Central Bank Digital Currencies (CBDCs) represent a digital form of national currency issued and regulated by a country’s central bank. As governments adopt digital transformation across payments, CBDCs are emerging as a tool to modernize monetary systems, bolster financial inclusion, and compete with evolving private digital money. In practice, countries like China are deploying digital yuan pilots across cities for retail payments, while Nigeria is deploying its eNaira to widen access in underserved communities. This article dives deep into the latest statistics across global CBDC strategies and outcomes. Read on for insights that underpin this evolving monetary frontier.

Editor’s Choice

- 134 countries, representing 98% of global GDP, are actively exploring or developing CBDCs.

- 11 countries have fully launched a CBDC as of early 2025.

- 53 countries are running pilot projects in 2025.

- 62% of central banks cite financial inclusion as a primary motivation for CBDC development in 2025.

- The global value of CBDC transactions is projected to reach $213 billion in 2025 (vs. ~$100B in 2023).

- 94% of central banks were exploring a CBDC by mid‑2024, with various levels of commitment.

- 31% of central banks have delayed their CBDC timelines (in 2025).

Recent Developments

- Momentum is growing; 44 countries were in pilot stages by late 2024, up from 36 the prior year.

- India’s e‑rupee in circulation reached ₹10.16 billion (~$122 million) by March 2025, up 334% from ₹2.34 billion (~$28 million) in 2024.

- Nigeria’s eNaira active users doubled (from 5 million in 2023 to 10 million in 2024).

- Saudi Arabia joined the BIS‑ and China-led mBridge cross‑border CBDC trial in mid‑2024.

- 31% of central banks have delayed planned CBDC rollouts in 2025.

- The United States House passed a bill to prohibit a direct retail CBDC, though the Senate has not yet acted.

- Project Helvetia III (Switzerland/France) extended its wholesale CBDC pilot mid‑2024.

- Nepal began preliminary CBDC piloting in April 2025, pegged 1:1 to its rupee.

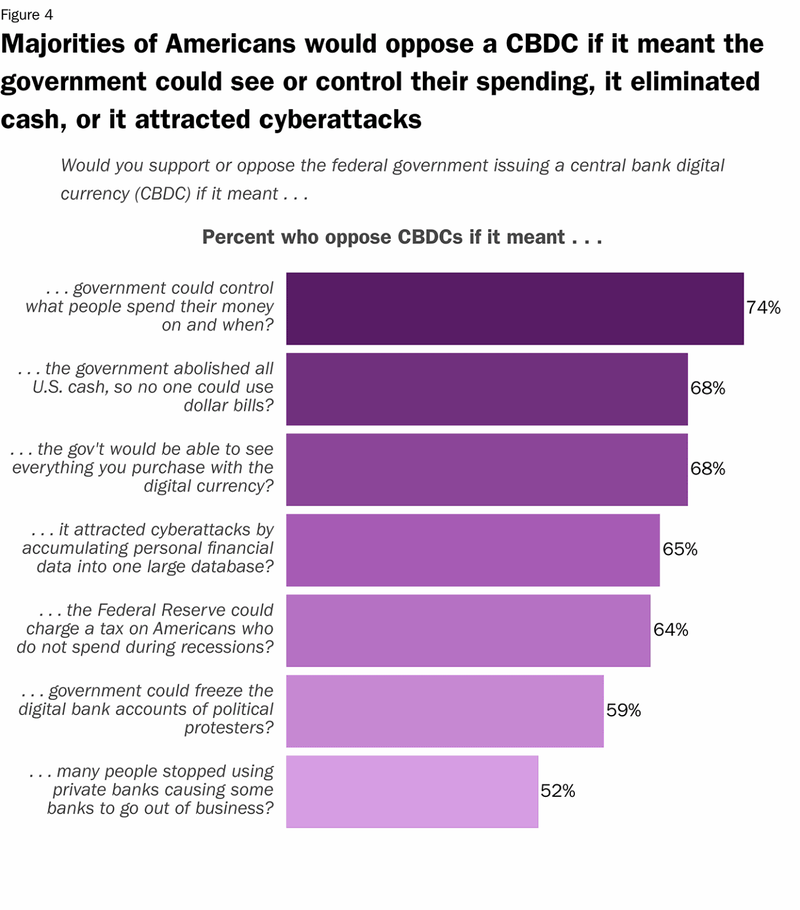

U.S. Public Resistance to CBDCs

- 74% of Americans oppose CBDCs if the government could decide how and when money is spent.

- 68% oppose adopting CBDCs if it meant abolishing all U.S. cash and eliminating dollar bills.

- 68% oppose if digital currencies allowed the government to track every purchase.

- 65% oppose if centralized CBDCs increase vulnerability to cyberattacks.

- 64% oppose if the Federal Reserve could impose taxes on people who fail to spend during recessions.

- 59% oppose if CBDCs gave the government power to freeze the digital accounts of political protesters.

- 52% oppose if CBDCs caused traditional banks to lose customers and risk closure.

What is a Central Bank Digital Currency (CBDC)?

- A CBDC is a digital version of fiat money issued by a central bank, equivalent in value to physical currency.

- Unlike cryptocurrencies, liability lies with the central bank, not private issuers.

- CBDCs may work alongside cash, not necessarily replacing it.

- Designs differ; some use distributed ledger technology, blockchains, or centralized databases.

- They may support programmable money (conditional spending rules) or smart‑contract attachments.

- CBDC architecture can choose privacy, offline usability, or anonymity trade‑offs.

- Functions include everyday retail payments, wholesale interbank settlements, cross‑border transfers, and government disbursements.

- The IMF’s Virtual Handbook offers design principles to help central banks compare designs.

Global Overview of CBDC Adoption

- An estimated 134 countries (or currency unions) are exploring or developing CBDCs in 2025, covering 98% of global GDP.

- All G20 countries are involved in some CBDC work.

- 72 countries are in advanced phases (pilot, development, or launch).

- As of mid‑2023, 11 countries have already adopted CBDCs, and 53 additional in advanced planning.

- A 2024 survey placed 94% of central banks working on CBDCs in some capacity.

- Across regions, adoption is uneven; East Asia and Africa show higher pilot activity, and many advanced economies favor wholesale designs.

- To date, only a handful of live retail CBDCs exist: the Bahamas (Sand Dollar), Jamaica, Nigeria, and a few others.

- Some countries have scaled back or delayed projects; ~31% reported delays in 2025.

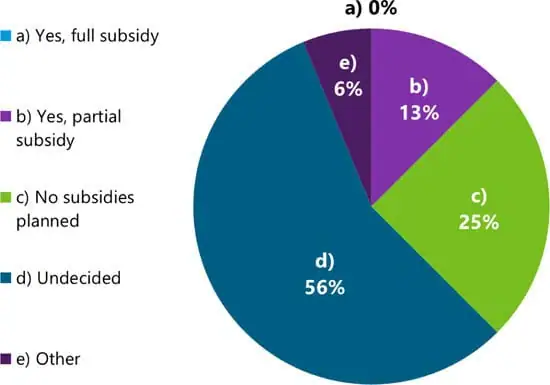

CBDC Subsidy Strategies

- 0% of countries plan to fully subsidize CBDC adoption.

- 13% are exploring partial subsidy models.

- 25% report that no subsidies will be provided for CBDC rollout.

- 56% remain undecided, representing the largest share.

- 6% fall into other unspecified categories.

Number of Countries Exploring or Launching CBDCs

- As of early 2025, 134 countries/currency unions are actively engaged in CBDC work.

- In 2023, that number was ~114, demonstrating growth over two years.

- 72 countries are now in advanced stages (pilot, development, launch).

- 53 countries are running pilot projects as of 2025.

- 11 countries have launched full CBDCs by Q1 2025.

- In June 2023, 11 had launched and 53 were in advanced phases.

- Growth in pilot count, from ~36 to ~44 pilot jurisdictions in one year.

- Delays affect adoption; ~31% of central banks pushed back their issuance timelines.

Key Drivers Behind CBDC Development

- Financial inclusion ranks top; 62% cite it as a core motive.

- Payment efficiency and cost reduction motivate many central banks.

- Modernizing legacy systems and enabling real‑time payments is a key objective.

- Competition from stablecoins and private digital currencies pushes central banks to offer sovereign alternatives.

- Monetary sovereignty and control over digital money is a strong geopolitical drivers.

- Programmability and fiscal policy delivery (conditional stimulus, automatic transfers) are attractive.

- Cross‑border payment pressure is triggering CBDC cross‑jurisdiction projects like mBridge.

- Reducing dependency on physical cash and managing cash logistics, which can cost up to 1.5% of GDP.

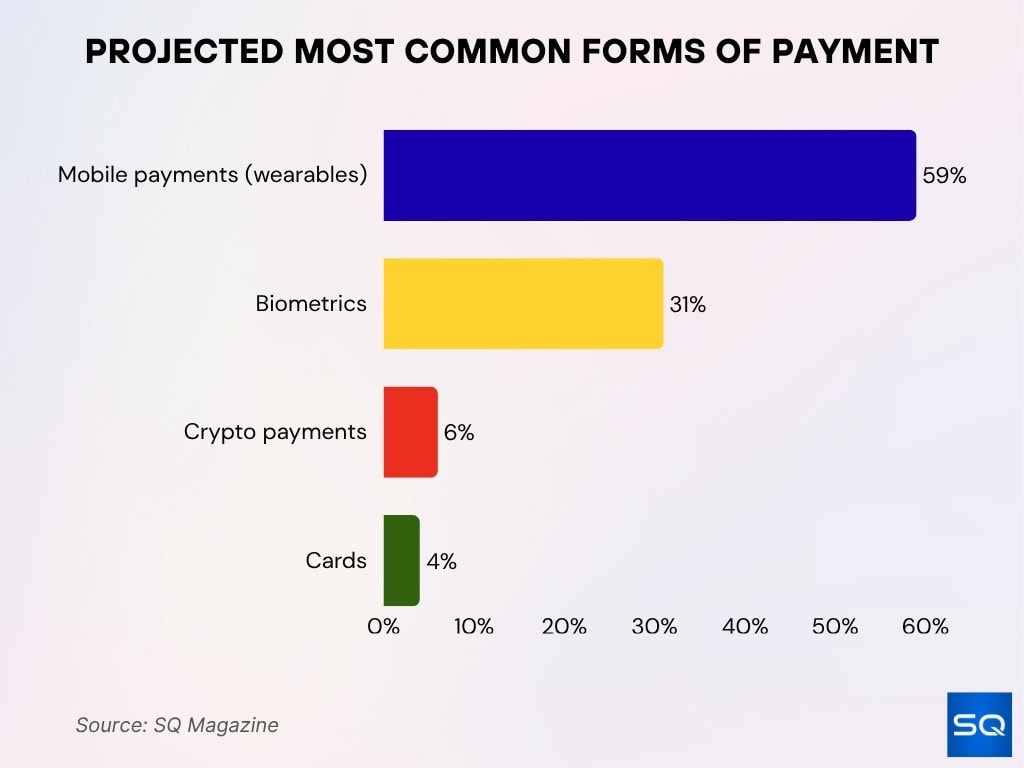

Future Payment Methods Projection

- 59% expect mobile payments via smartphones and wearables to dominate.

- 31% anticipate biometric payments such as facial recognition, fingerprints, and retinal scans becoming mainstream.

- 6% predict cryptocurrency payments will gain traction as a common method.

- 4% believe traditional cards will remain in use but play a smaller role.

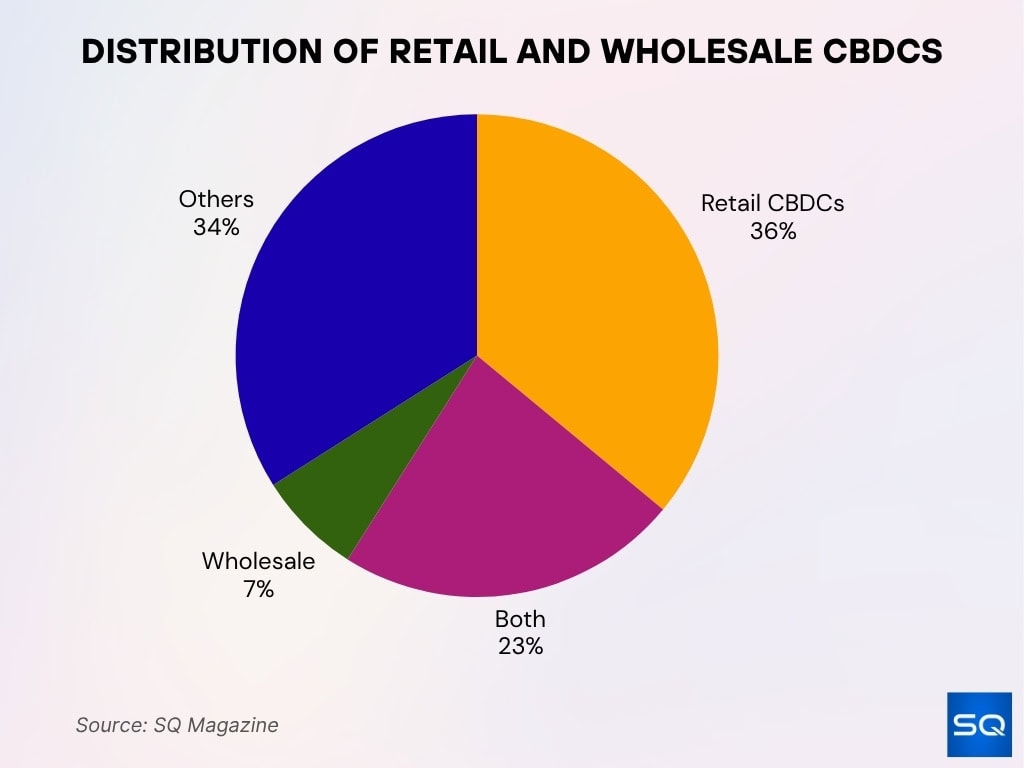

Breakdown: Retail vs Wholesale CBDCs

- Around 36% of countries focus solely on retail CBDCs, 7% on wholesale, and 23% on both types in 2025.

- In retail CBDC pilots, 68% include some form of offline payment functionality.

- 32% of countries with retail CBDCs allow interest-bearing wallets for users.

- Wholesale pilots like Helvetia and Jura have shown the ability to settle billions in interbank transactions, reducing settlement times by up to 50%.

- The BIS survey indicates that the chance of issuing a wholesale CBDC by 2030 now exceeds the chances of issuing a retail CBDC.

- Many central banks initially target wholesale use (interbank, settlement) before expanding to retail layers.

- Some central banks without issuance mandates are still working on retail projects; ~64.7% of such banks report retail CBDC work underway.

- Wholesale-only approaches may yield cost savings and risk reduction for financial institutions, but limit public access by design.

Major CBDC Projects and Pilots Worldwide

- India’s e‑rupee has grown rapidly, and reserves in circulation reached ₹10.16 billion (~$122 million) by March 2025.

- The mBridge project (China, Hong Kong, Thailand, UAE) is actively designing a multi‑CBDC bridge for real‑time cross‑currency transactions.

- Project Helvetia III (Switzerland/France) continues its wholesale CBDC experimentation in mid‑2024 and beyond.

- Project Jura (France / Switzerland) similarly explores cross‑jurisdiction wholesale settlement using digital central bank money.

- In Australia, the central bank announced Project Acacia, prioritizing wholesale CBDC work over retail versions.

- The US is working on Project Agorá, focused on wholesale cross‑border payments, in collaboration with several major central banks.

- In Africa, Nigeria’s eNaira continues to scale its user base and transaction activity.

- Some smaller nations (e.g., Bahamas, Jamaica) already have live retail CBDCs in circulation.

Retail vs Wholesale CBDCs

- 36% of countries focus on retail CBDCs, 23% on both retail and wholesale, and 7% solely on wholesale.

- Wholesale CBDC pilots like Project Helvetia (Switzerland) and Project Jura (France) showed potential to settle billions in interbank transactions and cut settlement times by up to 50%, though global estimates such as $48 billion remain approximate.

- 68% of retail pilots include offline payment functionality.

- Around 32% of countries provide interest-bearing wallets for retail CBDCs.

- 24% of central banks have launched retail CBDC pilots, double the share of wholesale pilots.

- Wholesale CBDCs help modernize markets by streamlining large-scale settlements.

- India’s Digital Rupee features both e₹-R (retail) and e₹-W (wholesale) models.

CBDC Statistics by Region and Country

- Asia (especially India, China) leads in pilot and scale‑up activity in retail CBDCs.

- Africa shows strong interest; several countries (Nigeria, Ghana, South Africa) are advancing pilots toward live systems.

- Latin America sees increasing CBDC momentum; countries like Brazil and Uruguay are in advanced research or pilot stages.

- In Europe, most activity centers on wholesale CBDC prototypes rather than retail issuance.

- Caribbean and small island states (e.g., Bahamas with the Sand Dollar) were among the earliest to launch retail CBDCs.

- Middle Eastern and Gulf nations are participating in mBridge and other cross‑border experiments.

- The United States remains mostly in exploratory or wholesale research, opting out of retail deployment for now.

- Switzerland’s central bank remains cautious about retail issuance, while continuing wholesale experiments via Helvetia.

CBDC Usage Rates and Adoption Metrics

- CBDC transaction volume will rise from ~307 million in 2024 to 7.8 billion by 2031.

- In India, daily usage of the e‑rupee is expanding significantly, reflecting uptake beyond pilot zones.

- Some retail CBDC pilots report user activation rates (percentage of wallets enabled) of 20–40% in localized areas.

- In jurisdictions with live CBDCs (e.g., Nigeria), wallet registration and transaction frequency are showing month-on-month growth.

- A sizable share of CBDC users (particularly in emerging markets) access via mobile wallets or apps, rather than bank-based interfaces.

- Some pilots track daily active users (DAU) as a metric, with several projects aiming for 100,000+ DAU in initial phases.

- Adoption often correlates with merchant acceptance; pilots that enroll >1,000 merchants show usage growth faster.

- In wholesale settings, adoption is measured in the number of participating institutions; many prototypes now count 10+ banks or clearing systems.

CBDC Transaction Volumes and Values

- The global CBDC market was estimated at USD 0.4 billion in 2024, with projections toward USD 3.0 billion by 2035.

- Wholesale pilot experiments have processed tens of billions in value, e.g., in Helvetia and Jura projects.

- Retail transaction volumes in live systems are modest currently, but scaling, e.g,. Nigeria’s monthly CBDC turnover reaching millions of dollars.

- Massive growth in payment counts is forecasted even if the average transaction size remains modest.

- Cross‑border CBDC corridors aim to settle billions in cross-currency transfers in pilot phases.

- Some wholesale trials report settlement time reductions of 30–50%, improving liquidity and throughput.

- CBDC systems aspire to process thousands of transactions per second (TPS) in scalable environments; many designs target 1,000–5,000 TPS.

- Value per transaction tends to be lower in retail use, higher in wholesale use (interbank, securities settlement).

Interoperability and Cross‑Border CBDC Initiatives

- The G20 roadmap targets that by 2027, 75% of cross‑border payments will be settled within one hour.

- CBDC interoperability is seen as critical, with models including bridges, hub architectures, and cross‑registering of ledgers.

- Experiments show CBDC systems can interoperate with legacy retail systems using a bridge layer that routes messages.

- mBridge aims to enable cross‑currency settlement among participant central banks in real time.

- The World Bank’s review of cross‑border CBDC models discusses designs like Aber, Jasper/Ubin, and intermediary currency models.

- Interoperability also implies harmonizing messaging standards (e.g., ISO 20022) and legal frameworks across jurisdictions.

- One challenge, liquidity management across corridors, especially when multiple currencies and FX conversion are involved.

- Some pilot corridors already support payment vs payment (PvP) atomic settlement to avoid principal risk.

CBDC Technology: Ledger Type and Architecture

- Among 26 surveyed CBDC systems, the most common architecture is a two‑tier model combining central bank backend with intermediary front-end operations.

- The dominant ledger choice is distributed ledger technology (DLT) in many pilot designs, but some opt for permissioned databases.

- Hybrid architectures—which split functions between central bank and intermediaries—are widely proposed to balance scalability and control.

- In hybrid models, the central bank maintains a ledger of retail balances but delegates customer-facing services to intermediaries.

- Some systems adopt offline‑capable protocols (e.g., secure element, e‑cash style) to emulate cash when connectivity is unavailable.

- Emerging research proposes semi‑hierarchical payment channel networks (PCNs) to improve throughput while preserving privacy features.

- Scalability targets in several CBDC proposals aim for tens of thousands of transactions per second (TPS) to match or exceed private payment rails.

- Combining ledger resilience, auditability, and privacy remains a core technical challenge in live and pilot systems.

CBDC Access Models: Account‑Based vs Token‑Based

- In account‑based models, users are identified and accounts are tracked centrally; in token‑based models, ownership of tokens (like digital cash) suffices for validation.

- Of the 26 CBDCs studied, token‑ or “digital cash” models were common in pilot designs alongside two‑tier architectures.

- Token-based models can enhance privacy and offline usability, though they may complicate compliance and control.

- Account‑based models ease AML/KYC enforcement and integration with existing banking systems.

- Hybrid access models (mixing account-based and token-like layers) are being explored to balance privacy and oversight.

- Tiered wallet systems (low tier with minimal identity, high tier with full KYC) are being proposed to manage access and privacy trade-offs.

- Some pilots allow switching between token and account modes depending on transaction type or risk profile.

- The choice of access model strongly affects user experience, regulatory compliance burden, and architecture complexity.

Financial Inclusion Impact of CBDCs

- In 2025, 62% of central banks cite financial inclusion as a leading driver for issuing a CBDC.

- The UNDP proposes tiered wallets with low identity requirements to onboard unbanked populations.

- CBDCs can help deliver direct government transfers (social benefits, subsidies) more efficiently and with lower leakage.

- In underserved regions, CBDCs offer a way to reduce the cost of remittances and micropayments.

- The integrated data in CBDC systems can help create credit histories for previously unbanked users (with consent).

- Design trade-offs exist; overly strict ID requirements may deter low-income users, while lax controls raise the risk of misuse.

- Pilot reports suggest that merchant acceptance is a key bottleneck for inclusion; users will adopt only where merchants accept CBDC.

- Complementary measures (digital literacy, agent networks) remain essential to drive real inclusion, beyond simply deploying the technology.

The Role of CBDCs in Payment Systems

- CBDCs aim to modernize national payment rails, enabling real‑time settlement 24/7, reducing delays in clearing and settlement.

- In wholesale use cases, CBDCs can shorten settlement chains and reduce counterparty risk.

- Retail CBDCs may enable programmable payments, automated tolling, and conditional disbursements (e.g., stimulus).

- CBDCs might replace or reduce the reliance on private stablecoin systems for domestic payments.

- They can enable better integration of government, social, and commercial payments into a unified infrastructure.

- CBDCs provide central banks with more direct visibility into payment flows, improving oversight and resilience.

- In cross‑border contexts, CBDCs can plug gaps in legacy correspondent banking systems.

- Some central banks envision CBDCs coexisting with private digital payment systems, offering interoperability rather than displacement.

CBDC and Monetary Policy Impact

- CBDCs can provide direct transmission of monetary policy by controlling interest rates on CBDC balances (if interest-bearing).

- In theory, negative rates or tiered rates can be more precisely applied via CBDC than via bank deposits.

- CBDCs might reduce the dependence on banks as intermediaries in credit transmission, altering banking sector roles.

- Some models warn of disintermediation; users may shift funds from commercial banks to CBDC holdings.

- Central banks may impose holding limits or tiered interest rates to mitigate bank-run risks.

- CBDCs allow more granular fiscal stimulus distribution (instant, conditional transfers), which could strengthen policy tools.

- Simulations suggest that CBDC adoption could slightly increase demand for reserves and affect liquidity management.

- The net effect on inflation, money supply, and interest rates depends heavily on design choices and user adoption patterns.

Privacy and Security Statistics in CBDC Systems

- Data/privacy frameworks are central; IMF’s 2024 fintech note outlines trade‑offs between data use and privacy protection.

- Weak privacy designs could allow real‑time government visibility into individual transactions.

- Reports warn of risks like fraud, AML evasion, corruption, and cybersecurity threats in CBDC systems.

- A study finds that robust designs can reduce fraud and protect users, particularly vulnerable groups.

- Some pilot proposals plan for data minimization, encryption at rest, and selective data access controls.

- An IMF privacy‑data framework suggests wallet tiers, anonymized aggregates, and strict governance for data access.

- Central banks may deploy cyber resilience metrics, e.g., target 99.999% uptime, intrusion detection,and periodic audits.

- Pilot security incidents are rare in public reports, but simulation and red‑teaming are standard in most projects.

Frequently Asked Questions (FAQs)

About 134 countries are exploring or developing CBDCs, representing roughly 98 % of global GDP.

Global CBDC transaction count is projected to rise from 307.1 million in 2024 to 7.8 billion by 2031.

94 % of surveyed central banks are exploring a CBDC, and 47 % expect to issue one within five years.

The digital rupee reached ₹10.16 billion (~$122 million) by March 2025, growing 334 % from ₹2.34 billion in 2024.

Conclusion

CBDCs have moved beyond concept into tangible pilots and limited launches, guided by a complex mix of technology, policy, and inclusion goals. Central banks worldwide are wrestling with architecture choices, access models, privacy trade‑offs, and monetary impacts. While real adoption remains modest, the diversity of approaches, from token-based wallets to wholesale systems, signals that no one “right” design dominates yet. Still, one fact is clear: as CBDCs gain real-world traction, they will reshape how payments, monetary policy, and inclusion intersect in national and global systems.