Stablecoins have emerged as a cornerstone of modern digital finance, blending the speed and accessibility of blockchain with the stability of fiat currencies. Stablecoin transaction volumes reached unprecedented heights, with on-chain activity underscoring their expanding role across global markets.

Real-world corporations are using stablecoins to settle cross-border payments instantly, reducing costs and delays vs traditional banking rails. Meanwhile, fintech innovators are integrating stablecoin rails for treasury operations and merchant checkout solutions.

As regulatory clarity grows and institutional interest rises, readers should explore how these trends are reshaping finance.

Editor’s Choice

- 30% of all on-chain crypto transactions in 2025 involved stablecoins, highlighting their centrality in blockchain activity.

- Annual stablecoin transaction volume surpassed an estimated $33 trillion in 2025.

- Stablechain wallets reached an estimated 316 million active users globally.

- Stablecoins represented over $12 trillion in global value transfers, rivaling traditional networks like Visa.

- 99% of stablecoins in circulation remain pegged to the US dollar as of late 2025.

- Active stablecoin usage grew 146% year-over-year on mainstream platforms in 2026 data.

Recent Developments

- US regulatory clarity advanced with the passage of the GENIUS Act in 2025, providing a federal framework for stablecoin issuance and reserves.

- Stablecoin supply continued to grow through early 2026, with total supply around $266 billion as of January.

- The debate between crypto firms and traditional banks shifted toward cooperation on standards and compliance.

- European regulators are pushing for more euro-denominated stablecoins to counter dollar dominance.

- Visa and payment providers are piloting stablecoin settlement services, though volumes remain early stage.

- Stablecoin adoption surveys show mixed consumer interest, with some low future plans despite broad awareness.

- Major stablecoin protocols expanded reserve and compliance reporting practices in 2025.

- Blockchain infrastructures improved scalability and cross-chain liquidity for stablecoin flows.

Business Adoption and Benefits of Stablecoins

- 64% of businesses use or plan to use stablecoins within the next three years, highlighting strong future adoption momentum

- 34% of businesses already use stablecoins today, showing substantial real-world implementation across industries

- 60% of businesses cite cost savings as a primary benefit, reflecting reduced fees compared to traditional payment systems

- 72% of businesses report faster payments and settlement, making speed the most widely recognized advantage of stablecoin use

Key Stablecoin Usage Statistics

- Stablecoins accounted for 30% of crypto transaction volume from January to July 2025.

- Annual stablecoin transaction volume grew 83% from 2024 to 2025.

- Stablecoin market cap surged to approximately $290 billion by late 2025.

- Year-over-year supply growth exceeded 50% in 2025.

- USDC circulation grew 78% year-over-year in 2025.

- On-chain stablecoin holders continued expanding, with on-chain wallets rising.

- On platforms like zerohash, transaction volume increased nearly sevenfold in 2025.

- Active stablecoin usage on mainstream platforms grew 146% year-over-year in 2026.

- Monthly stablecoin usage spanned 106 countries in 2025 reporting.

- Stablecoins represented a significant share of liquidity in decentralized finance protocols.

- Despite growth, adoption surveys show a small share of everyday consumer usage in retail segments.

Stablecoin Usage by Region and Country

- The United States maintains a dominant stablecoin share in global on-chain dollar transfers, with platforms reporting 690% transaction volume growth.

- Latin America sees 75% of institutional investors allocating to stablecoins, USDT at 68% market share; remittances projected 18-22% ($25.5-31.2B).

- In Argentina, crypto adoption hits 20% (8.6 million users), with stablecoins exceeding 40% adult population usage.

- Nigeria captures over 40% stablecoin market share in crypto, with $59 billion in remittances driving adoption.

- Turkey’s crypto volume nears $200 billion, stablecoins key amid lira volatility, though altcoins dominate speculation.

- The European Union euro-stablecoin market grows, EURC at 41% share post-MiCA; 10 banks plan euro-pegged launch H2.

- Singapore solidifies hub status, 95%+ licensed providers support stablecoins under new regulatory framework.

- The UAE approves dirham-backed DDSC stablecoin for institutional settlements, targeting $170 billion global market.

- Sub-Saharan Africa leads retail stablecoin transfers, representing 6-7% of GDP; inflows show 52% YoY growth.

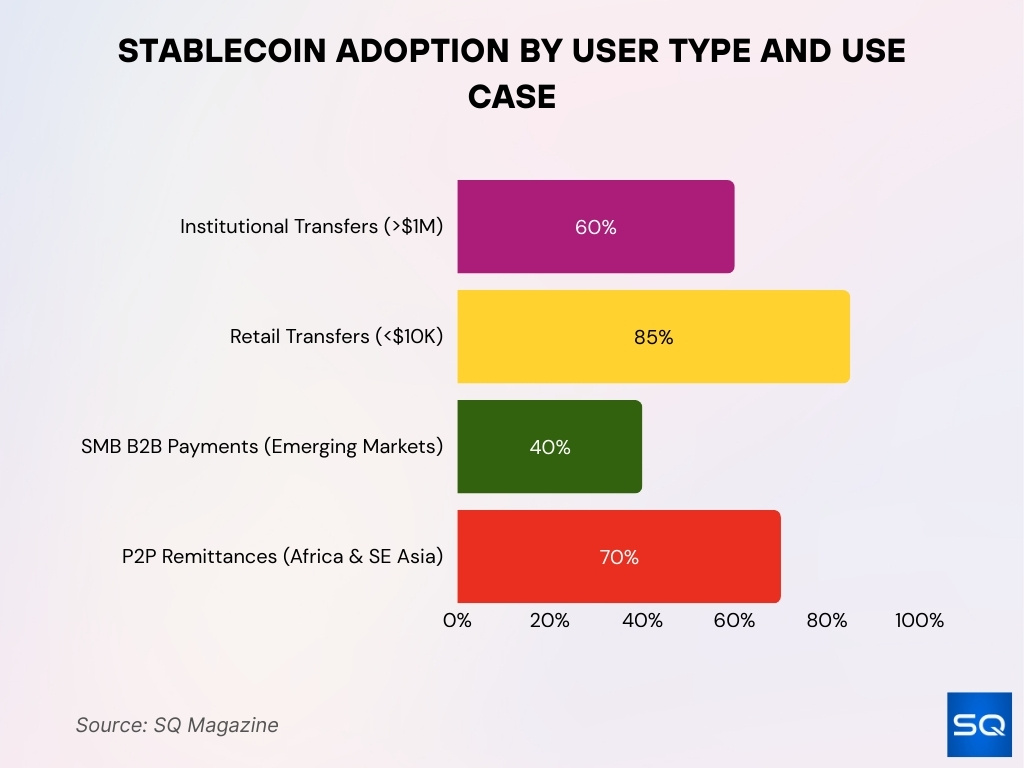

Adoption by User Type, Retail vs Institutional

- Institutional transfers above $1 million accounted for nearly 60% of total stablecoin transaction value in 2025, signaling growing corporate participation.

- Retail-sized transfers under $10,000 represented more than 85% of transaction count, highlighting widespread grassroots usage.

- Small and mid-size businesses accounted for nearly 40% of stablecoin-based B2B payments in emerging markets.

- Peer-to-peer platforms reported stablecoins representing over 70% of crypto remittance flows in Africa and Southeast Asia.

- Visa reported that stablecoin settlement pilots processed over $225 million in test transactions across participating partners in 2025.

- Coinbase disclosed that institutional clients drove a majority of USDC transaction volume growth in 2025.

- Fireblocks reported a 3x increase in institutional stablecoin payment flows year-over-year in 2025 across enterprise clients.

- A Deloitte 2025 survey found that 75% of merchants planning crypto acceptance preferred stablecoins over volatile cryptocurrencies.

- Hedge funds and asset managers increased stablecoin allocations for treasury management by over 50% year-over-year in 2025.

Leading Stablecoins by Market Cap and Volume

- Tether’s USDT remained the largest stablecoin with a market capitalization exceeding $110 billion in early 2026.

- USDC ranked second with a market cap of approximately $38 billion in Q1 2026.

- DAI maintained a circulating supply near $5 billion, largely driven by DeFi integrations.

- FDUSD surpassed $3 billion in market cap in 2025, reflecting rapid exchange-based adoption.

- USDT processed over $12 trillion in on-chain transaction volume in 2025, exceeding several traditional card networks in settlement value.

- USDC’s monthly transfer volume averaged more than $800 billion during peak 2025 activity.

- Algorithmic stablecoins represented less than 3% of the total stablecoin market cap in 2025.

- Over 99% of the total stablecoin supply remains US dollar-denominated, with euro and other currency pegs making up a small fraction.

- The top three stablecoins accounted for more than 85% of total market capitalization, indicating high market concentration.

Stablecoin Usage by Blockchain Network

- Ethereum hosted roughly 55% of the total stablecoin supply by market cap in 2025.

- Tron accounted for nearly 40% of the USDT circulating supply, driven by low transaction fees and emerging market usage.

- Solana saw stablecoin supply grow by over 120% year-over-year in 2025 as network performance improved.

- BNB Chain supported more than $7 billion in stablecoin liquidity across DeFi applications in 2025.

- Arbitrum and Optimism combined recorded a 2x increase in stablecoin bridging volume year-over-year in 2025.

- Polygon hosted over $2 billion in stablecoin TVL, supporting payments and NFT ecosystems.

- Avalanche processed more than $1.5 billion in stablecoin transfers monthly during peak 2025 usage.

- Cross-chain bridges facilitated over $10 billion in stablecoin transfers per month in 2025, reflecting rising multichain demand.

- Layer-2 networks collectively accounted for nearly 20% of stablecoin transaction count by late 2025, up from single digits two years prior.

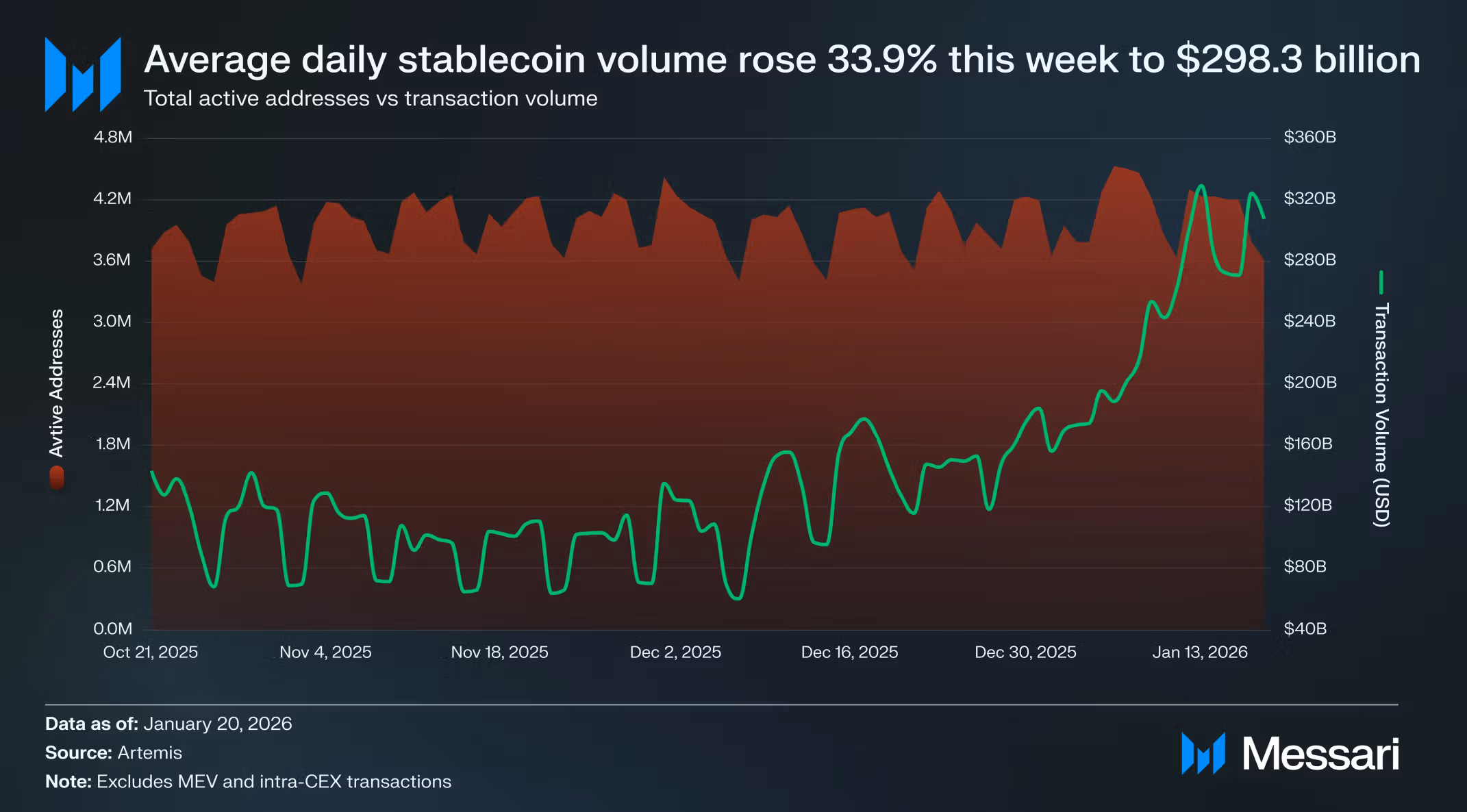

Stablecoin Transaction Volume and Network Activity

- Average daily stablecoin volume reached $298.3 billion, representing a 33.9% week-over-week increase.

- Transaction volume ranged from about $80 billion to over $320 billion, showing large swings in activity.

- Peak volume approached roughly $320–$330 billion in mid-January 2026.

- The lowest volume fell near $60–$80 billion in early November 2025.

- Daily active addresses fluctuated between approximately 3.5 million and 4.3 million.

- Typical network usage stayed around 3.8 million to 4.1 million active addresses per day.

- Address activity exceeded 4.2 million at peak levels in late December 2025 and January 2026.

Cross-Border Payments and Remittances

- Stablecoins processed more than $12 trillion in total transfer volume in 2025, with a significant share tied to cross-border activity.

- Stablecoins accounted for over 50% of all on-chain transfer value in 2025, much of it linked to international settlement flows.

- The World Bank reported global remittances reached $860 billion in 2025, with fintech firms increasingly integrating stablecoins to reduce costs below the global average of 6%.

- USDC-powered cross-border payment corridors expanded to more than 180 countries by late 2025.

- Enterprise cross-border stablecoin transactions increased 3x year-over-year in 2025.

- In Latin America, over 70% of surveyed crypto users cited remittances as a primary reason for using stablecoins.

- Stablecoin settlement pilots reduced international transaction settlement time from days to under 24 hours in select corridors.

- Stablecoins represented more than 60% of crypto-based remittance flows into Sub-Saharan Africa in 2025.

- Stablecoin transaction fees averaged under $1 per transfer on low-cost chains, significantly below traditional remittance fees.

Usage in Payments and Commerce

- 75% of retailers planning to accept crypto preferred stablecoins due to price stability in 2025 surveys.

- Stablecoins represented over 40% of total crypto payment volume processed by merchants in 2025.

- Shopify-integrated crypto payment providers recorded a 2x increase in stablecoin checkout volume year-over-year in 2025.

- Stablecoin-linked cards facilitated more than $3 billion in annualized spending across supported programs.

- Stablecoins accounted for over half of merchant crypto settlements in 2025.

- Stablecoin payout options expanded to more than 100 countries by 2025.

- Small businesses using stablecoin invoicing reduced settlement times from 2 to 3 days to same-day funding.

- Stablecoin transaction volumes on Solana-based payment apps grew by over 120% year-over-year in 2025.

- Nearly 30% of digitally native businesses explored stablecoin payment integration in 2025.

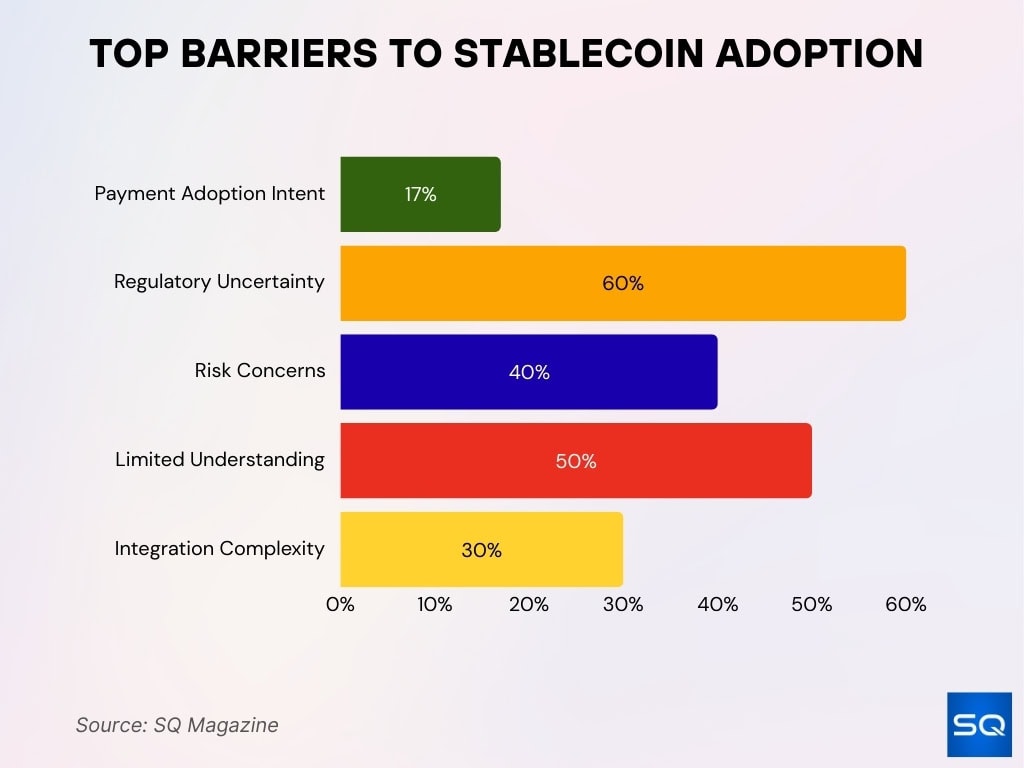

Barriers to Stablecoin Adoption

- Only 17% of surveyed consumers planned to use stablecoins for everyday payments in the next year.

- Over 60% of surveyed firms cited regulatory uncertainty as a top concern for institutional stablecoin usage.

- More than 40% of surveyed users cited risk concerns following past algorithmic stablecoin failures.

- Over 50% of US adults reported limited understanding of how stablecoins function.

- More than 30% of surveyed small businesses cited integration and accounting complexity as adoption barriers.

- Median Ethereum transaction fees exceeded $15 during peak periods in 2025, discouraging small retail payments.

- Fiat on-ramp restrictions slowed onboarding in several emerging markets despite high demand.

- Volatility in underlying collateral markets created balance sheet management challenges for issuers in 2025.

Usage in NFT and Gaming Ecosystems

- Stablecoins were used in over 35% of NFT marketplace transactions in 2025 to minimize volatility exposure.

- USDC ranked among the top three currencies by NFT transaction value in 2025.

- Blockchain gaming platforms saw stablecoin in-game transaction volume grow by over 90% year-over-year in 2025.

- Gaming-focused chains integrated stablecoin payment rails covering millions of active wallets.

- Polygon-based NFT projects processed more than $2 billion in stablecoin-denominated sales during 2025.

- More than 50% of new GameFi titles offered dollar-pegged payout options in 2025.

- Stablecoin liquidity pools in NFT marketplaces reduced slippage by up to 30% compared to volatile token pairs.

- Web3 gaming venture funding exceeded $2 billion in 2025, with many projects prioritizing stablecoin-based economies.

Regulation and Compliance Overview

- Federal stablecoin legislation proposals in 2025 required full reserve backing and regular disclosure requirements for issuers.

- The European Union’s MiCA framework required stablecoin issuers to maintain 1:1 reserve backing and capital buffers.

- Singapore mandated that single-currency stablecoins maintain 100% reserve assets in cash or cash equivalents.

- The UK proposed rules requiring stablecoin issuers to hold reserves in high-quality liquid assets covering 100% of liabilities.

- Major issuers published quarterly reserve attestations detailing asset composition in 2025.

- Over 80% of G20 jurisdictions were actively reviewing or implementing stablecoin oversight frameworks by 2025.

- Stablecoins were identified as a key area of systemic risk monitoring in the 2025 global financial stability reports.

- Multiple US state regulators approved trust charters for stablecoin issuers in 2025.

Frequently Asked Questions (FAQs)

Active stablecoin usage increased 146% year-over-year.

Zerohash estimates more than 1.4 billion SRAs worldwide.

Nearly 99% of fiat-backed stablecoins are pegged to the U.S. dollar.

Conclusion

Stablecoins have shifted from a crypto trading tool to a core financial infrastructure layer. Today, they processed trillions in value, expanded across retail and institutional channels, and entered mainstream payment and remittance systems.

However, growth comes with scrutiny. Regulators now demand reserve transparency and risk controls, while merchants and consumers weigh usability against complexity. Adoption continues to rise, yet trust, education, and compliance will determine long-term sustainability.