On a freezing January morning, 14-year-old Milo sat bundled in a hoodie, fingers tapping rapidly on his phone. What looked like idle time was actually intense strategy; he was leading his clan in a global multiplayer battle while waiting for the school bus. This simple moment is no outlier. It’s part of a massive behavioral shift reshaping entertainment across every age group and region.

By 2025, mobile gaming isn’t just a pastime, it’s a $200 billion cultural powerhouse influencing everything from social interaction to global tech innovation. In this article, we’ll break down the most impactful statistics from the mobile gaming world to help you understand the landscape, trends, and forces driving this fast-evolving industry.

Editor’s Choice

- The global mobile gaming market is projected to reach $206 billion in 2025.

- Mobile gamers now make up 54% of the total gaming population, overtaking PC and console combined.

- In 2025, subway surfing, royale battling, and word puzzle solving are among the top three mobile game genres by session length.

- The average mobile gamer spends 8.5 hours per week playing, a 12% increase from the previous year.

- 77% of mobile game revenue now comes from in-app purchases, with casual titles accounting for the majority.

- The US ranks #1 in mobile gaming revenue for 2025, surpassing China by a margin of $2.1 billion.

- Mobile gaming ads generated $62 billion globally in 2025, driven by playable ads and reward-based video formats.

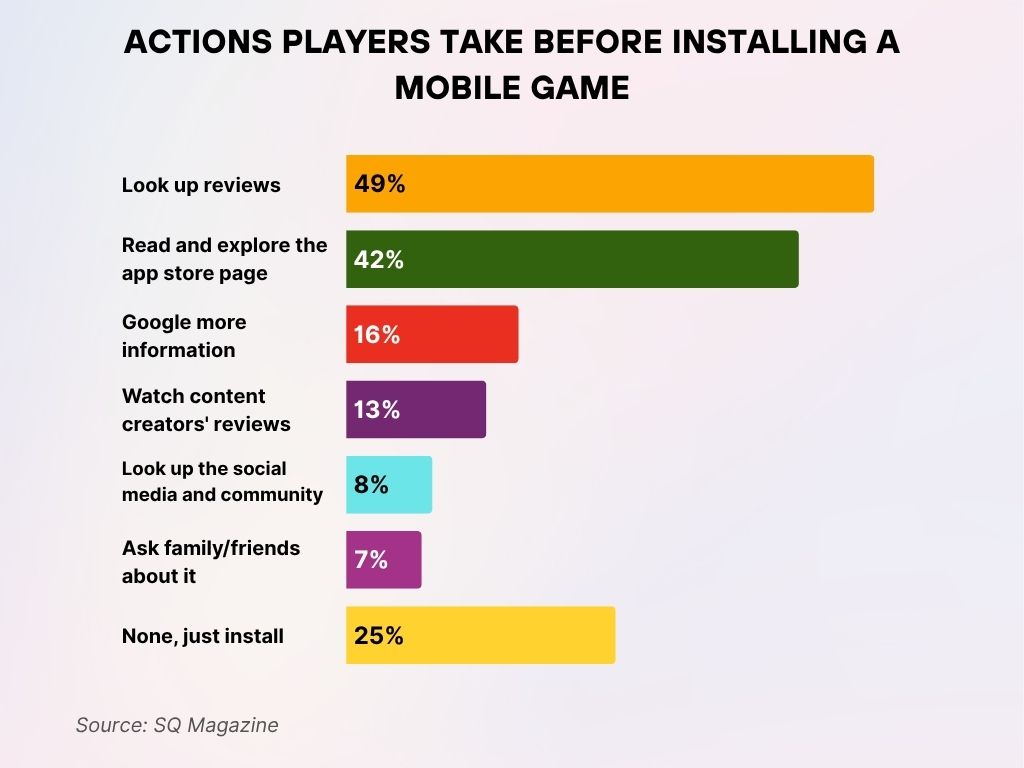

Actions Players Take Before Installing a Mobile Game

- 49% of players look up reviews before downloading a mobile game, making it the most common pre-installation step.

- 42% prefer to read and explore the app store page to understand features, ratings, and gameplay.

- 16% of users Google for more information to make informed decisions beyond app store details.

- 13% watch content creators’ reviews, highlighting the influence of gaming influencers.

- 8% check the social media and community presence of the game to gauge popularity and user sentiment.

- 7% rely on family or friends’ opinions before deciding to install.

- Interestingly, 25% of players take no prior action and just install the game immediately.

Global Mobile Gaming Market Size and Revenue

- The mobile gaming industry’s revenue is forecasted to reach $206 billion in 2025, growing at a CAGR of 7.4% since 2020.

- Asia-Pacific continues to dominate with over 50% of global mobile gaming revenue, led by markets in Japan, South Korea, and India.

- The US mobile gaming market reached $48.7 billion in 2025, showing a 10.3% YoY growth.

- Europe’s mobile gaming sector is valued at $31.4 billion, with notable contributions from the UK, Germany, and France.

- Subscription models like Apple Arcade and Google Play Pass contributed over $4.8 billion in combined global revenue.

- Indie mobile game developers saw record revenues, with nearly $3.1 billion generated in 2025 by self-published titles.

- 5G adoption has significantly increased average gameplay session times by 18%, due to reduced latency and seamless multiplayer experiences.

- In-game events and collaborations with streaming platforms helped push seasonal revenue spikes by up to 25% in Q2 and Q4.

- The average ARPU (Average Revenue Per User) across all mobile games globally is now $51.35.

- Cloud-based mobile game streaming services added $3.6 billion to the revenue pool, blurring lines between mobile and console gaming.

Most Downloaded Mobile Games Worldwide

- “Subway Surfers” retained its title as the most downloaded game of 2025, with over 330 million installs globally.

- “Free Fire” saw a resurgence, hitting 270 million downloads, fueled by optimized low-end device performance and events.

- “Roblox Mobile” surged to #3 globally, reaching 248 million downloads, especially popular among Gen Z.

- “Ludo King” remains a consistent hit in emerging markets, ranking in the top 10 with 190 million downloads in 2025.

- Newcomer “Chrono Odyssey Mobile” became the fastest mobile RPG to surpass 100 million downloads within six months.

- Puzzle games like “Brain Test 5” and “Wordscapes Ultra” gained top download spots in the education and wellness categories.

- Hyper-casual games made a comeback, with titles like “Slice Rush” and “Bridge Race 2” appearing in the top 20 charts globally.

- India and Brazil contributed the most to download volumes, together accounting for 22% of global mobile game installs in 2025.

- TikTok game integrations contributed to over 120 million game downloads, especially for short-form action titles.

- Cross-platform titles that integrate with PC and console, like “Genshin Impact” and “Minecraft Mobile”, saw a 15% increase in downloads.

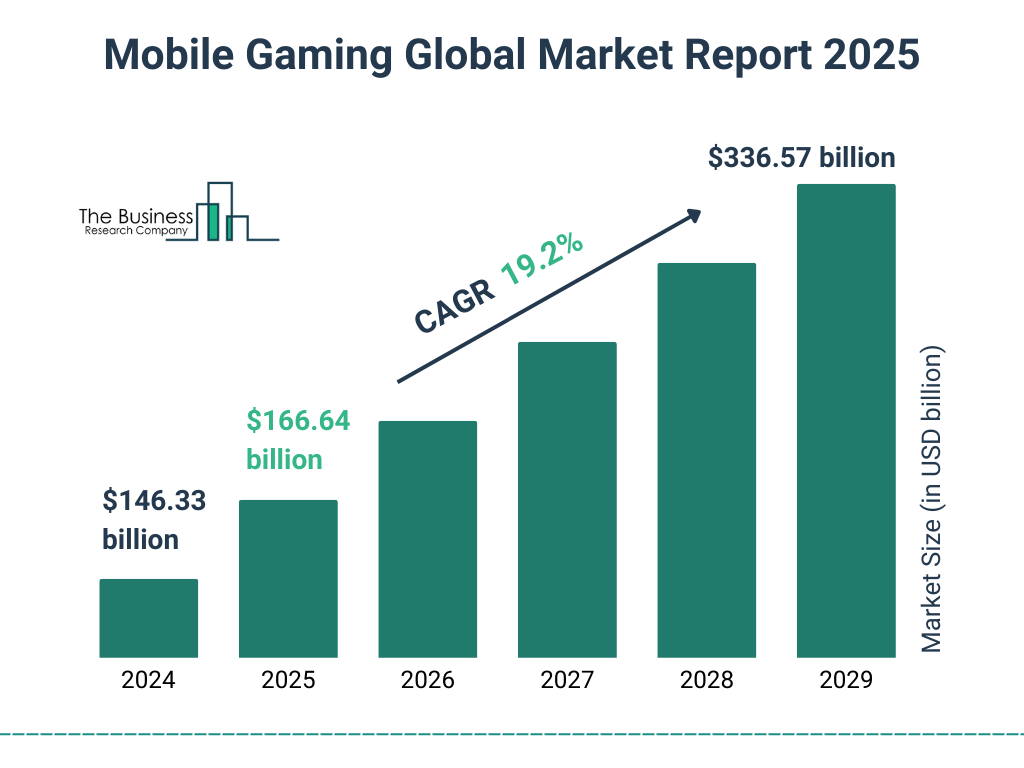

Mobile Gaming Market Growth Forecast

- The global mobile gaming market was valued at $146.33 billion in 2024.

- It is projected to grow to $166.64 billion in 2025.

- By 2029, the market size is expected to hit a massive $336.57 billion.

This growth reflects a Compound Annual Growth Rate (CAGR) of 19.2%.

Highest-Grossing Mobile Games

- “Honor of Kings” maintained its dominance with over $2.9 billion in revenue in 2025 alone.

- “Genshin Impact” followed closely at $2.6 billion, with seasonal updates and merchandise driving in-game sales.

- “Roblox Mobile” exceeded $1.7 billion, thanks to a surge in user-generated content purchases.

- “Candy Crush Saga” crossed the $1 billion mark again, celebrating its 13th year with global events.

- “PUBG Mobile” earned $1.3 billion, with its esports integration playing a huge role in monetization.

- “Coin Master” remains a top earner in casual gaming, generating $960 million in 2025.

- “Clash of Clans” made a strong comeback with $820 million in yearly revenue, bolstered by builder base enhancements.

- Japan’s mobile RPG “Fate/Grand Order” still leads in domestic revenue, with $670 million attributed to limited-time character drops.

- The top 10 highest-grossing mobile games together contributed to nearly 20% of all mobile game revenue globally.

- Revenue from battle passes and monthly subscription models rose 18% YoY, signaling increasing user willingness to commit long-term.

Demographics of Mobile Gamers

- As of 2025, 53% of mobile gamers globally are female, a trend that’s been steadily rising since 2020.

- The 18–34 age group represents 48% of the mobile gaming audience, making it the largest demographic segment.

- In the United States, 33% of all mobile gamers are aged 35 and above, showing increased adoption among older users.

- Teens aged 13–17 account for 16% of the mobile gaming base, with their average daily playtime reaching 96 minutes.

- 75% of women who play mobile games cite relaxation and stress relief as their primary motivators.

- Mobile gaming participation among parents with children under 12 has increased by 11% YoY, driven by family-friendly titles and edutainment apps.

- LGBTQ+ gamers report a higher engagement rate in narrative-rich mobile games, making up 7% of total spending in RPG and simulation categories.

- The average mobile gamer owns 2.7 gaming apps, with Gen Z users installing up to 5 or more.

- The average spending per gamer among millennials (ages 27–42) is $98 annually, compared to $74 among Gen Z.

- In 2025, mobile gaming saw higher participation from women in esports-style mobile games, especially in regions like Southeast Asia and South America.

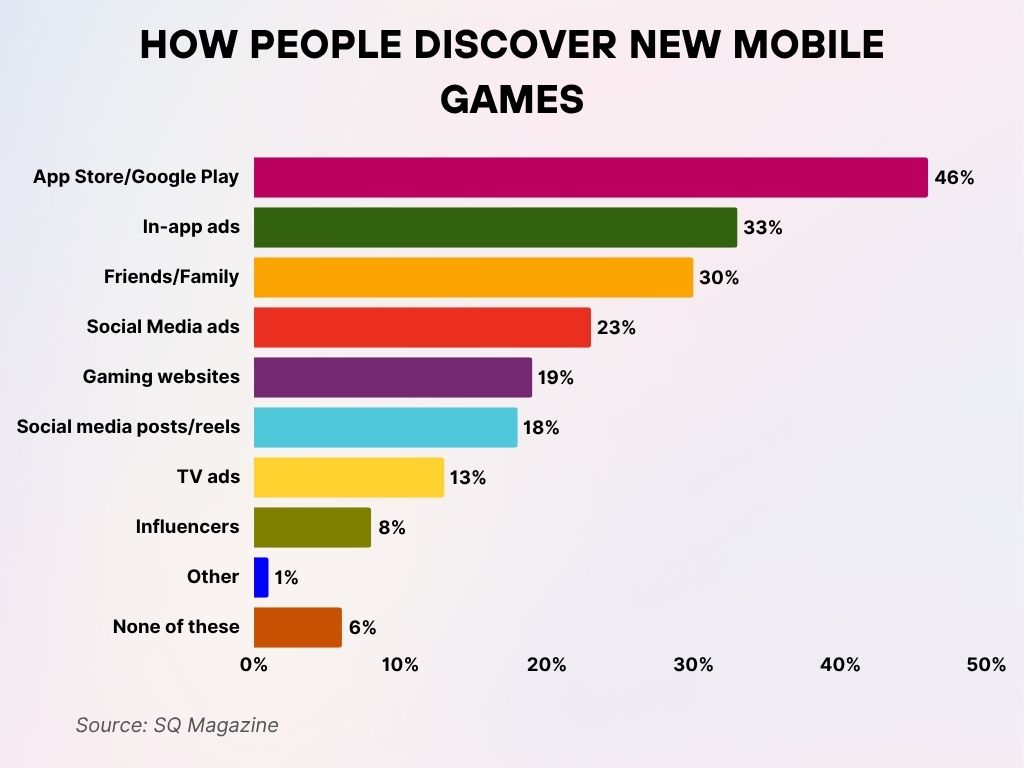

How People Discover New Mobile Games

- 46% of users find new games through the App Store or Google Play, making it the most popular discovery method.

- 33% are introduced to games via in-app ads, highlighting the power of advertising within other apps.

- 30% rely on recommendations from friends or family when looking for new mobile games.

- 23% discover games through social media ads, emphasizing the influence of paid promotions.

- 19% visit gaming websites to learn about the latest releases.

- 18% find games through social media posts or reels, driven by organic content and trends.

- 13% are influenced by TV advertisements for mobile games.

- 8% discover games from influencers, showing the growing yet smaller impact of creator endorsements.

- Only 1% choose “Other” methods of discovery.

- 6% of users reported that none of these methods influenced how they discover new games.

Regional Breakdown of Mobile Game Usage

- Asia-Pacific continues to dominate with 1.48 billion mobile gamers, accounting for over half the global player base.

- The United States has over 203 million active mobile gamers, with high penetration in both urban and rural areas.

- In Europe, mobile gaming is led by the UK, Germany, and France, together representing 162 million players in 2025.

- India added more than 95 million new mobile gamers this year, bringing its total to over 560 million, second only to China.

- Latin America’s mobile gaming market expanded to $12.3 billion, with Brazil and Mexico as the region’s strongest contributors.

- In the Middle East and North Africa (MENA), mobile game usage surged by 23% YoY, with Saudi Arabia and Egypt leading growth.

- Sub-Saharan Africa showed rising engagement, especially in Nigeria, where mobile gaming usage grew by 34% due to cheap data plans.

- South Korea and Japan maintain high ARPU, with players spending an average of $106 per year on mobile games.

- China’s regulatory restrictions have slightly slowed market growth, but it still ranks among the top two in global revenue and downloads.

- Cross-border collaborations, especially between US and Japanese developers, are enhancing cultural localization and improving retention in both markets.

In-App Purchase and Monetization

- 77% of mobile game revenue globally in 2025 comes from in-app purchases (IAPs), showing continued dominance of the freemium model.

- The average IAP transaction value is now $7.62, with the highest spending in strategy and RPG categories.

- Battle passes are used in nearly 60% of top-grossing titles and account for 22% of total IAP revenue.

- Live events and limited-time offers drive up to 30% more in-app purchases during peak promotion weeks.

- Subscription-based monetization saw a 13% growth YoY, reaching $4.2 billion globally in 2025.

- Players in North America are the highest spenders, averaging $112 per year per user, followed by Japan at $106.

- Gacha mechanics (randomized reward draws) remain a top monetization method, particularly in Asian markets.

- Rewarded video ads and incentivized engagement drive IAP conversions, boosting daily active user (DAU) spending by 18%.

- Mobile gamers are more likely to convert to paying users when onboarding flows include tutorials on in-game currency, conversion rates jump by 21%.

- Monetization in hyper-casual games has shifted toward hybrid models, combining IAP and ad revenue, increasing total revenue by 14% YoY.

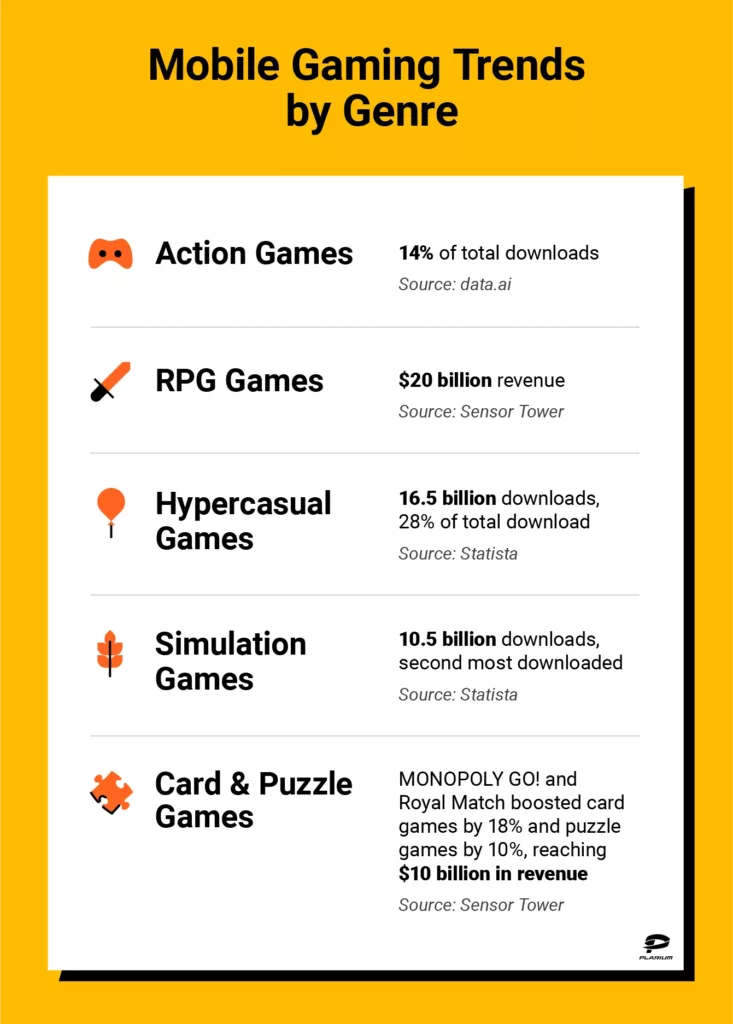

Mobile Gaming Trends by Genre

- Action Games account for 14% of total downloads, showing steady popularity among core gamers.

- RPG Games generated a massive $20 billion in revenue, proving strong monetization potential.

- Hypercasual Games saw 16.5 billion downloads, making up 28% of total downloads, the highest among all genres.

- Simulation Games recorded 10.5 billion downloads, ranking as the second most downloaded genre overall.

- Card & Puzzle Games saw a major boost, MONOPOLY GO! increased card game plays by 18%, and Royal Match lifted puzzle games by 10%, leading to $10 billion in total revenue.

Impact of Mobile Gaming on Traditional Gaming Platforms

- In 2025, 43% of former console gamers say they now spend more time gaming on mobile than on other platforms.

- The Nintendo Switch Lite lost some market share to mobile RPGs, particularly in the 10–18 age group.

- Cloud gaming services have made mobile a preferred platform for streaming traditional console games, cutting hardware reliance by 19%.

- Cross-platform play now influences 65% of game development roadmaps, with publishers prioritizing mobile integration.

- PlayStation and Xbox game publishers reported mobile spin-offs like “Horizon: Mobile Wilds” generating new user bases without cannibalizing console sales.

- Mobile-first ports of popular indie games have driven discoverability for titles like “Stardew Valley”, increasing overall game revenue by 28%.

- Developers using Unity and Unreal Engine increasingly design with a “mobile-as-primary” philosophy, reversing trends from just 5 years ago.

- The average daily playtime on mobile exceeded console playtime by 36 minutes in Q1 2025.

- Competitive shooters and MOBAs have migrated strongly to mobile, narrowing the gameplay quality gap between platforms.

- Traditional game studios now allocate up to 38% of their development resources to mobile game projects.

Mobile eSports and Competitive Gaming Growth

- The mobile eSports sector is projected to generate $3.4 billion in revenue globally in 2025.

- Popular titles like Mobile Legends: Bang Bang, PUBG Mobile, and Arena of Valor dominate mobile eSports circuits.

- North America now hosts 9 Tier-1 mobile eSports tournaments, up from 4 in 2022.

- Viewership on Twitch and YouTube for mobile esports has grown to 510 million hours watched in the first half of 2025.

- The Free Fire World Series 2025 attracted 2.3 million concurrent viewers, breaking its record from 2023.

- Prize pools for top mobile eSports events have crossed $2 million, rivaling mid-tier PC events.

- Team sponsorship revenue for mobile eSports grew 22% YoY, driven by non-endemic brands entering the scene.

- Women-led mobile eSports teams saw a 31% increase in participation and fan following, especially in Latin America.

- The accessibility of mobile eSports has led to a demographic shift, with 59% of viewers aged under 25.

- Mobile-first eSports platforms like Challengermode and Game.tv are expanding tournaments for smaller titles, democratizing competitive access.

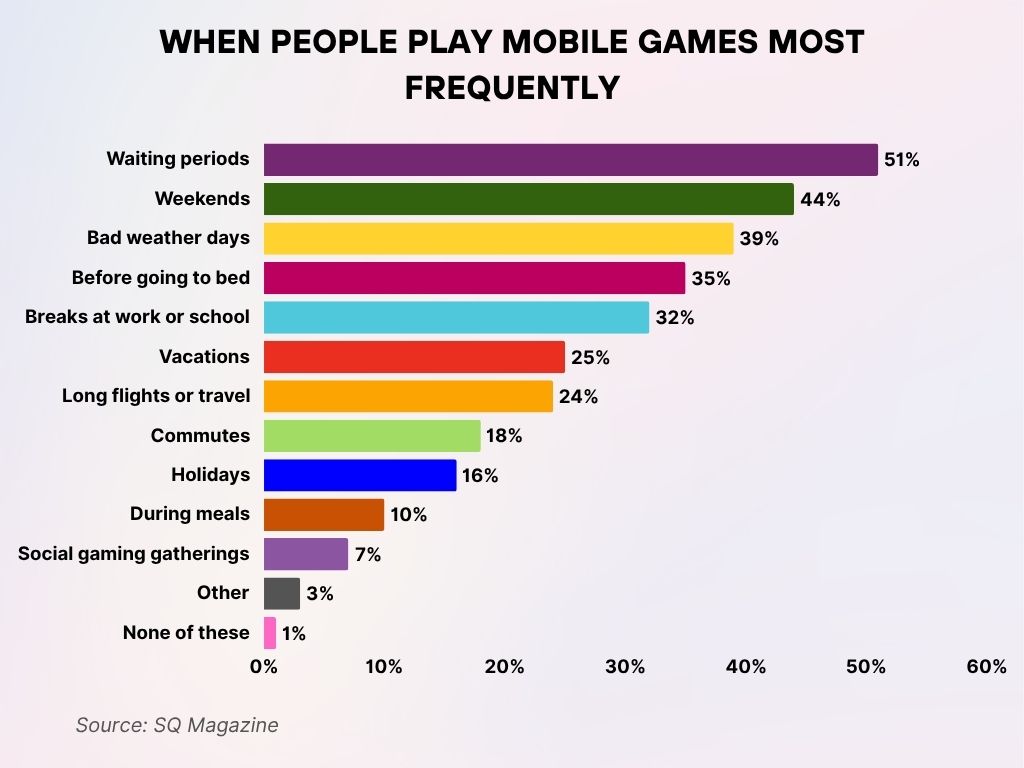

When People Play Mobile Games Most Frequently

- 51% of players turn to mobile games during waiting periods, making it the most popular occasion.

- 44% play more on weekends, enjoying extra leisure time.

- 39% pick up games on bad weather days, likely as indoor entertainment.

- 35% play before going to bed, showing gaming as part of nighttime routines.

- 32% game during breaks at work or school, using short free time to unwind.

- 25% play more on vacations, while 24% do so during long flights or travel.

- 18% play games on commutes, making use of travel time.

- 16% increase in gaming on holidays, likely due to free time and celebrations.

- 10% play during meals, highlighting gaming as a multitasking activity.

- 7% engage in social gaming gatherings, pointing to community playtime.

- 3% chose Other scenarios.

- Just 1% said none of these occasions applied to them.

User Retention and Engagement Metrics

- The average Day 1 retention rate for mobile games in 2025 stands at 32.5%.

- Day 7 retention has improved to 13.8%, largely due to better onboarding flows and real-time push notification strategies.

- Games with personalized user onboarding see a 45% higher retention rate than those with generic welcome flows.

- Puzzle and casual games maintain the highest session frequency, 4.1 sessions per user per day on average.

- The average mobile game session length is 17 minutes, with RPGs and multiplayer battle games driving the longest engagement.

- Implementing daily login rewards boosts 30-day retention by an average of 19%, especially in freemium models.

- Games that offer progressive leveling systems see 35% more time spent per session than those with static structures.

- Gamification elements like streaks, avatars, and virtual achievements have helped increase DAU (Daily Active Users) by 12.7% YoY.

- Social integration (e.g., co-op play, clan chats) increases player retention by up to 22% in strategy and combat games.

- Mobile games with integrated AI-based difficulty adjustment see higher engagement, especially among users aged 45+.

Advertising Trends in Mobile Games

- In 2025, mobile game ad revenue reached $62.1 billion globally, with video formats driving 68% of that.

- Rewarded ads remain the top-performing format, contributing to 45% of ad revenue across casual titles.

- Playable ads have a 3x higher engagement rate than static display formats and see CTR rates of up to 15.4%.

- The US leads mobile ad spending, generating $19.4 billion in mobile gaming ad revenue in 2025.

- Interstitial ads are still present but are used more strategically, games using fewer than three per session retain 27% more users.

- Integration of ad personalization via AI has led to a 12% boost in eCPM across Android platforms.

- Games using offerwalls as a secondary monetization option saw a 17% increase in ARPU, especially in Tier 2 and Tier 3 countries.

- Mobile developers have increasingly shifted to programmatic ad networks, now used in 73% of the top 200 games.

- Brand collaborations, like in-game items from fashion labels or films, have emerged as premium ad inventory, valued at $1.6 billion globally.

- The growing trend of short-form video ads under 10 seconds has increased ad completion rates to 91%.

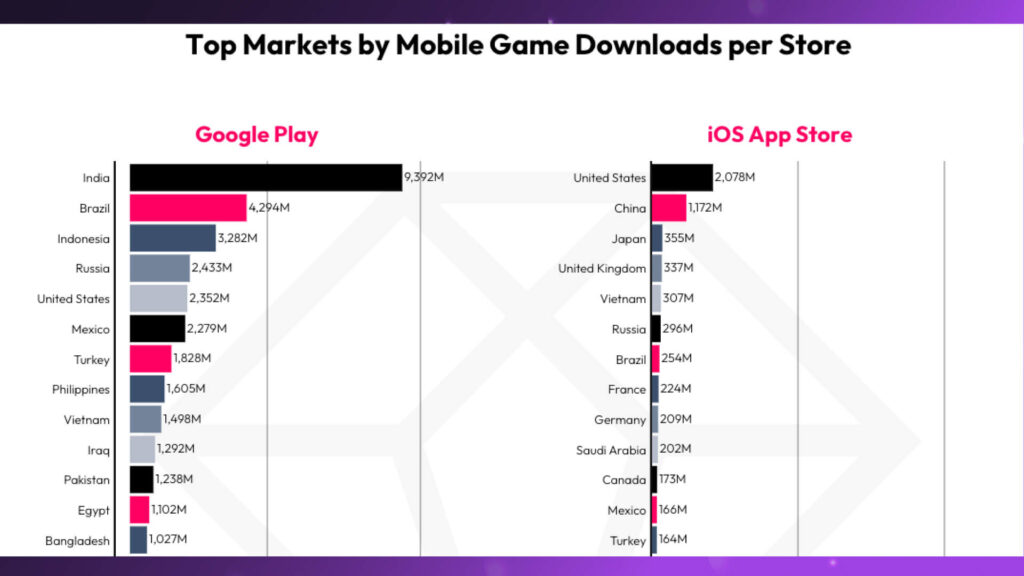

Top Countries by Mobile Game Downloads (Google Play vs. iOS App Store)

📱 Google Play:

- India dominates with 9.39 billion downloads, the highest globally.

- Brazil follows with 4.29 billion downloads, showing strong market engagement.

- Indonesia ranks third with 3.28 billion downloads.

- Other notable markets include:

- Russia: 2.43B

- United States: 2.35B

- Mexico: 2.28B

- Turkey: 1.83B

- Philippines: 1.60B

- Vietnam: 1.50B

- Iraq, Pakistan, Egypt, and Bangladesh also crossed 1B+ downloads each.

📲 iOS App Store:

- The United States leads with 2.08 billion downloads.

- China takes second place at 1.17 billion downloads.

Key iOS markets include:

- Japan: 355M

- United Kingdom: 337M

- Vietnam: 307M

- Russia: 296M

- Brazil: 254M

- France, Germany, and Saudi Arabia all exceed 200M+.

- Canada, Mexico, and Turkey complete the list with 170M–160M downloads.

Top Mobile Game Publishers and Developers

- Tencent Games remains the largest mobile game publisher, generating over $10.9 billion in 2025 mobile revenues alone.

- Activision Blizzard Mobile, driven by Call of Duty: Mobile and Candy Crush, earned $3.5 billion in the same year.

- miHoYo, developer of Genshin Impact, saw a record $2.6 billion mobile revenue in 2025.

- Supercell‘s new release, “Squad Busters,” gained over 80 million downloads in its first three months.

- Garena remains dominant in Southeast Asia, with Free Fire leading downloads and revenue in the region.

- Scopely, known for licensed titles like Star Trek Fleet Command, crossed $1.1 billion in mobile revenue in 2025.

- Playrix, developer of Homescapes and Gardenscapes, holds the #1 spot in puzzle game revenue worldwide.

- Zynga, now under Take-Two, launched a new social casino franchise, boosting its yearly mobile revenue to $950 million.

- NetEase released “Marvel Duel 2” in Q1 2025, already topping charts in China and Korea.

- Independent studio Dream Games, creator of Royal Match, hit $670 million in yearly earnings, outpacing many legacy studios.

Cloud Gaming and Its Role in Mobile

- Cloud gaming on mobile is now used by 27% of mobile gamers worldwide.

- Services like Xbox Cloud Gaming (xCloud) and NVIDIA GeForce NOW reported a combined $2.1 billion in mobile-based revenue.

- 70% of mobile cloud gamers say they use it to access AAA titles without needing a console or PC.

- Latency improvements through 5G have reduced lag by up to 40%, making real-time gameplay smoother for cloud-streamed titles.

- Subscription-based cloud services like Netflix Games and Apple Arcade Cloud saw user retention improve by 18% YoY.

- Game file size is less of a limitation as cloud lets players avoid downloads, saving an average of 3.4 GB per title.

- Cross-save functionality between mobile cloud and PC grew by 27%, enabling seamless transitions between platforms.

- Cloud gaming usage in emerging markets surged 33%, largely due to smartphone-first player bases and low desktop penetration.

- Indie developers leveraging cloud infrastructure can now distribute complex multiplayer titles to mobile with minimal latency.

Security and Privacy Concerns in Mobile Games

- 42% of mobile gamers in 2025 expressed concern over data privacy, especially with third-party ad SDKs.

- The introduction of Google’s Privacy Sandbox for Android is reshaping data collection practices, affecting 35% of ad networks.

- Over 1.3 billion fake accounts were detected and banned across major mobile games this year.

- Facial recognition and biometric logins are now supported in 28% of top-grossing games for added security.

- Children’s mobile games came under scrutiny, leading to new compliance rules under the revised US COPPA guidelines.

- In 2025, phishing scams via fake game clones rose 18%, with app stores removing 17,000 fraudulent titles in Q1 alone.

- Two-factor authentication (2FA) adoption among players has reached 54%, especially in PvP and eSports-enabled titles.

- Game developers using zero-knowledge login protocols are on the rise, ensuring minimal user data retention.

- In-game chat monitoring tools powered by AI helped reduce toxic behavior and grooming risks by 31% YoY.

- Leading publishers now offer transparency dashboards, allowing players to review data stored and request deletion.

Recent Developments in Mobile Gaming

- AI-powered NPCs are now standard in over 65% of strategy and adventure games, enabling real-time adaptive dialogue.

- Wearable integration, especially with smartwatches and AR glasses, is now a key focus for developers building fitness and action games.

- Apple’s new Game Mode in iOS 18 optimizes performance and battery life for high-end mobile gaming sessions.

- Haptic feedback innovations in 2025 have created richer, controller-like tactile experiences on mobile devices.

- AR gaming surged after the launch of “Pokémon Discover”, which blends AI-generated environments with real-world landmarks.

- Voice-controlled mobile games saw a 39% increase in downloads, largely driven by accessibility innovations.

- Netflix’s original game titles, like “Stranger Things: Dark Night”, garnered critical acclaim and over 50 million downloads globally.

- Blockchain-backed mobile games have declined in popularity by 26%, as focus shifts to more sustainable reward models.

- Accessibility features, like screen readers and customizable interfaces, are now present in over 40% of new releases.

- Game publishers are increasingly relying on AI for level design, cutting development cycles by up to 22%.

Conclusion

Mobile gaming in 2025 is no longer a niche or complementary medium, it’s the central pillar of global gaming culture. With exponential growth across monetization, eSports, cloud accessibility, and user engagement, the mobile ecosystem is more complex and promising than ever. Developers are innovating faster, players are engaging deeper, and markets that were once peripheral are now at the forefront of industry momentum.

Whether you’re a marketer, developer, investor, or player, understanding this space isn’t optional; it’s essential. As the line between casual and core gaming blurs, and mobile devices become powerful consoles in your pocket, the next level is already here. All you need to do is tap “Play.”