Apple’s workforce size offers key insight into how the company scales operations, adapts to industry shifts, and manages talent. This matters not just internally; Apple’s hiring influences local economies in Cupertino, Austin, and Bangalore, but also affects competition across Big Tech and the supply chain sectors. For example, its U.S. supplier spending supports millions of jobs across states. Read on to explore detailed workforce trends, demographic breakdowns, and what the future may hold.

How Many People Work At Apple?

- Apple’s global headcount hit 164,000 in FY 2024, up ~1.86% from 2023.

- From 2022 to 2023, the employee count dipped from 164,000 to 161,000 (−1.83%).

- Apple’s total workforce has grown by over 345% since 2009.

- Approximately 90,000 employees are based in the U.S. (as of the latest reports).

- In the U.S., Apple supports 2 million jobs across all states, via direct and indirect channels.

- Engineering is the largest department, with ~49,800 employees, about 41% of the workforce.

- Apple has conducted multiple rounds of layoffs in 2024, though its workforce reductions remain modest compared to peers.

Recent Developments

- In 2024, Apple made at least four rounds of layoffs, largely tied to project cuts (e.g., self-driving, microLED).

- Over 600 employees were laid off in California in mid‑2024 via WARN Act notices.

- Apple committed to a $500 billion U.S. investment over the next 4 years, including hiring 20,000 new workers for AI and manufacturing roles.

- Apple continues diversity, equity, and inclusion (DEI) efforts. At a 2025 shareholder meeting, investors rejected a proposal to ban DEI initiatives.

- The company remains among the most efficient per employee, generating ~$2.4 million in revenue per worker annually.

- Apple’s U.S. supplier spending exceeded $50 billion in recent years, reinforcing supply chain roles.

- Apple is expanding its AI, silicon, and advanced manufacturing footprint domestically, which may shift hiring toward R&D and engineering roles.

- Changes to hybrid work and return‑to-office policies are influencing retention, particularly among senior staff.

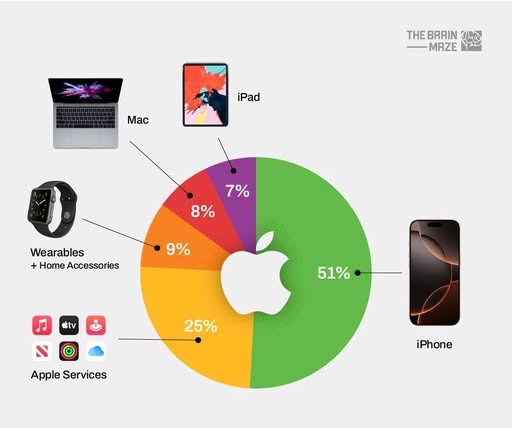

Apple Revenue Breakdown by Product

- iPhone contributes 51% of Apple’s total revenue, making it the company’s dominant product line.

- Apple Services generate 25% of revenue, showing strong growth from subscriptions and digital offerings.

- Wearables and Home Accessories account for 9%, driven by products like Apple Watch and AirPods.

- Mac sales represent 8% of revenue, reflecting steady demand for laptops and desktops.

- iPad contributes the remaining 7%, maintaining relevance in education and enterprise sectors.

Apple’s Current Team (Key People)

- Tim Cook, Chief Executive Officer (CEO since 2011). He has led Apple through its transition from a product-centric company to one increasingly focused on services, wearables, and sustainability. Under his leadership, Apple surpassed a $3 trillion valuation.

- Luca Maestri, Chief Financial Officer – Responsible for Apple’s financial strategy, Maestri has overseen Apple’s massive cash reserves, capital returns, and efficient cost controls. He joined the company in 2013 and became CFO in 2014.

- Jeff Williams, Chief Operating Officer – Often considered Cook’s right hand, Williams oversees Apple’s global operations and product development. He played a pivotal role in the Apple Watch and health technology platforms.

- John Ternus, Senior Vice President of Hardware Engineering – Ternus leads the hardware team responsible for flagship devices such as iPhone, iPad, and Mac. He succeeded Dan Riccio in 2021 and was instrumental in Apple Silicon’s rollout.

- Eddy Cue, Senior Vice President of Services Cue oversees Apple’s services business, including Apple Music, iCloud, Apple TV+, and the App Store. Services are now Apple’s second-largest revenue stream, contributing significantly to profitability.

- Craig Federighi, Senior Vice President of Software Engineering Federighi heads development of iOS, macOS, and Apple’s software platforms. Known for his keynote appearances, he’s a major influence on product usability and system architecture.

- Deirdre O’Brien, Senior Vice President of Retail + People – O’Brien manages Apple’s global retail strategy and HR operations, playing a central role in talent development and employee experience across the company.

- Johny Srouji, Senior Vice President of Hardware Technologies – Srouji leads Apple’s chip development initiatives, including the custom silicon (M1, M2, and now M3 chips) that power iPhones, iPads, and Macs.

- Carol Surface, Chief People Officer – A newer addition to the leadership team (joined in 2023), Surface oversees HR strategy, including DEI, hiring, and workplace culture.

- John Giannandrea, Senior Vice President of Machine Learning and AI Strategy – A former Google AI leader, Giannandrea now leads Apple’s push into generative AI and intelligent features under the Apple Intelligence brand.

Key Apple Workforce Statistics

- Fiscal 2024: 164,000 employees, a ~1.86% increase from 2023’s 161,000.

- 2023 saw a ~1.83% decline from 2022 (164,000 → 161,000).

- In 2022, the headcount rose by ~6.49% from 2021’s 154,000.

- In 2021, Apple had ~154,000 employees, and in 2020, ~147,000.

- Average revenue per employee in recent years is ~ $2.4 million.

- Apple supports 2 million jobs in the U.S. through direct, indirect, and ecosystem roles.

- In 2024, Apple’s U.S. supplier network involved 9,000+ suppliers and manufacturers.

- Apple’s workforce has increased since 2019 (~137,000 to 164,000) is ~ 20%+ growth in five years.

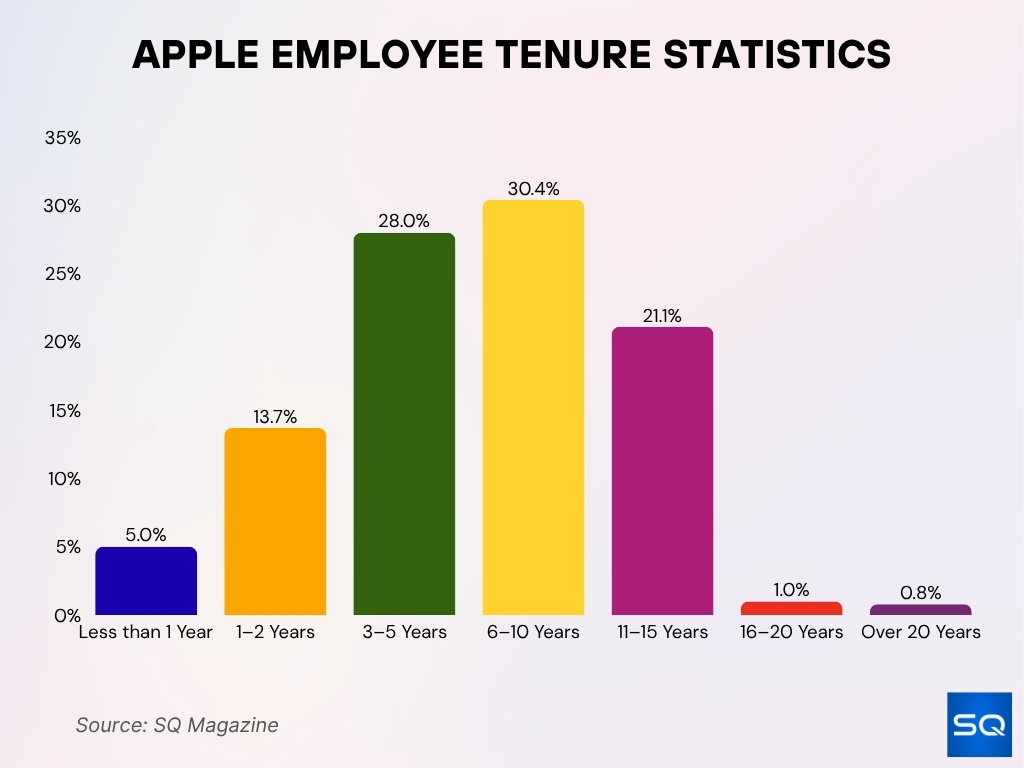

Apple Employee Tenure Statistics

- 30.4% of respondents have worked at Apple for 6–10 years, the most common tenure range.

- 28% have stayed with the company for 3–5 years, reflecting mid-term loyalty.

- 21.1% have been with Apple for 11–15 years, indicating strong long-term retention.

- Only 5% of employees reported working for less than 1 year, suggesting low early-stage churn.

- 13.7% of the workforce has worked at Apple for 1–2 years, representing newer hires.

- A very small fraction, at ~1% have stayed 16–20 years, with even fewer, ~0.8% surpassing 20 years.

Total Number of Apple Employees

- As of FY 2024 (Sept 28, 2024), Apple employed 164,000 people worldwide.

- In FY 2023, Apple’s headcount was 161,000.

- Apple’s 2022 total: 164,000, same as the 2024 figure.

- In 2021: 154,000 employees.

- In 2020: ~147,000 employees.

- By 2019: 137,000 employees.

- In earlier years (2010), the count was ~49,400.

Employee Count by Year

- 2010: ~49,400 employees.

- 2015: ~110,000 employees.

- 2018: ~132,000 employees.

- 2019: ~137,000 employees.

- 2020: ~147,000 employees.

- 2021: ~154,000 employees.

- 2022: ~164,000 employees.

- 2023: ~161,000 employees (decline).

- 2024: ~164,000 employees (rebound).

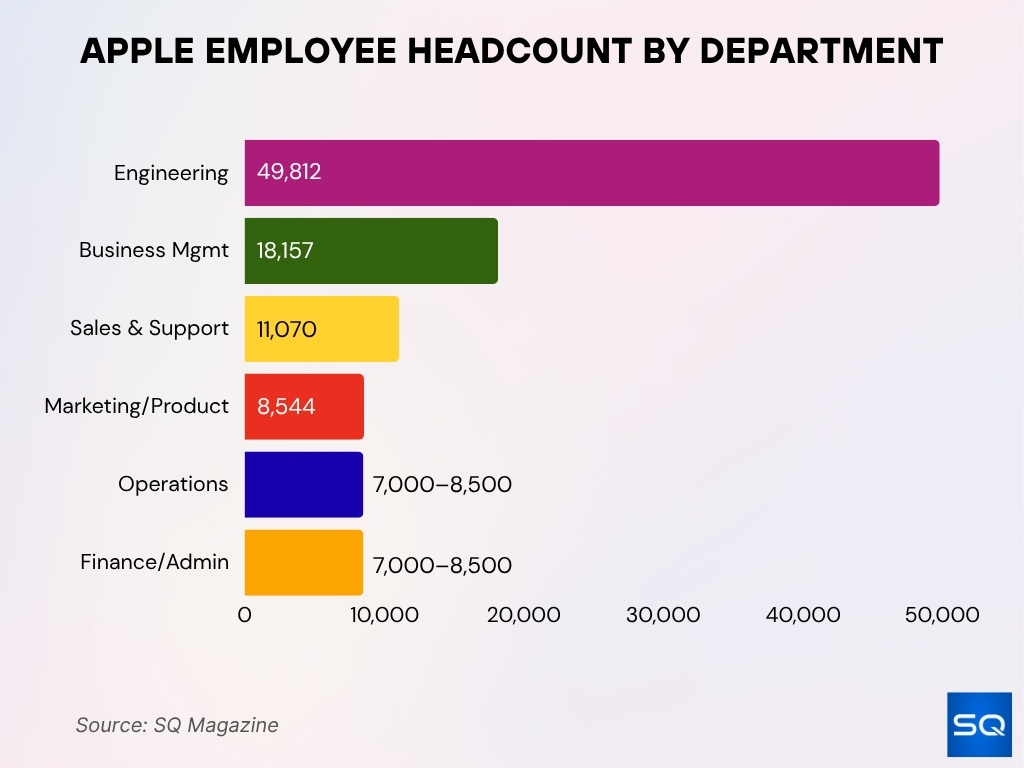

Headcount Breakdown by Department

- Engineering is by far Apple’s largest division, employing approximately 49,812 people, or ~41% of its total workforce.

- Business Management roles count around 18,157 employees.

- Sales & Support functions have ~11,070 workers.

- Marketing & Product teams combined have around 8,544 employees.

- Operations form a mid‑sized chunk, estimated at 7,000–8,500 employees.

- Finance & Administration also range in the same 7,000–8,500 band.

- IT, HR, Legal, and smaller specialized groups fill out the remainder, each likely in the low thousands.

- Apple tracks about 19 distinct departmental categories to map its headcount.

Workforce Demographics

- Globally, Apple’s workforce is 33.2% female and 66.8% male.

- Racial/ethnic composition: 42.3% White, 30% Asian, 14.8% Hispanic/Latino, 9% Black/African American, 3.8% other.

- Among leadership ranks, Apple has made incremental gains in underrepresented groups.

- In tech / R&D roles, the female share is lower than the corporate average.

- Apple’s diversity reports omit full breakdowns for all global employees.

- In past U.S. disclosures, Apple had ~55% White, 15% Asian, 11% Hispanic, and 7% Black employees.

- Gender skew was ~70% male / 30% female.

- Trends show a gradual improvement in hiring underrepresented groups.

- Apple imposes reporting transparency via its inclusion & diversity pages.

Employee Growth Trends

- From 2010 (≈49,400) to 2024 (164,000), Apple’s employee base has grown by over 230%.

- From 2019 (137,000) to 2024 (164,000), growth was ~19.7%.

- The period 2022 → 2023 saw a decline of ~1.83%.

- Apple rebounded in 2024 with a +1.86% increase.

- The 2022 increase (from 2021) was ~6.49%.

- The 2021 increase over 2020 was ~4.76%.

- Periods of contraction coincide with internal reorganization.

- Apple maintains lean revenue per employee metrics even amid growth.

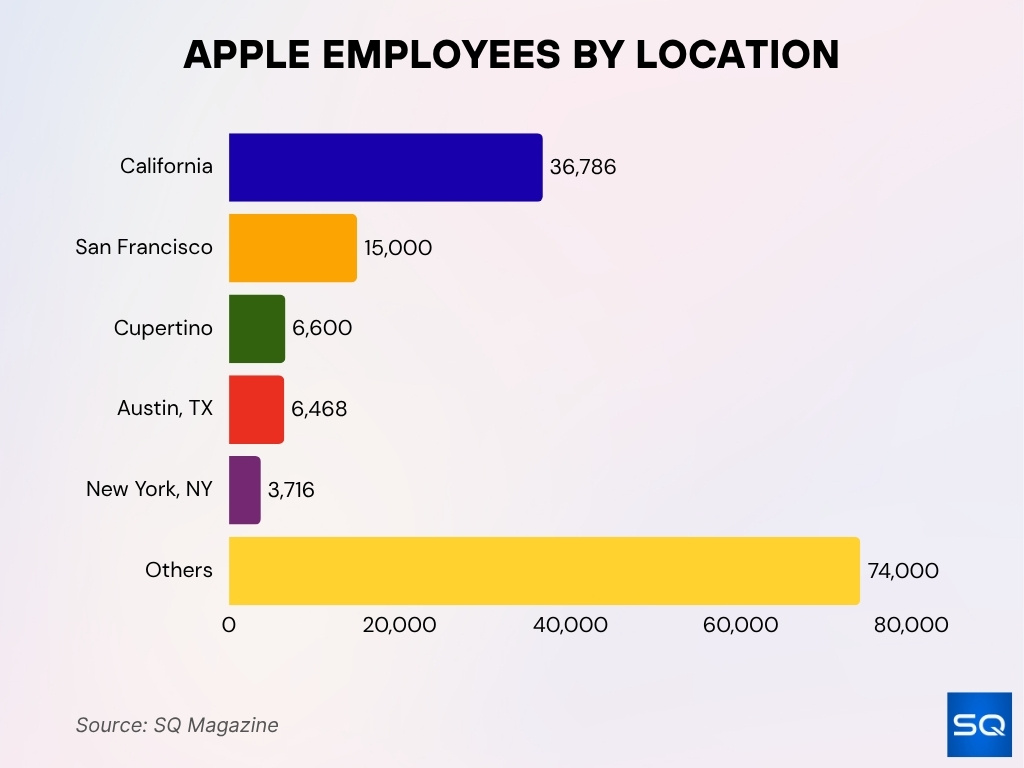

Employees by Location

- California is by far the largest U.S. concentration, with around 36,786 Apple employees in the state.

- In California counties, large clusters are in San Francisco (≈15,000) and Cupertino (≈6,600).

- Austin, Texas, is a major hub with ~6,468 employees.

- New York, NY hosts ~3,716 Apple employees.

- In “Other U.S.” states combined, roughly 74,000 employees are spread across roles.

- Internationally, Apple maintains offices, R&D, and sales staff in key markets.

- Apple reports 80,000 employees in the U.S. (direct employees).

- In the U.S., Apple also supports 450,000 jobs via its supplier network, and 1,530,000 jobs via the App Store ecosystem.

- Apple’s U.S. employee distribution has grown; in some states, employment soared by 41% over the past two years.

Hiring and Layoffs Overview

- In 2024, Apple conducted multiple rounds of layoffs.

- Over 600 California employees were notified under the WARN Act.

- Apple’s overall headcount remained relatively stable.

- Hiring continues in areas like AI, silicon engineering, and manufacturing.

- Apple expects to create ~20,000 new jobs in AI and manufacturing.

- Apple reports adding “3,828 new hires YTD”.

- Attrition and voluntary turnover account for several thousand departures annually.

- Layoffs appear targeted rather than broad.

- Public filings do not always break out layoff numbers by division.

Workforce in the United States

- Apple claims ~80,000 direct U.S. employees.

- Apple supports 450,000 U.S. jobs through its supplier network.

- Apple attributes 1,530,000 U.S. jobs to the App Store ecosystem.

- California houses ~36,786 of Apple’s U.S. staff.

- Texas has ≈8,407 employees.

- New York has ~4,291 Apple employees.

- Smaller states include ~729 in Connecticut, 1,516 in Georgia, and 1,391 in New Jersey.

- Apple operates in over 38 states from a supplier/manufacturer standpoint.

- Apple’s U.S. investment plan will anchor further hiring in regions such as Texas, Michigan, and North Carolina.

- In some states, Apple’s workforce has grown by ~41% over a two‑year span.

Median Salary and Employee Benefits at Apple

- The average Apple salary is ~$127,197 per year.

- For software engineers, the median total compensation is ~$345,000.

- Entry‑level roles appear in salary surveys as low as ~$48,079.

- Employees rate Apple’s benefits at ~4.6 out of 5.

- Apple’s internal “Benefits” valuation is ~$15,066 per employee.

- Apple offers an Employee Stock Purchase Program (ESPP).

- Health, dental, vision, mental‑health support, and disability coverage are standard.

- Tuition reimbursement and continuing education are offered.

- Apple provides paid time off, parental leave, and equity grants.

Job Creation Impact

- Apple claims 2 million U.S. jobs across employment, supply chain, and ecosystem.

- Apple spent over $50 billion with 9,000 U.S. suppliers.

- Developers on the App Store earned over $16 billion.

- Supplier ecosystem supports component manufacturing and logistics.

- Footprint extends to 38+ states.

- Apple plans to add ~20,000 jobs in AI and manufacturing.

- Multiplier effects stimulate jobs in local sectors.

- Apple influences local tax bases and infrastructure.

Future Outlook & Hiring Plans

- Apple will invest ~$500 billion and hire ~20,000 U.S. jobs in AI and R&D.

- Focus areas include generative AI, silicon design, and advanced manufacturing.

- Houston and other facilities will drive local job creation.

- Hiring will favor full-time, high-skilled roles.

- Expansion will be cautious in constrained regions.

- The outsourcing strategy may shift due to geopolitical pressures.

- Apple may grow its cloud and services labor force.

- Retention pressures may prompt benefit updates.

- Hybrid work policies will shape geographic hiring.

Frequently Asked Questions (FAQs)

Apple claims roughly 80,000 direct employees in the U.S.

Apple plans to create 20,000 new jobs in the U.S. over the coming four years.

Apple reported 164,000 employees for its fiscal year ending September 28, 2024.

The headcount grew by 1.86 %, rising from 161,000 in 2023 to 164,000 in 2024.

Conclusion

Apple’s headcount of ~164,000 underscores a strategy of steady, efficient growth rather than aggressive scaling. Its internal team leans heavily toward engineering, R&D, and operations, while contractors in global supply chains fill out operational depth. Though Apple has trimmed staff in certain project areas, its upcoming 20,000‑job U.S. hiring plan and $500 billion investment commitment signal a shift toward innovation, AI, and manufacturing.

Compared to more volatile peers, Apple’s trajectory emphasizes balance; it seeks growth but not overextension. In a changing tech and geopolitical landscape, Apple’s challenge will be to manage talent, costs, and structure in lockstep. Explore the full article to see how its workforce compares, what drives its decisions, and what’s next for Apple’s global teams.