In the early 1970s, a little-known South Korean electronics company made a daring bet on semiconductors, a move considered risky and ambitious at the time. Fast forward to 2025, Samsung Electronics isn’t just a brand; it’s a cornerstone of the global tech ecosystem. From smartphones and TVs to semiconductors and futuristic foldables, Samsung’s influence spans continents and industries.

This article dives deep into Samsung’s 2025 performance, drawing on the latest statistics to unpack the company’s financial health, product landscape, market share, and global footprint. Whether you’re an investor, tech enthusiast, or business strategist, these numbers tell the real story behind the blue-and-white logo.

Key Takeaways

- 1$211.2 billion in total revenue reported by Samsung Electronics in FY 2024, marking a 2.6% increase YoY.

- 2Samsung maintained its position as the world’s largest memory chip manufacturer, holding over 43% market share in DRAM.

- 3Samsung Galaxy S24 Ultra topped smartphone sales in South Korea with 1.6 million units sold in Q1 2025.

- 4The company invested $21.4 billion into R&D in 2024, making it the second-highest R&D spender globally.

- 5Samsung’s global workforce exceeded 267,000 employees, spread across 74 countries as of March 2025.

- 6Samsung Display accounted for 33.1% of the global OLED panel market in early 2025.

- 7Operating profit rose to $32.5 billion, up 12.1% from 2023 levels, despite global tech sector volatility.

Recent Developments

- In Q1 2025, Samsung launched the Galaxy Ring, a health-tracking smart ring, expanding into the wearable healthtech space.

- Samsung unveiled its first 3nm 2nd-gen GAA chip in January 2025, claiming up to 35% improved performance over 5nm chips.

- The merger of Samsung SDS’s cloud business with Naver Cloud was finalized in May 2025, aimed at enhancing cloud competitiveness in Asia.

- Samsung committed $44 billion in 2025 for building a new semiconductor plant in Taylor, Texas, targeting the US chip market expansion.

- The Samsung Galaxy S24 series crossed 18 million global shipments in its first two months after launch.

- In February 2025, Samsung introduced AI Live Translate Call across all new Galaxy devices, using on-device generative AI.

- Samsung partnered with Hyundai Mobis in 2025 to co-develop advanced vehicle display panels and autonomous driving solutions.

- Samsung has committed to achieving enterprise-wide net‑zero Scope 1 and 2 carbon emissions by 2050, with its Device eXperience division (consumer electronics) targeting net-zero by 2030. As of end‑2024, the DX division had achieved a renewable energy transition rate of 93.4 % for Scope 1 and 2 emissions.

- Samsung’s QLED TV lineup for 2025 received Quantum Dot HDR+ certification, offering 38% more peak brightness than last year’s models.

- Samsung announced One UI 7.0 Beta for developers in July 2025, integrating Galaxy AI features natively into the system interface.

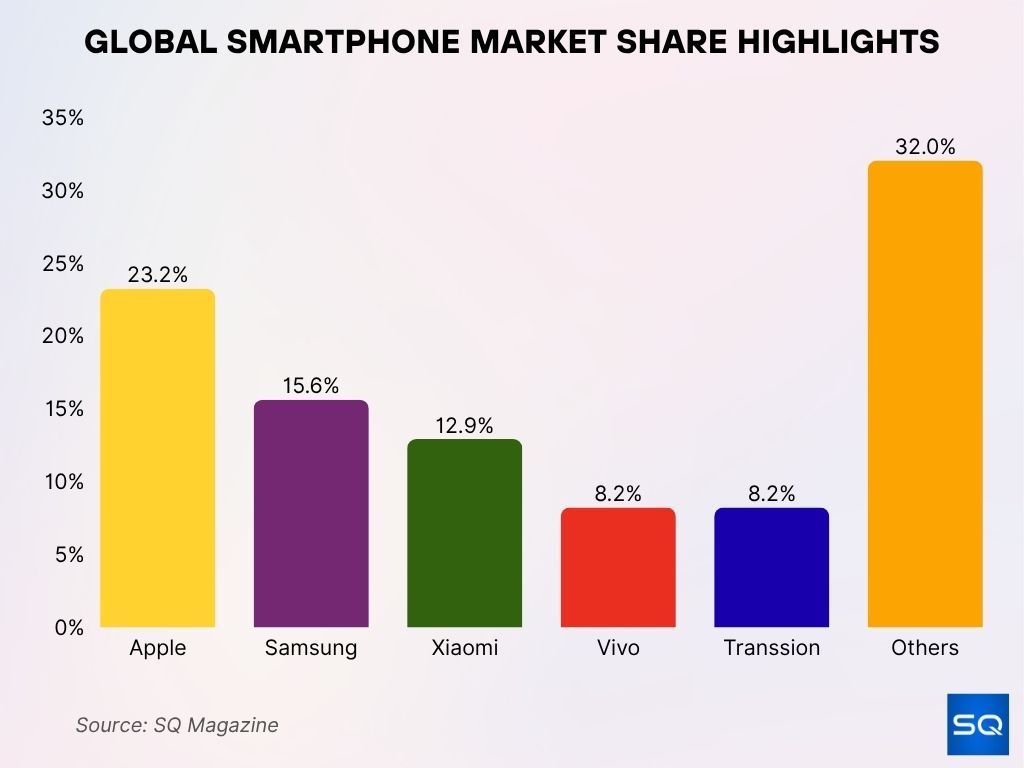

Global Smartphone Market Share Highlights

- Apple leads the global smartphone market with a 23.2% share, maintaining its strong premium market dominance.

- Samsung holds the second position with 15.6%, supported by its wide range of devices across price segments.

- Xiaomi captures 12.9% of the market, driven by competitive pricing and strong presence in emerging markets.

- Vivo and Transsion each account for 8.2%, showing steady growth in mid-range and budget smartphone segments.

- Others collectively make up 32%, reflecting the fragmented competition from various smaller and regional brands.

Overview of Samsung Electronics

- Founded in 1969, Samsung Electronics is the flagship subsidiary of the Samsung Group, accounting for over 70% of the conglomerate’s total revenue.

- Headquartered in Suwon, South Korea, the company operates across 3 core divisions: Consumer Electronics, Device Solutions, and IT & Mobile Communications.

- As of 2025, Samsung Electronics is the second-largest technology company globally by revenue, only behind Apple.

- The company holds around 1,600 subsidiaries globally, including Samsung Display, Samsung SDI, and Samsung Semiconductor.

- Samsung Electronics accounted for 20.1% of South Korea’s GDP in 2024, highlighting its vital national economic role.

- Samsung’s ecosystem covers semiconductors, smartphones, displays, TVs, home appliances, wearables, and enterprise solutions.

- In 2025, Samsung’s smartphone unit continues to lead in Android flagship innovation, particularly with its Galaxy Fold and Flip series.

- The Device Solutions division contributed to over 57% of operating profit in 2024, powered by strong memory chip demand.

- Samsung operates 33 global production facilities across Asia, Europe, and North America.

- The company’s motto, “Inspire the World, Create the Future,” continues to guide its multi-sector dominance and innovation strategy.

Revenue and Financial Performance

- Samsung Electronics reported KRW 285.4 trillion ($211.2 billion) in revenue for fiscal year 2024.

- This marked a 2.6% increase YoY, recovering from the chip slump that affected 2023 numbers.

- The Device Solutions division brought in KRW 131 trillion ($96.9 billion), accounting for 46% of total revenue.

- The IT & Mobile Communications division generated KRW 100.8 trillion ($74.5 billion), primarily from smartphone and tablet sales.

- Consumer Electronics posted KRW 53.6 trillion ($39.7 billion), driven by strong TV and appliance demand in Southeast Asia.

- Samsung’s Q1 2025 revenue reached KRW 72.9 trillion ($54 billion), a 4.3% QoQ increase, beating analyst forecasts.

- Net operating margin improved to 15.4% in 2024, compared to 13.7% in 2023.

- Revenue from premium product segments, foldables, 8K TVs, and gaming monitors rose 28% YoY in 2024.

- Samsung’s e-commerce and D2C sales jumped 19% globally in 2024, led by new digital retail strategies.

- Samsung Home Appliance division showed a double-digit growth in North America, contributing KRW 12.4 trillion ($9.2 billion) in revenue.

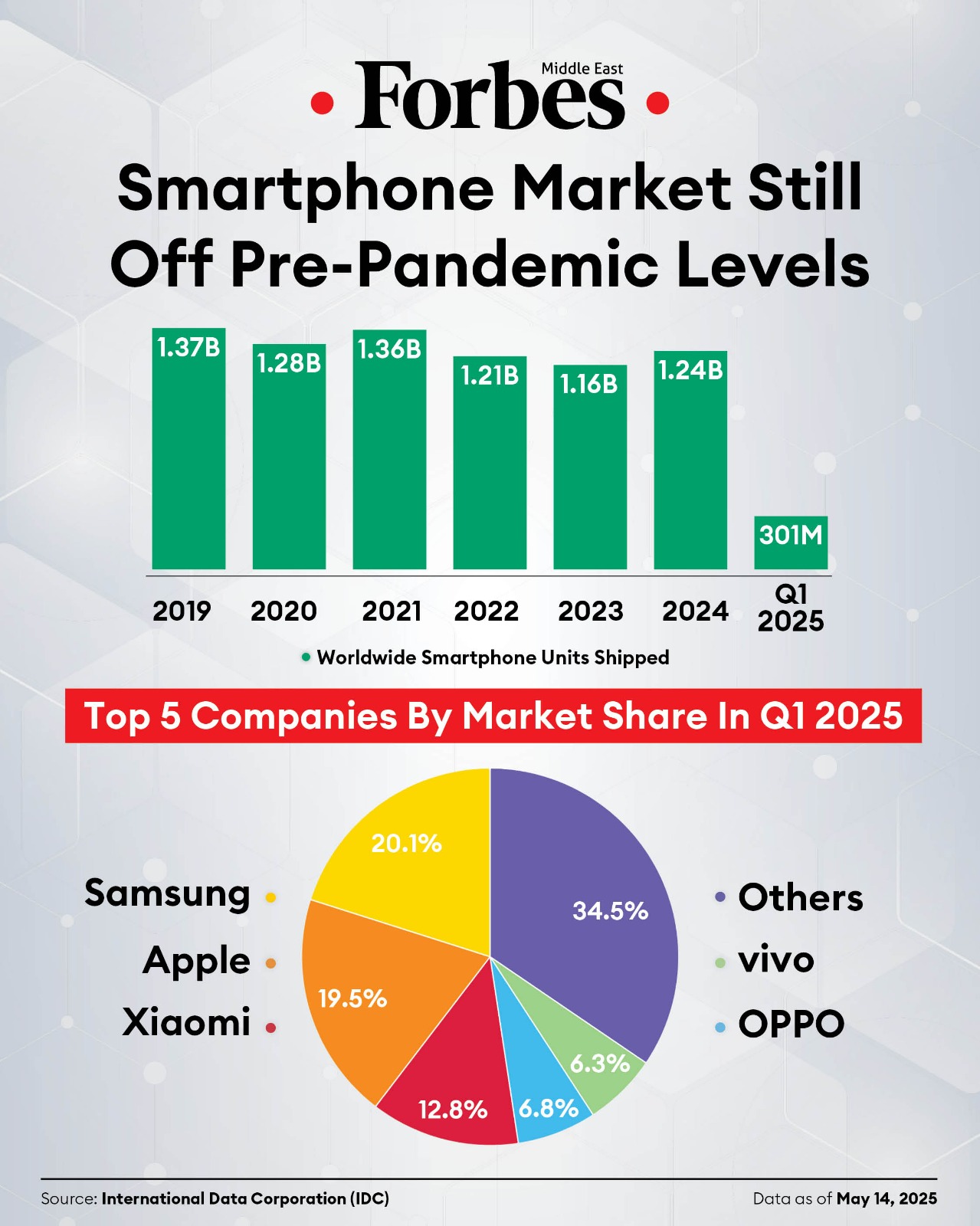

Smartphone Market Trends Highlights

- Worldwide smartphone shipments in Q1 2025 reached 301 million units, still below pre-pandemic levels.

- Annual shipment trend: peaked at 1.37B units in 2019, dropped to 1.16B in 2023, and is slightly recovering to 1.24B in 2024.

- Samsung leads Q1 2025 with 20.1% market share, maintaining its top position in global shipments.

- Apple holds 19.5%, closely competing with Samsung in the high-end smartphone market.

- Xiaomi captures 12.8%, driven by strong demand in budget and mid-range segments.

- OPPO holds 6.8%, maintaining a steady global presence.

- Vivo accounts for 6.3%, with continued growth in emerging markets.

- Others collectively dominate with 34.5%, showing the strength of smaller and regional smartphone brands.

Operating Profit and Net Income

- Samsung posted an operating profit of KRW 43.9 trillion ($32.5 billion) in FY 2024, up from KRW 39.1 trillion in 2023.

- Net income rose to KRW 35.2 trillion ($26 billion), a 9.8% YoY increase, driven by a rebound in chip prices and strong Galaxy S24 sales.

- The semiconductor unit alone contributed KRW 23.6 trillion ($17.4 billion) in operating profit, more than 54% of total profit.

- Profit margin in the semiconductor division increased from 21% in 2023 to 24.3% in 2024.

- Samsung Display reported KRW 6.1 trillion ($4.5 billion) in operating profit, with OLED panels driving growth.

- IT & Mobile division brought in KRW 10.3 trillion ($7.6 billion) in operating profit, thanks to increased foldable shipments.

- Samsung Electronics generated approximately $760,000 in net income per employee in 2024, based on roughly 268,000 employees and a net income of around $22.9 billion.

- Samsung’s Q1 2025 operating profit was KRW 11.2 trillion ($8.3 billion), marking the strongest Q1 in 3 years.

- Net income per share increased to KRW 5,200 ($3.85), a 12% growth YoY.

- Free cash flow reached KRW 24.8 trillion ($18.3 billion), supporting dividend stability and R&D expansion.

Market Capitalization and Brand Value

- As of July 2025, Samsung Electronics’ market capitalization stood at approximately $425 billion, making it the most valuable company listed on the Korea Exchange (KRX).

- Samsung ranked 5th globally among technology companies by market cap, just behind Apple, Microsoft, NVIDIA, and Alphabet.

- Brand value reached $99.4 billion in 2025 according to Interbrand, maintaining its position as the fifth most valuable brand in the world.

- Over the past decade, Samsung’s brand value has grown by more than 75%, fueled by global marketing campaigns and product innovation.

- In South Korea, Samsung accounts for over 20% of the total KOSPI index value, significantly influencing domestic investor sentiment.

- Institutional investors hold 53% of Samsung Electronics’ outstanding shares, with foreign investors contributing to nearly 35% of total holdings.

- The company’s price-to-earnings (P/E) ratio averaged 17.8 in 2025, reflecting strong investor confidence in future earnings potential.

- Samsung’s ADRs (American Depositary Receipts) trade actively on US exchanges, with average daily trading volumes exceeding $220 million.

- Dividend payouts totaled $10.7 billion in 2024, marking Samsung’s 12th consecutive year of shareholder returns.

- Share buybacks worth $4.2 billion were executed in late 2024 to boost share value and investor confidence.

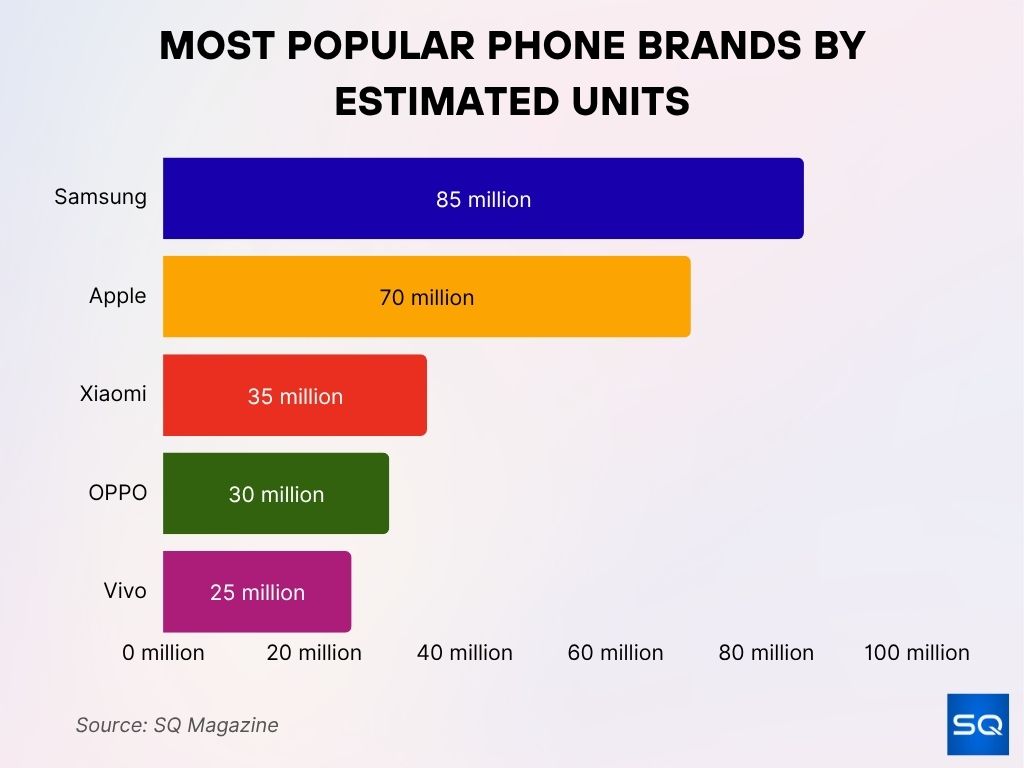

Most Popular Phone Brands by Estimated Units

- Samsung tops the list with an estimated 85 million units, showcasing its dominance across global markets and price segments.

- Apple follows closely with about 70 million units, continuing its stronghold in the premium smartphone category.

- Xiaomi holds the third spot with 35 million units, reflecting solid demand for its budget-friendly smartphones.

- OPPO reaches an estimated 30 million units, supported by its innovation in camera technology and fast charging.

- Vivo rounds out the top five with approximately 25 million units, driven by consistent performance in Asia and emerging markets.

Global Market Share

- In 2025, Samsung retained the No. 1 position in the global smartphone market with a 21.6% market share, ahead of Apple’s 20.4%.

- Samsung leads the global DRAM market with 43.5% share and the NAND flash market with 32.8% share.

- In the premium smartphone category (priced above $800), Samsung captured 19% global share, up from 16% in 2023.

- Samsung dominates the global foldable smartphone market with 62% market share, shipping over 18 million foldable units in 2024.

- The company holds 33.1% of the global OLED display market and is the largest supplier for brands like Apple, Xiaomi, and Oppo.

- Samsung Smart TVs commanded 30% of the global market in 2024, making it the leader for the 18th consecutive year.

- In home appliances, Samsung ranked No. 2 globally with an 11% market share, just behind Whirlpool.

- Samsung’s semiconductor foundry business maintained a 14.6% global market share, second only to TSMC.

- The brand captured 8.3% of the global tablet market in 2024, ranking third after Apple and Lenovo.

- In wearable devices, Samsung secured 9.5% global market share, driven by Galaxy Watch and Galaxy Buds.

Smartphone Sales and Shipments

- Samsung shipped 258 million smartphones in 2024, up 3.1% YoY, marking a recovery from the previous year’s decline.

- The Galaxy S24 series sold over 30 million units within its first 8 months, outperforming the S23 series by 12%.

- The Galaxy Z Fold5 and Z Flip5 together accounted for 18 million units shipped, cementing Samsung’s dominance in the foldable segment.

- Mid-range models like the Galaxy A15 and A35 contributed to 40% of total Samsung smartphone shipments in 2024.

- The average selling price (ASP) of Samsung smartphones rose to $402 in 2024, up from $380 in 2023.

- Samsung maintained over 50% smartphone market share in South Korea, with Apple in second place at 34%.

- In North America, Samsung held 29% of the smartphone market in early 2025, closely behind Apple’s 49%.

- India became Samsung’s second-largest smartphone market, accounting for 14% of global shipments.

- The Galaxy S24 Ultra alone generated $11.3 billion in revenue within the first half of 2025.

- Samsung increased direct-to-consumer (D2C) smartphone sales by 21% YoY, leveraging its online store and exclusive trade-in offers.

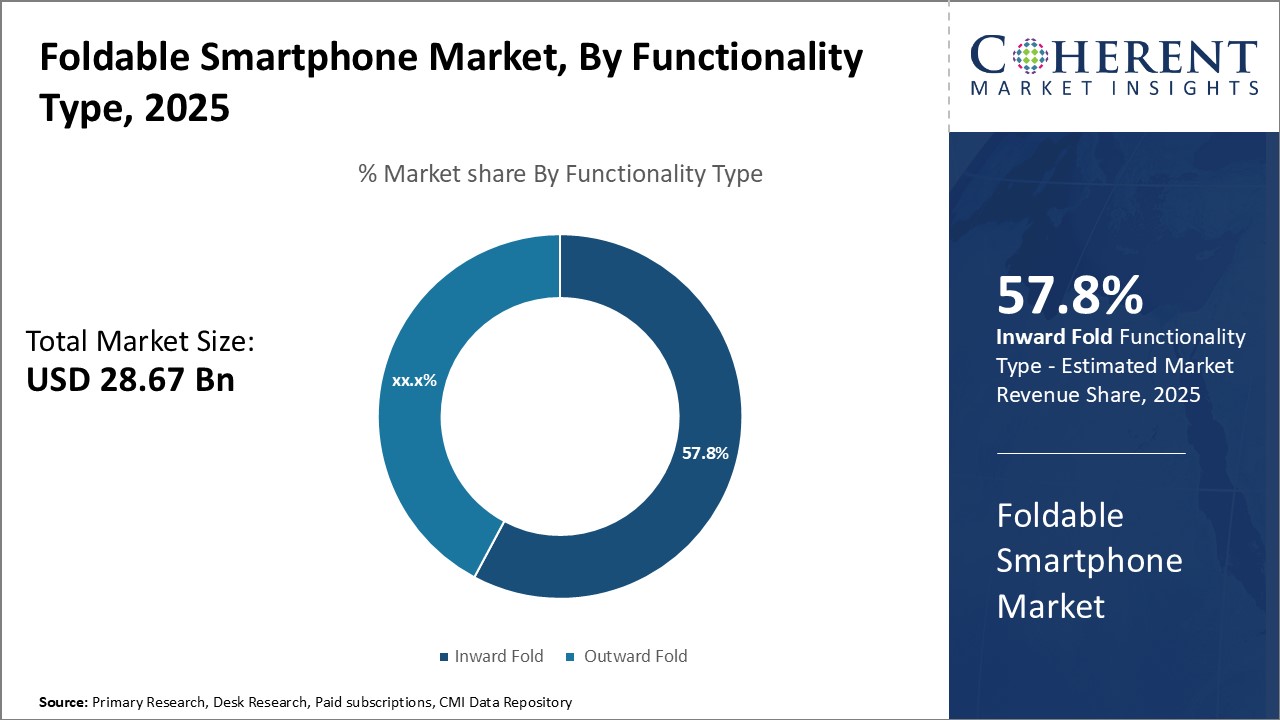

Foldable Smartphone Market by Functionality Type

- Total market size is projected at USD 28.67 billion in 2025.

- Inward fold smartphones dominate with a 57.8% market share, reflecting higher consumer preference and adoption.

- Outward fold models make up the remaining share, indicating a smaller but niche market presence.

- The strong demand for inward fold designs is driven by durability, user familiarity, and premium brand offerings.

Product Sales Statistics (TVs, Appliances, etc.)

- Samsung sold 38 million TVs in 2024, with QLED and Neo QLED models making up 65% of the total.

- Premium 8K TV sales grew by 26%, driven by larger screen sizes (75” and above).

- Samsung maintained the No. 1 position in the global TV market for the 18th consecutive year.

- In 2024, Samsung shipped 19 million home appliances, including refrigerators, washing machines, and air conditioners.

- Smart refrigerator sales surged 18% due to expanded Family Hub features and AI-driven energy optimization.

- The Bespoke appliance series saw a 32% sales growth, appealing to customization-focused consumers.

- Samsung’s monitor sales reached 12.7 million units in 2024, with gaming monitors up 42% YoY.

- The company sold 4.3 million air purifiers globally, boosted by growing environmental and health awareness.

- Samsung microwaves and ovens recorded double-digit growth in Southeast Asia, especially in Indonesia and Vietnam.

- Large-capacity washer sales increased 15%, supported by water-saving AI EcoBubble technology.

Semiconductor and Display Panel Statistics

- Samsung’s semiconductor revenue reached $96.9 billion in 2024, contributing nearly half of the company’s total revenue.

- DRAM shipments increased by 8% YoY, driven by AI data center demand and smartphone upgrades.

- NAND flash shipments grew 11%, supported by demand for high-capacity SSDs and enterprise storage.

- Samsung announced 2nm process mass production scheduled for late 2025, targeting mobile processors and AI chips.

- The foundry division generated $19.8 billion in 2024, up 7% from the previous year.

- Samsung Display shipped 720 million OLED panels in 2024, supplying to Apple, Google, and Huawei.

- Quantum Dot OLED TV panels grew 35% in shipment volume, targeting premium TV manufacturers.

- Automotive display shipments rose 28%, benefiting from partnerships with BMW and Hyundai.

- Samsung increased microLED production capacity by 40% to meet rising demand for luxury home displays.

- The company invested $6.4 billion in expanding its Pyeongtaek semiconductor plant in 2025.

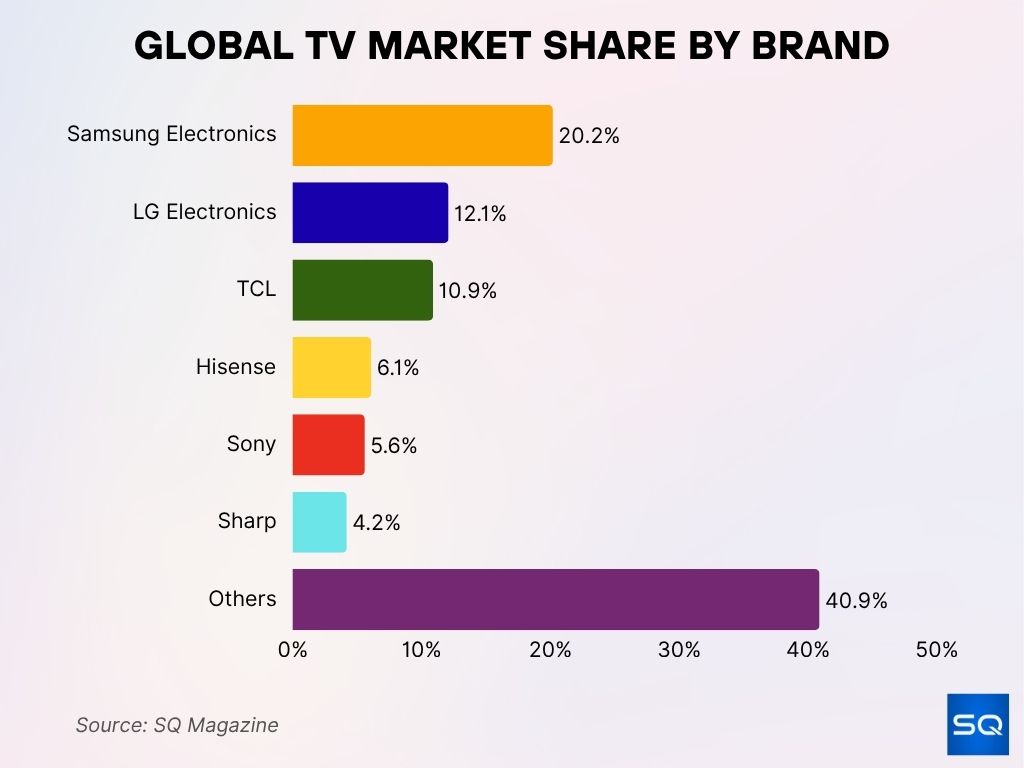

Global TV Market Share by Brand

- Samsung Electronics leads with 20.2% market share, maintaining its dominance in the global TV industry.

- LG Electronics holds 12.1%, supported by its premium OLED and innovative TV offerings.

- TCL secures 10.9%, driven by competitive pricing and strong performance in mid-range markets.

- Hisense captures 6.1%, steadily growing its presence in affordable smart TVs.

- Sony commands 5.6%, leveraging its reputation for high-quality display technology.

- Sharp accounts for 4.2%, holding a smaller but consistent share.

- Others collectively make up 40.9%, reflecting a highly fragmented market with many regional and niche brands.

Research and Development Statistics

- Samsung spent $21.4 billion on R&D in 2024, representing 10.1% of annual revenue.

- The company filed 8,972 patent applications globally in 2024, ranking second in the world.

- AI-focused R&D projects accounted for 28% of total R&D spending.

- Samsung operates 42 global R&D centers across South Korea, the US, India, China, and Europe.

- The company increased investment in quantum computing research by 34% in 2025.

- Samsung Research employs over 33,000 engineers dedicated to emerging technology development.

- More than 60% of R&D projects in 2025 target AI integration in consumer devices.

- Samsung increased its funding for biotechnology R&D by 22%, focusing on healthcare sensors and devices.

- The company launched a global AI accelerator program in 2025 to partner with startups in machine learning and robotics.

- Patent filings related to foldable technology rose by 18%, securing leadership in flexible display innovation.

Regional Sales and Revenue Distribution

- Asia-Pacific remained Samsung’s largest revenue contributor in 2024, accounting for 46% of total sales.

- North America generated 25% of revenue, with strong demand for premium smartphones, TVs, and home appliances.

- Europe represented 19% of total revenue, driven by growth in eco-friendly appliances and Galaxy flagship adoption.

- South Korea accounted for 12% of total revenue, with Samsung holding a dominant 50%+ smartphone market share domestically.

- Revenue in India grew 14% YoY, making it Samsung’s second-largest smartphone market after the US.

- Southeast Asia saw double-digit growth in consumer electronics, especially in Indonesia, Vietnam, and Thailand.

- Latin America contributed 6% of global revenue, with Samsung leading in smartphone shipments across Brazil, Mexico, and Chile.

- Middle East and Africa posted 8% revenue growth in 2024, driven by expanding retail presence and affordable Galaxy A-series models.

- Online direct-to-consumer sales accounted for 18% of total global sales in 2024, up from 15% in 2023.

- Regional revenue diversification helped buffer Samsung from currency fluctuations and regional economic slowdowns.

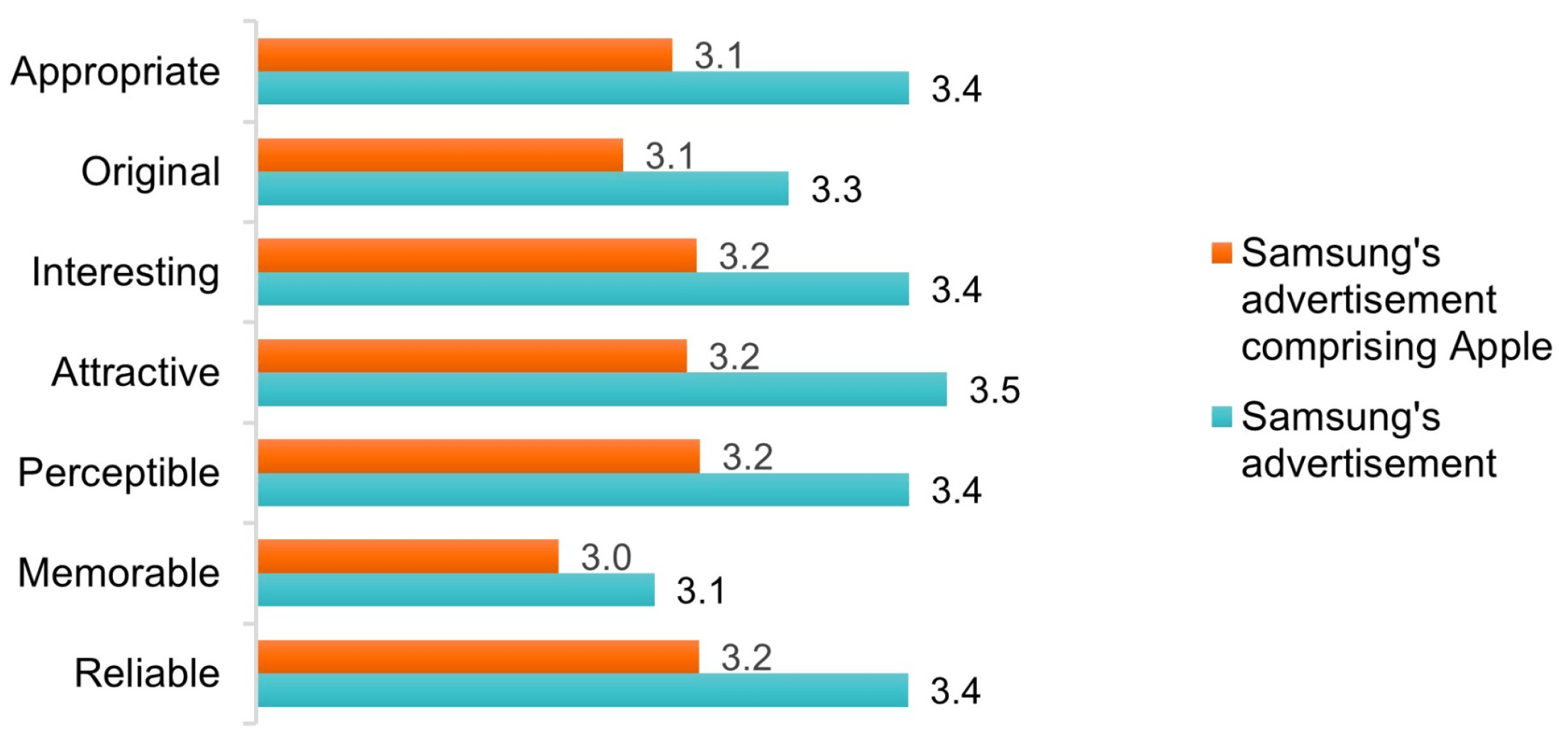

Comparative Perception of Samsung Advertisements (With and Without Apple Reference)

- Appropriate: Samsung ads with Apple reference scored 3.1, while standard Samsung ads scored higher at 3.4.

- Original: Apple-referencing ads scored 3.1, compared to 3.3 for regular Samsung ads.

- Interesting: Apple-referencing ads received 3.2, slightly lower than Samsung-only ads at 3.4.

- Attractive: Scored 3.2 for Apple-inclusive ads, outperforming slightly in Samsung-only ads with 3.5.

- Perceptible: Apple-inclusive ads scored 3.2, while Samsung-only ads reached 3.4.

- Memorable: The lowest gap, with Apple-referencing ads at 3.0 versus 3.1 for Samsung-only ads.

- Reliable: Equal pattern as most metrics, with 3.2 for Apple-inclusive ads and 3.4 for Samsung-only ads.

Global Workforce and Employee Statistics

- As of 2025, Samsung employs over 267,000 people worldwide across 74 countries.

- The workforce distribution: 43% in South Korea, 38% in other Asian countries, 12% in North America, and 7% in Europe and other regions.

- The average employee tenure is 11.2 years, reflecting strong retention in core technical roles.

- Samsung hired 14,800 new employees in 2024, mainly in semiconductor manufacturing, AI R&D, and software engineering.

- Over 30% of employees are engaged in research and development-related roles.

- Samsung’s average annual salary for tech positions in South Korea is approximately KRW 97 million ($72,000).

- The company increased diversity hiring by 17% in 2024, with a particular focus on women in engineering and leadership positions.

- Samsung offers 1.3 million hours of training annually across global operations, covering technical, leadership, and compliance topics.

- Employee satisfaction surveys showed 87% positive feedback for work-life balance initiatives introduced in 2024.

- The average training investment per employee rose to $2,350 in 2024, the highest in company history.

Patent and Intellectual Property Statistics

- Samsung filed 8,972 global patent applications in 2024, second only to IBM in global rankings.

- The company holds over 85,000 active patents worldwide across semiconductors, telecommunications, displays, and consumer electronics.

- Patents related to AI integration in smartphones increased by 28% in 2024.

- Foldable display technology patents account for over 1,500 active patents, ensuring Samsung’s lead in the segment.

- Samsung holds 35% of global patents related to memory chip design.

- The company’s 5G and 6G telecommunications patent portfolio ranks in the top three globally.

- Samsung licensed over 2,000 patents to other companies in 2024, generating $1.6 billion in licensing revenue.

- AI-powered display calibration technology patents increased 22% YoY.

- Samsung was granted 3,150 new patents in the US alone in 2024.

- The company’s IP portfolio valuation exceeds $50 billion, reflecting decades of R&D investment.

Samsung Galaxy S24 vs. S25 Series Comparison

- Galaxy S24 FE features a 6.7-inch display, 4,700 mAh battery, and starts at $649.99.

- Galaxy S24 has a 6.2-inch screen, a 4,000 mAh battery, priced from $799.99.

- Galaxy S24+ offers a 6.7-inch display, 4,900 mAh battery, starting at $999.99.

- Galaxy S24 Ultra comes with a 6.8-inch display, a 5,000 mAh battery, priced at $1,299.99.

- Galaxy S25 retains a 6.2-inch (FHD Plus) display, 4,000 mAh battery, starting at $799.99.

- Galaxy S25+ includes a 6.7-inch (QHD Plus) display, 4,900 mAh battery, starting at $999.99.

- Galaxy S25 Ultra upgrades to a 6.9-inch (QHD Plus) display, 5,000 mAh battery, priced at $1,299.99.

Social and Environmental Impact

- Samsung committed to achieving carbon neutrality by 2035 across all global operations.

- The company reduced greenhouse gas emissions by 13% in 2024 compared to 2023 levels.

- 54% of Samsung’s electricity in manufacturing now comes from renewable sources.

- Samsung recycled 8.7 million tons of e-waste globally between 2009 and 2024.

- Water usage in semiconductor plants decreased by 11% in 2024 through advanced recycling systems.

- The company invested $2.3 billion in green manufacturing technology in 2024.

- Samsung’s social contribution programs impacted 6.1 million people globally through education, health, and technology access initiatives.

- Over 1.2 million refurbished devices were resold or repurposed under Samsung’s sustainability program in 2024.

- Samsung’s Green Memory products reduced annual energy consumption by 45% compared to conventional chips.

- The company expanded its Samsung Solve for Tomorrow program to 38 countries, supporting STEM education.

Innovation and Technology Leadership

- Samsung leads in foldable smartphone technology, with over 18 million foldables sold in 2024.

- The company unveiled its first 3nm 2nd-gen GAA chip in early 2025, boasting 35% improved performance over previous nodes.

- Samsung Research is investing heavily in quantum computing, aiming for a functional prototype by 2028.

- The company introduced AI Live Translate Call in 2025, a real-time voice translation feature embedded in Galaxy devices.

- Samsung is a pioneer in 8K QLED technology, now integrated with AI-based upscaling.

- Its Galaxy AI ecosystem enables device-to-device contextual intelligence, linking smartphones, wearables, and smart homes.

- The company’s microLED technology is being scaled for luxury consumer and commercial display applications.

- Samsung launched the Galaxy Ring, entering the personal healthtech market in 2025.

- Partnerships with leading automakers have positioned Samsung as a major supplier of advanced automotive display and sensor systems.

- Samsung’s global leadership in OLED display panels continues with a 33.1% market share in early 2025.

Historical Growth and Milestones

- 1969 – Founded as Samsung Electronics Co., Ltd., focusing initially on black-and-white TVs.

- 1983 – Entered the semiconductor business, producing its first 64KB DRAM.

- 1995 – Launched its first mobile phone, entering the telecommunications market.

- 2009 – Became the world’s largest TV manufacturer.

- 2010 – Introduced the first Galaxy S smartphone, beginning a flagship legacy.

- 2012 – Surpassed Nokia to become the world’s largest smartphone vendor.

- 2017 – Acquired Harman International to expand into connected car technologies.

- 2019 – Released the Galaxy Fold, the first commercially available foldable smartphone.

- 2023 – Invested heavily in AI, 5G, and semiconductor manufacturing expansion.

- 2025 – Maintains leadership in smartphones, displays, and semiconductors, while expanding into healthtech and automotive electronics.

Conclusion

Samsung Electronics in 2025 is more than just a consumer electronics giant; it’s a global technology leader shaping industries from semiconductors to AI-powered health devices. With record-breaking revenues, sustained R&D investment, and a commitment to sustainability and innovation, Samsung continues to influence global tech trends while securing its future growth. Its dominance in smartphones, display technology, and semiconductor manufacturing positions it to remain a central player in the global economy well into the next decade.