WeChat has evolved beyond instant messaging. It now combines social networking, commerce, payments, and services in one app. Today, it remains central to communication in China and increasingly influences global users via its mini‑programs and digital payment tools. In industries like e‑commerce and fintech, WeChat’s data powers streamlined payment flows and enables brands to reach users where they already live. In media and advertising, its Official Accounts and Moments provide channels to distribute content and ads. Read on for up‑to‑date statistics about WeChat’s growth, users, and behavior.

Editor’s Choice

- WeChat is expected to have 1.481 billion monthly active users (MAU) worldwide in 2025, up from about 1.427 billion in 2024.

- The user base grew by about 3.78% year‑over‑year from 2024 to 2025.

- WeChat Pay users are projected at 1.318 billion in 2025, up from 1.225 billion in 2024.

- Mini Programs’ daily active users (DAU) are estimated to reach 764 million in 2025.

- The gender split is close to parity: around 53% male, 47% female in 2024.

- Users spend on average ≈82 minutes per day in the app.

- More than 45 billion messages are sent daily on WeChat.

Recent Developments

- The growth of MAU has slowed. WeChat grew ~2% year‑over‑year in 2024, indicating market saturation, especially domestically.

- Mini Programs continue expanding, DAU jumped from ~689 million in 2024 to 764 million projected in 2025.

- WeChat Pay user base increased by ~7–8% from 2024 to 2025.

- Demographic shifts, more users in lower‑tier cities (Tier 2, etc.) outside megacities, reflecting diffusion across China.

- The gender ratio has become more balanced; male users slightly lead, but the difference is shrinking.

- Usage time remains high (~82 minutes/day), showing that despite slower new user growth, engagement has stayed strong.

- International growth is modest but steady. Outside of China, adoption is rising slowly in Southeast Asia and among diaspora communities.

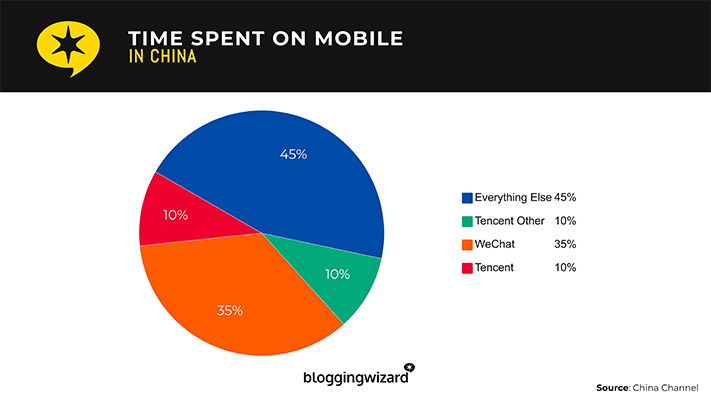

Time Spent on Mobile in China

- WeChat accounts for 35% of all mobile usage time in China, making it the most used individual app in the country.

- Tencent’s other apps represent 10% of mobile usage time, showcasing the breadth of Tencent’s app ecosystem beyond WeChat.

- Combined, Tencent controls 45% of all mobile usage time, matching the share of all non-Tencent apps combined.

- Everything Else (non-Tencent apps) also takes up 45% of mobile time, indicating a split market between Tencent and all other app developers.

WeChat User Growth

- At the end of 2024, WeChat had about 1.427 billion MAU; 2025 estimates place it at 1.481 billion.

- That’s an increase of ~54 million users (~3.78%) year‑over‑year.

- Growth was stronger in earlier years, from 2022 (~1.313 billion) to 2023 (~1.374 billion), then in 2024.

- China remains by far the largest single country in terms of user base, with over 1 billion users in China alone.

- Outside China, growth is slower, partly due to regulatory, language, and competitive factors.

- The MAU growth rate is tapering; recent yearly increases are in low single digits (2‑4%).

Monthly Active Users

- WeChat MAU is expected at 1.481 billion in 2025, up from ~1.427 billion in 2024.

- 2023 figure was ~1.374 billion.

- Year‑over‑year growth from 2024 to 2025 is around 3.78%.

- Earlier in 2022, MAU was ~1.313 billion.

- The growth rate has declined compared to the mid‑2010s, when YoY increases were often 10%+.

- Outside of China, MAU contributions remain relatively small, but user retention remains high among those who adopt it.

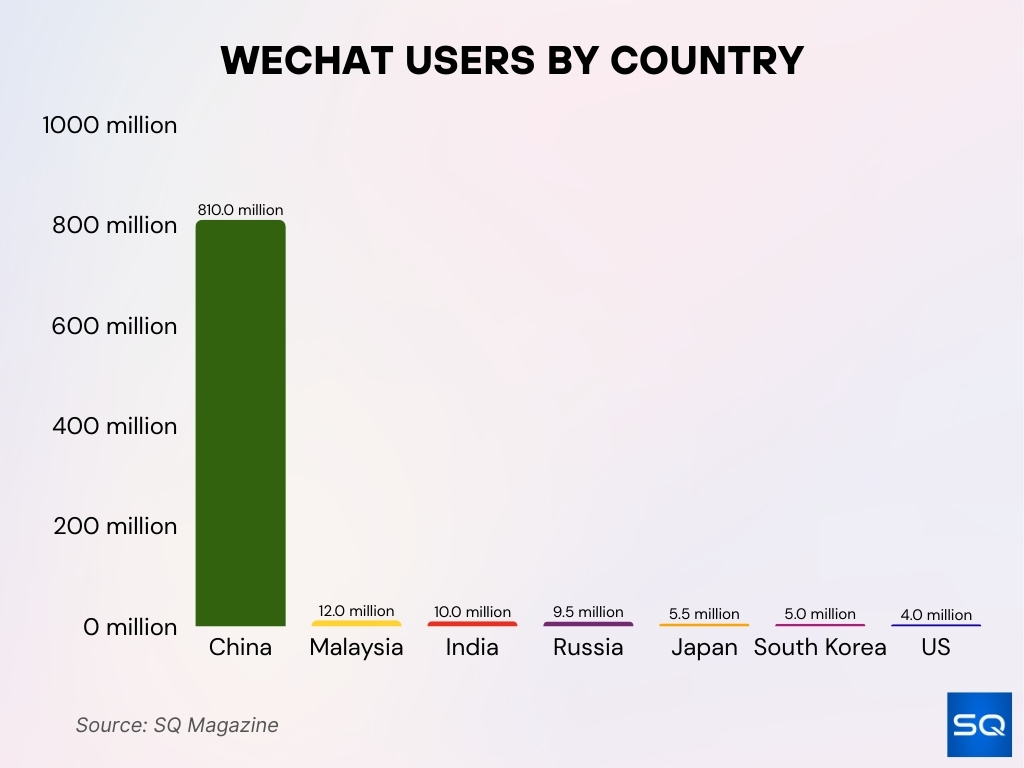

Geographical Distribution

- Around 57.9% of WeChat’s users (≈ 810 million) are located in China, making China the dominant market.

- Outside of China, Malaysia leads with ~12 million users in 2025.

- India has about 10 million WeChat users.

- Russia has approximately 9.5 million WeChat users.

- Japan ~5.5 million, South Korea ~5 million, United States ~4 million.

- Tier 2 cities in China now account for over 40% of WeChat’s user base, showing diffusion away from only the biggest urban centers.

- Lower-tier cities and rural regions are growing in share, Tier 4 cities are catching up with user counts in more developed tier‑1/2 cities.

- International growth remains modest; many users abroad use WeChat to maintain contact with friends/family in China rather than full ecosystem usage.

User Demographics

- The age group 25‑35 is heavily represented among active users, with a large concentration in that span.

- Users over 51 years old make up ~22.7% of the total in China.

- Under‑24s represent ~22.3%, 25‑30 ~13.7%, 31‑40 ~22%, 41‑50 ~19.2%.

- Gender ratio, ~53% male, 47% female.

- In China, approximately 78% of people aged 16‑64 use WeChat.

User Engagement and Time Spent

- On average, WeChat users spend ≈ 82 minutes per day in the app.

- Daily active usage of WeChat is very high; a large portion of MAUs engage daily, especially in China.

- WeChat users send ~45 billion messages daily, along with ~410 million audio/video calls per day.

- A high proportion of users open the app many times per day, and over 60% open it more than 10 times per day.

- Features such as Moments are accessed very frequently; many users check Moments every time they open the app.

- Engagement in Mini Programs is growing, with weekly usage of Mini Programs by more than 60% of users.

- Content consumption (articles, videos, shared posts) in Moments drives frequent user interactions (likes, comments, shares).

Features Usage Statistics

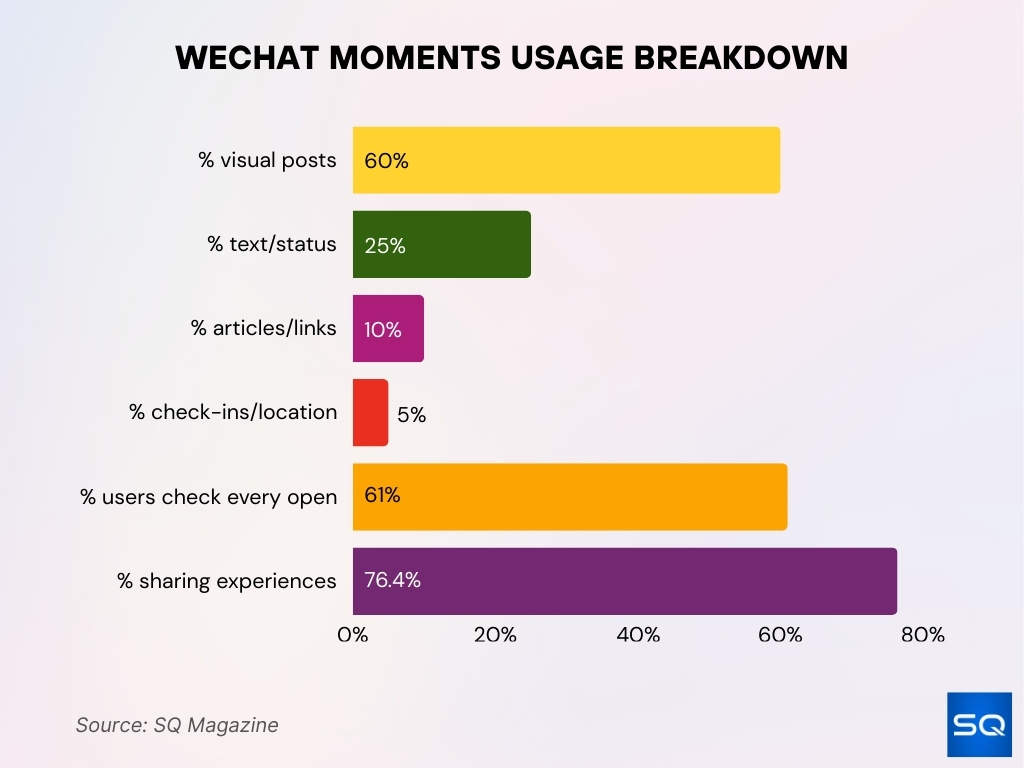

- Moments remains the most used social feature; many users open Moments every time they launch the app.

- WeChat Mini Programs now support over 4.3 million mini‑apps in the ecosystem.

- On average, a user interacts with about 9.8 mini-programs.

- More than 95% of Chinese companies have their own Mini Programs.

- In Moments, visual content (photos/videos) make up about 60% of posts, text/status updates about 25%, articles/links ~10%, location or check‑ins ~5%.

- Ads in Moments and similar social features drive discovery of Official Accounts; a sizable share of users discover new Official Accounts via Moments ads.

- “Official Accounts” are followed largely for news (≈ 74.2%) and promotions (≈ 41.9%) among users who follow them.

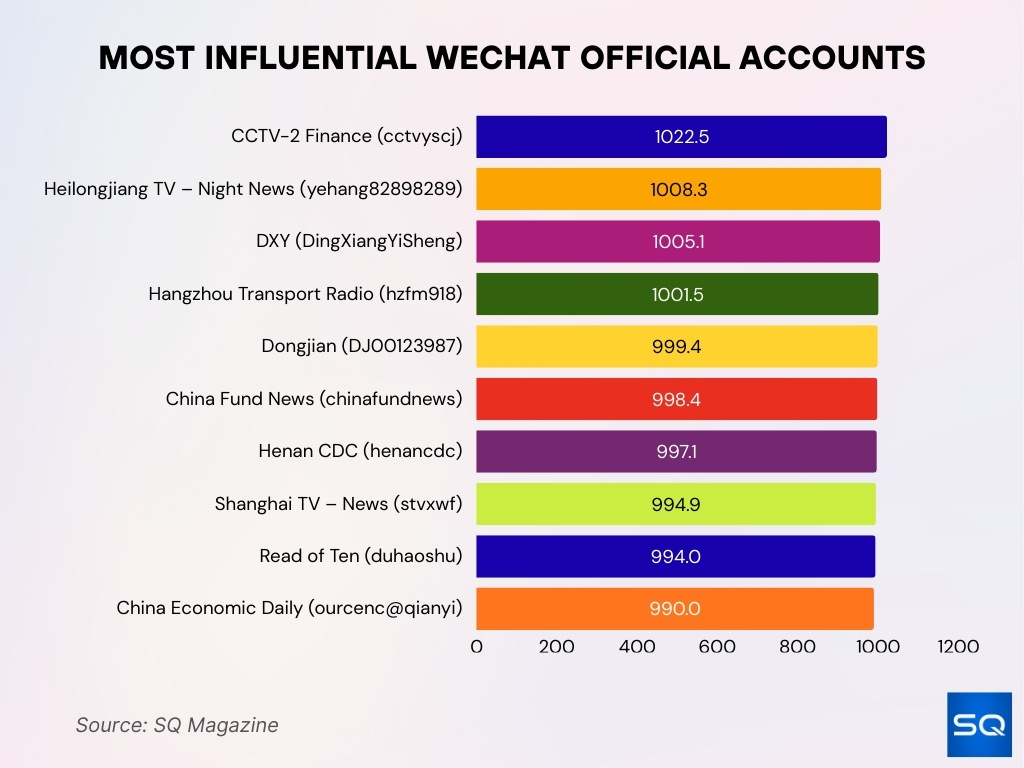

Most Influential WeChat Official Accounts

- CCTV-2 Finance ranks #1 with an influence index of 1022.5, making it the most authoritative financial media account on WeChat.

- Heilongjiang TV – Night News holds the #2 spot with 1008.3 points, reflecting its strong reach in regional news coverage.

- DXY (DingXiangYiSheng) comes in at #3 with 1005.1 points, showing its prominence in health and medical content.

- Hangzhou Transport Radio scores 1001.5, driven by daily updates on local traffic and commuting news.

- Dongjian (DJ00123987) earns 999.4 points, indicating significant influence in opinion and commentary content.

- China Fund News comes in at 998.4 points, highlighting its authority in investment and mutual fund reporting.

- Henan CDC scores 997.1 points, showing trust in public health and epidemic updates.

- Shanghai TV – News secures 994.9 points, representing major city broadcast news on the platform.

- Read of Ten (duhaoshu) reaches 994 points, reflecting strong engagement in reading, book reviews, or thought leadership.

- China Economic Daily rounds out the list with 990 points, reinforcing its role as a leading economic and policy publication.

Mini Programs Statistics

- Daily active users (DAU) for Mini Programs are projected at 764 million in 2025, up from ~689 million in 2024.

- Monthly active Mini Program users are very large, many hundreds of millions in China alone.

- Users spend an average of ≈ 68.1 minutes using Mini Programs per day, according to some estimates.

- Use of Mini Programs spans ecommerce, services (food delivery, ride‑hailing), gaming, reading, and lifestyle.

- Weekend ecommerce usage in Mini Programs jumps significantly (≈ 53%) compared to weekdays.

- A non‑trivial share of Mini Program users spend more than 1000 RMB per month in transactions via Mini Programs.

WeChat Pay and Digital Payments

- In 2024, WeChat Pay had about 1.225 billion active users; it is projected to reach 1.318 billion in 2025, a growth of ~7.6% year‑over‑year.

- WeChat Pay is used by over 90% of consumers for offline purchases in Tier‑1 & Tier‑2 Chinese cities.

- Over 200 million bank cards in China are linked to WeChat Pay.

- WeChat Pay supports transactions in multiple currencies and regions, particularly targeting cross‑border use.

- The combined mobile payment market in China remains heavily dominated by WeChat Pay & Alipay, together accounting for over 90% of mobile payments.

- WeChat Pay’s growth is increasingly driven by services beyond basic P2P transfers, integration with retail, utilities, ride‑hailing, etc.

- Lower‑tier and rural areas are seeing rising adoption of WeChat Pay, narrowing the gap with urban adoption.

WeChat Moments Usage

- In 2025, WeChat Moments had about 780 million daily active users.

- Of those, ~120 million publish updates frequently (photos/videos/statuses), indicating not just passive consumption.

- Visual content dominates in Moments, ~60% of posts are photos or videos.

- Text/status updates account for ~25% of content, shared links/articles ~10%.

- Check‑ins/location tags are less common (~5%) of total posts.

- Over 61% of users check Moments every time they open WeChat.

- ~76.4% of users use Moments for sharing experiences and catching up on friends’ stories.

Revenue and Monetization

- In 2023, WeChat generated about $16.38 billion in total annual revenue.

- Revenue from in‑app purchases (IAP) in WeChat rose steadily, ~$67.15 million in 2022, $71.39 million in 2023, and as of May 2024, $30.33 million has already been recorded.

- Average Revenue Per User (ARPU) is around $7 in 2023.

- WeChat is valued at over $60 billion as of early 2025, with expectations of hitting $62 billion by year‑end.

- Advertising is a major driver; many reports put WeChat’s ad revenue in 2023 at about $16 billion.

- Moments ads account for a large share of advertising revenue (≈ 70%) on WeChat.

- Growth in ad spend is particularly strong in video ads and performance‑based ads, exhibiting higher engagement rates.

Business and Workplace Communication

- WeChat’s enterprise offering, WeCom (formerly WeChat Work), has over 130 million monthly active users.

- About 90% of Chinese professionals prefer WeChat for business communication over email, phone calls, or texts.

- Over 87% of WeChat users report relying on the app for workplace communications in some form.

- Approximately 65 million companies use WeCom as of recent reports.

- Many users report that a large share of new contacts on WeChat are work‑related (≈ 57%).

International Reach and User Base

- Global Monthly Active Users (MAU) are estimated to be ~1.38‑1.48 billion in 2024‑2025, with the bulk in China.

- Outside China, WeChat has tens of millions of users (Malaysia ~12 million, India ~10 million, the US ~4 million, Russia ~9.5 million).

- Adoption outside China is often strongest among diaspora communities or for business/family communication.

- Cross‑border payments through WeChat Pay are growing (~35% growth in recent reports), especially in tourist‑destination countries near China.

Advertising Revenue and Trends

- In 2023, WeChat’s advertising revenue reached about $16 billion, growing ~20% from the previous year.

- Moments ads generate the largest share of ad revenue (~70% of the total advertising income).

- Click‑through rates (CTR) for performance ads (especially in mini programs) are increasing, reflecting better targeting and advertiser investment.

- Cost‑per‑click (CPC) in WeChat ads has risen by ~12% in recent years due to increased demand.

- Luxury brands have increased spending on WeChat advertising by ~30% year‑over‑year.

- Small and medium businesses (SMBs) make up a growing portion of ad spend (≈ 40%) thanks to more accessible targeting options.

- Video ads outperform static image ads in engagement by about 50%.

Frequently Asked Questions (FAQs)

WeChat has about 1.481 billion monthly active users worldwide in 2025.

WeChat Pay has around 935 million users.

Chinese users spend about 79 minutes and 42 seconds per day on average using WeChat.

Approximately 57.86% of all WeChat users (≈ 810 million) reside in China as of 2025.

Conclusion

WeChat today is no longer just a messaging platform. It operates as a multifaceted ecosystem, with payments, social media, mini‑apps, and business tools, all tightly woven into daily life, especially in China. Revenue growth may be entering a more mature phase, but WeChat continues to expand user adoption in payments, business communication, and advertising. International expansion remains a challenge but offers room for future gains. For marketers, developers, and businesses, the numbers confirm that WeChat remains a powerful channel, if approached with nuance and local insight.