Zoom and Microsoft Teams continue to dominate how businesses, educational institutions, and remote workers communicate today. As hybrid work solidifies its place in corporate culture, both platforms are pressed to innovate, scale, and address user demands.

From meeting sizes and AI tools to video quality and global reach, the competition shapes how organizations select tools. The following sections explore key statistics that show where Zoom and Teams stand today, and where the gaps and opportunities lie.

Editor’s Choice

- Zoom’s global market share is estimated to be between 40–55%, depending on the tracking source and segment focus (e.g., SMB vs. enterprise).

- Microsoft Teams’ market share ranges from 25% to 35%, based on varying estimates and whether enterprise bundling with Microsoft 365 is included.

- Zoom reports 300 million daily meeting participants, which may include repeat users in multiple meetings per day.

- Microsoft Teams has about 320 million daily active users globally.

- Zoom’s annual revenue in 2024 was $4.66 billion.

- Microsoft Teams generated over $8 billion in revenue in 2023-2024 through the Microsoft 365 ecosystem.

- Zoom has ~504,900 business customers worldwide.

Recent Developments

- Zoom raised its full‑year revenue forecast for 2025 (fiscal) to about $4.61–$4.62 billion, citing demand for hybrid work tools and increasing integration of AI.

- Zoom introduced its more advanced Virtual Agent 2.0 in mid‑2025, with more robust AI helpers for tasks like booking and returning, and a Custom AI Companion add‑on for business users.

- Teams continues to expand through its Microsoft 365 integration, pushing deep into enterprise with collaboration features and compliance tools.

- Teams Premium tier has attracted over 3 million users (seats) recently.

- Microsoft added features like persistent chat, threaded conversations, and workflow automation, which strengthen Teams’ differentiation.

- On the Zoom side, business customer growth (paying account upgrades) has steadily increased, even as much of its user base remains free or mixed use.

- Downloads of both apps globally remain strong; Zoom leads in many regions by volume, but Teams sees consistent enterprise sign‑ups.

Zoom vs Microsoft Teams: Key User Statistics

- Zoom has ~300 million daily active users.

- Teams has ~320 million daily active users, slightly ahead.

- Zoom had about 504,900 business customers globally.

- Zoom reports that 89% of its usage is for business meetings.

- Increases from previous years: Teams had ~270 million DAUs in 2022, rising to ~320 million by 2024.

- Zoom’s total number of annual meeting minutes exceeds 3.3 trillion minutes.

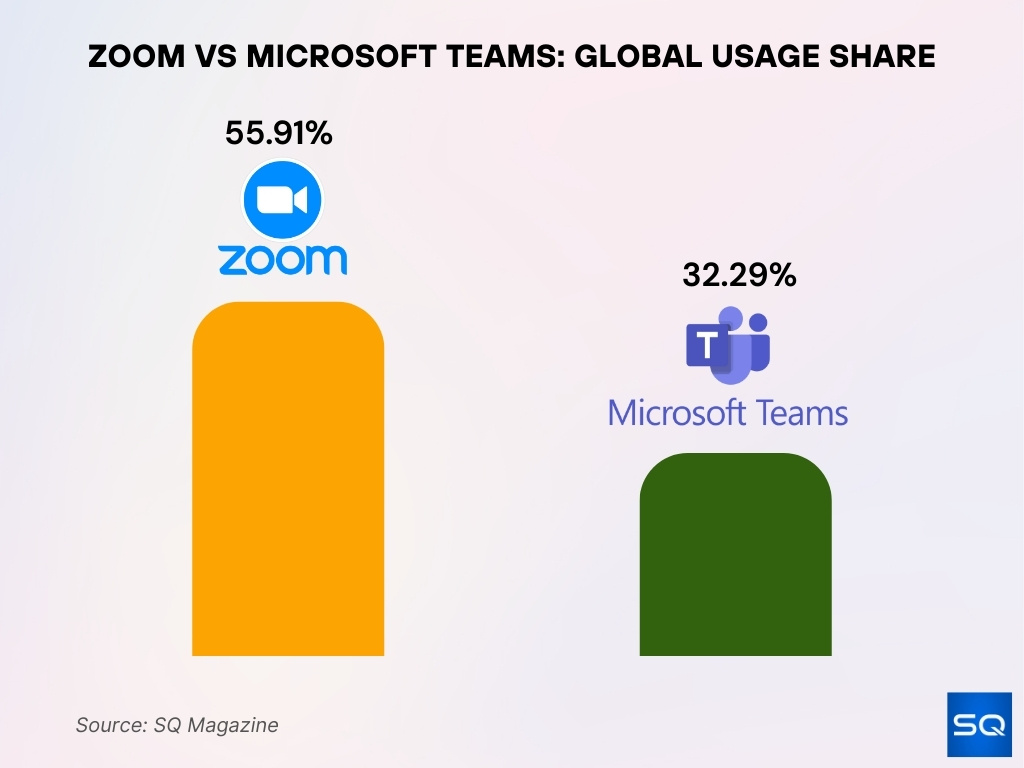

Market Share Comparison

- Zoom: 55.91% of the global videoconferencing software market.

- Microsoft Teams: 32.29% market share globally.

- Other competitors like Google Meet, WebEx, and Slack hold much smaller shares (single digits each) compared to these two.

- In segments where enterprise integrations and compliance are key, Teams tends to perform better, boosting its market share in those verticals.

- In regions where individual/SMB adoption is strong, Zoom often has higher penetration.

- Teams’ market share has grown more sharply post‑pandemic, due to bundling with Microsoft 365 and its value in workplace ecosystems.

Revenue and Financial Performance

- Zoom’s 2024 revenue: ~$4.66 billion.

- Zoom’s Q1 of fiscal year 2025 brought in $1.175 billion.

- Zoom’s revenue growth has slowed a bit; the year‑over‑year increase between 2023 to 2024 was modest (~3‑7%) compared to earlier years.

- Microsoft Teams’ revenue (via Microsoft 365 / Productivity & Business Processes segment) exceeded $8 billion in 2024.

- Microsoft’s productivity segment total is much larger, but Teams is a key growth driver within that.

- Zoom raised its 2025 full‑year revenue forecast to $4.61‑4.62 billion, largely driven by demand for hybrid work tools and AI.

- Zoom expects strong margins and earnings per share, ambitions boosted by paid add‑ons and AI companions.

- Teams’ revenue growth is somewhat less transparent (being bundled), but its estimation of over US$8 billion demonstrates it has overtaken many solo vendors in enterprise settings.

Daily Active Users and Growth Trends

- Teams had ~270 million daily users in 2022; that rose to ~320 million by 2024.

- Zoom jumped from ~10 million daily meeting participants in December 2019 to ~300 million by early 2020.

- Zoom’s DAU growth since its early days corresponds to a nearly 2,900% increase.

- Teams’ growth between 2019 and 2020 similarly shows an exponential rise, especially during the COVID‑19 lockdowns.

- Post‑pandemic (2022‑2024), both platforms have shown more steady, incremental growth rather than explosive jumps.

- Zoom’s number of business customers (paying users) is now ~504,900; growth in paid accounts is a key metric.

- Teams’ adoption by enterprises (number of companies, Fortune 100s) is rising; for instance, over 8 million US companies use Teams.

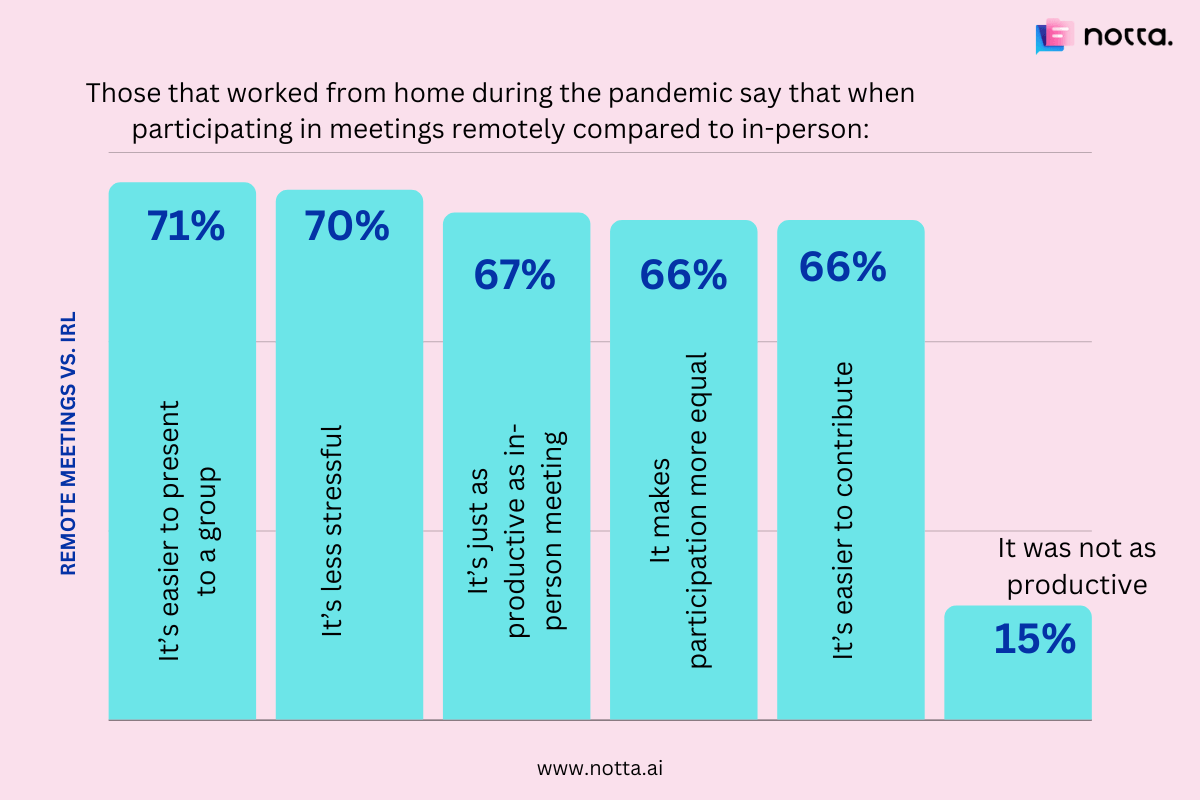

Remote Meetings vs In-Person: What Workers Really Think

- 71% say it’s easier to present to a group during remote meetings.

- 70% find remote meetings to be less stressful than in-person ones.

- 67% believe remote meetings are just as productive as in-person meetings.

- 66% feel remote meetings make participation more equal among attendees.

- 66% also say it’s easier to contribute in remote formats.

- Only 15% think remote meetings were not as productive as in-person meetings.

Regional Adoption and App Downloads

- Zoom’s mobile app saw millions of downloads in APAC in Q3 2024. Estimates range between 15–18 million.

- Microsoft Teams recorded an estimated 70–80 million global downloads during early to mid-2024.

- Zoom’s app download totals over time: ~187.23 million in 2022; ~324.47 million in 2021; ~740.26 million in 2020.

- Zoom was downloaded ~81.48 million times globally in the first half of 2023. That’s down vs. the same period in 2022 (~187 million).

- In APAC for the half‑year 2023, Zoom had ~37.14 million downloads; in EMEA, ~21 million; in North & Latin America (NALA,) ~23.34 million.

- Teams saw a steady quarterly pattern through 2023–2024, with each quarter yielding ~24‑28 million downloads.

- The comparative decline in downloads for Zoom since the peak pandemic years suggests maturing growth and perhaps saturation in certain regions.

Meeting Size and Participant Limits

- Zoom’s free Basic plan allows up to 100 participants per meeting; group meetings are limited to 40 minutes.

- Zoom’s Business & Enterprise paid plans allow up to 300 participants; with a Large Meeting add‑on, that goes up to 1,000 participants.

- Microsoft Teams’ free plan also supports 100 participants; for paid tiers, up to 300 participants in standard meetings.

- Teams supports live events / webinar‑style audiences up to 20,000 listen‑only attendees.

- In Teams, if breakout rooms are used, the regular meeting limit drops to 300 participants.

- Zoom allows various add‑ons, such as Large Meetings, Webinars, etc., to support high‑participant events.

- Teams’ “live events” / town halls can last up to 16 hours in some configurations.

- Zoom’s meeting time limits vary by plan: the free plan (~40 minutes group); paid plans allow much longer (30 hours in some plans).

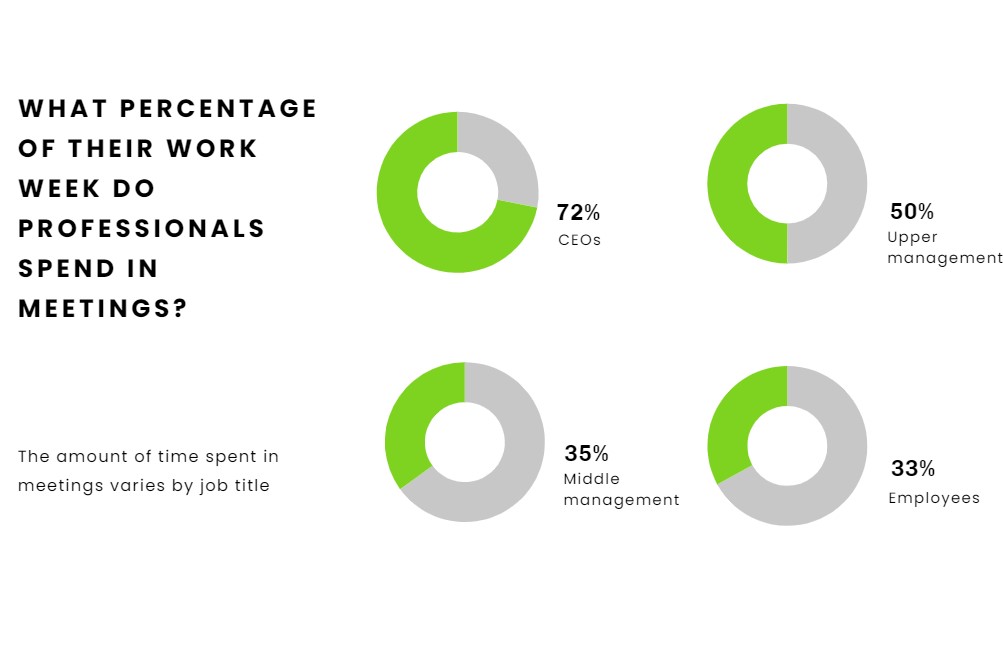

How Much Time Professionals Spend in Meetings

- CEOs spend 72% of their work week in meetings, the highest among all roles.

- Upper management dedicates about 50% of their weekly hours to meetings.

- Middle management spends 35% of their work week in meetings.

- Employees spend the least, with 33% of their week taken up by meetings.

Video and Audio Quality Metrics

- Both Zoom and Teams offer Full HD 1080p resolution in paid plans; Zoom defaults often at 720p unless upgraded or under strong network conditions.

- Teams supports 30 frames per second (fps) video on many paid tiers; Zoom similarly in many paid or higher plans.

- Zoom tends to handle low bandwidth or poor connections better for video/voice clarity.

- Teams supports live captions and transcription, with more language options in some plans.

- Both platforms have noise suppression/reduction options; Zoom has advanced audio isolation features in its higher‐tier plans.

- Latency and network usage: under stable broadband, both deliver good performance; under constrained networks, Zoom may show better adaptability.

- For large participant meetings (many video feeds), video quality may degrade due to reduced resolution per feed on both platforms.

AI Features and Automation Adoption

- Zoom offers its AI Companion in paid plans: meeting summaries, searchable transcripts, action items, etc.

- Microsoft Teams provides Copilot as a feature/add‑on, offering summaries, intelligent recaps, and similar automation tasks.

- As of mid‑2025, Teams Premium has grown to over 3 million seats/users.

- In pricing/plan comparisons, both platforms reserve some AI features behind higher tiers or premium licenses.

- Zoom’s AI features are included (or unlocked) with certain paid plans (Pro, Business, etc.).

- Teams integrates automation with Microsoft 365 tools (Outlook, SharePoint, OneDrive), which helps adoption in organizations already invested in the Microsoft stack.

- The rate of growth of AI/automation features in Teams is sharply increasing due to enterprise demand.

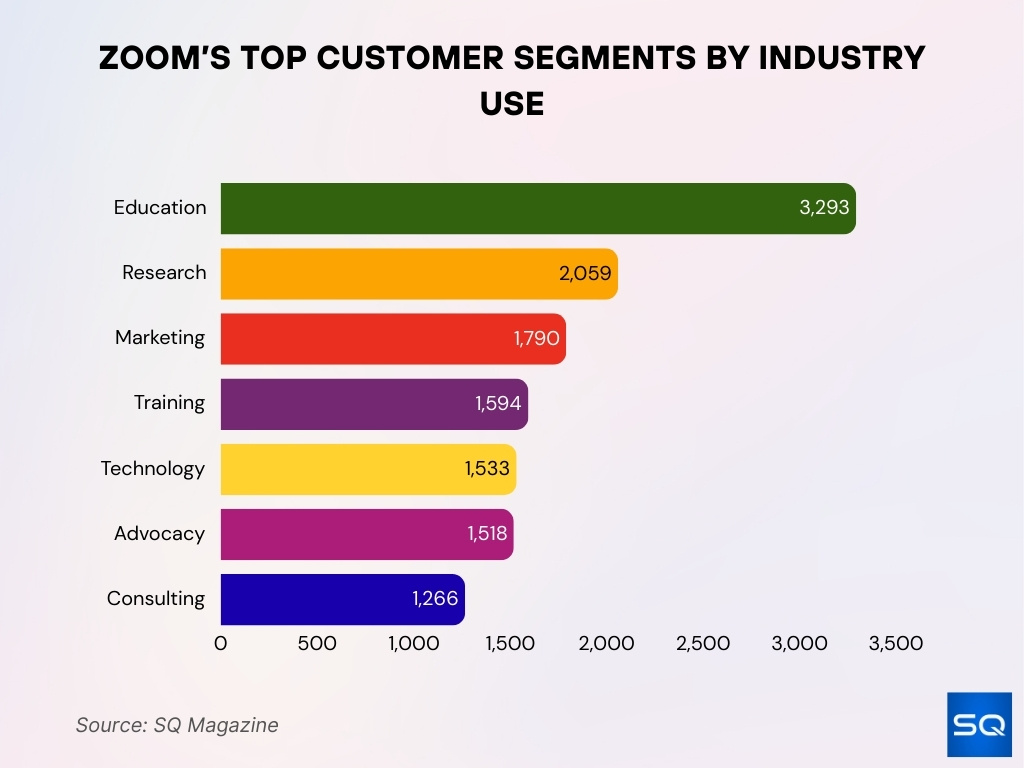

Zoom’s Top Customer Segments by Industry Use

- Education leads with 3,293 Zoom customers, making it the platform’s largest user segment.

- Research organizations follow with 2,059 customers leveraging Zoom for collaboration.

- Marketing teams account for 1,790 customers using Zoom for campaigns and outreach.

- Training services represent 1,594 customers, highlighting Zoom’s role in skill development.

- Technology firms contribute 1,533 customers, showing strong adoption in tech operations.

- Advocacy groups make up 1,518 customers using Zoom for outreach and mobilization.

- Consulting firms round out the list with 1,266 customers using Zoom for client communication.

Cloud Storage and File Sharing Stats

- Microsoft Teams’ paid plans typically include 1 TB of cloud storage per user via OneDrive or SharePoint for Business Basic and higher plans.

- Zoom’s paid plans offer 5–10 GB of included cloud storage for meetings or recordings; more storage requires purchasing add‑ons.

- Zoom’s Enterprise plans allow very large file storage capacities, several TBs, via an additional purchase.

- Within Teams, file sharing is tightly integrated, with sharing via OneDrive or SharePoint meaning files are saved automatically and versioned.

- Zoom allows local recording on free plans and cloud recording on paid plans; cloud recordings count against storage limits.

- For organizations doing many video recordings for webinars or training, Teams’ storage model tends to be more cost‑efficient due to built‑in cloud storage per user.

- Sharing large files via chat or meeting attachments: Teams handles large files via Microsoft 365 backend; Zoom allows attachments but often hits limits unless upgraded.

Educational and Healthcare Adoption Rates

- Microsoft Teams has approximately 183,000 Education tenants across 175 countries.

- A large majority, over 60% of teachers surveyed globally, anticipate increasing hybrid learning, with many already using Microsoft Teams for education.

- In healthcare, nearly half of providers, around 49%, use Zoom for telehealth. Far fewer, about 13%, use Teams in that capacity in the same dataset.

- For medical training, webinars, and live courses, both platforms are used, but Zoom’s ease of external access often gives it preference.

Webinar and Live Event Usage Stats

- Teams supports live event audiences up to 20,000 in listen‑only mode.

- Zoom Events or Webinars allow up to 10,000 viewers or more, depending on plan or add‑ons.

- Organizations running frequent webinars tend to spend more on Zoom or Teams webinar add‑ons or dedicated event platforms on top.

- Recording and analytics for large events: Teams offers built‑in OneDrive or SharePoint storage and reporting; Zoom offers analytics in its higher‑tier plans.

Customer Satisfaction and Ratings

- On Gartner Peer Insights, Zoom has approximately 4.5 stars based on over 7,900 reviews; Microsoft Teams has around 4.4 stars from 4,200+ reviews.

- Zoom was named “Customers’ Choice” in the 2025 Gartner Peer Insights for UCaaS.

- Zoom was recognized as a leader in the Forrester Wave UCaaS Q3 2025 report, especially for user feedback in areas like meeting experience and reliability.

- In user surveys or comparisons, approximately 50% of users find Zoom easier to use than competitors, and around 40% prefer it for external meetings.

- Some users report Teams being stronger for ongoing collaboration in chat, files, and internal meetings, but find Zoom better for large external events or webinars.

Mobile vs Desktop Usage Stats

- Both Zoom and Microsoft Teams are available on mobile and desktop. Many users report mobile usage for joining meetings and quick chat, while the desktop is used for deeper collaboration and file editing.

- Zoom’s free file storage plan is 5 GB on Pro, which tends to be managed more on desktop or cloud devices. Teams’ 1 TB per user is consistent across devices via cloud sync.

- In regions with strong mobile penetration, app downloads on mobile are still significant. For example, Zoom had 17.6 million mobile app installs in APAC in Q3 2024. Teams also had regional mobile download spikes.

- For external users or participants in webinars or live events, mobile join rates are higher. Full‑feature usage, such as sharing files and complex tasks, tends to happen more on a desktop.

Frequently Asked Questions (FAQs)

Zoom has about 55.91% of the global videoconferencing software market, and Microsoft Teams holds about 32.29%.

Zoom reports approximately 300 million daily active meeting participants, while Microsoft Teams has over 320 million daily users.

Microsoft Teams is used by over 8 million companies in the U.S., and Zoom has about 504,900 business customers worldwide.

Zoom’s 2024 revenue was about $4.66 billion, and Microsoft Teams’ revenue via Microsoft 365 and related enterprise segments exceeded $8 billion.

Conclusion

The Zoom vs. Microsoft Teams comparison shows a clear pattern: Zoom leads in market share, simplicity, and broad reach, particularly for external meetings, webinars, and organizations needing video‑heavy communication. Microsoft Teams, on the other hand, demonstrates strength in enterprise features, compliance, cloud storage, integration with Microsoft 365, and in sectors like education and internal collaboration.

Which platform is “better” depends heavily on your organization’s priorities:

- If you need large‑scale external events, ease of access, or widespread adoption, Zoom may be the more fitting choice.

- If your work demands compliance, extensive internal file‑sharing, chat history, or deep integration with Microsoft tools, Teams likely offers stronger long‑term value.

As hybrid and remote work continue to evolve, with rising expectations around security, automation, and user experience, both platforms will need to keep innovating. Now, you can use the detailed stats above to match what matters most to your team or institution.