Imagine a company with no physical servers, no bulky machines buzzing in the background, and no expensive on-site infrastructure, just secure, on-demand computing power accessible from anywhere in the world. That’s not a glimpse into the future, it’s the present. From small startups to global enterprises, cloud computing has fundamentally transformed how businesses operate, scale, and innovate. As we move through 2025, the cloud is no longer a “nice-to-have.” It’s the backbone of modern digital transformation.

Editor’s Choice

- Public cloud services will account for approximately $593.7 billion of total spending in 2025.

- By the end of 2025, over 95% of enterprises worldwide will have adopted multi-cloud or hybrid cloud environments.

- Cloud-native platforms will support more than 80% of digital workloads, accelerating developer productivity and agility.

- Spending on cloud security is expected to surpass $19.7 billion in 2025, reflecting rising concerns around compliance and data breaches.

- AI and machine learning services in the cloud are forecasted to reach $47.3 billion globally in 2025, highlighting the tight integration between cloud and advanced analytics.

- The cloud infrastructure services market, led by hyperscalers (AWS, Microsoft Azure, Google Cloud), will grow by 21.2% year-over-year in 2025.

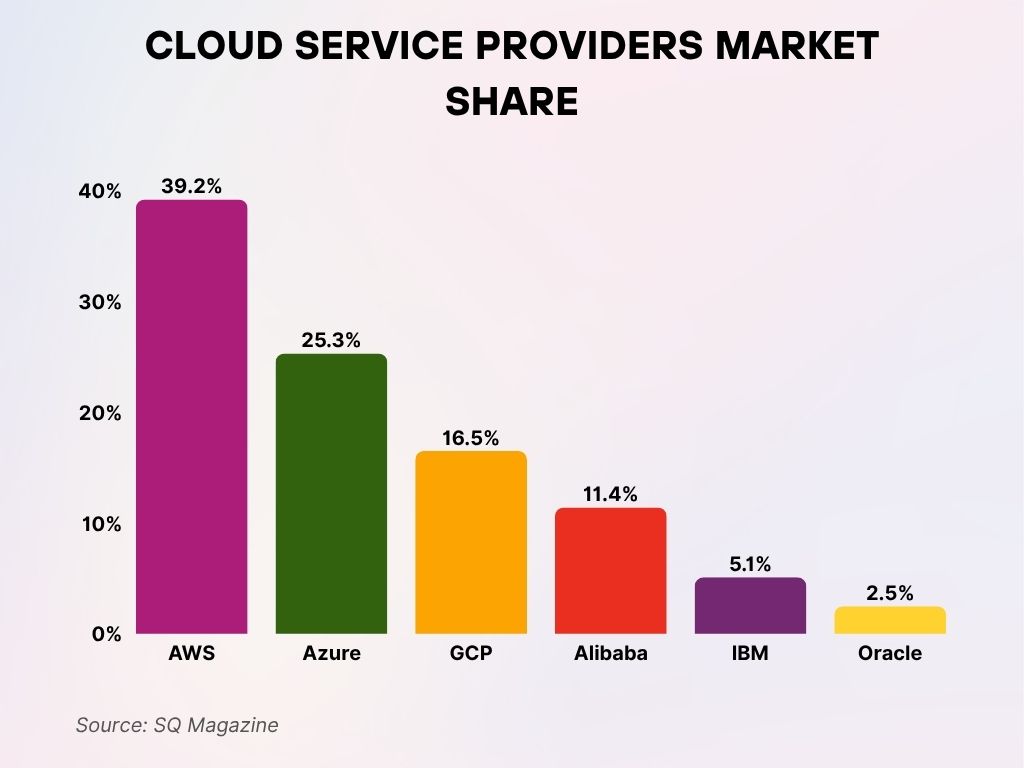

Cloud Service Providers Market Share

- AWS leads the cloud market with a dominant 39.2% share.

- Microsoft Azure holds the second-largest portion at 25.3%.

- Google Cloud Platform (GCP) captures 16.5% of the global market.

- Alibaba Cloud maintains a presence with 11.4% market share.

- IBM Cloud contributes a modest 5.1% to the total.

- Oracle Cloud accounts for the smallest share at 2.5%.

Global Market Size and Growth Trends

- The compound annual growth rate (CAGR) of the global cloud computing market from 2021 to 2025 is estimated at 17.5%, driven by SaaS, PaaS, and IaaS models.

- North America remains the largest cloud market in 2025, accounting for over 38% of total global spending.

- Asia-Pacific cloud revenue is projected to grow to $196.8 billion in 2025, making it the fastest-growing region.

- The European cloud market is estimated to reach $130.2 billion in 2025, fueled by GDPR-compliant services and sovereign cloud initiatives.

- The SaaS segment dominates the market with a projected value of $377 billion in 2025, representing over 45% of the cloud computing market.

- IaaS (Infrastructure as a Service) will generate $187.4 billion in revenue in 2025, thanks to scalable compute and storage options.

- PaaS (Platform as a Service) revenue is expected to hit $68.3 billion by 2025, as demand for cloud-native app development surges.

- The cloud adoption rate among small and medium-sized enterprises (SMEs) will cross 82% in 2025, reflecting increased affordability and agility.

- Global cloud computing revenue has nearly doubled since 2020, reflecting accelerated digital migration post-pandemic.

- Government cloud investment is projected to grow to $47.9 billion by 2025, supporting smart city, healthcare, and digital ID initiatives.

Public vs. Private vs. Hybrid Cloud Usage

- Public cloud continues to lead in adoption, with 72% of businesses using it as their primary deployment model in 2025.

- The private cloud market is projected to reach $103.4 billion globally in 2025, driven by financial services, defense, and healthcare sectors.

- Hybrid cloud adoption is estimated at 61% among enterprises in 2025, emphasizing flexibility and cost optimization.

- Multi-cloud strategies are used by 92% of enterprises in 2025, reflecting a shift away from single-vendor dependence.

- Edge-cloud hybrid models have gained traction in 2025, with 35% of businesses deploying edge computing in tandem with cloud infrastructure.

- The telecommunications industry leads in hybrid cloud adoption in 2025, at 68%, as it balances latency, compliance, and scalability.

- Public cloud workloads now constitute 58% of total enterprise workloads, while private cloud accounts for 21%, and on-premise for the remaining 21%.

- Enterprises with hybrid cloud deployments report 23% lower operational costs on average in 2025, compared to traditional on-premise environments.

- The retail and e-commerce sectors are leading adopters of public cloud in 2025, with 79% using public cloud services for core platforms.

- Financial institutions still maintain strong private cloud infrastructure, with 63% of them hosting critical applications in private clouds.

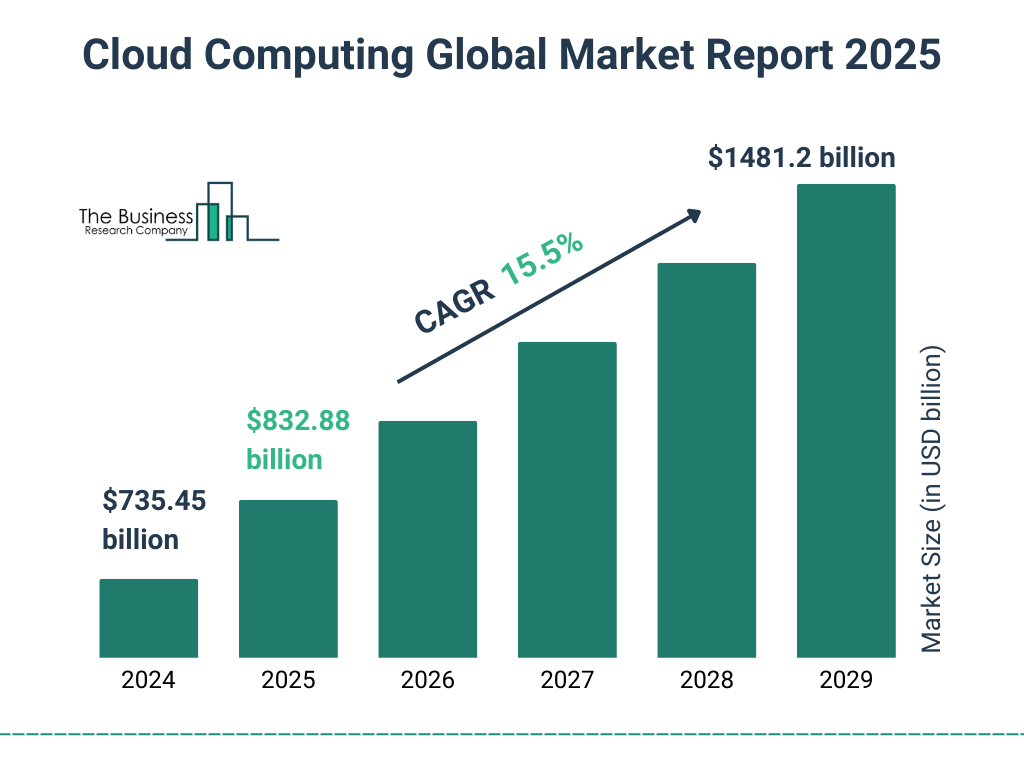

Cloud Computing Market Growth Forecast

- The global cloud computing market is projected to $832.88 billion in 2025.

- It is expected to reach $1,481.2 billion by 2029, showcasing significant expansion.

- The industry is growing at a CAGR of 15.5%, reflecting strong momentum and increasing demand for cloud solutions.

Enterprise Cloud Adoption Rates by Industry

- In 2025, healthcare cloud adoption rates have reached 76%, with a strong focus on secure data sharing and AI diagnostics.

- The manufacturing sector sees 69% of companies using cloud for predictive maintenance and IoT-based automation.

- Financial services report 84% cloud adoption, with continued growth in regulatory-compliant private cloud solutions.

- Retail and consumer goods industries lead in SaaS adoption, with 89% relying on cloud-based CRM, inventory, and logistics systems.

- Education sector cloud use has increased to 73% in 2025, fueled by hybrid learning platforms and administrative cloud tools.

- Energy and utilities show 61% cloud adoption, with focus areas on real-time monitoring and edge cloud solutions for remote sites.

- In 2025, media and entertainment has the highest rate of multi-cloud usage at 91%, supporting content distribution, VFX rendering, and streaming analytics.

- Government and public sector adoption stands at 57%, with a push toward digital infrastructure and citizen services.

- Transportation and logistics firms using the cloud have risen to 65%, leveraging real-time tracking and route optimization.

- The legal services industry remains cautious, with cloud adoption at 46%, though improving data governance frameworks are enabling gradual growth.

Cloud Spending and Budget Allocation Trends

- Global enterprise spending on cloud computing is expected to reach $596 billion in 2025.

- 60% of IT budgets in 2025 are allocated to cloud-based services and infrastructure.

- Spending on cloud-based software (SaaS) leads the pack at $292 billion in 2025, largely driven by workplace collaboration and CRM tools.

- IaaS spending will reach $141 billion, supporting flexible compute and disaster recovery solutions.

- Platform-as-a-Service (PaaS) investments are forecasted to grow to $72 billion in 2025.

- 23% of cloud budgets in 2025 are directed toward cloud-native development, including containers, serverless computing, and microservices.

- Cloud cost optimization tools will receive $8.9 billion in enterprise spending as companies work to control multi-cloud sprawl.

- By 2025, 83% of organizations have implemented FinOps (financial operations) practices to manage cloud spend more effectively.

- Shadow IT accounts for an estimated 15% of cloud-related spending, creating risks around security and cost visibility.

- Disaster recovery and business continuity spending will grow by 18% YoY, surpassing $17 billion in 2025.

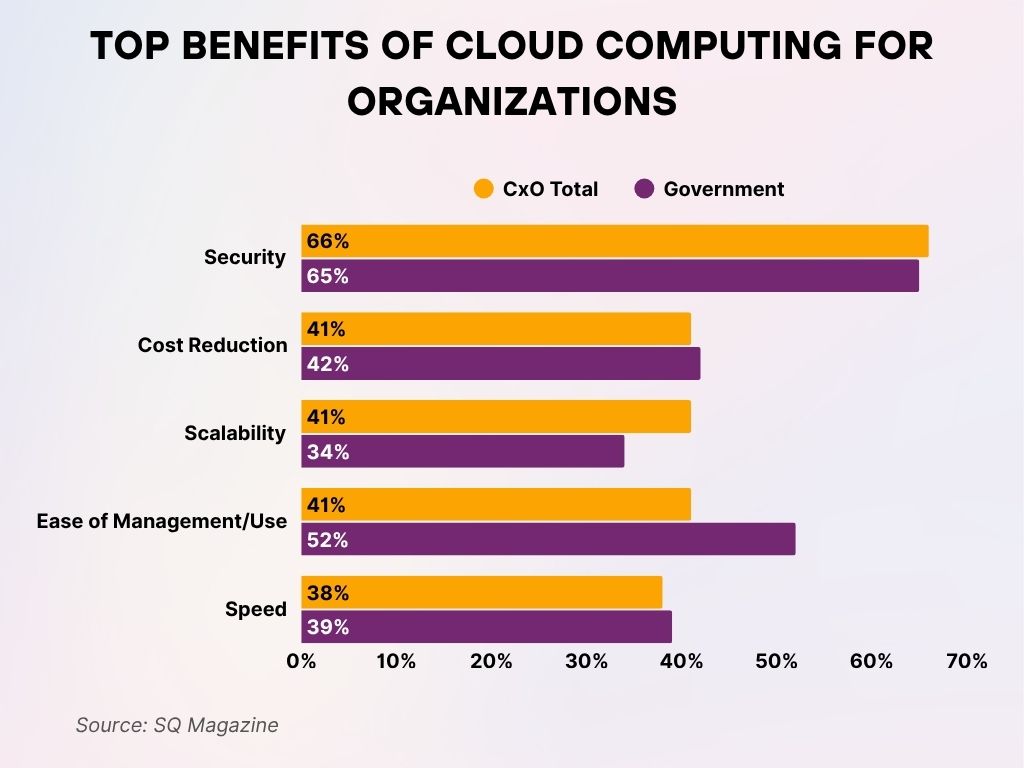

Top Benefits of Cloud Computing for Organizations

- Security is the top benefit, cited by 66% of CxOs and 65% of government respondents.

- Cost reduction is recognized by 41% of CxOs and 42% of government organizations.

- Scalability appeals to 41% of CxOs, compared to 34% in the government sector.

- Ease of management/use stands out for 52% of government users, while 41% of CxOs agree.

- Speed is valued similarly, with 38% of CxOs and 39% of government leaders highlighting it.

Cloud Security and Compliance

- The global cloud security market is valued at $19.7 billion in 2025, growing at a 14.3% CAGR.

- 82% of organizations rank security and compliance as their top challenge in cloud deployments in 2025.

- 71% of businesses have experienced at least one cloud-related security incident in the last 18 months.

- Data breaches involving cloud misconfigurations cost enterprises an average of $5.32 million per incident in 2025.

- Multi-cloud environments face 38% more vulnerabilities due to complex access management and identity controls.

- Zero trust architecture adoption has risen to 64% in 2025, especially among finance, healthcare, and federal agencies.

- 58% of companies use cloud-native security platforms (CNSPs) to secure containers and serverless workloads.

- Compliance automation tools in cloud environments have grown by 41% YoY, aiding in audits and continuous governance.

- Ransomware attacks targeting cloud environments are projected to increase by 18% in 2025.

- Shared responsibility models remain poorly understood by 29% of IT leaders, exposing gaps in incident response planning.

Workload Distribution Across Cloud Environments

- By 2025, 58% of enterprise workloads are hosted in public clouds.

- Private clouds now support 21% of workloads, typically for sensitive or regulated applications.

- Hybrid environments account for the remaining 21%, enabling dynamic workload balancing and compliance.

- Edge computing deployments are expected to host 15% of enterprise workloads in 2025, often tied to IoT and latency-sensitive applications.

- AI/ML workloads in the cloud have surged by 33% YoY, with 65% of organizations deploying them in multi-cloud setups.

- Containerized applications now make up 48% of cloud workloads, fueled by Kubernetes adoption and DevOps integration.

- Serverless architectures support 19% of workloads in 2025, offering cost-efficiency and scalability for event-driven use cases.

- Cloud-native app development is the primary driver of workload migration for 41% of organizations.

- High-performance computing (HPC) tasks are increasingly being run on cloud-based GPUs and TPUs.

- Enterprises using automated orchestration for workload deployment and scaling have reduced latency by 32% in 2025.

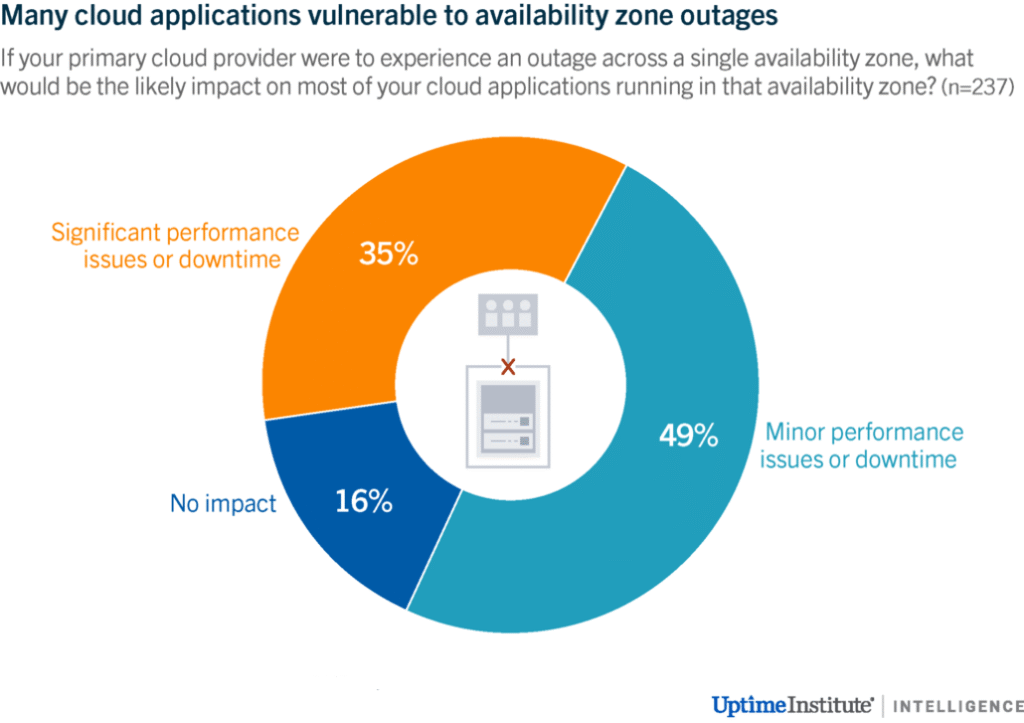

Impact of Cloud Availability Zone Outages on Applications

- 49% of respondents reported minor performance issues or downtime in the event of a single availability zone outage.

- 35% would experience significant performance issues or downtime, highlighting notable risk exposure.

- Only 16% said there would be no impact on their cloud applications.

Cloud-Based AI and Machine Learning Integration

- AI/ML cloud services will generate $47.3 billion in revenue in 2025, a 19.6% increase YoY.

- 87% of organizations using cloud AI report faster innovation cycles and time-to-market.

- Natural language processing (NLP) and computer vision are the top workloads driving AI adoption in cloud platforms.

- Cloud-based AutoML platforms now support 65% of machine learning use cases, reducing reliance on specialized talent.

- Model training costs have decreased by 38% since 2022 due to scalable cloud GPU instances.

- Generative AI services in the cloud (e.g., language models, code generation) account for 12% of all AI spending in 2025.

- Financial services and healthcare sectors are the highest adopters of cloud-based AI, with usage rates of 81% and 78% respectively.

- Edge AI in the cloud is emerging, with 33% of industrial firms deploying AI inference close to data sources via cloud extensions.

- Data pipeline orchestration tools, essential for AI, are used by 76% of enterprises in 2025 to ensure data readiness and reliability.

- AI/ML projects using cloud infrastructure experience a 28% faster deployment time compared to on-premise alternatives.

Cloud Storage and Data Volume Trends

- The global cloud storage market is valued at $217.8 billion in 2025.

- Enterprises are storing an average of 63% of their data in cloud environments by 2025, with legacy on-prem storage shrinking.

- Unstructured data accounts for more than 80% of total cloud-stored content, including video, logs, and documents.

- Cold storage services (e.g., Amazon Glacier, Azure Archive) now make up 19% of enterprise storage use in the cloud.

- Data growth in cloud environments is averaging 29% per year, requiring dynamic scaling and automated lifecycle management.

- By 2025, 80% of large organizations use multi-region cloud storage to ensure low latency and disaster recovery.

- Object storage formats dominate cloud data models, making up 71% of storage by volume.

- Cloud-based backup solutions are used by 91% of businesses in 2025.

- Data egress fees remain a pain point for 47% of enterprises managing hybrid or multi-cloud strategies.

- Data lake adoption has reached 66%, often integrated with AI pipelines and real-time analytics.

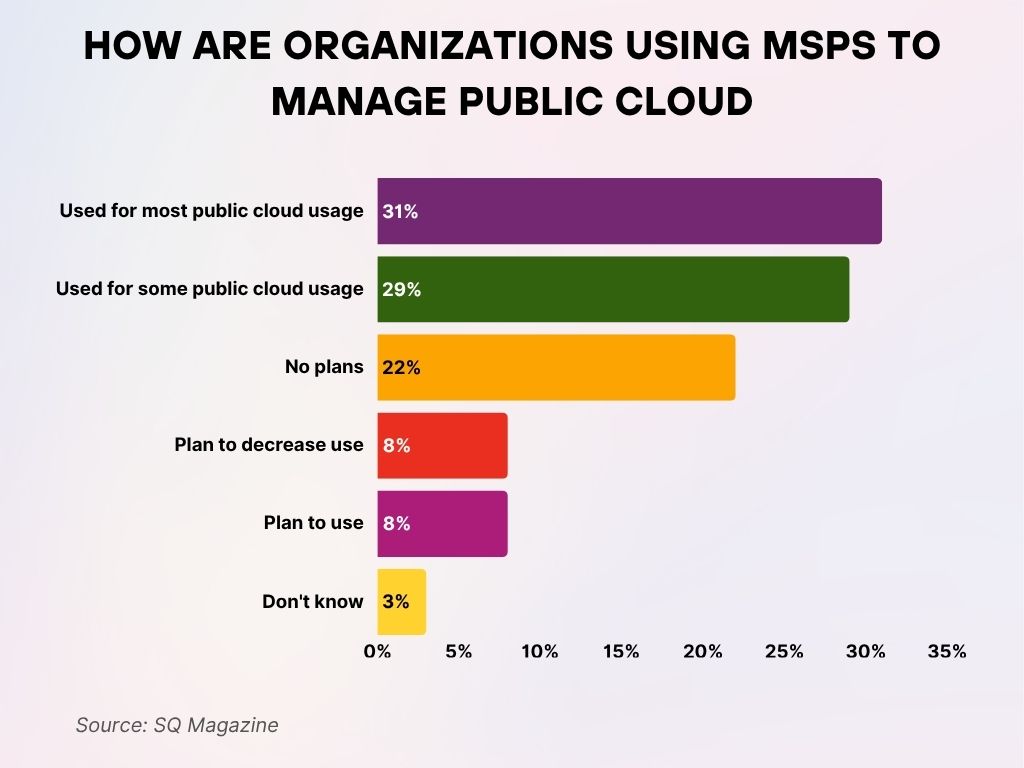

How Are Organizations Using MSPs to Manage Public Cloud

- 31% of organizations use MSPs for most public cloud usage, showing strong reliance on managed service providers.

- 29% report using MSPs for some public cloud activities, indicating partial outsourcing strategies.

- 22% have no plans to use MSPs, suggesting a preference for in-house management.

- 8% plan to decrease their use of MSPs, signaling possible shifts to internal capabilities.

- Another 8% plan to use MSPs in the future, hinting at upcoming adoption.

- Only 3% of respondents don’t know their MSP usage status, reflecting high awareness across organizations.

Cloud Computing and Remote Work Enablement

- 75% of companies in 2025 say cloud platforms are the foundation of their remote and hybrid work strategies.

- Use of virtual desktop infrastructure (VDI) in the cloud has grown to 38%, enabling secure remote access across industries.

- Collaboration SaaS platforms (e.g., Microsoft Teams, Zoom, Google Workspace) are used by 94% of remote-enabled firms.

- Cloud-based file sharing and document collaboration tools now serve 87% of the digital workforce.

- Remote-enabled organizations using cloud infrastructure report a 26% increase in employee productivity by 2025.

- Zero-trust cloud security models support 71% of remote work environments, mitigating risks from unmanaged devices.

- Companies with cloud-first strategies have 35% lower operational costs for remote IT support than traditional setups.

- HR and workforce analytics platforms in the cloud are used by 61% of companies to monitor distributed employee engagement.

- Cloud-hosted virtual training has grown by 41%, becoming standard in onboarding and upskilling workflows.

- By 2025, 51% of companies offer remote-first or hybrid roles supported entirely by cloud infrastructure.

Environmental Impact of Cloud Infrastructure

- Hyperscale cloud data centers are 5x more energy-efficient than traditional enterprise data centers as of 2025.

- Cloud providers are on track to achieve 82% renewable energy use across global operations in 2025.

- Google Cloud reports achieving carbon-neutral operations since 2017 and aims for net-zero by 2030, setting the industry benchmark.

- Microsoft Azure is targeting 100% renewable energy usage by the end of 2025, already at 87% today.

- AWS is expected to reach 100% renewable usage for its cloud operations by 2025, ahead of its original 2030 goal.

- Data center water usage for cooling is a growing concern, with new efficiency metrics (WUE) being adopted in 68% of facilities.

- Carbon-aware workload placement, dynamically shifting compute loads based on local grid sustainability, is adopted by 27% of large enterprises.

- Sustainability dashboards are used by 42% of cloud customers in 2025 to track emissions, efficiency, and reporting goals.

- Use of modular, liquid-cooled, and AI-optimized data center designs has increased by 34% since 2023.

- Cloud computing is enabling ESG reporting compliance for 56% of enterprises with cloud-native governance tools.

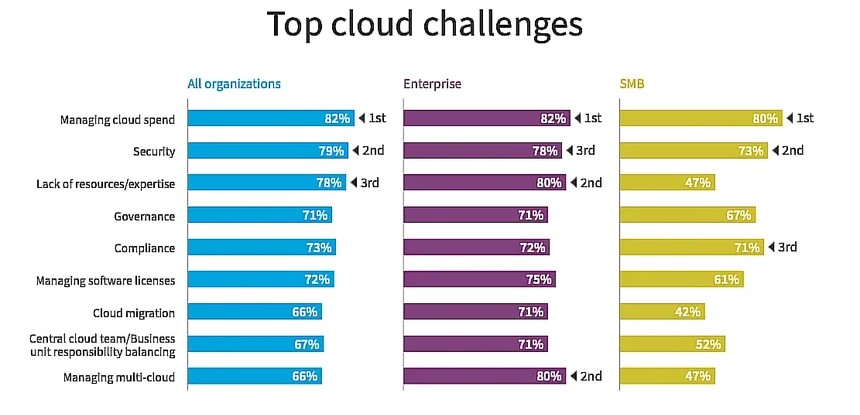

Top Cloud Challenges Faced by Organizations

- Managing cloud spend is the #1 challenge for all groups: 82% of enterprises, 80% of SMBs, and 82% overall.

- Security ranks high across the board: 79% overall, 78% enterprise, and 73% SMB.

- Lack of resources/expertise affects 78% overall and 80% of enterprises, but only 47% of SMBs.

- Governance is a concern for 71% of both enterprises and the general group, and 67% of SMBs.

- Compliance challenges impact 73% overall, 72% enterprise, and 71% SMB.

- Managing software licenses is an issue for 72% overall, with 75% in enterprise and 61% in SMB.

- Cloud migration causes problems for 66% overall, 71% enterprises, and only 42% of SMBs.

- Balancing responsibilities between central teams and business units challenge for 67% overall, 71% enterprise, and 52% SMB.

- Managing multi-cloud is a challenge for 66% overall, 80% enterprises, and just 47% of SMBs.

Recent Developments in Cloud Computing

- Confidential computing, protecting data while in use, has gained traction, with 37% of enterprises piloting solutions in 2025.

- Cloud-based quantum computing platforms are now offered by Amazon Braket, Microsoft Azure Quantum, and others, with over 11,000 enterprises engaged in early trials.

- AI-driven cloud optimization platforms are in use by 52% of enterprises to manage performance, auto-scaling, and cost.

- GPU cloud demand has surged by 46%, especially for large AI model training and generative AI deployments.

- Industry-specific cloud platforms (e.g., Cloud for Healthcare, Financial Cloud) are growing, with 41% of enterprises now subscribing to vertical clouds.

- Cloud container marketplaces have expanded rapidly, with over 160,000 Kubernetes-ready apps published in 2025.

- Low-code and no-code platforms hosted on cloud services are used by 63% of enterprises to accelerate internal development.

- Cross-cloud AI governance frameworks have emerged, helping 28% of firms enforce ethical AI use in distributed systems.

- Edge-native cloud solutions have been deployed by 33% of logistics, energy, and telecom companies.

- Cloud-native 5G infrastructure is rolling out faster, enabling new services and compute-intensive workloads at the edge.

Conclusion

The landscape of cloud computing in 2025 is not only bigger, it’s more integrated, more intelligent, and more essential than ever before. Businesses are no longer asking if they should adopt the cloud; they’re redefining how to optimize, secure, and scale within it. From enabling remote workforces to driving AI breakthroughs and sustainability goals, cloud technologies now underpin nearly every digital initiative. The shift isn’t just technological, it’s strategic, environmental, and operational. As cloud providers compete and innovate, enterprises must continue evolving their cloud maturity, governance, and integration to stay ahead in a world powered by the cloud.