In the heart of a remote fishing village in Indonesia, a local cooperative has started using blockchain to track the origin of its seafood, ensuring transparency for global buyers. Meanwhile, a Chicago-based pension fund just finalized a $500 million smart contract-based trade settlement in seconds instead of days. These aren’t isolated anecdotes; they’re markers of a global wave. Blockchain technology in 2025 isn’t just powering crypto anymore; it’s quietly rebuilding how we trust, trade, and transact.

This article breaks down the most up-to-date blockchain statistics for 2025, capturing its growth, use cases, and the evolving trust in decentralized ecosystems. Whether you’re a fintech strategist or simply blockchain-curious, these numbers help paint a clear picture of where this technology is heading.

Editor’s Choice

- The global blockchain market is projected to reach $96.3 billion in 2025.

- Over 47% of global enterprises now report blockchain in active deployment, not just pilot testing.

- Ethereum’s network surpassed 3 million daily transactions in Q1 2025, driven by a surge in L2 protocols and DeFi integrations.

- 87% of financial services firms globally are integrating blockchain in back-end operations to reduce cost and friction.

- $12.9 billion in total venture capital funding has been poured into blockchain startups in the first five months of 2025 alone.

- Tokenized assets have crossed the $5 trillion mark in market value, led by tokenized real estate and carbon credits.

- Blockchain developer jobs in the U.S. have risen by 29% YoY in 2025, with Solidity and Rust skills most in demand.

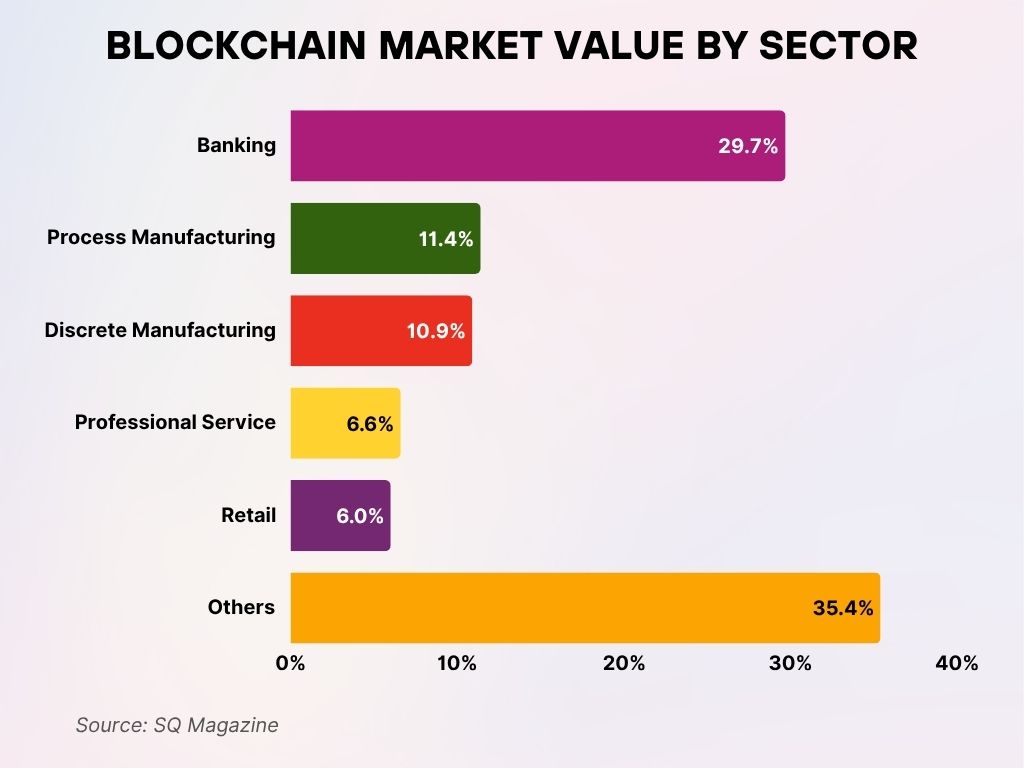

Blockchain Market Value by Sector

- Banking dominates the blockchain market with a 29.7% share, highlighting its critical role in driving decentralized finance innovations and secure transaction systems.

- Process manufacturing holds 11.4% of the market value, leveraging blockchain for supply chain transparency and real-time production tracking.

- Discrete manufacturing captures 10.9%, indicating strong adoption for improving part traceability and quality assurance across production lines.

- Professional services account for 6.6%, reflecting increasing reliance on blockchain for identity verification, smart contracts, and legal tech solutions.

- The retail sector contributes 6%, showcasing its use of blockchain in inventory management, fraud reduction, and enhancing customer trust.

- The “Others” category makes up the largest slice at 35.4%, emphasizing blockchain’s growing impact across diverse industries, including healthcare, logistics, and government operations.

Blockchain in Financial Services

- 87% of banks in G20 countries are using blockchain or DLT for clearing, settlements, or KYC processes.

- Digital asset custody services grew by 58% YoY in assets under custody, led by institutional inflows.

- $1.3 trillion in tokenized securities are actively traded on regulated platforms like SIX Digital Exchange and tZero in 2025.

- Blockchain-based bond issuance reached $412 billion in volume, with sovereign and green bonds leading adoption.

- Cross-border payment rails using blockchain (like RippleNet and JPM Coin) have cut costs by an average of 34%.

- Real-time settlements on blockchain have reduced clearing time from T+2 to T+0 in over 19 financial exchanges globally.

- KYC/AML blockchain services processed over 880 million identity verifications in Q1 2025.

- Programmable payments and conditional disbursements now make up 26% of enterprise smart contract executions in financial services.

- Trade finance digitization through blockchain reduced document fraud by 91%, according to consortium-led audits.

- Private permissioned blockchains, such as R3 Corda and Hyperledger Fabric, dominate B2B financial integration platforms in 2025.

Enterprise and Government Adoption Rates

- In 2025, 52% of Fortune 500 companies report having at least one blockchain project in production, not just in pilot.

- Government blockchain initiatives are active in over 71 countries, spanning digital identity, voting, tax systems, and land registries.

- Dubai, as part of its Blockchain Strategy, has digitized 100% of government documents, saving an estimated $1.1 billion annually.

- The U.S. Department of Defense is trialing blockchain for secure data transmission and logistics tracking across military supply chains.

- Latin America leads in public sector blockchain trials, with Brazil, Colombia, and Mexico piloting digital currency programs and identity chains.

- Public procurement platforms using blockchain reduced fraud and procurement delays by 38% across several EU member states.

- India’s Digital Locker, now blockchain-enabled, stores over 5 billion documents for public access and verification.

- South Korea mandates blockchain certification for certain fintech and digital ID applications starting Q2 2025.

- Among surveyed enterprises, 43% cite interoperability as their top concern when scaling blockchain systems.

- Municipal governments in Canada and Australia have launched tokenized green bond offerings to fund local sustainability projects.

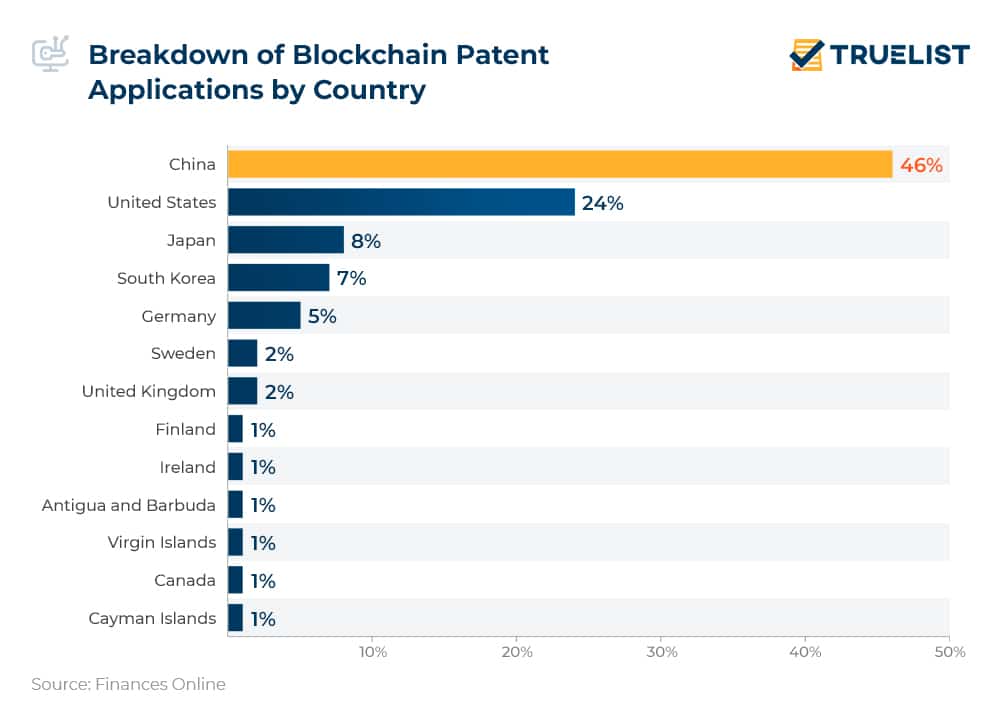

Global Leaders in Blockchain Patent Applications

- China leads the world in blockchain innovation, filing 46% of all blockchain patent applications, nearly double the next country.

- The United States holds the second spot with 24%, showing strong interest in securing intellectual property in blockchain tech.

- Japan contributes 8%, driven by its growing fintech sector and industrial automation solutions using blockchain.

- South Korea follows with 7%, reflecting its robust tech ecosystem and blockchain investments in gaming and finance.

- Germany accounts for 5%, marking its push for blockchain in manufacturing and logistics.

- Countries like Sweden and the United Kingdom hold 2% each, while Finland, Ireland, and smaller jurisdictions (e.g., Cayman Islands, Virgin Islands) each contribute 1%, highlighting global participation in blockchain patent activity.

Blockchain Technology Investment

- Global investment in blockchain-related startups reached $27.4 billion by mid-2025, already exceeding 2024’s full-year figure of $24.1 billion.

- Decentralized finance (DeFi) remains the largest investment sector, accounting for 31% of all blockchain venture deals.

- Corporate R&D budgets allocated to blockchain rose by 22% YoY, with big spenders including Microsoft, Oracle, and Alibaba.

- Over 920 active blockchain venture deals have been registered globally in 2025 so far, with the average deal size at $29.7 million.

- Decentralized AI and blockchain integration startups saw a sharp spike in funding, raising $3.1 billion in Q1 2025 alone.

- Blockchain M&A activity has increased by 44%, with over 112 deals closed in the first half of 2025.

- Crypto-focused hedge funds now manage a combined $83 billion in AUM, reflecting institutional confidence in on-chain finance.

- Retail investor participation in tokenized crowdfunding rounds surged 61% YoY, driven by fractional ownership of real-world assets.

- Blockchain infrastructure providers like node hosting, indexing, and RPC layer startups account for 18% of all funding rounds.

NFT and Web3 Blockchain Activity

- The NFT market size rebounded in 2025, now valued at $38.2 billion, with real-world utility NFTs leading growth.

- Gaming NFTs contribute over $9.4 billion in 2025 revenue, with popular platforms including Axie Infinity, Illuvium, and Mythos Chain.

- Music NFTs enabled artists to retain up to 85% of royalties, a dramatic shift from the traditional industry split.

- Decentralized identity NFTs (Soulbound tokens) are now used in 16% of verified DeFi platforms for KYC compliance.

- Top NFT marketplaces in 2025 by transaction volume include OpenSea, Blur, Magic Eden, and LooksRare, all of which now support multichain assets.

- Web3 wallets have reached over 240 million active users, growing by 19% YoY, primarily through embedded wallet SDKs in mobile dApps.

- Enterprise-branded NFTs, such as loyalty tokens and digital collectibles, are used by 28% of Fortune 100 companies for community engagement.

- Over 11 million people globally participated in Web3 governance voting using DAO platforms in Q1 2025 alone.

- NFT fraud incidents dropped by 35% YoY, largely due to advancements in smart contract auditing and dynamic metadata protections.

- Virtual real estate NFTs now have a combined valuation of $5.6 billion, with Decentraland and Otherside leading ownership density.

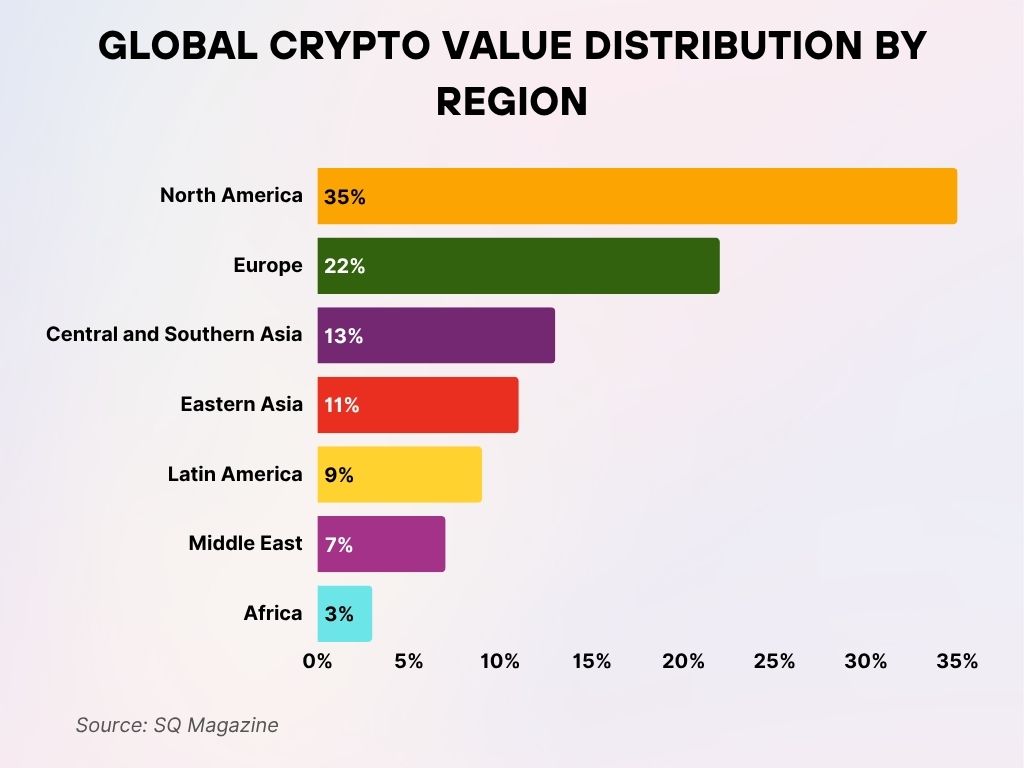

Global Crypto Value Distribution by Region

- North America leads the globe in crypto value received, accounting for 35% of total inflows, highlighting its dominance in both institutional and retail crypto adoption.

- Europe follows with 22%, reflecting a strong presence of regulated exchanges, fintech startups, and blockchain-friendly policies.

- Central and Southern Asia receive 13% of global crypto value, showing rapid growth in emerging markets with rising mobile-based crypto use.

- Eastern Asia secures 11%, fueled by strong tech infrastructure and high trading volumes despite regulatory uncertainties.

- Latin America holds 9%, signaling increasing use of cryptocurrencies for remittances, inflation protection, and financial inclusion.

- The Middle East captures 7%, driven by interest in blockchain for finance and logistics, and recent government-backed crypto initiatives.

- Africa, though currently at 3%, is a rising player leveraging crypto for cross-border payments and financial accessibility in underserved regions.

Blockchain Energy Consumption and Environmental Impact

- Bitcoin’s estimated annual energy usage dropped to 82 TWh in 2025, down 19% YoY, due to the adoption of more efficient ASIC miners.

- Ethereum’s switch to Proof-of-Stake continues to reduce global blockchain carbon emissions by 99.5% compared to its 2022 levels.

- Over 64% of Bitcoin mining operations now use at least some renewable energy, with Iceland and Paraguay hosting major green facilities.

- Blockchain-powered carbon marketplaces traded over $3.4 billion worth of verified carbon credits in the first half of 2025.

- Layer 2 scaling solutions have cut mainchain transaction load by 78%, indirectly reducing associated energy use.

- Solana, Near, and Algorand all boast average transaction energy costs of less than 0.001 kWh, making them among the greenest blockchains.

- Energy-as-a-service dApps allow residential solar users in 12 countries to tokenize and trade surplus power on-chain.

- Green mining certifications are now required in multiple U.S. states, including New York and California, to qualify for tax incentives.

- Blockchain for ESG tracking is deployed by over 240 multinational corporations, enhancing traceability for emissions and supply chains.

- University-led blockchain sustainability pilots in 2025 involve over 110 institutions experimenting with net-zero blockchain models.

Blockchain Security and Fraud Incidents

- Despite increased adoption, blockchain-based fraud dropped by 22% YoY globally, thanks to stronger smart contract standards and insurance tools.

- 2025 saw $1.76 billion in losses from blockchain exploits.

- Decentralized insurance protocols like Nexus Mutual and InsurAce processed over $960 million in claims in the first half of 2025.

- Real-time auditing protocols now secure over $40 billion in DeFi TVL, enhancing contract integrity through 24/7 automated scans.

- Multi-signature wallets are standard for 72% of DAO treasury management, greatly reducing single-point failures.

- Phishing attacks remain the top social-engineering method, accounting for 41% of fraud cases in crypto exchanges.

- Zero-knowledge proof systems are used in 25% of new ID and privacy-focused dApps, up from 16% last year.

- Bug bounty programs saw record participation, with over 8,500 white-hat disclosures made in Q1 and Q2 2025 alone.

- Chain monitoring tools, such as Chainalysis and TRM Labs, assisted in freezing over $620 million in stolen funds.

- Decentralized autonomous security councils (DASCs) are piloted across 12 ecosystems, using token-weighted voting to implement emergency security patches.

Blockchain Market Growth Outlook

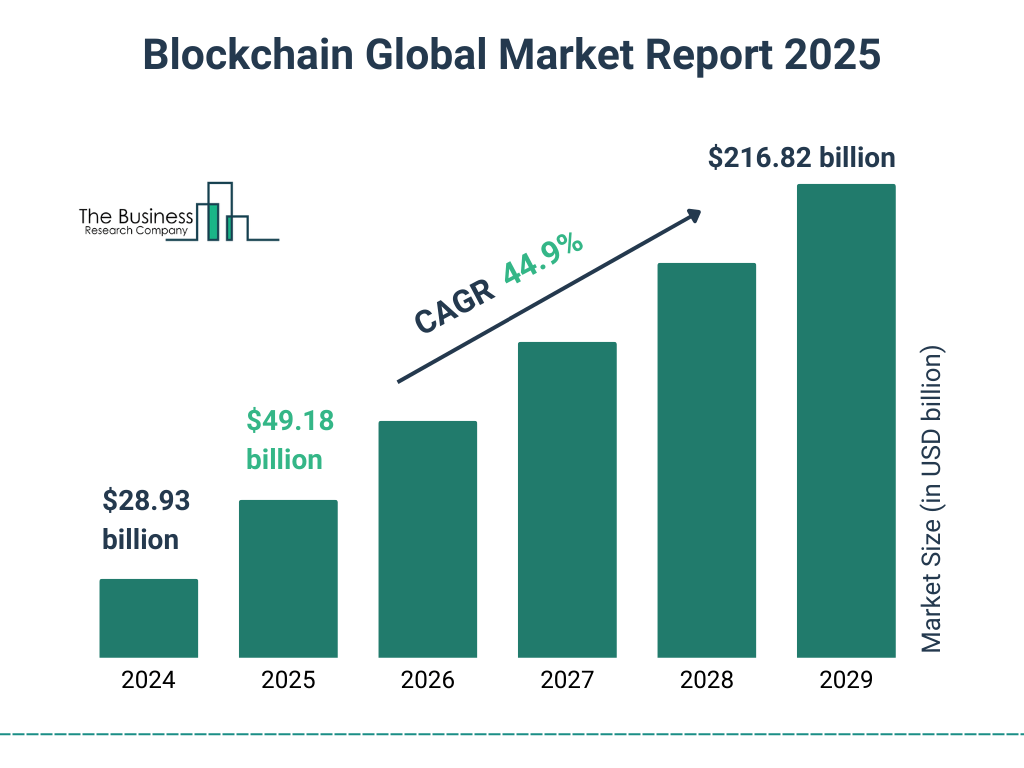

- The global blockchain market is projected to grow from $28.93 billion in 2024 to $216.82 billion by 2029.

- In 2025, the market is expected to reach $49.18 billion, reflecting rapid adoption across finance, supply chains, and digital identity.

- The industry is forecasted to grow at a CAGR of 44.9%, underlining blockchain’s transformation from emerging tech to core infrastructure.

This exponential rise highlights increasing enterprise investment, favorable regulations, and mainstream use cases driving long-term momentum.

Smart Contracts and Decentralized Application Usage

- As of mid-2025, over 6.1 million smart contracts are deployed monthly across major chains like Ethereum, Solana, and Avalanche.

- Decentralized applications (dApps) now serve more than 315 million unique users globally, growing 22% YoY.

- Finance and gaming continue to dominate dApp categories, accounting for 71% of user activity in 2025.

- Ethereum Layer 2 networks, including Arbitrum and Optimism, process 55% of all smart contract interactions, reducing fees and congestion.

- On-chain gaming ecosystems like Immutable X and Ronin record over 38 million active users monthly.

- Decentralized social platforms, such as Farcaster and Lens Protocol, boast 12.4 million active creators.

- Gasless transactions are now supported by 41% of popular dApps, improving accessibility for new users.

- The average transaction confirmation time for smart contracts on modern L1s has dropped below 1.6 seconds.

- AI-powered dApps integrating smart contracts now make up 11% of newly launched decentralized services in Q2 2025.

- OpenZeppelin, Chainlink Functions, and Superfluid remain top smart contract libraries used by developers in 2025.

- 80% of audited dApps now include automated exploit detection hooks to minimize contract vulnerability windows.

Public vs Private Blockchain Usage

- Public blockchains account for 62% of global transaction volume in 2025, compared to 38% on private and permissioned chains.

- Private blockchains dominate B2B use cases, including supply chains, health records, and internal financial systems.

- Ethereum remains the most-used public chain, followed by BNB Chain, Polygon, and Base.

- Hyperledger Fabric and R3 Corda are leading private blockchain frameworks adopted by banks, manufacturers, and pharma companies.

- Interoperable blockchain platforms, such as Polkadot and Cosmos, help bridge over $1.2 trillion in assets between public and private ecosystems.

- Data privacy mandates in the EU and APAC have driven a 19% increase in the deployment of permissioned blockchains in regulated sectors.

- Tokenized documents and certificates are more commonly issued on private chains for enterprise HR, compliance, and education.

- The average TPS (transactions per second) for public chains in 2025 reached 17,000 TPS, compared to 4,000 TPS for permissioned networks.

- Public blockchain fees decreased 43% YoY, driven by Layer 2 scaling adoption and increased competition among networks.

Top Use Cases of Blockchain Technology

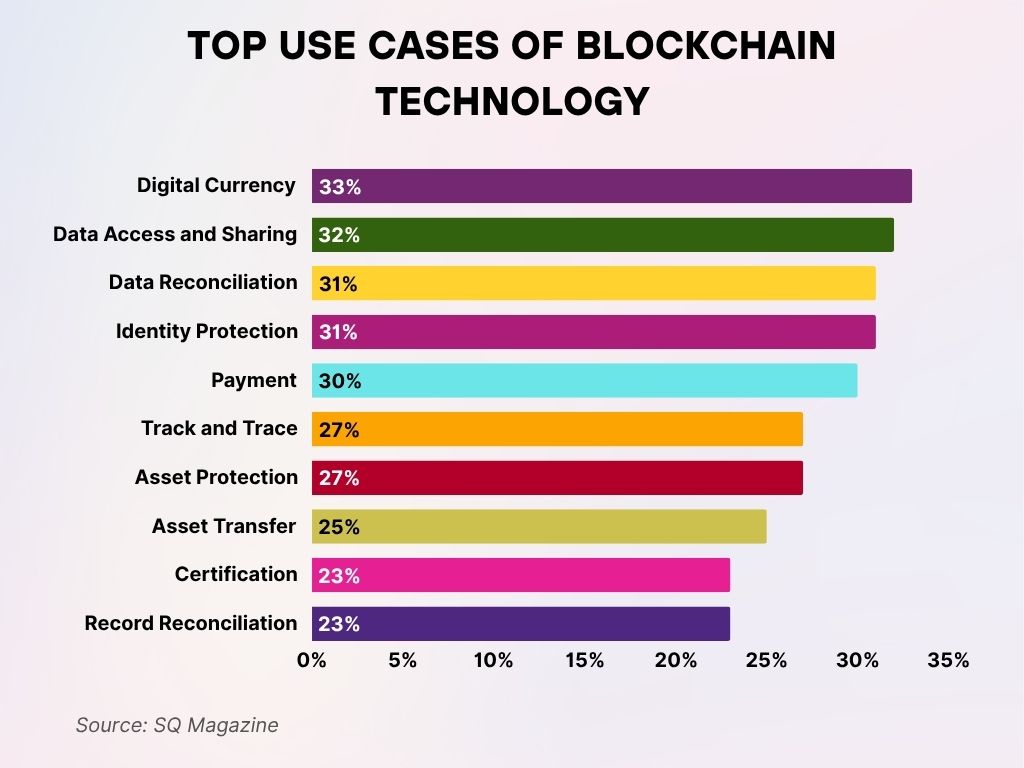

- Digital currency leads blockchain applications with 33%, showcasing its dominant role in powering cryptocurrencies and decentralized financial systems.

- Data access and sharing come in at 32%, reflecting how blockchain improves secure, permissioned data exchange across industries.

- Data reconciliation and identity protection are tied at 31%, emphasizing the demand for tamper-proof records and privacy-enhancing solutions.

- Payment solutions make up 30%, highlighting the continued integration of blockchain for faster, low-fee, cross-border transactions.

- Track and trace and asset protection each account for 27%, showing blockchain’s value in improving transparency and safeguarding digital/physical assets.

- Asset transfer stands at 25%, indicating the growing use of smart contracts and tokenization to streamline ownership changes.

- Both certification and record reconciliation are used by 23%, reinforcing blockchain’s credibility in maintaining accurate and auditable records.

Recent Developments in Blockchain Technology

- Zero-knowledge rollups (ZK-rollups) are now used in 35% of Ethereum transactions.

- Account abstraction, allowing smart contract wallets to mimic traditional ones, is supported by over 80% of Ethereum-compatible wallets.

- Intent-based transactions are in early beta on multiple chains, allowing users to authorize outcomes rather than exact steps.

- Decentralized physical infrastructure networks (DePIN) are being built for energy, storage, and location data, with Helium and Filecoin leading the trend.

- Quantum-resistance is now a priority, with chains like QANplatform and IronFish testing post-quantum cryptographic primitives.

- Cross-chain liquidity routing tools like Squid and LiFi have helped facilitate $1.6 trillion in interchain swaps in 2025.

- Modular blockchain architectures are gaining momentum, separating consensus, execution, and data layers for enhanced scalability.

- Blockchain oracles processed over 3 billion off-chain data calls monthly, with Chainlink and Pyth dominating the market.

- Intent-centric UX frameworks, such as Anoma and Espresso, are shifting dApp design from contract-level input to user-defined goals.

- Tokenized AI model training datasets are now in use by decentralized AI compute protocols, fueling privacy-first machine learning.

Top Crypto Exchanges by Trading Volume

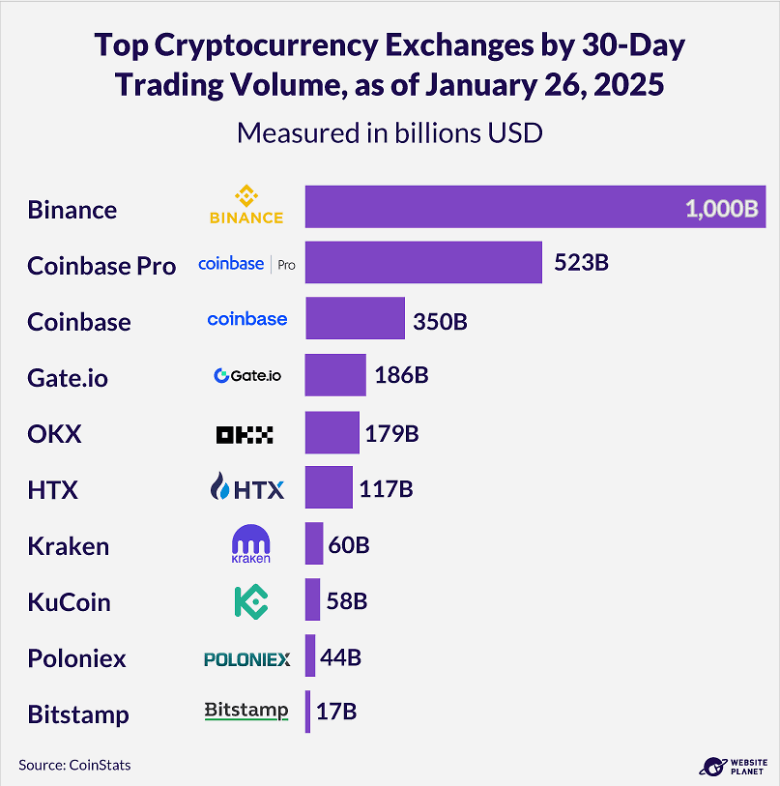

- Binance remains the undisputed leader with a massive $1,000B in 30-day trading volume, dominating the global exchange landscape.

- Coinbase Pro ranks second with $523B, underscoring strong institutional participation on the platform.

- Coinbase follows with $350B, driven by growing mainstream adoption in the U.S. market.

- Gate.io and OKX reported $186B and $179B, respectively, signaling significant traction in Asian and global markets.

- HTX (formerly Huobi) processed $117B, reflecting steady user activity despite regulatory pressure.

- Kraken and KuCoin posted $60B and $58B, serving active crypto traders and altcoin markets.

- Poloniex and Bitstamp recorded $44B and $17B, showing niche but consistent user bases in the industry.

Conclusion

Blockchain technology in 2025 has matured far beyond its origins in cryptocurrency. It now powers public infrastructure, underpins modern finance, drives sustainability innovation, and decentralizes access to digital ownership. The stats show a technology that’s becoming more scalable, more secure, and more usable across industries and regions.

From $96.3 billion in global market size to millions of new smart contracts deployed each month, blockchain’s momentum is undeniable. But what’s perhaps most compelling is the shift in mindset, organizations now view blockchain not just as a disruptive novelty but as a core part of digital transformation. The road ahead is less about hype and more about trust, infrastructure, and scalable value.