The battle between USD Coin (USDC) and Tether (USDT) is a defining narrative in the stablecoin landscape. Both are pegged to the U.S. dollar, but their growth, usage, and market positioning diverge sharply. In the U.S., both coins play significant roles in crypto trading, institutional treasury operations, and cross‑border payments. Globally, enterprises and DeFi protocols rely on USDC and USDT for liquidity and settlement. Whether you’re a trader, developer, or finance leader, understanding how these stablecoins compare is essential, and this article breaks down the latest data.

Editor’s Choice

- USDT remains the largest stablecoin worldwide, with a dominant share of total supply.

- USDC is growing faster in percentage terms in 2025 relative to USDT.

- USDT’s 24‑hour trading volume far exceeds USDC’s daily volume.

- Stablecoins hit over $27 trillion in transfer volume in 2024.

- USD‑denominated stablecoins now represent ~99% of all stablecoin supply.

- USDC has strong institutional adoption via payments and settlement integrations.

- Visa’s pilot program now allows USDC settlement with U.S. banks.

Recent Developments

- USDC’s circulating supply grew ~40% YTD in 2025, outpacing USDT’s ~14% growth.

- Google Trends data shows USDC search interest up 3% while USDT interest declined 25% in 2025.

- Visa announced live USDC settlement for U.S. banks, enhancing institutional utility.

- Circle completed its IPO in 2025 on the NYSE.

- Stablecoin transfer volume exceeded $27.6 trillion in 2024.

- Regulatory actions like the GENIUS Act in the U.S. offer clearer, stablecoin frameworks.

- DeFi protocols have expanded USDC integrations across major chains.

- Tether’s recent ventures outside crypto, like a sports investment bid, illustrated broader ambitions.

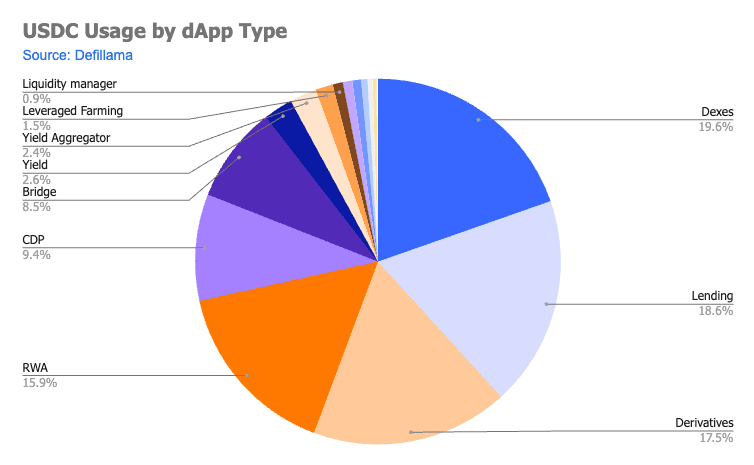

USDC Usage by dApp Type

- Dexes lead with 19.6% of USDC usage, driven by strong exchange integration.

- Lending platforms account for 18.6%, reflecting trust in borrowing protocols.

- Derivatives dApps use 17.5%, signaling growth in synthetic assets.

- RWA platforms hold 15.9%, highlighting real-world asset tokenization.

- CDPs take 9.4%, showing USDC’s role as stable collateral.

- Bridge protocols consume 8.5%, enabling cross-chain transfers.

- Yield-focused dApps use 2.6%, tied to interest-earning strategies.

- Yield Aggregators make up 2.4%, optimizing DeFi returns.

- Leveraged Farming represents 1.5%, used in amplified yield plays.

- Liquidity Managers have the smallest share at 0.9%, indicating niche use.

Overview of USD Coin and Tether

- USDC is a dollar‑pegged stablecoin launched by Circle in 2018.

- Tether (USDT) launched in 2014 and remains the largest stablecoin by supply.

- As of late 2025, USDT supply tops USDC by a wide margin.

- Both coins aim to maintain a 1:1 USD peg backed by reserve assets.

- USDC’s reserve model emphasizes monthly attestations and U.S. Treasury backing.

- Tether holds diverse reserves, including treasuries and other assets.

- The stablecoins operate on multiple blockchain networks for global compatibility.

- USDC’s ecosystem ties closely to Ethereum and Layer‑2 networks.

Why Compare USDC and USDT?

- USDC and USDT together account for nearly 90% of all stablecoin value.

- Total stablecoin market cap reached $300 billion, with USDT at $191 billion and USDC at $78.5 billion.

- Stablecoin transaction volume hit over $4 trillion year-to-date through August, up 83% from 2024.

- USDT monthly volumes peaked at $1.01 trillion in June, while USDC ranged to $1.54 trillion.

- 316 million unique addresses used stablecoins in the last 12 months.

- DeFi TVL surged to $237 billion in Q3, driven heavily by USDC and USDT flows.

- USDT daily trading volumes reached $40-200 billion, 5x higher than USDC’s $5-40 billion.

- ADGM in Abu Dhabi approved both USDT as AFRT and USDC with a full FSP license.

- USDT supply grew 25% to $175 billion in Q3 while USDC rose 68% amid volatility.

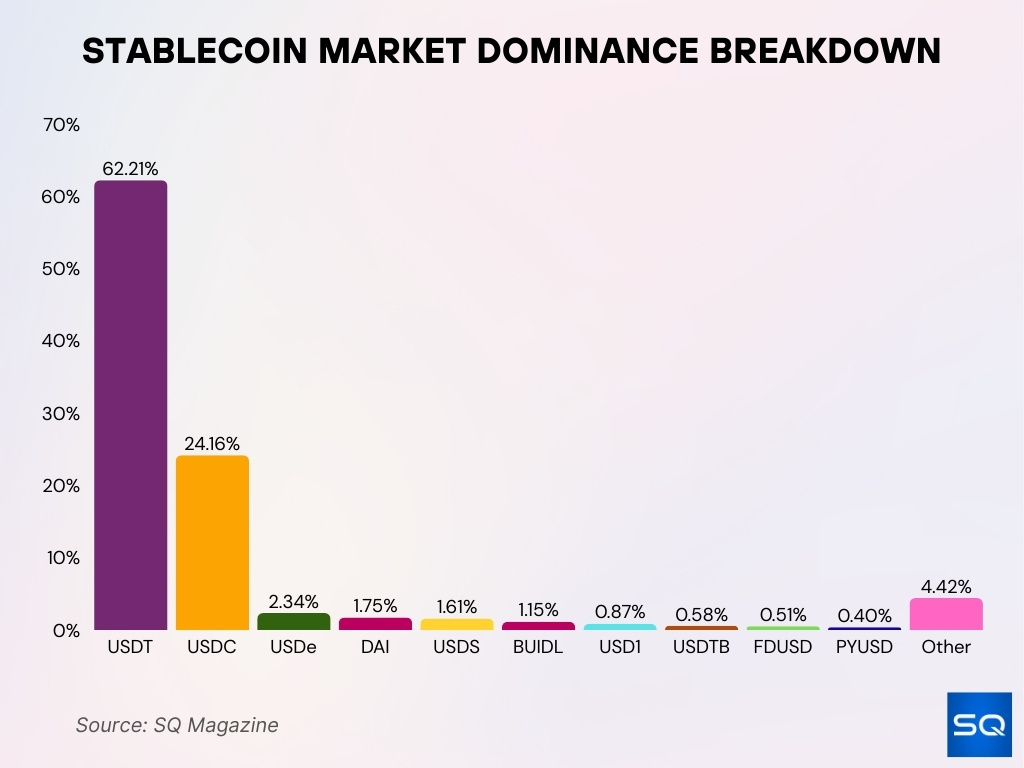

Stablecoin Market Dominance Breakdown

- Tether (USDT) leads with 62.21%, remaining the most used stablecoin worldwide.

- USD Coin (USDC) follows at 24.16%, driven by institutional trust and adoption.

- USDe holds 2.34%, gaining ground in the new stablecoin landscape.

- DAI accounts for 1.75%, reflecting demand for decentralized options.

- USDS and BUIDL have 1.61% and 1.15% respectively, showing growing traction.

- USD1, USDTB, FDUSD, and PYUSD have 0.87%, 0.58%, 0.51%, and 0.40% respectively, with niche adoption.

- Other stablecoins collectively hold 4.42%, capturing fragmented market share.

Circulating Supply and Total Supply Comparison

- USDT remains the largest stablecoin by market cap and supply.

- As of late 2025, USDT’s supply exceeds USDC by more than 2x.

- USDT’s supply grew ~9% in early 2025.

- USDC’s circulating tokens increased by ~68% through 2025.

- Over 72% of USDT’s tokens are on Ethereum and Tron.

- USDC’s majority supply remains Ethereum‑based.

- USDT wallets saw average balances rise to ~$1,250.

- New USDT wallet addresses grew 14.5% YTD, versus USDC’s ~5.8%.

Trading Volume and Exchange Listings

- USDT leads in daily trading volume with ~$52 billion.

- USDC’s daily volume averages ~$5.8 billion.

- USDT is listed on 470+ exchanges worldwide.

- USDC trades on 300+ exchanges with deep U.S. market integration.

- Volume spikes for USDT remain common in Asia‑Pacific markets.

- USDC’s trading is often concentrated in institutional corridors.

- Lower USDC volume volatility reflects specialized usage patterns.

- Tether’s market share in stablecoin trading volume exceeds 2/3 of the total volume broadly.

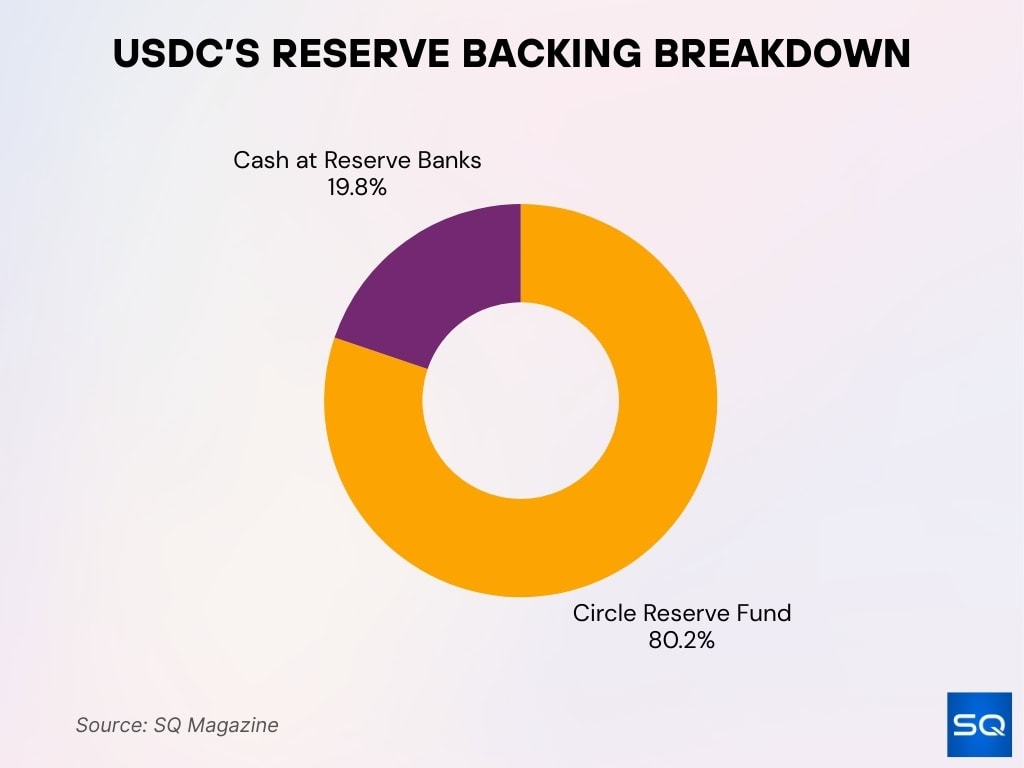

USDC Reserve Backing Breakdown

- Circle Reserve Fund accounts for 80.2% of USDC reserves, supporting stability and regulatory compliance.

- Cash at Reserve Banks makes up 19.8%, providing high liquidity and immediate redemption support.

Price Peg and Stability Metrics

- In 2025, USDC’s average daily deviation from its $1 peg was about ±0.002, reflecting strong stability performance.

- USDT’s average deviation in 2025 was ±0.006, showing wider fluctuation around $1 than USDC.

- Over 99.98% of USDC transactions in Q1 2025 cleared within 0.25% of the $1 peg.

- Tether’s price volatility index remained ~12% higher than USDC’s based on on‑chain spread metrics.

- USDC’s peg resilience often reflects its backing by liquid assets like cash and U.S. Treasury bills (approx. 90% in T‑bills historically).

- A weak credit rating from S&P for Tether in late 2025 heightened concerns about USDT’s backing quality and potential peg risks.

- Stablecoins, including USDC and USDT, are designed to maintain stable value relative to fiat, but fluctuations can occur during market stress.

- More institutional reserve holdings in safe, liquid assets correlate with better peg maintenance during volatile periods.

- USDC’s peg stability track record has been highlighted as near‑perfect compared with most other stablecoins in 2025.

Regulatory and Legal Developments

- U.S. Senate passed the GENIUS Act, establishing a federal framework for payment stablecoins with a 1:1 reserve backing and monthly audits.

- GENIUS Act limits issuers to subsidiaries of insured institutions, federal-qualified nonbanks, or state-qualified entities under $10 billion cap.

- More than 70% of global jurisdictions have advanced stablecoin policies, including licensing and reserve requirements.

- Hong Kong passed the Stablecoins Ordinance on May 21, 2025, effective August 1, with mandatory licensing for fiat-referenced stablecoins.

- EU MiCA regime fully implemented across 27 member states, mandating oversight for stablecoin issuers.

- 12 countries endorsed centralized stablecoins for cross-border trade amid regulatory acceptance.

- ADGM approved USDT as an Accepted Fiat-Referenced Token across 9 blockchains and granted Circle full FSP for USDC.

- 90% of stablecoin projects now publish regular reserve audits following enhanced transparency rules.

- 10 central banks announced collaborations with stablecoin providers for CBDC interoperability.

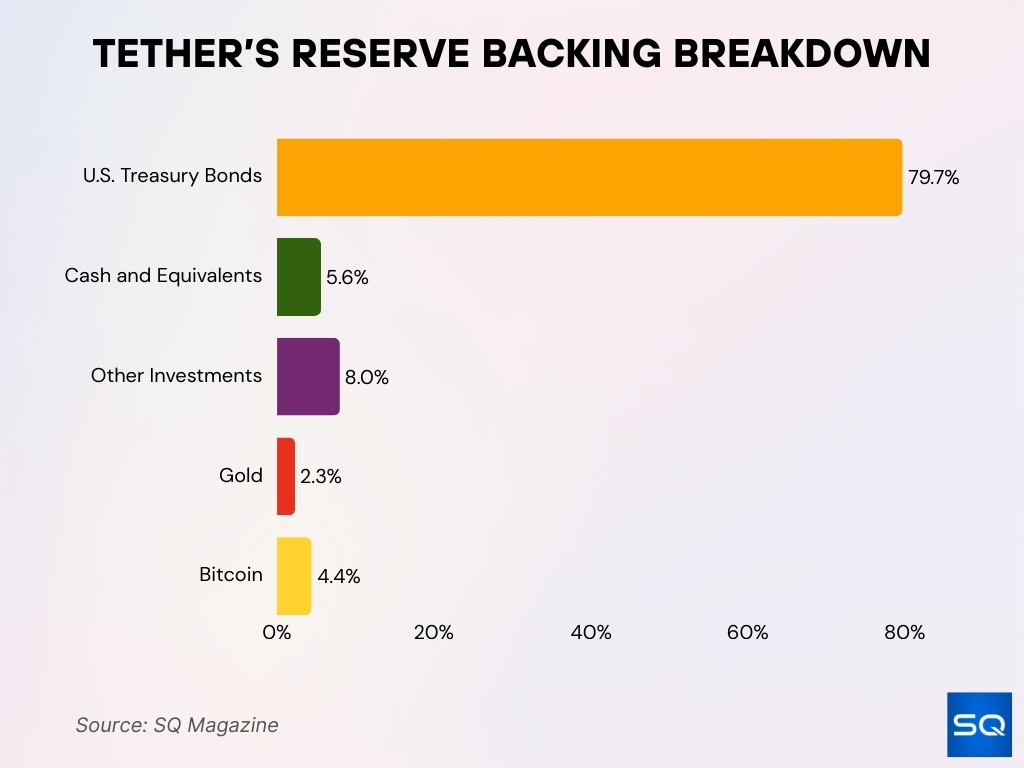

Tether Reserve Backing Breakdown

- U.S. Treasury Bonds make up 79.7% of Tether’s reserves, providing primary stability.

- Cash and Equivalents represent 5.6%, ensuring liquidity and redemption readiness.

- Other Investments account for 8.0%, covering various financial assets.

- Gold holdings contribute 2.3%, acting as an inflation hedge.

- Bitcoin makes up 4.4%, showing limited crypto exposure.

Smart Contract and Custodial Security

- Audited smart contracts experienced 98% fewer hacks than unaudited ones.

- Comprehensive stablecoin smart contract audits cost between $25,000-$150,000, depending on complexity.

- Leading auditors secured projects with market caps exceeding $100 billion.

- Multi-signature controls are adopted in 85% of institutional stablecoin protocols.

- $1.5 billion lost to smart contract exploits across DeFi platforms.

- Fixing vulnerabilities post-deployment costs 10x more than pre-launch audits.

- Projects with thorough audits raised 37% more capital from investors.

- 70% of stablecoin issuers implemented emergency pause functionality.

- AI agents identified exploits worth $4.6 million in 405 vulnerable contracts.

- Custodial breaches compromised 3 major stablecoin reserve systems YTD.

Controversies and Legal Incidents

- Tether has faced multiple regulatory investigations over reserve transparency since 2019, shaping ongoing scrutiny in 2024, 2025.

- In 2021, Tether settled with the New York Attorney General for $18.5 million, a case that still influences market trust metrics.

- Despite past issues, no major enforcement action against Tether occurred in 2024 or 2025, signaling regulatory stabilization.

- USDC avoided major legal penalties but experienced reputational stress after the Silicon Valley Bank collapse in 2023, when it briefly de‑pegged.

- During that event, USDC fell to ~$0.88 before recovering within 72 hours, highlighting systemic banking risk exposure.

- Surveys in 2024 showed 42% of U.S. institutional respondents viewed USDC as more transparent than USDT.

- Tether’s ongoing disclosures report over 80% of reserves in cash and cash‑equivalent assets in 2025.

- Academic research links higher controversy frequency with higher trading discounts for USDT during market stress.

DeFi and Protocol Performance

- USDC remains the most widely used stablecoin in U.S.‑centric DeFi protocols, including Aave and Compound.

- As of mid‑2025, USDC accounts for ~55% of stablecoin TVL in Ethereum‑based DeFi, while USDT dominates on Tron.

- USDT leads in total DeFi transaction count, driven by high‑frequency usage in Asia.

- USDC’s DeFi usage rebounded strongly in 2024, 2025, with TVL growth of ~38% year over year.

- USDT liquidity pools typically show higher yields but higher volatility, reflecting trader‑driven demand.

- USDC pools demonstrate lower slippage during high‑volume swaps, favored by institutions.

- DeFi stress tests in 2024 showed USDC maintaining peg stability better than USDT during rapid liquidations.

- Both stablecoins remain critical to on‑chain lending, derivatives margining, and yield strategies.

Cross‑Chain and Interoperability Statistics

- USDT operates natively on 10+ blockchains, with Tron holding the largest share of supply.

- Over 45% of all USDT supply circulates on Tron, driven by low fees and remittance usage.

- USDC supports Ethereum, Solana, Base, Arbitrum, and Optimism, with expanding Layer‑2 presence.

- In 2025, USDC cross‑chain transfer volume grew ~32% year over year.

- USDT cross‑chain transfers account for over 60% of stablecoin bridge volume globally.

- USDC increasingly uses native issuance rather than wrapped bridges, reducing exploit risk.

- Cross‑chain security incidents declined by ~18% in 2024, improving confidence in stablecoin mobility.

- Interoperability remains a key differentiator, with USDT prioritizing reach and USDC prioritizing compliance.

Institutional vs Retail Usage Metrics

- Institutional traders favor USDC, with ~64% of U.S. hedge funds preferring USDC for settlement.

- USDT dominates retail usage, especially in emerging markets and peer‑to‑peer transfers.

- Retail wallets hold smaller average USDC balances (~$420) compared to USDT (~$1,200).

- USDC is increasingly used in B2B payments, payroll pilots, and treasury management.

- USDT sees higher usage in crypto‑to‑crypto trading pairs, especially outside the U.S.

- Institutional on‑chain volume using USDC grew over 30% in 2025, driven by regulated entities.

- Retail USDT transaction counts remain 3x higher than USDC globally.

- Usage data suggests USDC aligns with compliance‑first strategies, while USDT emphasizes access and liquidity.

Pros, Cons, and Strategic Positioning

- USDT daily trading volumes range $40-200 billion, 5x higher than USDC’s $5-40 billion.

- USDT captured 82.5% of Q3 trading volume, up from 77.2% in Q2.

- USDC institutional OTC turnover surged 2900%, claiming 74.6% of global volume.

- USDT market cap reached $175 billion in Q3, growing 25% YTD.

- USDC DeFi TVL dominates at $7.3 billion across protocols.

- USDC reserves hold $9.2 billion liquidity buffers versus USDT’s $6.7 billion.

- Enterprises use both stablecoins, with USDT for liquidity and USDC for compliance.

Frequently Asked Questions (FAQs)

Around 59–64 % of total stablecoin capitalization.

Together, they hold ~82–90 % of the global stablecoin market capitalization.

Stablecoin transaction volume surpassed $27 trillion per year.

Conclusion

The choice between USD Coin and Tether reflects more than market cap or trading volume; it reflects strategy. USDC appeals to institutions seeking regulatory clarity, predictable behavior, and integration with traditional finance. USDT, meanwhile, remains the backbone of global crypto liquidity, especially in retail‑driven and emerging markets. As stablecoins continue shaping payments, DeFi, and digital finance, understanding these differences helps users align each asset with their risk tolerance and operational needs.