Stablecoins, cryptocurrency tokens pegged to traditional currencies, are no longer niche assets. With the passage and enforcement of Markets in Crypto‑Assets Regulation (MiCA) in the EU, stablecoins now sit at the intersection of digital finance and formal regulation. From cross-border payments to institutional liquidity tools, the stakes are high on both sides, for innovation and for stability. Below, we present key statistics and initial insights into how MiCA is shaping the stablecoin landscape.

Editor’s Choice

- The global stablecoin market capitalization surpassed $300 billion by Q3 2025, up 14% since the end of Q2.

- As of mid‑2025, stablecoins collectively processed over $4 trillion in on‑chain yearly volume, an 83% increase over the same period in 2024.

- Within the EU, as of late 2025, more than 50 stablecoin issuers are projected to be MiCA‑compliant.

- About 84% of stablecoin issuers report higher compliance costs under MiCA in 2025.

- Around 95% of active stablecoin issuers now publish quarterly audited reports, per MiCA requirements.

- In Europe, the shift toward euro‑denominated stablecoins is accelerating; euro‑backed tokens are expected to rise from 12% in 2023 to 30% of the EU stablecoin market in 2025.

- Global stablecoins now comprise roughly 7.5% of the total crypto‑asset market capitalization, underscoring their growing share of the broader crypto ecosystem.

Recent Developments

- ESMA published over 5 delegated regulations detailing complaint-handling under MiCA by early 2025.

- MiCA Level 2/3 technical standards began enforcement as of February 2025.

- MiCA became fully applicable on December 30, 2024, with transitional regimes lasting until mid-2026.

- By mid-2025, 53 MiCA licenses had been granted across the EU.

- Of these, 14 licenses were to stablecoin issuers, with the rest given to crypto-asset service providers.

- Germany, the Netherlands, and Malta lead with 28 licenses combined, showing geographic concentration.

- Platforms had to cease non-MiCA-compliant stablecoin trading by the end of Q1 2025.

- Around 85% of EU crypto-asset service providers had applied for or secured MiCA licenses by mid-2025.

- MiCA compliance boosted institutional trust, with 90% of firms reporting increased confidence in regulated crypto services.

- EU custodians reported safeguarding over €520 billion in crypto assets under MiCA rules by 2025.

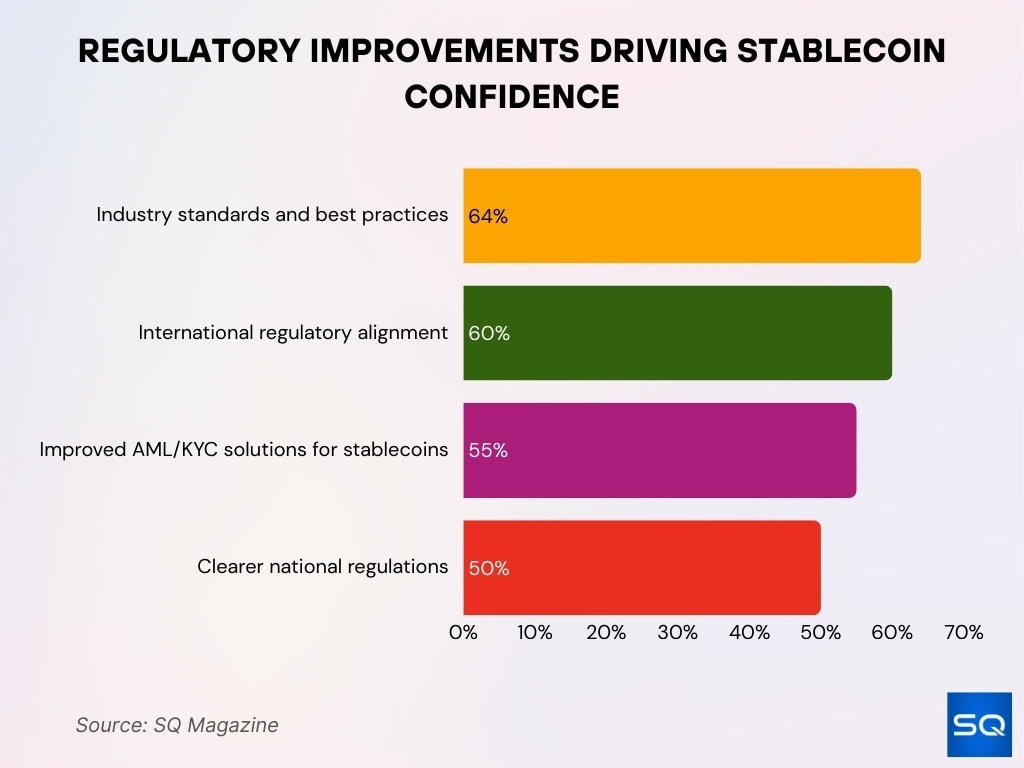

Regulatory Improvements Driving Stablecoin Confidence

- 64% of companies cite industry standards and best practices as the top driver of growing trust in stablecoins.

- 60% say global regulatory alignment boosts adoption, especially under cross-border frameworks like MiCA.

- 55% believe stronger AML and KYC systems are increasing institutional trust in stablecoin ecosystems.

- 50% emphasize clearer national rules as critical for stablecoin adoption and long-term market stability.

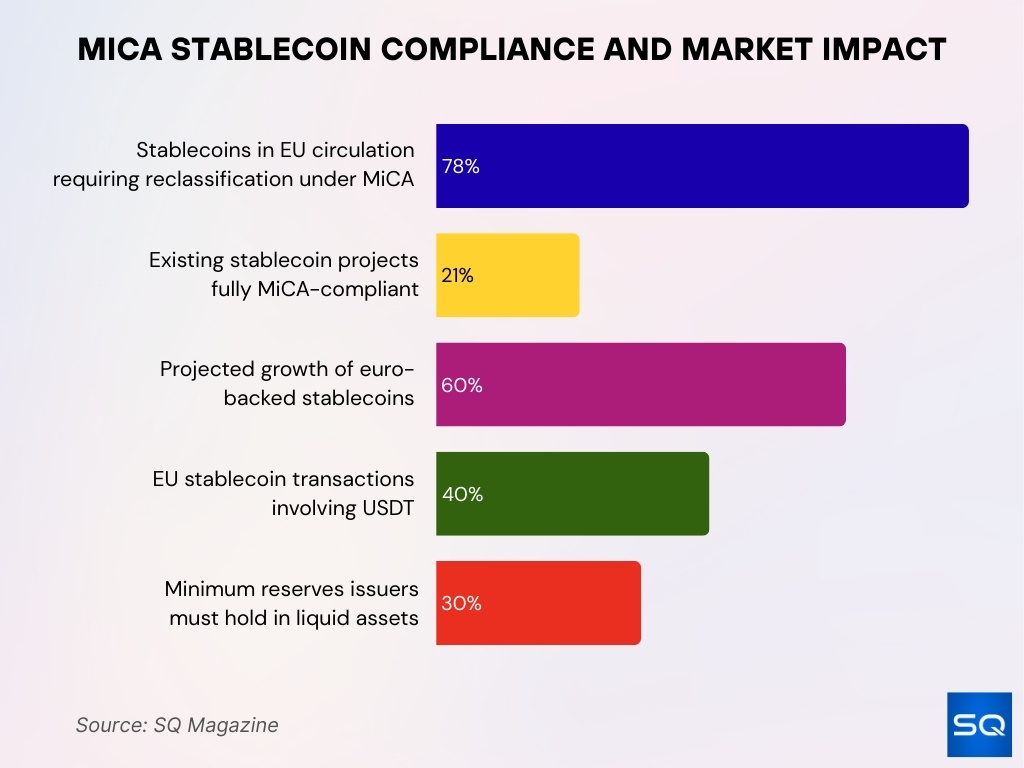

Overview of MiCA and Its Impact on Stablecoins

- Regulators say 78% of stablecoins in EU circulation require reclassification under MiCA by 2025.

- MiCA mandates at least a 30% reserve in bank deposits for all stablecoin issuers.

- Only 21% of existing stablecoin projects fully complied with MiCA standards by early 2025.

- MiCA bans algorithmic stablecoins, eliminating 60% of poorly backed tokens by 2025.

- 92% of stablecoin issuers maintain full reserve backing under MiCA rules.

- Investors report a 50% rise in confidence due to MiCA’s clearer stablecoin framework.

- Euro-backed stablecoins are projected to increase by 60% in 2025 as regulatory clarity boosts adoption.

Regulation of Stablecoin Crypto Assets in MiCA

- MiCA became fully applicable, including stablecoin rules, on December 30, 2024.

- Over 1,200 crypto firms submitted MiCA license requests by mid-2025.

- Approximately 45% of stablecoin issuer applications were rejected due to strict MiCA standards in 2025.

- MiCA mandates 100% reserve backing for 92% of stablecoin issuers by mid-2025.

- MiCA’s technical standards (Level 2/3) started rolling out on January 1, 2025.

- About 78% of stablecoins in the EU require reclassification under MiCA by 2025.

- The European Central Bank holds veto rights over large stablecoin issuers in 2025.

- MiCA bans algorithmic stablecoins, reducing non-compliant stablecoins by 60% in 2025.

- Up to 1,000 firms linked to stablecoin issuance are expected to register under MiCA by 2025.

- National competent authorities across the EU began issuing MiCA licenses to crypto-asset service providers on December 30, 2024.

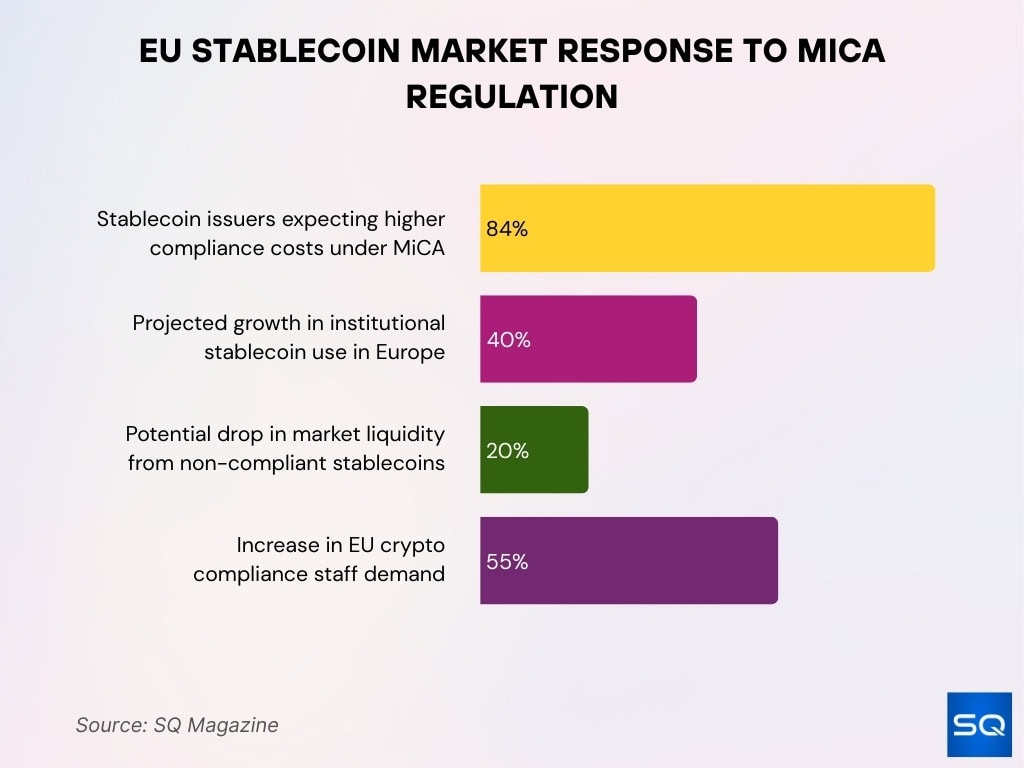

Market Impact of MiCA Regulation on Stablecoins

- 84% of issuers expect increased compliance costs under MiCA in 2025.

- Institutional stablecoin use in Europe is set to grow 40% in 2025 due to regulatory clarity.

- Non-compliant tokens may face delistings, cutting EU market liquidity by up to 20%.

- MiCA-like laws are being considered in 12+ countries, including the UK, Switzerland, and Singapore.

- Compliance hiring surged 55% in the EU in 2025 as firms strengthen regulatory teams.

Key Regulatory Requirements for Stablecoins Under MiCA

- MiCA mandates 100% reserve backing for fiat-backed stablecoins (EMTs) in 2025.

- Issuers must hold reserves only in regulated EU financial institutions.

- Issuers must publish a detailed white paper outlining risks and redemption commitments, requiring 100% compliance.

- Issuers and board members carry personal liability for the accuracy and updates of the white paper.

- Stablecoin issuers must redeem tokens at par value on demand to ensure digital-cash stability.

- Issuers must conduct quarterly audits to prove liquidity and full reserve backing.

- Only licensed EU credit institutions or e-money institutions may issue EMTs under MiCA.

- MiCA restricts EMT stablecoins to payment functions, excluding yield-bearing tokens.

- Regulators set daily transaction limits at €200 million per issuer to manage payment flows.

E-Money Tokens (EMTs) Under MiCA

- Banks and authorized financial institutions may issue EMTs under MiCA in 2025.

- Issuers must maintain 100% fiat-reserve backing, held by regulated EU institutions.

- EMT issuers must conduct quarterly stress tests to prove they can withstand 30%+ mass redemptions.

- MiCA prohibits algorithmic EMTs outright.

- Issuers must keep EMT reserves entirely inside the EU to prevent capital flight.

- Analysts project euro-backed EMTs to surge by 50% in 2025 under MiCA.

MiCA’s Stablecoin Regime

- 78% of EU stablecoins will need reclassification under MiCA by 2025.

- Only 21% of projects meet full MiCA compliance as of early 2025.

- Euro-backed stablecoins are expected to grow 60% in 2025, driven by ECB priorities.

- USDT accounts for 40% of EU stablecoin transactions and may require major restructuring for 2025 compliance.

- Issuers must hold 30% of reserves in highly liquid assets in 2025.

- Payment flows face a limit of €200 million per day per issuer under MiCA in 2025.

- Reserves must remain in EU institutions in 2025 to ensure European-controlled backing.

How EMT Regulations Will Reshape the Market

- 17 licensed EMT issuers operate across 10 EU countries as of late 2025.

- Traditional banks now represent 40% of new EMT issuers, up from 10% in 2024.

- Regulated EMT stablecoins account for 25% of all stablecoin transaction volume in the EU by 2025.

- Algorithmic or yield-bearing stablecoins dropped by 60% due to EMT regulatory disincentives.

- 35% of smaller stablecoin projects exited the EU market in 2025 due to compliance costs.

- User adoption of EMT stablecoins rose by 50% in 2025, driven by regulatory clarity.

- 100% fiat-reserve backing under EMT rules reduced offshore reserve reliance by 70%.

- Consumer protection measures led to a 45% drop in stablecoin-related complaints in 2025.

- The EMT regime pushed a 30% increase in use cases for payments and cross-border remittances.

- Stablecoins made compliant with EMT regulations increased market trust by 55%, according to surveys.

Effects of MiCA on Stablecoin Market Stability

- Stablecoin market cap exceeded $280 billion globally as of September 2025.

- 75% of stablecoin supply is dominated by the top 5 issuers, highlighting concentration risk.

- Fully backed fiat-pegged stablecoins are projected to rise by 45% under MiCA rules.

- Offshore reserve use dropped by 70% due to MiCA’s euro-based liquidity requirements.

- Institutional demand for MiCA-compliant stablecoins grew by 50% in 2025.

- Non-compliant stablecoins exited the EU market, consolidating liquidity around 60% fewer tokens.

- On-chain stablecoin usage for payments increased by 35% in the EU post-MiCA enforcement.

- Redemption-at-par and liquidity requirements lowered issuer insolvency risk by 40%.

- Market fragmentation dropped by 30%, increasing overall stablecoin market stability.

- Transparency and regulatory safeguards boosted user confidence by 55% in MiCA markets.

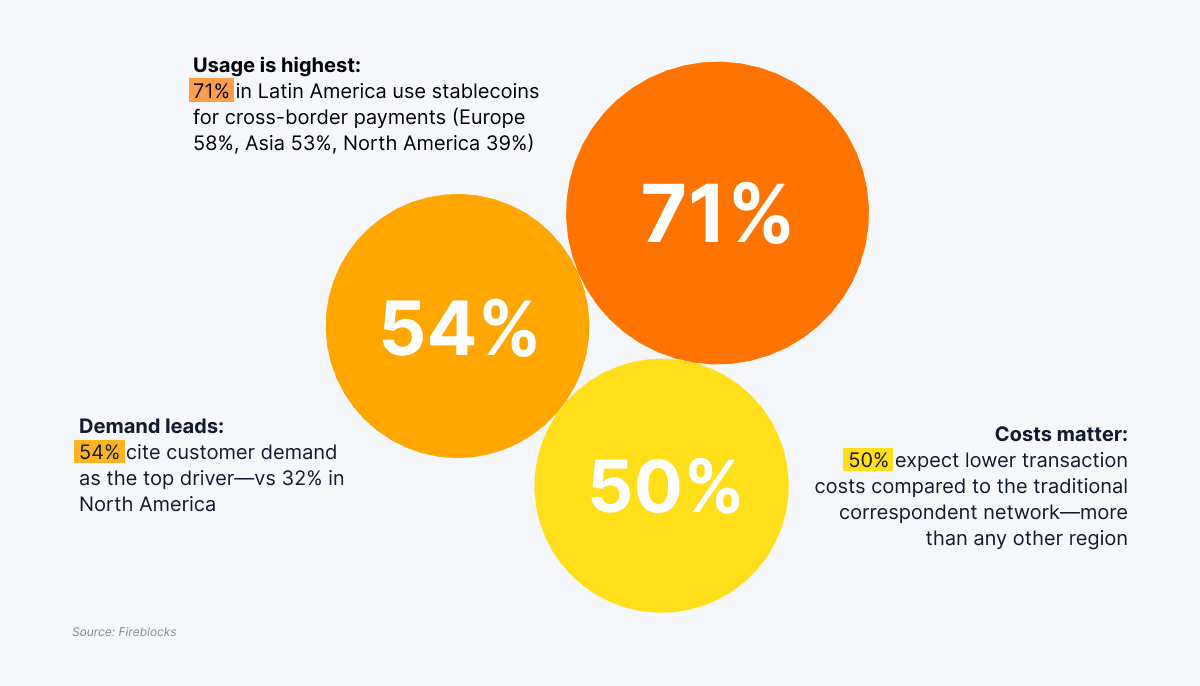

Global Stablecoin Adoption and Usage Insights

- 71% of Latin American users rely on stablecoins for cross-border payments, marking the highest global usage.

- 58% of Europeans use stablecoins in payments, showing deep integration across the region.

- 53% adoption in Asia reflects strong fintech growth and reliance on remittances.

- North America trails at 39%, highlighting slower uptake due to regulatory hesitations.

- 54% of businesses say customer demand is the main reason they adopt stablecoins, vs 32% in North America.

- 50% expect lower costs than traditional banking, making stablecoins a cost-effective solution.

Investor and Consumer Protection Measures Under MiCA

- Crypto transaction complaints in the EU fell by 27% within six months after MiCA enforcement.

- 100% of MiCA-licensed platforms publish detailed white papers with full risk disclosures.

- Stablecoin issuers maintain 1:1 reserves in liquid assets to ensure redemption at face value.

- 72% of European crypto investors prefer using MiCA-compliant platforms for increased trust.

- MiCA licensing reduced scams and fraud exposure by 40% across the EU crypto market.

- Insider trading and market abuse incidents dropped by 35% due to enhanced compliance rules.

- MiCA mandates cover non-EU firms serving EU clients, impacting 85% of foreign crypto service providers.

- MiCA’s unified supervision regime increased retail investor confidence by 50% in regulated platforms.

- Regular audits under MiCA led to 30% higher transparency scores among stablecoin issuers.

Penalties and Enforcement Actions Under MiCA

- In 2025, EU regulators issued approximately €486 million in cumulative financial penalties for MiCA non‑compliance, up 18% compared to 2024.

- In that year, 38% of violations involved stablecoin issuers failing to maintain required reserve levels.

- Roughly 68% of sanctioned entities in 2025 were unregistered Crypto‑Asset Service Providers (CASPs), operating without proper MiCA licensing.

- For major violations, MiCA allows fines up to €5 million or 3%–12.5% of annual turnover, depending on severity and token type.

- Early enforcement has led to some major players delisting non‑compliant stablecoins for EU customers, reflecting MiCA’s real-world impact on market access.

Issuer Compliance and Licensing Statistics

- The EU granted 53 MiCA licenses by late 2025, including 14 stablecoin issuers and 39 CASPs.

- 91% of crypto firms admitted unpreparedness for full MiCA compliance in 2024-25.

- 42% of European crypto startups expect increased operational costs due to MiCA.

- 75% of firms have appointed a dedicated compliance officer to manage MiCA obligations.

- Many firms delayed token issuance pending MiCA licensing, with 60% citing regulatory hurdles.

- Non-compliant or high-risk firms exited or restructured, reducing the EU crypto market by 15%.

- MiCA replaces fragmented national laws, aiming to regulate 100% of stablecoin and crypto services.

- Over 80% of non-EU firms targeting EU consumers plan to obtain MiCA licenses.

Implications for Non-EU Stablecoin Issuers Accessing the EU Market

- 100% of non-EU stablecoin issuers targeting EU clients must comply with MiCA licensing and reserve rules.

- The “reverse-solicitation” loophole is considered ineffective by regulators for over 90% of non-EU firms.

- 23% of non-EU issuers faced delays or rejections by EU national authorities in 2025.

- Complying with non-EU issuers increased operational costs by 35% due to structural and legal adaptations.

- Non-compliance risks include fines, license bans, or blocking access to 100% of EU clients.

- License approval wait times averaged 9 months, causing loss of first-mover advantage for 40% of non-EU firms.

- MiCA compliance gained 55% market share in the EU over non-compliant foreign stablecoins.

- EU users migrated away from non-compliant tokens by 30% in favor of MiCA-approved stablecoins.

- 65% of non-EU stablecoin issuers reconsidered EU market entry against compliance costs in 2025.

- The global stablecoin industry is seeing a geographic shift with 20% more issuers relocating operations to the EU.

Frequently Asked Questions (FAQs)

By mid‑2025, the European Union had granted 53 licences under MiCA: 14 to stablecoin issuers (EMTs) and 39 to crypto‑asset service providers

Two leading dollar‑denominated stablecoins together accounted for ≈ 89% of stablecoin market capitalization, with 63% and 26% held by the top two, respectively.

MiCA implementation is projected to cut the share of poorly backed or fraudulent stablecoins by 60% in 2025.

Conclusion

Since the full application began, Markets in Crypto-Assets Regulation (MiCA) has significantly reshaped the stablecoin and crypto‑asset landscape in Europe and beyond. It has introduced robust investor protections, transparent reserve and disclosure requirements, and a unified licensing regime. As a result, enforcement actions and penalties have already climbed, and firms, both inside and outside the EU, are adjusting their business models to meet MiCA standards.

Early data suggests MiCA improves consumer confidence and reduces risky, non‑compliant operations. However, compliance burdens remain high, especially for smaller or non‑EU issuers. For the global stablecoin market, MiCA is emerging not just as an EU rulebook but as a benchmark with broad international influence.