Airtable, founded in 2012, has evolved from a hybrid spreadsheet‑database to an AI‑native platform used by hundreds of thousands of organizations. Understanding its employee count reveals how its product, operations, and competitive stance scale along with its workforce. In sectors like SaaS and no‑code/low‑code tools, staffing levels impact everything from feature delivery to customer service. This article explores not only how many people work at Airtable now, but how its staffing has changed and what that implies for its future.

How Many People Work At Airtable?

- Airtable employs about 833 people globally, up ~7.2% from the year before.

- The company added 172 new hires year‑to‑date, which is ~5% of its total workforce.

- Engineering is one of Airtable’s largest departments, estimated to have between 270 and 650 employees.

- Sales & Support has ~274 employees, making it one of the biggest teams.

- TrueUp estimates Airtable has around 800 employees, but the $12 billion valuation is outdated; secondary market data in 2024–2025 places Airtable’s valuation between $3.8 and $5 billion.

- GrowJo estimates 971 employees, noting a ~12% decline in employee growth over the past year.

- Airtable reduced its workforce by 27% (≈ 237 employees) in September 2023, shifting focus toward enterprise customers.

Recent Developments

- In September 2023, Airtable cut ~27% of its workforce (about 237 employees) in a restructuring aimed at realigning toward enterprise clients.

- In late 2024, the company reported cash flow positivity while maintaining ~30% annual growth.

- The platform launched Cobuilder in July 2024, which quickly became its fastest‑adopted feature.

- In April 2025, Airtable introduced a new AI assistant to streamline app creation and management.

- The company rebranded itself as an AI‑native app platform, emphasizing natural conversation and workflow automation features.

Airtable’s Current Team (Key People)

- Howie Liu, Co-Founder & CEO – Liu has been at the helm since Airtable’s inception in 2012, steering the company through rapid growth, major funding rounds, and a pivotal shift toward AI-native operations.

- Andrew Ofstad, Co-Founder & Chief Product Officer – Ofstad oversees Airtable’s user experience and product roadmap, ensuring the platform remains intuitive while expanding its capabilities.

- Emmett Nicholas, Co-Founder & CTO – As the technical lead, Nicholas is responsible for platform architecture and innovation, particularly in engineering infrastructure and AI integration.

- Archana Agrawal, Chief Marketing Officer – Formerly at Atlassian, brings enterprise marketing expertise, helping Airtable penetrate competitive B2B SaaS markets.

- Samantha Bufton, Chief Product Officer (joined post-2023 restructuring) – Previously with SurveyMonkey, Bufton drives product strategy with a strong focus on enterprise workflows and automation.

- Matt Soldo, Head of AI & Automation – Soldo leads development of AI-based features like Cobuilder and Airtable’s conversational interface tools, introduced in 2024–2025.

- Chris Yeh, Chief Business Officer – Yeh plays a key role in business development and enterprise sales strategy, aligning product offerings with high-value customer needs.

- Emily Le, General Counsel – Leading legal and compliance, ensures that Airtable’s global expansion and product innovations adhere to international regulations and data privacy standards.

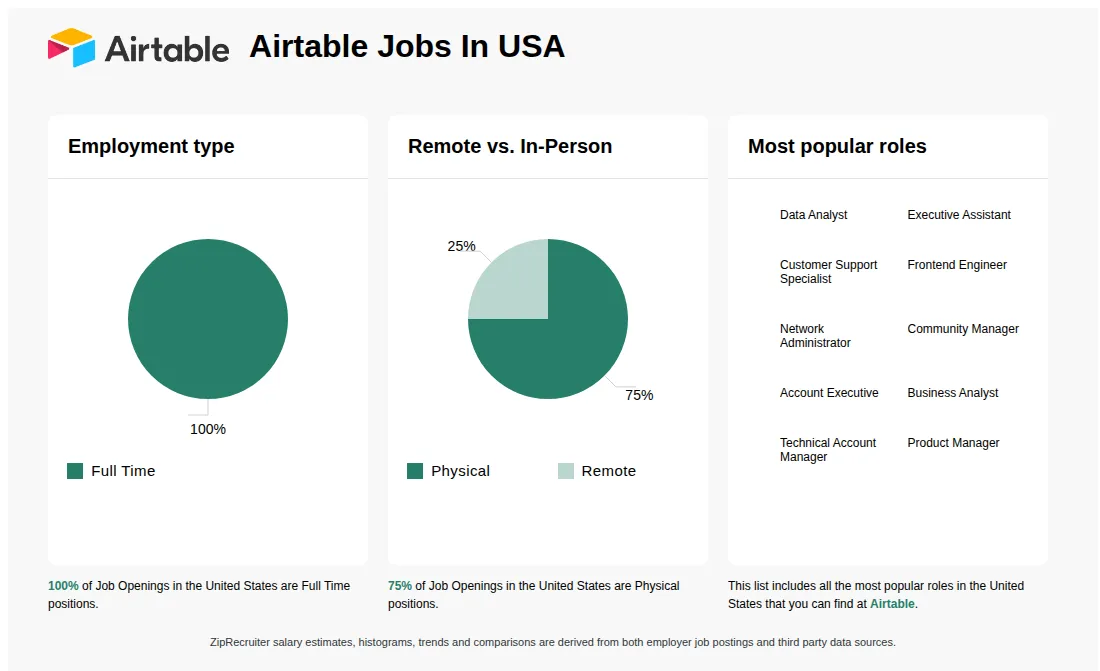

Airtable Jobs in the USA

- 100% of Airtable job openings in the United States are for full-time positions.

- 75% of available roles are in-person (physical) jobs, while only 25% are remote.

- Popular job titles include Data Analyst, Customer Support Specialist, Network Administrator, and Frontend Engineer.

- Additional in-demand roles include Executive Assistant, Community Manager, Business Analyst, and Product Manager.

- Technical roles such as Technical Account Manager and Product Manager reflect Airtable’s focus on technical support and platform scalability.

- Customer-facing roles like Account Executive and Customer Support Specialist highlight a strong emphasis on user experience and growth.

Airtable Employee Count Over Time

- As of mid‑2025, Unify reports ~833 employees globally.

- TrueUp gives a close estimate of 800 employees.

- GrowJo lists 971 employees, also reporting a ~12% drop year‑over‑year in the headcount growth rate.

- In December 2023, Airtable had 548 employees (per Tracxn) at that time.

- The cut of ~237 employees in 2023 reduced headcount by 27%.

- Some sources (LeadIQ) list ≈ 932 employees as of August 2025.

- Other sources disagree: Latka reports 788 total employees in a recent snapshot.

Workforce Reduction and Restructuring Events

- The 27% layoff in September 2023 removed about 237 employees, targeting cost rationalization and enterprise focus.

- Earlier, in December 2022, Airtable laid off ~20% of its staff (~254 employees).

- These reductions followed periods of rapid growth, where expanding too broadly was seen as risky.

- Post‑restructuring, Airtable appears to have shifted hiring toward engineering, product, and enterprise operations rather than horizontal expansion.

- After layoffs, metrics like revenue growth (~30%) and cash flow positivity were cited to show financial discipline.

- The company’s valuation estimates also reflect market correction, from ~$11‑12B to closer estimates ~$3.7‑4B in some secondary market valuations.

Official Sources and Employee Count Estimates

- Unify reports 833 total employees at Airtable as of mid‑2025.

- According to Unify, about 172 new hires year‑to‑date (YTD) represent ~5% of the total workforce.

- Unify also records 77 departures, or ~7.2% net growth from the previous year.

- SignalHire shows departmental listing, confirming 17 distinct departments in Airtable’s org structure.

- GrowJo gives another estimate of 971 employees, but notes a –12% decline in growth over the past year.

- LinkedIn classifies Airtable as having 501‑1,000 employees, which is consistent with the mid‑800‑to‑900 range.

- Marketful claims that post‑optimizational restructuring (including layoffs) brings Airtable to approximately 600 employees, though other sources see higher numbers.

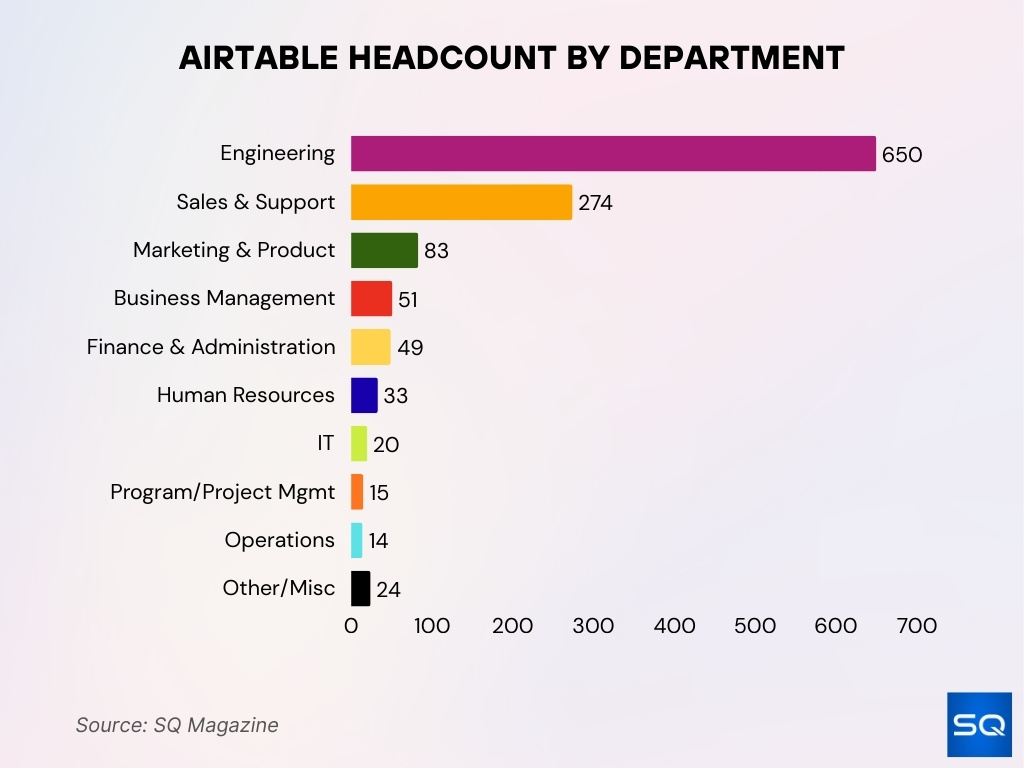

Airtable Headcount by Department

- Engineering holds roughly 270–650 employees, depending on the source; Unify says ~650 in Engineering.

- Sales & Support is also large, ~274 employees, making it one of the biggest teams.

- Marketing and Product combined have about 83 employees.

- Business Management has around 51, Finance & Administration has about 49, and Human Resources ~33.

- Smaller departments, Information Technology (~20), Program & Project Management (~15), Operations (~14).

- “Other” or mixed/unspecified roles account for ~24 employees.

Airtable Workforce Growth and Trends

- Between 2024 and 2025, Unify reports ~7.2% growth in total employee count.

- New hiring rate YTD as of mid‑2025 is ~5% of the total workforce.

- The rate of departures is such that net growth is modest, and growth is positive but not explosive.

- GrowJo notes a 12% drop in employee growth last year, suggesting potential cooling in hiring or headcount expansion.

- Following workforce reductions in 2023, Airtable has focused on growth in engineering, product, and customer‑facing teams, rather than across all departments equally.

- Geographic distribution shows increasing remote or distributed staff (“Other” category), which suggests a trend toward flexibility in location.

- Smaller departments have seen less growth; major hiring continues to concentrate in core product, engineering, and support functions.

Airtable Employee Count Compared to Competitors

- GrowJo lists Airtable with 971 employees, but also records a decline in growth (~12%) year‑over‑year.

- Asana has ~3,550 employees (as per GrowJo for 2025).

- Smartsheet is reported to have ~3,330 employees as of 2024.

- Airtable is significantly smaller than these companies in headcount, although its revenue growth, retention metrics, and enterprise adoption (e.g., net dollar retention ~170%) are competitive.

- Revenue per employee, GrowJo estimates ~$200,200 per employee for Airtable.

- Competitors like Asana and Smartsheet have larger overheads, a more global presence, which typically means higher employee counts but also greater complexity and cost bases.

- Airtable’s comparatively leaner structure may provide agility advantages in product development or strategic pivots.

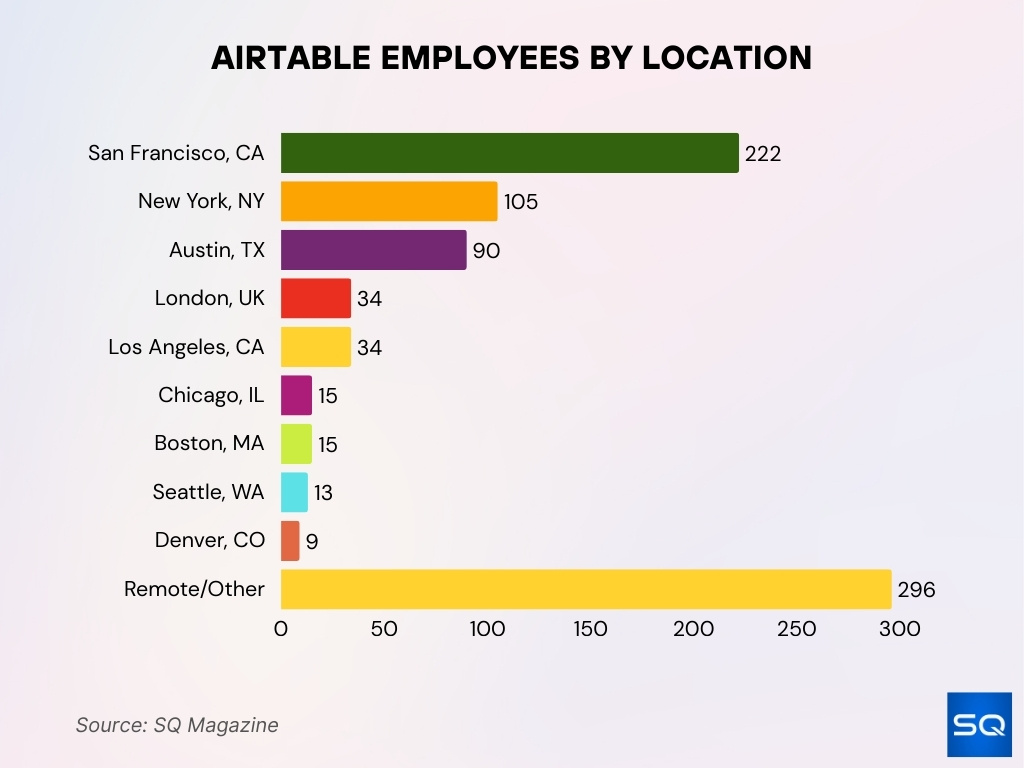

Airtable Employees by Location

- San Francisco, CA, hosts the largest single office, with 222 employees.

- New York, NY has about 105 employees.

- Austin, TX has ~90 employees.

- Offices in London, UK, and Los Angeles, CA, each have ~34 employees.

- Chicago, IL, and Boston, MA each have ~15 employees.

- Seattle, WA ~13 employees, Denver, CO ~9.

- A large remote / “Other” category counts ~296 employees, showing a significant portion of the workforce is distributed.

Factors Influencing Airtable’s Staffing Needs

- Airtable’s shift toward enterprise customers since 2023 has increased demand for product reliability, customer success, and security, requiring hiring in support, operations, and engineering.

- Launch of AI‑powered features such as Cobuilder (mid‑2024) and a newer AI assistant (April 2025) demanded more specialized staff in AI/ML, UX, and infrastructure.

- Cost discipline following the 27% workforce reduction in September 2023 (~237 employees) led to tighter headcount growth and reallocation of roles to priority areas.

- Maintaining cash flow positivity while growing revenue by ~30% annually means scaling hiring only in revenue‑supporting areas.

- Geographic strategy, emphasis on distributed teams and remote work (“Other” category has ~296 employees) helps tap global talent pools and reduce dependency on costly hubs.

- Competition from other no‑code / SaaS platforms pushes Airtable to invest in customer success, retention (net dollar retention ~170%) to sustain growth, which implies staffing in sales, support, and account management.

Airtable Employee Count and Product Innovation

- Engineering (~270 employees per Unify) remains one of the largest departments, underscoring Airtable’s investment in building features.

- Sales & Support (~274 employees) is similarly large, showing that innovation is paired with user feedback and support scaling.

- Smaller departments like Information Technology, Operations, and Program & Project Management have lower headcounts but play critical roles in rolling out complex features and integrations.

- AI and automation tools are being developed, which require machine learning infrastructure and data engineering, likely putting strain on backend teams.

- The pace of feature launches is supported by dev/test/release workflows, and engineering growth supports that. Unify’s data showing ~172 new hires YTD suggests ongoing investment in R&D.

- Innovation in product must be balanced with maintenance and bug fixing; a non‑negligible portion of staff is likely dedicated to technical debt and stability.

- Customer usage (450,000+ organizations, including large enterprise clients) demands scalable, secure, and performant infrastructure. That imposes hiring pressure in site reliability, QA, and security.

- Internationalization and localization require product adjustments, compliance, and sometimes legal or regulatory engineering.

Reported Benefits of AI in Airtable Use

- 66% of respondents say AI in Airtable helps facilitate better insights and measurements.

- 61% report improvements in asset usage and return on investment (ROI) through AI.

- 59% highlight AI’s role in surfacing relevant ideas that boost customer loyalty.

- 56% benefit from AI in scaling content generation while reducing costs.

- 39% mention AI as useful for aiding enablement across workflows and teams.

Impact of Employee Count on Customer Support

- With ~274 employees in Sales & Support, Airtable has a substantial support capacity relative to its total workforce (~833).

- A sizeable distributed/remote staff provides flexibility to manage support across time zones, reducing response times.

- Enterprise adoption (100% YoY growth in large customers) brings higher expectations for uptime, SLAs, and onboarding, so support teams must be staffed sufficiently with senior and specialized roles.

- Product complexity increases support burden; support teams need training and technical depth.

- Support costs likely increase as the customer base grows (450,000+ organizations), even if a large proportion are on smaller plans.

- Employee reductions in 2023 likely led to rebalancing in support teams, focusing more resources on high-value customers.

- High net dollar retention (~170%) indicates that existing customers are spending more, keeping churn low requires strong support, so staffing here is a lever.

Future Hiring Trends and Workforce Projections

- Given current growth (~7.2% year‑over‑year headcount growth per Unify) and controlled hiring, Airtable is likely to increase staff modestly in 2025‑2026, especially in engineering and support.

- Emphasis on AI product lines suggests future hiring in ML engineers, data scientists, infrastructure, and AI safety/compliance roles.

- More roles remote or hybrid to tap global talent, likely expansion of “Other” location category.

- Possible expansion in European and Asia markets could require localization, sales, support, and legal hires.

- Infrastructure scale‑up, more DevOps, site reliability engineering, and security roles to support enterprise requirements.

- Customer success & account management teams may grow to serve enterprise clients more deeply.

- Headcount growth may slow if valuation corrections, macroeconomic pressures, or funding limitations persist.

- Airtable may focus on metrics like revenue per employee, gross margins (~90%) to ensure profitability rather than purely scale.

Airtable Funding and Valuation Milestones

- Airtable completed Series F funding in December 2021, raising ~$735 million, valuing the company at about $11.6‑11.7 billion.

- Earlier rounds include:

• Series E, ~$270 million.

• Series D, ~$185 million.

• Series C, ~$100 million.

• Series B, ~$52 million.

• Series A, ~$3 million. - Total funding since inception, $1.35‑1.40 billion.

- Valuation dynamics,

• Peaked at ~$11.7 billion in 2021.

• Secondary market and private estimates in 2024‑2025 suggest a valuation nearer $3.8‑5 billion. - Revenue milestones,

• ARR was ~$375 million in 2023.

• ARR at $478 million in 2024 (≈27% YoY growth) toward 2025. - Net dollar retention (NDR) ~170% for enterprise customers vs ~130‑120% for competitors.

Frequently Asked Questions (FAQs)

Airtable is estimated to have 971 employees according to GrowJo, though other sources put the headcount between 600 and 900+

ARR in 2024 was about $478 million, growing around 27% year‑over‑year from the 2023 figure of ~$375 million.

Airtable’s net dollar retention among enterprise clients is about 170%, which exceeds competitors like Asana (~130%) and Monday.com (~120%).

Over 450,000 organizations globally use Airtable as of 2025.

Conclusion

Airtable’s workforce today reflects a company in transition. The company is investing heavily in engineering, AI, and support functions while reigning in excesses and navigating valuation corrections. For users, investors, or observers, the key to Airtable’s future will be balancing innovation with efficiency.

As the company heads into the next phases, AI tools, enterprise expansion, global footprint, and staffing decisions will heavily influence its product pace, customer satisfaction, and competitive standing. Explore the full article to see how Airtable stacks up against competitors, forecasts its growth, and what its staffing numbers might mean for upcoming product releases and market impact.