Back in 2010, the cloud was merely a buzzword, caught between hype and hesitation. However, by 2025, it has evolved into the backbone of modern operations, supporting everything from small startups to multinational corporations. In fact, whether it’s scaling operations overnight or enabling real-time data access across the globe, cloud computing now serves as a foundational pillar of digital infrastructure.

Moreover, this evolution hasn’t just been rapid; it has been truly transformative. Therefore, as we progress further into 2025, it is important to explore the latest cloud adoption trends by industry, region, and business size in order to understand what is currently shaping the global digital economy.

Editor’s Choice

- 94% of enterprises are now using some form of cloud service in 2025.

- The global cloud market is projected to reach $732 billion by the end of 2025.

- 83% of mid-sized businesses have shifted over half of their workloads to the cloud.

- The United States leads regional adoption, with 68% of businesses running most operations on the cloud.

- The healthcare sector saw a 41% YoY increase in cloud spending, the highest across industries.

- Small businesses are adopting the cloud at a faster rate, with 61% running more than 40% of their operations in the cloud.

- Asia-Pacific is the fastest-growing region, with a projected 18.2% CAGR in cloud services through 2025.

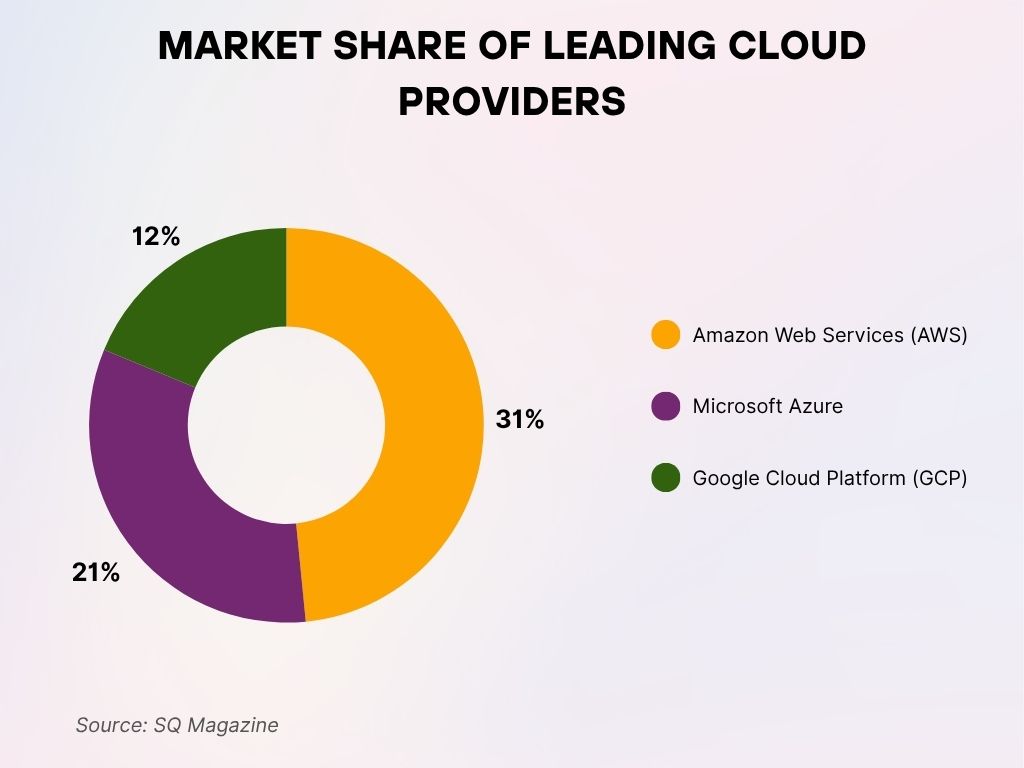

Market Share of Leading Cloud Providers

- Amazon Web Services (AWS) holds the largest market share among cloud providers at 31%.

- Microsoft Azure is the second-largest cloud provider, capturing 21% of the global market.

- Google Cloud Platform (GCP) ranks third with a market share of 12%.

Global Cloud Adoption Rates

- As of 2025, 94% of enterprises worldwide are using cloud computing.

- 72% of all global workloads are now cloud-hosted, compared to 66% last year.

- 78% of IT decision-makers consider the cloud their primary infrastructure strategy.

- 55% of organizations are now following a cloud-first policy when adopting new technologies.

- The number of companies adopting cloud-native architectures has reached 49%, a 7% increase YoY.

- 83% of organizations globally have adopted at least one SaaS product in their operations.

- 37% of companies now operate in a fully cloud-native environment, with no reliance on traditional data centers.

- Only 3% of enterprises have no current plans to move to the cloud, a record low.

- Public cloud usage among businesses increased to 69% in 2025.

- Edge computing, a companion to cloud infrastructure, is now deployed by 29% of enterprises to support latency-sensitive workloads.

Cloud Adoption by Business Size

- 94% of large enterprises now operate on a cloud-first basis.

- 83% of medium-sized businesses use cloud-based ERP or CRM systems.

- Among small businesses, 61% now run over 40% of their core workloads in the cloud, up from 54% last year.

- Startups are heavily cloud-reliant, with 87% built using cloud-native architectures from day one.

- SMBs (small and mid-sized businesses) spend an average of $21,000 per year on cloud services in 2025.

- For large enterprises, annual cloud expenditure has risen to $14.3 million, a 9% YoY increase.

- 72% of businesses with fewer than 50 employees rely on SaaS platforms as their primary IT environment.

- Mid-sized companies are the fastest-growing cloud adopters, with a 19% YoY growth rate.

- In 2025, cloud-based collaboration tools are used by 93% of all companies, largely normalized across the board.

- Cloud adoption among microbusinesses (under 10 employees) increased to 42%.

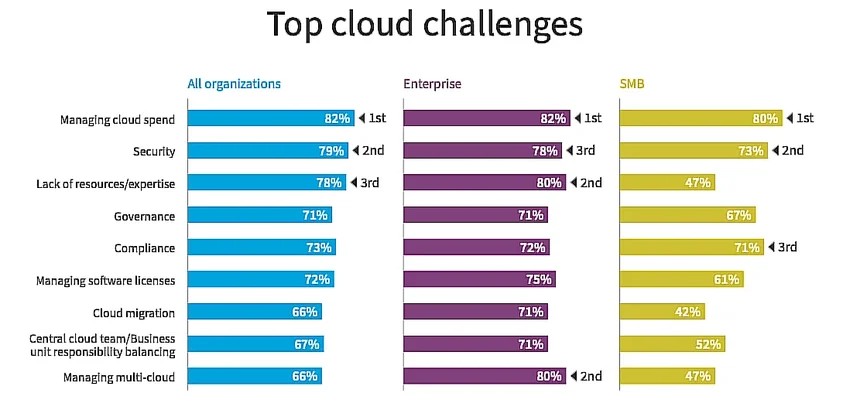

Top Cloud Challenges Faced by Organizations

- Managing cloud spend is the #1 challenge for all groups: 82% of enterprises, 80% of SMBs, and 82% overall.

- Security is a major concern, affecting 79% of all organizations and 73% of SMBs.

- Lack of resources/expertise impacts 78% overall, 80% of enterprises, but only 47% of SMBs.

- Governance challenges are faced by 71% of enterprises and 67% of SMBs.

- Compliance is cited by 73% overall and is a top 3 concern for SMBs at 71%.

- Managing software licenses affects 72% of all organizations and 75% of enterprises.

- Cloud migration is a hurdle for 66% of all groups, with 71% of enterprises and only 42% of SMBs affected.

- Balancing responsibilities between cloud teams and business units is a concern for 67% overall.

- Managing multi-cloud environments is challenging for 66% overall, 80% of enterprises, and 47% of SMBs.

Cloud Adoption by Industry

- The healthcare sector reported a 41% YoY increase in cloud adoption, the highest across all sectors.

- Financial services companies have reached 88% cloud usage in 2025, led by compliance-friendly cloud platforms.

- The retail industry has 73% of its digital operations now in the cloud, driven by e-commerce growth.

- Manufacturing reported 67% of operations running on hybrid cloud infrastructures.

- The education sector has a 64% adoption rate for cloud learning management systems.

- Government and public sector adoption reached 51%, growing steadily despite regulatory hurdles.

- Telecommunications firms operate 86% of their core services in the cloud in 2025.

- Media and entertainment businesses rely on the cloud for real-time streaming, now used by 79% of providers.

- Energy companies increased their investment in cloud-based analytics by 36% YoY.

- The logistics industry uses cloud-driven supply chain platforms in 69% of large enterprises.

- Legal services cloud adoption crossed the 58% mark, with secure document storage leading use cases.

Regional Cloud Adoption Trends

- The United States leads globally, with 68% of all business operations running on cloud infrastructure.

- Canada follows with 61% of enterprise workloads hosted in the cloud.

- In Europe, Germany and the UK show strong maturity, both reporting 65%+ cloud adoption.

- France reached 58% in 2025, a jump from 52% in 2024.

- Asia-Pacific is the fastest-growing cloud market, with a projected 18.2% CAGR through 2025.

- China leads regional growth in Asia, with 72% of enterprises adopting cloud services in 2025.

- India saw 41% YoY growth in cloud adoption, especially among tech startups.

- In Latin America, Brazil leads with 59% adoption, while Mexico follows at 51%.

- Middle East adoption sits at 47%, with the UAE and Saudi Arabia investing heavily in cloud data centers.

- Africa remains emerging, with 26% cloud usage across enterprise-level firms.

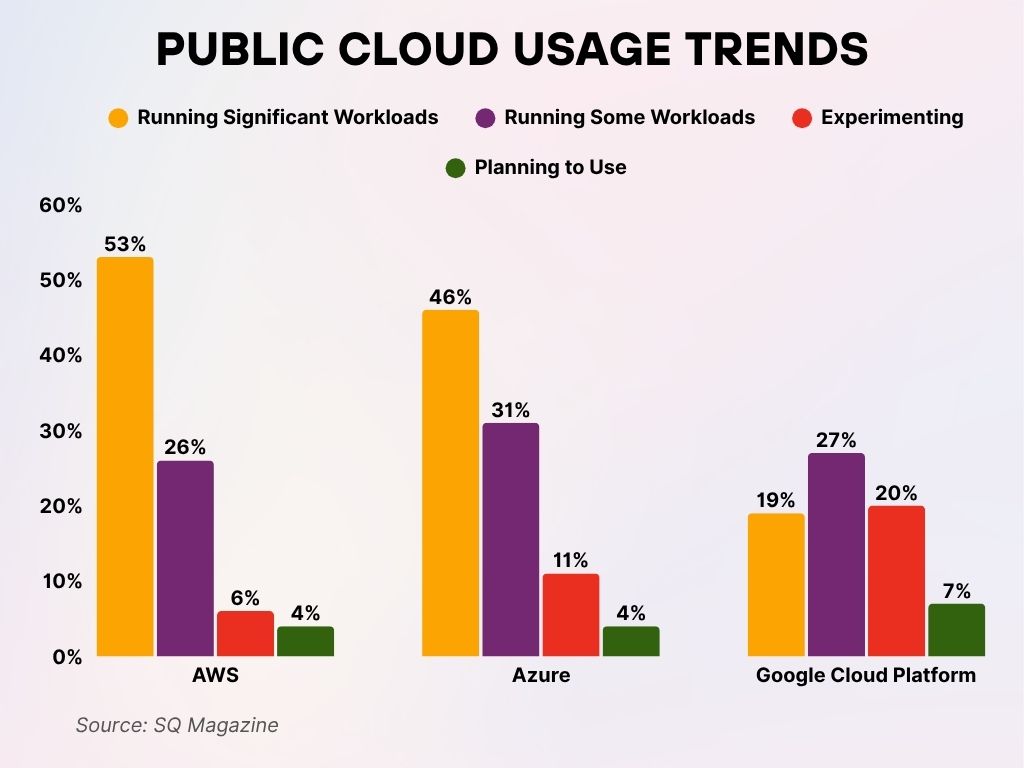

Public Cloud Usage Trends

- AWS remains the top choice, with 53% of organizations running significant workloads on the platform.

- 26% of organizations use AWS for some workloads, while 6% are experimenting and 4% are planning to use it.

- Azure is the second most used provider, with 46% of organizations running significant workloads and 31% using it for some workloads.

- 11% of organizations are experimenting with Azure, and another 4% are planning to adopt it.

- Google Cloud Platform (GCP) is still growing, with 19% running significant workloads and 27% running some workloads.

- 20% of organizations are experimenting with GCP, and 7% are planning to use it in the future.

Public vs Private vs Hybrid Cloud Adoption

- In 2025, 69% of businesses are using a public cloud infrastructure as their primary environment.

- Private cloud adoption stands at 32%, often used by heavily regulated sectors like healthcare and finance.

- Hybrid cloud adoption continues to rise, now used by 54% of enterprises for mission-critical workloads.

- 41% of organizations say hybrid environments give them better security and compliance flexibility.

- Among government institutions, 47% have adopted private clouds, citing sovereignty and data control.

- Public cloud solutions dominate in startup ecosystems, with 82% of startups exclusively using them.

- Hybrid cloud spending has grown by 21% YoY, with enterprises favoring it for balancing agility and control.

- The top reasons for adopting a hybrid cloud in 2025 are cost efficiency (62%) and business continuity (58%).

- 23% of organizations that use private cloud have started integrating public cloud services to scale operations.

- By 2025, multi-environment cloud strategies are in place in 65% of enterprise-scale companies.

Multi-Cloud and Hybrid Cloud Strategies

- 89% of enterprises report having a multi-cloud strategy in place in 2025.

- The average organization now uses 3.4 different cloud providers.

- 68% of IT leaders say a multi-cloud setup improves risk mitigation and service resilience.

- Hybrid multi-cloud environments are deployed by 43% of Fortune 500 companies.

- 37% of firms adopted multi-cloud to avoid vendor lock-in, an increase of 8% YoY.

- Cloud interconnectivity spending rose to $9.6 billion in 2025, reflecting the complexity of multi-cloud infrastructure.

- 58% of CIOs say they experienced fewer service disruptions after shifting to multi-cloud architecture.

- 22% of companies with hybrid strategies say they saw cost savings of over 20% after optimization.

- Data portability and performance optimization are the top drivers behind multi-cloud orchestration adoption in 2025.

- FinOps tools adoption has doubled in 12 months, helping organizations manage costs across multi-cloud landscapes.

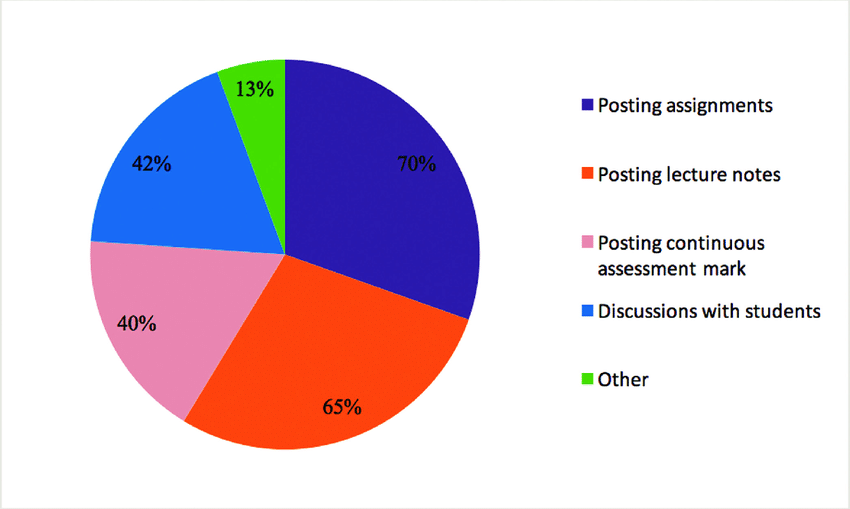

Usage of Cloud Computing in Higher Education

- 70% of institutions use cloud platforms for posting assignments, making it the most common academic use.

- 65% rely on cloud services for posting lecture notes, enhancing accessibility for students.

- 40% use the cloud to share continuous assessment marks with learners.

- 42% engage in discussions with students via cloud-based platforms.

- 13% of activities fall under other uses, reflecting diverse but less common applications.

Cloud Migration Drivers

- Scalability remains the top driver of cloud migration, cited by 71% of decision-makers in 2025.

- Cost reduction motivated 64% of organizations to accelerate migration from on-premises systems.

- Performance and speed improvements were key for 58% of IT leaders pushing cloud transitions.

- Security enhancement was listed as a primary driver by 45% of businesses surveyed.

- Remote workforce enablement remains a leading reason for adoption, chosen by 52% of companies.

- AI and machine learning compatibility now influence 39% of migration strategies.

- 45% of companies cite legacy system limitations as the main blocker driving cloud adoption.

- Data center exit strategies are in progress for 33% of large organizations.

- Businesses with global footprints are prioritizing regional cloud expansion, now at 27% globally.

- Compliance and regulation demands, especially GDPR and HIPAA, influenced cloud moves for 31% of firms in 2025.

Cloud Cost Optimization Statistics

- 19% average savings were achieved by organizations that implemented FinOps practices in 2025.

- 38% of companies cited unused resources as their primary source of cloud waste.

- Auto-scaling infrastructure saved an estimated $11.2 billion globally in 2025.

- Rightsizing efforts helped 26% of organizations cut costs by 20% or more.

- 54% of enterprises now use cost observability tools as part of routine operations.

- Reserved instances and commitment-based pricing led to 28% lower average bills.

- 45% of IT teams reported difficulty predicting multi-cloud billing, leading to budget variances.

- Cloud spend optimization is a top-three priority for 61% of CFOs in 2025.

- Organizations that used automation to manage workloads saved on average 15% annually.

- Wastage due to overprovisioning dropped to 12%, the lowest in the past five years.

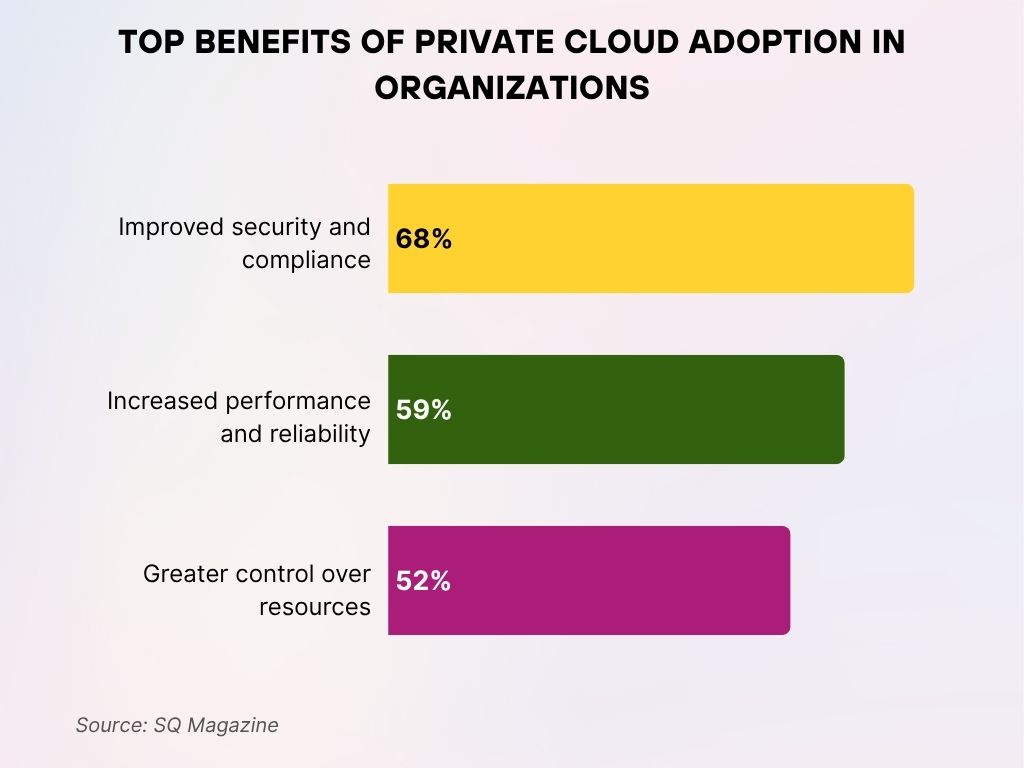

Top Benefits of Private Cloud Adoption in Organizations

- Improved security and compliance are the leading benefits, cited by 68% of organizations adopting private cloud solutions.

- 59% of organizations report increased performance and reliability as a key advantage of private cloud adoption.

- Greater control over resources is highlighted by 52% of organizations leveraging private cloud infrastructure.

Cloud-Native Technologies Adoption

- 49% of organizations have fully embraced cloud-native architecture in 2025, up from 42% last year.

- Kubernetes remains the most widely used orchestration tool, deployed by 68% of cloud-native teams.

- Serverless computing is used by 33% of businesses to reduce overhead and streamline deployment.

- Containers are used in 71% of new cloud deployments across enterprise and SMB environments.

- CI/CD pipelines in cloud-native applications increased by 27% YoY, emphasizing agile workflows.

- 29% of organizations migrated legacy apps to microservices-based architecture in 2025.

- Cloud-native observability tools saw a 41% rise in adoption, addressing performance bottlenecks.

- Platform engineering teams now exist in 36% of large enterprises to manage cloud-native workflows.

- 12% of new startups in 2025 are built entirely on serverless infrastructure.

- Enterprises using container security platforms grew by 22%, reflecting a shift in DevSecOps maturity.

Cloud Adoption by Application or Workload Type

- Customer-facing apps are the top cloud workload, deployed by 81% of enterprises.

- Data analytics platforms are hosted in the cloud by 66% of organizations.

- Dev/test environments in the cloud reached 74%, allowing faster deployment cycles.

- ERP systems are cloud-hosted by 58% of medium-to-large companies.

- CRM tools like Salesforce or HubSpot are used in the cloud by 85% of sales-led organizations.

- Email and collaboration suites are hosted in the cloud by 92% of businesses.

- Disaster recovery and backup workloads account for 39% of cloud usage in 2025.

- IoT analytics workloads are cloud-hosted in 34% of industrial and manufacturing firms.

- HR and payroll systems are cloud-based in 62% of mid-market firms.

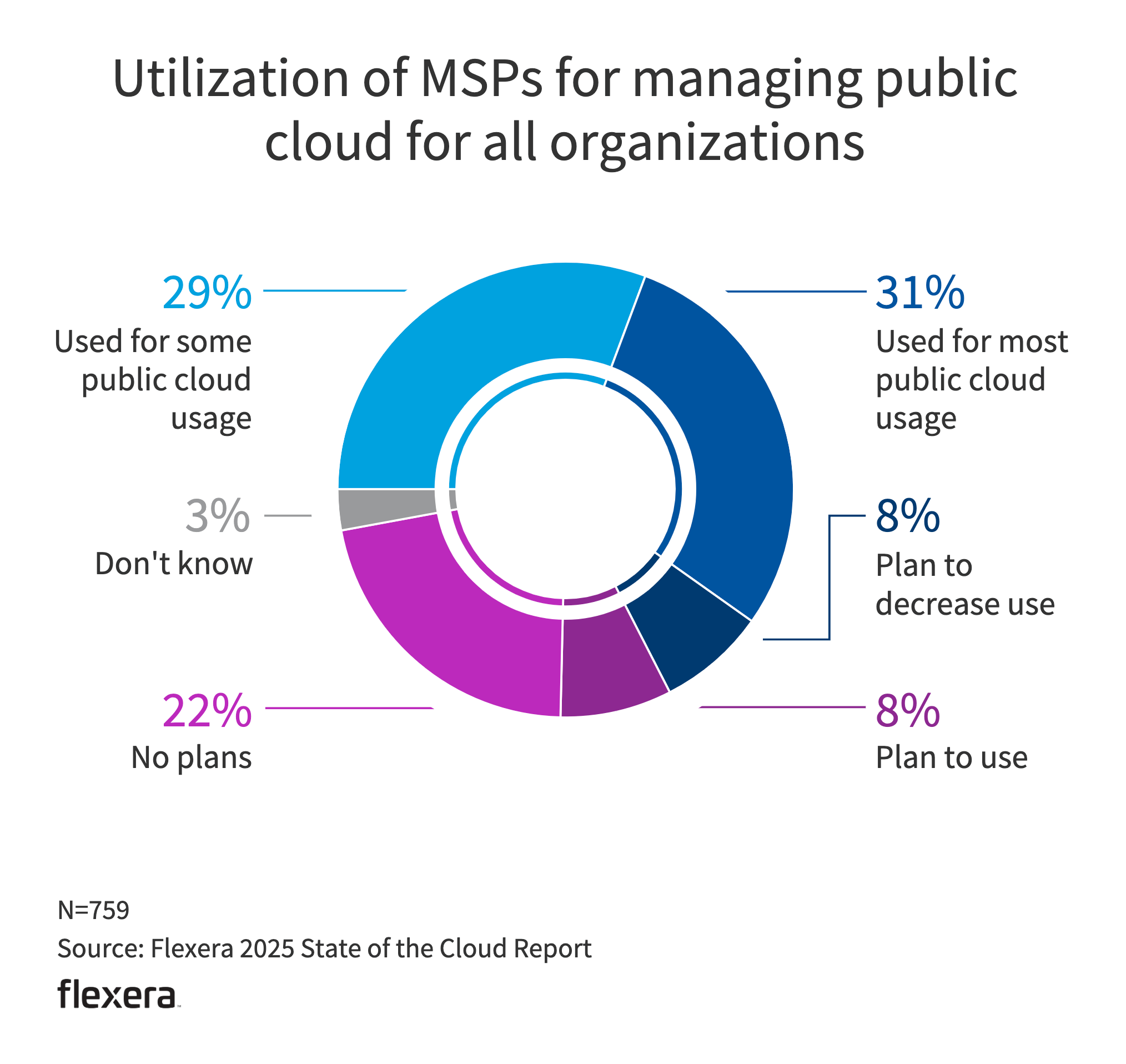

Utilization of MSPs for Managing Public Cloud

- 31% of organizations use MSPs for most of their public cloud workloads.

- 29% utilize MSPs for some of their public cloud usage.

- 22% have no plans to use managed service providers for public cloud management.

- 8% of organizations plan to use MSPs in the future.

- Another 8% expect to decrease their use of MSPs.

- 3% of respondents are unsure about their MSP usage.

Cloud Repatriation Trends

- 22% of organizations reported partial cloud repatriation in 2025 due to cost or compliance concerns.

- Of those, 47% cited unexpected costs as the leading reason for pulling workloads back on-premises.

- Latency-sensitive workloads, especially in fintech and gaming, were moved back on-prem by 18% of firms.

- The hybrid cloud became the landing zone for 69% of repatriated workloads, not traditional data centers.

- Security compliance concerns drove 32% of companies to consider alternatives to public cloud.

- Despite repatriation, 91% of firms maintain some level of cloud infrastructure post-shift.

- Data sovereignty laws in Europe triggered repatriation actions by 15% of multi-national corporations.

- 12% of repatriation decisions were influenced by poor interoperability across cloud vendors.

- Enterprises with over $100 million in IT budgets were 3x more likely to repatriate certain workloads.

Impact of Cloud Adoption on Revenue and Growth

- 63% of cloud-driven companies reported higher revenue growth than their industry average peers.

- Digital-native companies grew 2.3x faster in revenue than those relying on traditional IT.

- 46% of firms linked cloud-based agility to improved customer acquisition rates.

- Businesses using cloud analytics saw a 31% improvement in forecasting accuracy.

- E-commerce platforms that transitioned to the cloud saw 28% YoY revenue increases in 2025.

- Companies using AI through cloud platforms reported an average 21% increase in operational efficiency.

- SMBs using cloud tools grew their customer base 1.9x faster than non-adopters.

- 74% of CFOs confirmed cloud investments delivered ROI within 12–18 months.

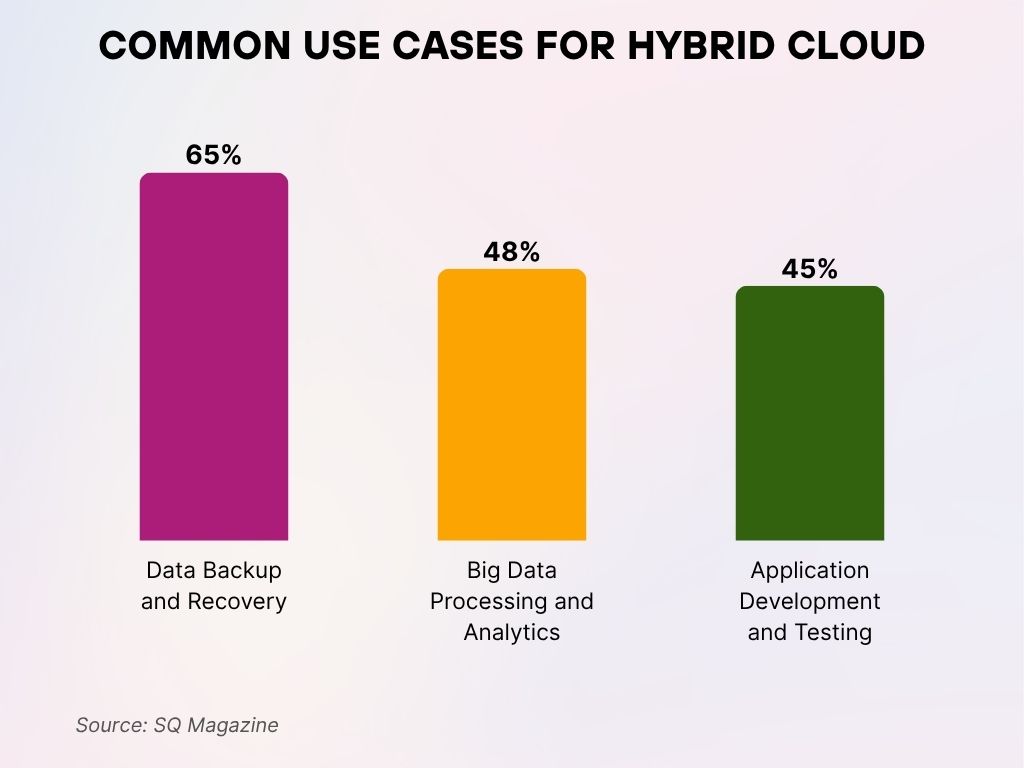

Common Use Cases for Hybrid Cloud

- 65% of organizations use a hybrid cloud for data backup and recovery, making it the top use case.

- 48% rely on a hybrid cloud for big data processing and analytics, highlighting its role in data-driven operations.

- 45% adopt hybrid cloud for application development and testing, supporting agile and scalable software workflows.

Cloud Adoption and Digital Transformation

- 88% of companies stated cloud adoption was the cornerstone of their digital transformation in 2025.

- Cloud helped reduce project lead times by 34%, enabling faster innovation cycles.

- 69% of digital transformation leaders integrated AI and ML tools via cloud ecosystems.

- Cloud platforms enabled real-time data integration across silos in 51% of enterprises.

- Customer personalization driven by cloud analytics improved engagement by 29% on average.

- Digital twins hosted in the cloud were used by 18% of manufacturing firms for process simulation.

- Cloud-native API strategies accelerated integration timelines for 46% of companies.

- Legacy modernization efforts were cloud-powered in 61% of transformation roadmaps.

Sustainability and Environmental Impact

- 40% of cloud buyers factored in sustainability when selecting a provider in 2025.

- Major providers now run 72% of their data centers on renewable energy sources.

- Cloud adoption reduced enterprise carbon footprints by an average of 15% through better resource efficiency.

- Green cloud regions offered by hyperscalers grew to 38 globally, supporting eco-conscious choices.

- Server utilization rates in cloud data centers hit 71%, compared to 44% in traditional environments.

- Carbon accounting APIs are used by 19% of companies to track cloud emissions.

- Data center water usage dropped by 11% in newer cloud facilities in 2025.

Skills and Workforce Trends

- 31% of IT job postings in 2025 require cloud proficiency as a baseline skill.

- AWS and Azure certifications are held by 46% of cloud professionals.

- The average salary for a cloud engineer in the U.S. rose to $137,000.

- Cloud security specialists saw a 22% YoY increase in demand across regulated industries.

- Hybrid cloud architects are among the top 5 fastest-growing tech roles in 2025.

- 43% of IT departments now operate using a cloud center of excellence (CCoE) model.

- Training budgets for cloud skills rose by 18%, reflecting a need for continuous education.

- Women in cloud roles increased to 27%, marking progress in tech workforce diversity.

Recent Developments and Future Outlook

- M&A activity among cloud infrastructure providers exceeded $40 billion in the past 12 months.

- Major players like AWS, Azure, and Google Cloud launched new AI-centric data regions.

- Cross-cloud interoperability standards are being developed to ease workload portability.

- Data sovereignty laws in over 30 countries have shifted cloud strategy roadmaps.

- Startups in climate-tech are increasingly building on cloud-native frameworks.

- Open-source cloud projects like OpenStack are regaining attention for private deployments.

- Looking ahead, hybrid and multi-cloud will become the de facto standard by 2027, according to analysts.

- Sustainability transparency reporting in cloud contracts is likely to become mandatory in EU jurisdictions.

Conclusion

Cloud computing in 2025 is no longer just about scalability or flexibility; it’s become the backbone of digital innovation, operational resilience, and sustainable growth. From powering real-time applications to accelerating AI deployments, cloud services are central to business strategy in nearly every sector. However, adoption comes with its complexities, cost, security, compliance, and skills remain key hurdles. Still, organizations that master cloud strategy stand to outperform competitors on every major metric: speed, cost-efficiency, and customer value. As we look ahead, cloud technology will continue to evolve, driving the next wave of enterprise transformation.