In the evolving world of workplace collaboration tools, Slack and Microsoft Teams remain two of the most influential platforms. Businesses rely on them to streamline communication and foster remote or hybrid work, whether in a startup managing agile sprints or a large enterprise coordinating global teams. From team chat to video meetings, their usage underscores a shift in how work gets done. Let’s explore the detailed statistics behind both platforms.

Editor’s Choice

- Microsoft Teams reached roughly 320 million monthly active users (MAUs).

- Slack reported up to 79 million daily active users (DAUs).

- Microsoft Teams held about 37% market share among team-collaboration platforms in 2025.

- Slack’s market share was nearly 13% in the same segment in 2025.

- Slack was projected to generate approximately $4.22 billion in revenue by 2025.

- Among users, 65% of Slack users say they feel empowered to make strategic decisions versus 46% of Teams users.

Recent Developments

- In 2024, Microsoft Teams announced surpassing 320 million monthly active users, showing sustained growth post-pandemic.

- Slack’s DAUs plateaued near 42 million by 2024, suggesting a slower growth trajectory compared to Teams.

- Microsoft’s bundling of Teams with Microsoft 365 has accelerated its enterprise penetration and revenue.

- Slack was acquired by Salesforce in 2021 for $27.7 billion, marking a major consolidation event.

- The global shift toward hybrid work in 2023-25 has favored platforms that support video, chat, and integrated workflows, boosting both tools.

- Teams has expanded its third-party app ecosystem, now supporting over 1,400 apps, which enhances its appeal for enterprise integration.

- Slack emphasizes ease of setup and developer-friendly integrations, positioning itself as a flexible tool for agile teams and smaller organizations.

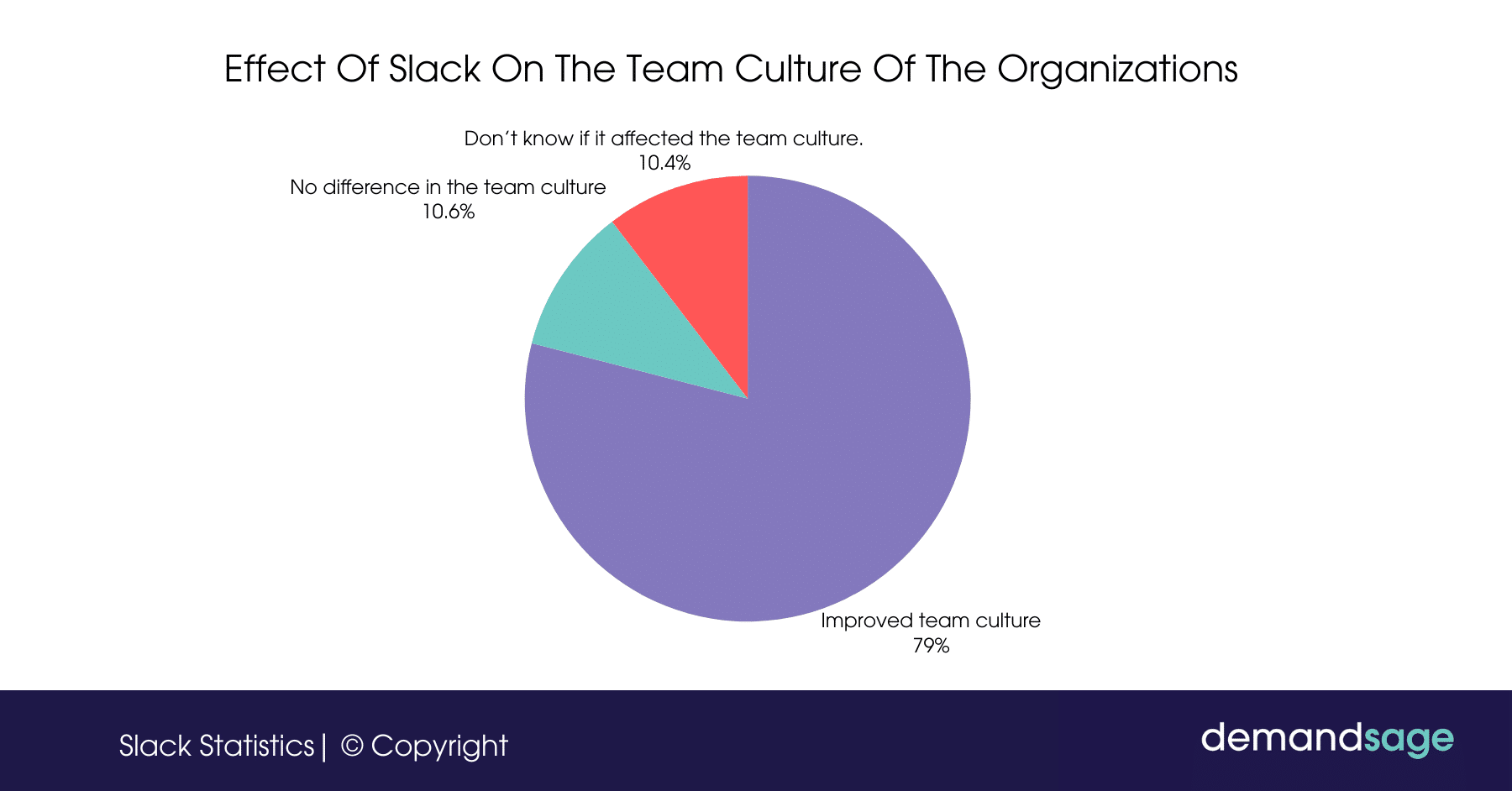

Effect of Slack on Team Culture

- 79% of organizations reported that Slack improved their team culture, enhancing collaboration and communication among members.

- Around 10.6% said there was no difference in their team culture after adopting Slack.

- Approximately 10.4% of respondents were unsure if Slack had any impact on their organization’s team culture.

Slack vs Microsoft Teams Overview

- Microsoft Teams had 320 million monthly active users worldwide in 2024.

- Slack’s daily active users reached 32.2 million in 2023, projected to hit 47.2 million by 2025.

- About 65% of Slack users feel empowered to make strategic decisions, compared to 46% of Teams users.

- Slack provides 5 GB storage in its free plan, while Teams offers 1 TB per user in Microsoft 365 plans.

- Slack’s user base is skewed younger, with 33.29% aged 25-34, compared to 61% aged 35-54 for Teams.

- Microsoft Teams includes extensive enterprise governance and security features used by IT, education, healthcare, and government sectors.

- Slack is favored by tech startups and marketing sectors, representing about 7% of users in advertising.

Market Share Comparison

- Microsoft Teams held approximately 37% of the global collaboration-platform market in 2025.

- Slack held around 13% of the global collaboration platform market in 2025.

- Slack’s market share has grown by over 40% since 2020.

- Slack dominates in tech startups with a 52% market share in organizations under 500 employees.

- Slack is used by over 950,000 organizations worldwide as of 2025.

- Microsoft Teams has over 320 million monthly active users globally.

- Slack’s monthly active users are projected to reach 47.2 million by 2025.

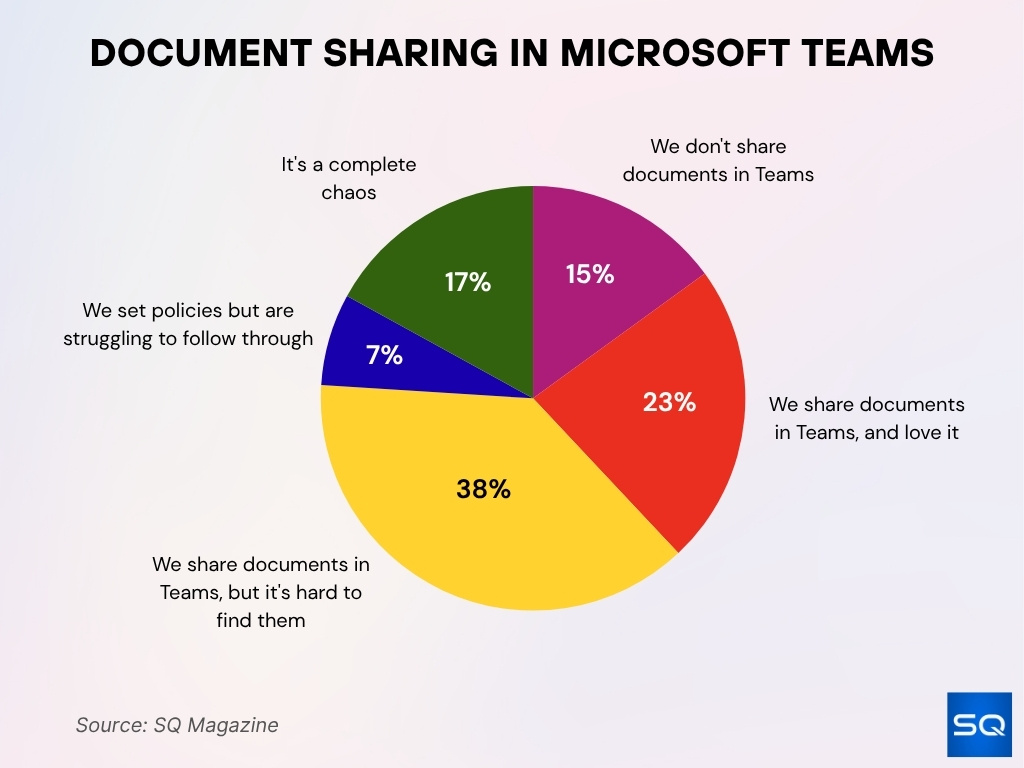

Document Sharing in Microsoft Teams

- 38% of users said they share documents in Teams but find it hard to locate them, highlighting a challenge in document organization.

- 23% of respondents reported that they share documents in Teams and love it, showing satisfaction with the platform’s collaboration tools.

- 15% said they don’t share documents in Teams, suggesting limited adoption in some workplaces.

- 17% described the experience as complete chaos, indicating issues with file management or workflow clarity.

- Only 7% mentioned that they set sharing policies but struggle to follow through, pointing to gaps in policy implementation.

User Base and Active Users Data

- Microsoft Teams reached around 320 million monthly active users.

- Slack was reported to have up to 79 million monthly active users.

- For Slack, in 2025, there were over 615,000 companies using it, according to vendor data.

- Microsoft Teams usage extends across company sizes, 21% small businesses, 47% mid-sized, and 32% large enterprises.

- In the United States alone, Microsoft Teams is used by over 8 million companies.

- Many organizations using Teams still run Slack in parallel; around 66% of companies using Teams also use Slack.

Revenue and Financial Statistics

- Slack was projected to generate about $4.22 billion in global revenue by 2025.

- Slack’s annual revenue grew from around $390 million in 2019 to the projected multibillion-dollar figure by 2025.

- Slack’s acquisition cost – $27.7 billion in July 2021 – reflects the strategic value of the platform.

- Slack’s valuation peaked at $27 billion in 2021, illustrating investor confidence in collaborative software growth.

- Cost-per-user estimates suggest Teams’ bundling with Microsoft 365 gives it a competitive advantage in pricing and adoption.

- Slower revenue growth for Slack compared to Teams suggests the platform may be more focused on flexibility than scale.

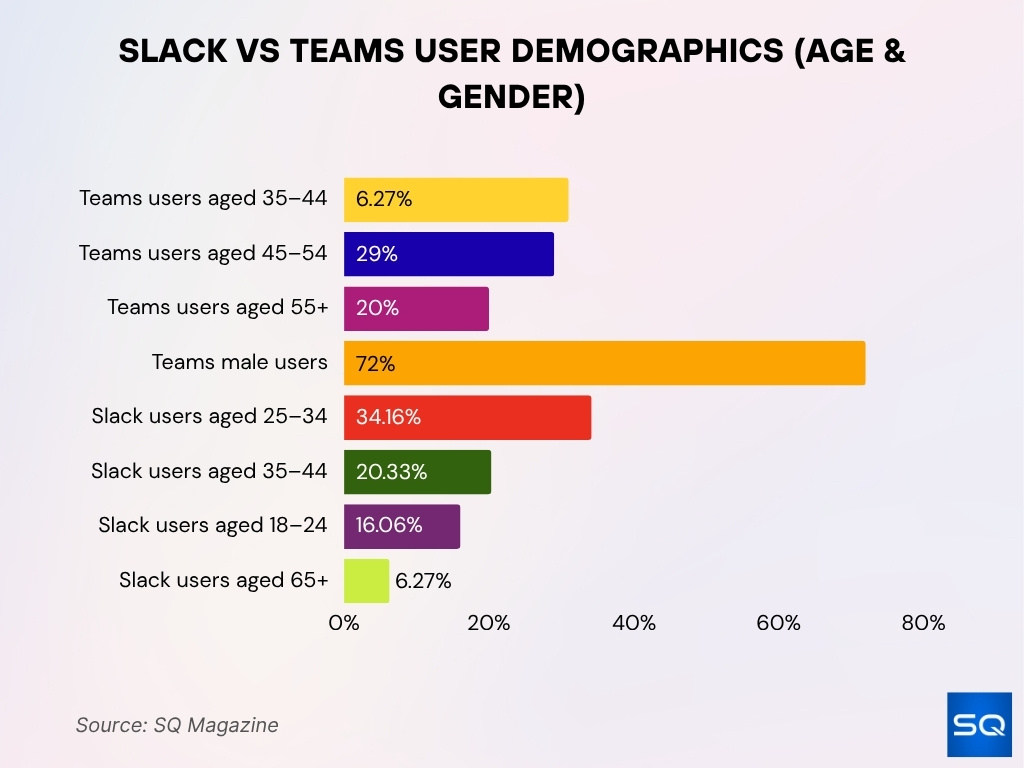

Demographics and Age Groups of Users

- For Microsoft Teams, as of 2023, 31% of users were aged 35-44, while 29% were aged 45-54.

- On that same platform, 20% of users were aged 55 and above.

- In the U.S., Teams users skew male; about 72% of its user base are men.

- For Slack, website-visitor data show 34.16% are aged 25-34, followed by 20.33% aged 35-44.

- Slack users aged 18-24 make up roughly 16.06% of that sample.

- Slack’s share of users aged 65+ is only about 6.27% in the visitor data.

- Understanding this distribution helps companies align platform choice with their team demographics and culture.

Industry Adoption and Usage

- Microsoft Teams is used by over 90% of Fortune 500 companies in 2025.

- Slack usage in developer and engineering teams is 54% higher than Teams.

- 77% of Fortune 100 companies reportedly use Slack for collaboration.

- Slack handles 2.3 times more daily messages per user in environments where both tools are used.

- Microsoft Teams is the default platform in healthcare, education, and government sectors.

- Slack has a market share of 18.6% in 2025, versus Teams’ 37% market share in team collaboration tools.

- Teams’ deep Microsoft 365 integration drives adoption in large enterprises and regulated industries.

- Slack is favored by smaller and mid-sized agile firms, while Teams is preferred by large, risk-averse organizations.

- Hybrid work trends increased Slack and Teams adoption, with 70% of companies using video and chat together.

- Slack boasts a 98% enterprise client retention rate as of 2025, indicating strong loyalty.

Pricing Comparison

- Slack’s entry-level paid plan is priced at $7.25 per user per month (billed annually).

- Teams is available via Microsoft 365 Business Basic at about $6 per user per month, making it more cost-effective if the organization already uses Microsoft tools.

- Some sources list Teams plans from as low as $4 per user per month for core features.

- Slack’s AI add-on costs around $10 per user per month, whereas Teams’ AI add-on (Copilot for Microsoft 365) is about $30 per user per month.

- Slack’s pricing structure shows limitations in lower-tier plans (e.g., message history, integrations), which may force upgrades.

- Teams’ bundled value (Office apps + storage) often gives it an edge for companies already in the Microsoft ecosystem.

- For organizations prioritizing simplicity and minimal investment, Slack’s predictable single-tool cost may appeal.

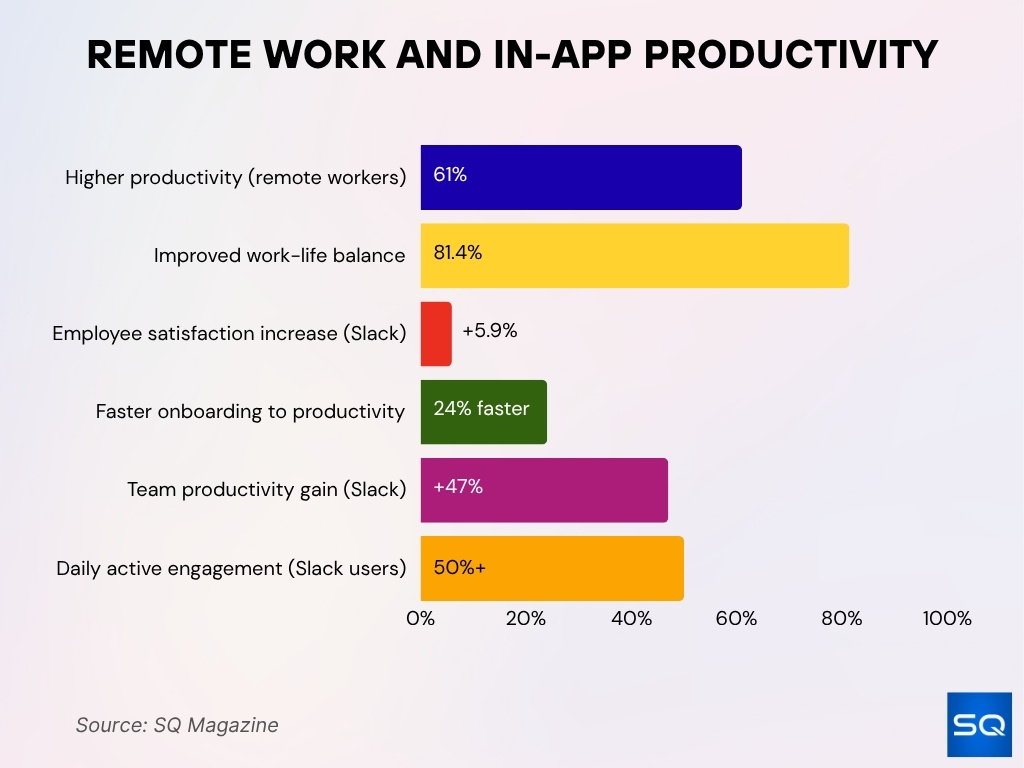

Productivity and In-App Tools

- 61% of remote workers report higher productivity working from home.

- 81.4% of remote employees experience improved work-life balance.

- Slack users saw a 5.9% increase in employee satisfaction after adoption.

- Onboarding time to full productivity is 24% faster for Slack users.

- Slack reports a 47% productivity gain for teams using their platform.

- Over 50% of Slack users spend 90+ minutes actively engaged daily on the platform.

Ease of Setup and Onboarding

- Slack setup typically takes 3 minutes or less, requiring no IT approval.

- Teams onboarding is reported to be 30-50% longer due to complex feature configurations.

- Slack’s guest access works via simple email invitations, while Teams often requires Microsoft or Azure AD accounts.

- Slack’s free plan allows for unlimited users, helping small teams test without cost.

- In Teams, guest access setup can involve multiple admin policy configurations, especially in regulated companies.

- About 70% of Slack users report faster onboarding due to fewer prerequisites.

- Organizations using Microsoft 365 find Teams onboarding streamlined for existing account holders.

- Slack’s intuitive interface reduces training time by up to 40% compared to Teams.

Feature Comparison (Chat, Channels, Video Calls)

- Slack supports up to 15 participants in native video calls on paid plans.

- Teams Business Basic supports up to 300 participants in meetings.

- Slack’s interface is rated 40% more intuitive by users in messaging workflows.

- Teams integrates real-time co-editing of Office documents in channels.

- Slack’s threaded conversations and emoji reactions score higher in user satisfaction surveys.

- Teams offers advanced meeting features like breakout rooms and live event support.

- Slack’s huddles enable quick audio chats with up to 50 participants.

App Integrations and Ecosystem

- Slack supports over 2,600 third-party integrations in its app directory.

- Teams integrates deeply with over 250 Microsoft 365 apps, including Word, Excel, and PowerPoint.

- Slack has more than 750,000 custom bots and integrations deployed worldwide.

- Microsoft Teams’ Power Platform enables the creation of custom apps and workflows without coding.

- Slack’s marketplace saw a 34% growth in workflow automation usage in 2025.

- Teams’ integration enables automatic file versioning and real-time co-editing across Microsoft apps.

- About 65% of Slack enterprise clients use custom-built bots for automation.

- Slack GPT powers over 20 million AI-assisted workflows monthly as of 2025.

- Slack integrations cover CRM (Salesforce, HubSpot), project management (Asana, Trello), and development tools (GitHub, Jira).

AI Features and Automation Adoption

- As of 2025, about 47% of organizations cite employee skilling in AI as a top workforce strategy over the next 12–18 months.

- More than 46% of companies globally report using AI agents to automate business processes.

- Microsoft 365 Copilot has its “AI adoption score” metric, where a score of 100 means each licensed user uses Copilot at least three days a week.

- Over 230,000 organizations have used Copilot Studio to build AI agents and automations by mid-2025.

- 79% of business leaders believe AI will accelerate their careers, versus 67% of employees.

- 92% of companies plan to increase AI investments over the next 3 years, although only 1% consider themselves “mature” in deployments.

- Slack has begun piloting AI features (channel recaps, thread summaries) in FY 25.

- Organizations adopting collaboration platforms need to factor in automation readiness, not just messaging and video.

Remote and Hybrid Usage Data

- In 2025, global remote-work prevalence reached about 48% of the workforce.

- In the U.S., over 32.6 million people worked remotely in 2025, representing around 22% of the workforce.

- Hybrid job postings grew from 15% in mid-2023 up to nearly 24% by mid-2025.

- 97 Fortune 100 companies support remote or hybrid models.

- Remote/hybrid workers report increased productivity and efficiency (remote: 42% say increased productivity, efficiency: 38%).

- As hybrid becomes the norm, companies favor tools that support channel-based work rather than persistent chat only.

- The shift to hybrid increases demand for strong meeting-scheduling, file-sharing, and documentation features as part of communication platforms.

Customer Satisfaction and User Ratings

- Slack has a user-review rating of 4.7 out of 5 in one review aggregator.

- Microsoft Teams has an average rating of 8.0 / 10 across thousands of verified reviews.

- On Capterra, Teams users rated it with an overall “Ease of Use” score of 5/5.

- Slack users report a 24% faster onboarding to full productivity when service teams use Slack.

- 54% of B2B buyers prefer live Slack communications for issue resolution, and teams using Slack saw 3–4× faster resolution times.

- Vendors emphasize simplification of workflows and fewer silos as drivers of user adoption and ratings.

- Since Teams is bundled in many Microsoft 365 subscriptions, perceptions of value-for-money tend to lift its ratings in enterprise contexts.

Growth Trends and Historical Statistics

- Slack reported 42 million daily active users (DAUs) globally by early 2025, a 12% year-over-year growth from 2024.

- Microsoft Teams had over 320 million active users globally by 2024/2025.

- Microsoft Teams’ revenue and cloud/AI growth were significant, with a 67% year-over-year surge in commercial bookings in FY 2025.

- Slack’s acquisition by Salesforce for $27.7 billion in 2021 remains a landmark event.

- Market segmentation continues to evolve, with Teams dominating large enterprises and Slack thriving in tech-centric organizations.

- Adoption of collaboration tools will increasingly hinge on automation, AI, and ecosystem integration rather than chat alone.

Frequently Asked Questions (FAQs)

Over 1,400 apps.

$7.25 per user per month.

~48% of the workforce is working remotely.

Conclusion

The comparison between Slack and Microsoft Teams shows a nuanced picture. Teams holds scale, enterprise-grade integration, and revenue momentum; Slack retains a strong user experience, agility, and appeal in certain segments. For organizations, the decision now hinges less on “which tool” and more on which workflow, which ecosystem, and which readiness for automation and hybrid work. As AI features, remote-work dynamics, and in-app productivity grow in importance, selecting the right platform becomes a strategic decision rather than just a communications choice.