In 1975, Microsoft was born out of a simple idea: a computer on every desk and in every home. Fast forward to 2025, that vision has not only materialized, but it’s evolved into something much larger. Today, Microsoft shapes how businesses operate, how people collaborate, and how AI integrates into daily workflows. Whether it’s the influence of Azure on cloud transformation or Copilot quietly drafting emails across the globe, Microsoft’s reach touches nearly every aspect of the digital economy. Let’s explore the most recent statistics to understand just how far this tech titan has come.

Editor’s Choice

- $252 billion in revenue was reported by Microsoft for fiscal year 2025, marking its highest-ever annual revenue.

- $88 billion in operating income was recorded, showcasing strong profitability across all divisions.

- Microsoft’s cloud revenue grew to $138 billion, solidifying its position as the second-largest cloud provider globally.

- Microsoft 365 commercial users surpassed 400 million in early 2025.

- Windows 11 is now installed on 31% of all Windows devices worldwide.

- The Azure AI and Copilot suite is active across 65% of Fortune 500 companies.

- Microsoft Teams usage reached 360 million monthly active users in Q1 2025.

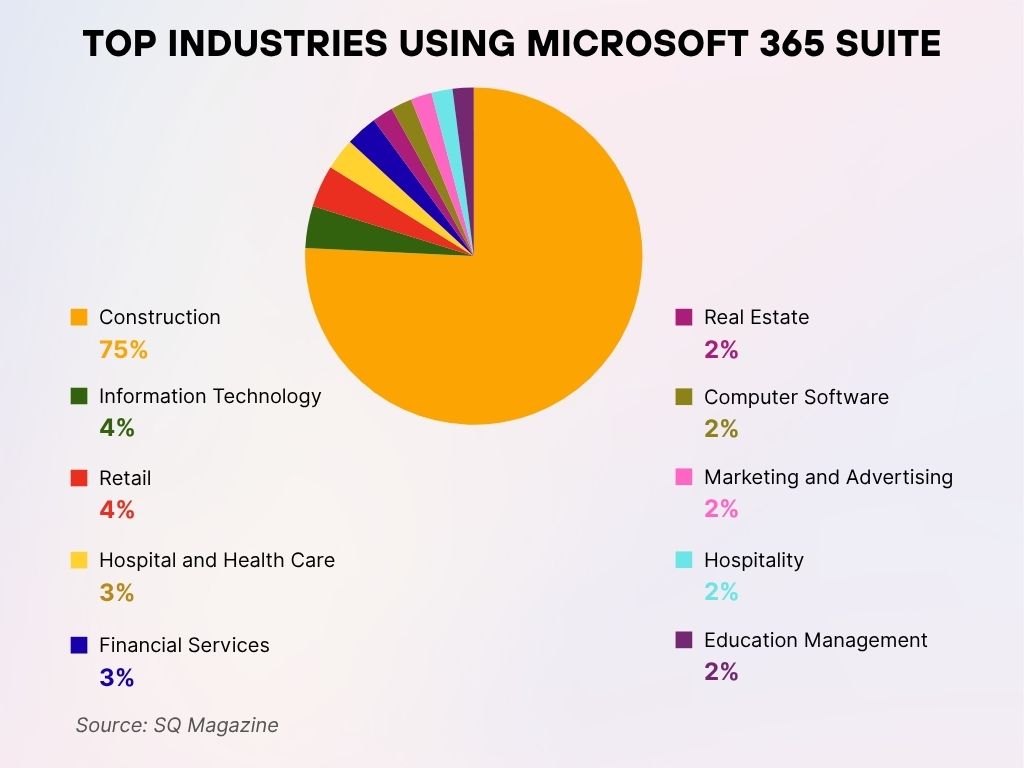

Top Industries Using Microsoft 365 Suite

- Construction leads with a massive 75% adoption rate, making it the top industry using Microsoft 365.

- Information Technology and Retail both show a 4% usage share, reflecting widespread digital adoption.

- Hospital and Health Care, and Financial Services each hold a 3% share of Microsoft 365 usage.

- Real Estate, Computer Software, Marketing and Advertising, Hospitality, and Education Management each contribute 2% to the total user base.

- All other industries combined make up the remaining share, emphasizing Microsoft 365’s reach across various sectors.

Microsoft Revenue and Growth

- Microsoft reported $252 billion in revenue for FY 2025.

- Productivity and Business Processes contributed $77.8 billion, driven by Microsoft 365, LinkedIn, and Dynamics 365.

- Intelligent Cloud revenue reached $100.4 billion, reflecting continued Azure expansion.

- More Personal Computing generated $73.8 billion, including Windows OEM, Surface, and gaming.

- Microsoft’s net income climbed to $86 billion, a 9% year-over-year increase.

- Microsoft’s market cap stood at $3.15 trillion as of July 2025, second only to Apple.

- Annual R&D spending hit $30 billion, with increased focus on AI and quantum computing.

- Microsoft now earns 55% of its total revenue from cloud services alone.

- Advertising revenue from LinkedIn and Bing Ads crossed $19 billion this year.

- The company’s global partner ecosystem contributed over $1.2 trillion in indirect economic impact in 2025.

Windows Operating System Market Share

- As of mid-2025, Windows holds 72.2% of the global desktop OS market.

- Windows 11 adoption has grown to 31%, while Windows 10 still commands 39% of devices.

- Enterprise adoption of Windows 11 reached 55%, driven by integrated AI features and security updates.

- Microsoft continues to support over 1.5 billion active Windows devices worldwide.

- The average device lifecycle for Windows OS is now 4.5 years, with consistent update rollouts.

- Windows 10 End-of-Life has been extended to October 2026 for enterprise long-term servicing channels.

- Emerging markets see 14% year-over-year growth in Windows device shipments.

- Windows Server 2025, launched in Q1, already accounts for 12% of all active server installations.

- The education sector sees Windows OS adoption at 78%, driven by partnerships with device manufacturers.

- In the US, Windows dominates with 69% desktop share, while macOS holds 18%.

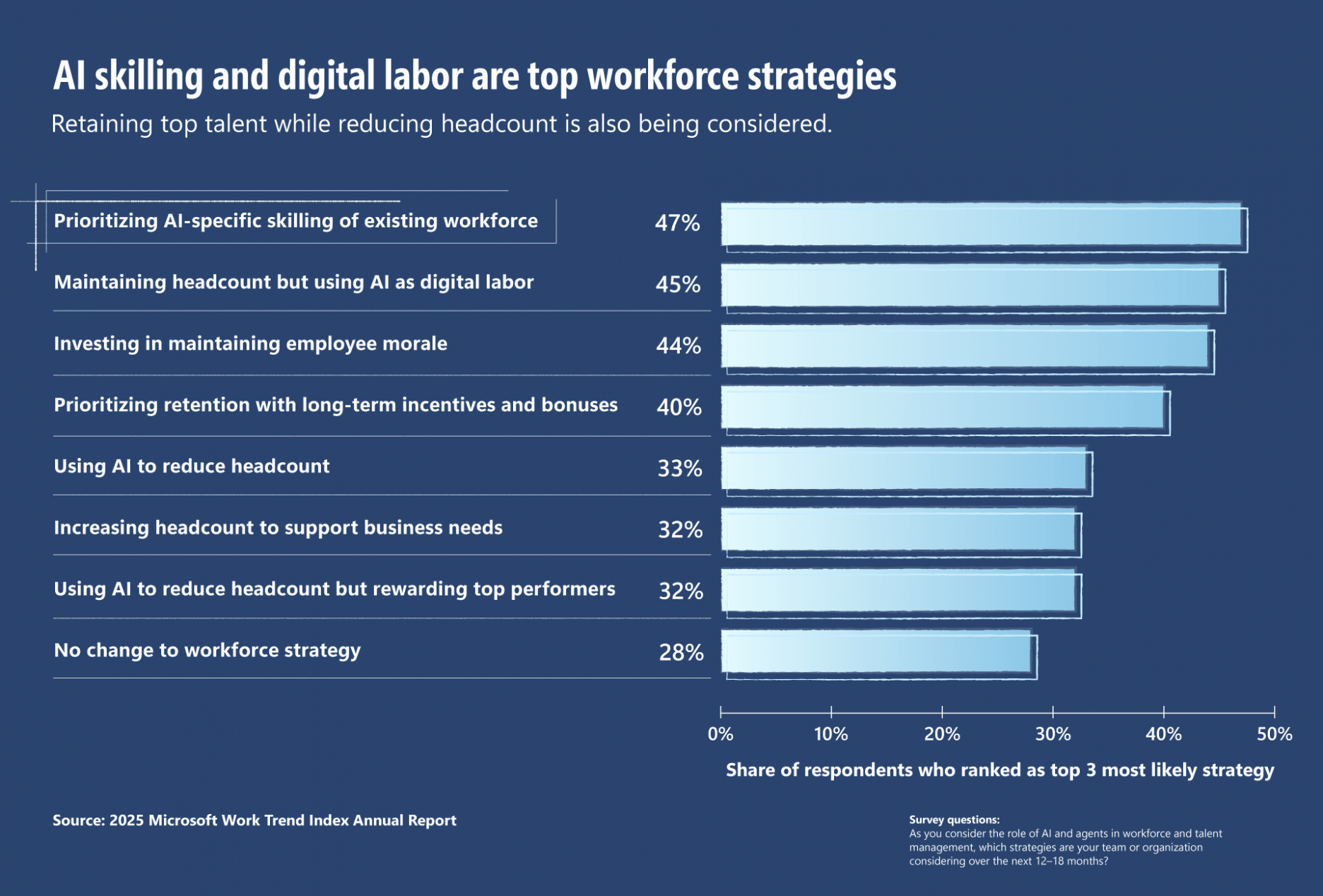

Top Workforce Strategies in the Age of AI

- 47% of organizations are prioritizing AI-specific skilling of their existing workforce.

- 45% plan to maintain headcount while leveraging AI as digital labor.

- 44% are focused on boosting employee morale to retain talent.

- 40% prioritize retention with long-term incentives and bonuses.

- 33% are using AI to reduce headcount as a cost-saving measure.

- 32% aim to increase headcount to support expanding business needs.

- Another 32% are reducing headcount with AI but also rewarding top performers.

- 28% report no changes to their current workforce strategy.

Azure Cloud Services Market Performance

- Microsoft Azure generated $68.2 billion in revenue in the first three quarters of FY 2025.

- Azure now commands 25% of the global cloud infrastructure market, second to Amazon Web Services.

- Azure AI services experienced 42% growth, led by demand for large language models and cognitive APIs.

- Azure holds 38% of the hybrid cloud market, favored by large enterprises for flexibility.

- Azure Kubernetes Service (AKS) adoption rose by 48%, becoming a top choice for container management.

- Over 95% of Fortune 500 companies now use Microsoft Azure in some capacity.

- Azure has 65 global regions, more than any other cloud provider in 2025.

- Microsoft launched Azure Quantum Elements, a new suite for chemistry and materials science, in May 2025.

- Sustainability-conscious clients now contribute to $11 billion of Azure’s total yearly revenue.

- The new Azure Confidential Computing services protect data in use and are now used by 18% of Azure enterprise tenants.

Microsoft Gaming Division

- Xbox division revenue reached $21.5 billion in FY 2025, up 12% from the previous year.

- Game Pass subscribers now total 41.7 million, making it one of the most successful subscription models in gaming.

- Activision Blizzard contributed $4.2 billion to Microsoft’s gaming revenue in its first full year post-acquisition.

- Minecraft continues to dominate, with monthly active users topping 176 million in 2025.

- Xbox Cloud Gaming saw a 34% increase in active users, driven by mobile and smart TV expansion.

- Xbox Series X|S has sold a combined 32 million units, with strong performance in North America and Europe.

- Gaming on Windows PC brought in $6.4 billion, including game sales, subscriptions, and third-party store revenue.

- ID@Xbox indie program now supports over 5,000 developers, fostering a growing ecosystem.

- Microsoft announced a new cloud-native gaming studio called VoltWorks in April 2025.

- Xbox’s average revenue per user (ARPU) reached $38.75, the highest in its history.

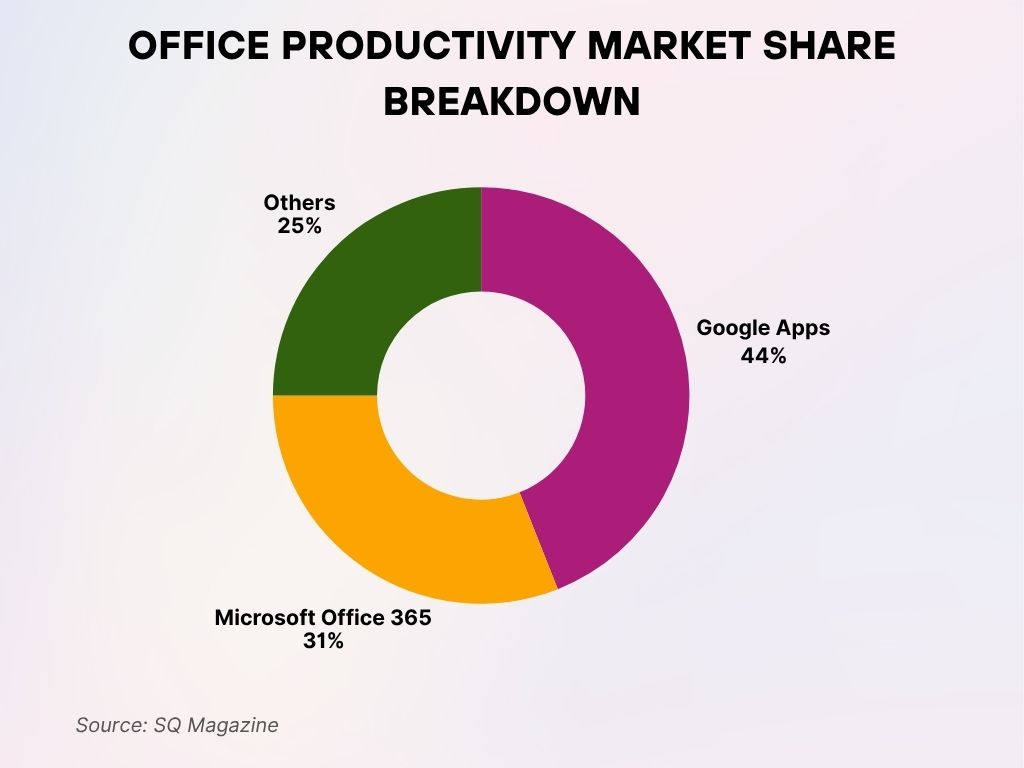

Office Productivity Market Share Breakdown

- Google Apps dominates the market with a 44% share, making it the leading office productivity suite.

- Microsoft Office 365 holds a strong 31% market share, securing the second spot.

- Other platforms collectively account for the remaining 25%, showing continued competition in the space.

LinkedIn User and Revenue Insights

- LinkedIn revenue reached $17.8 billion in FY 2025, up 9% YoY.

- The platform now hosts over 1.1 billion members, with growth led by India, Southeast Asia, and Latin America.

- Talent Solutions made up $9.6 billion of total LinkedIn revenue, driven by AI-powered recruitment tools.

- LinkedIn Learning grew to 8.3 million subscribers, with a focus on AI, leadership, and technical skills.

- Marketing Solutions saw a 12% YoY growth, bringing in $4.3 billion in ad revenue.

- Content sharing on LinkedIn increased by 29%, with newsletters and thought leadership posts leading.

- AI-based Skills Match and Career Explorer tools helped over 14 million job seekers in 2025.

- Microsoft reports LinkedIn engagement grew 23%, as measured by session length and return frequency.

- Small businesses now represent 19% of active advertisers on the platform.

- The LinkedIn app saw a 26% increase in downloads across Android and iOS in the first half of 2025.

AI and Copilot Integration Metrics

- Microsoft Copilot is now embedded in 95% of Microsoft 365 enterprise tenants as of mid-2025.

- 85 million monthly users interact with Microsoft 365 Copilot for tasks ranging from writing to coding.

- GitHub Copilot has over 2.3 million paid developers, making it the most adopted AI assistant in software development.

- Copilot usage in Power BI increased dashboard creation speed by 31%, improving productivity metrics.

- Copilot Studio, introduced in late 2024, now supports over 18,000 enterprises building custom AI agents.

- Microsoft Copilot is estimated to reduce meeting follow-up time by 60% in Outlook and Teams.

- New enterprise Copilot APIs allow third-party integration into ERP, CRM, and vertical SaaS applications.

- Copilot for Security, launched in March 2025, is already used by 43% of Fortune 100 companies.

- Microsoft research shows a 22% reduction in employee burnout when Copilot tools are used consistently.

- 75% of enterprise users report that AI copilots have made daily tasks “significantly easier or faster.”

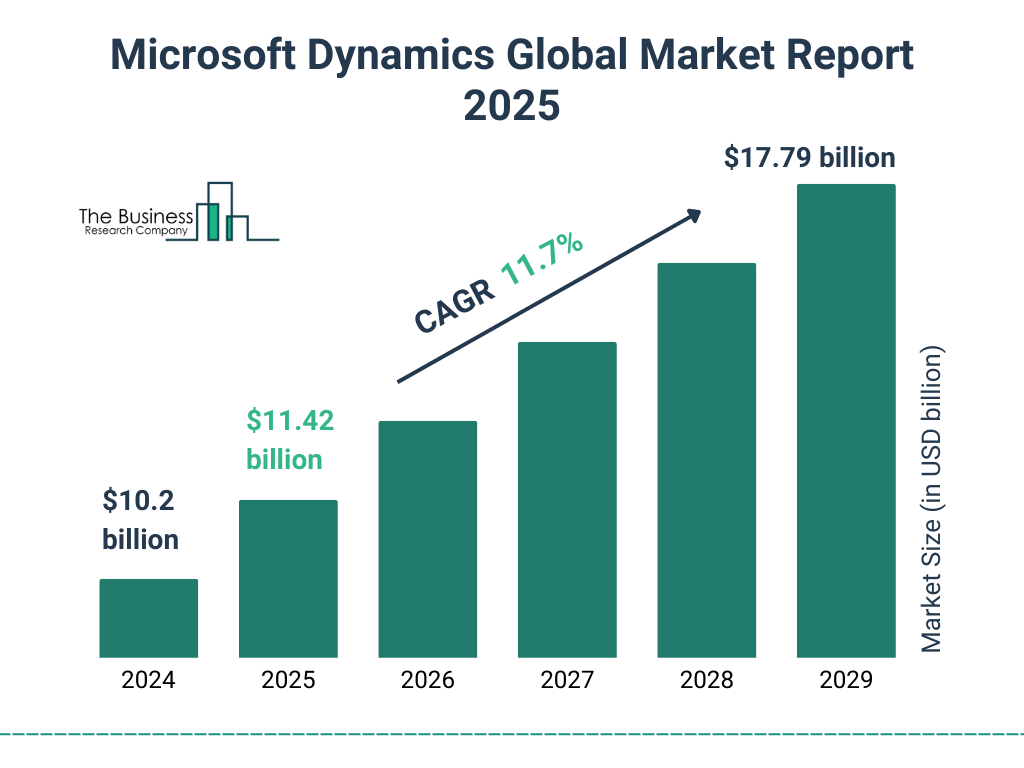

Microsoft Dynamics Global Market Growth

- The Microsoft Dynamics market is projected to grow to $11.42 billion in 2025.

- It’s expected to continue rising to reach $17.79 billion by 2029.

- The market is expanding at a CAGR of 11.7%, signaling strong long-term growth.

Microsoft Teams Usage

- Microsoft Teams now has 360 million monthly active users globally as of June 2025.

- Daily active users (DAUs) have crossed the 220 million mark, reflecting deep integration in hybrid workplaces.

- Virtual meeting minutes exceeded 7 billion hours per month, up 18% year-over-year.

- Teams Phone is used by over 20 million PSTN-enabled users, making it a key telephony alternative.

- Live translation and real-time captions are now used in 42% of all meetings.

- Teams has a 97% uptime reliability rate, with consistent global performance.

- Apps and integrations through Teams Marketplace have reached 2,400 certified apps.

- Microsoft reports a 46% increase in Teams usage for frontline and field worker scenarios.

- The new Teams Compact Mode, released in February 2025, reduced user screen fatigue by 19%.

- Teams Premium subscriptions grew 40%, driven by AI meeting summaries and advanced security features.

Surface Hardware Sales and Market Trends

- Microsoft’s Surface revenue reached $8.9 billion in FY 2025.

- The Surface Pro 10, released in Q2, is the fastest-selling Surface model to date, with 2.7 million units sold in its first quarter.

- Surface Laptop Studio 2 saw 48% higher adoption among creatives and engineering professionals.

- Enterprise Surface deployment rose by 36%, especially in hybrid-ready organizations.

- Surface Duo sales remain niche but saw a 22% increase in corporate-issued devices.

- The education sector accounted for 17% of Surface sales, largely driven by discounted bulk orders.

- Microsoft’s global hardware market share in premium laptops now stands at 5.2%, led by the Surface brand.

- Refurbished Surface device sales climbed 63%, aligning with Microsoft’s sustainability strategy.

- Surface sales in Europe grew 28% YoY, driven by strong Q1 performance in Germany and France.

- The launch of Copilot-integrated Surface devices has improved average selling price (ASP) by $112 per unit.

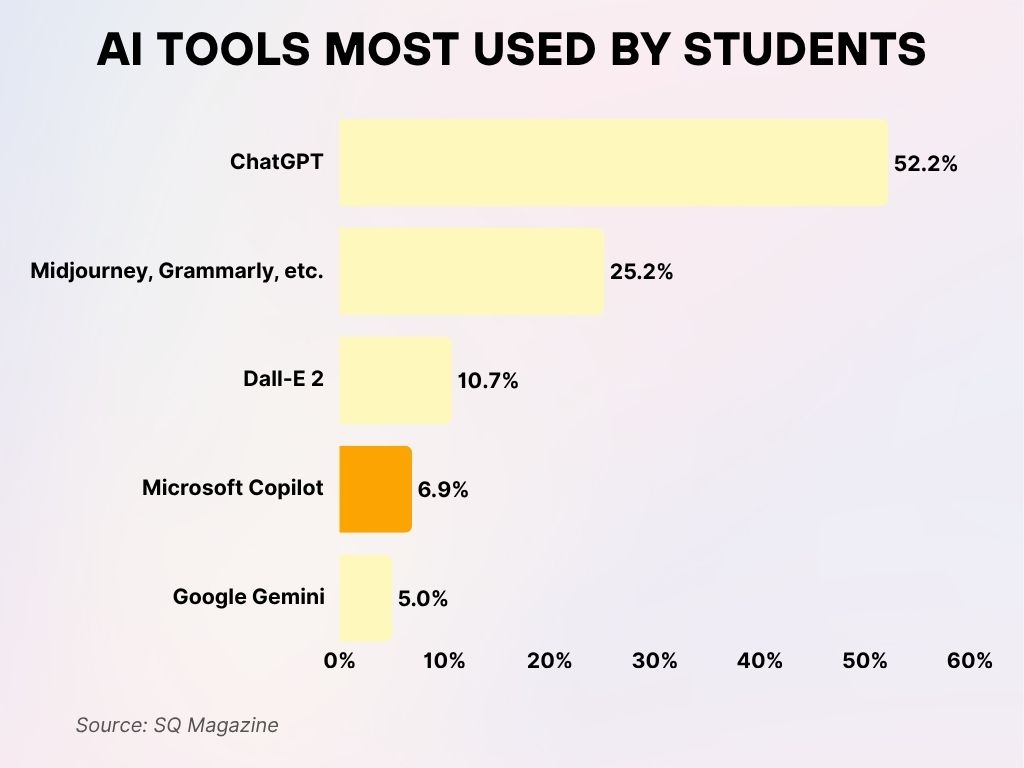

AI Tools Most Used by Students

- ChatGPT dominates student usage with a leading 52.2% share, highlighting its role in academic support and productivity.

- Midjourney, Grammarly, and similar tools are used by 25.2% of students, showing a strong interest in creative and writing assistance.

- Dall-E 2 captures 10.7% of usage, reflecting student engagement in AI-generated visual content.

- Microsoft Copilot is used by 6.9% of students, mainly for productivity and coding tasks.

- Google Gemini rounds out the list with 5% usage among students.

Cybersecurity and Compliance

- Microsoft’s cybersecurity business is now worth $28.5 billion, making it one of the largest in the world.

- Over 1.1 million organizations rely on Microsoft Defender and Security Copilot tools.

- Microsoft Defender for Endpoint protects more than 600 million devices across platforms.

- The newly launched Security Copilot reduces incident investigation time by 48%.

- Microsoft detects and blocks 65 billion threats per day, including phishing and ransomware attacks.

- Zero Trust adoption through Microsoft Entra and Purview climbed 41% YoY.

- Microsoft processed over 1 trillion security signals daily as of mid-2025.

- Azure Active Directory, now renamed Microsoft Entra ID, has 720 million monthly active users.

- Microsoft is compliant with over 120 global regulatory frameworks, including FedRAMP High and ISO 27001.

- Compliance Manager usage increased by 35%, supporting audit readiness across multiple sectors.

Global Workforce and Diversity Data

- Microsoft has a global workforce of 227,000 employees in 2025, with 46% based outside the US.

- Women represent 34.5% of Microsoft’s global workforce, with women in leadership roles at 31%.

- In the US, Black and African American employees now make up 7.1% of the workforce.

- Microsoft’s neurodiversity hiring initiative has grown 19%, supporting inclusion for autistic and ADHD individuals.

- Employees working remotely or hybrid environment now account for 74% of the total headcount.

- Microsoft continues to invest in global employee well-being, with mental health resources used by 61% of staff.

- Average employee tenure is now 6.8 years.

- The company maintains a pay equity rate of 99.8% across gender and race categories.

- Microsoft provided over 5.2 million training hours in 2025 to upskill its global workforce.

- The employee satisfaction score stands at 88%, reflecting steady morale post-pandemic.

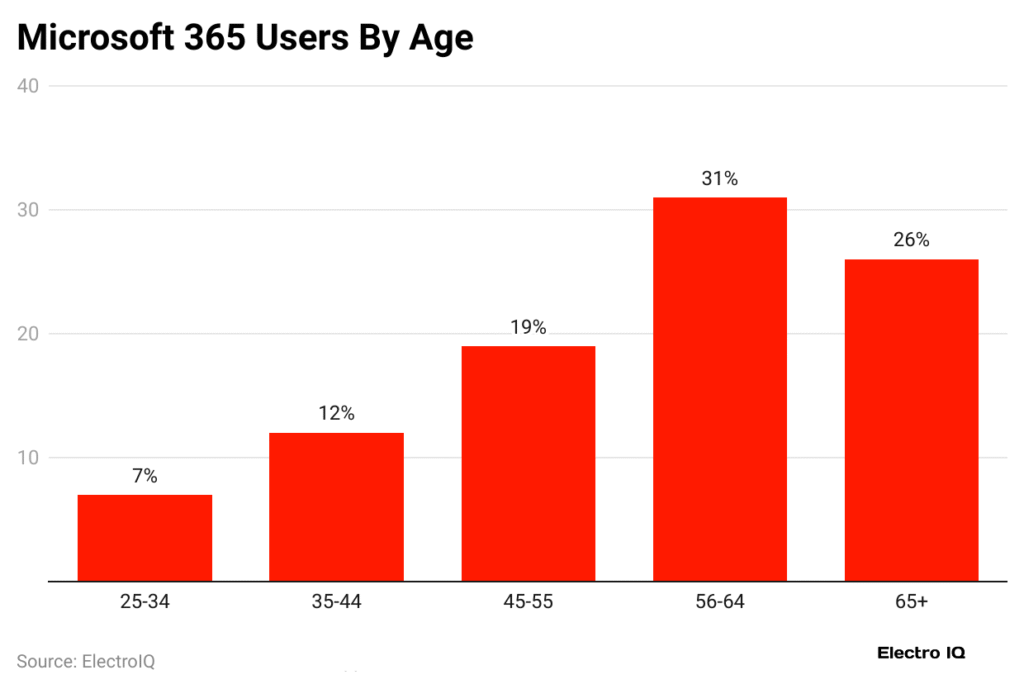

Microsoft 365 User Demographics by Age

- The 56–64 age group leads with 31% of Microsoft 365 users.

- Users aged 65 and older follow closely at 26%, indicating strong adoption among seniors.

- The 45–55 group accounts for 19% of users, showing steady engagement.

- The 35–44 segment represents 12%, with lower but notable usage.

- The youngest group, ages 25–34, makes up just 7%, reflecting minimal usage among younger professionals.

Recent Developments in Microsoft’s Business

- In April 2025, Microsoft unveiled Copilot Studio, a low-code tool for customizing AI copilots across apps and services.

- Microsoft acquired CitusData AI, an AI-focused database startup, for $2.1 billion, strengthening Azure Synapse.

- Partnerships with NVIDIA and AMD have expanded, powering Microsoft’s AI workloads with cutting-edge chips.

- Microsoft launched Fabric, a new data platform that integrates Power BI, Azure Synapse, and Data Factory in one.

- The Microsoft Mesh mixed-reality platform entered public preview, with 400+ organizations piloting use cases.

- Microsoft began building a quantum supercomputer prototype, targeting operational capability within five years.

- Bing Chat Enterprise, based on OpenAI’s models, is now deployed in 120+ countries, serving enterprise-grade AI chat.

- In response to climate goals, Microsoft reduced its Scope 1 and 2 emissions by 38% year-over-year.

- Microsoft’s AI Responsibility Report 2025 emphasized transparency, bias mitigation, and model oversight.

- In June 2025, Microsoft and OpenAI expanded their collaboration to bring multi-modal capabilities to enterprise clients.

Conclusion

From its early beginnings to its current dominance in AI, enterprise software, and cloud infrastructure, Microsoft’s 2025 statistics tell a clear story: this is a company deeply embedded in the digital transformation of every major industry. With Copilot reshaping productivity, Azure securing more of the cloud, and Microsoft 365 evolving into a truly intelligent platform, the next phase of growth looks not only promising but fundamental to how the world works.