Regulatory control over cryptocurrency trading grew sharply as governments sought to balance innovation with market stability and consumer protection. Across major jurisdictions, new legislation, agency actions, and enforcement campaigns reshaped the rules of engagement for crypto firms. From licensing mandates to AML standards, we now see regulation affecting volumes, capital flows, and business models across the industry. In sectors such as institutional asset management and remittance services, compliance regimes already influence the choice of counterparties and operational footprints. Dive into this article for a data‑driven lens on global crypto regulatory trends.

Editor’s Choice

- The average compliance cost for small and mid‑sized crypto firms rose 28% in 2025, reaching $620,000 annually.

- 90% of centralized exchanges in North America were fully KYC compliant in 2025, up from ~85% in 2024.

- The global crypto exchange market is projected to $71.35 billion in 2025.

- Binance holds ~39.8% of spot trading volume among centralized exchanges in 2025.

- APAC region saw a 69% year-on-year increase in on‑chain crypto activity (12 months ending June 2025).

- Sub‑Saharan Africa recorded a 52% growth in on‑chain value, reaching over $205 billion.

- In the 2025 Global Crypto Adoption Index, India ranks first, the U.S. second, among 151 nations.

Recent Developments

- In January 2025, the EU’s Markets in Crypto‑Assets Regulation (MiCA) became fully applicable, creating unified rules for issuers and service providers.

- The U.S. passed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) in July 2025 to regulate stablecoin reserves and disclosures.

- Many jurisdictions are converting draft crypto regimes into enforceable law, with over 60% of 24 major jurisdictions introducing new policy in 2024–2025.

- State regulators in the U.S. have updated crypto exchange or money transmitter legislation, even amid federal ambiguity.

- EU agencies are moving supervisory authority from national regulators to ESMA, aiming for consistent oversight across member states.

- Global regulatory commentary increasingly warns of stablecoin risks and calls for systemic resilience.

- The Atlantic Council tracks that, among 75 countries, 45 fully legalize crypto, 20 partially ban, and 10 ban outright.

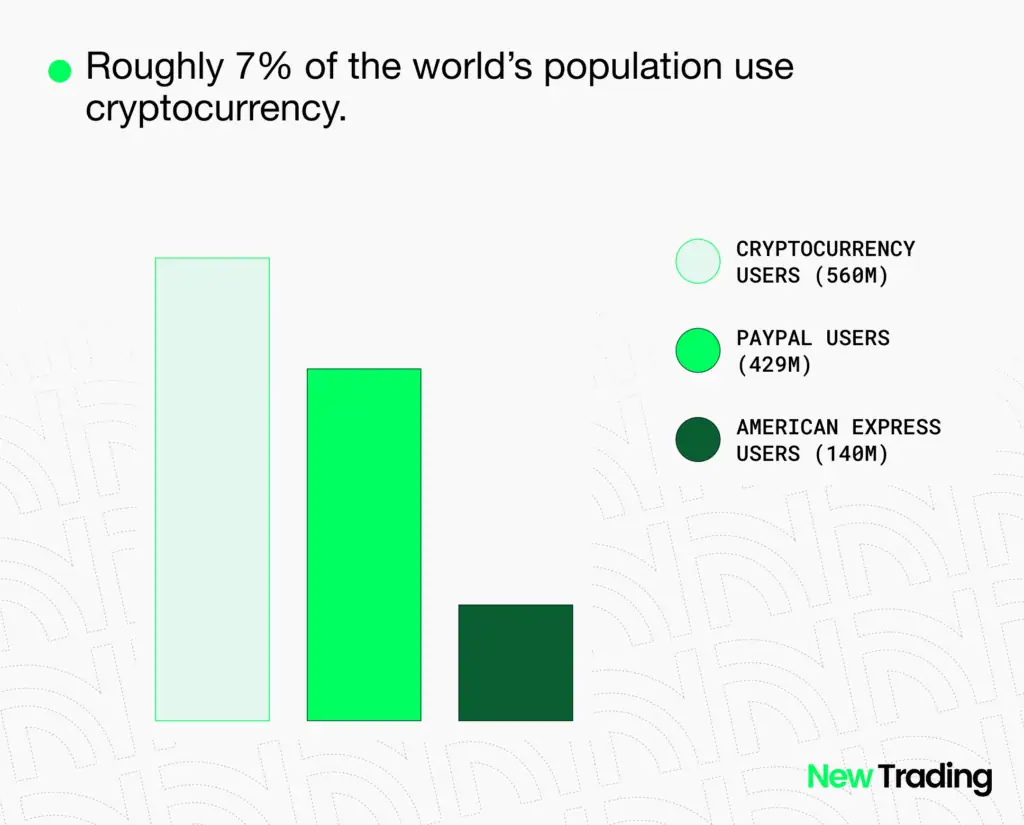

Global Cryptocurrency Adoption vs Traditional Payment Platforms

- Around 7% of the global population, or roughly 560 million people, now use cryptocurrency for transactions.

- PayPal follows with 429 million active users, maintaining a strong presence in digital payments but still behind crypto adoption.

- American Express counts about 140 million users, far fewer than both crypto and PayPal.

- The global crypto user base surpasses PayPal’s by over 130 million and is four times larger than American Express’s.

- These figures show how cryptocurrency has already overtaken major legacy payment networks in worldwide reach and active engagement.

Global Regulatory Landscape Overview

- According to PwC, 2025 marks a turning point in crypto regulation worldwide as many nations move from draft regimes to active enforcement.

- Over 70% of the 24 jurisdictions representing ~70% of global crypto exposure took steps to implement crypto regulation in 2024–2025.

- The Atlantic Council’s tracker indicates cryptocurrency is legal in 12 G20 countries, covering over 57% of global GDP.

- In the Global Legal Insights survey, 30+ jurisdictions updated blockchain & crypto laws in 2025, spanning AML, licensing, taxation, and token issuance.

- Regions diverge; some adopt innovation‑friendly regimes (e.g., UAE, Singapore), others emphasize control and restriction.

- The EU now mandates cross‑border conformity under MiCA, limiting national divergence.

- In Latin America and Africa, several countries respond to high grassroots adoption with regulations to curb illicit use.

- Regulatory unpredictability remains; some nations invert liberal policies depending on perceived risks.

Cryptocurrency Legality by Country and Region

- Among 75 countries tracked, 45 allow crypto fully, 20 partially ban, and 10 prohibit outright.

- India is ranked #1 in crypto adoption and maintains legal trading with evolving regulation frameworks.

- The United States moved up to #2 globally in adoption in 2025, under a more favorable regulatory tone.

- The Philippines ranked 9th overall in grassroots adoption but lags in DeFi and institutional activity.

- In Sub‑Saharan Africa, on‑chain activity reached $205 billion, up 52% year-on-year.

- Vietnam legalized crypto under a new digital tech law in 2025, with ~20.69% of its population using digital assets.

- In the U.S., 50+ states each have a patchwork of crypto licensing or money transmitter rules; federal clarity remains pending.

- Several Latin American nations have explicit or de facto permissive regimes, while others face volatility and regulatory backlash.

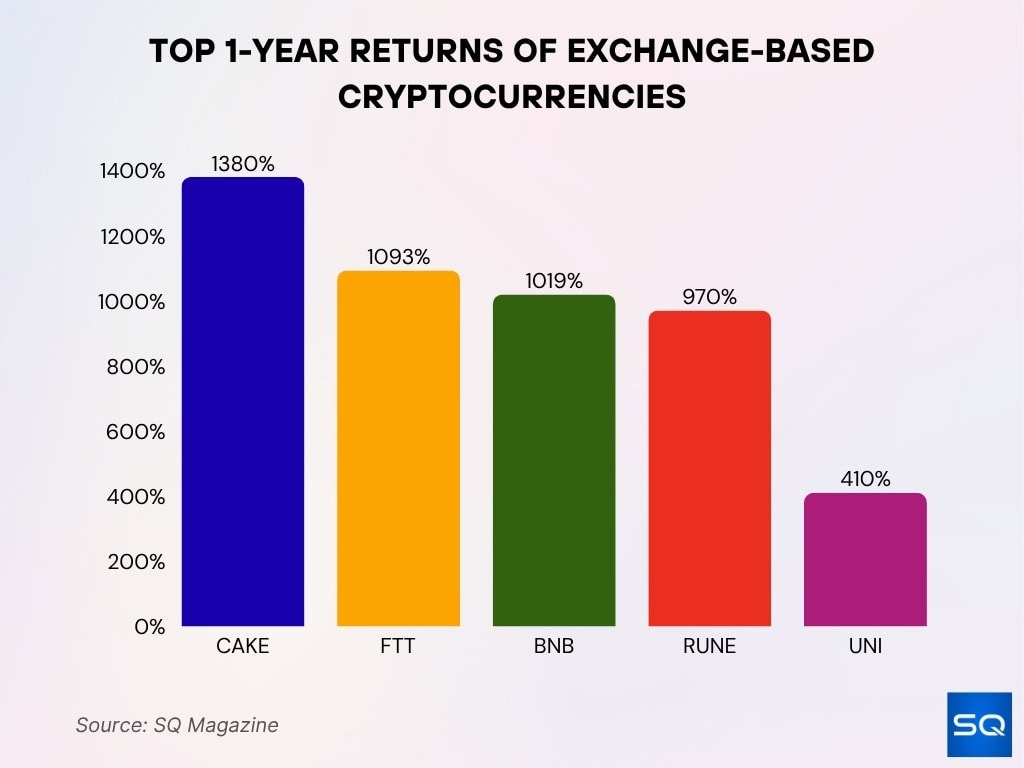

Best 1-Year Performers Among Exchange-Based Cryptocurrencies

- CAKE achieved a remarkable 1,380% return, making it the top-performing exchange-based cryptocurrency of the year.

- FTT (FTX Token) delivered a strong 1,093% gain, fueled by the rapid expansion of the FTX ecosystem.

- BNB (Binance Coin) surged 1,019%, supported by Binance’s global trading dominance and user growth.

- RUNE (THORChain) rose 970%, reflecting growing demand for cross-chain liquidity solutions.

- UNI (Uniswap) gained 410%, maintaining its leading position in decentralized exchange trading.

Licensing and Registration of Crypto Exchanges

- In the U.S., many states require crypto firms to hold money transmitter licenses (MTL) or equivalent.

- Some states still do not clearly define licensing for digital asset businesses, creating legal ambiguity.

- In Europe, under MiCA, crypto‑asset service providers (CASPs) must register and meet capital, governance, and risk management standards.

- The Global Crypto Regulation Report notes that exchanges must now also comply with data governance, reporting, and operational resilience standards.

- In the UAE, the Virtual Assets Regulatory Authority (VARA) oversees registration, licensing, and compliance for exchanges and wallet providers.

- In Southeast Asia, Singapore requires licensing under the Payment Services Act (PSA) for crypto payments and exchange services.

- Many exchanges serving multiple regions maintain multiple licenses to comply with local rules, increasing operational cost and complexity.

- 54% of global exchanges halted operations in at least one jurisdiction due to licensing or regulatory gaps.

Cryptocurrency Exchange Reporting Rules

- Under the OECD’s Crypto‑Asset Reporting Framework (CARF), crypto exchanges must report three classes of transactions annually.

- CARF’s rules are slated for implementation in the EU beginning January 1, 2026, making 2027 the first reporting year.

- Many U.S. platforms will issue Form 1099‑DA to users in 2025 under new IRS rules.

- Exchanges must increasingly furnish wallet addresses, user tax identifiers, and transaction histories to tax authorities.

- Noncompliant reporting may trigger audits, with fines starting at $5,000 or 0.5% daily interest accruals for under‑reporting.

- The U.S. IRS is combining on‑chain data with identity data from exchanges to match trades to users.

- Some jurisdictions require real‑time or near‑real‑time reporting for large trades or movement thresholds.

- Exchanges serving multiple jurisdictions must adopt multijurisdictional reporting engines.

- In Canada, beginning in 2025, exchanges are required to report transactions that exceed CA$10,000.

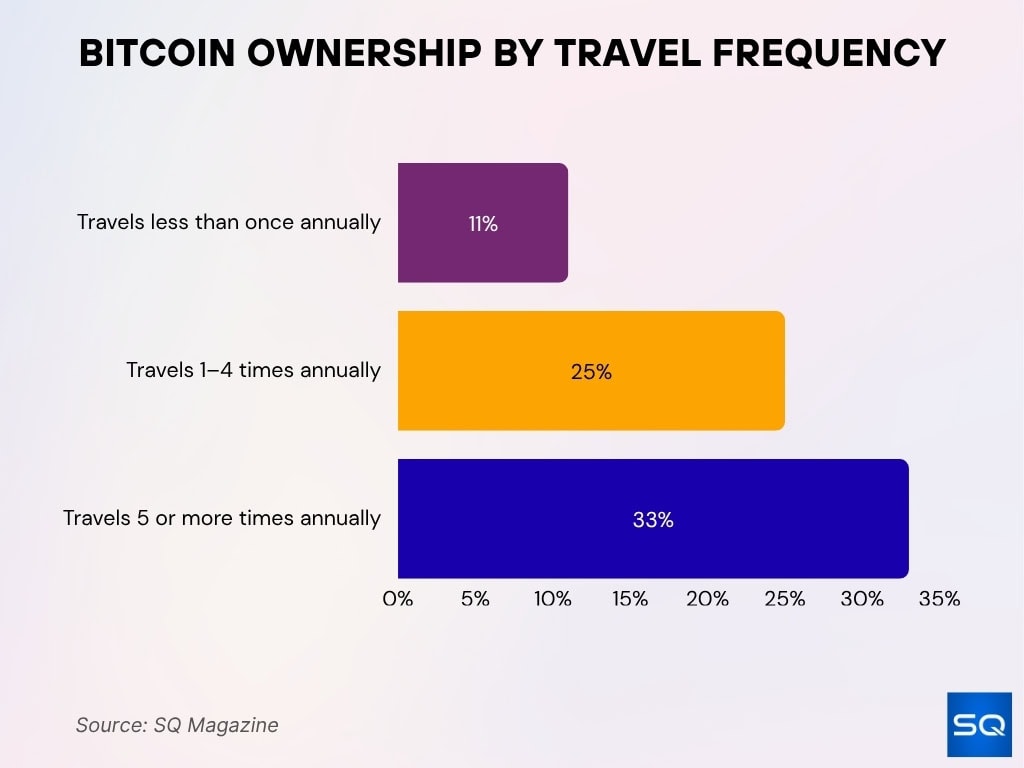

Bitcoin Ownership by Travel Habits

- 11% of people who travel less than once a year own Bitcoin.

- 25% of those who travel 1–4 times per year hold Bitcoin.

- The highest ownership rate, 33%, is seen among individuals who travel five or more times annually.

- The trend shows a positive link between frequent travel and Bitcoin ownership, likely due to greater exposure to global payment systems and digital finance solutions.

Anti‑Money Laundering (AML) & Know Your Customer (KYC) Compliance

- Global AML fines rose 42% year over year, reaching $6.6 billion in 2025.

- AML and KYC compliance now consume ~34% of total compliance budgets in many crypto firms.

- In 2025, FATF and national regulators expanded liability to “enablers”, meaning compliance officers and directors may face criminal charges.

- In the EU, the 6th AML Directive (6AMLD) imposes criminal penalties and stricter rules on beneficial ownership for crypto operators.

- Regulators now emphasize real-time monitoring, stronger due diligence, and AI-enhanced transaction screening.

- The number of suspicious transaction reports (STRs) tied to virtual assets increased by 25% from 2024 to 2025.

- Some firms now re‑screen KYC profiles daily for high-risk customers.

- Regulatory guidance now suggests cross‑border transaction monitoring is mandatory.

Taxation of Cryptocurrency Trading

- India in 2025 enforces both a 1% TDS (Tax Deducted at Source) and a 30% flat tax on crypto gains.

- The European Union standardized crypto tax treatment under MiCA.

- New U.S. IRS rules require cost basis by wallet‑by‑wallet, eliminating the universal pool method.

- Under the upcoming DAC8, EU member states will force intermediaries to report on crypto-asset transactions.

- In Canada, crypto exchanges must report customer transactions above CA$10,000 to tax authorities.

- Some Latin American countries now treat crypto gains as capital gains taxed at rates between 15% to 35%.

- In 2025, the U.S. government reversed an IRS expansion that would have classified DeFi platforms as brokers.

- Many tax authorities are now retrieving blockchain data via subpoenas or exchange cooperation.

- Penalties for failure to report crypto gains can reach $5,000 or more, plus back taxes and interest.

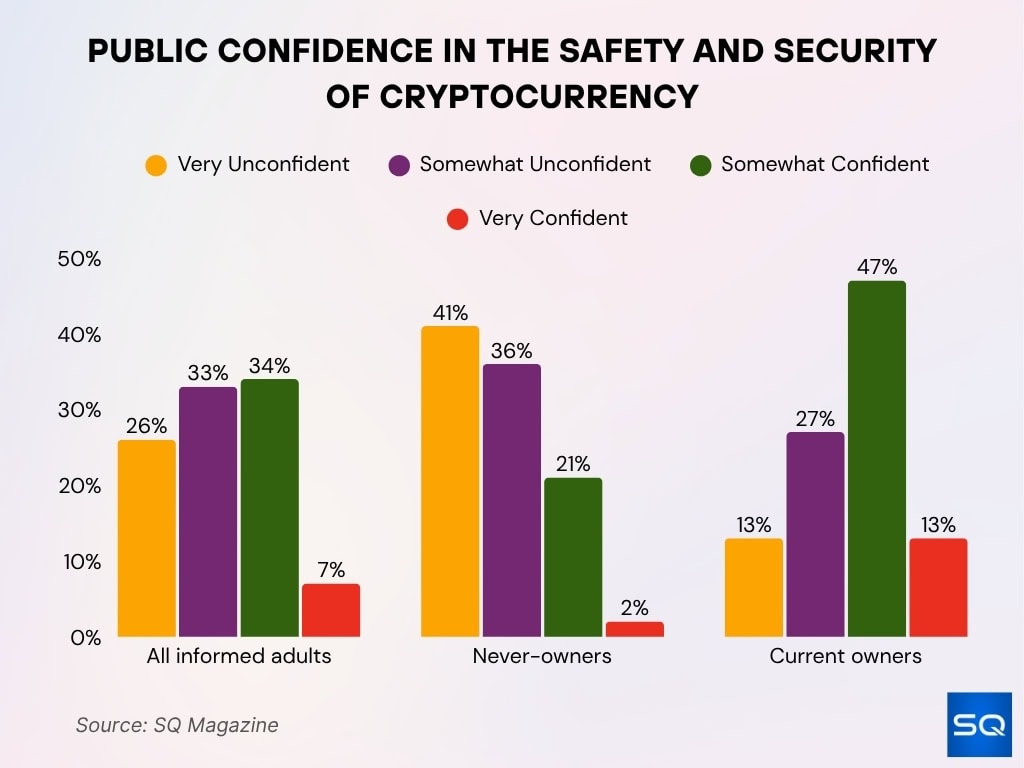

Public Trust in Cryptocurrency Safety and Security

- Among informed adults, only 7% are very confident in crypto’s safety, while 34% are somewhat confident.

- A combined 59% express doubt, with 26% very unconfident and 33% somewhat unconfident.

- Among never-owners, 41% are very unconfident, and just 2% report very high confidence in crypto security.

- Another 36% of never-owners feel somewhat unconfident, while 21% say they are somewhat confident.

- Current crypto owners show stronger trust, with 47% somewhat confident and 13% very confident in safety measures.

- Only 13% of owners feel very unconfident, and 27% report being somewhat unconfident, indicating generally higher confidence among active users.

Consumer and Investor Protection

- In the EU, MiCA mandates insurance for custodial wallet providers and financial guarantees for user protection.

- MiCA also requires whitepapers and risk disclosures before token issuance or public offering.

- In the U.S., the SEC’s July 2025 staff guidance tightened disclosure requirements for crypto ETPs.

- FINRA’s 2025 oversight report flags crypto securities handled by member firms as subject to existing securities law rules.

- The number of investor complaints to U.S. regulators about crypto fraud rose by 30% in 2025.

- Regulators in Asia now require segregation of client assets and periodic audits for exchanges.

- Some jurisdictions impose cooling-off periods or withdrawal delay rules to protect retail users.

- Platforms must now maintain transparent order books and audit trails.

Enforcement Actions and Legal Cases

- The U.S. DOJ and SEC have conducted numerous enforcement actions in 2025, particularly against unregistered exchanges and fraud schemes.

- Several crypto CEOs and founders have faced charges for securities violations and money laundering.

- The DOJ is predicted to increase criminal prosecutions tied to illicit uses of crypto.

- In the U.S., one landmark case in 2025 involved a decentralized finance issuer judged liable for unregistered securities issuance.

- Regulators in Europe and Asia imposed fines exceeding €100 million across multiple crypto firms for noncompliance.

- Some exchanges have been forced to exit or curtail operations in jurisdictions following court rulings.

- Courts in the U.S. reaffirmed the application of the Howey test to digital asset offerings in decisions during 2025.

- Regulatory agencies also issued cease-and-desist orders to unlicensed service providers.

- A notable settlement in 2025 saw a crypto platform pay $50 million to resolve charges of misleading investors.

Regulatory Impacts on Market Capitalization and Trading Volume

- In Q2 2025, the total crypto market cap exceeded $3.5 trillion, though it represented a 7% drop from December 2024.

- Bitcoin’s share of total crypto assets recovered to about 60% in mid‑2025.

- The stablecoin market cap crossed $230 billion, with USDT (~65%) and USDC (~26%) dominating.

- Global crypto market cap fell 9% in Q1 2025, stabilizing near $2.62 trillion amid tighter rules.

- Bitcoin holds ~42% market share in 2025 under stricter compliance regimes.

- In North America, monthly crypto transfer volumes exceeded $2 trillion, with ~$16 trillion from Jan–Jul 2025.

- Regulatory tightening sometimes triggers capital outflows or volume slumps.

- Some exchanges reported 10–25% drops in trading volume in jurisdictions after new licensing mandates.

- Institutional inflows to crypto ETFs hit $5.95 billion in one week in 2025, showing sustained investor interest.

Stablecoin Regulation Statistics

- The GENIUS Act, passed in mid‑2025, mandates that stablecoins be backed one-to-one with U.S. dollars.

- Stablecoin market cap rose to >$230 billion in 2025.

- USDT retained ~65% stablecoin market share, with USDC at ~26%.

- New USD-backed stablecoins have entered the market, adding competition.

- JPMorgan forecasts stablecoins could drive an extra $1.4 trillion in dollar demand by 2027.

- Regulatory proposals target stricter disclosure, reserve audits, and redemption rights.

- Depeg risks and systemic concentration remain under scrutiny.

- Stablecoins’ growing role in payments and DeFi increases cross-border regulatory focus.

CBDC (Central Bank Digital Currency) Regulatory Statistics

- As of 2025, over 100 jurisdictions are exploring or piloting CBDCs.

- Roughly 10 countries have launched live retail CBDCs.

- 40% of central banks expect to issue a CBDC within 5 years.

- In the Asia-Pacific region, China’s digital yuan has seen broad pilot usage involving millions.

- Smaller economies experiment with CBDCs for remittance efficiency.

- Regulatory designs vary; some allow anonymity while others mandate surveillance.

- Interoperability standards remain undeveloped.

- Infrastructure and privacy challenges persist before full rollouts.

Cryptocurrency Exchange Platform Market Growth

- The global crypto exchange market is projected to $71.35 billion in 2025.

- Binance holds ~39.8% of spot trading volume.

- Many platforms operate in multiple legal regimes requiring multi‑jurisdiction compliance.

- About 54% of exchanges suspended operations in at least one jurisdiction due to regulatory conflicts.

- Mergers and exits rose in 2024–2025 as complexity increased.

- New platforms focus on tokenized assets and staking solutions.

- Exchanges now offer institutional-grade custody and insurance.

- Expansion into decentralized exchanges is growing, though risky.

Global Cryptocurrency Adoption Compared to Other Payment Platforms

- In 2025, ~861 million people (≈11.0% penetration) use cryptocurrencies.

- India ranks first, and the U.S. second, in global adoption.

- Compared to credit cards or mobile wallets, crypto remains niche.

- About 50% of SMEs globally began accepting crypto payments in 2025.

- Crypto transactions in some nations exceed the GDP of medium-sized economies.

- Adjusted on-chain transaction value in North America reached $16 trillion (Jan–Jul 2025).

- The remittance segment via crypto is estimated at $25 billion annually.

- Institutional flows via crypto ETFs narrow the gap with traditional finance.

Compliance Costs for Crypto Businesses

- Compliance budgets rose 28% in 2025, averaging $620,000 annually.

- AML/KYC consumes ~34% of total compliance expenditure.

- Multijurisdictional firms often maintain 30+ compliance staff and dedicated legal teams.

- Licensing and audits delay expansion for startups.

- Firms estimate 15–20% revenue drag from compliance burden.

- Some exchanges cite $5–10 million annual cost increases.

- Compliance failures impose a higher risk than investment in controls.

- Regulatory complexity burdens incubators and cross-border operators.

Decentralized Finance (DeFi) Regulation Statistics

- As of 2025, the DeFi market cap is $98.4 billion.

- The average investor allocates ~12% of their crypto portfolio into DeFi products.

- DeFi crime events caused over $10 billion in direct losses and ~$1.3 billion in indirect losses.

- About 55% of events cause an average 14% price drop.

- 68% of crime events lead to spikes in trading volume.

- Some jurisdictions mandate DEX registration or user blocking.

- DeFi auditing firms saw 25–40% revenue increases in 2025.

Frequently Asked Questions (FAQs)

Illicit volume fell to 0.4% of total crypto transaction volume in 2025, down from 0.9% in 2023.

APAC saw a 69% increase in on‑chain crypto activity over the prior 12 months.

Approximately 861 million people globally use crypto in 2025, representing an 11.02% penetration rate.

Global crypto ETFs attracted a record $5.95 billion in inflows in a single week.

The crypto market size declined 18.6% in Q1 2025, reaching $2.8 trillion from a prior high of $3.8 trillion.

Conclusion

The landscape of cryptocurrency regulation is transitioning from theory to enforcement. Across licensing, reporting, stablecoins, tax, and DeFi, jurisdictions are testing rules with tangible consequences for market cap, trading volume, and platform strategy. Stablecoin frameworks like the GENIUS Act, combined with increasing AML/KYC scrutiny and platform exit decisions, underscore how regulation now shapes market dynamics, not just labels. Yet adoption continues climbing, and exchanges and DeFi protocols must adapt or risk exclusion. The interplay between regulation and innovation will define the next chapter of digital assets.

Maya

A well-researched article with valuable regulatory insights. The statistics and analysis help readers understand how global rules are evolving. Very informative.