3D printing, also known as additive manufacturing, has moved beyond prototyping. Today, it’s increasingly central to manufacturing, healthcare, and supply chains. Industry players are leveraging it for faster product cycles, localized production, and custom solutions. Real‑world examples include medical device firms making patient‑specific implants and automotive companies 3D printing lightweight metal parts to boost fuel efficiency. These changes show promise and trade‑offs that we’ll unpack as we explore the full picture ahead.

Editor’s Choice

- North America held more than 35% of the global 3D printing revenue share in 2024.

- Industrial printers made up over 77% of total revenue in 2024 in the 3D printing market.

- Hardware components accounted for more than 65% of total revenue in 2024.

- The prototyping application segment generated over 55% of total revenues globally in 2024.

- Metal materials by revenue contributed over 53% of the global material share in 2024.

- The healthcare additive manufacturing market is expected to grow at a 17.5% CAGR between 2024,2029.

Recent Developments

- Companies are moving toward localized manufacturing, reducing reliance on global supply chains.

- Integration of AI‑driven optimization in print paths, material usage, and design workflows is rising.

- Post‑processing accessibility (finishing, curing, cleaning) is becoming a bigger concern, and demand for tools that simplify it is growing.

- Entry‑level 3D printers (under US$2,500) shipments increased by 15% year‑over‑year in Q1 2025, surpassing one million units globally.

- Chinese companies accounted for 95% of those entry‑level machines shipped globally.

- Meanwhile, shipments of industrial and mid‑range professional machines declined (17% and 13%, respectively) in the same period.

- At MIT, researchers developed a chip‑based 3D printer the size of a coin using silicon photonics to cure resin by light, currently limited to flat patterns but promising for future volumetric printing.

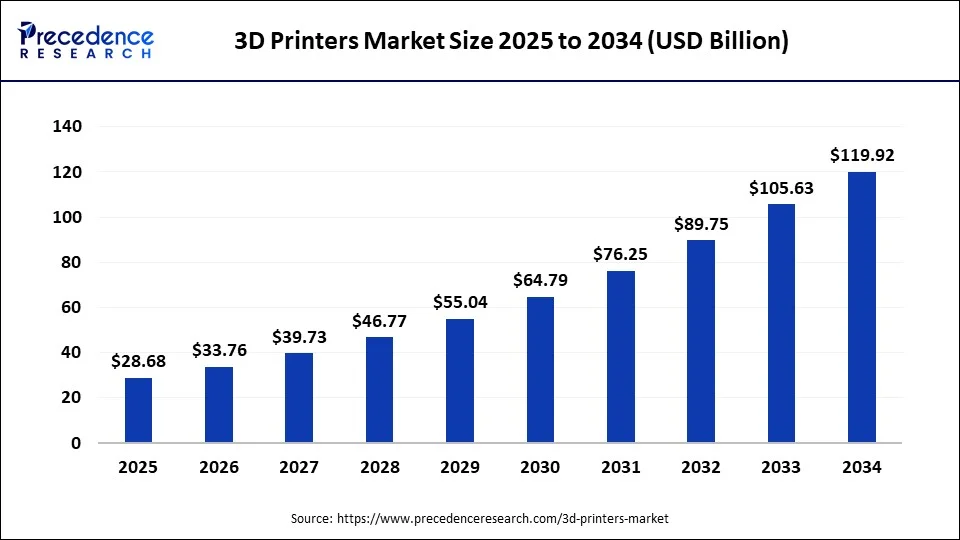

3D Printing Market Growth Outlook

- The global 3D printers market will reach $28.68 billion in 2025.

- It will climb to $33.76 billion in 2026, showing steady early-stage growth.

- By 2027, the market will rise to $39.73 billion as adoption accelerates across industries.

- In 2028, the market will hit $46.77 billion, driven by advances in materials and faster print speeds.

- The market will cross $55.04 billion in 2029, nearly doubling from 2025 levels.

- By 2030, the market will reach $64.79 billion, fueled by demand in aerospace, healthcare, and automotive.

- The 2021 CAGR estimate pushes the value to $76.25 billion, showing strong upward momentum.

- In 2032, the market will grow to $89.75 billion, entering the mainstream for production parts.

- By 2033, the market will jump to $105.63 billion as large-scale industrial use cases expand.

- In 2034, the market will hit $119.92 billion, more than four times the 2025 valuation.

3D Printing Adoption Rates and Trends

- In North America, the 3D printing market grew to $8.61 billion in 2024 and is expected to keep expanding at ~18.6% CAGR through 2034.

- The U.S. 3D printing market (hardware + materials + systems) was estimated at $5.93 billion in 2024, on track for substantial growth.

- In the U.S., the rapid prototyping & services sector revenue is expected to reach $4.3 billion in 2025, with a ~17.2% CAGR over the past five years.

- Globally, more than 60% of the market revenue comes from hardware (printers, printer machines) when splitting between hardware, software, and services.

- The software & services segment is growing faster than hardware in percentage terms (though from a smaller base).

- Manufacturers cite complex geometries and customization as leading reasons for adopting 3D printing.

- There’s a trend of increasing use inside firms (in‑house) rather than only outsourcing.

By Industry/Vertical

- The automotive vertical captured more than 25% of global revenue share in 2024 across applications.

- Healthcare (including dental) is one of the fastest‑growing sectors, with forecasts of ~17.5% CAGR through 2029.

- Aerospace uses 3D printing for lightweight parts, tooling, and spare parts; it is steadily increasing its share of industrial usage.

- Education and research sectors adopt 3D printing primarily for prototyping, teaching, and development projects. Growth is moderate but steady.

- Consumer goods industries use desktop/entry‑level printing more than industrial types.

- The construction/housing vertical is emerging, particularly for printing walls, structural components, and “formwork”.

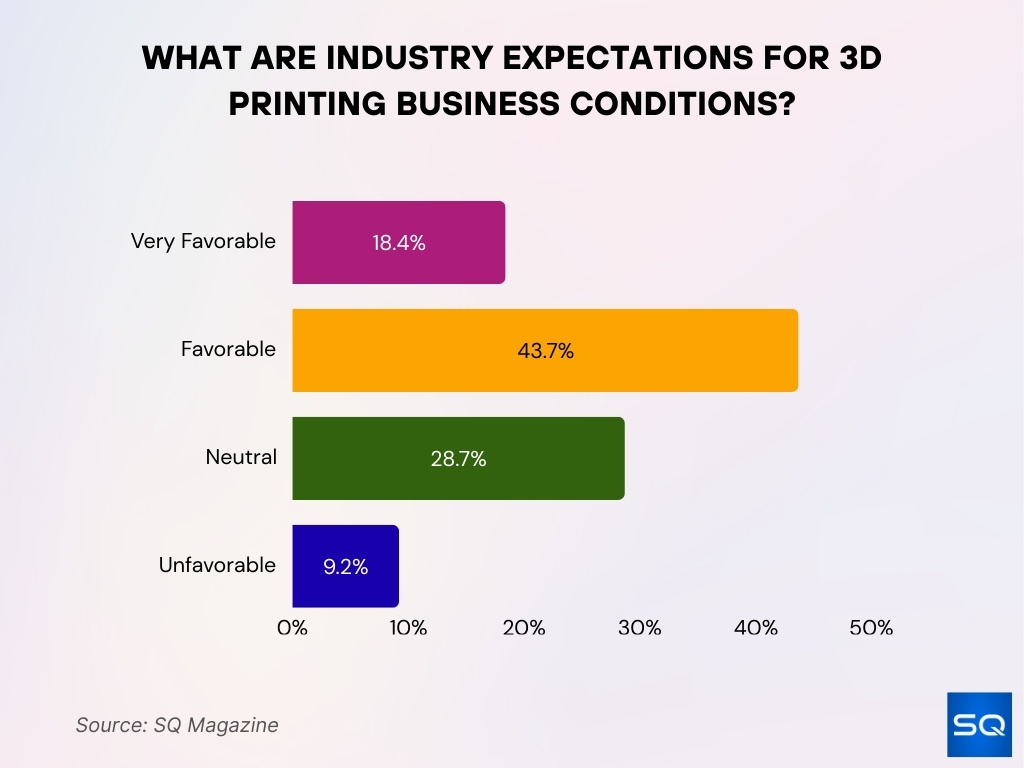

What Are Industry Expectations for 3D Printing Business Conditions?

- 43.70% of respondents expect favorable business conditions in 2025.

- 28.70% believe conditions will remain neutral, showing cautious optimism.

- 18.40% expect very favorable outcomes, indicating strong confidence in the sector.

- 9.20% foresee an unfavorable environment, reflecting minimal concern.

Market Segmentation by Printer Type

- In 2024, the industrial printer segment generated ~77% of total revenues in the global 3D printing market by printer type.

- The desktop 3D printing market grew from about $4.21 billion in 2024 to $4.86 billion in 2025, a CAGR of ≈ 15.5%.

- Forecasts project the desktop segment to reach $8.87 billion by 2029, with a CAGR of ~16.2%.

- Revenue share for industrial printers is much higher than desktops; in 2024, industrial machines accounted for more than 70–76% of printer revenues globally.

- Growth in desktop printers is strong in educational, hobbyist, and small business sectors, driven by lower cost, plug‑and‑play design, open‑source firmware, and improved consumer materials.

- Regional differences, North America holds a large share of both desktop and industrial printer markets, Asia‑Pacific is rising faster, especially in consumer/desktop demand.

3D Printing in Prototyping vs. End‑Use Production

- In 2024, prototyping contributed over 55% of global 3D printing revenues.

- End‑use production is growing, particularly in aerospace, medical, and automotive, where certification and materials allow deployment of final parts.

- Metal 3D printing is a key enabler of end‑use production; its growth rate is among the fastest of all material segments.

- Demand for customized end‑use parts (implants, dental devices, personalized tools) is pushing companies to validate 3D printing for regulated manufacturing.

- Prototyping still remains more cost‑efficient for many design cycles, but improvements in speed, precision, and material variety are narrowing the gap for production.

- Some businesses are using 3D printing for hybrid production (print some parts, machine others) to balance cost vs performance.

- Rapid iteration cycles, prototyping use is strong in R&D and education, while production tends to involve industrial printers and stricter quality control.

Industrial vs. Desktop 3D Printing

- The desktop 3D printing market in 2025 is valued at $6.7 billion, with growth expected to reach $11.9 billion by 2030 (≈ 12.3% CAGR).

- Industrial printers made up ~71‑77% of 3D printer revenue in 2024.

- Entry‑level / consumer desktop machines (under USD 2,500) saw shipments increase by ~15% year‑over‑year in Q1 2025, surpassing one million units globally.

- In contrast, shipments of industrial and mid‑range professional machines declined in that same period (industrial down ~17%, mid-range pro ~13%), indicating shifting demand.

- Desktop machines are strongest in education, small workshops, hobbyists, and small business prototyping. Industrial machines dominate for large-scale, high-precision, metal parts, tooling.

- Industrial 3D printing faces high capital costs, complex material handling, and longer qualification cycles, raising barriers for small firms. Desktop units lower that barrier.

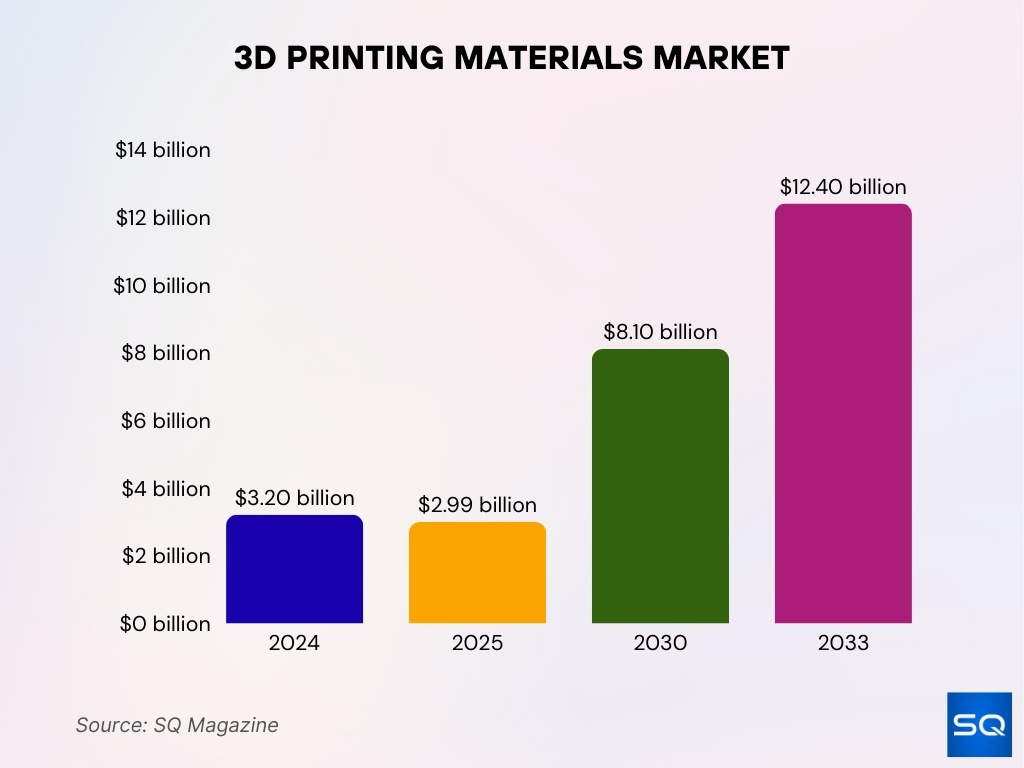

3D Printing Materials Overview

- The global 3D printing materials market was valued at $3.2 billion in 2024 and is projected to grow to around $ 12.4 billion by 2033, at a CAGR of ~15.6% between 2025,2033.

- Another forecast shows the materials market at $2.99 billion in 2025, rising to $8.10 billion by 2030 (~22.05% CAGR).

- By material type, plastics (polymers) held about 47.25% of the materials market share in 2024.

- Among forms, filament was dominant in revenue in 2024, with a revenue share of ~68.4%.

- Ceramics and composites are gaining traction, though from smaller bases.

- Key industries driving material demand: aerospace & defense (with high metal usage), automotive (both metal+polymer), and medical/dental (biocompatible polymers and metals).

Key 3D Printing Companies and Market Share

- Major players in 2025 include Stratasys (US), EOS GmbH (Germany), HP Development Company, L.P. (US), 3D Systems, Inc. (US), General Electric (US), Materialise (Belgium), Nano Dimension (US), voxeljet AG (Germany), SLM Solutions (Germany), and Renishaw plc (UK).

- Several companies are forming strategic partnerships, e.g., 3D Systems + Daimler Truck AG partnered to produce nearly 40,000 bus spare parts on demand, cutting delivery times by up to 75%.

- Desktop Metal filed for Chapter 11 in mid‑2025 while selling European assets.

- Companies making big investments in material & process innovation are more likely to gain market share in industrial and aerospace verticals.

Healthcare, Automotive, and Aerospace

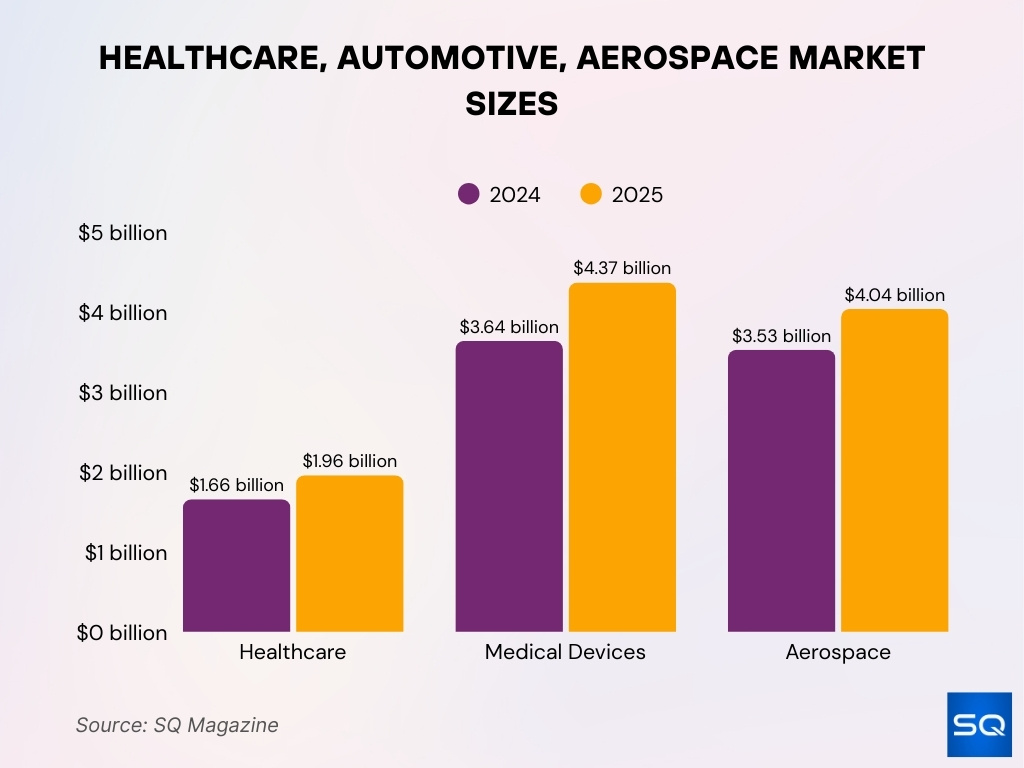

- Global 3D printing in the healthcare market is valued at $1.66 billion in 2024, projected to reach $1.96 billion in 2025, and is expected to grow to $8.71 billion by 2034, with a CAGR of ~18.0%.

- Medical devices made via 3D printing are expected to grow from $3.64 billion in 2024 to $4.37 billion in 2025, and further to $18.84 billion by 2035, at ~15.7% CAGR.

- The aerospace 3D printing market was valued at $3.53 billion in 2024 and is projected to be $ 4.04 billion in 2025, growing to $14.53 billion by 2032, at ~20.1% CAGR.

- North America held about 43% of the healthcare 3D printing market share in 2024.

- The automotive 3D printing market size in 2024 was about $4.64 billion, with forecasts to reach $31.01 billion by 2032, growing at ~26.8% CAGR from 2025,2032.

- Aerospace demand is especially strong in lightweight components, spare parts, and tooling. More than 34.8% of aerospace 3D printing revenue in 2024 came from North America.

Construction and Housing

- Large‑scale concrete 3D printing and other building‑component printing are increasingly used in pilot projects globally.

- Cost savings of up to 30‑60% have been reported in some case studies for labor and material.

- Speed‑to‑build is a compelling advantage; time to erect small housing units is reported as 50‑70% faster.

- Regulation, standards, and material durability remain a constraint.

- Use in affordable housing, emergency shelters, and disaster recovery is emerging as a case application.

Frequently Asked Questions (FAQs)

The global 3D printing market size is projected to be $29.29 billion in 2025, with a CAGR of ≈ 18.52% from 2025 to 2034

The industrial printer segment generated more than 77% of total revenues in 2024.

North America held over 35% of the global 3D printing revenue share in 2024.

The automotive vertical captured more than 25% of the global 3D printing revenue share in 2024.

Conclusion

3D printing today finds itself at a tipping point. Adoption has broadened across industries like healthcare, aerospace, and automotive. At the same time, challenges, cost, speed, and regulation still limit the full potential in many sectors. As technologies mature and standards evolve, we expect many of today’s constraints to lessen.