Uniswap is set to transform its tokenomics and governance with a bold proposal that introduces protocol fees and a massive UNI token burn.

Quick Summary – TLDR:

- Uniswap proposes to activate protocol fees and immediately burn 100 million UNI tokens from its treasury.

- The initiative, called UNIfication, aims to align incentives and create long-term value for UNI holders.

- Over $985 million in fees have already been generated this year, with expectations to surpass $1 billion in 2025.

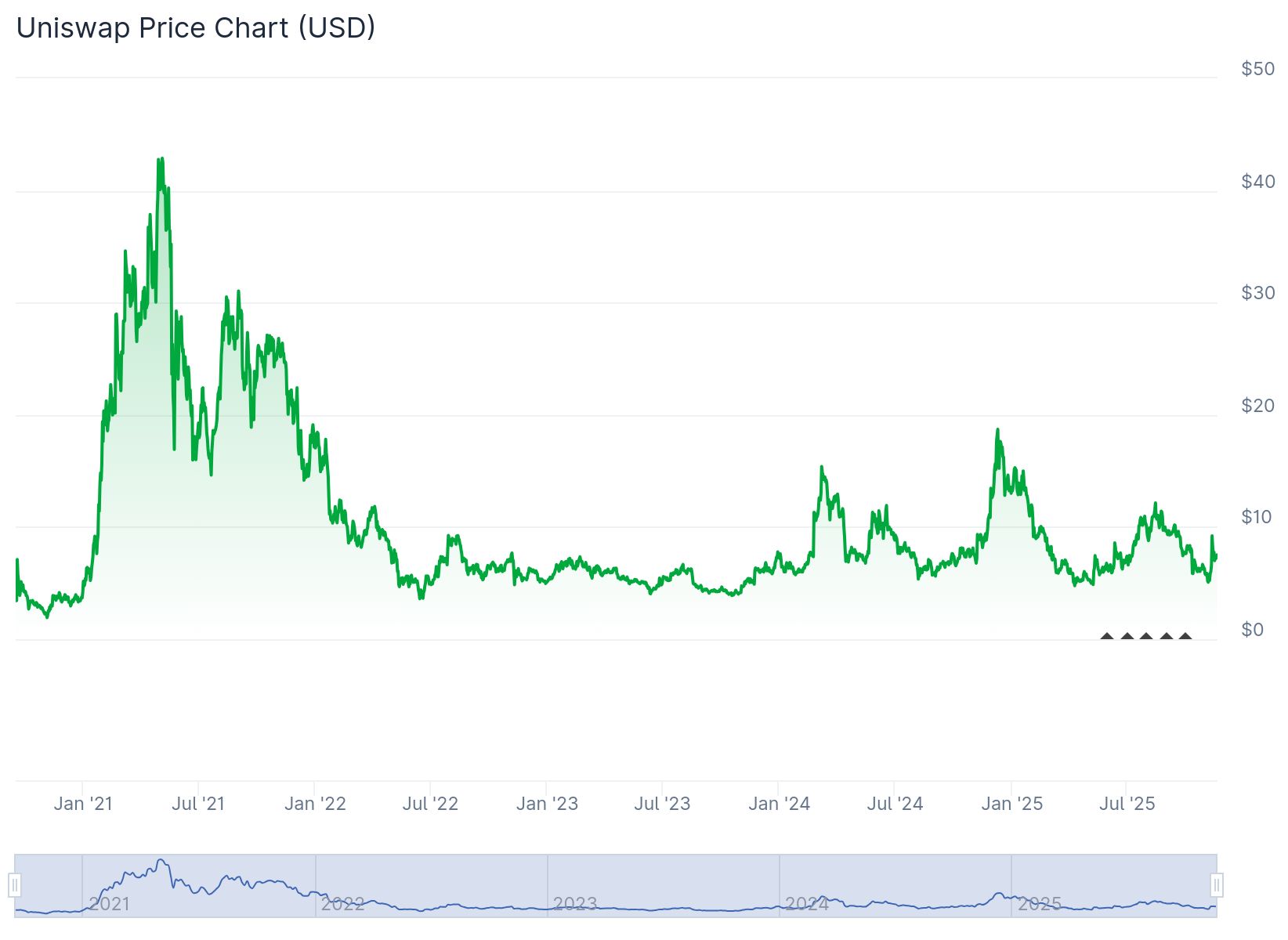

- The move has already driven UNI’s price up by more than 50 percent, drawing strong interest from the crypto community and institutions.

What Happened?

Uniswap Labs and the Uniswap Foundation jointly proposed a governance initiative titled UNIfication that activates protocol fees for the first time and introduces a significant token burn mechanism. This shift comes amid growing regulatory clarity in the United States and seeks to better align incentives across the Uniswap ecosystem.

Just submitted the UNIfication proposal for temperature check 🦄

— Hayden Adams 🦄 (@haydenzadams) November 18, 2025

If this vote passes, the only step left is the full onchain votehttps://t.co/rNkdanOOag

Uniswap’s Deflationary Makeover

Under the UNIfication proposal, Uniswap will activate a 0.05 percent protocol fee from each trade on the platform. This fee will come out of the existing 0.3 percent total, with 0.25 percent still going to liquidity providers. All collected protocol fees will be used to buy and burn UNI tokens, reducing supply and adding long-term value pressure.

As a symbolic reset, 100 million UNI tokens from the treasury, roughly 16 percent of circulating supply and worth around $800 million at current prices will be burned immediately upon proposal approval. This amount reflects what could have been burned if fees had been active since Uniswap’s inception.

A Revenue Model for the Future

Uniswap has already generated over $985 million in fees year-to-date, averaging nearly $93 million per month. After a slow start to the year, monthly fees have grown by about 17 percent each month since Q2. October alone brought in $132 million, one of the highest months in 2025.

If governance fully activates the v3 fee switch, the protocol could redirect 10 to 25 percent of LP fees back to Uniswap, unlocking potential annual revenues in the high hundreds of millions. Under UNIfication, all such revenue would be directed to the UNI burn system unless the community votes otherwise.

More Than Just a Burn

The proposal also outlines structural changes:

- Sequencer fees from Unichain, Uniswap’s Layer-2 network, will go toward UNI burns.

- A new Protocol Fee Discount Auction (PFDA) will auction off fee discounts while internalizing MEV, adding another revenue layer.

- Uniswap Labs and the Foundation will merge governance efforts, moving teams and resources under a shared development strategy.

- Frontend, wallet, and API fees will be turned off, focusing efforts solely on protocol value.

- Governance-owned Unisocks liquidity will be migrated from v1 to v4, then burned, permanently locking the token’s supply curve.

Market Reaction and Community Response

The crypto market reacted quickly. UNI’s price jumped from $7.24 to over $10.22, with trading volumes spiking to $787 million. Within two hours of the proposal announcement, UNI gained over 35 percent in value, boosting its market cap by $1.6 billion.

Institutional interest has surged, with names like Arthur Hayes of BitMEX reportedly accumulating. The crypto community on X has been abuzz, debating everything from the passive income potential to concerns over centralization and governance control.

Voting on the proposal is taking place on Snapshot from November 17 to 24, and if passed, the changes could go live by Q1 2026.

SQ Magazine Takeaway

I love seeing a protocol as influential as Uniswap take a bold step to rethink its economics. Burning 100 million tokens is not just a headline, it’s a signal to every UNI holder that value creation and alignment are top priorities. The fee activation gives Uniswap a real shot at long-term sustainability, while the token burn adds a deflationary twist that investors crave. Of course, there are tradeoffs and regulatory questions ahead, but this kind of structural shift is exactly what mature DeFi needs right now.