Blockchain is steadily gaining ground in healthcare finance, where secure, transparent transactions are a critical demand. In payment processing, claims settlement, and data exchange, blockchain’s immutable ledger offers new guardrails against fraud and leakage. For example, insurers are exploring smart contracts to automate reimbursements, while pharmaceutical supply chains are using them to trace drug provenance. This article will unpack the latest statistics behind blockchain’s impact on healthcare finance and show where the numbers are heading.

Editor’s Choice Statistics

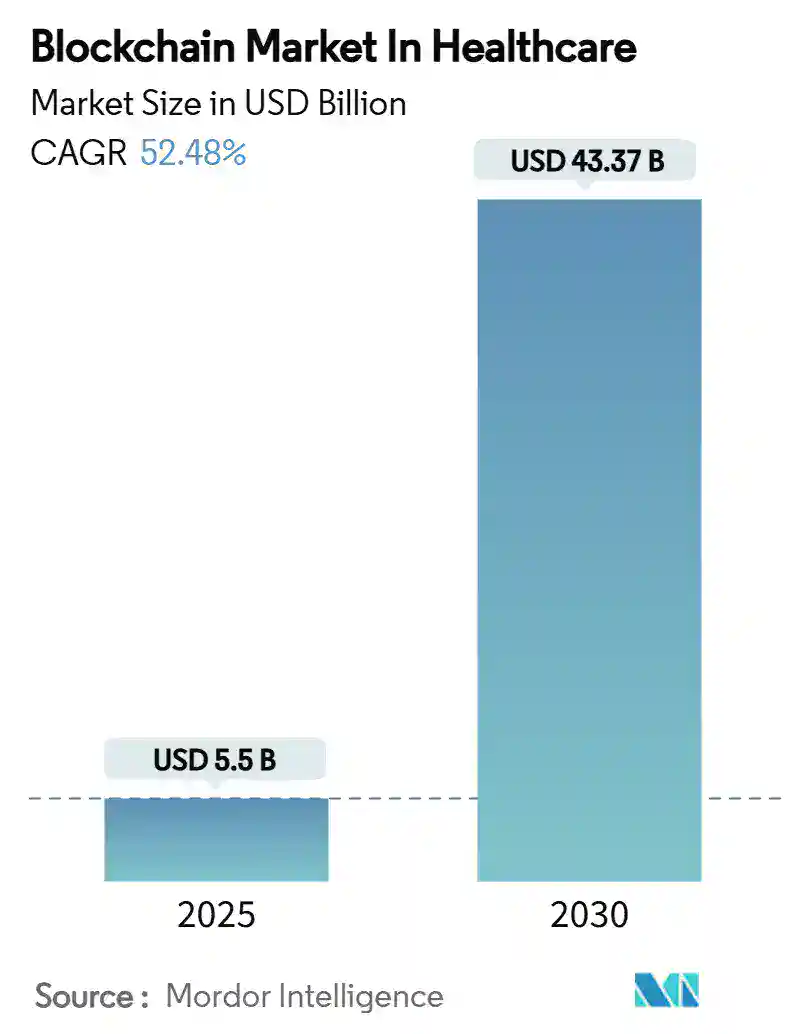

- The global blockchain in healthcare market is estimated at $5.5 billion in 2025.

- The same market is projected to reach $43.37 billion by 2030, implying a CAGR of ~52.48% between 2025 and 2030.

- In 2024, North America held ~43% market share in blockchain healthcare adoption.

- Venture funding to blockchain‐healthcare startups reached $2.5 billion in 2023.

- Over 60% of blockchain investments in healthcare finance are focused on payment processing and fraud prevention in 2025.

- Hospitals using blockchain for claims management report ~30% reduction in administrative time and costs in 2025.

- In Q1 2025, healthcare saw 125 million ACH transactions, an 8% increase year‑over‑year.

Recent Developments and Innovations

- The European Health Data Space (EHDS) regulation took effect in March 2025, standardizing health data exchange across EU states.

- A new consortium in March 2025 between Circular Protocol, Arculus, and IT Lab integrates blockchain into clinical networks for secure data sharing.

- Researchers propose hybrid models combining blockchain + cloud to manage consent and transparency in neonatal systems.

- SCALHEALTH architecture demonstrates parallel blockchains (health, financial) for IoT systems in healthcare, improving scalability and security.

- The integration of AI with blockchain is being actively explored, especially for secure predictive analytics and smart contracts in healthcare decision systems.

- Pilot trials in EHR sharing now embed zero‑knowledge proofs on blockchains to allow selective data visibility while preserving privacy.

- Several healthtech firms are pushing tokenization of payment flows, enabling programmable payments tied to care delivery milestones.

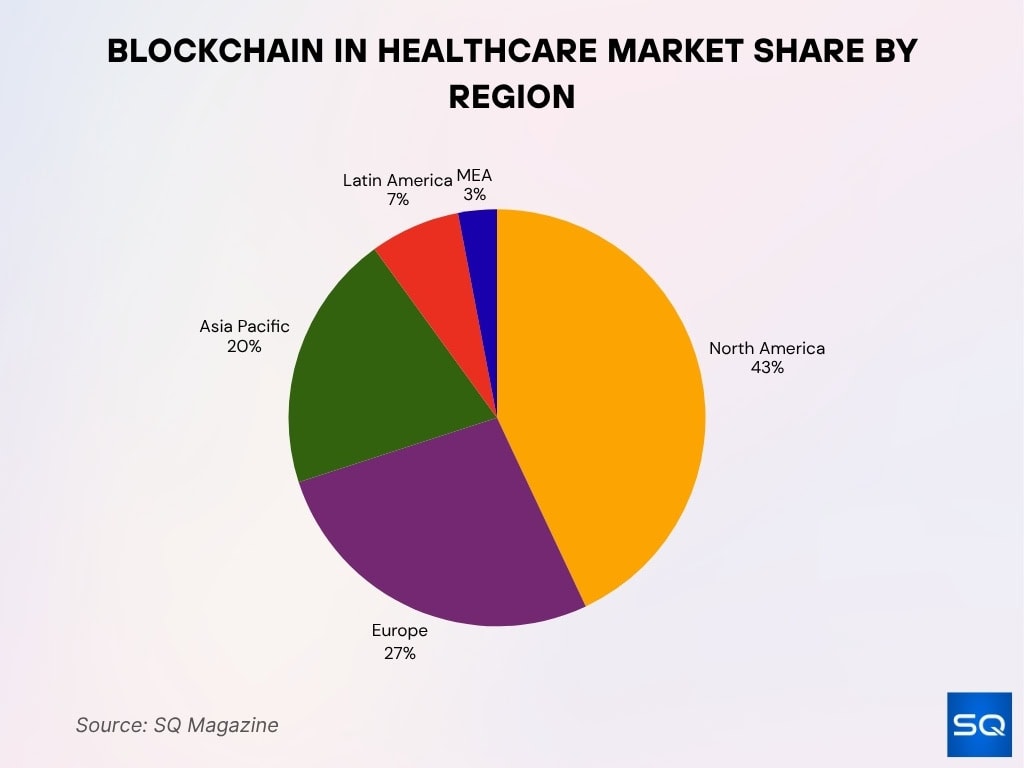

Regional Market Share of Blockchain in Healthcare

- North America leads with a 43% market share, driven by robust adoption of blockchain across hospital networks and insurance systems.

- Europe follows with 27%, supported by strong regulatory frameworks and widespread digital health initiatives.

- Asia Pacific holds 20%, fueled by rapid digital transformation and government-backed innovation in emerging economies.

- Latin America accounts for 7%, reflecting steady but accelerating integration of blockchain solutions in healthcare operations.

- Middle East & Africa (MEA) captures 3%, marking the early stages of blockchain adoption across regional healthcare ecosystems.

Market Growth and Size Overview

- The blockchain healthcare market is poised to grow from $5.5 billion in 2025 to $43.37 billion in 2030 (CAGR ~52.48%).

- Alternative estimates put the 2024 base at $2.9 billion, with a projection toward $52.6 billion by 2033 (CAGR ~36.3%).

- In a more bullish forecast, some sources estimate the 2025 market size at $15.86 billion, rising to $693.2 billion by 2035 (CAGR ~45.9%).

- The U.S. blockchain in healthcare market was valued at $2.88 billion in 2024 and is expected to grow steeply by 2034.

- North America dominated with ~43% share in 2024, leaving significant room for growth in Asia-Pacific and Latin America.

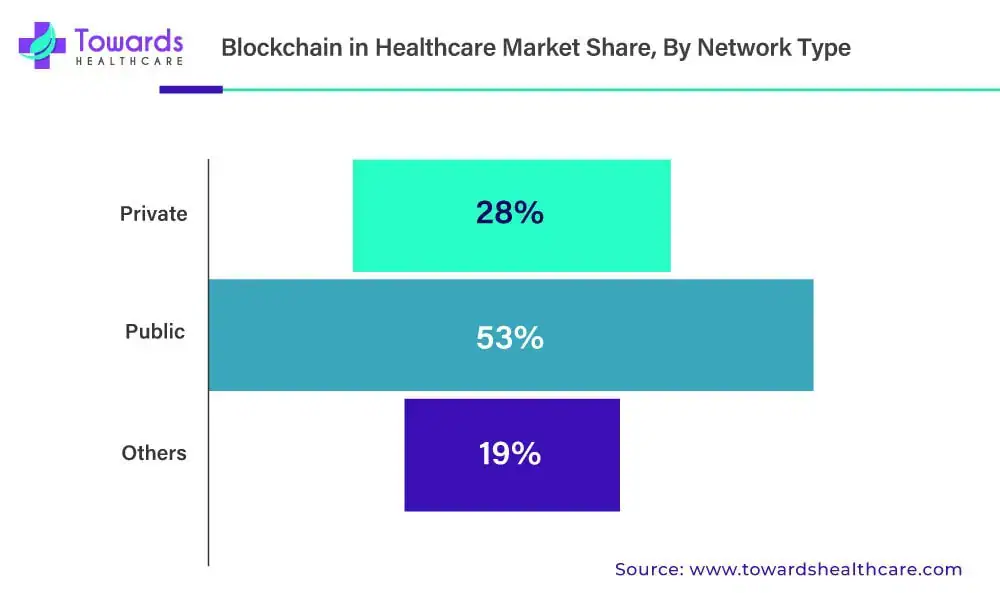

- The public network segment currently leads in adoption; however, permissioned/private blockchain usage is forecast to grow faster.

- Among applications, clinical data exchange/interoperability holds the largest slice (~46% share in 2024).

- The pharmaceutical supply chain segment is also a major driver, especially for drug serialization and tracking.

Key Investment Trends and Funding Statistics

- Venture capital investment into blockchain‐healthcare hit $2.5 billion in 2023, with continued momentum expected through 2025.

- Healthcare providers and insurers have invested nearly $1 billion in blockchain infrastructure (billing, claims platforms) by 2025.

- Over 60% of blockchain funding in healthcare is funneled toward payment processing and fraud prevention solutions.

- Key institutional investors include Andreessen Horowitz, Google Ventures, and Insight Partners.

- Projections forecast total investment in blockchain healthcare finance to exceed $10 billion by 2026.

- In 2024–2025, there’s been a shift from proof-of-concept pilots to enterprise-level funding rounds in healthcare blockchain firms.

- Private equity and corporate venture arms now prefer funding startups with regulatory alignment and clear ROI paths.

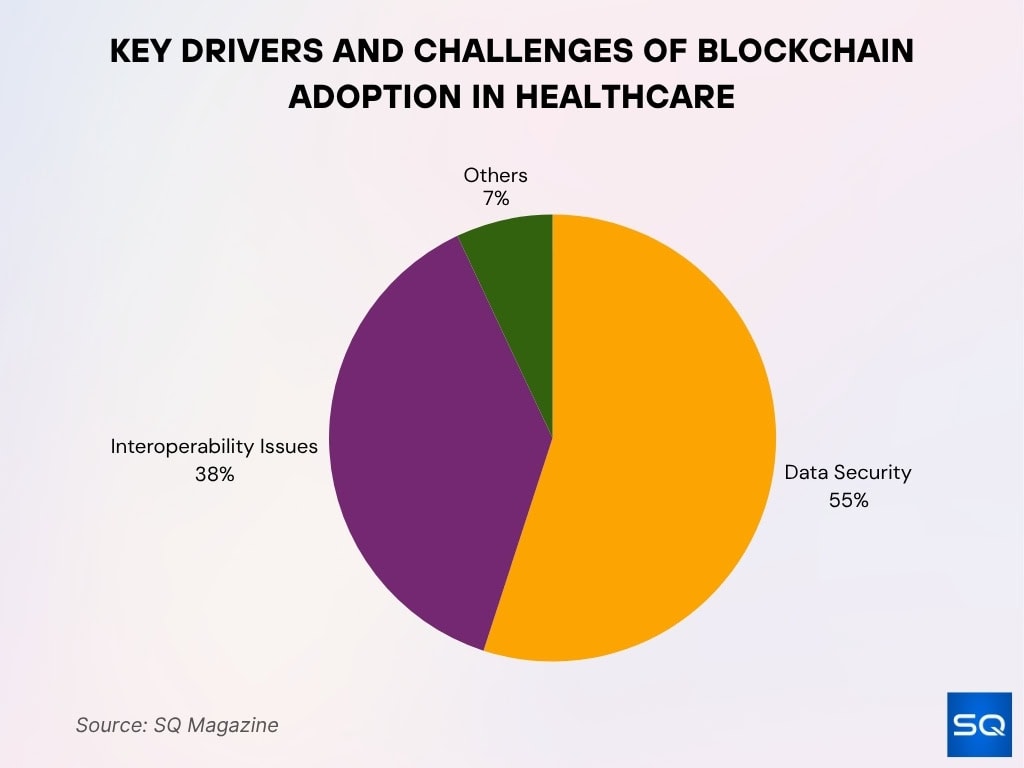

Key Growth Drivers and Challenges of Blockchain in Healthcare

- 55% of healthcare executives plan to adopt blockchain to enhance data security and patient privacy over the next few years.

- Interoperability remains limited, with only 38% of providers using blockchain for seamless data sharing across systems in 2025.

- Rising cyber threats have accelerated blockchain adoption following a 264% surge in ransomware attacks in 2024, leading to tougher HIPAA enforcement in 2025.

- Smart contracts are streamlining operations, helping automate billing and claims adjudication, and supporting the market’s growth toward $23.2 billion in 2025.

- Regulatory uncertainty continues to hinder smaller players as new HIPAA security rule proposals increase compliance costs and complexity.

- Cost-saving opportunities are expanding, with the blockchain healthcare segment valued at ~$194 million in 2025, reflecting efficiency-driven investments.

- Workforce shortages remain a key barrier, as the limited availability of skilled blockchain specialists slows adoption despite growing market demand.

Growth Drivers in Healthcare Blockchain

- Rising data breach costs in healthcare are a major driver, with the average cost per record breach in U.S. healthcare over $10,000.

- Fragmented patient data across multiple systems spurs demand for unified, auditable ledgers via blockchain.

- Increased regulatory pressure pushes organizations to adopt stronger data integrity measures.

- The shift to value‑based care encourages tighter coordination, for which transparent financial and clinical workflows enabled by blockchain are beneficial.

- Growth in telehealth and remote monitoring amplifies demand for secure, interoperable data sharing frameworks.

- Pharmaceutical companies need stronger anti‑counterfeit measures in supply chains, driving adoption of blockchain tracking.

- Investors increasingly favor projects with privacy-preserving features in healthcare.

- Advances in layer‑2 scaling and interoperability standards lower technical barriers to blockchain deployment.

- Public–private consortia and healthcare alliances help share the cost and risk of blockchain adoption across stakeholders.

Adoption Rates Among Healthcare Providers

- By 2025, roughly 30% of healthcare providers globally are expected to use blockchain‑enabled systems for insurance claims processing.

- Around 84% of healthcare executives already report interest or active evaluation of blockchain in financial or data applications.

- Actual full deployment remains low, with many institutions at the pilot stage.

- In the U.S., less than 10% of hospitals have publicly disclosed blockchain initiatives as of 2024.

- Among adopters, permissioned or consortium blockchains are preferred over public networks in ~70% of cases.

- Use is concentrated in large systems and academic medical centers rather than small clinics.

- The rate of adoption is higher in regions with strong regulation and digital health infrastructure than in emerging markets.

- Barriers like a lack of standardization, legacy systems, and cultural resistance slow broader adoption.

- In 2025, pilot projects outnumber full production deployments by a factor of ~3 to 1 in healthcare blockchain.

Blockchain in Healthcare Market Share by Network Type

- Public networks dominate the landscape with a 53% market share, driven by transparency, decentralization, and open-access healthcare data solutions.

- Private networks hold 28%, favored by hospitals and insurers for their controlled access and enhanced data privacy.

- Other network types represent 19%, reflecting consortium and hybrid models gaining traction for balancing openness and compliance needs.

Cost Savings and Efficiency Improvements

- Pilot studies show up to 30% reduction in administrative and claims processing time with blockchain adoption.

- In trials of blockchain in claims, insurers report 20% lower overhead costs relative to legacy systems.

- Supply chain traceability reduces counterfeit risk and wastage, saving 5–10% of logistics costs in pharma trials.

- Smart contracts automate reimbursements, cutting settlement cycles by 40–50% in pilot settings.

- Interoperable data exchange reduces duplicate testing, with savings estimated at $50–100 per patient over time.

- Blockchain‑enabled audit logs reduce manual audit labor by 25–30% in financial compliance processes.

- Error correction and fraud investigation costs drop by 10–15% with immutable ledgers.

- The ROI on pilot projects often breaks even within 2–3 years.

- Integrated blockchain systems may reduce IT maintenance and reconciliation costs by 15–20% versus legacy architectures.

Regulatory and Compliance Financial Impacts

- Compliance with data protection laws increasingly mandates auditability, driving demand for blockchain’s immutable record features.

- Penalties for noncompliance in U.S. healthcare can exceed $50,000 per incident, making traceability attractive.

- Regulators in the EU, the U.K., and Singapore are actively evaluating blockchain architectures for health data sovereignty frameworks.

- Audit readiness costs drop when organizations maintain immutable ledgers, with some firms reporting a 30% reduction in audit preparation efforts.

- Blockchain projects with built-in access control and encryption help satisfy storage minimization and data retention rules.

- Regulators are exploring blockchain registries for regulatory reporting, reducing duplication across oversight bodies.

- The cost of regulatory audits can be trimmed if blockchain provides mandatory traceability.

- Some jurisdictions offer regulatory sandboxes for blockchain in health, reducing compliance risk and costs for innovators.

- Failure to maintain proper audit trails in claims can trigger clawbacks, and blockchain’s immutable logs reduce that risk exposure.

Blockchain Market Overview in Healthcare

- The blockchain in the healthcare market is valued at $5.5 billion in 2025.

- It is projected to reach $43.37 billion by 2030, reflecting strong long-term expansion.

- The industry is growing at an impressive CAGR of 52.48%.

- Growth is driven by increasing demand for secure data management, transparent transactions, and cost-efficient healthcare operations.

Fraud Prevention & Claims Processing Metrics

- In the U.S., healthcare insurance fraud is estimated to cost $105 billion annually.

- Studies combining blockchain with machine learning report improved fraud detection accuracy by 10–15%.

- Smart contract–based multi‑signature claim systems ensure no single party can alter claims once submitted.

- In pilot systems using blockchain, claim processing error rates dropped by up to 25% compared to legacy systems.

- Blockchain’s immutable audit trail means fewer manual investigations, with firms reporting ~15% reduction in investigation costs.

- Some platforms enforce business rules via smart contracts, automatically rejecting suspicious claims.

- Analytical frameworks built on blockchain can trace claim lineage for improved accountability.

- In regions with pilot blockchain claims systems, reimbursement times have shortened by 30–40%.

- Blockchain helps coordinate multiple stakeholders, ensuring synchronized, real‑time claim updates.

Data Security & Breach Reduction Statistics

- In 2024–2025, the U.S. healthcare sector experienced over 700 data breaches, exposing more than 275 million records.

- The average cost of a healthcare data breach in 2025 is $7.42 million.

- The average time to identify and contain a breach in healthcare is 279 days.

- Some breaches in 2025 impacted 5.6 million individuals in a single incident.

- On average, in 2025, each data breach compromised 71,276 records.

- Blockchain pilot studies report 20–30% fewer unauthorized writes.

- Deployments with hybrid blockchain + encryption architectures help protect sensitive patient data.

- Audit trails in blockchain are resilient to tampering.

- Analyses project blockchain in health systems could reduce data breach costs by 10–15%.

Comparative Statistics vs Traditional Systems

- Traditional claims processing systems have error rates of 3–7%, while blockchain pilots reduce that to below 2%.

- Legacy systems require manual reconciliation, costing 10–15% of operational budgets.

- Traditional audit cycles may take weeks, while blockchain reduces audit lead times by ~30%.

- Data silos in legacy systems result in 5–10% inefficiency in resource usage.

- Blockchain ensures a consistent single source of truth, cutting sync latency.

- Blockchain embeds security at the application/data layer, making unauthorized tampering harder.

- Legacy investigations require merging logs; blockchain centralizes logs immutably.

- Blockchain systems may have 15–20% lower maintenance and auditing costs over a 5‑year horizon.

- Blockchain smart contracts minimize rule drift and oversight errors.

Return on Investment (ROI) Metrics

- Many pilot projects aim to break even within 2–3 years.

- Some organizations forecast an ROI of 150–200% over 5 years.

- Claim‑processing savings yield 5–10% year‑on‑year cost savings.

- Reconciliation costs can drop by up to 30%.

- Avoided breach costs can shift ROI dramatically.

- Some budget models show payback by year 3 or 4.

- Token incentives and data marketplaces may further boost ROI.

- Conservative projections estimate a 10–12% internal rate of return (IRR).

- Long‑term TCO may drop 15–20% compared to legacy systems.

Technological Trends (AI, IoT, Multi‑chain)

- Integration of AI + blockchain enables secure predictive analytics and anomaly detection.

- Multi‑chain architectures separate financial and health data, improving privacy and performance.

- The hChain architecture demonstrates IoT + blockchain integration for EHRs.

- Edge computing stores summaries on the chain, reducing data volumes.

- Use of zero‑knowledge proofs is growing for privacy preservation.

- Cross-chain bridges enable flexibility across public and permissioned networks.

- Smart oracles pull in regulatory and benchmark data in real time.

- Tokenization of claims or incentives allows micro‑payments linked to care events.

- Layer‑2 scaling (rollups, sidechains) enhances performance in high‑volume use cases.

Frequently Asked Questions (FAQs)

The market is forecast to reach $43.37 billion by 2030, growing from an estimated $5.5 billion in 2025 (implying a ~52.48% CAGR).

Over 60% of blockchain investments in healthcare finance are directed toward payment processing and fraud prevention in 2025.

Hospitals report up to 30% reduction in administrative time and costs using blockchain for claims management.

Blockchain in insurance claims could reduce fraudulent claims by up to 75%, potentially saving over $25 billion annually.

Conclusion

Blockchain in healthcare finance is no longer a speculative idea but an evolving reality, pilots are scaling, new architectures are emerging, and real dollars are being saved. When compared to traditional systems, blockchain offers stronger fraud resistance, auditability, streamlined claims, and meaningful data security gains. The ROI is increasingly compelling. As AI, IoT, and multi‑chain systems mature, blockchain will likely be foundational to next-generation health finance and data ecosystems. Read on to explore each section in full, with deeper context, analysis, and real-world case studies.