The cryptocurrency wallet Phantom Wallet has scaled dramatically, becoming a central hub for millions of users to manage assets, swap tokens, and interact with DeFi and NFTs across multiple blockchains. Its growth reflects broader shifts in Web3 adoption, where wallets evolve from niche tools into everyday financial infrastructure. In real-world terms, developers on blockchains like Solana now build on Phantom’s user base to ensure liquidity and reach, while NFT creators and traders lean on Phantom’s multichain support to access global marketplaces. Dive into the data below to understand what Phantom’s surge means for users, the crypto ecosystem, and where wallet-powered finance is headed.

Editor’s Choice

- Phantom Wallet reached ≈ 15 million monthly active users (MAUs) by early 2025.

- It processed ~850 million on-chain transactions during 2024.

- Annual swap volume via Phantom exceeded $20 billion.

- Total assets under self-custody within Phantom wallets reached about $25 billion by January 2025.

- Following its Series C funding in January 2025, Phantom’s valuation rose to $3 billion.

- By mid‑2025, active user count climbed further, reports cite ~17 million MAUs as a peak.

- Phantom supports multiple major blockchains (e.g., Solana, Ethereum, Polygon, Bitcoin, Base, Sui), enabling a true multichain wallet experience.

Recent Developments

- $150 million Series C funding closed in January 2025, valuing Phantom at $3 billion.

- Grew to 15–17 million monthly active users by mid-2025, up 5x year-over-year.

- Mobile app downloads reached ~24 million by the end of 2024.

- Annual revenue hit $79.1 million in 2025, with a peak weekly at $44.14 million.

- Processed over $25 billion in self-custodied assets as of mid-2025.

- Hyperliquid perps integration drove $1.8 billion volume and $930,000 revenue with 17,000 users.

- Accounts for ≈35% of Solana’s total volume on high-activity days in 2025.

- Expanded to support six major blockchains, including Ethereum, Bitcoin, and Sui, by 2025.

- Team grew to ~244 employees across five continents as of March 2025.

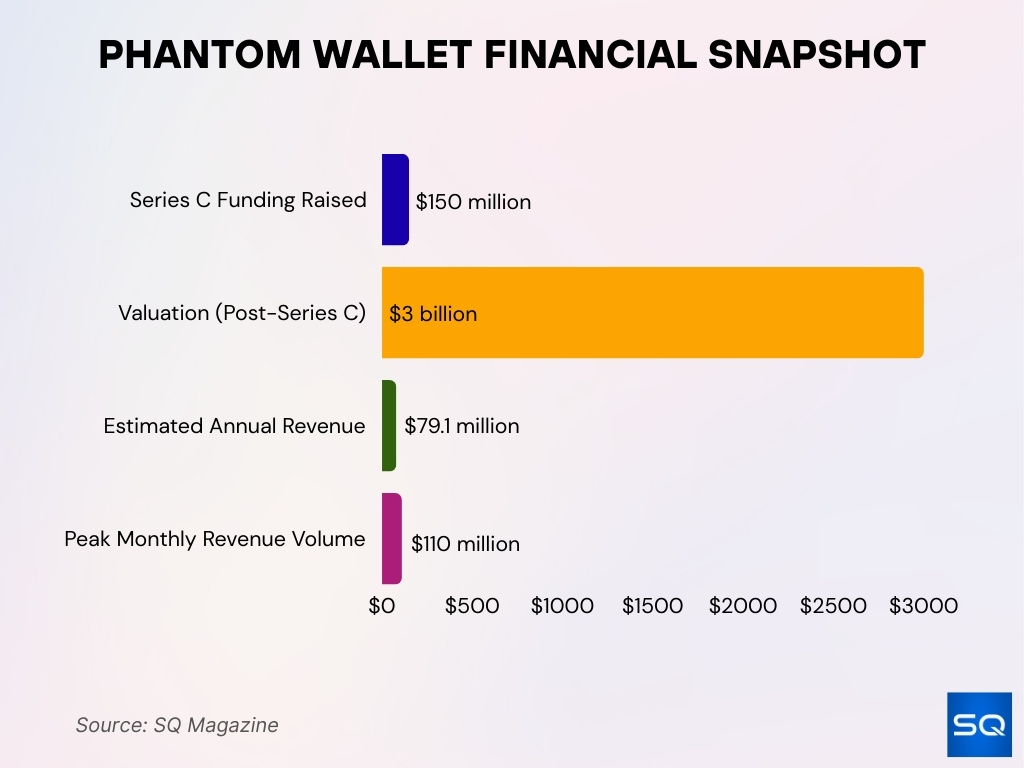

Phantom Wallet Revenue and Valuation

- Raised $150 million in Series C funding in Jan 2025, pushing valuation to ~$3 billion.

- Estimated annual revenue stands at $79.1 million.

- Peak monthly revenue hit ~$110 million during high-activity periods.

- Acquisitions of SimpleHash, Blowfish, and Bitski likely increased both cost structure and valuation.

Monthly Active User (MAU) Statistics

- In 2024, Phantom recorded roughly 10 million MAUs.

- By early 2025, that number had risen to about 15 million MAUs.

- By mid‑2025, Phantom reportedly peaked at ≈ 17 million MAUs, marking a significant jump over 2024.

- This growth from 2024 to 2025 represents approximately a 50–70% increase in active users.

- Compared to post‑FTX lows in 2023, MAUs increased by a factor of ~28× by 2025.

- On average, users opened the Phantom app about 12 times per day in 2025.

- A noticeable share of MAUs engage in more than just holding; many are active in swapping, DeFi activity, or NFT interactions.

- The rapid rise in MAUs suggests Phantom is gaining traction not only in traditional crypto strongholds but also in emerging markets where ease-of-use matters.

Total Wallet Downloads and Installs

- Mobile app downloads reached ~24 million globally by the end of 2024.

- Cumulative downloads surged 5x from 2023 lows amid Solana ecosystem growth.

- Browser extension installs complement mobile, enabling desktop access for millions.

- Install base supports 10 million MAUs in 2024, rising to 15 million by early 2025.

- Growth spiked with multichain expansion, adding Ethereum, Bitcoin, and Sui support.

- Outpaced niche wallets, capturing 39.4% Solana market share in wallet usage.

- App store rankings hit the top 32 overall and #1 in utilities during the 2025 peaks.

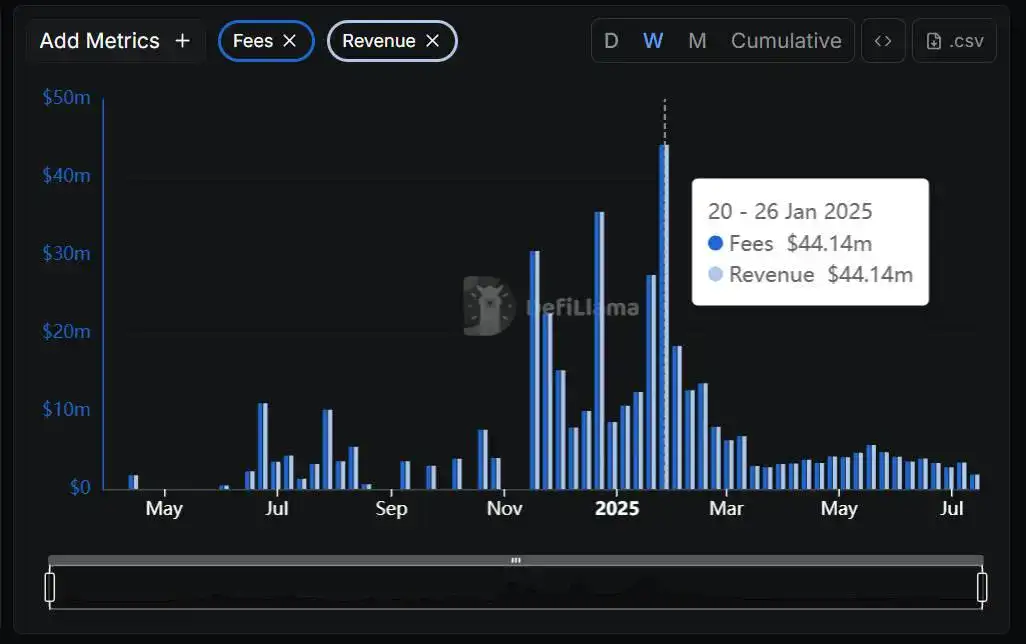

Phantom Wallet Revenue and Fees Highlights

- Peak weekly revenue hit $44.14 million during Jan 20–26, 2025, marking Phantom’s strongest single-week performance.

- Revenue matched fees every week, confirming that fees are Phantom’s primary income source.

- Weekly revenue ranged $20 million to $40 million from Oct 2024 to Jan 2025, driven by strong user and transaction growth.

- Revenue surged sharply in late Q4 2024 after a low-activity summer period.

- May to Aug 2024 weekly revenue stayed below $5 million, reflecting minimal on-chain activity.

- Post-peak revenue stabilized at ~$10 million to $15 million weekly by May to Jul 2025, indicating durable user engagement.

On‑Chain Transaction Volume Statistics

- Processed 850 million on-chain transactions in 2024.

- Averaged ~27 transactions per second at peak throughput in 2024.

- Facilitated $20 billion in annual swap volume as of 2025.

- Supported 120 million token swaps throughout 2024.

- Bridged over $613 million across chains, with $421.6 million to Solana.

- Users traded 788,000 different tokens via swaps in 2024.

- Daily trading volume exceeded $1.25 billion with 10 million+ transactions on peak days.

- Perpetual futures via Hyperliquid surpassed $1 billion cumulative volume.

- Accounted for ≈35% of Solana’s total volume on high-activity days in 2025.

Bridge and Cross-Chain Activity Statistics

- Supports over 400 DEXs and 18 cross-chain bridges.

- Cross-Chain Swapper moves assets across Solana, Ethereum, Polygon, Base, and more.

- Weekly swaps peaked at ≈10 million in late 2024.

- Record embedded swap volume hit $5.7 billion in January 2025.

- Weekly embedded swap volume stabilized near $700 million post-peak.

- 97% of swap activity and volume remains on Solana.

- Bridging reduced user friction by eliminating the need for multiple wallets.

- Cross-chain activity accounts for a large share of Phantom’s transaction volume.

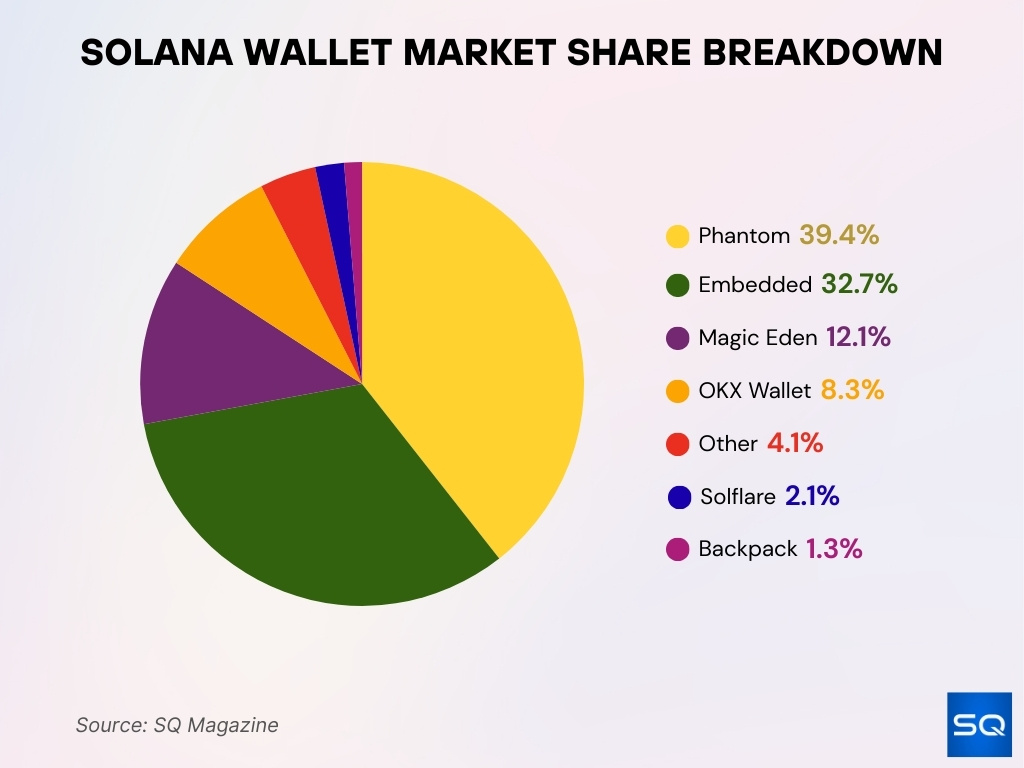

Solana Wallet Market Share Breakdown

- Phantom Wallet leads with a 39.4% share, dominating the Solana wallet landscape.

- Embedded wallets hold 32.7%, driven by seamless dApp integration and onboarding.

- Magic Eden Wallet has 12.1%, popular among NFT traders and collectors.

- OKX Wallet captures 8.3%, boosted by its cross-chain support and Solana focus.

- Other wallets represent 4.1%, reflecting a fragmented tail beyond top players.

- Solflare Wallet holds 2.1%, with traction among DeFi users.

- Backpack Wallet has 1.3%, linked to xNFT and token-gated experiences.

- Combined, Phantom, Embedded, and Magic Eden control over 84% of Solana’s wallet ecosystem.

User Activity and Engagement Metrics

- Annualized fees reached $221.31 million from swaps and bridges.

- 30-day fees totaled $18.14 million, showing steady engagement.

- 7-day fees generated $5.79 million across in-wallet services.

- Daily fees averaged $1.03 million with consistent user activity.

- Users opened the app ~12–16 times per day on average.

- Peak weekly revenue hit $44.14 million in January 2025.

- Cumulative fees surpassed $436.14 million to date.

- Swap operations drove 30% of all wallet fees in 2025.

Demographic and Geographic Distribution Statistics

- Assets under management exceed $25 billion globally.

- Supports chains including Ethereum, Bitcoin, Polygon, Base, and Sui.

- The growing user base includes emerging markets with lower crypto familiarity.

- Multichain support attracts cross-region and cross-asset investors.

- Monthly active users totaled ≈17 million by mid-2025.

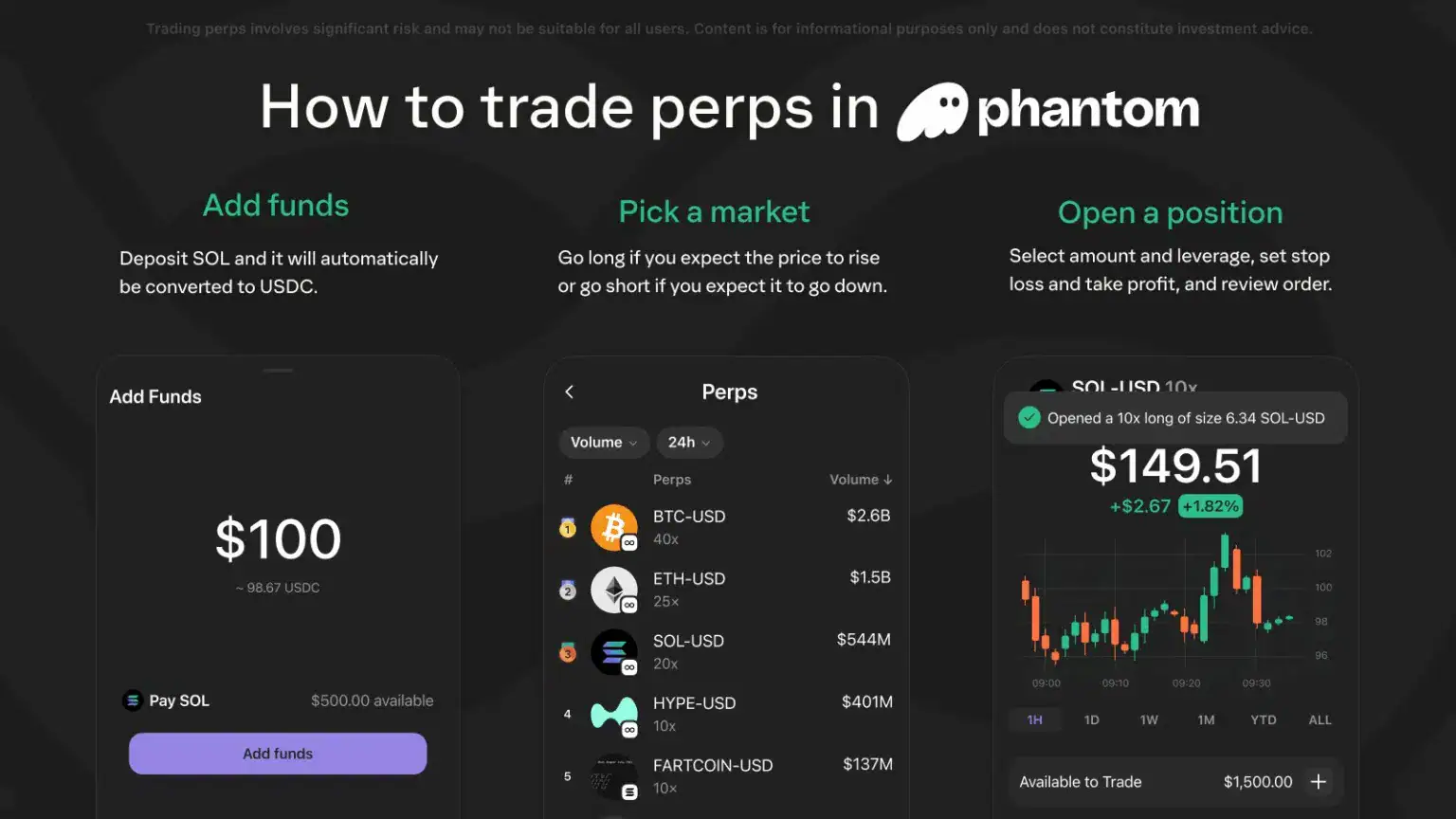

Phantom Wallet Perpetuals Trading Overview

- Users deposit SOL, which is automatically converted to USDC for perpetual trading within Phantom.

- $100 deposit example yields ~98.67 USDC, with a sample wallet showing $500 in SOL.

- Leverage up to 40x is supported for selected perpetual markets.

- Top 24h perpetual volumes: BTC-USD $2.6 billion (40x), ETH-USD $1.5 billion (25x), SOL-USD $544 million (20x), HYPE-USD $401 million (10x), FARTCOIN-USD $137 million (10x).

- Sample trade: 10x long on SOL-USD, 6.34 SOL at $149.51, resulting in +1.82% gain (+$2.67).

- Users can set leverage, stop loss, and take profit, appealing to both beginner and advanced traders.

- Dashboard offers chart intervals from 1H to ALL, with $1,500 trading balance shown.

- Phantom enables fully embedded DeFi perpetuals trading, removing the need to exit the wallet.

DeFi Usage and Protocol Interaction Statistics

- Used by 17 million monthly active users for DeFi and token swaps.

- Embedded swapper handles $20 billion in swap volume annually.

- Multichain access covers DeFi protocols on Solana, Ethereum, Polygon, Base, and others.

- Verified token metadata reduces exposure to scam tokens.

- Staking and liquid staking tokens are supported for native yield generation.

- Token management, swaps, and bridging contribute to high platform activity.

- Embedded swap and bridge volume peaked at $5.7 billion in January 2025.

- Fees from DeFi interactions surged to $221 million annually.

- Users conducted over 850 million on-chain transactions in 2024.

Staking and Yield Generation Statistics

- Native SOL staking is integrated with real-time rewards tracking.

- PSOL liquid staking token launched in May 2025 for liquidity.

- PSOL offers higher rewards than native staking via MEV tips and fees.

- Daily PSOL trading volume reached $3 million as of late 2025.

- 958,501 SOL total staked in PSOL stake pool.

- PSOL stake pool delivers 6.73% APY currently.

- PSOL leverages the Solana stake pool program, audited 9 times.

- Liquid staking preserves liquidity for DeFi and trading use.

Device and Platform Usage Statistics (Web, iOS, Android, Browser)

- Phantom is available as a browser extension and mobile app on iOS and Android.

- Mobile app accounts for ~60% of total active users by 2025.

- Browser extension used by ~40% of users, mainly for desktop activities.

- Mobile users engage 12–16 times daily on average.

- Nearly 100% feature parity across platforms reduces user friction.

- Mobile interface has a 4.8-star average rating on major app stores.

Multichain Usage Statistics by Supported Networks

- Supports six mainnets: Solana, Ethereum, Polygon, Bitcoin, Base, and Sui.

- Solana dominates with 97% of swap activity and volume.

- Unified view displays tokens/NFTs from all six chains in one interface.

- Ethereum and Base expansion broadens beyond Solana users.

- Sui integration coincides with its $1.5–2.6 billion TVL growth.

- Bitcoin support enables Ordinals and native BTC management.

- Polygon adds EVM compatibility for DeFi and NFT access.

- Cross-chain bridging moved $613 million total, $421.6 million to Solana.

Frequently Asked Questions (FAQs)

Over $20 billion in annual swap volume.

Phantom raised $150 million in its Series C round (Jan 2025), at a $3 billion valuation.

Phantom supports six major mainnet blockchains (Solana, Ethereum, Bitcoin, Polygon, Base, and Sui) by 2025.

Conclusion

Phantom Wallet has evolved well beyond its origins as a Solana-only wallet. It now combines multichain support, NFT and DeFi tools, staking, cross-chain swaps, and security protections under a unified interface. Users benefit from the convenience of managing tokens, NFTs, staking, and bridging across six major chains, all within a single wallet that works on mobile and desktop.

For those exploring crypto, whether NFT collectors, DeFi users, or holders seeking staking rewards, Phantom offers a compelling, flexible, and relatively secure entry into Web3. As the crypto ecosystem continues evolving, Phantom’s breadth of features and commitment to usability may well keep it at the forefront of wallet choices for both newcomers and experienced users.