Online payment fraud sits at the intersection of rapid digital adoption and persistent criminal ingenuity. As global online transactions surge, so do fraudulent attacks that siphon money from consumers and businesses alike. This threat affects everyone from small e-commerce sellers coping with chargebacks to financial institutions defending card networks. In retail and fintech, payment fraud can mean lost revenue, rising operational costs, and strained customer trust. Dive into this article to understand the latest statistics shaping online payment fraud.

Editor’s Choice

- 3.3% of e-commerce revenue is lost annually to payment fraud.

- 79% of marketplaces report rising fraud rates in 2025.

- $4.61 per $1 lost is the total cost impact on U.S. merchants for every fraud dollar in 2025.

- 57.8% of U.S. ecommerce fraud was generated domestically in 2025.

- 45% of merchant dispute volume is attributed to first- and third-party fraud.

- $43.6 billion, projected global ecommerce fraud losses by 2027.

Recent Developments

- 79% of online marketplaces reported increased fraud activity in the past year.

- Nearly half of all scam blocks in 2025 happened in the final quarter.

- Governments globally are tightening online fraud regulation, including rules forcing platforms to remove fraudulent ads and reimburse institutions for customer losses.

- Machine learning and large-scale graph analysis techniques are emerging as advanced fraud detection methods in 2025 and 2026 research.

- Telemetry shows surging e-shop scams across desktop and mobile environments.

- Merchants are deploying more fraud detection tools, on average 5 per business, to adapt to evolving threats.

- Credit and debit card fraud projections show steady upward pressure through 2027.

Types of Fraud

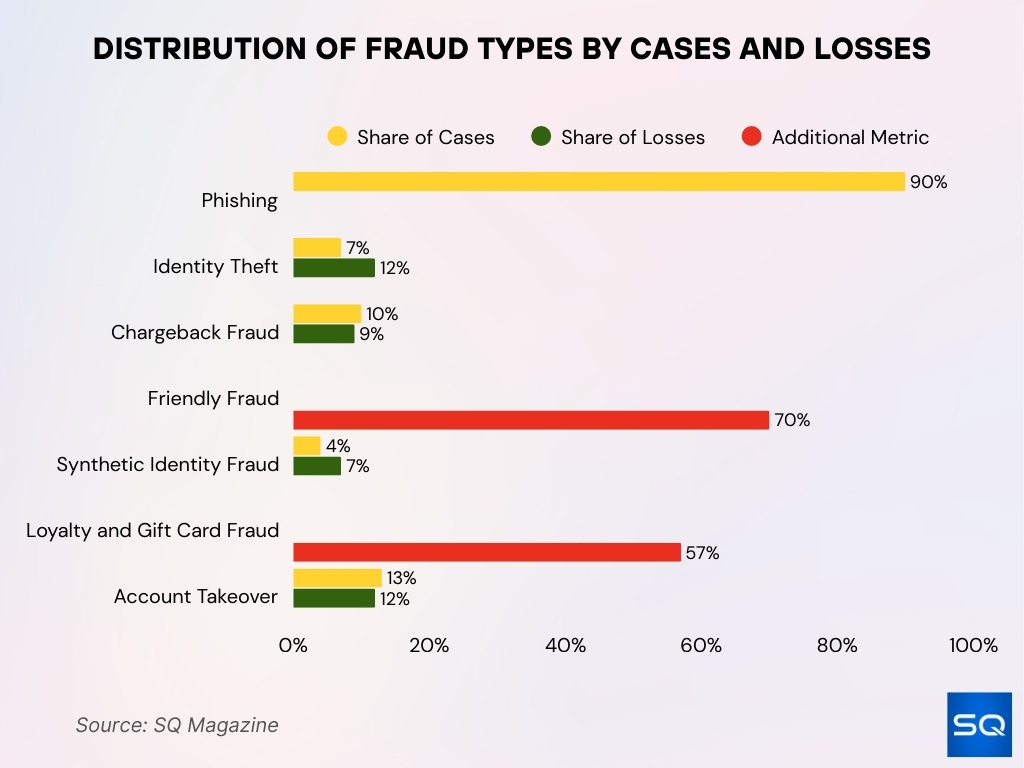

- Phishing constitutes 90% of successful cyber attacks.

- Identity theft generates 12% of total fraud losses from 7% of cases.

- Chargeback fraud accounts for 10% of fraud cases and 9% of losses.

- Friendly fraud stems from 70% of all chargebacks.

- Card-not-present fraud losses reach $28 billion globally.

- Synthetic identity fraud drives 7% of losses from 4% of cases.

- Loyalty and gift card fraud: 57% of consumers experienced it recently.

- Account takeover comprises 13% of fraud occurrences and 12% of losses.

Fraud Losses

- Annual global ecommerce fraud losses already sit around $48 billion per year.

- E-commerce represents 3.3% of yearly revenue, lost to payment fraud.

- Chargebacks alone could account for $28.1 billion in merchant losses by 2026.

- Losses from chargebacks are projected to reach $41.69 billion by 2028.

- U.S. merchants incur, on average, $4.61 in total cost for every $1 lost to fraud.

Phishing Attacks

- Phishing contributes 90% of successful cyber attacks.

- 43% of global merchants report phishing attacks.

- 82.6% of phishing emails contain AI-generated content.

- Automated tools enable 1.13 million phishing attacks quarterly.

- Simulated phishing tests yield click rates of 3-7%.

- Phishing combines with social engineering in 68% of breaches.

- Data breaches fuel phishing, exposing 2.6 billion records yearly.

- 193,407 phishing complaints were reported to the FBI.

- Remote purchase fraud via phishing costs $16.6 billion.

- 45% of professionals victim to phishing scams.

Common Methods

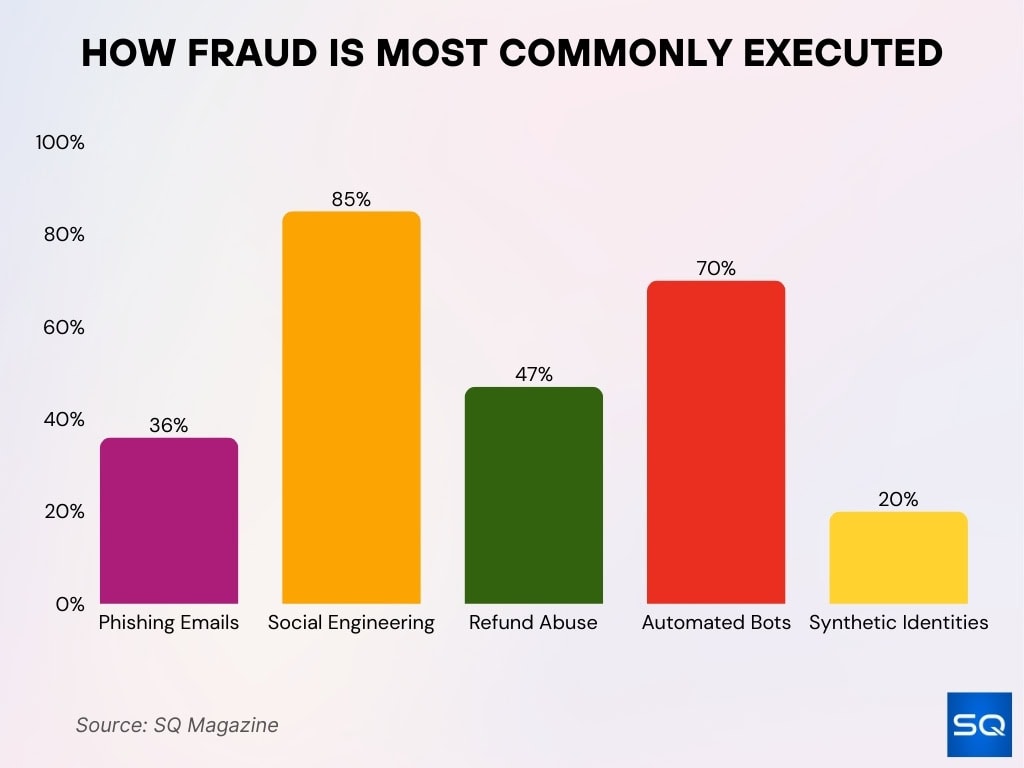

- Phishing emails account for 36% of data breaches.

- Social engineering succeeds in 85% of targeted attacks.

- Data breaches expose 2.6 billion personal records annually.

- Refund abuse affects 47% of merchants.

- Automated bots drive 70% of online fraud attempts.

- Synthetic identities represent 20% of fraud cases.

- Chargeback exploitation causes $25 billion in global losses.

Chargeback Fraud

- E-commerce chargeback rates average 0.6%-1% for CNP payments.

- Friendly fraud comprises 70% of all chargebacks.

- Global chargeback costs are projected at $125 billion.

- U.S. merchants lose $15 billion to chargeback fraud annually.

- Merchants spend $35 per $100 in chargeback disputes.

- Average chargeback value reaches $169.13.

- eCommerce chargeback rates surged 222% year-over-year.

- 72% of merchants saw friendly fraud chargeback increases.

- Merchants win only 17.4% of fraud-coded chargebacks.

- Chargeback volume is expected to grow 24% by 2028.

Friendly Fraud

- Friendly fraud accounts for 70% of all chargebacks.

- 72% of merchants report increased friendly fraud disputes.

- Subscription services face 3x higher friendly fraud rates.

- Merchants lose $100 billion annually to friendly fraud globally.

- Average friendly fraud chargeback costs merchants $250 per incident.

- 65% of friendly fraud stems from customer confusion.

- Unclear billing descriptors contribute to 40% of disputes.

- Lost goods from friendly fraud total $25 billion yearly.

- 85% of merchants now use chargeback mitigation tools.

- Dispute analytics reduces friendly fraud by 45%.

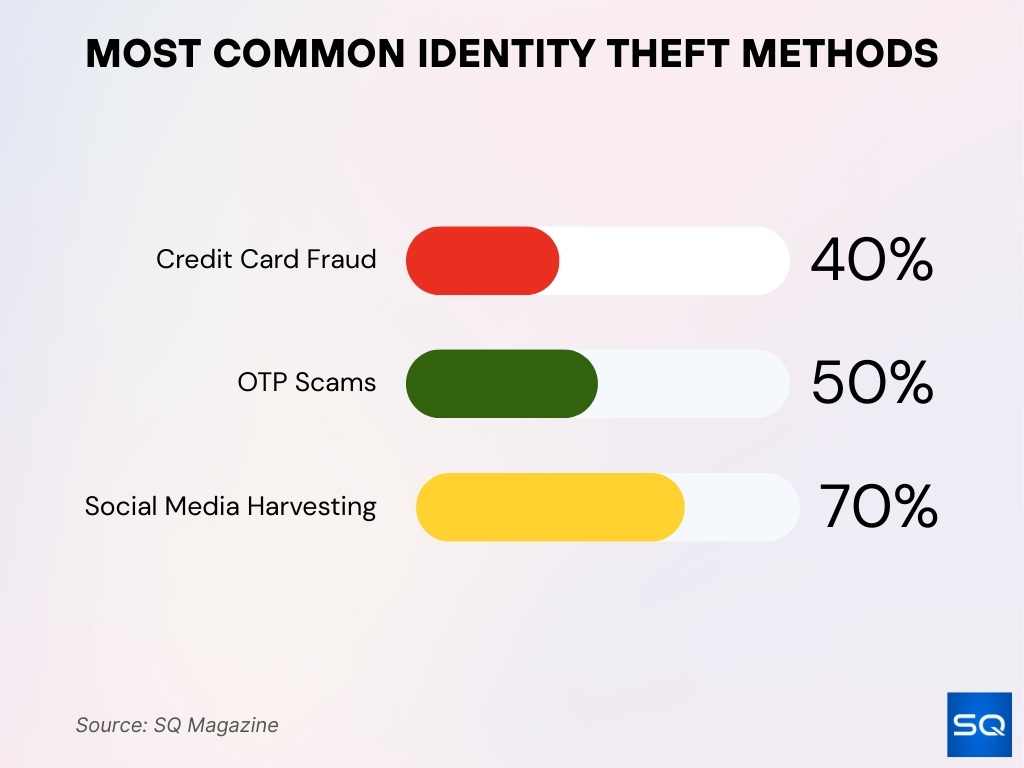

Identity Theft

- Identity theft enables 40% of credit card fraud reports.

- OTP scams account for 50% of cybercrime cases regionally.

- Social media harvesting aids 70% of account takeovers.

- Identity theft drives 12.5 billion in financial services losses.

- Data breaches exposed 149 million credentials recently.

- 80% of new account fraud uses stolen identities.

- Businesses lose $7 million annually to identity fraud.

- 323,459 credit card fraud reports tied to identity theft.

- Global identity fraud rate stands at 2.2%.

- Victims recover credit damage in 6 months.

Card-Not-Present Fraud

- CNP fraud losses total $28 billion globally.

- CNP transactions comprise 73% of e-commerce fraud.

- CNP drives 60% of chargeback disputes.

- Bots execute 80% of CNP card testing attacks.

- CNP fraud rates average 1.5% of transactions.

- Merchants incur $5.7 billion in CNP prevention costs.

- 3DS authentication cuts CNP fraud by 70%.

- CNP fraud surged 25% in high-risk categories.

- Global CNP volume reaches $3.5 trillion annually.

E-Commerce Fraud

- Global e-commerce fraud losses hit $81 billion.

- U.S. merchants lost $55 billion to e-commerce fraud.

- Fraud equals 3.3% of online revenue annually.

- 82% of marketplaces report rising fraud rates.

- Mobile commerce fraud surged 33% over desktop.

- Peak shopping fraud spikes 200% during holidays.

- Small retailers face 5x higher fraud costs.

- Cross-border fraud rates are 3x domestic orders.

- Digital wallet fraud grew 45% year-over-year.

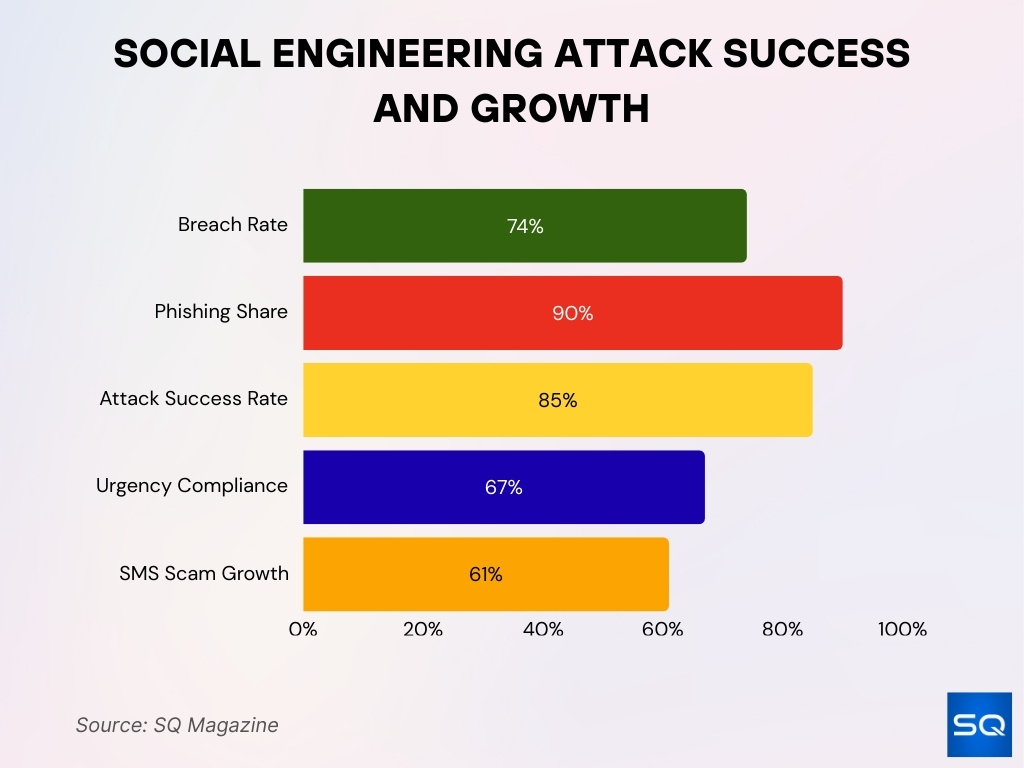

Social Engineering

- Social engineering causes 74% of cybersecurity breaches.

- Phishing represents 90% of social engineering attacks.

- 85% of targeted social engineering attacks succeed.

- Business Email Compromise costs $2.9 billion annually.

- Urgent language boosts compliance by 67% in scams.

- SMS scams increased 61% year-over-year.

Credit Card Fraud

- Global credit card fraud losses surpass $35 billion.

- CNP transactions fuel 85% of credit card fraud.

- Credit card fraud comprises 45% of U.S. payment fraud.

- Fraudsters test cards with $1 micro-transactions in 75% of attacks.

- EMV chips cut in-store fraud by 87%.

- Account takeover drives 30% of card misuse.

- Losses projected at $43 billion by 2028.

- Merchants absorb 90% of CNP credit card losses.

Alternative Payments

- Digital wallet fraud rose 25% year-over-year.

- BNPL fraud surged 26% in the first half of 2025.

- Account takeovers cause 80% of digital wallet fraud.

- Alternative payments exceed 50% of global e-commerce volume.

- P2P payment scams up 22% with billions lost.

- Crypto wallet fraud increased 25%.

- QR code scams in alt payments grew 35%.

- Strong authentication reduces alt payment fraud 60%.

Regional Trends

- North America suffers $15 billion in digital payment fraud losses.

- U.S. online fraud losses exceed $16.6 billion.

- Asia-Pacific accounts for 48% of global fraud incidents.

- Latin America ecommerce revenue loss hits 20% to fraud.

- Europe’s phishing scams rose 35%.

- Africa’s mobile money fraud surged 28%.

- Cross-border fraud increased 20% globally.

- Latin America fraud attempts up 32%.

Industry Impacts

- Retailers lose $207 for every $100 in fraud.

- Financial institutions face a $4.61 cost per $1 fraud loss.

- Fraud adds 3.3% to consumer prices via fees.

- Subscription services suffer 3x average friendly fraud.

- 98% of merchants are hit by fraud, impacting their experience.

- High fraud drops approval rates by 15-20%.

- Processors terminated 12% high-risk merchants.

- 75% plan fraud prevention budget hikes.

Frequently Asked Questions (FAQs)

The Asia-Pacific region accounts for about 45% of global digital payment fraud cases.

71% of victims were unaware of reimbursement policies in the context of authorised push payment (APP) fraud.

Approximately 75% of digital payment fraud incidents now involve mobile devices.

Conclusion

Online payment fraud continues to evolve alongside digital commerce, creating persistent financial and operational risks. Across ecommerce, credit cards, and alternative payments, fraud losses now total tens of billions of dollars annually, affecting every region and industry. As fraud techniques grow more sophisticated, businesses must rely on accurate data, layered defenses, and informed customers. Understanding these statistics provides a foundation for building safer and more resilient payment ecosystems.