Mobile banking has become a core pillar of how U.S. consumers manage money. From fast transfers to real-time notifications, it reshapes daily finances and touches commercial branches and fintech alike. In one real-world example, banks now report that over 55% of U.S. consumers consider mobile their primary access point, outpacing branches for the first time. In another case, UPI in India handles an astounding 20 billion transactions worth about $293 billion in a single month, highlighting the power of mobile systems in emerging markets. Discover how these shifts are redefining banking. Explore the full article ahead.

Editor’s Choice

- 72% of U.S. adults use mobile banking apps in 2025, up from 65% in 2022 and 52% in 2019.

- 2.17 billion people globally used mobile banking by the end of 2025, a 35% increase since 2020.

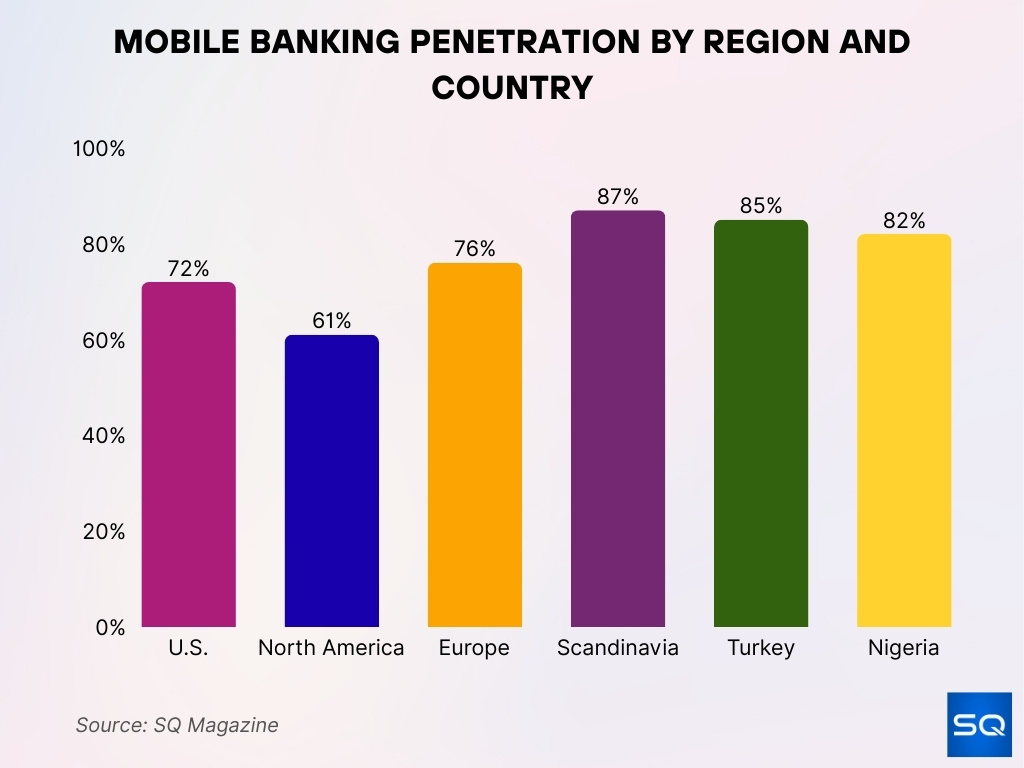

- 61% mobile banking penetration in North America in 2025, rising from 58% in 2023.

- 64% of U.S. adults prefer mobile banking over traditional methods, up from 58% in 2023.

- In Europe, penetration reached 76% in 2025, and top markets like Norway, Denmark, and Sweden exceeded 87%.

- There were 860 million mobile banking users in China in 2025.

- Globally, 89% of banks had launched mobile banking apps by the end of 2025.

- Nigeria (82%) and Turkey (85%) boast some of the highest national mobile banking uptake.

Recent Developments

- By 2025, Bankrate found more than one‑third of U.S. consumers faced attempted financial fraud, and nearly 40% of those targeted lost money.

- Account takeover fraud (ATO), especially via mobile wallets and P2P apps, remains a top threat in 2025.

- Financial institutions reported a surge in criminal activity; 60% noted increased fraud, with nearly 70% of enterprise banks especially affected.

- Smishing attacks in the U.S. compromised up to 115 million payment cards in a year, many used to infiltrate digital wallets.

- Generative AI is enabling deepfake scams, one bank paid out $25 million after a voice-fraud incident, and U.S. fraud losses could reach $40 billion by 2027.

- FTC reports show losses by older adults (60+) hitting over four times since 2020, with scams posing as government or business agents.

- Online scams cost Americans $16.6 billion in 2024, with 73% of adults personally targeted by scams or attacks.

- Cybercrime globally is expected to cost over $9 trillion in damages in 2024, one of the world’s largest economic threats.

Adoption Rates by Region

- 72% of U.S. adults use mobile banking apps as of 2025, marking strong national uptake.

- North America’s penetration stands at 61% in 2025.

- Europe leads with 76% mobile banking usage; high performers include Scandinavia with over 87% adoption.

- Turkey (85%) and Nigeria (82%) rank among the world’s highest mobile banking penetration.

- China reaches over 860 million mobile banking users, by far the largest national base.

- Globally, 66% of the population now has access to mobile banking, with the strongest growth in India, Nigeria, and Bangladesh.

- UPI in India processes 20 billion transactions per month, managing nearly $293 billion, showing deep integration with mobile systems.

- India’s UPI surpasses Visa, handling over 640 million transactions per day versus Visa’s 639 million.

Usage Demographics

- Millennials: 68% now primarily use mobile banking apps in 2025.

- In the U.S., 80% of millennials use mobile banking as their main channel, compared to only 30% of baby boomers.

- Gen Z (18‑24 years): 72% actively use mobile banking apps, marking the fastest growth.

- Among baby boomers, usage has doubled from 15% in 2018 to 30% in 2025.

- Young adults 15‑24 use mobile banking 3.9 times more than those 65+.

- College graduates show a 54% adoption rate, higher than those without a high school diploma.

- Those earning $75,000+ use mobile banking 74% more often than households earning $15k–$30k.

- Households identified as two or more races have the highest usage: 58%, around 25% higher than White individuals.

Growth Trends in Mobile Banking Users

- Global mobile banking users numbered 2.17 billion by the end of 2025, a 35% jump since 2020.

- In the U.S., adoption rose to 72% in 2025, up from 65% in 2022 and 52% in 2019.

- U.S. app downloads rose 22% in 2025, as demand soared for payments, budgeting, and investing tools.

- Mobile banking usage in the Northeast U.S. grew 253% from 2017 to 2023.

- Globally, 89% of banks launched mobile apps by 2025, a testament to a global digital shift.

- In the Asia‑Pacific region, transaction volume grew 34% in 2025, led by e‑commerce, QR payments, and real‑time clearing.

- Mobile banking use tripled worldwide between 2017 and 2023, underscoring accelerating adoption.

- Non‑homeowners use mobile banking 1.3 times more often than homeowners.

Leading Online Banking Platforms

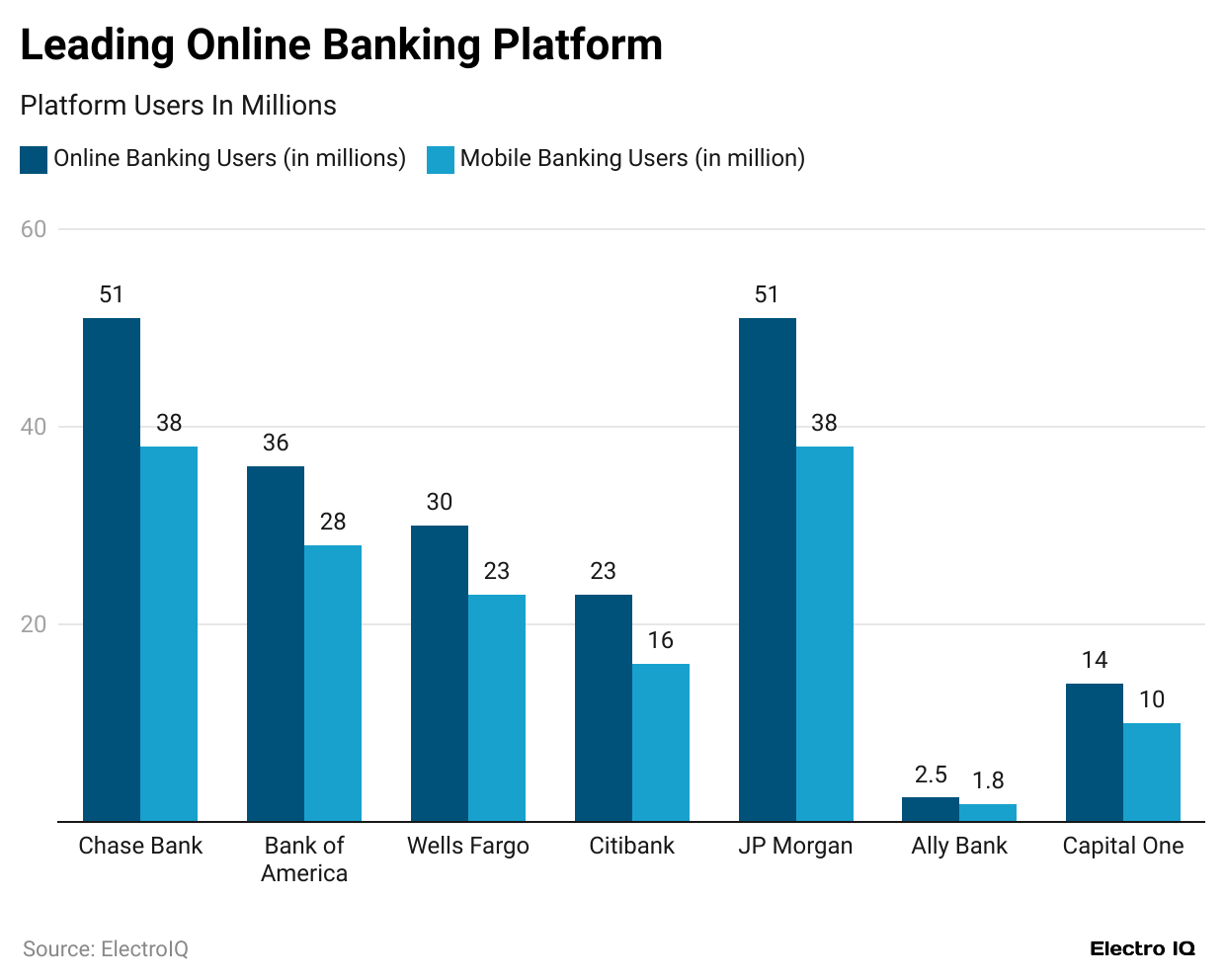

- Chase Bank leads with 51 million online and 38 million mobile users.

- JP Morgan matches Chase in online users, with 51 million, also serving 38 million mobile users.

- Bank of America records 36 million online and 28 million mobile users.

- Wells Fargo serves 30 million online and 23 million mobile users.

- Citibank has 23 million online and 16 million mobile users.

- Capital One counts 14 million online and 10 million mobile users.

- Ally Bank is smaller but still significant, with 2.5 million online and 1.8 million mobile users.

Transaction Volumes

- Global mobile payment transactions are projected to reach $13 trillion by 2025, underscoring the shift toward mobile-first spending.

- In 2023, mobile payments alone totaled $7.39 trillion, marking a 14% annual increase.

- QR‑code–based mobile payments are forecasted to surge from $5.4 trillion in 2025 to over $8 trillion, reflecting a 48% year‑on‑year jump.

- Digital wallet transactions globally reached $10 trillion in 2024 and are expected to swell to $17 trillion by 2029.

- In e‑commerce, mobile device revenue is expected to hit $2.5 trillion in 2025, accounting for over 63% of total retail e‑commerce.

- In the Asia‑Pacific region, 70% of e‑commerce volume comes from mobile wallets, driven by super‑app ecosystems.

- India’s mobile wallet transaction value is set to exceed $1.5 trillion by 2026.

Impact of Mobile Banking on Financial Inclusion

- 79% of adults now have access to formal financial services, up from 51% in 2011.

- Around 900 million unbanked adults own a mobile phone, including 530 million with smartphones, indicating strong potential for inclusion.

- Mobile money has helped rural households smooth consumption during shocks like illness or poor harvests, boosting resilience.

- In developing economies, over 50% of women in countries like Zimbabwe, the Ivory Coast, and Gabon now have access to mobile money accounts.

- Following India’s pandemic response, 25 million new mobile financial accounts were opened, primarily among women, highlighting mobile banking’s reach.

- A $300 billion annual finance deficit for women entrepreneurs signals opportunity; mobile banking can serve as a bridge.

- Financial inclusion isn’t universal; 31% of unbanked adults lack even a mobile phone, emphasizing infrastructure gaps.

Bank Readiness Across Generations

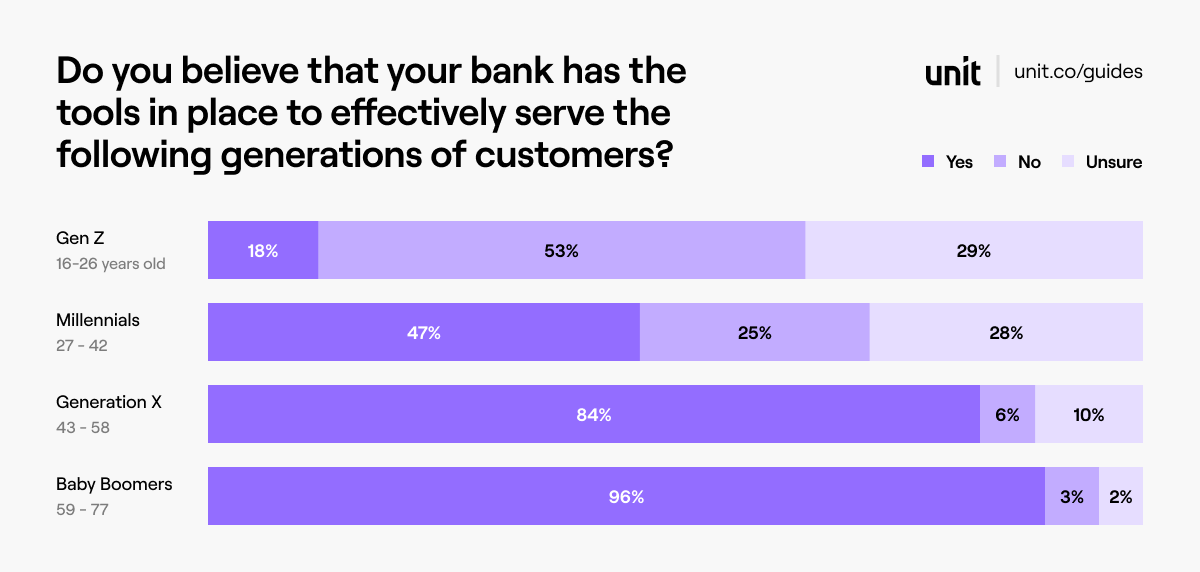

- Only 18% of Gen Z feel banks are ready, while 53% say no and 29% remain unsure.

- Among Millennials, 47% believe banks are prepared, but 25% disagree and 28% are unsure.

- Generation X shows confidence, with 84% saying yes, only 6% no, and 10% unsure.

- Baby Boomers are the most confident, with 96% agreeing, just 3% disagreeing, and 2% unsure.

Security Concerns and Fraud Statistics

- One in 20 verification attempts in 2025 is fake; fraudsters increasingly exploit deepfakes and real-time payment scams.

- 60% of financial institutions and fintechs reported an increase in fraud, with nearly 70% of large banks particularly impacted.

- A Bankrate survey reveals that over one‑third of U.S. consumers were targeted by attempted fraud between January 2024 and January 2025, and nearly 40% suffered monetary loss.

- In India, fraud in loans and digital payments tripled in FY25 compared to FY24, jumping from ₹12,230 crore to ₹36,014 crore.

- In 2023, 57% of financial institutions reported fraud-related losses exceeding $500,000, and 25% reported losses over $1 million.

- Deepfake-enabled scams are rising sharply, exposing bank consumers to new risks.

- Mobile banking apps must balance convenience with protection; biometrics and encryption are key, but risk remains.

Mobile Banking vs Online Banking Usage

- By 2025, 216.8 million Americans will use digital banking services, including mobile and online platforms.

- The share of U.S. mobile banking users reached 48% in 2023, tripling in under a decade.

- 77% of consumers now prefer digital banking, and mobile usage is 2.5× more popular than online (browser-based) access.

- A 2024 survey found 41% prefer mobile banking, compared to 33.5% favoring online web access.

- Around 34% use mobile banking apps daily, while 36% log into online banking at least weekly.

- Only 18% still visit a branch, and a mere 4% prefer calling a representative, underscoring digital dominance.

- In 2025, 77% of consumers preferred managing their accounts via app or computer, with 80% of millennials leading and 72% of Gen Z.

Use of Online, Mobile, and Traditional Banking

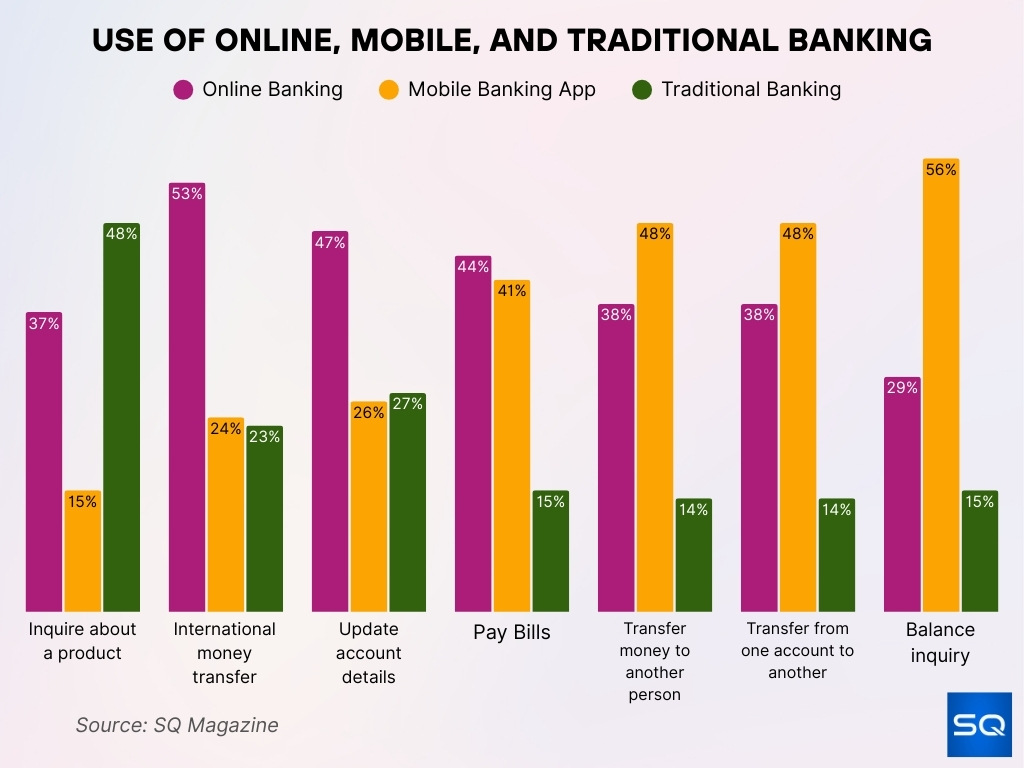

- 37% inquire about a product online, while 48% still rely on traditional banking.

- 53% use online platforms for international money transfers, compared to 24% via mobile apps.

- 47% update account details online, while 27% still prefer traditional branches.

- 44% pay bills online, but 41% now use mobile apps for this task.

- 48% transfer money to another person through mobile apps, compared to 38% online.

- 48% also use mobile apps to transfer between accounts, with only 14% relying on traditional banking.

- 56% conduct balance inquiries via mobile apps, compared to 29% online and 15% in-branch.

Mobile Banking App User Engagement

- Consumer banking apps surpassed 2 billion downloads by June 2025, reflecting a 5.1% year-over-year increase, and now consistently exceed 500 million quarterly downloads.

- Mobile-banking leaders resolve over 80% of routine interactions entirely within the app, boosting convenience and retention.

- 90% of users use mobile banking apps to check their account balance, while 79% view recent transactions, underscoring dashboard reliance.

- Among Millennials, 97% use mobile banking apps, compared to 89% of all consumers.

- Average smartphone users interact with 30 apps per month, and 51% check apps 1–10 times daily, indicating frequent engagement potential.

- Key engagement metrics to track in 2025 include DAU, MAU, session duration, retention and churn rates, core indicators of stickiness and value.

- Personalization and financial planning tools within apps are driving sustained engagement and building better financial habits.

Future Projections for Mobile Banking Growth

- The mobile banking industry surpassed $1.3 billion in revenue last year and is projected to triple by 2030, implying a sustained CAGR of over 15%.

- AI-driven banking, such as chatbots and automated insights, receives a boost as global AI software spending reaches £241 billion by 2025, with banking leading adoption.

- By 2030, South Africa’s Vodacom plans to grow its financial services customers from 85 million to over 120 million, targeting 15–20% annual growth in fintech revenue.

- Banking apps are projected to embed deeper AI, blockchain, and IoT functionalities, enhancing personalization, automation, and security.

- Projections show super-app ecosystems integrating payments, investing, insurance, and commerce, especially where 5G and IoT are widespread.

- Open banking APIs and gamified UX are set to further personalize and retain users in the upcoming years.

- Virtual assistants are underperforming now, but AI-enabled enhancements may soon deepen user engagement and satisfaction.

Influence of 5G and AI on Mobile Banking

- AI tools now handle 85% of customer queries in real time via chatbots, reflecting rapid automation.

- Earlier detection and prevention of fraud are being driven by AI-powered pattern analysis and machine learning; regulatory frameworks such as PSD2 and GLBA also strengthen authentication and real-time monitoring.

- 5G’s ultra-low latency and bandwidth are enabling immersive super-apps and real-time financial services; apps can integrate investing, commerce, and insurance in one interface.

- AI’s role in personalization, custom budgeting tools, and spending insights is becoming a standard feature expectation.

- Real-time alerts, predictive fraud detection, and biometric logins, powered by AI and 5G, are now table stakes for security-savvy users.

- With faster networks, mobile-first banks can resolve user needs entirely inside apps, aligning with McKinsey benchmarks.

Digital Wallets and Mobile Banking Integration

- Digital wallet transactions reached $10 trillion in 2024 and are forecasted to grow to $17 trillion by 2029.

- QR-code payments, mobile wallet transfers, and super-app integrations represent key overlaps between wallets and banking platforms.

- Platforms like the Philippines’ Maya Wallet offer payments, crypto trading, insurance, and cross-border transfers in one app.

- In Latin America, apps like Peru’s Yape reached 20 million users by 2025 and expanded merchant integration via QR and remittance services.

- Real-time payment tools such as India’s UPI handle over 640 million daily transactions, surpassing even Visa’s volume.

- India is expanding UPI globally, planning interoperability with nations across Asia, Europe, Africa, and beyond.

Mobile Banking in Developing Economies

- Vodacom in Africa expects significant user and revenue gains, doubling its financial services customers and focusing on underserved markets.

- Maya Wallet in the Philippines enables cross-border and crypto transactions, alongside financial protections.

- Yape in Peru and Bolivia serves over 20 million users and 2 million merchants by 2025, increasing inclusion in a largely cash-based economy.

- UPI’s expansion has reached rural and Tier‑2 cities in India, promoting deep nationwide financial inclusion.

- AI, mobile money, and fintech are transforming access. Vodacom, UPI, and Maya show how inclusion and innovation align in emerging markets.

Conclusion

Mobile banking today is a powerful blend of speed, personalization, and growing global access. With 2 billion app downloads, leading banks resolving 80% of routine tasks in-app, and mobile payments soaring toward $17 trillion, the transformation is unmistakable. AI, 5G, and super-app models are steering future growth, while fintech innovators like Maya, Yape, UPI, and neobanks bring inclusion to the forefront. As mobile platforms bridge gaps and reshape financial habits, the user stands to benefit from speed, security, and flexibility like never before.