In the financial services sector, the adoption of blockchain technology has shifted from “nice to have” to a business imperative. From faster payments to stronger compliance, financial institutions are embracing blockchain to drive change. For example, major banks are now deploying blockchain networks to support settlement systems, and global firms are tokenizing assets to deepen liquidity. In retail banking, the technology is also powering digital identity verification and cost reductions. Read on to explore detailed statistics on how blockchain is transforming finance.

Editor’s Choice

- Over 80% of Fortune 500 companies are using blockchain in some capacity in 2025.

- Among financial institutions surveyed, traditional banks showed a blockchain adoption increase of 47.3%, while fintech firms demonstrated 68.9% adoption in a recent study.

- Banking holds the largest share (approx. 29‑30%) of blockchain usage within industry verticals according to a 2025 estimate.

- Institutional adoption is now production, not pilot, with major banks, asset managers, and insurers deploying live systems in 2025.

- Empirical data show that blockchain adoption correlates with greater transparency and lower operating costs within banking operations.

Recent Developments

- Blockchain use in payment reconciliation reduced error rates by over 90% in 2025.

- Real-time gross settlement systems using blockchain processed over $3 trillion in transactions in 2025.

- Contactless payments powered by blockchain grew by 33% year-over-year in 2025.

- 84% of fintech companies globally included blockchain in their payment infrastructure in 2025.

- Banks adopting blockchain showed a transparency improvement with a beta value of approximately 0.218.

- Blockchain adoption resulted in a statistically significant reduction in operating costs with a beta value of around -0.109.

- Global blockchain-based peer-to-peer lending platforms processed loans worth $176.5 billion in 2025.

- 89% of surveyed financial institutions reported improved transparency and trust in trade finance using blockchain in 2025.

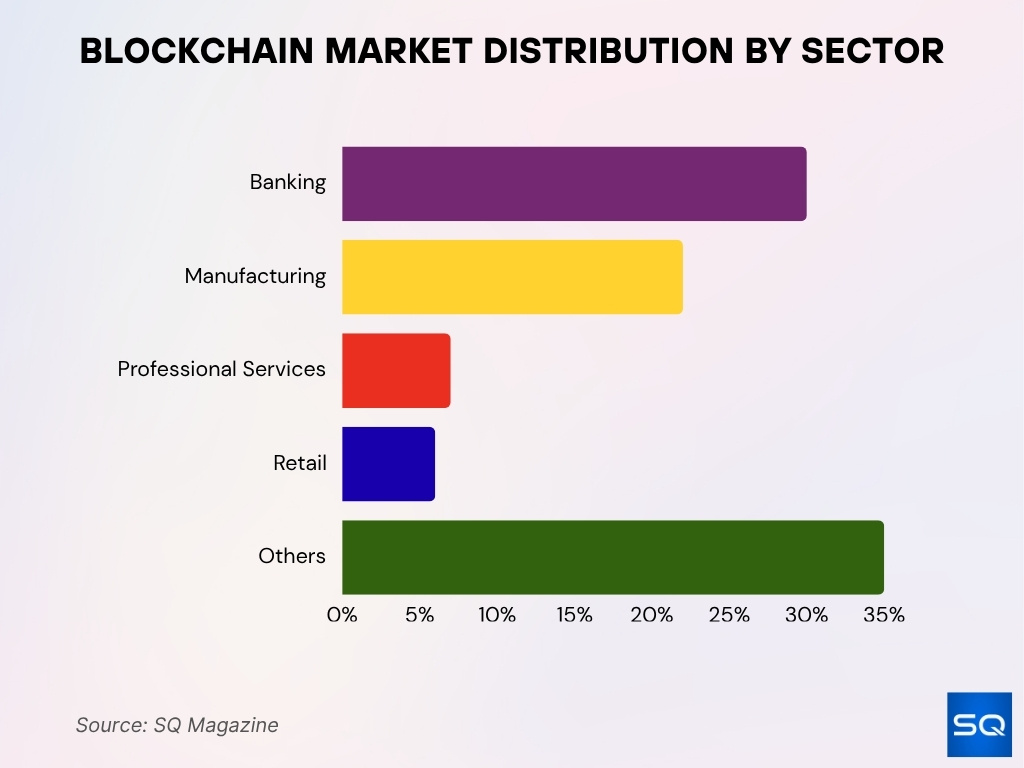

Blockchain Market Share by Sector

- Banking: Largest share at 29–30%, led by adoption in cross-border payments, trade finance, and digital identity.

- Manufacturing: Holds 21–22%, driven by use in supply chain transparency, inventory tracking, and smart contracts.

- Professional Services: Accounts for 6–7%, used for auditing, compliance, and legal document verification.

- Retail: Makes up 6%, fueled by loyalty programs, product authentication, and data security use cases.

- Others: Covers 35%, including energy, healthcare, and logistics, focusing on secure data exchange and process efficiency.

Blockchain Adoption Rates in Financial Services

- A study found that approximately 47.3% of traditional banks increased blockchain adoption, while fintech peers reached approximately 68.9%.

- Banking accounted for 29‑30% of overall blockchain deployment across sectors in 2025.

- More than 80% of Fortune 500 companies will have adopted blockchain technology in some form by 2025.

- In emerging markets, blockchain in financial services is being studied as part of broader inclusion efforts up to 2025.

Major Use Cases in Financial Services

- Blockchain reduces payment settlement times by up to 88% with an average settlement in 27 seconds in 2025.

- Cross-border blockchain payments grew at 45% annually, reaching $3 trillion in 2025.

- 56% of global banks actively participate in cross-border blockchain initiatives in 2025.

- Total Value Locked (TVL) in DeFi protocols reached $123.6 billion with 14.2 million active users in 2025.

- Crypto lending platforms with full KYC compliance saw 28% higher lending volumes in 2025.

- 78% of institutional investors had formal crypto risk management frameworks, including blockchain solutions, in 2025.

- Blockchain-based digital identity management market expected to reach $1.57 billion in 2025, growing at a CAGR of 85.6%.

- Tokenized real-world assets reached a total value of approximately $33 billion in 2025.

- Central banks and financial institutions deploy blockchain CBDC frameworks, with more than 30 countries piloting digital currencies by 2025.

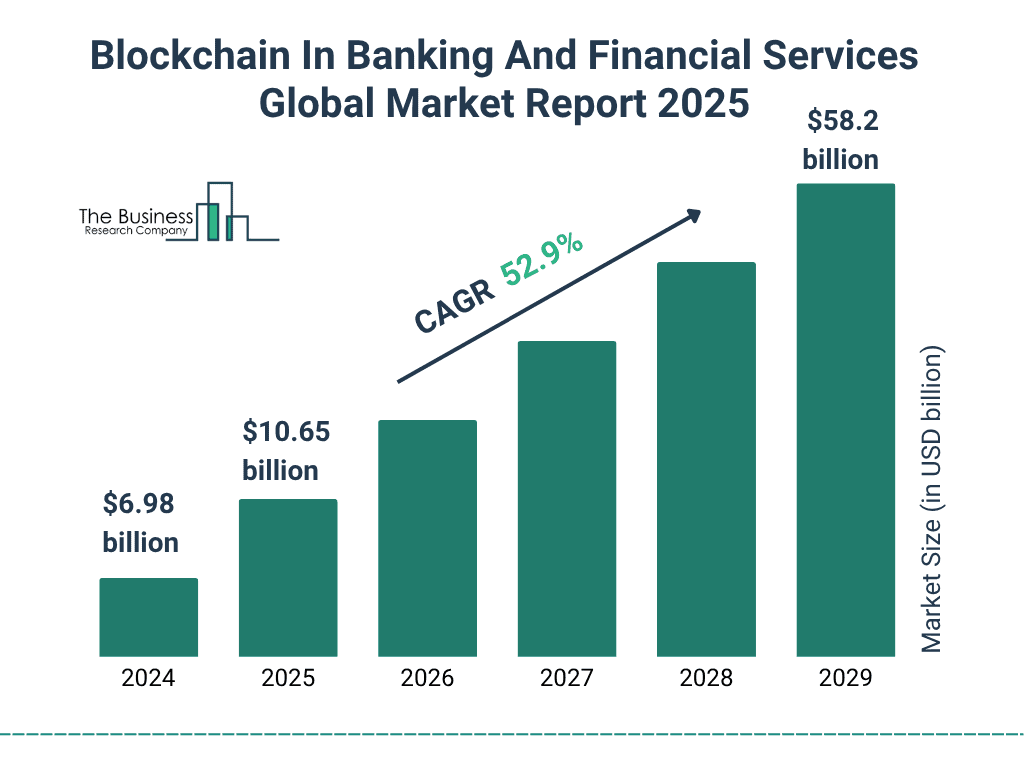

Blockchain in Banking and Financial Services Growth

- CAGR of 52.9% projected for blockchain in banking and finance from 2024 to 2029.

- Market to grow from $6.98 billion in 2024 to $58.2 billion by 2029, showing rapid expansion.

- 2025 forecast: $10.65 billion, fueled by blockchain in payments, settlements, and digital ID.

- 2026 estimate: over $16 billion, driven by cross-border transactions and DeFi use cases.

- 2027–2028: fast growth phase pushing market past $37 billion as adoption scales.

- Growth highlights blockchain’s rising impact on security, transparency, and cost efficiency in finance.

Payments and Settlements Powered by Blockchain

- In 2025, blockchain‑based payment systems cut settlement times from hours or days to minutes or seconds in many deployments.

- Nearly 90% of businesses involved in payment processing deployed blockchain‑based solutions in 2025, with more than 560 million users worldwide.

- Settlement network errors decreased by approximately 42.6% in institutions adopting blockchain engines.

- Smart‑contract‑enabled payment rails automate up to 60% of manual reconciliation steps in large banks.

- Corporations using blockchain for settlement report cost savings of 15% to 30% in payment‑processing overhead.

- Blockchain‑powered settlement networks are projected to support more than $2 trillion in cross‑border payment volume in 2025.

- More than 560 million people globally use blockchain‑enabled payment systems in 2025.

Cross‑Border Transactions and Remittances

- Global cross‑border payments exceeded $40 trillion in 2024 and are expected to grow about 5% per year through 2027.

- Blockchain‑enabled cross‑border transaction fees in 2025 are 70% to 80% lower than traditional correspondent‑banking fees.

- Settlement time for cross‑border payments can drop from 3–5 business days to under an hour using blockchain or tokenised rails.

- Blockchain‑enabled remittance flows handled approximately 15% of global remittance volume, around $100 billion in 2025.

- Stablecoins are used for approximately 3% of the $200 trillion global cross‑border payments volume by 2025.

- Digital money and blockchain rails could reduce remittance costs by up to 60% in certain corridors.

- Blockchain real‑time rails are most active in emerging‑market corridors with the highest traditional‑fee burdens.

- Some banks eliminate “nostro‑vostro” pre-funding through blockchain, freeing up liquidity tied in correspondent accounts.

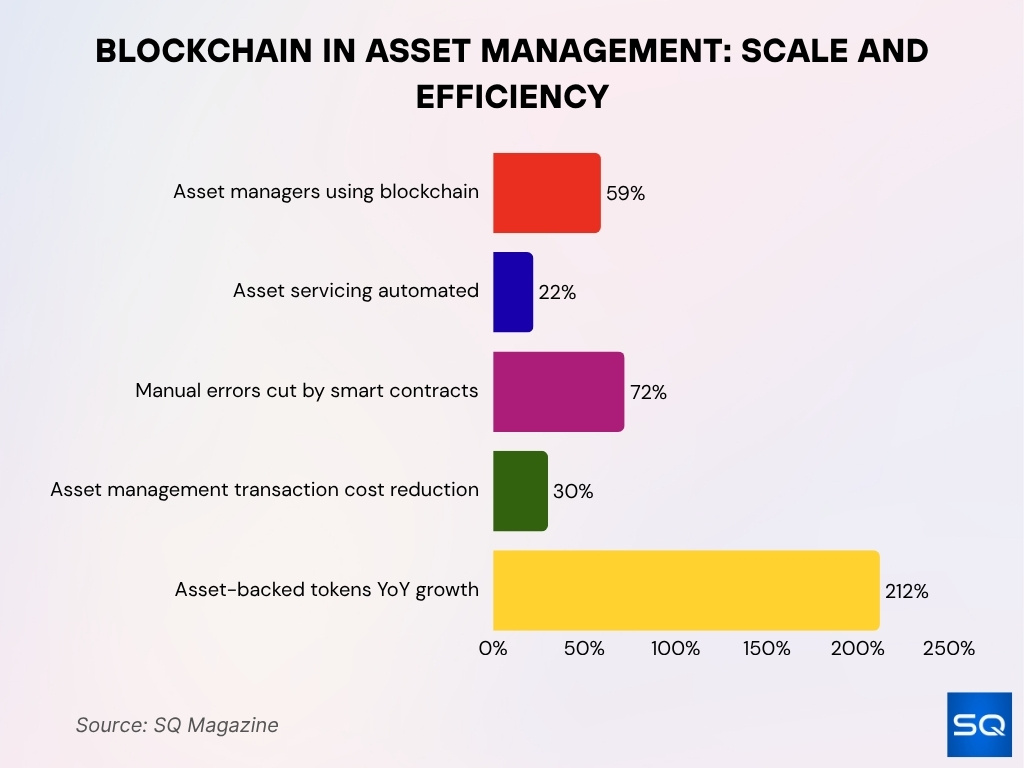

Blockchain Transforming Asset Management

- 59% of asset managers globally use blockchain for portfolio management in 2025.

- 22% of asset servicing is automated by smart contracts, reducing manual errors by 72%.

- Transaction costs dropped by up to 30%, enabling broader investment access via blockchain.

- Asset-backed tokens surged 212% YoY, led by gold, real estate, and private credit.

Decentralized Finance (DeFi) in Financial Services

- By mid‑2025, active DeFi wallets reached 14.2 million globally.

- Weekly DeFi transaction volume exceeded $48 billion by mid‑2025.

- The average DeFi user executed 11.6 transactions per month in the same period.

- Mobile DeFi wallets grew by 45%, representing 58% of users in 2025.

- More than 2,000 decentralized applications will include DeFi modules by 2025.

- Research notes that DeFi still presents wealth‑concentration risks and high vulnerability exposures.

- Only a fraction of jurisdictions have defined comprehensive DeFi frameworks as of 2025.

Blockchain for Regulatory Compliance and AML

- Blockchain‑based systems enabled more than 470 million people to access financial services for the first time by 2025 via digital identity and KYC solutions.

- Blockchain in AML compliance reduced transaction‑processing costs by 42.6% and decreased cross‑border times by 78.3% in some cases.

- About 40 jurisdictions were evaluated as largely compliant with updated crypto‑asset AML standards in 2025.

- The blockchain identity innovation market is projected to reach $7.6 billion in 2025, according to alternative forecasts.

- Institutions using blockchain identity systems cut onboarding time by 20% to 40% compared to legacy KYC.

- 2025 saw a decisive regulatory shift with more agile compliance models using blockchain‑powered tools.

- Private‑blockchain rails and RegTech solutions are increasingly embedded in AML frameworks for digital‑asset institutions.

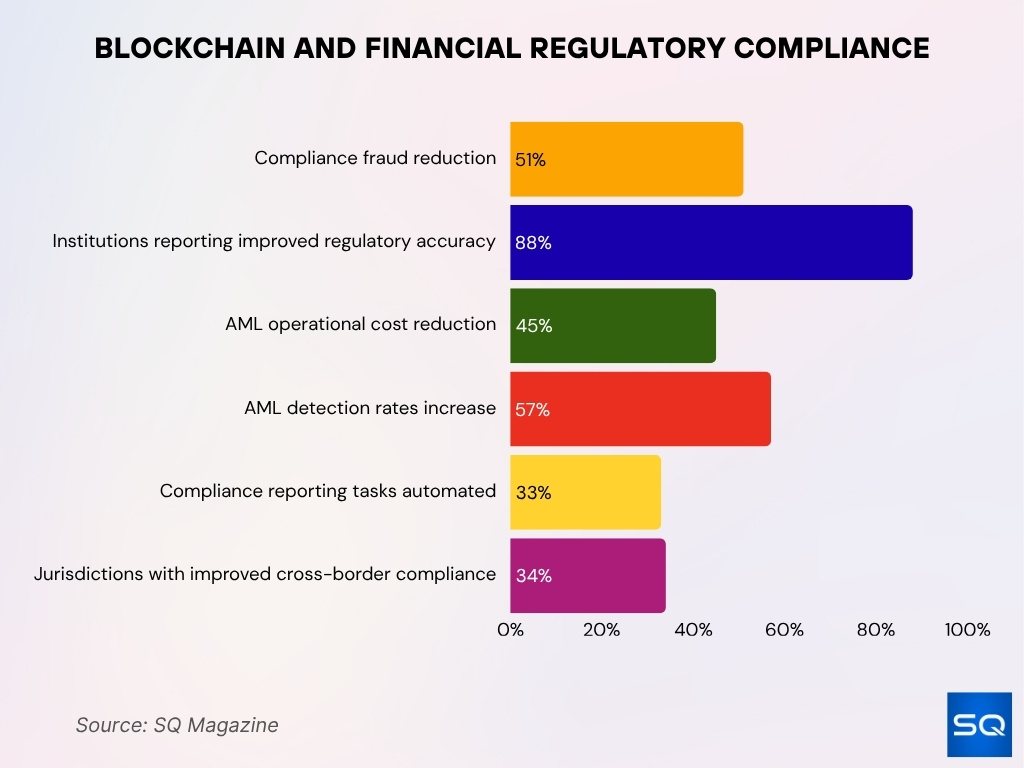

Blockchain Modernizing Regulatory Compliance

- Compliance-related fraud fell by 51% in 2025 due to blockchain’s immutable ledger.

- 88% of financial institutions using blockchain saw improved regulatory accuracy in 2025.

- AML process automation via blockchain cut operational costs by 45% and boosted detection by 57%.

- 33% of compliance reporting tasks were automated with centralized blockchain, reducing human errors.

- Cross-border compliance transparency rose, curbing tax evasion across 34% more jurisdictions in 2025.

Impact on Fraud Prevention and Risk Management

- In 2024, U.S. consumer fraud losses exceeded $12.5 billion, a year‑over‑year increase of about 25%.

- 79% of organizations experienced attempted or actual payment fraud in 2024.

- 63% cited business email compromise as their primary fraud vector.

- 87% of financial institutions saw positive ROI from fraud‑prevention investments.

- Blockchain systems reduced processing costs by 42.6% and cross‑border processing times by 78.3% in certain models.

- Immutable ledgers and big‑data analytics improved detection of anomalous flows and strengthened risk‑management capabilities.

- Using blockchain for identity verification reduces onboarding time by up to 40%, lowering exposure to identity‑fraud risk.

- Synthetic identity fraud continues to rise, with professionals expecting growth through 2025.

- Blockchain‑based verification reduces false positives in fraud‑alert systems by around 30%.

Blockchain‑Based Digital Identity and KYC

- The global blockchain identity‑management market is projected to grow from $1.57 billion in 2025 to $118.96 billion by 2032.

- Institutions adopting blockchain identity systems reduced onboarding times by 20%‑40%.

- More than 470 million people gained access to financial services through these identity solutions by 2025.

- Shared blockchain KYC ledgers reduce duplicate verification and customer friction.

- By mid‑2025, more than 40 jurisdictions had launched blockchain‑based identity pilots.

- Smart‑ledger identity systems produced 30%‑50% cost reductions in KYC operations.

- The decentralised ledger model improves the integrity of identity records and reduces identity theft occurrences.

Tokenization of Financial Assets

- The global tokenization market is projected to reach $1,244.18 billion in 2025, up from $865.54 billion in 2024.

- Tokenised U.S. treasuries and money‑market assets reached $7.4 billion in 2025, an 80% YTD increase.

- Tokenised real‑world assets reached nearly $18 billion on public blockchains by early 2025.

- Asset managers are shifting from pilot programs to production‑grade tokenized funds in 2025.

- Liquidity remains limited for many token classes, with low secondary‑market activity.

Central Bank Digital Currencies (CBDCs) and Stablecoins

- By March 2025, circulation of the digital rupee reached ₹10.16 billion, about 334% higher than in 2024.

- Global stablecoin transaction volume reached $4 trillion from January to July 2025, with annualised estimates near $8 trillion.

- Stablecoin‑based cross‑border payments reduce costs by up to 96%, with fees as low as 0.5%.

- More than 75% of U.S. banks were exploring or piloting stablecoin integration in 2025.

- CBDC models can reduce intermediary fees and improve cost structures for fintechs.

- Over 100 central banks were engaged in CBDC development by early 2025.

- Many stablecoins still underperform traditional money on metrics like liquidity and safety.

Cost Reduction and Operational Efficiency

- Blockchain reduces transaction costs by 30%‑40%, with some networks offering fees below 1%.

- Blockchain implementation led to a 42.6% cost reduction and 78.3% drop in cross‑border processing time in one study.

- Smart contracts can cut trade‑finance costs by 50%‑80%.

- Blockchain adoption significantly improves operational efficiency and reduces overhead in banking.

- Real‑time clearing and settlement reduce idle capital and improve liquidity efficiency.

- Shared blockchain infrastructure reduces fixed costs for institutions entering digital‑financial markets.

- Blockchain‑based onboarding reduces staffing and error‑correction overhead alongside time savings.

Key Challenges and Barriers to Adoption

- 73% of financial institutions cited regulatory uncertainty as the top barrier to blockchain adoption in 2025.

- Integration with legacy systems is challenged by 65% of firms due to outdated technology and security risks.

- Scalability limits affect transaction throughput, with major blockchains processing only 15-30 transactions per second as of 2025.

- Over $21 billion in tokenized real-world assets face liquidity constraints due to regulatory and market structure barriers.

- 77% of crypto and blockchain firms report data privacy and governance as major compliance challenges in 2025.

- Only 32% of financial institutions moved beyond pilots to full blockchain deployment in 2025.

- Platform fragmentation affects 80% of blockchain projects due to a lack of interoperability standards.

- Initial blockchain investment costs for mid-sized firms range from $10,000 to $100,000, limiting adoption.

- About 39% of blockchain firms experienced data security breaches in 2024, increasing institutional hesitation.

- Regulatory compliance costs increased by 27% year-over-year in 2025, affecting project viability.

Forecasts and Future Trends in Financial Blockchain

- The global asset-tokenization market is expected to reach $5.25 trillion by 2029 with a 43.36% CAGR.

- Stablecoin transaction volume surged to $710 billion monthly in 2025, reshaping payment infrastructure.

- Institutional adoption of tokenized assets could enable 24/7 trading of previously illiquid assets by 2026.

- Over 30 countries are piloting CBDCs, focusing on interoperability and financial inclusion in 2025.

- Blockchain and machine learning integration for fraud prevention is projected to reduce fraud losses by 30% by 2027.

- By 2030, up to $4 trillion in asset issuance and settlements could be tokenized globally.

- Regulatory clarity for blockchain is expected to improve for 55% of token issuers by late 2025.

- Competitive pressure on traditional financial institutions will intensify as 67% of firms accelerate blockchain adoption.

- Digital identity solutions in blockchain financial services are projected to grow at an 85.6% CAGR through 2030.

Frequently Asked Questions (FAQs)

Around 80 % of financial institutions were exploring blockchain technologies by 2025.

Transaction costs dropped by about 42.6 % in that study.

Cross‑border processing times decreased by around 78.3 %.

About 60% of central banks had accelerated CBDC efforts, with 11 countries fully launched and 49 in pilots.

Conclusion

The deployment of blockchain technology in financial services is no longer confined to experimental pilots. The data show meaningful traction in fraud prevention, digital identity, asset tokenisation, cost reduction, and CBDCs or stablecoins. At the same time, systemic challenges, from regulatory uncertainty to technical integration and liquidity constraints, remain significant. Institutions that stay ahead will do so by aligning clear business use cases with strong risk frameworks and resilient infrastructure. As blockchain moves further into the mainstream of finance, stakeholders should focus on interoperability, transparency, and scalable models of trust and efficiency.

Dawid Cameron

Well presented blockchain statistics for financial services. The article offers strong clarity and useful insights for both beginners and experts.