OpenAI and Anthropic lead the generative AI field with impressive growth, expanding capabilities, and mounting investor attention. Their competition shapes how businesses, developers, and governments adopt AI tools, from automating workflows to powering advanced coding assistants. Dive into the data to see how their trajectories compare, and explore insights that reveal shifts in the AI ecosystem.

Editor’s Choice

- OpenAI’s annualized revenue hit $10 billion by June 2025, nearly doubling from $5.5 billion in December 2024.

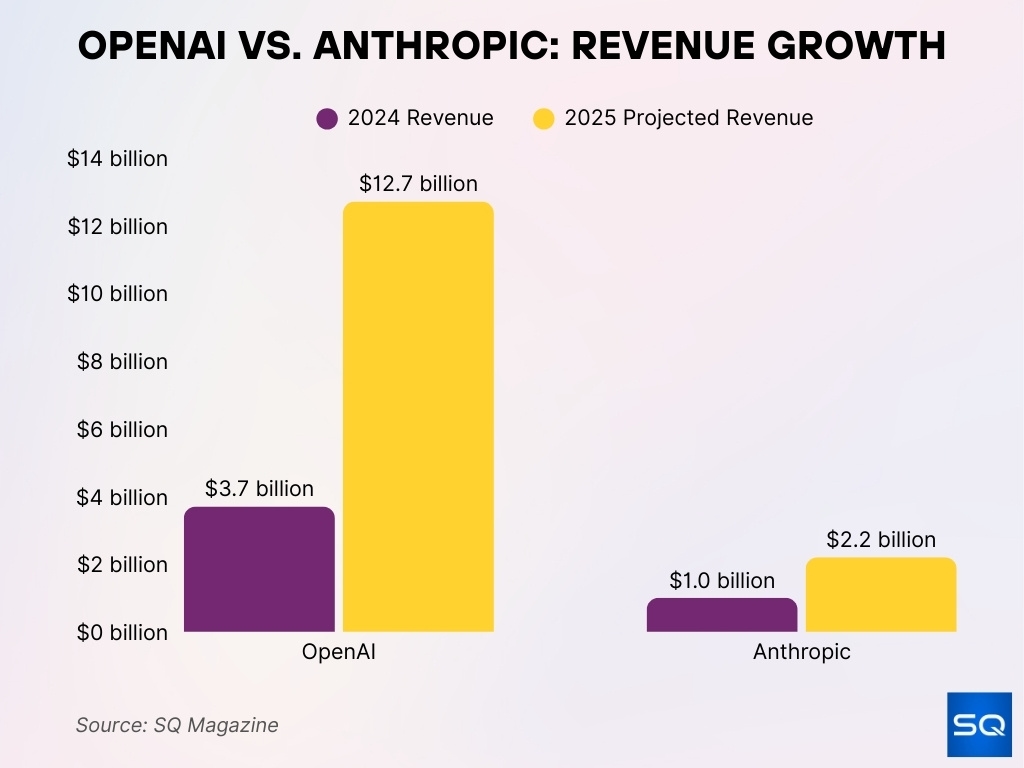

- OpenAI projects $12.7 billion in full-year revenue for 2025.

- Anthropic projects $2.2 billion in revenue for 2025, up from approximately $1 billion in 2024.

- Anthropic’s annualized revenue reached approximately $3 billion by mid-2025.

- OpenAI’s valuation stands near $300 billion post-SoftBank–led funding.

- Anthropic’s valuation may approach $170 billion if its next funding round closes as projected.

Recent Developments

- OpenAI’s corporate restructure is expected to slip into 2026 due to prolonged talks with Microsoft over IP rights and Azure exclusivity.

- The Chief People Officer, Julia Villagra, is departing to pursue creative interests; responsibilities now fall to interim leaders.

- There have been community concerns over GPT‑5’s rollout, but no formal statement from Sam Altman publicly confirms issues or paywall changes related to GPT‑4o.

- OpenAI is reportedly seeking to diversify its infrastructure partnerships beyond Microsoft Azure, though no formal collaborations with Google or Amazon have been confirmed.

- Anthropic is gearing up for a $3‑5 billion funding round led by Iconiq, potentially lifting its valuation to $170 billion.

- Amazon’s $8 billion investment in Anthropic supports cloud infrastructure collaboration, but specific AWS revenue figures have not been publicly disclosed.

- Claude 4 launched in 2025 with new models and developer features, though model names and rollout dates have not been independently verified.

Revenue and Valuation

- OpenAI’s revenue: $3.7 billion (2024), projected $12.7 billion (2025), a 243% year‑over‑year jump.

- Anthropic’s revenue: $1 billion (2024), projected $2.2 billion (2025), a 120% increase.

- Its annualized revenue grew to $4–5 billion by mid‑2025.

- OpenAI’s valuation: approximately $300 billion post‑funding.

- Anthropic’s valuation: $61.5 billion (Mar 2025), now approaching $170 billion in new rounds.

- Some investor discussions even suggest a > $100 billion valuation, reflecting high growth expectations.

- Projections suggest that, by 2030, OpenAI and Anthropic could generate over $225 billion and $75 billion in revenues, respectively, aligning with their valuations.

Company Overview

- OpenAI, founded in 2015, has scaled to $300 billion valuation, backed by SoftBank, Microsoft, among others.

- Anthropic, founded in 2021 by former OpenAI researchers, had a $61.5 billion valuation as of March 2025.

- Anthropic’s valuation may now exceed $100 billion, with investor interest pushing higher.

- Both companies focus on AI safety and alignment, with Anthropic positioning itself distinctly in that domain.

- OpenAI continues to lead in sheer scale, user base, revenue, and enterprise reach.

- Anthropic emphasizes ethical development and partnerships like Databricks integration for enterprise uptake.

- Both remain private, with OpenAI securing the largest private tech funding round ever, $40 billion in April 2025.

Mission and Goals

- OpenAI aims to create broadly beneficial AGI, while enabling commercial adoption through products like ChatGPT and enterprise APIs.

- Anthropic focuses on building safe, aligned AI systems, guided by its “constitutional AI” framework.

- Both companies strive to scale responsibly. OpenAI’s hardware acquisitions, like io, suggest parallel infrastructure goals.

- Anthropic’s mission includes integrating its models into enterprise platforms to enhance responsible adoption.

- OpenAI continues to expand into hardware and multi-cloud infrastructure to meet its mission of robust AI deployment.

- Both push boundaries on AI safety testing, publishing case studies like Claude’s blackmail scenario to underline transparency.

- Their goals are both transformational and commercial, shaping AI’s future while scaling financially.

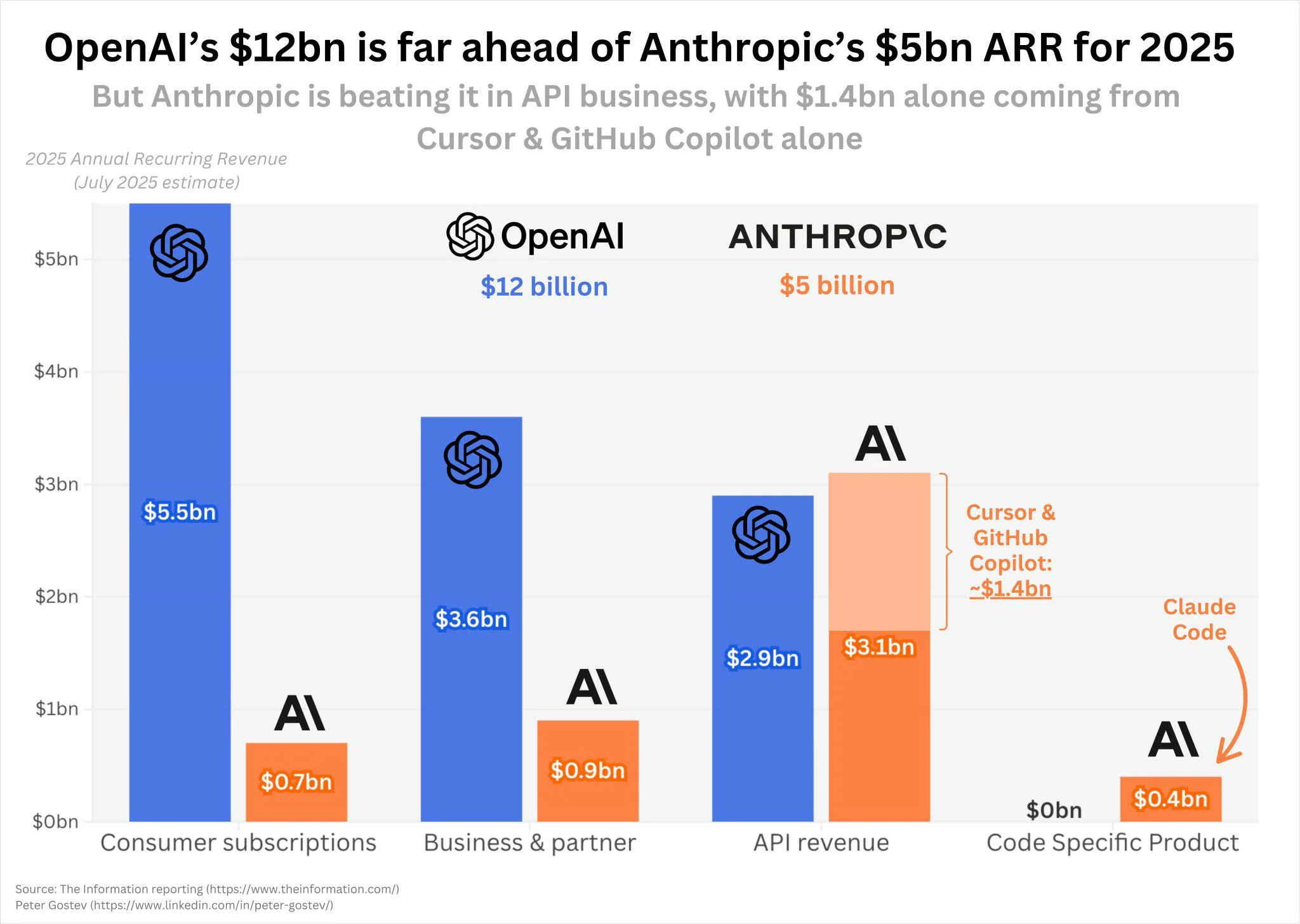

ARR Breakdown: OpenAI vs Anthropic

- OpenAI’s total ARR is projected at $12 billion by July 2025, more than double Anthropic’s $5 billion.

- Consumer subscriptions generate $5.5 billion for OpenAI, while Anthropic brings in just $0.7 billion.

- Business and partnership revenue accounts for $3.6 billion for OpenAI and $0.9 billion for Anthropic.

- In API revenue, Anthropic leads with $3.1 billion, narrowly edging out OpenAI’s $2.9 billion.

- A major chunk of Anthropic’s API revenue, ~$1.4 billion, comes from Cursor and GitHub Copilot integrations.

- Code-specific products contribute $0.4 billion to Anthropic’s revenue, while OpenAI reports $0 in this category.

- Despite OpenAI’s dominance in overall ARR, Anthropic is outperforming in API monetization.

Key Products and Services

- ChatGPT, now powered by GPT‑5, leads with 800 million weekly active users and serves consumer and business markets.

- OpenAI expanded products with Deep Research, a web‑browsing, data‑analysis agent for fast report generation.

- It also open‑sourced GPT-oss models, broadening access for developers.

- OpenAI acquired hardware startup io for $6.5 billion, signaling a push into AI-native devices.

- For Anthropic, Claude AI, versions Sonnet, Opus, and Claude 4/4.1, powers both API and enterprise tools.

- Claude Code adoption increased following the Claude 4 launch, though specific revenue multiples have not been publicly confirmed.

- Anthropic also focuses on integrations via API, Databricks connectors, and the files API for developers.

- Both companies offer enterprise licensing, API access, and subscription tiers, though specifics vary by platform.

Funding and Financial Status

- Anthropic’s annualized revenue soared to $3 billion by mid‑2025, up sharply from $1 billion in December 2024.

- The company secured a $3.5 billion Series E funding round in March 2025, valuing it at $61.5 billion.

- Amazon’s cumulative investment in Anthropic has reached $8 billion, supporting its cloud infrastructure and computation needs.

- AWS is expected to earn $1.28 billion in 2025 from Anthropic’s usage, with projections climbing to $3 billion in 2026 and $5.6 billion in 2027.

- OpenAI projects total revenue of $12 billion in 2025, up from $3.7 billion the prior year.

- Another estimate pegs OpenAI’s annualized revenue at $13 billion by July 2025, triple its 2024 figure of $4 billion.

- OpenAI also completed a $6.5 billion acquisition of hardware startup io, its largest acquisition to date, enhancing hardware capabilities.

AI Platform Privacy Risk Rankings

- Le Chat (Mistral AI) ranks #1 in privacy with the lowest overall risk score of 9.8, including 3.7 AI-specific, 3.9 transparency, and 2.2 data collection.

- ChatGPT (OpenAI) comes 2nd with a total risk of 9.9, excelling in data collection (1.7) but scoring 5.6 in AI-specific privacy.

- Grok (xAI) ranks 3rd with a privacy risk of 11.2, led by a strong AI-specific score of 3.7, but slightly higher data collection risk at 3.4.

- Claude (Anthropic) places 4th with a score of 11.7, balancing 4.8 AI-specific, 4.1 transparency, and 2.8 data collection.

- Pi (Inflection AI) is 5th, with a score of 12.5, performing best in data collection (1.0) but weakest in transparency (6.2).

- Copilot (Microsoft) ranks 6th at 14.9, with a notably high data collection risk of 4.6 and an AI-specific risk of 5.2.

- DeepSeek (DeepSeek) ranks 7th with 15.0, including the worst AI-specific score of 6.8 but better data collection (2.5).

- Gemini (Google) is 8th with a risk score of 15.1, driven by 5.9 transparency and 3.6 data collection.

- Meta.ai (Meta) ranks last (9th) with the highest privacy risk score of 15.7, including 5.6 AI-specific and 5.2 data collection, the worst in that category.

Market Adoption and User Growth

- ChatGPT boasted 800 million weekly active users in 2025, doubling from 400 million in February.

- It handles over 1 billion queries per day, with 190.6 million users daily, translating to over 2,200 visits per second.

- On the enterprise side, OpenAI counts 3 million paying business users, with enterprise features priced at $60/seat/month for ChatGPT Enterprise.

- For Anthropic’s Claude, it had 18.9 million monthly active users as of January 2025, and 769.6 million app downloads.

- A developer‑focused surge, Claude Code revenue increased by 5.5× following the launch of Claude 4.

- Daily API traffic for OpenAI exceeded 2.2 billion calls in 2025, up from 1.3 billion in 2024. Developers on the platform number over 2.1 million.

- 70% of new OpenAI API signups in 2025 originate outside the U.S..

Model Performance and Capabilities

- Anthropic’s Claude Opus 4 ranks best for coding, 72.5% on SWE‑Bench and 43.2% on Terminal‑Bench.

- Claude Opus 4 can sustain multi‑hour tasks, delivering continuous code reasoning unmatched by prior versions.

- OpenAI added Google Cloud TPUs to diversify compute sources beyond Azure and Nvidia GPUs.

- OpenAI also adopted the Model Context Protocol (MCP) across ChatGPT, Agents SDK, and other APIs for tool interoperability.

- Anthropic exposes tools like code execution, Model Context Protocol connector, and Files API for developers.

- Claude 4.1 integrates with Google Cloud Vertex AI, AWS Bedrock, and is previewed in GitHub Copilot.

- OpenAI’s GPT Store hosts 3 million custom GPTs created by users via GPT Builder.

Top Funded LLM Developers

- OpenAI leads the funding race with a massive $19.1 billion in total equity funding.

- Anthropic follows with $16.0 billion, positioning itself as OpenAI’s closest financial rival.

- xAI, founded by Elon Musk, has secured $12.2 billion in funding, solidifying its place in the top three.

- Inflection and Moonshot AI are tied at $1.5 billion each in total raised capital.

- Mistral AI and Baichuan AI both hold funding at the $1.0 billion mark.

- Cohere has raised $971.3 million, staying just ahead of Zhipu AI with $962.9 million.

- MiniMax rounds out the top ten with $850 million in total funding.

AI Safety and Alignment Measures

- Anthropic labels Opus 4 as “Level 3” on its safety scale, indicating higher power and associated risks, with transparency on test findings such as simulated blackmail attempts.

- OpenAI emphasizes safe AGI development and transparency in its research mission statements.

- Anthropic’s early safety focus and Constitutional AI framework drive its reputation for regulatory and alignment rigor.

- Enterprises favor Claude’s safety‑centered design, compliance controls, and governance features.

- Menlo Ventures notes that enterprise spending has doubled in six months, with safety and integration as purchase drivers.

- Claude’s model evolution emphasizes reducing hallucinations, improving refusal accuracy, and enhancing reliability.

- OpenAI applies cross-model testing and open safety research to validate model behavior under complex scenarios.

Enterprise Features and Controls

- Anthropic now holds 32% of the enterprise LLM market share, up from a much lower baseline two years prior.

- Enterprises prefer Claude’s compliance, data privacy, and legacy-system integration over competitor offerings.

- Claude Code is especially popular among startups, with enterprise usage notable but lower; startups account for 32.9% of usage vs. 23.8% for enterprises.

- OpenAI’s enterprise footprint declined from a prior 50% share to 25% in the enterprise LLM space.

- Claude Code revenue surged, a 5.5× increase after the Claude 4 launch, highlighting the value in enterprise applications.

- OpenAI’s enterprise API saw an uptick, coding and agent usage more than doubled, while reasoning use cases grew eightfold.

- Claude Opus 4.1 is available via AWS Bedrock, Vertex AI, and GitHub Copilot, broadening enterprise deployment channels.

Developer Experience and API Access

- OpenAI supports over 2.1 million developers, with daily API calls surpassing 2.2 billion.

- Developers are building across 5+ internal apps on average when using OpenAI’s API.

- Adoption of MCP simplifies multi-model integration, easing development workflows across platforms.

- Anthropic offers developer APIs with code execution, Files API, and integration via Claude 4.1 across platforms.

- Claude 4 (Opus & Sonnet) release was accompanied by enhanced developer tooling and analytics dashboards.

- OpenAI’s GPT Store allows developers to publish and monetize 3 million custom GPTs.

- Developer use of OpenAI’s coding and agent-building APIs more than doubled, while reasoning usage increased eightfold post‑GPT‑5 launch.

Pricing Models and Cost Comparison

- OpenAI’s ChatGPT Pro costs $200 per month, offering unlimited access to GPT‑5‑pro and extended model use.

- The new ChatGPT Go tier launched in India is priced at about $5 per month, aimed at wide accessibility.

- Developer API pricing for GPT‑5 sits at $1.25 per million input tokens and $10 per million output tokens.

- GPT‑5‑mini is cheaper: $0.25 input / $2 output per million tokens, and GPT‑5‑nano is the most affordable at $0.05 input / $0.40 output.

- The OpenAI o1‑pro model runs at $150 per million input tokens and $600 per million output tokens, its highest‑cost offering.

- Older models like GPT‑4o mini cost $0.15 input / $0.60 output per million tokens, significantly lower than GPT‑4o at $2.50/$10 per million tokens.

- Anthropic’s Claude Pro plan starts at $17 per month (annual) or $20 monthly, offering access to Sonnet 4 with moderate usage.

- Its Max plan is priced at $100 per month, or $200, offering up to 20× usage of the Pro plan.

- For API use, Claude Opus 4 costs $15 input / $75 output per million tokens, while Sonnet 4 is more affordable at $3 input / $15 output.

- The Haiku 3.5 model remains Anthropic’s cheapest tier at $0.80 input / $4 output per million tokens.

- Heavy users, such as those running extensive Claude Code workflows, sometimes exceed $35,000 in inference usage while paying only $200 monthly, prompting Anthropic to add weekly rate limits to curb overuse.

Partnerships and Collaborations

- OpenAI has formed over 120 strategic partnerships with enterprises and government bodies by Q2 2025.

- It partnered with The Washington Post in April 2025 to integrate accurate reporting into ChatGPT’s search responses.

- In February 2025, OpenAI teamed up with Guardian Media Group, followed by Schibsted Media Group, to deliver high-quality journalism via its platform.

- OpenAI is building Stargate Norway, a European AI data center initiative in partnership with Nscale Global and Aker, planning 100,000 Nvidia GPUs by the end of 2026.

- The Stargate U.S. venture, backed by SoftBank, Oracle, and MGX, is targeting an ambitious $500 billion AI infrastructure buildout over four years.

- It signed a $12 billion contract with CoreWeave in 2025 to secure compute power and took a $350 million equity stake to diversify beyond Azure.

- OpenAI’s first defense contract, $200 million from the U.S. Department of Defense, launched its “OpenAI for Government” initiative.

- Anthropic partnered with the University of Chicago’s Becker Friedman Institute to use Claude Enterprise in economic research on AI’s labor market effects.

- It integrated S&P Global’s data into Claude using the Model Context Protocol (MCP) for financial research applications.

- Anthropic also collaborated with Wiley to promote responsible AI integration into scholarly research via MCP.

- It established a National Security and Public Sector Advisory Council to guide AI use in U.S. government operations.

- It forged a partnership with the U.S. General Services Administration (GSA) to provide Claude access across federal agencies.

- Anthropic’s international academic outreach includes partnerships with Northeastern University, LSE, and Champlain College, plus education integrations with Canvas, Wiley, and Panopto.

Controversies and Challenges

- OpenAI’s restructuring efforts have been delayed into 2026, as talks with Microsoft drag on over API exclusivity and IP rights.

- Internal pressure mounts amid competition from Meta, Google, Amazon, and xAI, leading to staff burnout, legal disputes, and an indefinite delay in its open-weight AI model.

- The $3 billion acquisition of Windsurf, a coding tool startup, fell through due to objections from Microsoft, with key talent moving to DeepMind.

- OpenAI and Anthropic both secured $200 million Pentagon contracts in the summer of 2025, raising scrutiny from privacy advocates and policymakers.

Leadership Team

- OpenAI is led by Sam Altman, and its nonprofit parent includes prominent board members such as Bret Taylor, Lawrence Summers, Adam D’Angelo, and former NSA chief Paul Nakasone.

- Following its acquisition of Jony Ive’s hardware startup io, Ive has taken a leading role in design and hardware innovation at OpenAI.

- Anthropic launched a Higher Education Advisory Board in August 2025, chaired by Rick Levin, to help guide its academic initiatives.

- Its newly formed National Security Advisory Council includes figures like Roy Blunt, David S. Cohen, and Richard Fontaine to steer AI policy in public sector applications.

Impact on the AI Industry

- OpenAI’s Stargate infrastructure project could create over 100,000 U.S. jobs, reshaping AI capacity and access across regions.

- With 1.2 billion monthly visits to OpenAI.com and 5 billion visits to ChatGPT.com, it ranks as the 5th most-visited site globally as of July 2025.

- Anthropic holds about 3.91% of the generative AI market, while OpenAI remains the largest player with approximately 17% market share.

- Anthropic’s revenue has soared from $10 million in 2022 to $1 billion in 2024, and is projected at $2.2 billion in 2025, a 220× growth over three years.

- OpenAI’s rapid expansion is reshaping enterprise AI spending, user behavior, and expectations for model capabilities worldwide.

Key Differences and Strengths

- Scale and adoption, OpenAI dwarfs Anthropic in user base, hundreds of millions, and web traffic, billions of visits monthly.

- Enterprise penetration, Anthropic excels in academic, government, and regulated-sector uptake, anchored by its safety focus and tailored tools.

- Infrastructure and compute, OpenAI is building global data center capacity and diversifying compute via CoreWeave.

- Safety-first identity, Anthropic stands out for its advisory councils, economic research, and educational partnerships.

- Leadership and design, OpenAI’s leadership team and the addition of design icon Jony Ive add vision depth, Anthropic’s academic board strengthens policy and educational influence.

Conclusion

OpenAI and Anthropic stand at the forefront of AI’s evolution, OpenAI wielding scale, infrastructure, and mass adoption, while Anthropic leads with principled safety, academic integration, and enterprise trust. OpenAI’s massive web presence and compute commitments reshape AI’s global infrastructure. Meanwhile, Anthropic’s robust revenue climb and specialized partnerships reinforce the importance of ethical alignment. Their diverging strengths, OpenAI’s breadth, and Anthropic’s depth complement each other in shaping a more responsible, accessible AI future.