Virtual Private Networks (VPNs) have become a core tool for digital privacy, secure remote access, and content access control. Their use now spans far beyond tech enthusiasts, impacting consumers, businesses, and even entire nations. For example, remote workforces rely heavily on VPNs to access internal systems securely, while citizens in restrictive countries use VPNs to overcome censorship. The stats ahead will show how VPN adoption is evolving across regions, devices, demographics, and market structures, and invite you to dive deeper into trends shaping today.

Editor’s Choice

- Estimates suggest up to 1.75 billion global users have accessed a VPN at least once.

- A global adoption rate of 22.9% of all internet users use VPNs.

- 42% of Americans reportedly use a VPN.

- Only 40% of VPN users report daily or nearly daily usage.

- 54% are male among the VPN user base as of recent demographic surveys.

- 72% of VPN users connect via desktop or laptop (versus mobile).

- North America accounts for about 35% of the global VPN market share.

Recent Developments

- Surfshark introduced 100 Gbps servers to reduce congestion and improve throughput.

- Proton expanded free VPN server coverage to 8 global locations to improve performance in underserved regions.

- Windscribe patched its WireGuard implementation for quantum-resistant encryption to anticipate future threats.

- Some VPN demand shifts now correlate strongly with regulatory changes (e.g., site bans, content restrictions).

- Zscaler’s ThreatLabz report expects 81% of organizations to adopt Zero Trust, which may reduce reliance on traditional VPNs.

- Marketing and infrastructure investments have increased; many providers emphasize speed, privacy, and usability aggressively in 2025.

- The global VPN services market is projected to grow with a CAGR of ~15.8% from 2025 onward.

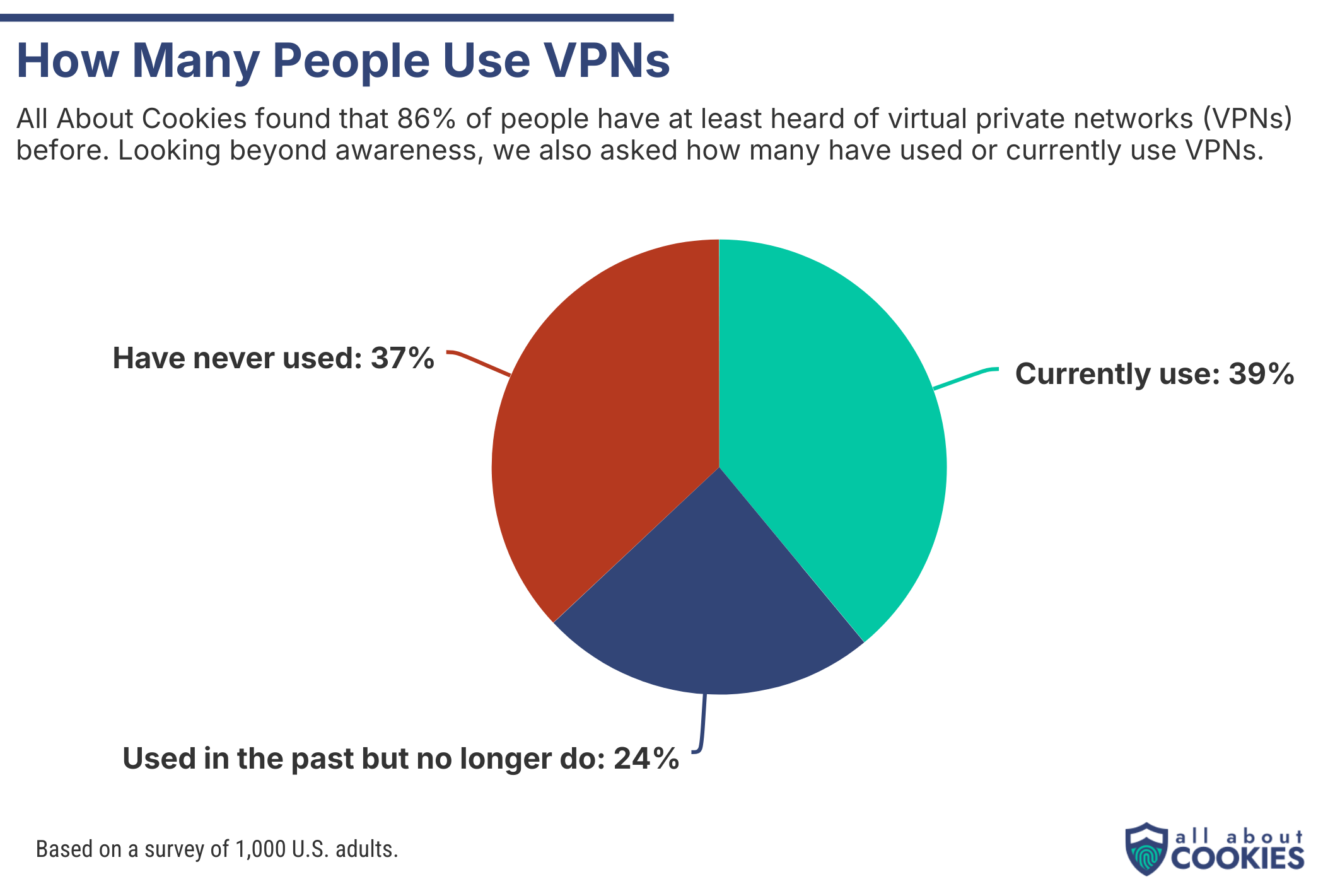

VPN Usage Among U.S. Adults

- 39% of Americans currently use a VPN, showing that nearly 4 in 10 internet users rely on VPNs for privacy or access.

- 24% of respondents used a VPN in the past but no longer do, suggesting past adoption was driven by specific needs like streaming or remote work.

- 37% of Americans have never used a VPN, indicating room for market growth as awareness and cybersecurity concerns increase.

- The survey found 86% awareness of VPNs overall, reflecting strong familiarity even among non-users.

- Based on a survey of 1,000 U.S. adults, this highlights national trends in consumer VPN adoption.

Global VPN Adoption Statistics

- Around 22.9% of all internet users globally use VPN services.

- The user base is estimated at ~1.75 billion online users.

- Some forecasts project 2 billion VPN users globally, marking ~15% year‑on‑year growth.

- In the U.S., 42% of internet users reportedly use a VPN.

- In Russia, adoption is ~37.8%, in the UAE, ~36.2%, and in India, adoption is large, though market value estimates are also cited.

- In the Middle East, high adoption rates include the UAE, 36%, Qatar, ~17%+, Oman, ~35%, and Saudi Arabia, ~29% (as a share of the population).

- Some market research values the VPN services industry at $30+ billion currently.

- Forecasts expect 20%+ annual growth in many regional markets over the next few years (e.g., India, Japan, Brazil).

Usage by Region

- North America leads regional VPN markets with an estimated 42% adoption in the U.S. and up to 35% market share globally in 2025.

- Asia-Pacific drives fastest VPN growth with 15.7% CAGR, boasting 55–61% usage in Indonesia and 43–45% in India.

- In the Middle East & Africa, certain countries, like the UAE and Qatar, see penetration rates near 38–59%, heavily fueled by censorship and content restrictions.

- Latin America trails average global VPN penetration, with Brazil and Mexico at about 31%, while South Africa is below 4%.

- Europe shows moderate, yet rising, VPN usage, with the Netherlands at 10.4%, the UK at 7.2%, and most Western European countries within 6–15%.

- In Indonesia, 55–61% of the population uses VPNs regularly, marking the highest national share worldwide.

- India experiences significant growth, with VPN usage now at 43–45% among internet users in 2025.

- The U.S. VPN adoption rate stands at 42%, much higher than the global average of 23%.

- During periods of censorship or unrest, countries like Indonesia have seen VPN usage spike by as much as 373%, highlighting the reactive nature of demand in restrictive environments.

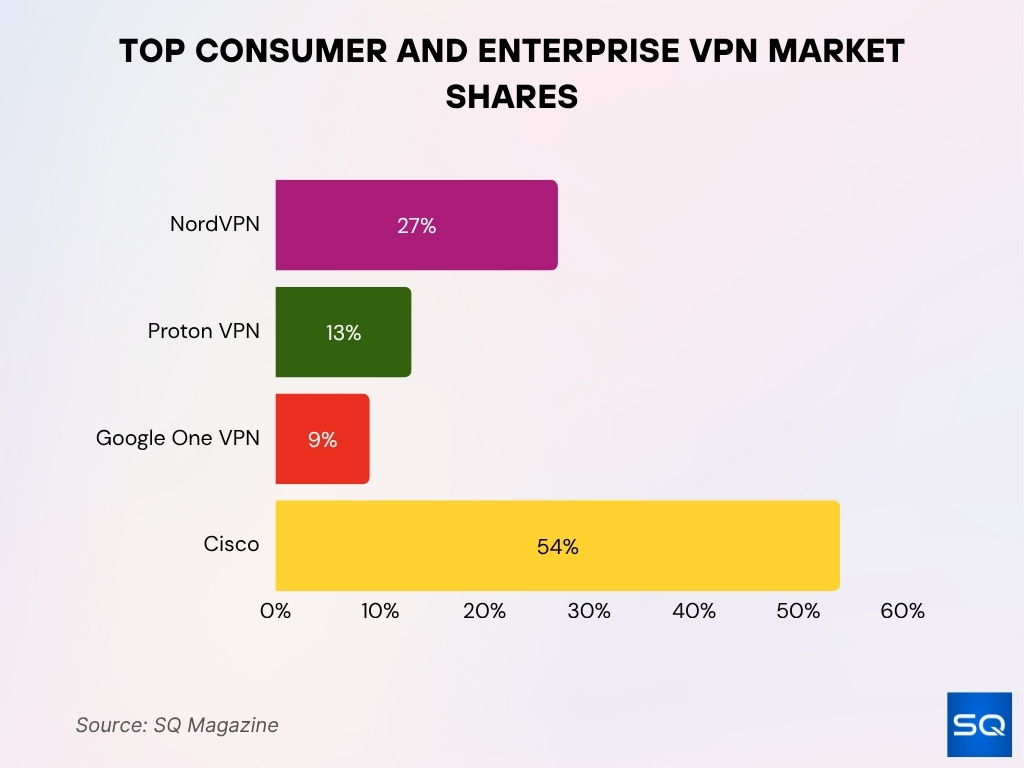

Provider Market Share

- In the U.S., NordVPN holds ~27% of the VPN user market share, followed by Proton VPN ~13%, and Google One VPN ~9%.

- Among enterprise VPNs, Cisco holds a commanding ~54% share of the corporate VPN market.

- The top 5 providers account for about one‑third of the total market.

- Remote access VPNs dominate about 85% of the VPN services market.

- The VPN market size is projected to grow from $61.42 billion in 2024 to ~$71.25 billion in 2025.

- Other estimates place the 2025 market valuation at $88.96 billion, with commercial VPN use contributing ~55.7% of revenue.

- North America had over 53.2% market share in 2024.

- NordVPN leads in revenue growth, mobile performance, and pricing competitiveness.

VPN User Demographics

- Demographic surveys suggest VPN users skew slightly male, with some estimates placing the share at 54%, though gender gaps vary across countries and usage types.

- Two‑thirds (≈ 66%) of VPN users are aged 16–34 (Gen Z and younger Millennials).

- The age group 25–34 accounts for ~33% of users, and 16–24 about 35%.

- Only ~4% of users are aged 55+, showing limited adoption in older cohorts.

- VPN users are more likely to have university or postgraduate education.

- The propensity to use VPNs rises with education level; postgraduate users are overrepresented among VPN users.

- Males show a higher preference for personal VPN use; among males, ~57% report personal use vs ~43% for females in one survey.

- Income-level trends are weaker, but one U.S. sample saw heavier VPN use in the $25,000–$49,999 bracket.

By Device (Mobile vs Desktop)

- 32% of mobile users use a VPN daily or almost daily in 2025.

- Among PC and laptop users, 29% report daily or nearly daily VPN usage.

- 61% of mobile VPN users access the service at least once a week.

- 59% of desktop/laptop users do so at least once weekly.

- Some reports suggest 67% of VPN usage occurs on mobile devices as of 2025.

- Older estimates say ~75% of VPN users rely on desktops for primary access.

- In consumer surveys, ~72% use VPNs on computers (desktop/laptop) vs ~69% on mobile devices.

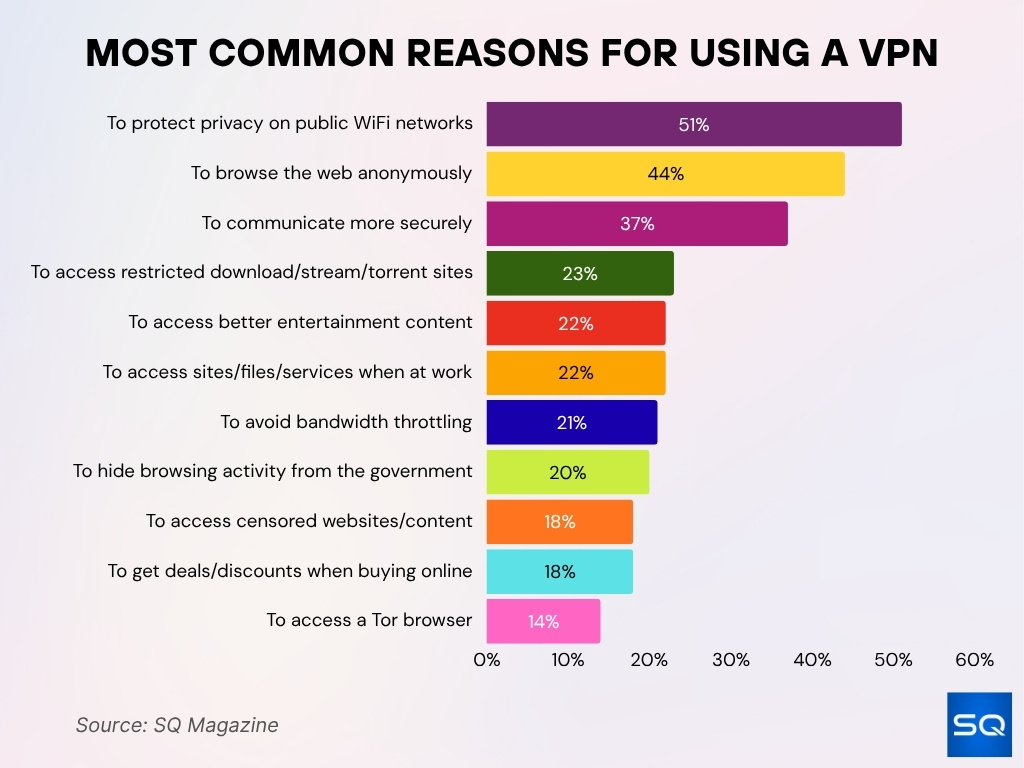

Most Common Reasons for Using a VPN

- 51% of users say they use a VPN to protect privacy on public WiFi networks, making it the leading reason for VPN adoption.

- 44% use VPNs to browse the web anonymously, reflecting growing awareness of digital tracking and data collection.

- 37% rely on VPNs to communicate more securely, especially through encrypted messaging and remote collaboration tools.

- 23% use VPNs to access restricted downloads or streaming/torrent sites, bypassing geo-blocks or content restrictions.

- 22% use VPNs for better entertainment access, such as watching region-locked shows or sports events.

- Another 22% depend on VPNs to access work-related files or services, highlighting strong corporate and remote work demand.

- 21% use VPNs to avoid bandwidth throttling, ensuring faster streaming and gaming performance.

- 20% seek VPNs to hide browsing activity from government surveillance, reflecting privacy concerns in regulated regions.

- 18% use VPNs to access censored websites or restricted online content, especially in countries with strict internet laws.

- 18% leverage VPNs to find deals or discounts while shopping online, using location-based pricing differences.

- 14% use VPNs to access the Tor browser, aiming for maximum anonymity on the dark web.

Streaming and Gaming

- 42% of users use VPNs specifically to stream geo-blocked content.

- About 23% of American VPN users cite streaming region-locked content as the main reason for their VPN use in 2025.

- The global video streaming VPN market is sized at $2.5 billion in 2025, with continued double-digit annual growth driven by region-lock demand

- Gaming VPN services are projected to hit $468 million in 2025, growing at an 11.7% CAGR as gamers seek lower ping and global release access.

- Up to 45% of VPN users implement obfuscation or dedicated IPs to evade bans by top platforms like Netflix, Amazon, and Hulu.

- Demand for VPNs increases by 300–700% following major game launches or content drops in restricted regions.

- In markets with strict streaming region locks, over 36% of all VPN traffic is attributed to bypassing these restrictions.

- Survey data show 60% of leading VPN providers offer servers labeled as “gaming-friendly” or optimized for low-latency performance in 2025.

- U.S. gamers using VPNs report an average 20-40 ms ping reduction on select titles with optimized servers.

- Nearly 1 in 3 gamers in competitive regions use VPNs for early access and DDoS protection in online multiplayer games.

Consumer vs Business VPN Usage Trends

- In the 2025 U.S. survey data, personal VPN use remains stronger than business sole-use, 17% use for personal reasons, and 8% exclusively for work.

- Business VPN use saw a sharper decline compared to personal VPN use.

- Globally, many organizations still use VPNs as part of remote access tools, but newer models (Zero Trust, SASE) are gaining adoption.

- 63% of businesses offer VPN access for remote teams.

- In the U.S., ~40% of companies had adopted VPNs by 2024.

- However, some 21% of companies had never used VPN software prior to COVID-19.

- In recent U.S. surveys, over 52% of VPN users reported paying for a subscription.

- 48% use free VPNs, though less secure providers are criticized in industry reviews.

- Many consumer VPNs now bundle features (e.g., malware blocking, ad blocking) to compete beyond just encryption or anonymity.

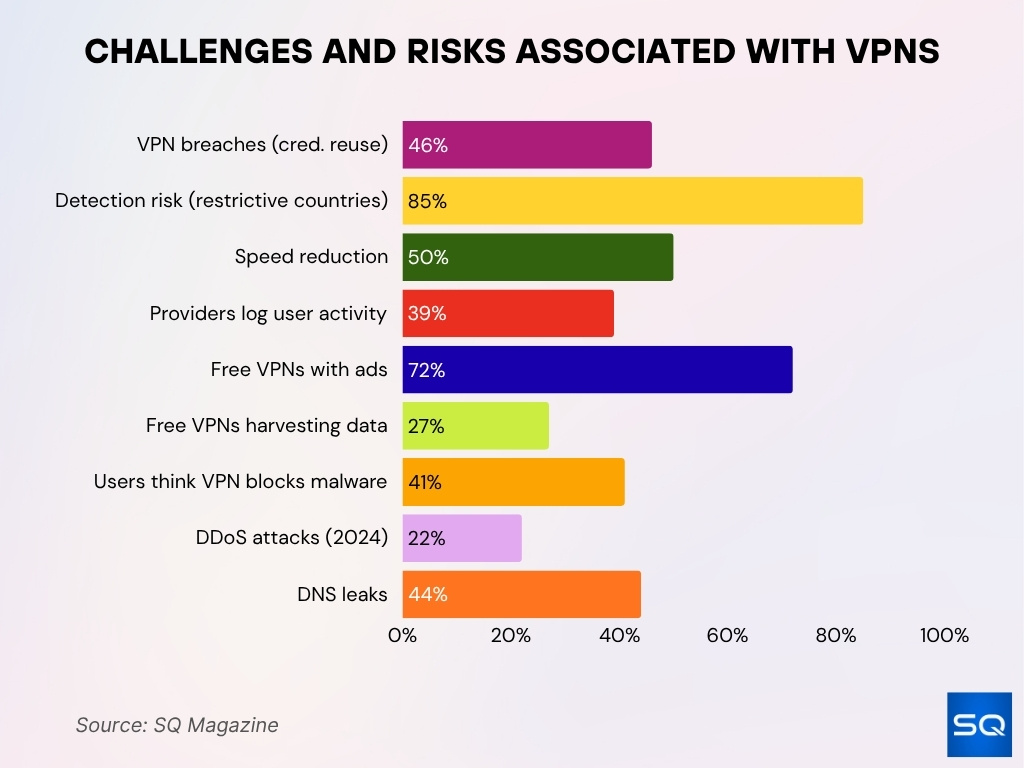

Challenges and Risks Associated With VPNs

- 46% of VPN breaches involve credential reuse or weak passwords, making account compromise a major risk.

- 85% of VPN users in restrictive countries face detection risks due to deep packet inspection or traffic fingerprinting by ISPs and authorities.

- VPN connectivity can reduce internet speed by up to 50% because of additional routing and encryption processes.

- 39% of major VPN providers log connection timestamps or user activity, raising privacy policy concerns.

- About 72% of free VPN apps display ads, with 27% found to harvest user data for third parties.

- 41% of users mistakenly believe that using a VPN protects them from all malware and endpoint vulnerabilities.

- DDoS attacks on VPN servers surged by 22%, causing widespread connectivity issues for users.

- DNS leaks, often from misconfigured VPNs, expose up to 44% of VPN users’ traffic to their ISPs or other third parties.

Corporate VPN Adoption

- In 2024, U.S. corporate VPN adoption reached 40%.

- Many remote or hybrid‑work organizations depend on VPNs for secure access to internal systems, though that reliance is shifting.

- A portion of VPN providers is being integrated into broader access solutions (e.g., SASE, micro‑segmentation).

- As of 2025, up to 93% of large enterprises report using VPNs or similar secure remote access tools.

- Still, 21% of companies never had VPNs before the pandemic began.

- The VPN detection market was valued at $380 million in 2024, growing to $410 million in 2025.

Security Statistics

- VPNs do not protect against viruses or malware.

- WireGuard-based VPN connections can be disrupted by 700 Mb/s of adversarial traffic.

- OpenVPN can be overwhelmed with ~100 Mb/s flood traffic, and strongSwan with ~75 Mb/s.

- In 2025, 62% of security breaches exploited weak or stolen remote access credentials.

- 81% of companies now conduct quarterly assessments of remote access risks.

- 65% of organizations plan to replace or phase out traditional VPNs.

- 96% of organizations prefer a Zero Trust model, and 81% plan to implement zero trust strategies within 12 months.

- Providers now integrate post‑quantum encryption, obfuscation, and stealth protocols.

Legality and Restrictions by Country

- VPNs remain fully legal in 160+ countries, including the U.S., Canada, UK, EU, Japan, and Australia.

- VPNs are completely banned in at least seven countries as of 2025: North Korea, Iraq, Belarus, Myanmar, Turkmenistan, Iran, and Russia.

- Russia, China, and Iran only permit government-approved VPNs, with unapproved use risking penalties up to $2,200 in China and jail time in Iran.

- Russian law passed in 2024 increased fines and targeted the removal of nearly 100 VPN providers from app stores for non-compliance.

- Myanmar’s 2025 cybersecurity law authorizes equipment seizure and fines for unauthorized VPN use.

- In China, an estimated 50–70 million users still use obfuscated VPN protocols to bypass national blocks despite government crackdowns.

- Globally, 7 countries enforce full bans on VPNs, with an additional 14 imposing restrictions or partial bans, affecting about half the world’s internet users.

Innovations and Future Trends in VPNs

- Over 50% of leading VPN providers have announced plans or pilots for post‑quantum encryption deployment by late 2025.

- Stealth protocols enabled on platforms like Proton and Windscribe offer near-undetectable VPN traffic, with obfuscation defeating most DPI methods now used by ISPs and governments.

- 51% of enterprises have adopted ZTNA to reduce traditional full‑tunnel VPN reliance as part of SASE integration strategies.

- Multi-hop routing and onion-over-VPN are included in 32% of major VPN products as a premium anonymity feature in 2025.

- 65% of top-tier VPN services now bundle tracker blocking, encrypted DNS, and split tunneling as standard features.

- Decentralized VPNs (dVPNs) grew at a 140% year-over-year rate, with serverless models starting to appear in commercial offerings in 2025.

- 29% of mobile VPN sessions in 2025 will be routed via edge locations to boost speed and connectivity for mobile users.

- 40% of the top 20 VPN providers underwent independent third-party audits or transparency reporting within the past 12 months.

Cost and Payment Statistics

- Median monthly cost for paid VPNs is $10, ranging $2 to $15.

- ExpressVPN costs ~$12.99/month, with 2‑year plans as low as ~$3.49/month.

- 28% of VPN users rely on free plans in 2025.

- ~64% of VPN users prefer paid subscriptions.

- 26% of users pay out-of-pocket, and others have employer or co-pay models.

- Of those who used free VPNs earlier, 34% switched to paid in 2025.

- PureVPN forecasts a ~$77 billion market by 2026.

Frequently Asked Questions (FAQs)

Around 22.9% of internet users worldwide use VPN services.

The VPN market is projected to grow from about $61.42 billion in 2024 to ~$71.25 billion in 2025, implying a CAGR of ~16.7%.

Approximately 42% of Americans reportedly use a VPN.

About 32% of mobile VPN users connect daily or nearly daily.

Conclusion

VPNs remain a central tool in the battle for online privacy, security, and access control. Their prevalence spans billions of users globally, with major providers capturing market leadership while innovation pushes the technology toward greater resilience, anonymity, and integration with modern security architectures. Yet, hard limits exist, detection techniques, regulatory crackdowns, and design flaws still challenge the promise of perfect protection. For users, balancing price, trust, and features is key. For businesses, VPNs are evolving from a blunt tool to one layer among identity, endpoint, and zero‑trust strategies.