The use of smart contracts is transforming how financial services operate, from automating settlements to enabling tokenized assets. In the banking sector, firms are deploying smart contract workflows to reduce manual hand-offs and lower error rates. In the insurance industry, claims automation via smart contracts is speeding payouts and cutting costs. The following sections present detailed data and trends showing how smart contract adoption is playing out.

Editor’s Choice

- Approximately 70% of new smart contract platforms in 2025 prioritize interoperability, reflecting the demand for cross-chain functionality in enterprise finance.

- Public blockchains power approximately 62% of smart contract deployments in 2025.

- Large enterprises (10,000+ employees) represent about 60% of smart contract usage in 2025.

- The Ethereum ecosystem still holds roughly 70% of the smart contract share in 2025.

- North America contributes around 40% of global smart contract activity in 2025.

- Financial institutions expect about 85% adoption of smart contracts in some form by 2025.

Recent Developments

- Across global finance, an estimated 85% of institutions plan to adopt smart contracts by 2025.

- Multi-ledger and cross-chain smart contract deployments are growing by 30% to 60% in 2025.

- A study found that 59% of contracts on Ethereum in 2024 involve multiple contract dependencies.

- The public blockchain segment accounted for roughly 60% of smart contract market revenue in 2022–24.

- Enterprise blockchain adoption is shifting from pilots to scaled solutions in 2025, driven by business outcomes.

- Integration with legacy systems remains an issue; around 30% of enterprises reported integration hurdles in 2025.

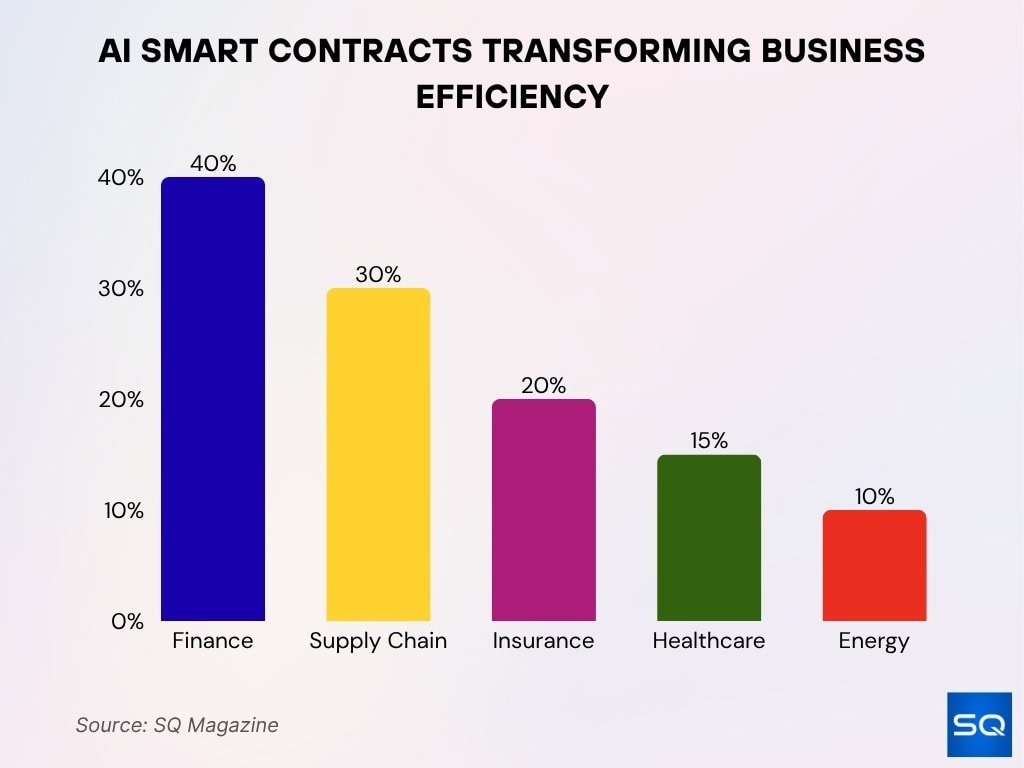

AI Smart Contracts Transforming Business Efficiency

- Finance (40%) uses AI-driven smart contracts for automated settlements and DeFi systems.

- Supply Chain (30%) leverages smart contracts for real-time tracking and logistics transparency.

- Insurance (20%) adopts smart contracts for automated claims and fraud reduction.

- Healthcare (15%) applies smart contracts to secure patient data and streamline billing.

- Energy (10%) focuses on decentralized energy trading and efficiency optimization.

Platform Adoption Insights

- Ethereum remains dominant, holding about 70% of smart contract platform share in 2025.

- Binance Smart Chain (BSC) commands around 15% share in 2025, driven by lower fees and ease of access.

- Solana supports about 8% of smart contracts in 2025.

- Polygon saw approximately 50% growth in smart contract adoption during 2025.

- Approximately 70% of newly launched platforms in 2025 embed interoperability features.

- Enterprise-oriented platforms such as Hyperledger registered +20% adoption among private finance deployments in 2025.

- Developer tooling improvements and modular frameworks accelerated platform innovation in 2025.

- The maturation of Layer 2 networks under Ethereum sharpened competition among platforms for finance use cases.

Blockchain Type Distribution (Public, Private, Hybrid)

- Public blockchains account for about 62% of smart contract deployments in 2025.

- Private blockchains represent roughly 25-30% of deployments, especially in enterprise finance.

- Hybrid or consortium blockchains, combining public and private features, saw around 40% growth in 2025.

- In 2024, the public segment held ~60% revenue share, and the large enterprise segment dominated the share of blockchain types.

- For financial institutions, controlled access (private) deployments increased due to compliance and risk-management concerns.

- Many projects now adopt hybrid architectures to balance transparency (public) and confidentiality (private).

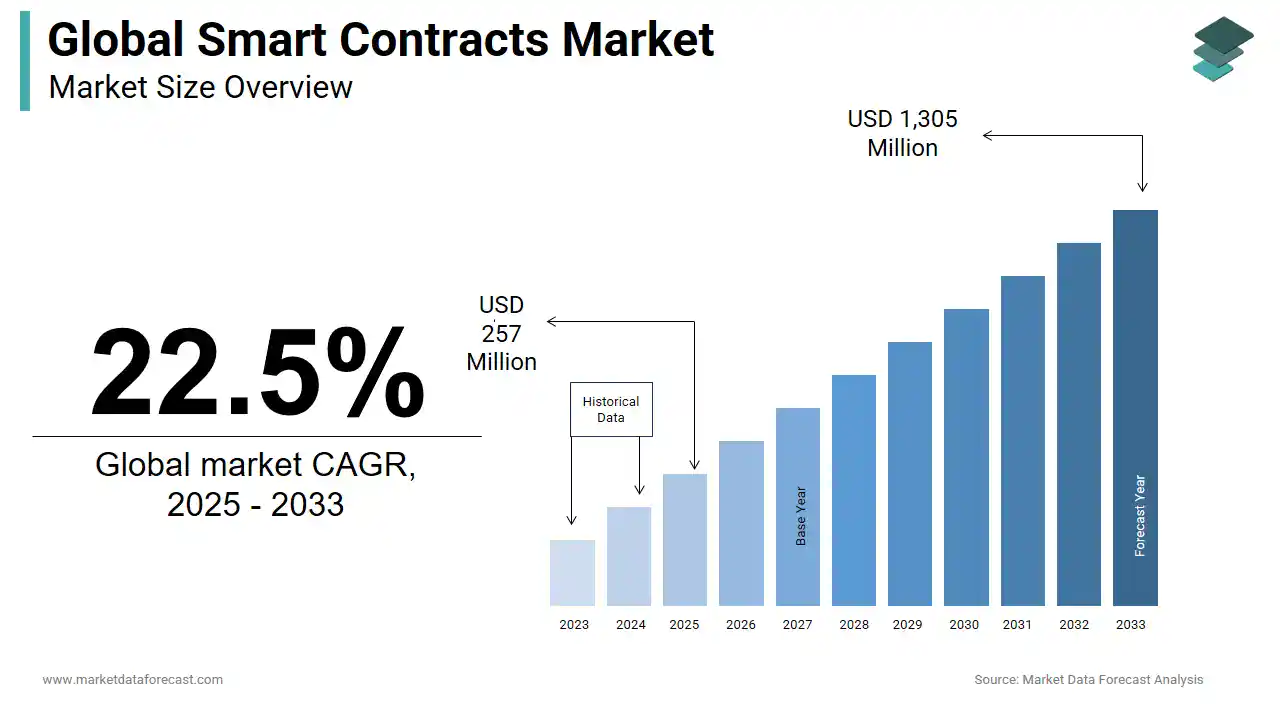

Global Smart Contracts Market Growth

- The global market will expand from $257 million (2025) to $1.3 billion (2033).

- This equals a 22.5% CAGR across the forecast period.

- By 2027, value will exceed $400 million with growing enterprise automation.

- By 2030, it could surpass $780 million via fintech and supply chain adoption.

- The rise to $1.3 billion by 2033 marks smart contracts’ mainstream adoption.

Adoption by Enterprise Size (Large Enterprises vs. SMEs)

- Large enterprises (10,000+ employees) represent about 60% of smart contract usage in 2025.

- SMEs (small and mid-sized enterprises) recorded a 35% adoption increase in 2025.

- Enterprises with $1 billion+ revenue are roughly twice as likely to have smart contract implementations in 2025 compared with smaller firms.

- More than 80% of multinational corporations plan to expand their smart contract or blockchain usage in 2025.

- Mid-sized firms (e.g., 500–2,000 employees) saw around 45% growth in adoption in 2025, supported by blockchain as a service (BaaS) platforms.

- SMEs frequently use smart contracts for leaner operations, such as automation of supplier payments or escrow flows.

- The difference in adoption stems in part from resource availability (skills, infrastructure) and regulatory readiness across enterprise sizes.

End-Use Sector Adoption (Banking, Insurance, Real Estate, etc.)

- In 2025, the banking sector leads with about 48% of smart contract use-cases in finance.

- Insurance firms account for roughly 26% of smart contract adoption, particularly for claims automation and fraud prevention.

- The real estate industry represents approximately. 15% of smart contract deployments, with emphasis on tokenized sales and escrow services.

- Healthcare use of smart contracts in financial workflows rose ~18% in 2025, driven by data sharing and billing applications.

- Supply-chain related financial applications (though adjacent to core finance) saw ~22% growth in smart contract usage in 2025.

- Government finance and procurement smart contract pilots represent roughly 10% of projects in 2025.

- Fintech companies indicated that about 60% of them will adopt smart contracts by 2025 to streamline lending, borrowing, and investment workflows.

- Across the U.S., many banks reported smart contract pilots for settlement and syndicated loan workflows, though full-scale numbers are not yet public.

- The real estate tokenization wave intersects with smart contracts; properties using tokenized ownership via smart contracts are gaining investor interest.

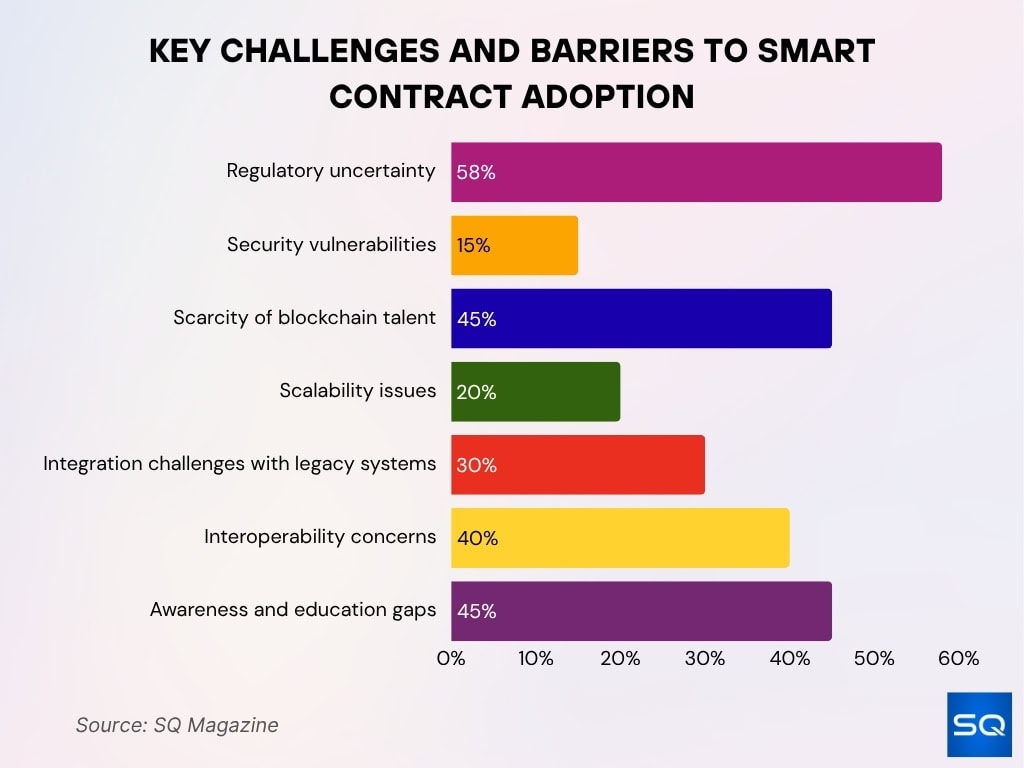

Challenges and Barriers to Adoption

- Regulatory uncertainty (~58%) remains the top barrier for businesses in 2025.

- Security vulnerabilities (~15%) from smart contract bugs caused financial losses.

- Blockchain talent shortage (~45%) hindered developer recruitment in 2025.

- Scalability issues (~20%) led to high transaction costs on public blockchains.

- Integration challenges (~30%) with legacy systems slowed enterprise rollout.

- Interoperability concerns (~40%) limited cross-chain asset transfers in 2025.

- Awareness gaps (~45%) kept small businesses from adopting smart contracts.

Adoption in Traditional vs. Decentralized Finance (TradFi vs. DeFi)

- Within the broader financial ecosystem, around 90% of financial services companies report active engagement with blockchain tech, many involving smart contracts.

- On-chain stablecoin transfers, a key DeFi smart contract application, moved over $20.2 trillion by May 2025, up from $13.8 trillion a year earlier.

- Cross-border payment solutions integrating smart contracts reduced remittance fees by ~25% by 2025.

- Smart contract-enabled DeFi lending and borrowing platforms have grown meaningfully, as shown in academic reviews bridging TradFi and DeFi risk frameworks.

- Smart legal contracts (used more in TradFi contexts) represent about 43% of the global smart contracts market in 2025.

- In 2025, smart contract market share in financial services (both TradFi & DeFi) accounted for around 46% of total market activity in 2024 data.

- Adoption of smart contracts for TradFi settlement/infrastructure use cases (e.g., DLT in capital markets) shows material operational benefits.

- Traditional banks are increasingly experimenting with tokenization and smart contract integrations to compete with DeFi’s speed and transparency advantage.

Key Use Cases and Applications in Finance

- Automated claims processing in insurance via smart contracts, triggered by predefined conditions, is increasingly adopted.

- Smart contracts for trade finance (e.g., letters of credit) have seen a ~50% surge in adoption by 2025.

- Digital wallets incorporating smart contracts for automated payments make up ~25% of fintech use cases by 2025.

- DeFi smart contracts have processed over $150 billion in trades via DEXs by 2025.

- Smart contract-based microfinance platforms increased accessibility by ~15% in 2025.

- Tokenised asset management (smart contract-driven) grew ~40% in 2025.

- Invoice and supply-chain finance use cases are adopting smart contracts to reduce friction and manual reconciliation.

- On-chain settlement of delivery-versus-payment via smart contracts in capital markets is becoming actionable.

- Smart contracts for escrow and fund releases in property or structured finance arrangements are gaining traction in 2025.

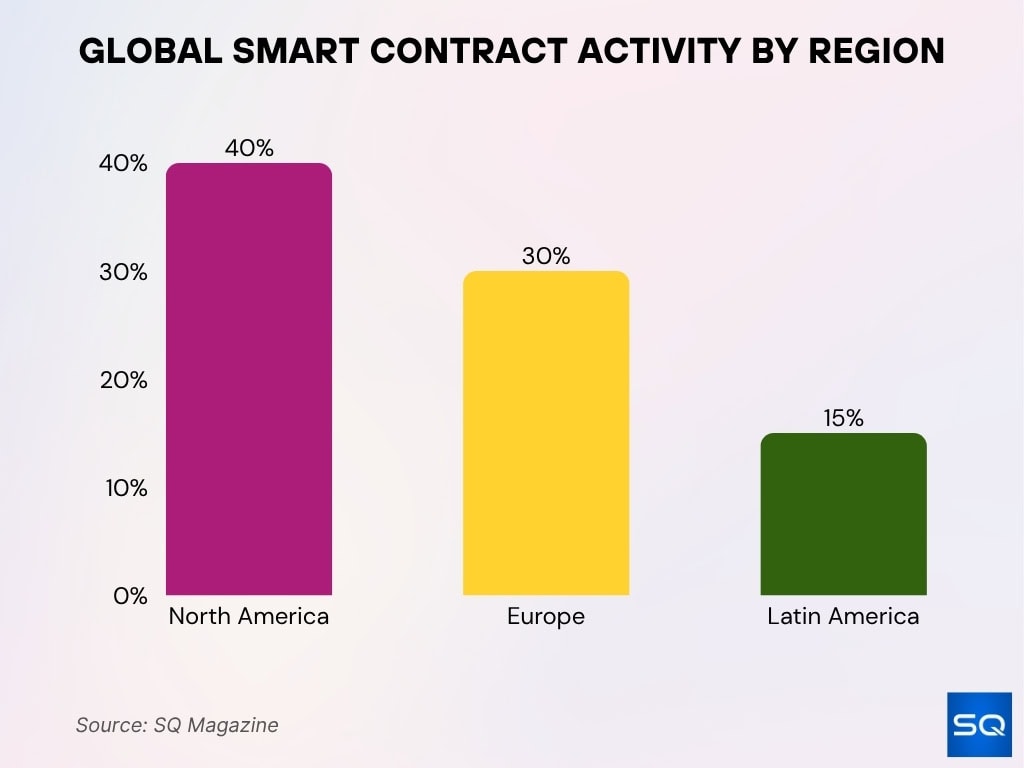

Regional Insights

- North America (~40%) leads in 2025, driven by US fintech innovations.

- Europe (~30%) focuses on regulatory compliance and public blockchain adoption.

- Latin America (~15%) advances digital identity and financial inclusion use cases.

Adoption in Payments and Settlements

- Over $7.4 billion in tokenised U.S. Treasury products relied on smart contracts in 2025, marking an ~80% year-to-date jump.

- Stablecoin-based payments processed over $40 billion daily via smart contracts in Q3 2025.

- 60% of asset managers piloted smart contract-powered money-market products in 2025.

- Cross-border smart contract settlements reduced transaction times from 2-3 days to under 5 minutes at test banks.

- Major payments infrastructure firms saw 20–30% cost reductions from automating reconciliation using smart contracts.

- 38% of finance-sector payment corridors in LATAM used stablecoins and smart contracts in 2025.

- Smart contract adoption in settlements allowed banks to free up 15% more collateral for lending by minimizing pending capital.

- Tokenised money-market experiments posted over $2 billion in real-time smart contract settlements in H1 2025.

- 22% of cross-border payment flows in APAC are now managed via programmable stablecoin smart contracts.

- Payments firms reported a 25% increase in velocity for transactions settled with smart contracts in 2025.

Tokenization, Asset Management, and Real Estate

- The global assets-tokenization market (which relies on smart contracts) reached ~ $1,026 billion (≈ $1.03 trillion) in 2024 and is expected to grow to ~$5,453.98 billion by 2029.

- Tokenised asset-management use cases driven by smart contracts increased by ~40% in 2025.

- Tokenised U.S. Treasury products (on-chain, smart contract-enabled) surpassed $7.4 billion in mid-2025.

- Projections suggest the tokenised real-estate market could reach ~$3 trillion by 2030, up from tens of billions today.

- Real estate transactions using digital assets (NFTs/smart contracts) saw a ~30% rise in customer inquiries in 2025.

- Smart contracts enable fractional ownership, automated dividend distribution, and secondary trading in tokenised assets.

- Asset managers are increasingly using smart contracts for real-world asset (RWA) tokenisation, liquidity enhancement, and transparency.

- Tokenisation efforts via smart contracts help open previously illiquid assets to broader investor bases and enable programmability of asset flows.

Adoption in Lending, Borrowing, and Microfinance

- Loan agreements governed by smart contracts reached approximately $150 billion, a 20% year-over-year growth, in 2025.

- Micro-lending platforms using smart contracts disbursed about $1.3 billion in 2025, enhancing access for underserved borrowers.

- Peer-to-peer (P2P) lending via smart contracts handled roughly $15 billion by 2025.

- Smart-contract-based borrowing protocols (in DeFi) expanded user bases by more than 30% in 2025.

- Enterprises noted ~65% faster contract enforcement for lending operations when smart contracts were used.

- Small and mid-sized lenders using smart contracts reported cost reductions of ~20% in servicing loans in 2025.

- Collateral management under smart contracts improved repayment rates by around 10% in pilot programs.

- Tokenised collateral frameworks backed by smart contracts now support real-world assets in lending pools in 2025.

Insurance and Claims Automation Statistics

- Approximately 58% of insurers plan to increase blockchain spending (including smart contracts) in 2025.

- Automated claims-processing via smart contracts has shifted settlement from weeks to hours in many cases.

- Decentralized insurance platforms leveraging smart contracts cut manual claims-handling costs by 60-80% in 2025.

- In traditional insurance workflows, firms report a ~30% decrease in claim processing costs when smart contracts are deployed.

- Smart contracts are used for parametric insurance payout triggers (e.g., weather events) in ~30% of new use cases.

- Controlled access and privacy-compliant blockchains support real-time claims settlement, per recent academic findings.

- Around 26% of smart contract deployments in finance (in 2025) are insurance-related.

- Multi-signature smart contracts are being adopted by insurers to strengthen fraud prevention and audit trails.

Benefits and Efficiency Gains from Smart Contracts

- Smart contract adoption is projected to reduce financial services operational costs by ~30% on average.

- Firms deploying smart contracts report process-cycle time reductions of ~40% in 2025.

- Smart contracts enable “straight-through processing” of contracts, eliminating manual intervention in over 50% of cases in pilot deployments.

- Liquidity locked in settlement flows fell by an estimated 25% for institutions using smart contracts.

- Programmable payments via smart contracts improve accuracy and reduce errors by ~35%.

- Tokenised assets governed by smart contracts improve investor access and fractional ownership by roughly 40% in 2025.

- For payments and settlements, the shift to smart contracts resulted in real-time or near-real-time execution in an increasing number of institutions.

- Enhanced transparency and auditability from smart contracts reduce reconciliation workloads by ~30%.

Security, Privacy, and Risk Considerations

- Although smart contract deployment rises, ~15% of deployments in 2025 reported vulnerabilities or bugs that caused financial losses.

- Researchers warn of systemic risk; one contract exploited can amplify losses across interconnected smart contracts.

- Compliance with data-privacy regulations (e.g., GDPR, HIPAA) remains an issue in about 20-25% of blockchain / smart-contract use cases in finance.

- Hybrid blockchain models (public + private) are used by ~45% of enterprises to mitigate privacy risk.

- Firms cite ~30% of adoption delays due to concerns around scalability and security of smart contract infrastructure.

- Multi-party smart contract frameworks require robust governance; roughly 32% of firms noted governance as a top barrier.

- Smart contracts rely on oracles (external data feeds), improper oracle design increases risk in ~18% of setups.

- Cyber-attack vectors on smart contracts remain rising, firms estimate losses could hit billions if unaddressed.

Regulatory and Compliance Developments

- Government-backed digital-asset frameworks in the U.S., EU, and Asia increasingly reference smart-contract rules in 2025.

- Roughly 58% of firms say regulatory uncertainty is a major barrier to smart contract adoption in finance.

- Regulatory sandboxes for programmable contracts (smart contracts) exist in more than 12 jurisdictions globally by mid-2025.

- Compliance costs drop by about 15% for smart-contract-enabled workflows under approved frameworks.

- Standard-setting bodies are working to define the legal status of self-executing contracts; about 40% of heavy-adoption firms report active policy engagement.

- Audit and certification of smart contracts are expected to become mandatory in regulated finance by 2026 in several jurisdictions.

- Privacy-by-design provisions in blockchain/smart-contract law are now referenced in ~22% of new regulations.

- Cross-border regulatory coordination on tokenised assets and smart contracts is improving, with ~30% of institutions expecting clearer guidance in the next 12 months.

Frequently Asked Questions (FAQs)

About 85% of global financial institutions are expected to adopt smart contracts by 2025.

Decentralized exchanges had processed over $150 billion in trades via smart contracts by 2025.

Microfinance platforms enabled about 15% greater accessibility via smart contracts in 2025.

Approximately 15% of deployments in 2025 reported vulnerabilities or bugs that caused financial losses.

Conclusion

In summary, the adoption of smart contracts in finance is both significant and accelerating. Large-scale lending, insurance claims automation, payments settlement, and tokenised asset frameworks all benefit from improved speed, accuracy, and cost efficiency. At the same time, security, governance, and regulation remain key hurdles. As the technology moves from pilots into enterprise-grade deployment, organizations that act early and thoughtfully position themselves to reap meaningful gains. If you’d like to dive into detailed breakdowns by platform, sector, and enterprise size, let’s explore further.