The stablecoin ecosystem is rapidly evolving, and Tether (USDT) remains at its centre. With usage spanning global payments, trading pairs, and everyday savings in emerging markets, its impact is tangible, from crypto exchanges settling trades to remittance corridors bypassing traditional bank rails. In the U.S., institutional desks rely on USDT liquidity for hedge and flow operations. Abroad, users hedge currency volatility by holding USDT as a digital dollar alternative. Read on to explore the latest statistics and what they reveal about Tether’s role in global finance.

Editor’s Choice

- Circulating supply of USDT reported at about $182 billion as of mid-2025.

- USDT processed monthly on-chain transfers in excess of $700 billion, peaking at $1.01 trillion in June 2025.

- On-chain transfers of USDT on the TRON network averaged $20 billion daily, and the network supports over 8.3 million daily transactions.

- The Asia-Pacific region accounts for over 45% of global USDT volume in Q1 2025.

- Tether holds nearly $120 billion in U.S. Treasury securities as part of its reserve backing.

Recent Developments

- In September 2025, Tether added approximately 8,889 BTC (worth about $1 billion) to its reserves, while USDT supply neared $175 billion.

- The company is planning a U.S.-focused stablecoin (tentatively “USAT”) to expand into regulated U.S. markets.

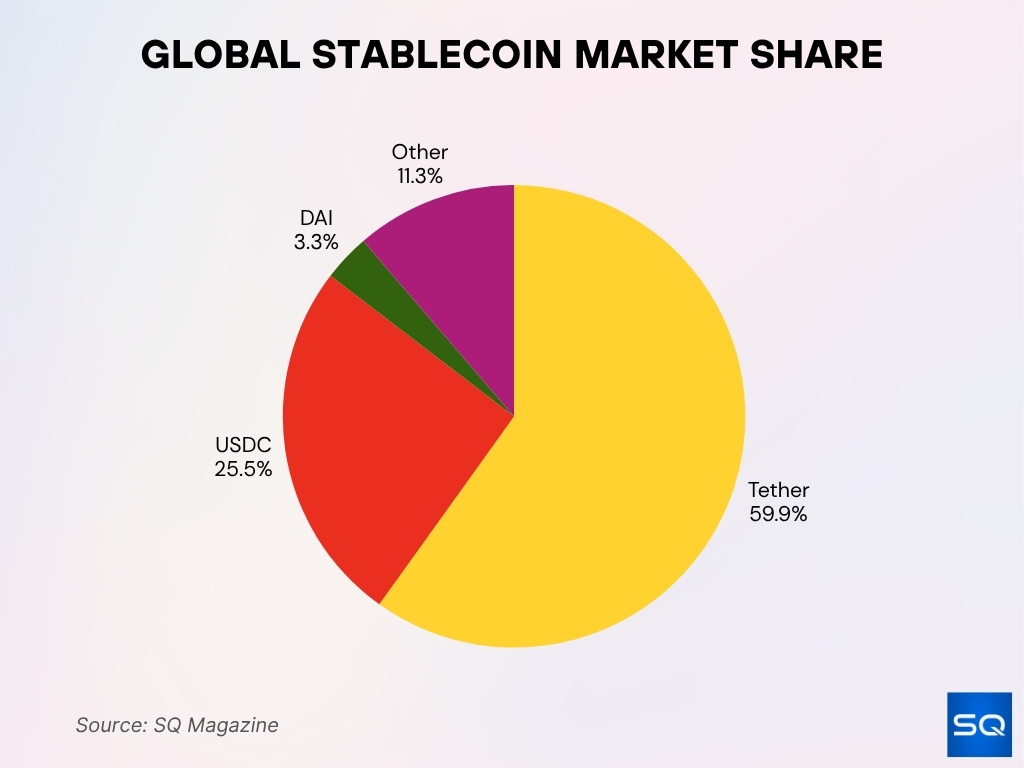

- Despite still increasing in dollar terms, USDT’s market share of the stablecoin market slipped to about 59.9% by October 2025, down from ~70% in November 2024.

- Minting activity on TRON: about $16 billion USDT issued on TRON in early 2025, with total TRON-hosted USDT supply exceeding $75.7 billion.

- The regulatory environment shifted, and the EU’s Markets in Crypto-Assets (MiCA) regime began to take effect, affecting stablecoin issuance and platform listings in Europe.

- Tether published its Q1 2025 attestation, confirming reserves and reporting an operating profit of over $1 billion.

- On-chain transaction turnover for USDT-ETH pairs on Ethereum fell ~39% in Q1 2025 compared to Q1 2024.

- Tether’s U.S. Treasury holdings alone make it one of the largest non-sovereign holders of U.S. debt, impacting short-term Treasury yields.

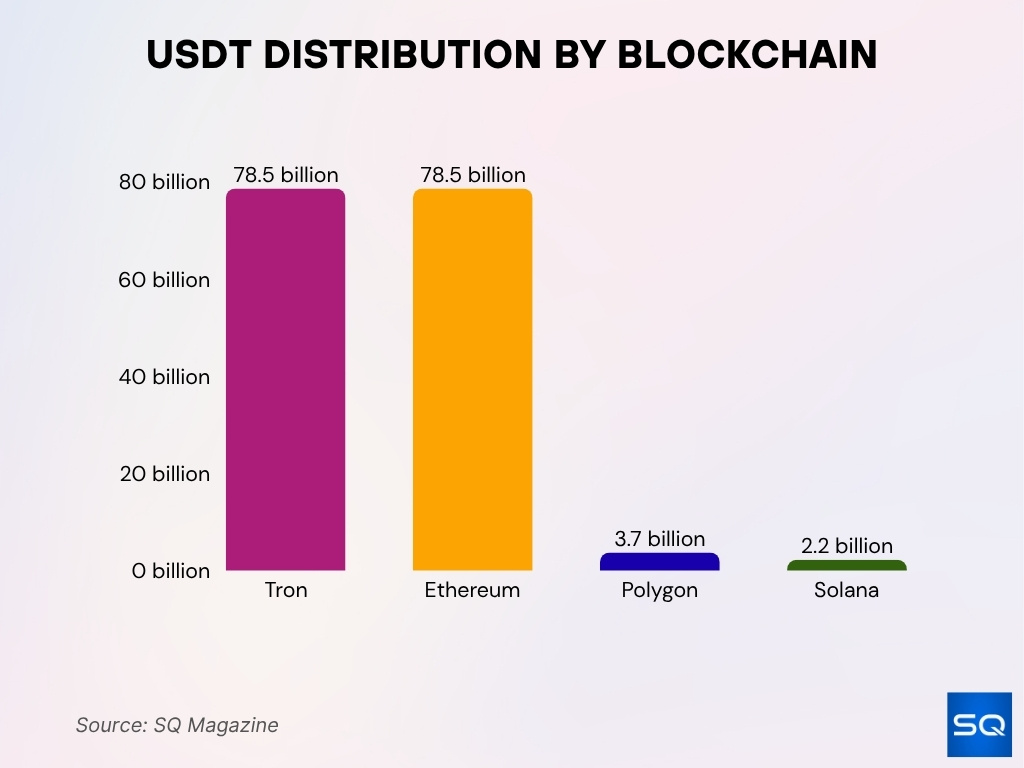

Blockchain Networks Supporting Tether

- Tron leads with the largest USDT supply at 78.5 billion tokens, matching Ethereum’s 78.5 billion, making both dominant chains for Tether as of October 2025.

- Polygon supports a smaller but notable 3.7B USDT, while Solana hosts 2.2B USDT, reflecting moderate adoption on emerging networks.

Market Capitalization Statistics

- According to live data, market cap sits at about $183.2 billion with circulating supply ~157.1 billion tokens.

- Year-over-year growth, from around $127 billion in 2024 to about $152.7 billion in 2025 (≈20% growth).

- USDT represents about 4.44% of the total crypto asset market value as of May 2025.

- The stablecoin market overall exceeded $230 billion by early 2025, and USDT alone comprised a dominant portion.

- On-chain data shows USDT transfers on TRON alone have cumulatively reached hundreds of billions of dollars, underscoring the scale behind the market cap.

Trading Volume Statistics

- The daily trading volume of Tether (USDT) exceeded $140 billion in 2025, making it the most-traded cryptocurrency by volume.

- On the TRON network alone, USDT transfers averaged $20 billion a day as of May 2025.

- In early 2025, DEX transaction volume using USDT exceeded $19 billion in just one month.

- On the major centralized exchanges, USDT trading pairs accounted for about 41% of all transactions globally in 2025.

- USDT’s dominance in perpetual futures contracts on crypto exchanges reached roughly 62% of all stablecoin-based margin trading.

- Year-over-year, USDT’s peer-to-peer transfer volume increased significantly, particularly in emerging markets, rising by more than 30% from 2024 to 2025.

- On some platforms, USDT recorded an average slippage of under 0.01% during large-volume trades in 2025.

Tether (USDT) Global Impact Highlights

- 433 million users now use Tether, making it the most widely adopted stablecoin globally.

- 39 million new users joined in Q1 2025, reflecting rapid growth in global adoption.

- If Tether were a country, its U.S. Treasury holdings would rank 19th globally, among the top sovereign debt holders.

- USDT reinforces the U.S. dollar’s supremacy, bridging international trade, remittances, and payroll.

- Tether acts as a “digital dollar” in emerging markets, expanding U.S. financial influence where banks fall short.

- By enabling dollar-based savings and payments, USDT remains a key pillar in the global crypto economy.

Tether Usage in Exchanges

- USDT remains the most common quote currency on crypto exchanges, used in over 73% of global spot trades during 2025.

- On major exchanges (e.g., Binance, OKX, Bybit), USDT volume exceeded $240 billion per month each in 2025.

- On the Kraken platform, 24-hour USDT trading volume reached ~$75.9 billion at one point in 2025.

- USDT’s presence spans over 400 exchanges globally, more than any other cryptocurrency.

- USDT liquidity pools on DEXs held over $19.5 billion in combined liquidity across platforms.

- In perpetual futures markets, USDT-based margin trades accounted for approximately 62% of all stablecoin margin positions.

- Slippage for large trades in USDT pairs remained under 0.01%, supporting its role in high-volume trading.

Geographic Distribution of Tether Usage

- More than 58% of USDT users are based outside North America, with a heavy presence in Asia and South America.

- Average transaction sizes in North America (~$35,000) exceed those in Asia-Pacific (~$11,500) when using stablecoins like USDT.

- The U.S. market saw crypto activity surge by ~50% between January and July 2025 compared with the same period in 2024.

- South Asia emerged as the fastest-growing region for crypto adoption in 2025, boosting USDT flows correspondingly.

- Reports show that USDT is more popular in emerging markets than some competing stablecoins.

- On-chain data indicate large USDT flows in corridors connecting Asia to the Middle East, reflecting trade settlements and remittances.

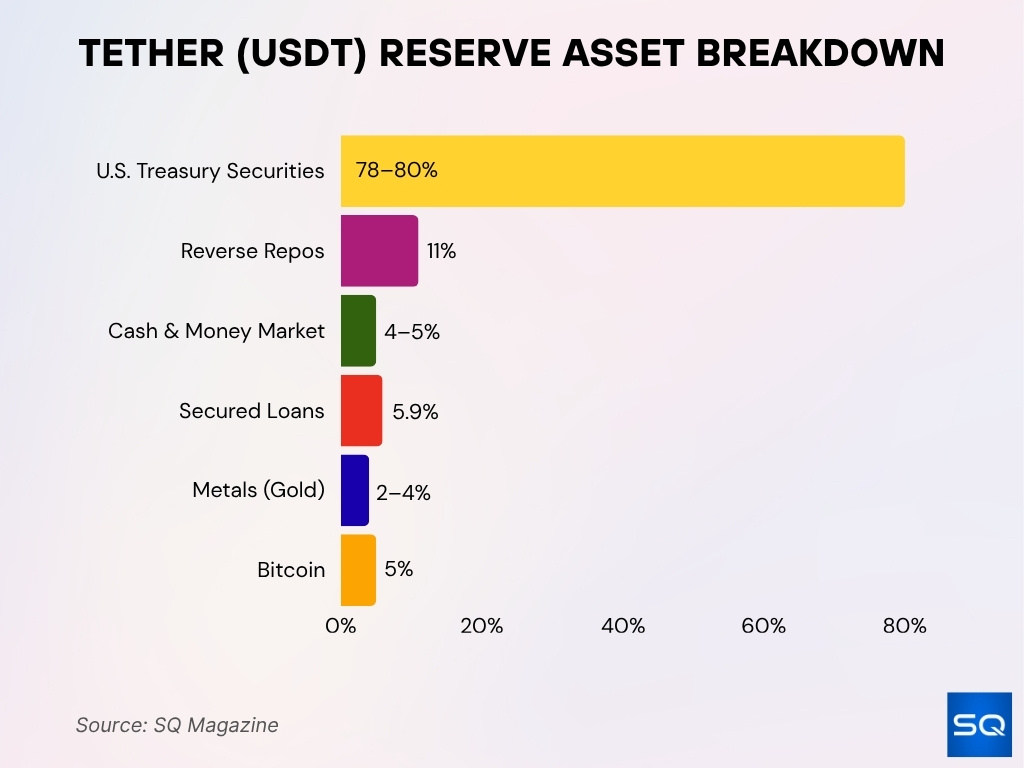

Tether (USDT) Reserve Composition Snapshot

- 78–80% of reserves are held in U.S. Treasuries, forming the backbone of Tether’s asset base.

- 11% of reserves are in reverse repos, ensuring short-term liquidity with government-backed collateral.

- 4–5% is allocated to cash and money market funds, supporting redemptions and daily operations.

- 5.9% of reserves are tied to secured loans, adding diversification to the asset structure.

- Tether holds 11.6 tons of physical gold, worth about 2–4% of total reserves as of Q3 2025.

- Over 100,000 BTC are part of reserves, making up nearly 5% of Tether’s asset backing.

Adoption and User Growth

- The user base of Tether (USDT) grew by 13% in Q1 2025.

- On-chain data show more than 10.7 million active USDT-holding addresses, a +19.2% year-over-year increase.

- The global stablecoin market (including USDT) expanded its supply roughly 28% year-over-year, signalling broad adoption.

- Emerging markets lead adoption, lower- and middle-income countries drove the surge in 2025, with the U.S. ranking fourth.

- More than 39 million new users joined USDT in Q1 2025 alone.

- USDT adoption is increasingly crossing into non-trading use-cases (remittances, inflation hedge) as seen in Latin America and Africa.

- The forecast from the issuer anticipates accelerated user growth in the U.S. market via a planned stablecoin launch compliant with U.S. rules.

- The average USDT wallet value is reported to be around $970, reflecting both retail and institutional usage.

Tether (USDT) Stablecoin Market Share

- Tether dominates with 59.9% of the global stablecoin market as of October 2025.

- USDC holds 25.5%, while DAI accounts for 3.3%, reflecting the remaining share among major competitors.

Wallet Distribution and On-Chain Activity

- On-chain transfers of USDT surpassed 43 million transactions in January 2025 alone.

- The top 100 addresses hold about 37% of the total supply, down from ~41% in 2023, indicating slightly improved token distribution.

- On the TRON network, USDT averages ~4.1 million transactions per week, making it the most-transferred token there.

- Over 1.4 million smart contracts have interacted with USDT by Q1 2025, demonstrating usage in DeFi and tokenized platforms.

- The number of non-custodial wallets holding USDT (self-custody) rose by ~ 22% from 2024 to 2025.

- On some layer-2 networks, the transaction cost of moving USDT is under $0.01, enhancing micropayment capability.

- Wallet-holding data show that the average wallet retains around $970 worth of USDT, although distribution varies significantly between exchange-custodied and self-custody wallets.

Environmental Impact and Energy Consumption

- USDT transactions on TRON and Polygon are reported to consume less than 0.0001 kWh per transfer, positioning them among the most energy-efficient major crypto assets.

- Emissions per transaction tied to USDT on relevant networks are estimated at 99.95% lower than legacy proof-of-work chains such as Bitcoin.

- Upgrades in network architecture (e.g., Ethereum’s move to proof-of-stake) contributed to a ~ 98% reduction in USDT-related emissions on that network since pre-2022 levels.

- USDT now supports Layer-2 settlement and bridges, reducing settlement latency and energy per dollar transferred.

- The issuer has formed partnerships to integrate environmental metric tracking with USDT flows and DeFi networks.

- Because USDT is heavily hosted on efficient networks like TRON and Polygon (rather than just Ethereum), its incremental energy footprint remains modest compared with major networks.

- That said, despite lower per-transaction energy use, the sheer scale of USDT transfers (in the trillions of dollars) implies that cumulative environmental impact should still be monitored as adoption expands further.

Reserve Asset Breakdown

- As of 30 June 2025, the issuer’s reserve assets backing USDT stood at $162.575 billion, exceeding liabilities by about $5.47 billion.

- Breakdown, ~$105.52 billion in U.S. Treasury Bills (residual maturity < 90 days).

- Reverse repurchase agreements, ~$16.34 billion (overnight) and ~$1.67 billion (term) as of the same date.

- Money market funds, ~$6.35 billion.

- Secured loans, ~$10.14 billion.

- Bitcoin holdings, ~$8.93 billion (using BTC price ~$107,240) as of June 30, 2025.

- Precious metals (physical gold), ~$8.73 billion.

- Around 80% of backing assets are U.S. Treasuries or equivalents, with the remainder including secured loans, gold, and crypto-assets.

Frequently Asked Questions (FAQs)

About 65% of the stablecoin market.

About $228 billion for the stablecoin market.

About a 28% increase year-over-year.

Approximately $129.5 billion in 24-hour volume.

Conclusion

The nearly trillion-dollar scale of stablecoins is anchored today by USDT, and as we’ve seen, its growth across user addresses, transactions, on-chain flows, and global adoption remains strong. At the same time, the distribution of wallets, energy efficiency of transactions, and transparency of reserve assets show meaningful evolution in how USDT operates. Nevertheless, as stablecoins take on a larger role in global finance, questions around regulatory compliance, reserve structure, and systemic risk require ongoing vigilance. For readers interested in the full statistical picture of USDT, including trading volumes, geographic usage, and exchange flows, read on to the complete article.