In early 2020, when offices shut their doors and teams scattered across continents, Slack became more than just a messaging tool; it became the digital office. Fast-forward to 2025, Slack continues to serve as the nerve center for modern workplaces, facilitating everything from watercooler chats to critical project updates. Whether you’re a team of five or a multinational corporation, Slack’s impact is undeniable and measurable. In this article, we’ll unpack the latest Slack usage statistics, adoption trends, and the evolving landscape of team collaboration.

Editor’s Choice

- Slack surpassed 42 million daily active users globally in early 2025, marking a 12% year-over-year growth from 2024.

- Over 215,000 organizations now use Slack in some capacity, ranging from startups to Fortune 100 giants.

- Slack Connect usage surged by 35% in 2025, enabling over 100 million inter-company messages per week.

- In the latest fiscal year, Slack contributed $2.3 billion in revenue under Salesforce, a 14% increase from the previous year.

- More than 750,000 custom apps and integrations are active within Slack workspaces globally.

- The average Slack user sends 92 messages per day, reflecting high engagement and communication intensity.

- Slack’s retention rate among enterprise clients is above 98%, highlighting long-term satisfaction and integration depth.

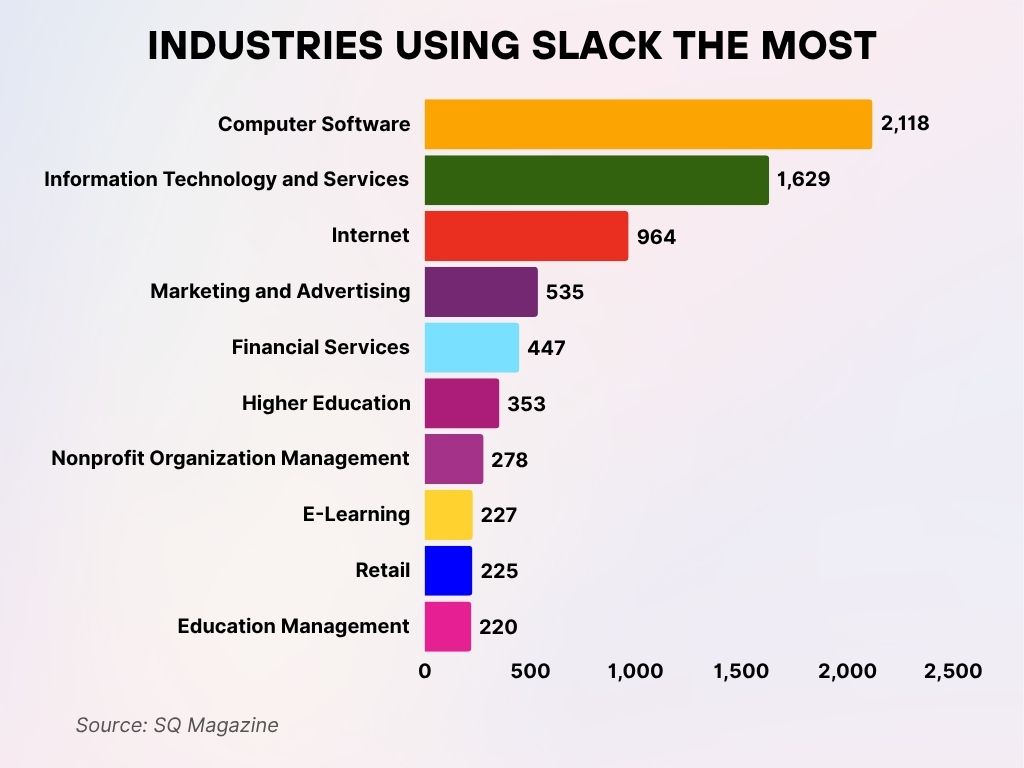

Industries Using Slack the Most

- The Computer Software industry leads with 2,118 companies actively using Slack, making it the most dominant sector.

- Information Technology and Services follows closely with 1,629 companies, highlighting strong adoption in tech-focused fields.

- The Internet industry ranks third with 964 companies, reflecting Slack’s popularity among digital businesses.

- Marketing and Advertising firms make up 535 users, indicating a growing trend among creative and client-driven teams.

- The Financial Services sector includes 447 companies, showing increasing reliance on modern communication tools.

- Higher Education accounts for 353 institutions, demonstrating Slack’s use in academic collaboration.

- Nonprofit Organization Management sees usage from 278 organizations, proving its value in mission-driven work.

- E-Learning platforms have 227 users, emphasizing Slack’s role in remote education and training.

- The Retail industry shows a modest yet notable presence with 225 companies.

- Education Management rounds out the list with 220 companies, reinforcing the app’s appeal in administrative settings.

Total Number of Slack Users Globally

- As of Q2 2025, Slack boasts an estimated 52 million registered users, including both free and paid accounts.

- The platform added roughly 8 million new users in the last 12 months alone.

- Since its acquisition by Salesforce in 2021, Slack’s user base has grown by over 75%.

- Slack is now deployed in more than 180 countries, spanning all continents.

- Approximately 80% of Fortune 100 companies use Slack in at least one department or team.

- The global distribution includes 14 million paid users, which account for about 27% of the total user base.

- Slack saw its highest quarterly user growth in the APAC region, up 18% year-over-year.

- Nonprofit and education organizations now represent over 2 million users on the Slack platform.

- Slack has localized versions in 12 languages, aiding its global adoption.

- More than 10 million users access Slack via mobile devices daily.

Slack’s Market Share in the Team Collaboration Software Industry

- Slack holds an estimated 18.6% market share in the team collaboration software segment as of 2025.

- Microsoft Teams remains the dominant player at 44%, followed by Zoom Team Chat with 10%.

- Slack continues to dominate in developer-heavy startups and agile environments, holding 40%+ penetration in that niche.

- In tech sector organizations with fewer than 500 employees, Slack leads with 52% market share.

- Slack’s growth in non-tech sectors like healthcare and legal has risen by 22% year-over-year.

- Compared to 2020, Slack’s overall market share has increased by more than 40%.

- Among organizations using multiple collaboration tools, Slack is included in 65% of those stacks.

- Slack’s market presence is strongest in North America (45%), followed by Europe (28%).

- Slack continues to outpace new entrants like ClickUp and Zoho Cliq in user satisfaction and integration variety.

- Investment in enterprise-focused capabilities has expanded Slack’s footprint in businesses with 10,000+ employees, contributing to 30% of new revenue in 2025.

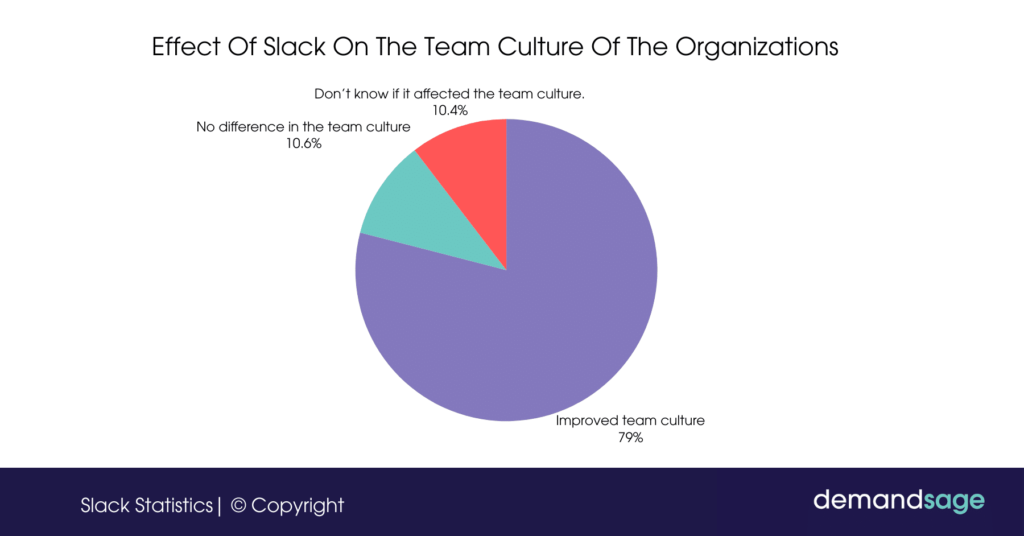

Impact of Slack on Team Culture in Organizations

- 79% of organizations reported that Slack improved team culture, indicating a strong positive influence on collaboration and communication.

- 10.6% said there was no difference in their team culture after using Slack.

- 10.4% were unsure if Slack had any effect on their team culture.

Enterprise vs. Free Plan Adoption Rates

- As of 2025, roughly 27% of all Slack users are on a paid plan, while 73% remain on the free tier.

- Slack Pro and Business+ plans make up the bulk of paid subscriptions, accounting for 65% of revenue.

- Enterprise Grid adoption has increased by 21% year-over-year, largely among Fortune 500 companies.

- Over 93,000 organizations now subscribe to at least one form of Slack’s premium offerings.

- Nonprofit discounts and educational access programs have expanded Slack’s paid user base by 18% in 2025.

- Businesses that upgrade to paid plans report a 32% increase in cross-functional team visibility within the first six months.

- Among organizations with more than 1,000 employees, 85% use Slack’s Enterprise features.

- Slack’s free plan limitations (e.g., 90-day message history) have pushed more than 10,000 teams to upgrade this year.

- The average annual spend per Slack customer has risen to $425, up from $370 last year.

- Slack’s integration with Salesforce’s Customer 360 is exclusive to enterprise accounts and has driven new signups by 13% in 2025.

Geographic Distribution of Slack Users

- North America continues to lead, representing 45% of Slack’s total user base.

- The EMEA region accounts for 29%, with significant traction in the UK, Germany, and France.

- Asia-Pacific saw the highest growth rate at 19% YoY, especially in India, Australia, and Japan.

- Slack is used in over 180 countries, with localized support in 12 languages.

- Latin America now contributes 5% of the global Slack user base, with Brazil and Mexico as key markets.

- In the Middle East, Slack adoption rose by 11%, largely due to the rise in remote and hybrid tech startups.

- Canada alone accounts for nearly 1.2 million users, up 8% from the prior year.

- Germany remains Slack’s largest non-English speaking market, with over 750,000 active users.

- India’s tech hubs like Bengaluru and Hyderabad are experiencing double-digit Slack growth rates.

- Slack has set up regional infrastructure in Singapore and Ireland to support performance in high-demand markets.

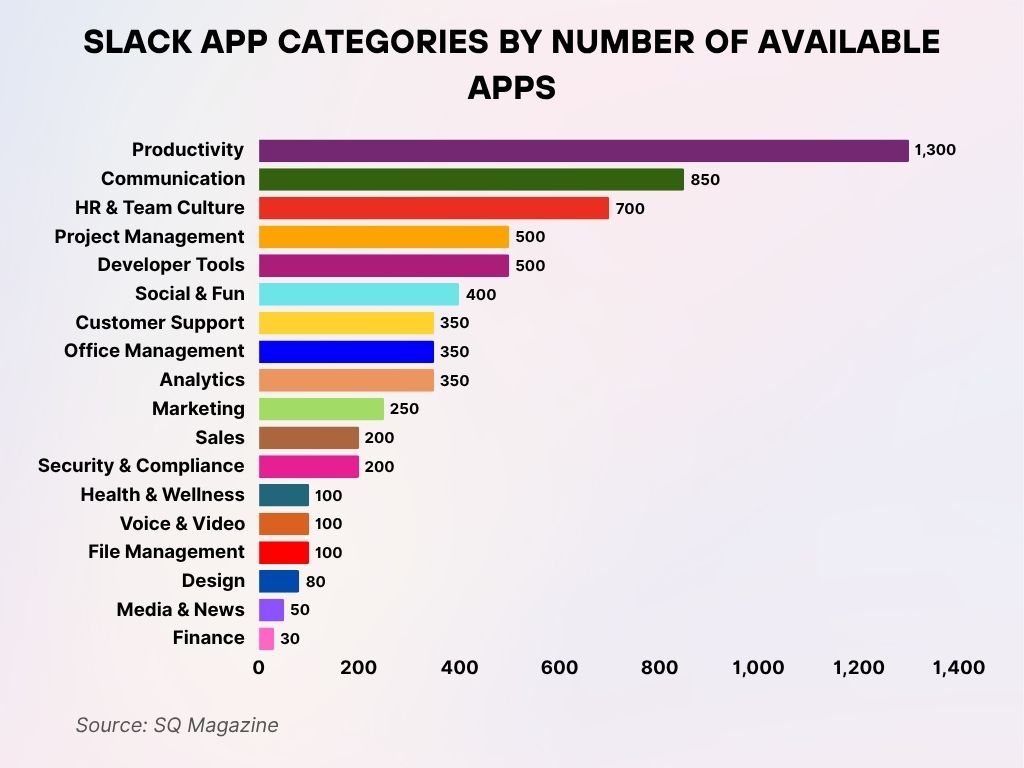

Slack App Categories by Number of Available Apps

- The Productivity category leads with approximately 1,300 apps, making it the most supported use case on Slack.

- Communication tools come next, with around 850 apps, highlighting Slack’s core purpose.

- HR & Team Culture apps account for about 700 apps, showing a strong focus on employee engagement.

- Project Management and Developer Tools categories each offer around 500 apps, supporting team workflow and tech development.

- The Social & Fun category includes about 400 apps, encouraging informal team bonding.

- Categories like Customer Support, Office Management, and Analytics each feature roughly 350 apps, reflecting operational support.

- Marketing tools have around 250 apps, and Sales tools about 200 apps, supporting business growth.

- Smaller categories such as Security & Compliance, Health & Wellness, Voice & Video, and File Management range from 100 to 200 apps.

- The least represented categories are Design (80 apps), Media & News (50 apps), and Finance (30 apps).

Slack App Integrations and Bot Usage Statistics

- There are now over 2,600 apps available in the Slack App Directory, including Trello, Google Drive, and Jira.

- More than 750,000 custom bots and integrations are deployed across all Slack workspaces.

- Slack Workflow Builder usage grew 34% in 2025, with 40% of paid teams using it weekly.

- Over 65% of enterprise clients use custom-built internal Slack bots for automation and data pulls.

- Zapier and Make.com are the most commonly used platforms for third-party Slack automations.

- Slack GPT, introduced in 2024, now powers over 20 million AI-assisted workflows monthly.

- Calendars, task managers, and CRM tools are the top three integration categories by daily usage.

- On average, users interact with at least 3 integrations daily, with power users reaching up to 10.

- Bots handle approximately 18% of internal requests, such as PTO checks, help desk tickets, or standup updates.

- Slack Connect integrations allow seamless automation between external partners, which are used by 33% of enterprise clients.

Average Time Spent on Slack Per User

- In 2025, users spend an average of 1 hour and 42 minutes per day actively using Slack.

- Power users, especially in engineering and product roles, spend up to 3.1 hours daily.

- Peak Slack usage time is 10 a.m. local time, with activity tapering off after 6 p.m..

- Teams send an average of 92 messages per user per day.

- Direct messages account for about 38% of total usage, while channels account for the rest.

- Slack’s Do Not Disturb mode is activated by 45% of users during focused work periods.

- Users check Slack an average of 13 times daily, showing habitual workplace reliance.

- Roughly 23% of usage happens on mobile devices, especially in sales and operations teams.

- Notifications are the most-clicked Slack feature, with the average user engaging with 8 alerts per session.

- On Fridays, time spent on Slack decreases by about 11%, reflecting lighter internal coordination.

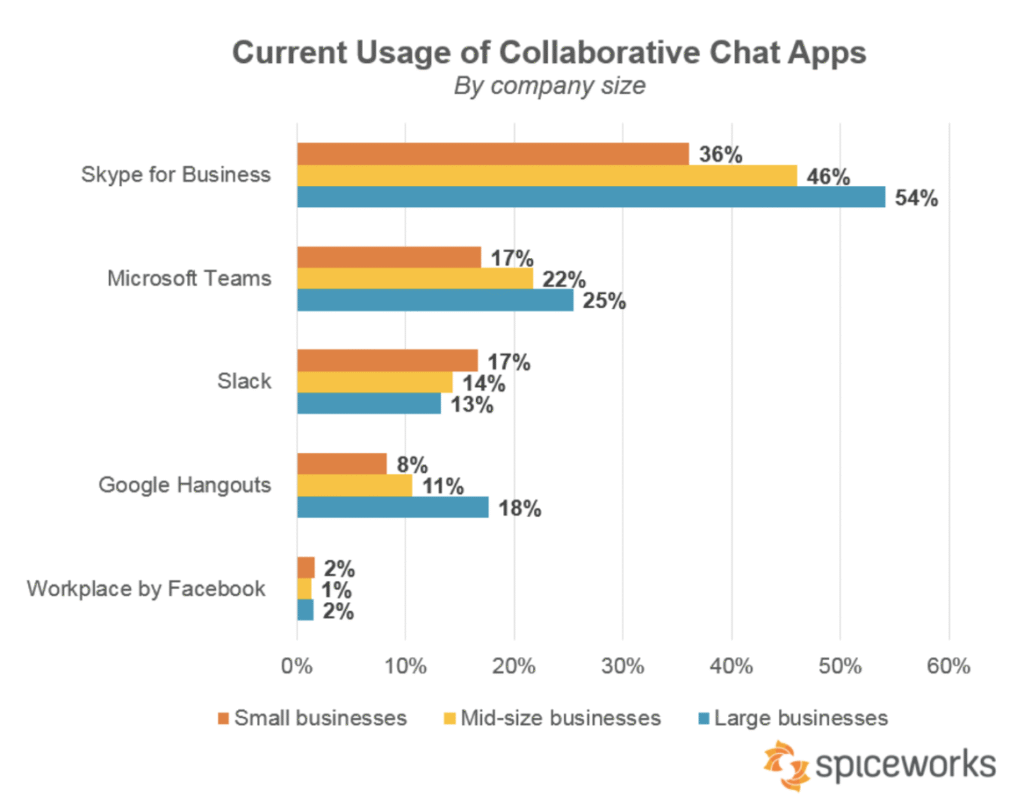

Current Usage of Collaborative Chat Apps by Company Size

- Skype for Business is the most used, with 54% of large, 46% of mid-size, and 36% of small businesses using it. It remains a top choice across all company sizes.

- Microsoft Teams is steadily growing, used by 25% of large, 22% of mid-size, and 17% of small businesses. Its Microsoft integration is a key draw.

- Slack shows balanced use across businesses, 17% small, 14% mid-size, and 13% large. It’s especially popular with startups.

- Google Hangouts is more common in larger firms, 18% large, 11% mid-size, and 8% small businesses. Adoption drops with smaller companies.

- Workplace by Facebook has the lowest usage, just 2% of small and large, and 1% of mid-size businesses. It hasn’t gained much traction.

Slack Usage in Remote and Hybrid Work Environments

- In 2025, over 72% of Slack users operate in a remote or hybrid work model.

- Remote-first companies use Slack channels for all core workflows, from daily check-ins to quarterly planning.

- Asynchronous communication via Slack has increased by 19%, reducing reliance on meetings.

- Hybrid teams that use Slack report a 27% improvement in team alignment compared to email-heavy teams.

- Emoji reactions and threads are used in 78% of workplace interactions, softening tone and reducing miscommunication.

- Slack serves as the primary work hub in 60% of fully remote organizations surveyed.

- Slack’s integration with Zoom and Google Meet has seen a 15% uptick, helping streamline virtual meetings.

- Standup bots and status updates are heavily adopted by remote teams, with a 40% increase from last year.

- Remote teams using Slack report 23% faster resolution times on internal tickets or support requests.

- Slack huddles, launched in 2021, are now used in 16% of remote conversations, with higher adoption in startups and SMBs.

Comparison of Slack Usage with Microsoft Teams and Zoom

- As of 2025, Slack holds 18.6% market share, compared to Microsoft Teams’ 44% and Zoom’s 10% in team collaboration tools.

- Teams dominates in enterprises with existing Microsoft 365 licenses, but Slack leads in tech-forward startups and agile teams.

- In companies using both Slack and Teams, Slack is preferred for internal team collaboration in 61% of cases.

- Zoom Chat, while widely adopted for meetings, is used for persistent messaging by only 9% of organizations.

- Slack users report 15% higher satisfaction scores than Teams users in UX and workflow integration surveys.

- Slack outpaces Zoom in terms of third-party integrations, supporting over 2,600 apps compared to Zoom’s 1,500+.

- Switching from Teams to Slack is most common in startups and growth-stage firms scaling agile processes.

- In environments where both Slack and Teams are available, Slack handles 2.3x more daily messages per user.

- Slack GPT and Workflow Builder have given Slack an edge in automation and AI-assisted workflows versus Teams’ Power Automate.

- Among developers and engineering teams, Slack usage is 54% more prevalent than Microsoft Teams.

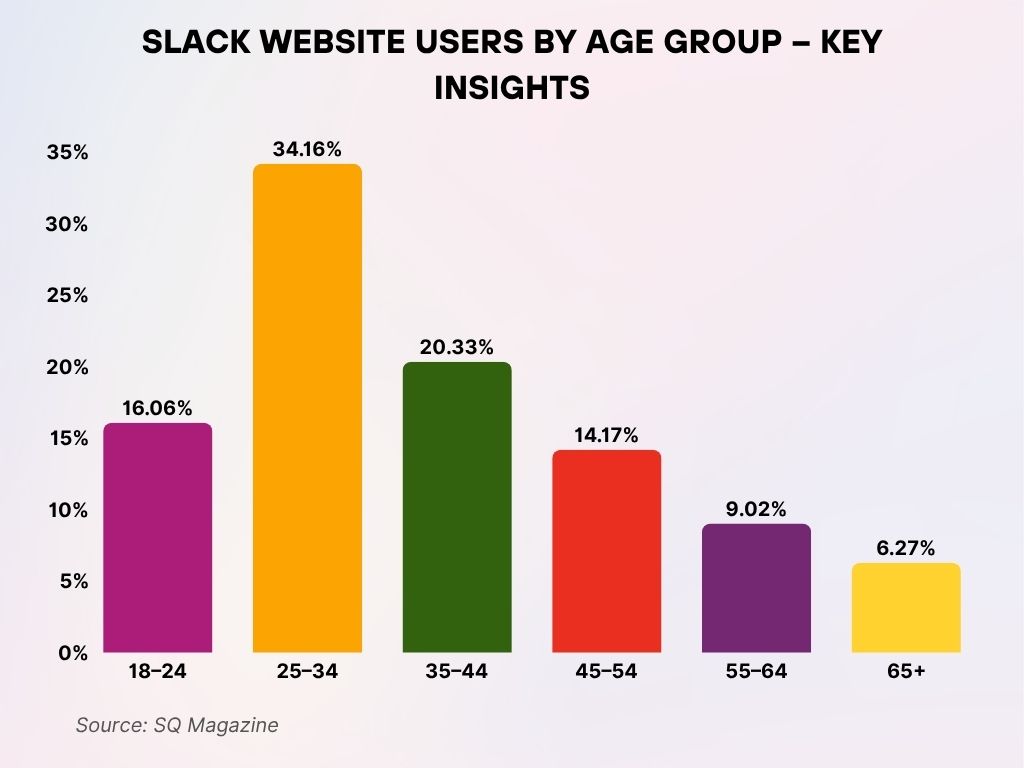

Slack Website Users by Age Group – Key Insights

- The 25–34 age group makes up the largest share of users at 34.16%. This group is the most active on the website.

- Users aged 35–44 account for 20.33%. They represent the second-largest user base.

- The 18–24 age group follows with 16.06%. Younger users are also highly engaged.

- 14.17% of users fall in the 45–54 age group. Mid-life users still contribute significantly.

- Only 9.02% of users are between 55–64. Usage drops noticeably in this range.

- The 65+ age group represents just 6.27% of users. Seniors are the least represented demographic.

Financial Performance and Revenue Statistics

- In 2025, Slack generated $2.3 billion in annual revenue.

- Recurring revenue accounts for over 94% of total earnings, driven by long-term enterprise subscriptions.

- Customer acquisition costs have decreased by 8% year-over-year, thanks to bundled offerings via Salesforce.

- Slack’s net revenue retention rate is 132%, indicating strong upsell momentum and user expansion within organizations.

- Slack’s enterprise segment contributed more than $1.1 billion, nearly half of total revenue.

- Average revenue per user (ARPU) reached $425 annually, with Enterprise Grid clients averaging over $1,100 per seat.

- Post-Salesforce acquisition, Slack’s financials have been reported within Salesforce’s Platform & Other category.

- Slack Connect has become a key monetization lever, with paid features contributing $260 million in 2025.

- Revenue from app integrations and ecosystem partnerships brought in $180 million, up 20% YoY.

- Slack’s operating margin reached 24%, reflecting improved scalability and reduced infrastructure costs.

Security and Compliance Adoption Rates

- Slack Enterprise Grid includes over 100 built-in compliance controls, including HIPAA, FINRA, and GDPR adherence.

- Over 88% of enterprise clients leverage Slack’s Enterprise Key Management (EKM) for data encryption.

- Multi-Factor Authentication (MFA) is enabled by 91% of paid workspaces in 2025.

- Slack complies with ISO/IEC 27001, 27017, and 27018, meeting global data protection standards.

- SOC 2 Type II compliance is now maintained across all Slack data centers.

- Data Loss Prevention (DLP) integrations, such as with Nightfall or Netskope, are active in 27% of enterprise accounts.

- Slack has improved audit log granularity, allowing real-time compliance tracking for IT administrators.

- Slack Shield, a suite of advanced security features, was adopted by 34% of clients handling sensitive data.

- More than 140 third-party security apps are available in the Slack App Directory as of 2025.

- Slack’s incident response time has improved to under 4 hours for critical vulnerabilities.

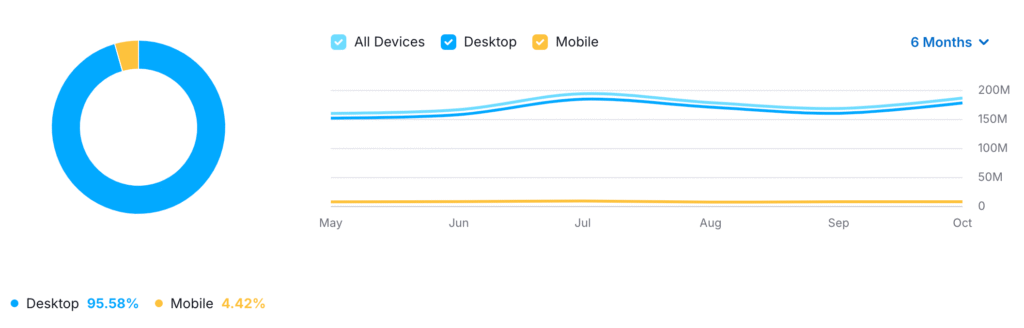

Slack Device Usage Breakdown

- Desktop dominates with 95.58% of the website traffic. This shows users heavily prefer browsing on computers over other devices.

- Mobile usage is minimal, making up just 4.42%. This suggests mobile optimization may not be a top priority for this audience.

- Traffic trends stayed steady over the 6-month period, with a slight rise in July and October. Desktop and overall traffic followed similar patterns throughout.

- Mobile traffic remained consistently low month after month, showing little variation in user behavior on phones.

Slack’s Impact on Team Productivity and Communication

- Teams using Slack report an average 32% decrease in internal email volume, improving response speeds and clarity.

- Companies see a 23% increase in cross-functional collaboration within six months of Slack implementation.

- On average, teams resolve issues 21% faster when workflows are run through Slack integrations.

- Slack improves meeting efficiency, with a 19% reduction in scheduled meetings due to asynchronous updates.

- Onboarding time for new hires is cut by 27% when using Slack channels and automated welcome bots.

- Team satisfaction scores rise by 15% when Slack replaces fragmented tools for messaging and task management.

- Threaded conversations reduce information overload and improve clarity for 78% of users in internal surveys.

- Slack Huddles have decreased the need for ad hoc Zoom meetings by 18%, especially in remote teams.

- Employees using Slack report feeling 11% more aligned with goals and deliverables compared to traditional tools.

- Slack’s automation features save an average of 5.6 hours per employee per week, translating to measurable ROI.

Recent Developments in Slack’s Product and Features

- Slack GPT, launched in 2024, reached mainstream adoption in 2025 with over 20 million AI interactions per month.

- New features like AI-powered summaries, instant translations, and message rewrites have improved global collaboration.

- Canvas, a new documentation feature, allows users to create collaborative wikis and project briefs within Slack.

- Slack added “Custom Channels by Role,” enabling dynamic permissions for enterprise workflows.

- Huddles now support video, screen sharing, and live co-annotations, bridging the gap between chat and meetings.

- Slack’s new “Priority Inbox” feature helps users sort messages based on urgency and frequency.

- Native Salesforce integration enhancements now allow users to trigger CRM actions directly within Slack.

- Expanded Slack Connect capabilities let users invite external partners to shared channels with stricter compliance filters.

- Smart Recaps, a daily digest of mentions and unresolved threads, helps reduce missed updates.

- Slack rolled out offline draft mode in 2025, a long-requested feature allowing mobile users to write and queue messages offline.

Conclusion

From a startup-friendly messenger to a core part of enterprise tech stacks, Slack’s evolution is as strategic as it is substantial. With over 42 million daily active users, strong enterprise adoption, and deep integration across tools and workflows, Slack continues to redefine how teams communicate. The platform’s shift toward AI-powered productivity, robust security, and seamless cross-company collaboration sets the stage for its continued growth in an increasingly hybrid, asynchronous world. As we look ahead, Slack remains one of the most essential digital hubs for modern work, evolving not just with technology but with how people prefer to work.