The peer-to-peer payments app Venmo has transitioned from splitting dinner tabs to powering everyday commerce. In the United States, it now handles billions in transactions for friends, families, and small businesses alike. For example, a college student may use Venmo to share rent with roommates, while a café accepts Venmo QR payments at the register. With rapid growth across metrics, the following sections offer a detailed look at its latest numbers, from user counts to payment volumes.

Editor’s Choice

- As of 2025, estimates show Venmo’s total payment volume has risen to over $325 billion.

- Venmo’s monetized monthly active users rose by 24% in 2024.

- The “Pay With Venmo” feature saw its usage and payment volume increase by more than 50% in early 2025.

- Merchants accepting Venmo grew, with PayPal reporting merchant growth of +50% year-over-year for Pay With Venmo.

- There are ~95.4 million active Venmo accounts in the U.S. as of recent data, suggesting traffic potential across web + mobile channels.

Recent Developments

- In Q1 2025, Venmo’s parent company, PayPal, reported that Venmo revenue grew 20% year-over-year.

- Monthly active cardholders using the Venmo debit card rose about 40% in that same period.

- Venmo’s “Pay With Venmo” payment volume surged more than 50% in early 2025.

- PayPal projects that Venmo’s debit-card payment volume will grow at a compound annual growth rate (CAGR) above 20%, with Pay With Venmo expected to grow ~2× that rate.

- In 2024, Venmo’s app downloads showed signs of deceleration: weekly download rates reached about 261K–289K in Q2.

- The social-commerce market in the U.S., which drives features like Venmo’s social feed, is forecast at $104 billion for 2025.

- The business-profile offering and merchant QR acceptance both scaled significantly, indicating Venmo’s shift toward commerce beyond peer transfers.

- Venmo introduced new recurring payment and split-rent features in 2025, used by millions of households.

Venmo User Insights and Behavioral Trends

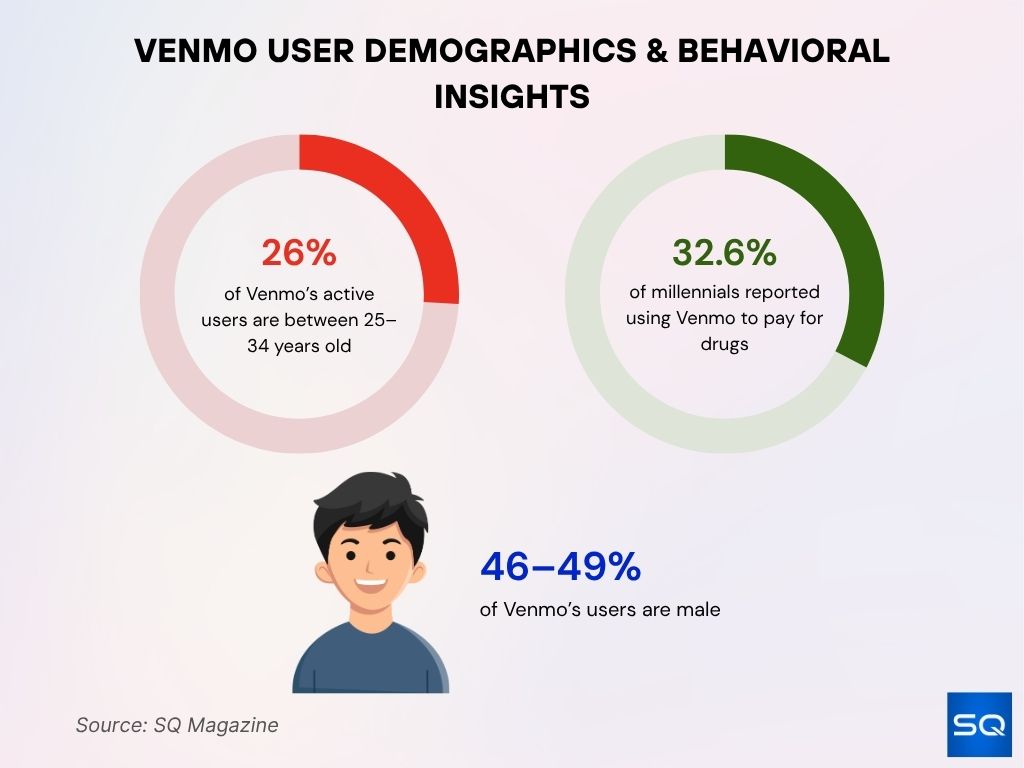

- 26% of Venmo users are aged 25–34, making it the platform’s largest user age group.

- 51–54% of users are female, while 46–49% are male, showing a near-equal gender split in 2025.

- 32.6% of millennials use Venmo for drug-related payments, including marijuana and prescription drugs, per multi-year fintech surveys.

Total and Annual Payment Volume

- In Q1 2024 alone, Venmo generated about $69 billion in payment volume.

- For 2025, estimates place TPV at $325 billion.

- Venmo’s payment volume growth continues despite competition, reflecting its strong peer-to-peer base and commerce push.

- Year-over-year (YoY) volume growth in 2024 was ~17%.

- When compared to the broader U.S. mobile payments market (which hit ~$7.39 trillion in 2023), Venmo holds a meaningful though still modest share.

- The migration of users into debit card and in-store transactions through Venmo is helping drive incremental volume beyond pure peer transfers.

Adoption Among Businesses

- A 2025 estimate from Statista placed Venmo SMB adoption closer to 28–35%, with some variation by industry.

- Over 2.55 million POS terminals now support Venmo in 2025.

- More than 608,000 websites in the U.S. list Venmo as a payment option in 2025.

- Among the “top 80%” of U.S. retailers, approximately 80% report that they accept Venmo.

- Businesses that introduced Venmo payments reported an average 19% boost in transaction efficiency in 2025.

- About 33% of SMBs cite integration with Venmo or similar as key to growth.

- Large and mid-sized businesses using Venmo’s business profile functionality have seen increased use of recurring payments and subscription models.

Global Digital Wallet Market Outlook

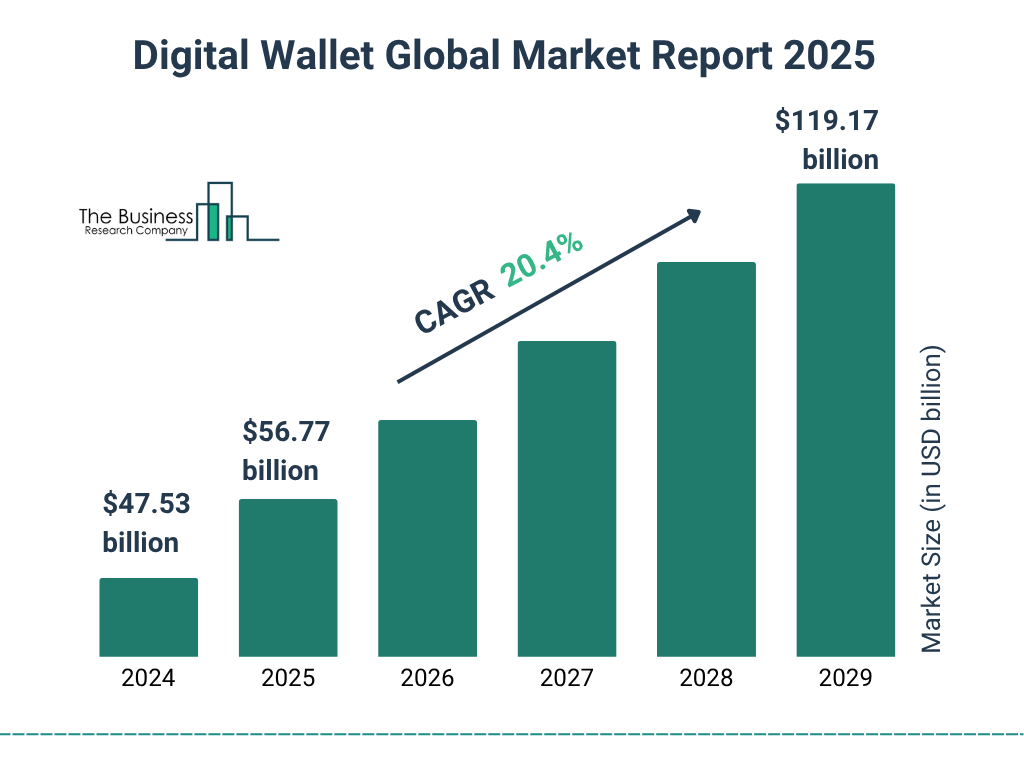

- The digital wallet market is projected to reach $119.17 billion by 2029, more than doubling its 2025 value.

- Market size in 2025 is expected to hit $56.77 billion, driven by mobile payments and e-commerce growth.

- 20.4% CAGR through 2029 underscores rapid adoption across global economies.

- Widespread trust in contactless and app-based payments is fueling steady, long-term expansion.

- By 2029, digital wallets will be core to global finance, cementing their role in mainstream financial systems.

Transaction Fee Statistics

- Venmo charges merchants for goods and services payments a fee of 1.9% + $0.10 per transaction for standard business profiles.

- Instant bank or debit-card transfers incur a fee of 1.75% (minimum $0.25, maximum $25) as of early 2025.

- Sending money via a credit card on Venmo typically incurs a 3% fee.

- For merchants using Venmo Business, some sources list a higher “seller transaction fee” rate of 3.49% + $0.49 per U.S. transaction in certain integrations.

- Standard transfers (1-3 business days) remain free for users when transferring to a linked bank account.

- For goods and services payments tagged as purchases by personal profiles, the same 1.9% + $0.10 fee applies even to non-business users selling items.

App Downloads

- Lifetime downloads of the Venmo app reached approximately 380 million by mid-2025, with about 11 million installs occurring in the first half of 2025.

- In Q3 2024, Venmo’s downloads declined 21% compared with the same quarter a year earlier.

- The app ranked 4th in the U.S. Google Play “Finance” category during recent months, with an estimated ~500k downloads in one month.

- While growth in new installs has softened, the existing user base size gives Venmo a strong base for future feature expansion.

- Mobile-payments category growth remains robust, globally over 299 billion app downloads expected in 2025.

- The slowing download rate suggests saturation in core peer-to-peer markets, underscoring the need for Venmo to diversify usage (merchant, social commerce).

Venmo Checkout Impact on Business Performance

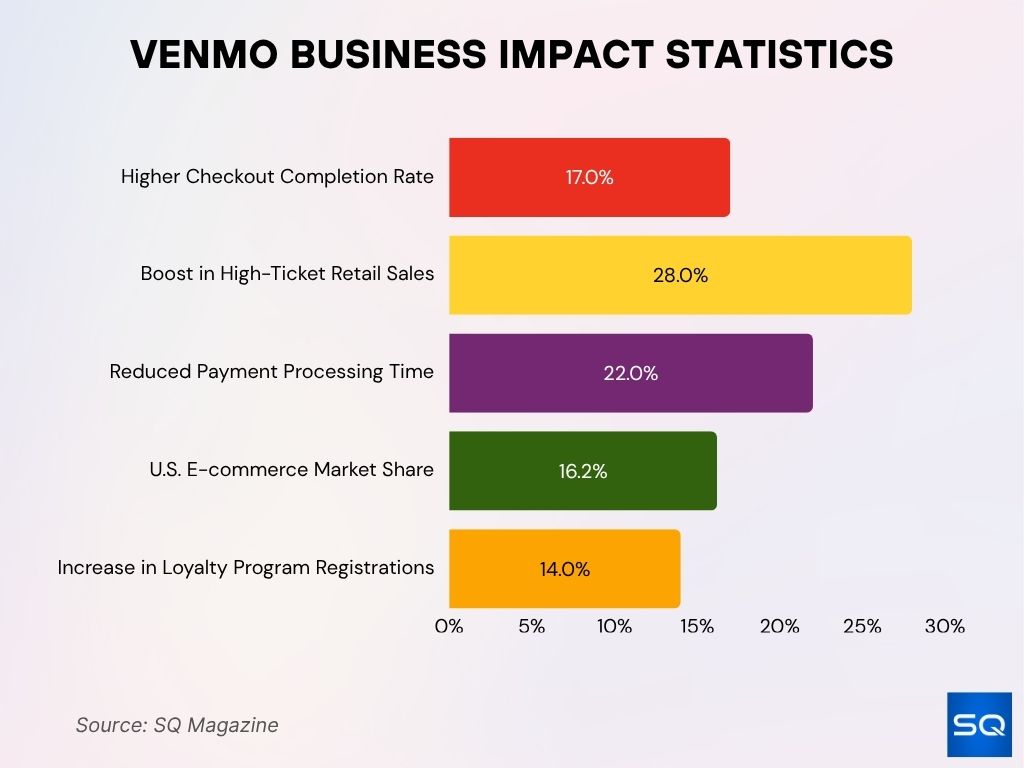

- Businesses saw a 17% increase in checkout completion rate after integrating Venmo in 2025.

- Venmo’s Pay Later+ feature boosted high-ticket sales by 28%, especially in fashion and electronics.

- Small businesses cut payment processing time by 22%, improving checkout flow in 2025.

- Venmo captured 16.2% market share at U.S. e-commerce checkouts in 2025.

- Large retailers using Venmo ads saw a 14% uptick in loyalty signups and repeat purchases.

Payment Methods

- In the U.S., digital wallets accounted for ~16% of payment method share in 2025, with Venmo among the key players.

- Among participating Venmo users, the majority fund payments via a linked bank account or debit card (fee-free) rather than via credit card (3% fee).

- Credit-card funding incurs a higher fee and appears to be used less frequently in business transactions, reflecting cost sensitivity.

- Instant-transfer methods (1.75% fee) are increasingly used by users who prioritise speed, standard bank transfers remain free and remain popular.

- Venmo’s integration into merchant and checkout flows allows users to link their preferred payment method and pay via Venmo seamlessly.

- The shift toward in-store (debit card, Venmo balance) and online wallet funding reinforces Venmo’s transition beyond peer-to-peer payments.

- Overall, the ease of funding methods and low friction are core to Venmo’s growth in commerce rather than simply P2P transfers.

- Because Venmo operates mainly within the U.S., currency‐conversion or cross-border payment method options remain limited compared with global wallets.

POS vs Online Payments

- For businesses that enabled Venmo at checkout, checkout completion rates improved by 17% on average in 2025.

- The average POS transaction value via Venmo in 2025 was reported at $47, while the average online payment value was $72.

- Venmo holds an estimated 16.2% market share of U.S. e-commerce checkouts in 2025.

- Among college campuses in the U.S., 73% now support Venmo for student payments and tuition services in 2025.

- The growth of the “Pay With Venmo” button for online checkouts contributed to more online volume versus in-store uptake.

- POS adoption continues to grow, and the number of terminals supporting Venmo has surpassed 2.55 million in 2025.

- Online e-commerce merchants integrating Venmo have cited a 14% lift in conversion when the option is displayed.

Venmo’s U.S. Market Share and Competitive Standing

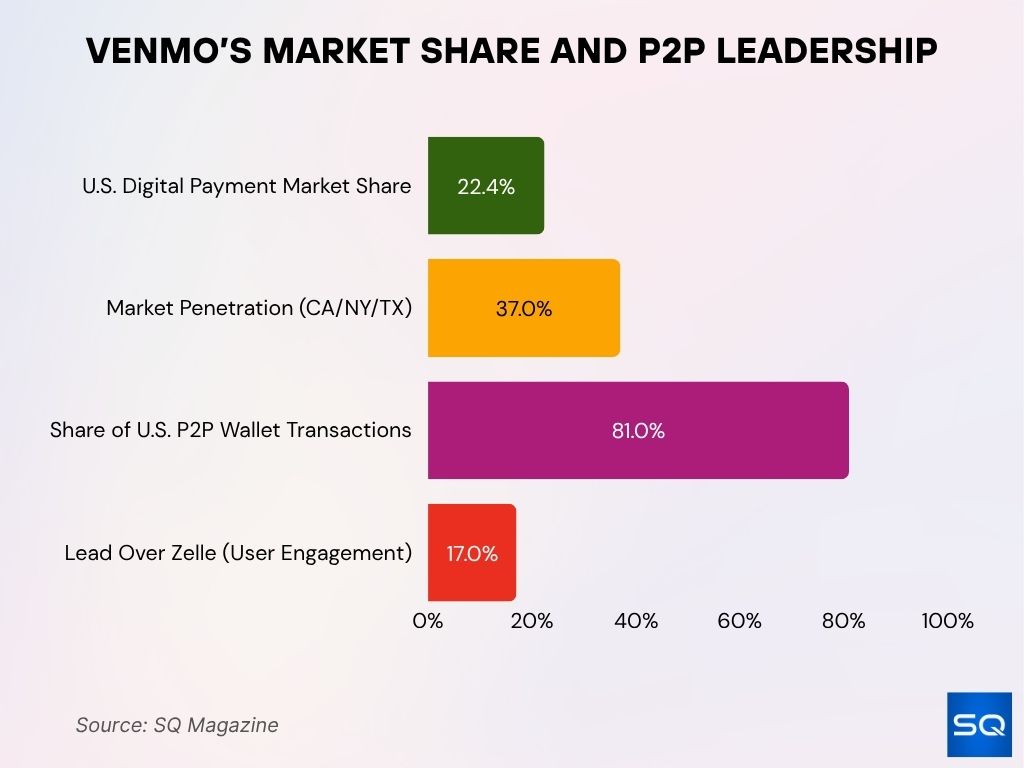

- Venmo held a 22.4% share of the U.S. digital payment market in 2025, remaining competitive with Apple Pay and PayPal.

- In California, New York, and Texas, Venmo led with 37% market penetration, dominating urban digital wallet usage.

- Venmo captured 81% of all U.S. P2P digital wallet transactions in 2025, sustaining its leadership in peer payments.

- Venmo outperformed Zelle by 17% in monthly user engagement as of Q2 2025.

Social Media Linked Payments

- In 2025, transactions linked to social-media features (peer posts + checkout interactions) represent about 20% of Venmo’s total payment volume.

- The social-payments market in the U.S. is forecasted at roughly $104 billion in revenue for 2025.

- Venmo reports that ~65% of users engage with the app weekly.

- Among Venmo’s users, about 68% are Gen Z or Millennial, groups that integrate social media and mobile payments.

- Brands leveraging Venmo’s social-feed style expect higher engagement. Venmo’s business brief cites a ~73% conversion rate when offering the “Pay with Venmo” option.

- The default social feed on Venmo (public or friends-only transactions) continues to drive network effects and new user signups via referrals.

- Social-linked payments (i.e., posts + purchases) are increasingly embedded into influencer and creator commerce, although precise data from Venmo remains broadly aggregated.

Marketing Distribution

- Venmo’s user-acquisition distribution comprised ~65.75% direct marketing, ~28.18% search, ~2.05% referrals, ~1.89% social, and ~1.96% email.

- Venmo’s parent company, PayPal Holdings, noted that monetized monthly active users increased ~24% in 2024, signaling effective marketing and product-monetization alignment.

- The brand’s appeal to Gen Z and Millennials, with ~68% of users in these cohorts, underscores a targeted marketing strategy toward younger demographics.

- Influencer campaigns and “social check-out” integrations form part of Venmo’s marketing ecosystem.

- Marketing focus has expanded from purely P2P transfers to merchant checkout flows (“Pay with Venmo”), boosting conversion and visibility.

- Marketing distribution efforts also emphasize features like Venmo debit card roll-out and QR-code in-store acceptance, broadening awareness beyond the usual peer-payment use cases.

Website Traffic Statistics

- Conversion data suggests high engagement; Venmo’s active users have cited a ~73% conversion rate in merchant contexts.

- Global mobile payments, which include Venmo, reached $7.39 trillion in transaction volume in 2023, hinting at large traffic and usage context, though not Venmo-specific.

- Web-traffic patterns show peaks around social-commerce features and campaign launches, aligning with Venmo’s social-feed and merchant-checkout growth strategy.

- Because Venmo integrates into merchant checkout flows (online and in-store), traffic to payment-gateway endpoints (webpages) has grown, though publicly available split data are limited.

Employee Count

- The total number of Venmo employees in 2025 is approximately 1,285.

- Venmo’s staff has grown from 500 employees in 2018 to the current figure, indicating ongoing expansion.

- PayPal, which owns Venmo, reported its employee count remained steady at 23,200 in 2025, suggesting Venmo’s staffing has increased in line with its growth.

- Venmo’s workforce is supported by major operations in North America, Europe, Asia, Africa, and Australia.

- The company’s strategic growth into merchandise, partnerships, and compliance implies staffing support in merchant services, risk management, and customer support.

- With Venmo’s monthly active cardholders up ~40% in Q1 2025, staffing for card operations and fraud monitoring likely expanded significantly.

Frequently Asked Questions (FAQs)

Around 20%.

Approximately 13.8 million monthly visits.

A rise of about 40%.

28%-35%.

Conclusion

The statistics for Venmo illustrate a significant evolution from a peer-to-peer transfer app into a broader-commerce and social-payments platform. Its integration of social media-style features, merchant checkout flows, and debit-card expansion underscores a strategic shift toward everyday payments. While growth in new downloads appears to moderate, transaction volume, merchant adoption, and user engagement continue to climb. For businesses and marketers, Venmo offers a compelling channel, but behind that promise lies a platform adapting to scale, compliance, and commerce-driven demands. Explore the full article to see how Venmo’s journey unfolds across revenue, adoption, fees, and more.