Dropbox continues to evolve. The company faces headwinds, including slowing revenue growth and macroeconomic pressures. Workforce changes have become central to its strategy as Dropbox reshapes operations for efficiency and future products. Below, we explore how many people work there now, how that number has changed, and what recent developments mean for Dropbox’s workforce.

How Many People Work At Dropbox?

- As of December 31, 2024, Dropbox had 2,204 employees, a drop of 489 employees (-18.16 %) from 2023.

- In 2023, Dropbox had 2,693 employees, down 425 (−13.63 %) from 2022.

- Dropbox announced a workforce reduction of about 20 % (~528 employees) in late October 2024.

- Earlier in April 2023, the company laid off approximately 16 % of its global workforce (~500 employees).

- Revenue per employee in 2024 hovered around $943,000, which was an increase of roughly 19.3 % from revenue per employee in 2023.

- In its 2024 10-K filing, Dropbox cited that the layoffs would cost between $63 million and $68 million in cash severance and benefits, with additional non-cash charges.

- The workforce cuts were intended to make the company’s structure “flatter” and to eliminate overinvestment in underperforming areas.

Recent Developments

- In Q2 2025, Dropbox revenue reportedly dipped ~1.4 % year over year to about $626 million.

- Dropbox’s annual recurring revenue (ARR) at the end of Q2 2025 was about $2.542 billion, down roughly 1.2 % year over year.

- Paying users in Q2 2025 stood at about 18.13 million, slightly down from Q1 2025. The company signaled a slight decline in full-year paying users as it shifts focus toward monetization over acquisition.

- The company has been under pressure from activist investor Half Moon Capital to end the dual-class share structure and address slowing growth and a declining paid-user base.

- Dropbox is investing in its product Dash (AI-powered universal search) as part of its effort to drive growth beyond its mature File Sync & Share (FSS) business.

- The company projects that workforce reductions will improve margins and free up capital for new investments.

- Most severance and other employee-related expenses tied to the layoffs were to be recognized in Q4 2024, with some extending into H1 2025.

Dropbox’s Current Team (Key People)

- Drew Houston, CEO & Co-founder, continues to lead Dropbox’s strategic direction, product vision, and organizational culture. He has held the CEO role since the company’s founding in 2007.

- Tim Regan, Chief Financial Officer, manages financial operations, investor relations, and long-term capital planning. He’s been a key figure during recent restructuring and cost-optimization efforts.

- Melanie Rosenwasser, Chief People Officer, leads Dropbox’s global HR strategy, including Virtual First initiatives, diversity efforts, and talent acquisition.

- Ali Dasdan, appointed Chief Technology Officer in March 2025, brings decades of engineering experience and is spearheading innovation across Dropbox’s AI and infrastructure platforms.

- Ashraf Alkarmi, General Manager and Senior Vice President of Core Products, was appointed in late 2024 and is responsible for product vision and development for core Dropbox services.

- Will Yoon, Chief Legal Officer, oversees all legal, compliance, privacy, and corporate governance matters, especially critical as the company faces activist investor challenges.

- Olivia Nottebohm, a former Chief Operating Officer, played a key role in Dropbox’s early post-IPO structure but is no longer in the current leadership roster.

- Lisa Campbell, an independent board director, contributes experience from Autodesk and serves on governance and audit committees.

- Abhay Parasnis, another board member and former CTO at Adobe, helps guide Dropbox’s technology roadmap from a governance perspective.

- Dropbox’s leadership is actively reshaping the organization to support its Virtual First model and product-led growth in a leaner structure.

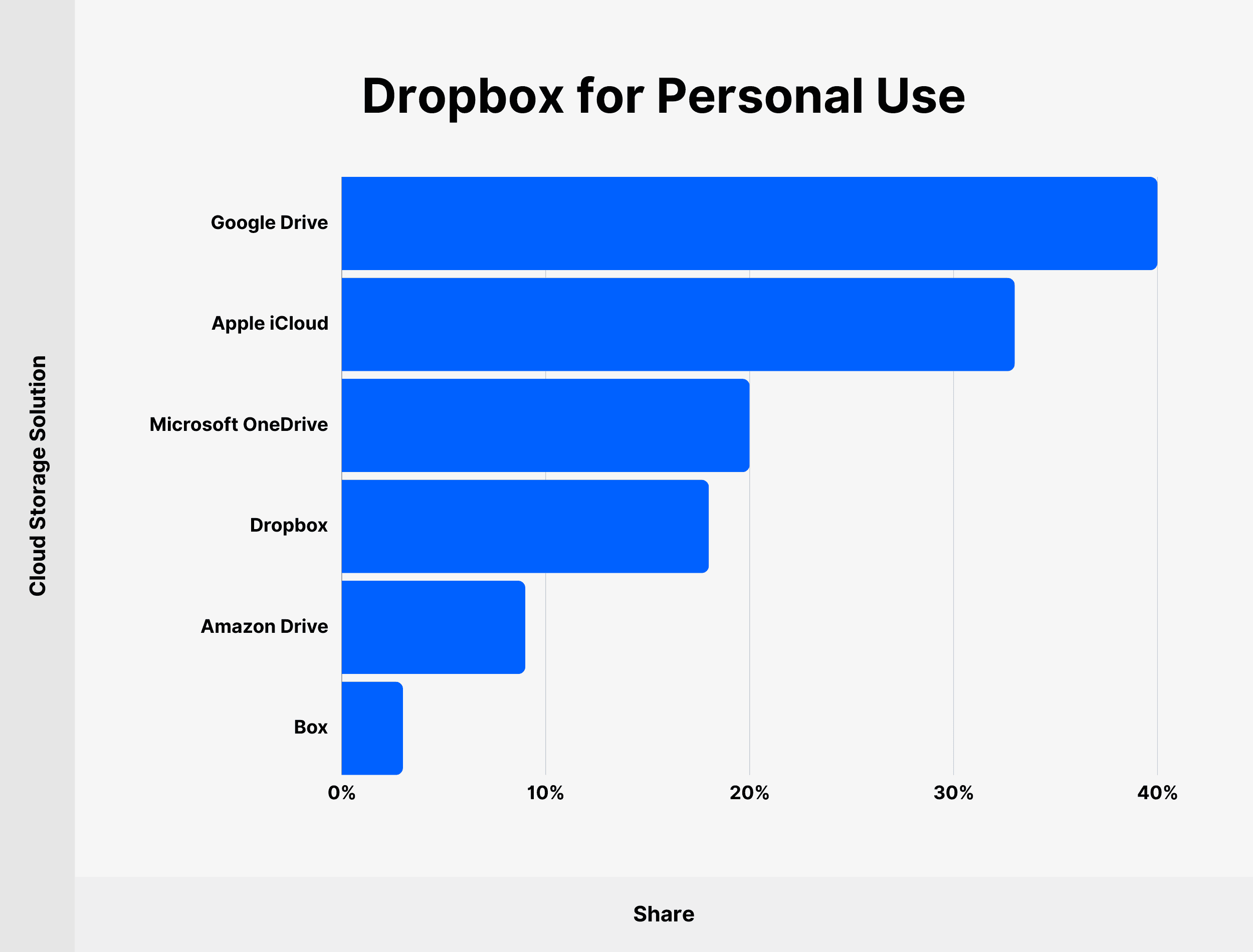

Cloud Storage for Personal Use

- Google Drive dominates personal cloud storage with a 40% market share, making it the most preferred platform for individual users.

- Apple iCloud follows closely with 33%, driven by its seamless integration with iOS and Mac devices.

- Microsoft OneDrive holds a respectable 20% share, benefiting from its bundling with Microsoft 365 subscriptions.

- Dropbox accounts for 18%, maintaining relevance despite growing competition from tech giants.

- Amazon Drive captures just 9% of the personal storage market, signaling limited consumer adoption.

- Box trails with a modest 3%, reflecting its stronger focus on business users rather than individuals.

Dropbox Employee Count Overview

- Total employees as of Dec 31, 2024: 2,204.

- That number reflects a decrease of 489 employees (~−18.16 %) compared to 2023.

- In 2022, Dropbox had 3,118 employees; in 2023, headcount dropped to 2,693.

- The drop from 2022 to 2023 was 425 employees (~−13.63 %).

- Between 2021 and 2022, Dropbox’s workforce grew slightly, then began declining. For example, end-2022 vs end-2021 saw growth of 451 employees (~+16.91 %) before the later drops.

- Recent changes reflect both reductions and strategic repositioning rather than just simple scaling back.

- No recent public data shows a full restoration of the headcount to pre-2022 levels.

Recent Workforce Reductions and Layoffs

- In October 2024, Dropbox reduced its global workforce by ~20 %, affecting ~528 employees.

- In April 2023, layoffs were about 16 % of the workforce (~500 employees), attributed to slowing growth and a shift toward different skill sets (especially AI-focused).

- Layoffs were focused on areas where Dropbox considered it had overinvested or underperformed.

- Severance and benefits packages for the 2024 layoffs were expected to cost $63-68 million in cash.

- Additional expense recognition for those layoffs included $47-52 million in non-cash or other charges.

- Employees impacted in the 2024 layoffs were eligible for 16 weeks of pay, with an extra week per year of service. Equity, leave payouts, and visa support were included.

- These layoffs are part of a restructuring that aims to flatten the organization and improve efficiency.

- The cost savings are intended to go toward investment in growth areas (like Dash, AI) and improving Dropbox’s core business.

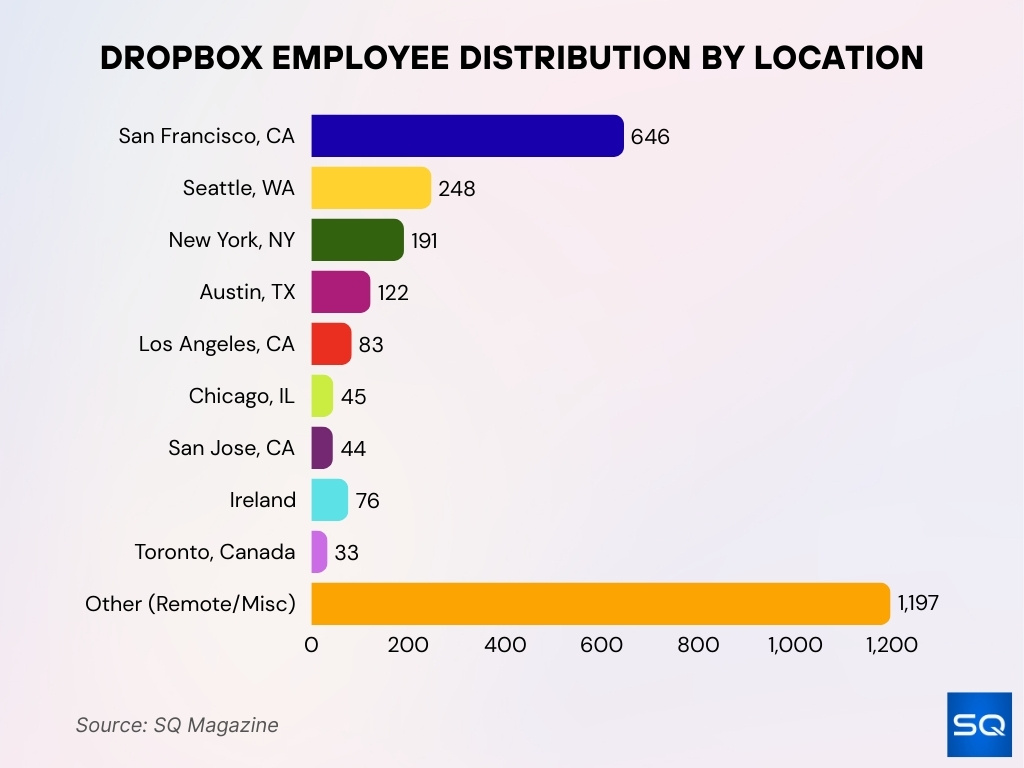

Employee Distribution by Location

- The largest physical hub is San Francisco, CA, with ~646 employees.

- Seattle, WA has around 248 employees.

- New York, NY, employs approximately 191.

- Austin, TX has about 122 employees.

- Los Angeles, CA has ~83 people.

- Chicago, IL has ~45 employees.

- Internationally, Ireland is a key location with ~76 employees.

- Toronto, Canada, seats ~33 employees.

- San Jose, CA has ~44 employees.

- A large “Other” category (~1,197 employees) includes remote, flexible locations or employees not tied to these major hubs.

Virtual First and Remote Work Model

- Dropbox adopted a Virtual First policy in October 2020, making remote work the default for individual work.

- An internal survey in 2025 shows that approximately 70 % of employees report higher productivity when working remotely.

- About 76 % of employees highlight having uninterrupted work time under the virtual-first setup.

- Roughly 70 % have adopted modified work schedules to accommodate flexibility.

- Internal metrics report a threefold increase in job applicants since moving toward virtual first.

- Time to hire has improved, about 15 % faster now than before the virtual-first shift.

- There’s been a 16 % increase in diverse candidates applying for roles since virtual-first policies were strengthened.

- Dropbox has formalized a Virtual First Toolkit (including remote communication practices, asynchronous work modules, etc.) to help teams operate effectively.

Comparing Dropbox Headcount to Competitors

- As of end-2024, Dropbox had ~2,204 employees globally.

- Compare that to typical headcounts at companies with similar cloud storage or collaboration tools, e.g., Box, Google Drive, Teams, Microsoft OneDrive.

- Dropbox’s recent layoffs (~20 %) shrink its margin between the total employee base and competitors still aggressively hiring.

- Virtual-first and remote work give Dropbox competitive advantages in recruiting versus companies insisting on a return to the office.

- Despite a smaller headcount compared to some major competitors, Dropbox’s revenue per employee, productivity metrics suggest their leaner model may be relatively efficient.

- The “Other” and remote/flexible location category in Dropbox distribution allows it to tap talent more broadly than competitors anchored in specific geographies.

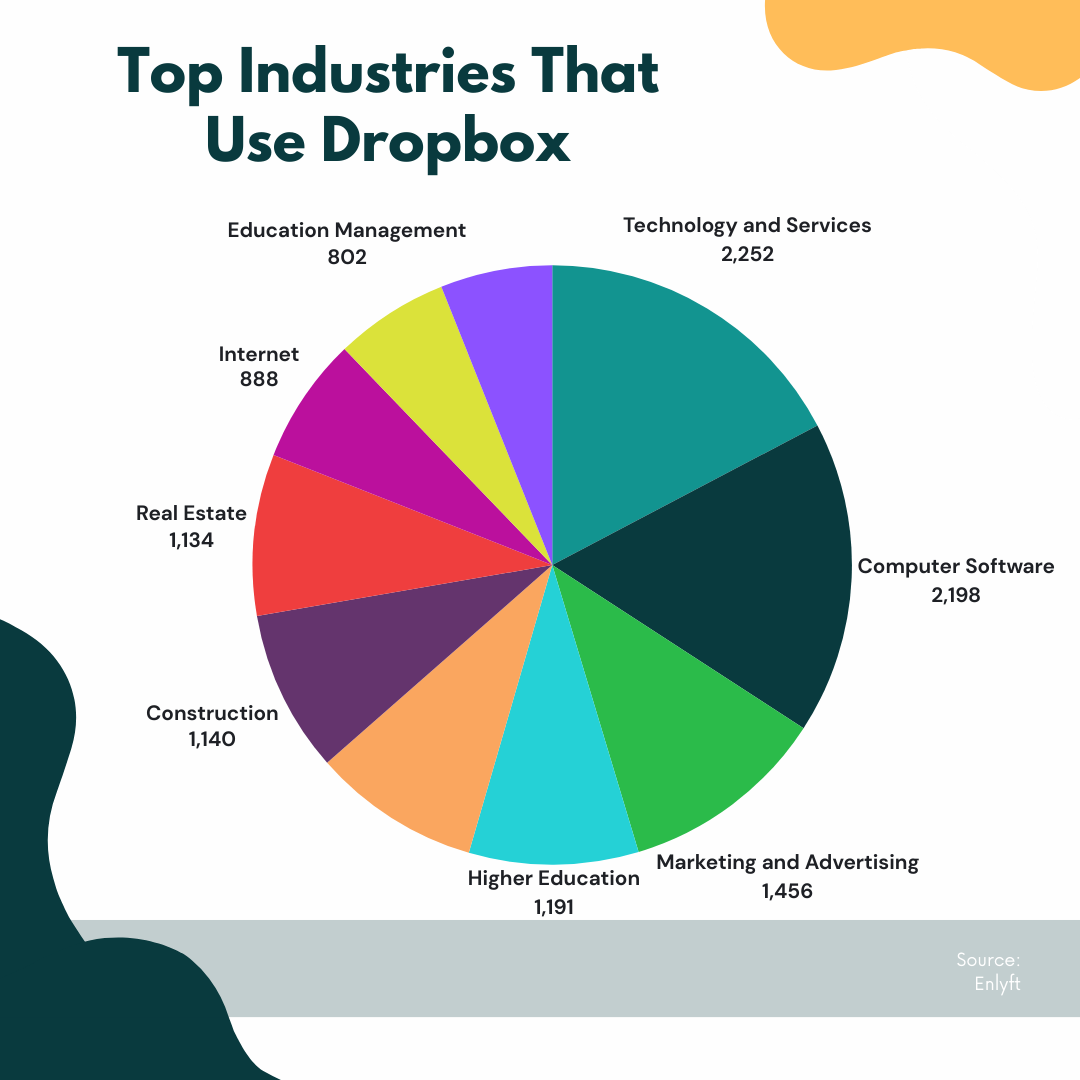

Top Industries That Use Dropbox

- Technology and Services leads with 2,252 companies using Dropbox, reflecting its widespread adoption in IT and SaaS operations.

- Computer Software is close behind, with 2,198 companies leveraging Dropbox for code, collaboration, and deployment workflows.

- Marketing and Advertising firms make up a strong user base, with 1,456 companies relying on Dropbox for content sharing and client campaigns.

- Higher Education institutions account for 1,191 organizations, using Dropbox for academic collaboration and digital resource distribution.

- The Construction industry includes 1,140 companies, often using Dropbox for project files and job site documentation.

- Real Estate firms follow with 1,134 users, benefiting from Dropbox’s document storage and client-access capabilities.

- Internet-based businesses represent 888 companies, including startups and digital platforms.

- Education Management organizations number 802, often using Dropbox to streamline school administration and curriculum sharing.

Impact of Workforce Changes on Company Performance

- The layoffs of ~20 % of the workforce in October 2024 (~528 people) were intended to reduce overinvestment and improve efficiency.

- After workforce reduction, Dropbox projects improved operating margins, thanks to lower fixed costs and leaner organizational structure.

- The remote work model helps lower real estate, travel, and in-office facility costs, contributing to cost savings.

- Survey data suggests employee productivity, quality of deep work, and satisfaction rose under Virtual First, which can indirectly contribute to better execution and customer satisfaction.

- Faster hiring and more diverse candidates may bring in new skills and perspectives faster, which helps innovation and product development.

- However, there are trade-offs; remote collaboration brings communication overhead, asynchronous work can slow decisions, and managing across time zones adds complexity.

- Employee morale and retention seem better under flexible models, which helps reduce turnover costs. Dropbox claims the lowest attrition since adopting Virtual First.

Employee Compensation and Benefits

- According to Glassdoor (2025), salaries at Dropbox vary widely. Account Managers might earn ~$205,424/year, while Engineering Managers can reach ~$608,987/year.

- For Human Resources roles (IC5 in the U.S.), typical total compensation ranges between $314,000‑$373,000, inclusive of base, bonuses, and stock.

- For new grads, the average base salary is around $176,000, with a range between $172,000‑$198,000 depending on role/location.

- Remote roles at Dropbox report a median base pay of ~$186,000, with some remote senior engineering product roles reaching $314,000‑$425,000.

- The total value of Dropbox’s employee benefits package is estimated at ~$17,200 per employee, covering insurance, health & wellness, retirement, etc.

- Benefits include health & wellness reimbursement, gym/wellness stipends, flexible/unlimited PTO and sick leave, and home office support.

- Dropbox provides a 401(k) match up to $6,000, and employer contributions for Health Savings Accounts (HSA).

- Perks also include learning & development opportunities, employee discounts, and financial wellness tools.

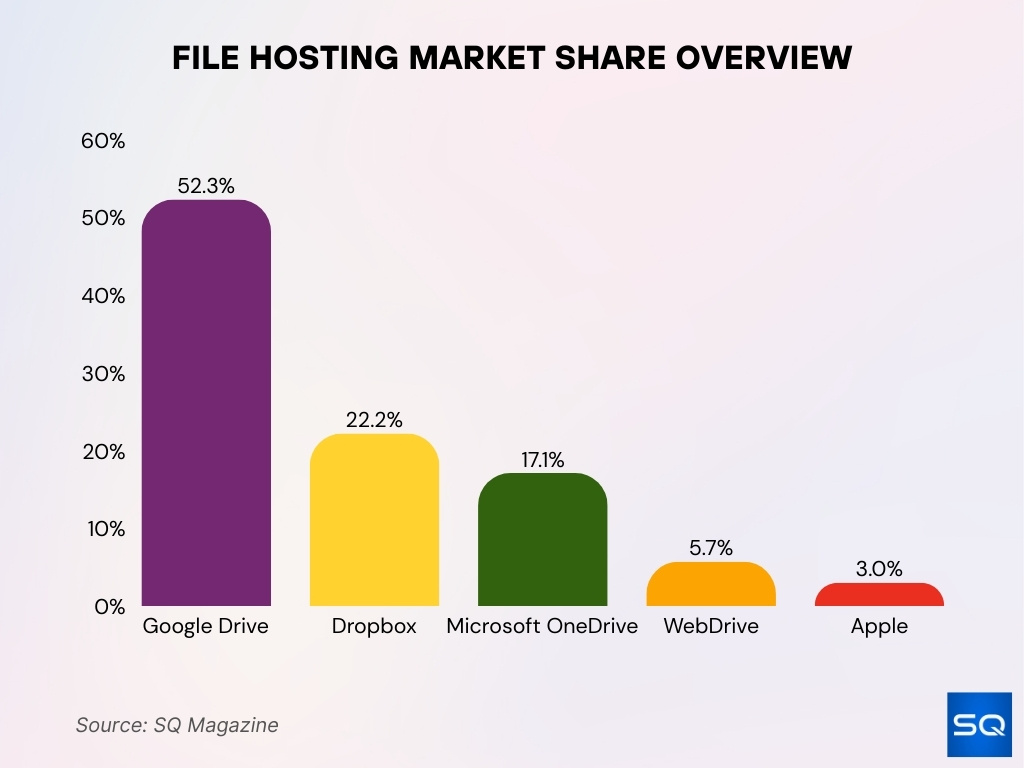

File Hosting Market Share Overview

- Google Drive dominates the market with a commanding 52.3% share, making it the top choice for both individuals and businesses.

- Dropbox ranks second with a solid 22.2% share, proving its continued relevance in secure and user-friendly file hosting.

- Microsoft OneDrive captures 17.1% of the market, boosted by its seamless integration with Office 365 and enterprise solutions.

- WebDrive holds a niche position with 5.7%, often used in specialized enterprise environments and remote server mapping.

- Apple’s iCloud accounts for 3.0%, reflecting its limited role in broader file hosting beyond Apple’s ecosystem.

Dropbox Hiring Trends and New Roles

- After the layoffs of 2023-2024, Dropbox has been increasingly hiring for AI-related roles, particularly around its Dash product and universal search.

- Leadership changes reflect a shifting focus toward stronger technology and core product leadership.

- There is growth in remote / distributed role postings, indicating Dropbox continues to expand hiring beyond its major hubs.

- Competitive pay packages are being offered for senior engineering roles, especially for remote or high-skill positions.

- New grads see entry roles with strong base pay (~$170‑$200k), especially in software engineering and product.

- Dropbox maintains internal hiring for leadership roles, as seen in recent promotions.

Challenges and Future Outlook for Dropbox Workforce

- One major challenge is slowing growth in its core business, which has pushed Dropbox to adjust its workforce and product strategy.

- Pressure from activist investors to change governance (dual-class share structure) adds external scrutiny and could impact leadership decisions.

- Maintaining high employee morale after layoffs and restructuring is a risk.

- Competition for skilled AI, cloud, and product engineers remains intense.

- Remote and virtual-first working models provide flexibility but also challenges in coordination, maintaining culture, onboarding, and managing cross-time zone work.

- Expense management is increasingly important, and stock-based compensation, benefit costs, and severance payouts are large line items.

- Future outlook depends heavily on success of new product investments, ability to stabilize revenue, and an efficient cost structure.

Frequently Asked Questions (FAQs)

Dropbox had 2,204 employees at the end of 2024.

Dropbox’s revenue per employee is about $1.15 million.

Dropbox’s trailing twelve‑month revenue was about $2.53 billion, showing a small 0.04 % decline year‑over‑year.

Dropbox laid off about 528 employees in October 2024, equal to roughly 20 % of its workforce.

Conclusion

Dropbox now operates with a significantly leaner team than just a few years ago, placing a stronger emphasis on efficiency, product leadership, and remote work. Compensation and benefits remain competitive for those in high-skill roles, while new hires in AI and core product areas are a clear priority. However, challenges around retention, external investor pressure, and maintaining organizational coherence in a flatter structure still loom large. As Dropbox moves through, its trajectory will depend not just on how many people work there, but how well those people are organized, motivated, and aligned with its long-term goals.