric tons of e-waste in 2024, a 9.2% increase YoY, and expects higher returns in 2025.

- More than 310 million devices now contain recycled rare earth elements, up 17% from last year.

- Apple’s trade-in and recycling program usage rose 13%, driving up customer retention and sustainability credits.

- In 2025, iPhone 15 packaging eliminated all plastic, making Apple’s phone lineup fully fiber-based.

- Apple’s Supplier Clean Energy Program contributed to 16.8 million metric tons of CO₂e avoided in 2024, with further reduction expected this year.

- The Apple Renew program expanded to 28 more countries in 2025, making it easier for users to return old devices for credit.

- Consumer surveys in Q1 2025 showed that 73% of US Apple buyers consider environmental impact a major purchase factor.

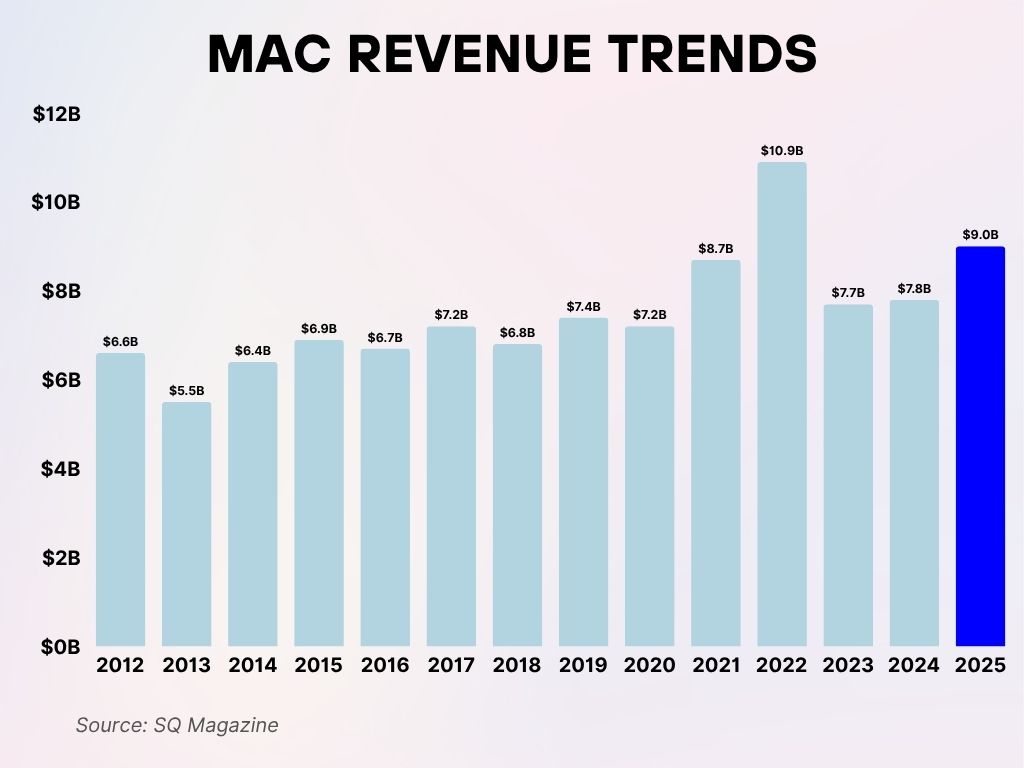

Q1 Mac Revenue Trends

- In Q1 2025, Mac revenue reached $9.0 billion, marking a year-over-year increase from $7.8 billion in 2024.

- The highest Q1 revenue was recorded in 2022 at $10.9 billion, driven by strong demand during the remote work boom.

- Revenue dipped to $7.7 billion in 2023, followed by a modest recovery in 2024 and continued growth in 2025.

- From 2012 to 2025, Mac Q1 revenue rose from $6.6 billion to $9.0 billion, showcasing long-term growth.

- The lowest point in this period was in 2013, with revenue at just $5.5 billion.

Mac’s Q1 revenue performance reflects steady innovation, cyclical demand shifts, and Apple’s ability to recover from market dips.

Recent Developments in Apple Sales

- In May 2025, Apple finalized its $1.2 billion acquisition of a Swiss AR lens startup, aiming to bolster Vision Pro’s next-gen optics.

- Apple began trialing a subscription-based hardware bundle, “AppleFlex”, in select US markets, bundling iPhone, Mac, and services.

- Apple Intelligence, a new on-device AI engine, was previewed at WWDC 2025, with beta available by September.

- Early Q2 data shows Vision Pro accessory sales crossed $520 million, highlighting strong interest in the device ecosystem.

- Apple introduced a new “Mac Ultra” line aimed at 3D designers and AI developers, boosting professional-grade desktop sales.

- Services revenue expanded with the launch of Apple Learning+, a paid educational platform that saw 1.5 million sign-ups in 90 days.

- In March 2025, Apple became the first US company to reach a $3.7 trillion market cap, driven by record service margins and hardware synergies.

- Apple introduced UWB (Ultra-Wideband) 2.0 across iPhone and AirTag, improving accuracy and leading to a 16% increase in accessory sales.

- A global partnership with OpenAI was announced, integrating ChatGPT-based features into Siri by Q4 2025.

- Apple’s Buy Now, Pay Later (BNPL) usage rose 11% YoY, especially among younger US and UK consumers.

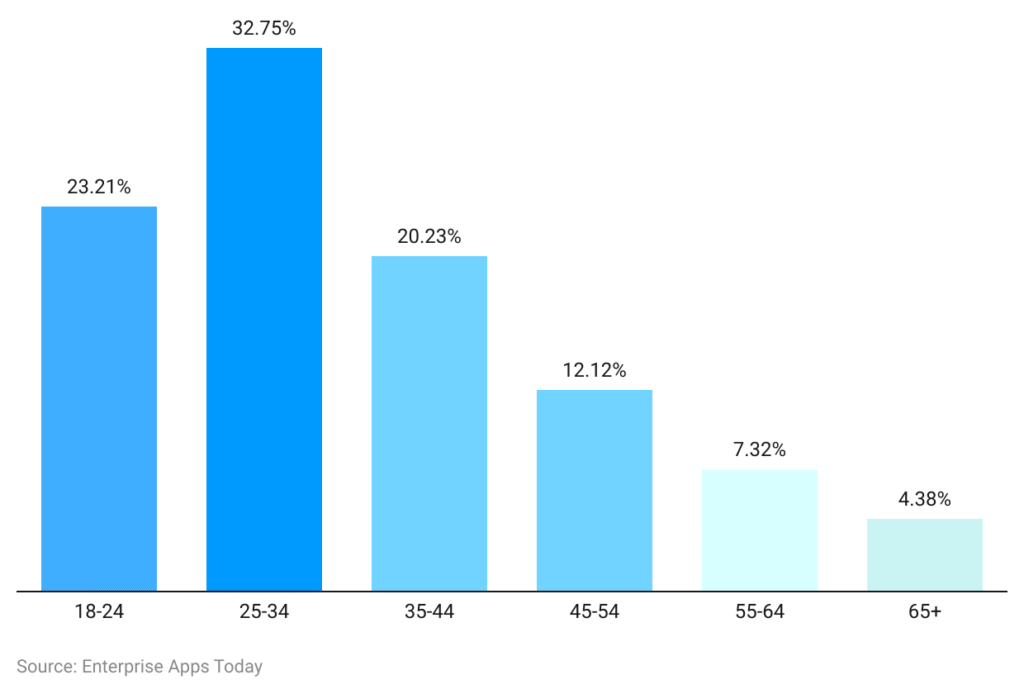

Apple User Demographics by Age

- The largest share of Apple users falls in the 25–34 age group, making up 32.75% of the user base.

- Users aged 18–24 represent the second-largest segment at 23.21%, highlighting strong appeal among younger adults.

- The 35–44 age group accounts for 20.23%, showing continued popularity among professionals and mid-career users.

- Usage drops in older groups: 12.12% for ages 45–54, 7.32% for 55–64, and just 4.38% among users 65 and older.

These insights emphasize that Apple’s core demographic is primarily millennials and younger Gen X users.

Conclusion

As 2025 unfolds, Apple remains not only a technology leader but also a sales powerhouse across product categories and geographies. From the stunning growth in India to the deepening impact of sustainability on purchase decisions, Apple is evolving with its audience while still dictating the pace of the industry.

Quarter after quarter, new product lines like the Vision Pro and AI-enhanced services like Apple Intelligence show that Apple isn’t standing still. Instead, it’s carving new territory in consumer electronics, digital ecosystems, and even education.

For businesses, consumers, and investors, one thing is clear: Apple’s sales statistics aren’t just numbers; they’re a preview of where the digital world is headed.