Figma has risen from a niche design tool to an industry powerhouse. In real-world terms, this size enables Figma to staff robust AI, product, and design teams, for example, to build Figma Make, which turns text prompts into working prototypes, and to scale operations in regions like Asia or Europe for localized growth. Below you’ll find detailed data and trends about how Figma’s workforce has developed over time.

How Many People Work At Figma?

- 1,646 employees as of March 31, 2025, up 62.33 % year over year.

- Over 1,600 employees globally (per Figma’s own newsroom).

- Employee growth of 632 new hires compared to the prior year.

- According to comments by Figma’s leadership and third-party surveys, a significant portion of users, estimated at around 66%, are not professional designers, indicating the platform’s broader accessibility

- Approximately 85 % of Figma’s users are located outside the U.S.

- In Q2 2025, revenue grew 41 %, reaching $249.6 million.

- As of mid-2025, Figma launched its IPO under the ticker FIG.

Recent Developments

- Figma has publicly stated it now has over 1,600 employees globally.

- The company continues to expand its product suite with Figma Make, Figma Sites, and more AI-based tools.

- In Q2 2025, revenue surged 41 % year over year, reflecting reinvestment into talent and infrastructure.

- Figma has ramped hiring, some sources report 1,916 total employees by mid-2025, a 12.9 % increase from prior figures.

- The IPO filing and debut have sharpened investor focus on headcount, burn rates, and growth.

- Figma increased its large-account/customer base, and customers spending $100K+ annually grew 47 % year over year.

- The firm’s IPO valuation opened above expectations, putting pressure on scaling responsibly.

Figma’s Current Team (Key People)

- Dylan Field – Co-Founder, Chief Executive Officer, President, and Chairman as of April 2025. He has led Figma since its founding and remains deeply involved in vision, operations, and fundraising.

- Yuhki Yamashita – Chief Product Officer. He oversees product strategy, feature development, design systems, and integrations.

- Praveer Melwani – Chief Financial Officer. He handles financial planning, investor relations, and capital structure.

- Nadia Singer – Chief People Officer. She leads talent acquisition, HR, culture, and people operations.

- Sheila Joglekar Vashee – Chief Marketing Officer. She drives Figma’s global marketing, brand, and growth initiatives.

- Nairi Hourdajian – Chief Communications Officer. She leads corporate communications, media strategy, and public messaging.

- Mike Krieger – Board Director (joined in 2025). Known for co-founding Instagram and as a product leader, he brings deep product and design experience.

- Luis von Ahn – Board Director (joined in 2025). Co-founder and CEO of Duolingo, bringing entrepreneurial and design-oriented leadership to the board.

- Bill McDermott – Board Director (joined in 2025). Former CEO of ServiceNow, providing enterprise and go-to-market experience at the board level.

- Other Board Members & Advisors – Figma’s Board includes additional members such as Mamoon Hamid, Kelly Kramer, John Lilly, Andrew Reed, Danny Rimer, and Lynn Vojvodich Radakovich, contributing backgrounds in venture capital, operations, and technology.

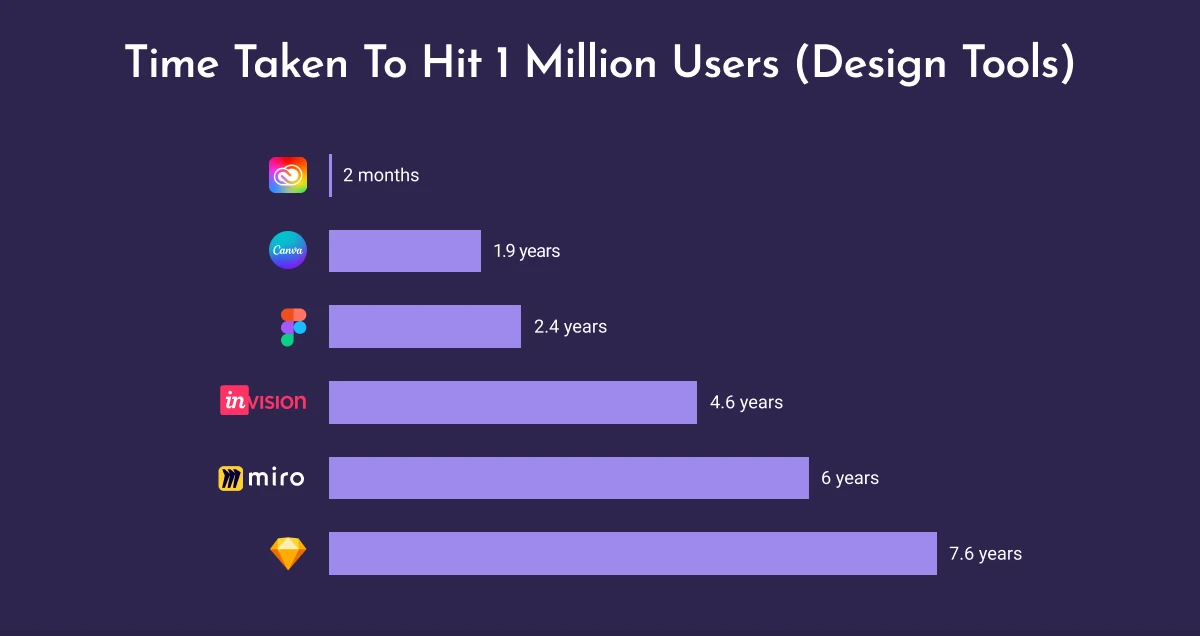

Time Taken to Reach 1 Million Users (Design Tools)

- Adobe Creative Cloud Express hit 1 million users in just 2 months, showcasing explosive early adoption.

- Canva reached 1 million users in 1.9 years, reflecting strong mainstream appeal in design.

- Figma achieved 1 million users in 2.4 years, driven by collaborative design features.

- InVision took 4.6 years to cross 1 million users, slower compared to newer rivals.

- Miro needed 6 years to reach the milestone, highlighting its gradual adoption curve.

- Sketch had the slowest path, taking 7.6 years to hit 1 million users.

Headcount Growth

- From ~1,014 employees (Dec 2022) to 1,646 by March 2025, a growth of ~62.3 %.

- Net increase of 632 employees in the latest period measured.

- Some sources list 1,916 employees as of mid-2025, implying more growth beyond public filings.

- Using alternate sources, Figma is sometimes cited as having 2,119 employees in 2025.

- PitchBook indicates 2,473 employees in 2025, potentially inclusive of contractors or subsidiaries.

- The variation in numbers suggests either rapid hiring, late reporting, or inclusion of non-full-time staff.

- Growth rate between the last measurable year and 2025 is often reported between ~12 % to 60+ %, depending on the source definition.

- The hiring spike correlates with product expansion and IPO preparation, often a lead indicator of a strategy shift.

- Some headcount increases are likely concentrated in engineering, AI, and product teams to support Figma’s toolset expansion.

Numbers by Year

- 2022 (end of year), ~1,014 employees (baseline for comparison).

- 2023, Implied headcount ~1,014 + growth (data less clearly published).

- March 31, 2025, 1,646 employees.

- Mid 2025 (Alternative figure), 1,916 employees.

- 2025 (other reports), 2,119 employees.

- 2025 (PitchBook estimate), 2,473 employees, including wider definitions.

- Growth from 2022 to 2025 (core reported numbers), ~62 %.

- Year-over-year percent growth in the recent period, +62.33 % (from the prior year).

- The year-on-year deltas emphasize that Figma is scaling aggressively around its product and monetization inflection points.

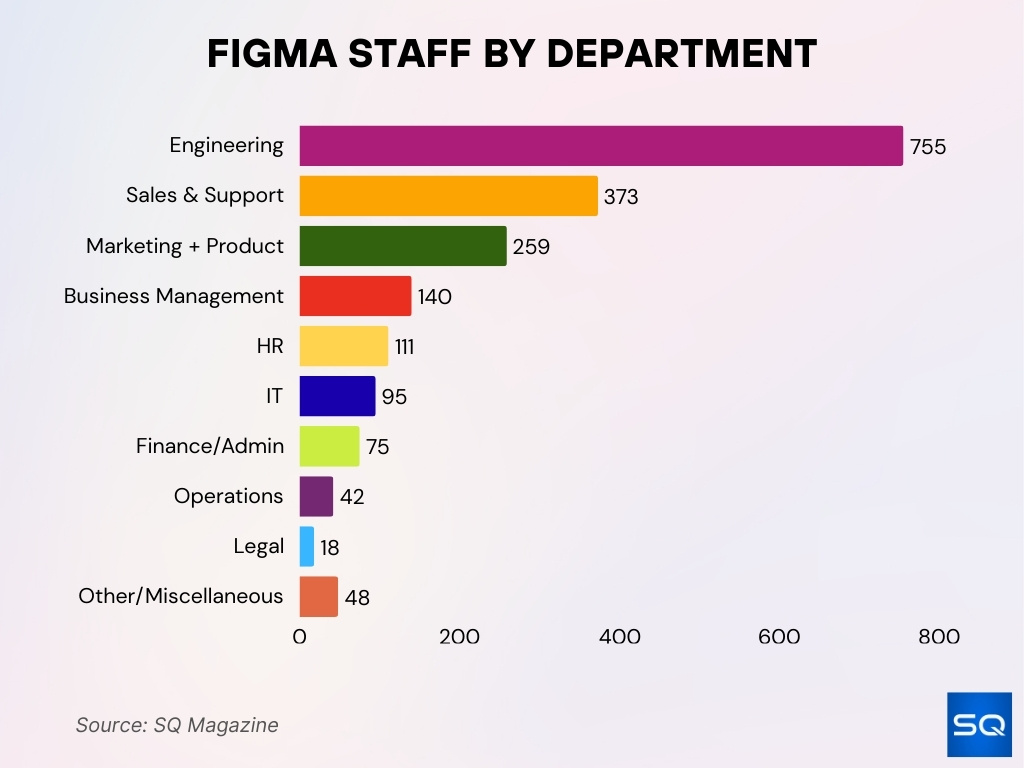

By Department

- Engineering is the largest department, with ~ 755 employees, representing around 39-40 % of the total staff.

- Sales & Support comprises ~ 373 employees, a major customer-facing function.

- Marketing + Product combine for ~ 259 employees (together forming the “product and market” core).

- Business Management (strategy, corporate planning) accounts for ~ 140 employees.

- HR totals ~ 111 employees (people operations, recruiting, etc.).

- Information Technology (internal infrastructure, tools) has ~ 95 employees.

- Finance & Administration functions number ~ 75 employees.

- Operations teams (logistics, cross-functional support) count ~ 42 employees.

- Legal / compliance / “Other” roles fill out the rest, ~ 18 in Legal plus ~ 48 in other miscellaneous roles.

New Hires & Attrition Rate

- In 2025, Figma added 105 new hires (year-to-date in that dataset).

- Those new hires represent ~ 5 % of the total workforce.

- Reported attrition (voluntary turnover) is near 5 % of the total staff.

- Year-over-year headcount growth is ~ 7.2 % (i.e., net increase over last year).

- Because hiring (5 %) exceeds attrition (5 %) by a margin, Figma experiences modest net growth.

- Balanced attrition rates across departments reduce over-dependency on any single team losing talent.

- The scale of “Other/remote/regional” roles suggests some flexibility in staff movement and location switching rather than full exit.

- Owing to public data limitations, we don’t see detailed attrition by function, but the aggregate numbers point to relatively stable retention.

Average Salary & Compensation

- Total compensation at Figma ranges from $79,600 (Data Analyst, low end) up to $732,896 (Senior Software Engineer or higher) per year.

- The reported average annual salary across the company is ~ $131,945 (base + extras).

- Software engineering roles often command six-figure base salaries, e.g., L1 ~ $125,000, L2 ~ $170,000, up to Level 5 roles with high equity components.

- Some reported base for Level 4 engineers is ~$200,000 to $250,000 (plus RSUs).

- Software engineers at Figma in New York earn between $118,000 and $178,000 per year (base estimates).

- The highest paid position reported is Director of Sales at ~$209,956.48 annually.

- Figma’s compensation & benefits rating is ~ 3.8 out of 5 according to employee reviews.

- Legal roles (General Counsel) at ~$306,715 per year, while admin roles may fall much lower.

- The wide variance between roles highlights the impact of role seniority, equity, location, and performance bonuses in pay structure.

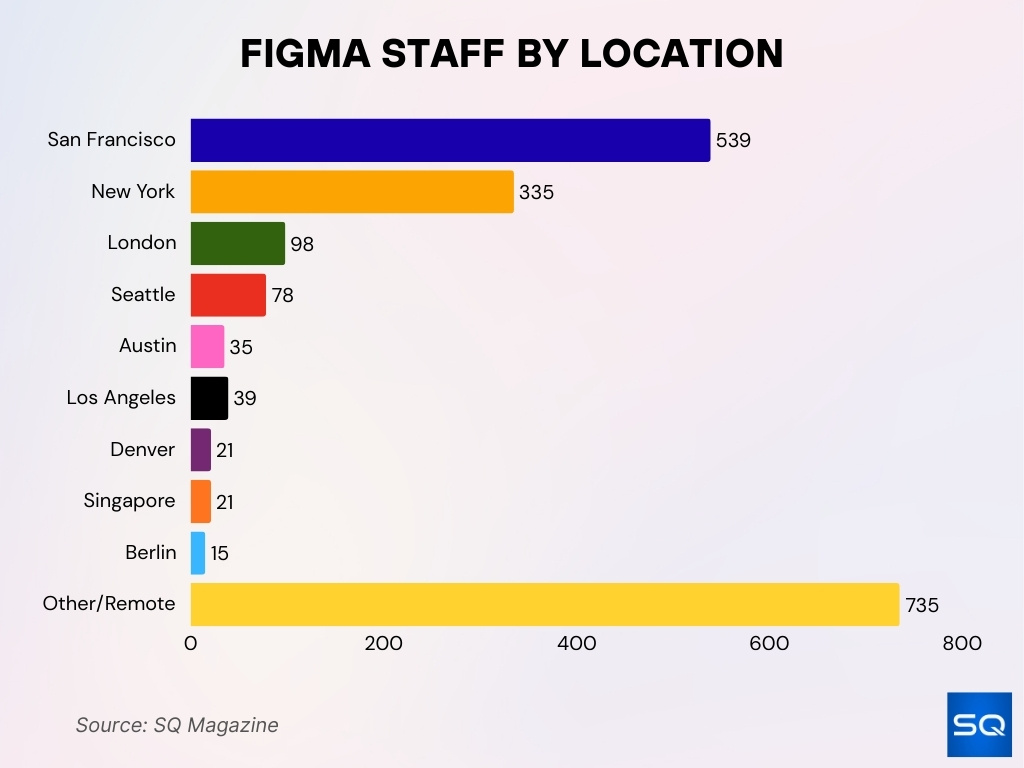

Distribution by Location

- San Francisco is Figma’s largest office hub with ~ 539 employees working there.

- New York is second, with ~ 335 employees stationed there.

- London, ~ 98 employees.

- Seattle, ~ 78 employees.

- Austin, TX, ~ 35 employees.

- Los Angeles, ~ 39 employees.

- Denver, ~ 21 employees.

- Singapore, ~ 21 employees.

- Berlin, ~ 15 employees.

- The “Other” category (smaller offices, remote or regional hubs) covers ~ 735 employees, ~ 38 % of Figma’s workforce.

Employee Satisfaction & Culture Ratings

- On Glassdoor, employees rate Figma 3.9 out of 5 overall.

- ~ 69 % of employees would recommend working at Figma to a friend.

- ~ 80 % of employees believe Figma has a positive business outlook.

- On Glassdoor, the sub-ratings include work-life balance ~ 3.2, culture & values ~ 4.0, career opportunities ~ 3.5 (out of 5).

- On Blind (employee community platform), Figma gets a rating of 4.4 out of 5 overall (based on 159 reviews).

- In those Blind reviews, Company Culture, 4.5 / 5.

- Compensation / Benefits, 4.1 / 5.

- Management, 3.9 / 5.

- On Great Place to Work metrics, ~ 96 % of Figma employees say it is a “great place to work” (though this is older data).

- In reviews, positive remarks highlight a strong mission, autonomy, and interesting work; negatives tend to cite leadership consistency, workload, and compensation.

Office Locations

- The main headquarters is at 760 Market Street, Floor 10, San Francisco, CA.

- Hub offices also exist in New York, London, Berlin, Paris, Tokyo, Seattle, Singapore, and possibly additional regional sites.

- Figma follows a hybrid work model, combining remote flexibility with hub-based work in key cities.

- In San Francisco, the headquarters houses central leadership, product, and core engineering teams.

- New York serves as a major U.S. hub for product, sales, and regional operations.

- European operations are anchored via the London and Berlin offices, enabling closer engagement with EMEA markets.

- The Tokyo and Singapore offices help Figma expand its presence in Asia and Southeast Asia.

- Reviews and local listings show these same geographies as active office locations.

- Some offices are smaller or serve as remote/“hub” anchors rather than fully staffed centers.

- In total, Figma currently lists eight global offices in addition to its HQ.

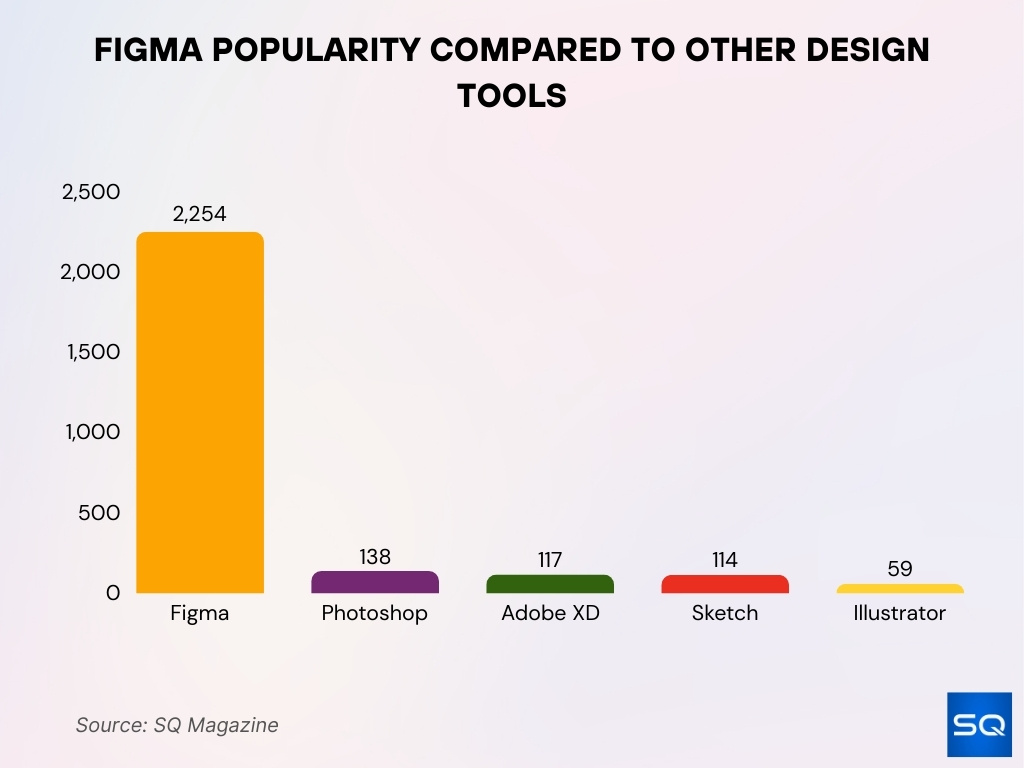

Figma Popularity Compared to Other Design Tools

- Figma dominates with a popularity score of 2,254, far ahead of all competitors.

- Photoshop follows at just 138, showing how much smaller its share is compared to Figma.

- Adobe XD records 117, reflecting limited adoption despite Adobe’s ecosystem.

- Sketch stands close with 114, but is still dwarfed by Figma’s reach.

- Illustrator trails at only 59, highlighting its niche use in design workflows.

Comparison with Competing Companies (Employee Size)

- Adobe, one of Figma’s historic competitors, had ~ 35,000 employees as of recent years, vastly larger than Figma’s ~1,600–2,000 scale.

- Canva reportedly has over 4,000 employees globally, placing it ahead of Figma in sheer headcount.

- Webflow and Framer are smaller by headcount, estimates put them in the hundreds to low thousands of employees, well under Figma’s size.

- In terms of design & collaboration tools, Figma’s direct headcount scale is closer to niche players like Sketch’s maintaining teams, but Figma outpaces many in growth and institutional backing.

- As Figma introduces tools overlapping with Webflow (Figma Sites) and Canva (Figma Buzz), its ability to staff product, AI, and infrastructure aggressively becomes a differentiator.

- Compared to large SaaS companies of scale, Figma is still small, but in the design-tool niche, it is among the larger players by headcount.

- Figma’s acquisition of talent, features, and global presence may give it leverage to compete in staffing breadth against older, more diversified incumbents.

- The contrast in size also implies different operational pressures (e.g., culture, management layers) than extremely large incumbents.

- In sum, Figma’s headcount places it between boutique niche design firms and sprawling, diversified software giants.

Future Outlook for Headcount

- Given the current trajectory, Figma may double its headcount within 3–5 years as product scope, markets, and enterprise ramp increase.

- AI, infrastructure, and web publishing modules will likely receive disproportionate staffing growth.

- Regional offices (Asia, LATAM) may expand to reduce latency, improve localization, and support sales growth.

- Remote and distributed roles may form a larger share of total staffing, especially in less core functions.

- Figma may adopt more contractors/freelancers / part-time specialists to manage scaling risk.

- The company may increasingly invest in leadership development and management training to support new layers.

- Staff in legal, compliance, security, data privacy, and risk roles will likely grow as regulation intensifies.

- A push into adjacent verticals (e.g., marketing tools, site publishing) may lead to expansion of cross-domain teams.

- Figma must balance growth with retention strategies; investments in culture, perks, and internal mobility will matter.

- As Figma becomes more mature, we could see stabilization of headcount growth to more modest annual percentages (e.g., 10–20 %) as it focuses on profitability and operational efficiency.

Frequently Asked Questions (FAQs)

As of March 31, 2025, Figma had 1,646 employees.

That represented an increase of 632 employees, or 62.33 % growth over the prior year.

Some sources place Figma’s workforce in 2025 at 2,119 employees.

UnifyGTM reports that Figma had 1,916 total employees by mid-2025 (a 12.9 % increase).

Conclusion

Figma has grown into a mid-sized technology company. Its workforce composition, growth patterns, and geographic footprint reflect a company in transition, from lean startup to scalable software platform. While its headcount still lags much larger rivals, its agility, talent investments, and product expansion keep it in a nimble position.

In scaling further, Figma must guard against cultural drift, operational overload, and retention challenges. Nonetheless, its trajectory suggests it will continue to hire in AI, infrastructure, and new product domains, further cementing its position as a leading design and web platform.

Explore the full article to dive deeper into Figma’s department-level trends, compensation patterns, and what it all means for its next phase of growth.