Password managers are gaining momentum as critical tools against rising cybersecurity threats. Recent data shows growth in both market size and user awareness, but usage remains uneven across demographics and regions.

Real-world impact: many U.S. businesses now include password manager mandates in security policies to reduce credential leaks; meanwhile, financial and health sectors worldwide are investing in enterprise vaults to protect sensitive user information.

Editor’s Choice

- 36% of U.S. adults (≈94 million people) use a password manager, up from 34% last year.

- Global password manager market value projected at $3.22 billion in 2025, up from about $2.74 billion in 2024.

- Forecast CAGR of about 15.8% from 2025 to 2032 for the global market.

- In many corporate settings, 76% of companies still rely on traditional password authentication rather than alternatives.

- The average person manages 168 passwords for personal accounts + 87 for work = ~255 total credentials.

- Over 78% of people globally admit to reusing passwords across accounts.

- More than 50% of U.S. adults use insecure methods like memorization, browser storage, or writing passwords down instead of using a password manager.

Recent Developments

- A report by Dashlane shows passkey adoption rose by 400% in 2024. Among Dashlane users, 1 in 5 now have at least one passkey stored in their vault.

- The global market growth outlook has been adjusted upward, currently projected to expand from $4.9 billion in 2024 to approximately $14.5 billion by 2033.

- Increased search interest in Bitwarden in mid-2025, surpassing some competitors in normalized search volume.

- Regulatory pressures (e.g., GDPR, NIS-2) and zero-trust security strategies are pushing enterprises to adopt vaults, privileged access management, and better audit controls.

- Remote work remains a major catalyst; many users report needing to manage more than 30 passwords, especially with hybrid schedules.

- Browser and device-integrated solutions are gaining ground versus standalone apps, especially for users less familiar with cybersecurity tools.

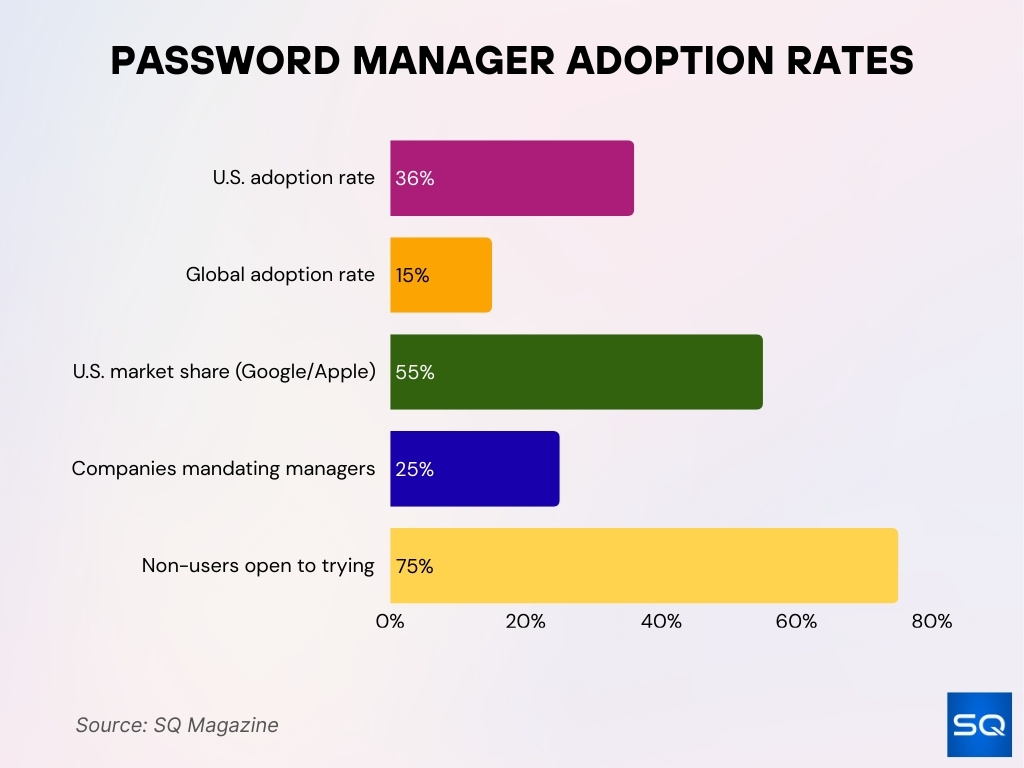

Password Manager Adoption Rates

- 36% of U.S. adults use password managers, which is about 94 million people.

- Globally, standalone password manager adoption remains modest; many users rely on browser storage or device defaults rather than third-party tools.

- About 15% of internet users globally use a password manager.

- Among those who don’t use password managers, 75%+ are open to trying when tools are usable, secure, and affordable.

- Tech giants (Google, Apple) hold over 55% of the U.S. password manager market share via pre-installed or built-in solutions.

- Enterprise adoption lags in mandate strength; only about 25% of companies require employees to use a password manager.

Global Password Manager Market Size

- $2.74 billion was the market size in 2024.

- Forecasted to reach $3.22 billion in 2025.

- By 2032, expectations put it around $9.01 billion under a CAGR of roughly 15.8%.

- Alternate forecasts estimate $2.3 billion in 2024 with a projected CAGR of 19.7%, reaching $9.7 billion by 2033.

Demographics of Password Manager Users

- Users in the U.S. aged 18-34 (Millennials / young adults) are more likely to adopt password managers than older cohorts.

- Tech-savvy or professional users (IT, cybersecurity, remote workers) have higher adoption and awareness levels.

- Among non-users, cost, trust, and perceived complexity are major deterrents, especially among older and less technical demographics.

- Income and education level correlate, higher education or income → more likely to use dedicated password managers rather than browser storage.

- Gender differences, some studies suggest men emphasize security and feature richness, whereas women tend to prioritize ease of use and brand/integration.

- Geographically, the U.S. and other high-connectivity countries have higher adoption rates compared to lower-income or rural areas.

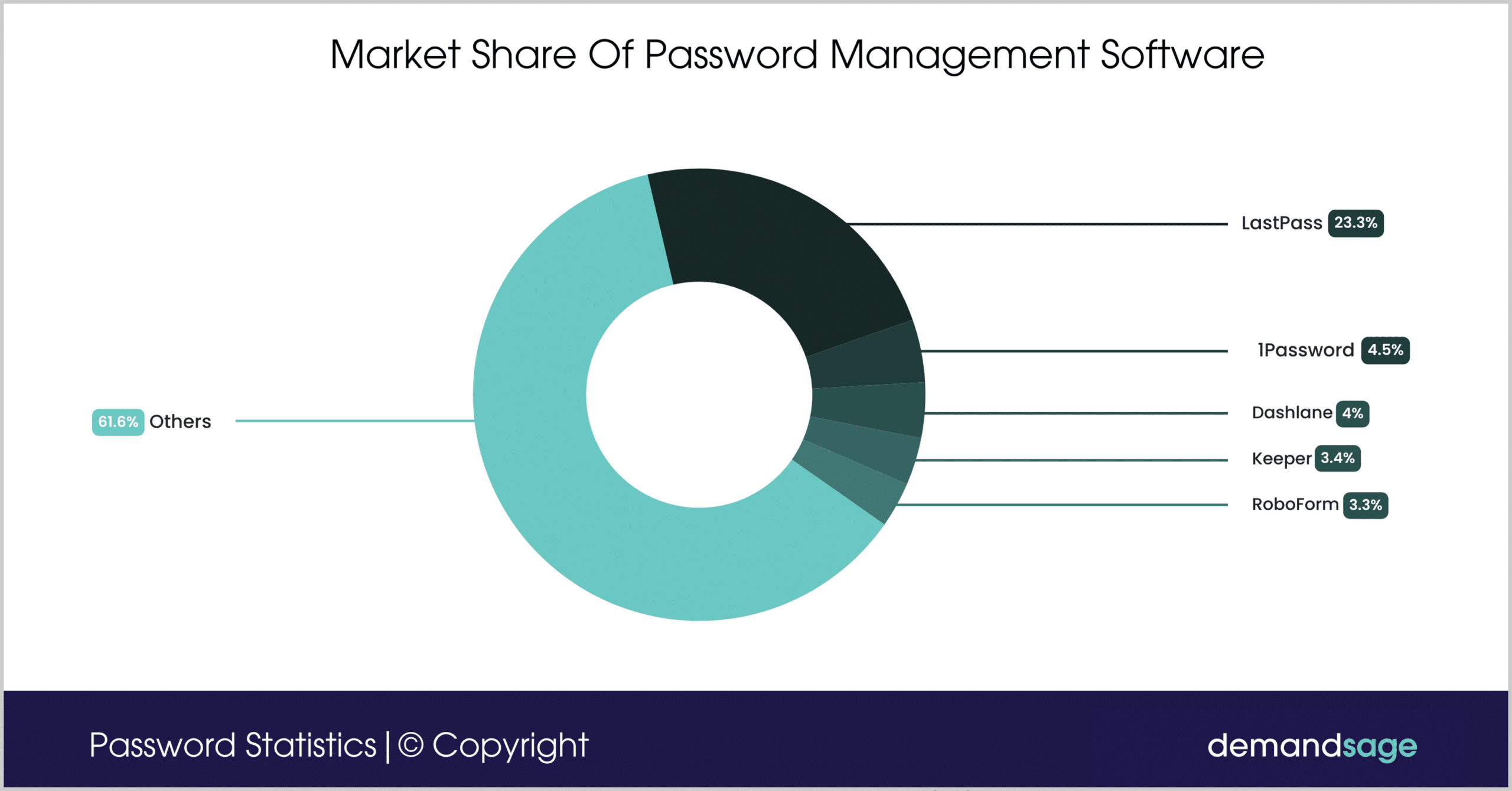

Market Share of Password Management Software

- LastPass holds 23.3% of the global password manager market, making it the leading provider.

- 1Password captures 4.5% of the market, showing steady adoption among professionals and enterprises.

- Dashlane controls 4% of the market, with a focus on ease of use and strong security features.

- Keeper accounts for 3.4%, positioning it as a competitive option in enterprise and personal security.

- RoboForm holds 3.3%, reflecting its long-standing presence in the market.

- Others dominate with 61.6%, showing a highly fragmented market where smaller tools collectively lead.

Usage Trends

- Individuals manage on average 70–80 passwords across both personal and professional accounts.

- Users log in 5-7 times daily for private accounts, and professionals report 10-15 logins/day for work-related services.

- Over 75% of users install their password manager on multiple devices, which is up from ~71% last year.

- Use on desktop/laptop jumped to 90%, up from 77% in previous years.

- Mobile usage (phones) remains high at 83%, little changed from recent years.

- Tablet use is waning, dropping to 36% from ~44-46% in earlier years.

- Many users rely on built-in or browser-integrated password managers rather than dedicated third-party apps, driven by convenience.

- Remote work & cloud app proliferation have increased demand, and users with >30 passwords are more common among hybrid/remote workers.

Benefits and Security Impact

- Americans who use password managers were less likely to experience identity theft or credential theft in the past year, 17% with managers vs. 32% without.

- 29% of U.S. adults had identity or login credentials stolen in the past year.

- Users overwhelmingly report feeling safe with their service; about 90% of users of password managers feel secure using them.

- Stolen credentials featured in 53% of data breaches in 2025. A password manager, combined with good practices, can reduce this exposure.

- Having unique, strong passwords (which managers generate) dramatically reduces credential reuse risks.

- Use of password managers aligns with NIST’s 2025 guidelines, emphasizing password length over forced complexity, eliminating mandatory periodic reset unless compromise is suspected.

- Password managers aid in detecting breached or reused credentials via built-in breach-alert services.

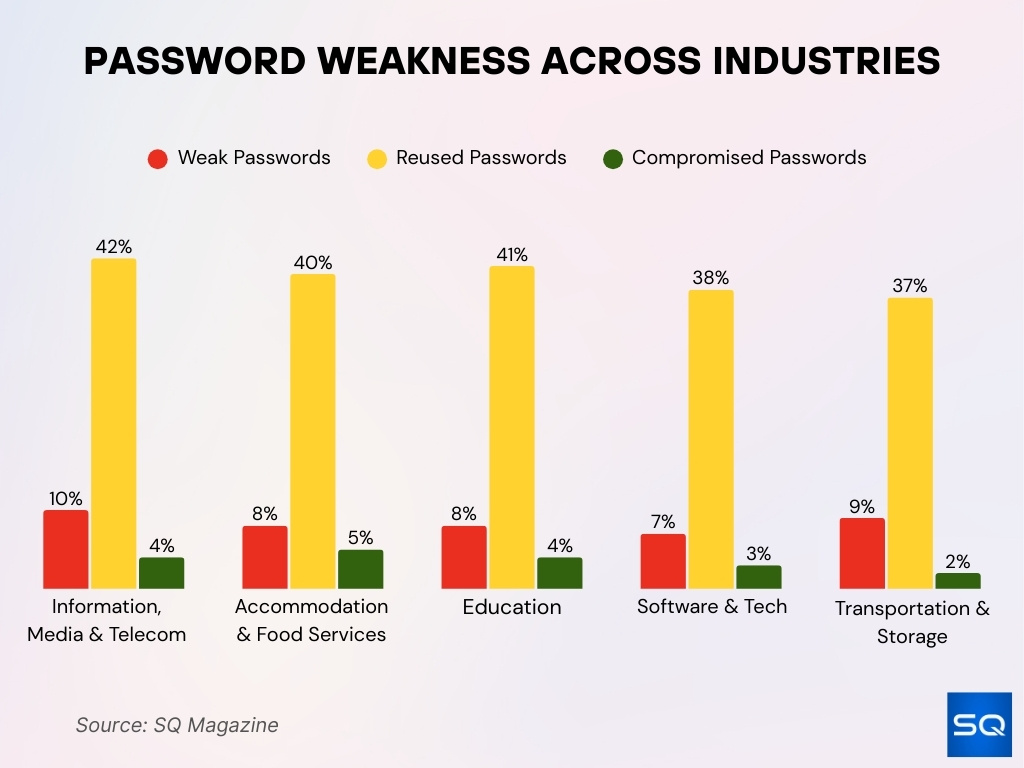

Password Weakness Across Industries

- In Information, Media, and Telecom, 42% of passwords are reused, 10% are weak, and 4% are compromised.

- In Accommodation and Food Services, 40% of passwords are reused, 8% are weak, and 5% are compromised.

- In Education, 41% of passwords are reused, 8% are weak, and 4% are compromised.

- In Software and Tech, 38% of passwords are reused, 7% are weak, and 3% are compromised.

- In Transportation and Storage, 37% of passwords are reused, 9% are weak, and 2% are compromised.

Reasons for Using Password Managers

- Convenience, automatic password generation, autofill, and cross-device sync reduce friction.

- Fear of identity theft or credential theft, many users cite having had credentials compromised (or knowing someone who did) as a reason.

- Forgetfulness, a common reason people start using a manager, “frequently forgetting passwords,” is cited by ~44% of recent users.

- Password reuse: Many users want to avoid reusing the same password across sites.

- Security best practices and compliance, organizations adopt them because regulations or internal policy demand MFA, zero-knowledge, auditing, etc.

- Integration with passkeys/biometrics / MFA, modern authentication demands push users toward managers who support these features.

- Peace of mind, knowing that passwords are stored encrypted, that weak or reused ones are flagged.

Common Barriers to Adoption

- Trust concerns, ~65% of U.S. respondents said they do not trust password managers.

- Cost, a sizable percentage (~32%) are unwilling to pay for premium password management tools.

- Perceived complexity, users who are less tech-savvy often feel password managers are too complicated or hard to set up.

- Fear of a breach of the manager itself, high-profile incidents make users wary that even vaults can be compromised.

- Over-reliance on browser storage or memorization, either out of habit or believing the built-in manager is “good enough.”

- Lack of awareness: Some users don’t know about features like breach alerts, strong password generation, or passkey support.

- Device compatibility or syncing concerns, worries that vaults won’t work across all devices, browsers.

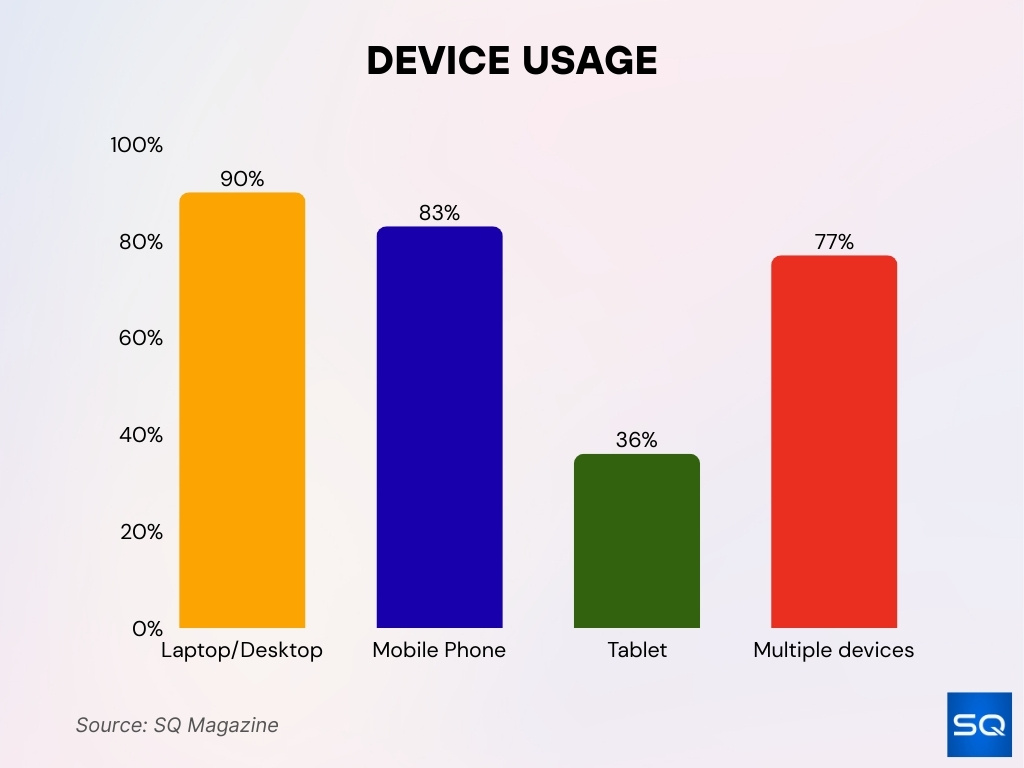

Usage by Device

- Laptop/desktop usage jumped to 90% among users.

- Mobile phone usage remains high at ~83% for password managers.

- Tablets are declining; Only 36% of users reported using password managers on tablets.

- The multiple device install base grew, 77% of users have managers installed on more than one device (up from 71% last year).

- Users tend to prefer the device where they do most of their online work for primary use (often laptops/desktops for work, mobile for frequent personal use).

- Cross-device syncing is a key expectation; users without good sync report friction.

- Desktop error rates, UI lag, and compatibility issues are more frequently complained about on older hardware or less common OS.

User Satisfaction With Password Managers

- ~90% of American users of password managers report that they feel safe with their selected service.

- Keeper Security scored highest in G2 for Secrets Management tools, 97% of users believe it is headed in the right direction, and 93% would recommend it.

- Users who use password managers are significantly less likely to report having had credentials or identity theft over the past year.

- Satisfaction correlates strongly with features like autofill reliability, cross-device sync, and breach alerts.

- Support and speed matter; premium plans with better support tend to get higher trust/satisfaction scores, especially among business users.

- Reliability across devices is key; users who have the manager installed on multiple devices report fewer frustrations and better continuity.

- Security incidents or perceived vulnerabilities reduce satisfaction sharply when a manager has had a public breach or disclosure, and trust drops.

Pricing and Cost Trends

- The Global Password Manager market is projected to grow from $3.06 billion in 2024 to $3.75 billion in 2025, with a CAGR of ~22.6% for that period.

- Global password management market forecasts expect it to reach about $8.26 billion by 2029.

- For individuals, introductory/promo prices for premium vaults vary; for example, Total Password offers $1.99/month in the first year (billed annually), but jumps to $9.99/month afterward.

- Business-oriented “Teams” plans sometimes start as low as $1.79/user/month, depending on the vendor, when bought in multi-user packs.

- Cost transparency is becoming more common; pricing guides in 2025 more often break out feature tiers (sharing, identity breach alert, passkey support) vs. just storage/user limits.

In Business and Enterprise

- Large enterprises accounted for ~70% of the password manager market in 2024.

- MFA usage is high in business contexts (often paired with password managers). In medium-sized firms, ~34% are using MFA, and smaller businesses (~25 users or fewer) are around 27%.

- Some teams prioritize solutions that support features like role-based access, password rotation, secure sharing, and auditing. These drive costs in enterprise plans.

- Businesses show sensitivity to ROI, password reset support, breach risk mitigation, and regulatory compliance are among the key drivers.

- There is a trend toward using cloud-hosted or hybrid deployment models for enterprise password management. Cloud-hosted offerings held about a 60% share in recent years.

Impact on Identity Theft and Credential Security

- In 2024, 36% of American adults used password managers; among them, 17% experienced identity theft or credential theft in the past year, versus 32% among non-users.

- 29% of U.S. adults had their identity or login credentials stolen in the past year.

- Over 50% of adults still use insecure password management methods like memorization, browser storage, or written records.

- Among people who don’t use a password manager, around 37% say they believe they don’t need one.

- Password reuse remains widespread, globally, 78% confess to reusing passwords, and many users use the same or similar passwords across multiple sites.

- Weak passwords are a factor in many data breaches, both in corporate breaches and consumer incidents. Estimates put weak or reused credentials as root causes in 30-50% of breaches, depending on region/sector.

Adoption by Region/Country

- North America holds a strong share of market revenues (≈ ~33-38%) for password management globally.

- The Asia-Pacific region is the fastest-growing market, often showing higher CAGR projections (~28-29%).

- Europe / Western Europe is are mature market with solid adoption, but growth rates are generally lower than in emerging markets.

- In India, many users use browser-integrated or device default password storage for less sensitive accounts; dedicated third-party tools have lower awareness/usage.

Frequently Asked Questions (FAQs)

The global password management market is projected to reach $9.01 billion by 2032.

The market is expected to grow at a 27.54% CAGR from 2025 to 2030.

65% of U.S. respondents reported that they do not trust password managers.

36% of American adults subscribed to password manager services in 2024.

Conclusion

Password managers today are more than convenience tools; they’re increasingly essential for reducing identity theft risk, enforcing security hygiene, and meeting regulatory and workplace demands. Market growth is strong, innovation (passkeys, biometrics, smart breach alerts) continues, and pricing is adjusting to user expectations, though cost jumps and trust concerns remain barriers.

Problems persist, and many users still rely on weak passwords, reuse credentials, or trust browser storage even when dedicated tools would offer stronger protection. The region-based disparities suggest an opportunity for education and access-focused solutions in emerging markets.

If you’re evaluating whether to adopt (or upgrade) a password management solution, these trends and statistics should help you make informed decisions about cost vs benefit, security features, and long-term risk.