Samsung remains one of the world’s largest employers, with a substantial global presence in multiple sectors. You’ll find its workforce playing a critical role in manufacturing, innovation, and regional economies. From boosting local job markets to powering cutting-edge R&D, its people shape industries and communities alike. Explore how Samsung’s workforce has changed, and where it’s headed, in this detailed analysis.

How Many People Work At Samsung?

- 262,647 employees (late 2024), spanning more than 240 global bases in 76 countries.

- The workforce declined from 270,278 in 2022 to 267,860 in 2023 and now stands at 262,647.

- 137,350 global (non‑Korea) employees in 2024, 125,297 domestic (Korea‑based).

- Of the 2024 workforce, 88,984 are in development, 105,571 are in manufacturing, and 18,731 are in quality assurance and EHS.

- In 2025, Samsung employs over 267,000 people across 74 countries.

- Workforce distribution (2025): 43% in South Korea, 38% in other Asian countries, 12% in North America, 7% in Europe, and other regions.

- Samsung operates with 15 regional offices, 33 production sites, 40 R&D centers, 7 design centers, and 109 sales offices.

Recent Developments

- By late 2024, Samsung’s total workforce stood at 262,647, reinforcing its vast global footprint across 76 countries.

- Employment declined nearly 2.8% from 270,278 in 2022 and 267,860 in 2023, totaling a decrease of 7,631 employees.

- Global (outside Korea) headcount dropped by 15,001, even as domestic (Korea) employment rose by 7,370.

- Samsung continues trimming both non-fixed-term (259,434 in 2024) and fixed-term (3,213) positions.

- Investment in R&D fuels hiring, and R&D spending increased from ₩28.3 trillion (~$20.7B) in 2023 to ₩35 trillion (~$25.7B).

- In 2024, the company hired 14,800 new employees, especially in semiconductor manufacturing, AI R&D, and software engineering.

- Workforce expanded globally, with over 267,000 employees across 74 countries as of 2025.

Samsung’s Current Team (Key People)

- Jun Young‑hyun – Vice Chairman & CEO: Sole Chief Executive since March 2025, Jun leads global strategy across semiconductors, consumer electronics, and mobile communications. Previously, he oversaw Device Solutions (DS), Memory Business, and the Samsung Advanced Institute of Technology (SAIT).

- Lee Jae‑yong – Executive Chairman: As the de facto head of Samsung Group since 2022, Lee shapes long-term vision, governance, and major investment decisions across the conglomerate.

- Tae‑Moon Roh – President & Acting Head of DX Division: Leads the Mobile eXperience (MX) Business and oversees the Device eXperience (DX) Division. He played a key role in launching AI-powered devices like the Galaxy S24 and S25 series and spearheaded revenue growth from ₩109 trillion in 2023 to ₩114 trillion in 2024.

- Won‑joon Choi – COO, MX Business: Appointed as the first-ever Chief Operating Officer for Samsung’s MX Business in April 2025, he manages global operations and R&D coordination within mobile experience.

- Mauro Porcini – President & Chief Design Officer (CDO): Appointed in 2025, Porcini brings seasoned design leadership to Samsung. He directs global design strategy and shapes product user experiences across all lines.

- Je‑Yoon Shin – Chairman of the Board & Independent Director: Serving since March 2024, Shin brings expertise in economic policy and fiscal affairs to the board with a strong governance focus.

- Young‑Hyun Jun (DS Division): In addition to his CEO duties, Jun continues to head the Device Solutions Division, including memory, systems LSI, and foundry, and leads SAIT, reinforcing his central role in tech innovation.

- Young Sohn – President & Chief Strategy Officer, SSIC: Youth Sohn leads the Samsung Strategy and Innovation Center (SSIC) in Silicon Valley, directing the company’s investments in AI, IoT, digital health, mobility, and disruptive technologies.

- KS Choi – President & CEO, Samsung Electronics North America: Guides Samsung’s strategic operations in North America, focusing on growth, customer loyalty, and market leadership.

- Dave Das – EVP, Mobile eXperience Business (Samsung Electronics America): Responsible for mobile product sales, marketing, carrier partnerships, and strategy across the U.S. market.

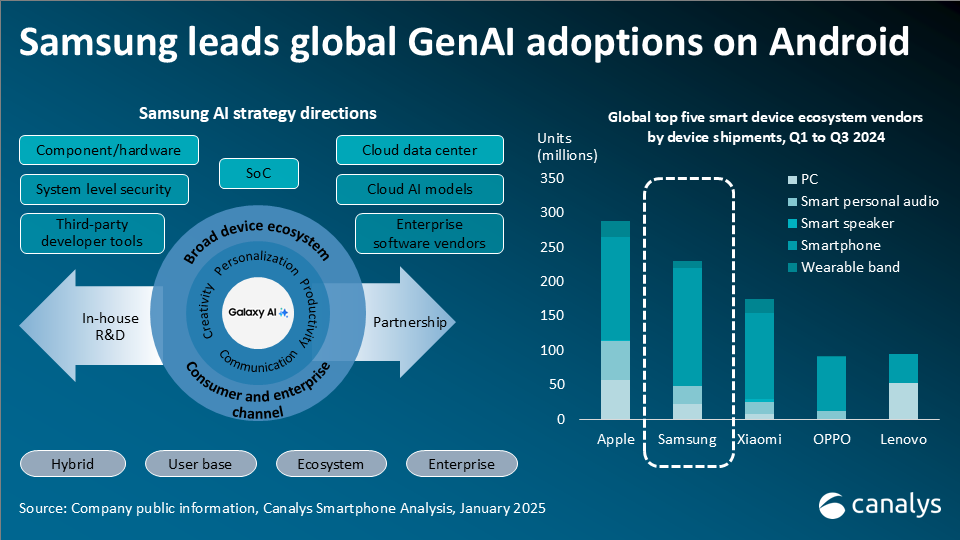

Global Smart Device Ecosystem Vendors

- Apple shipped about 280 million units, maintaining its lead in global smart device shipments.

- Samsung shipped roughly 230 million units, ranking second and leading GenAI adoption on Android.

- Xiaomi followed with nearly 160 million units, strengthening its global market presence.

- OPPO recorded around 85 million units, with steady growth in smartphones and wearables.

- Lenovo also shipped about 85 million units, supported by strong PC and smartphone sales.

Samsung Total Employee Count

- 262,647 total employees by late 2024, across 76 countries and over 240 global facilities.

- Earlier in 2024, the workforce hovered around 267,860, as reported in early-year data.

- Reports from mid‑2025 indicate consistent employment figures, with Samsung still employing over 267,000 globally across 74 countries.

- Fortune Global 500 figures noted 270,372 employees around 2023.

Samsung Employee Count by Year

- 2022: 270,278 employees.

- 2023: 267,860 employees, down from 2022.

- 2024: 262,647 employees, a further reduction.

- The trend shows a gradual reduction, a total net drop of ~ 7,631 employees over two years (~2.8%).

Global Versus Domestic Employees

- 2024: Domestic (South Korea): 125,297, Global (non‑Korea): 137,350.

- 2023: Domestic: 120,756, Global: 147,104.

- 2022: Domestic: 117,927, Global: 152,351.

- Over three years, the domestic headcount increased by ~ 7,370, while the global staff decreased by ~ 15,001.

- Samsung’s workforce remains balanced, around 48% domestic and 52% global as of 2024.

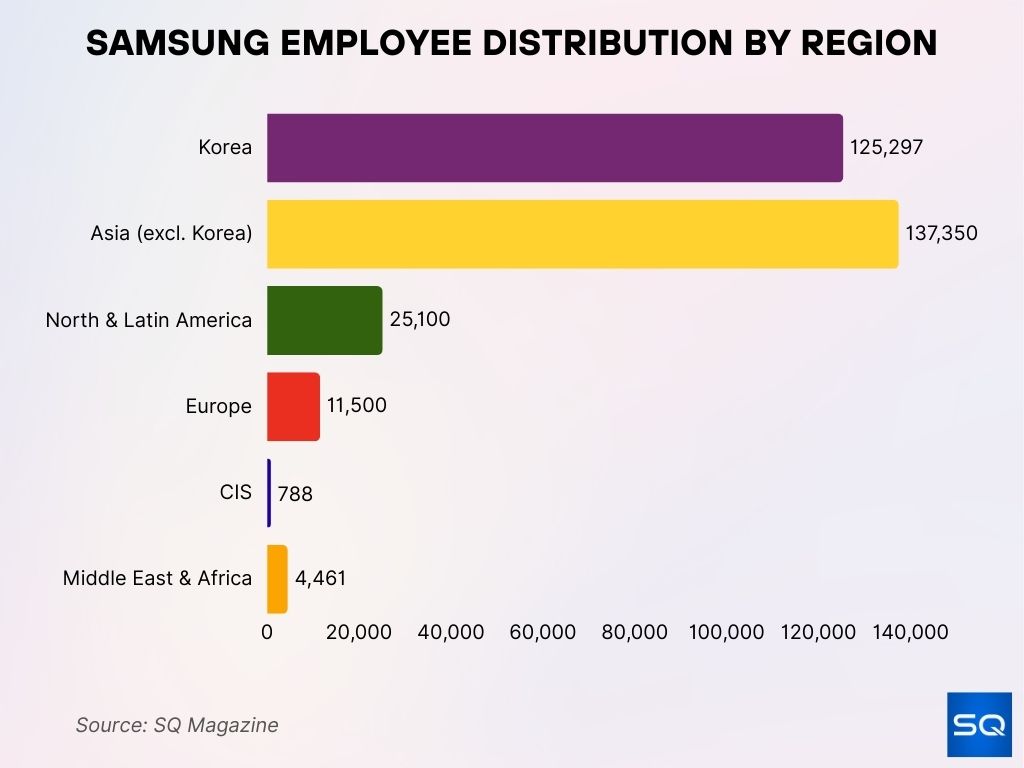

Employee Distribution by Region

- Samsung employed 125,297 people in Korea and 137,350 in Asia (including Southeast Asia, China, and Japan), totaling 262,647 globally.

- In the North and Latin America, employment stood at 25,100.

- Europe accounted for 11,500 employees.

- The CIS region had 788 employees, down significantly from prior years.

- The Middle East and Africa hosted 4,461 employees.

Employee Count by Job Type

- Development roles grew from 80,423 (2022) to 88,984 (2024).

- Manufacturing staff declined from 117,190 (2022) to 105,571 (2024).

- Quality assurance & EHS rose to 21,386 in 2023, but dipped to 18,731 in 2024.

- Sales and marketing positions held steady at around 23,466 in 2024, up from 24,703 in 2022.

- Other roles, including administration, research support, fell from 28,199 (2022) to 25,895 (2024).

- There’s consistent hiring in R&D, paired with a gradual shift away from manufacturing roles.

- The growth in Development jobs, ~8,500 added over two years, underscores Samsung’s focus on innovation.

Age Group and Gender

- Employees under 30 dropped from 83,155 (2022) to 63,531 (2024).

- 30s age group increased slightly to 114,035 in 2024.

- 40 and above rose from 75,516 to 85,081 over the same span.

- The female share of the workforce declined from 35.1% (2022) to 33.1% (2024).

- By role, development had 19.7% females, manufacturing had 41.8%, and sales/marketing saw 35.2% females.

- Regionally, female representation, Korea: 25.8%, Asia ex-Korea: 43.1%, N. & L. America: 33.6%, Europe: 33.3%.

- By rank, the manager level rose to 18.2% women, executive level to 7.4% in 2024.

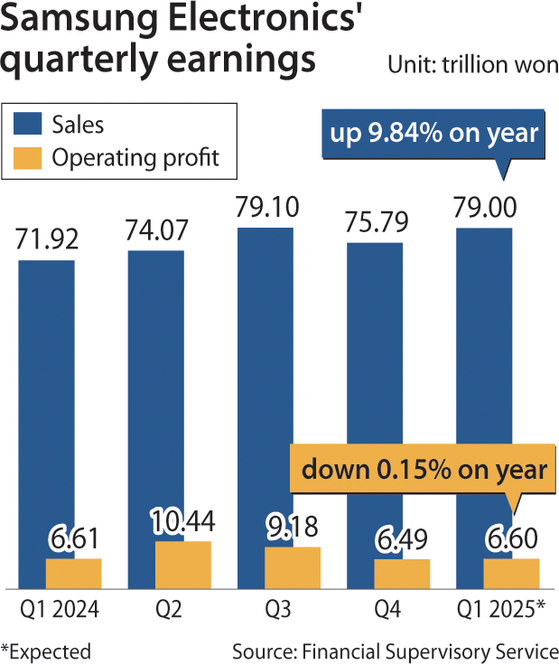

Samsung Electronics’ Quarterly Earnings

- Q1 2024 sales reached 71.92 trillion won with an operating profit of 6.61 trillion won.

- Q2 2024 saw sales of 74.07 trillion won and the highest operating profit of 10.44 trillion won.

- Q3 2024 recorded 79.10 trillion won in sales and 9.18 trillion won in profit.

- Q4 2024 slipped to 75.79 trillion won in sales with 6.49 trillion won profit.

- Q1 2025 (expected) projects 79.00 trillion won in sales and 6.60 trillion won profit.

- Overall, sales rose 9.84% year-on-year, while operating profit dipped 0.15% year-on-year.

Leadership and Executive Count

- Working-level employees shrank from 182,323 (2022) to 164,895 (2024).

- In contrast, manager-level employees rose from 86,498 to 96,294 over the same period.

- The executive level remained stable, 1,458 in 2024 compared to 1,457 in 2022.

Recent Employee Growth or Reductions

- The total workforce decreased by ~7,631 employees from 2022 to 2024 (~2.8% decline).

- Non-fixed-term roles fell from 266,613 to 259,434, and fixed-term roles dropped from 3,665 to 3,213.

- Age demographics show fewer younger employees and more older age groups, suggesting workforce aging.

- Development roles rose while manufacturing shrank, highlighting a strategic shift.

- Female representation slightly declined overall, yet improved in managerial and executive ranks.

New Hires and Recruitment Initiatives

- Samsung hired 14,800 new employees in 2024, focused largely on semiconductor manufacturing, AI R&D, and software engineering.

- 30% of employees now engage in research and development–related roles, signaling a strong innovation focus.

- The average employee tenure across the company stands at 11.2 years, signaling solid retention in core roles.

- Female new hires in 2024, 29.5% in Korea, 30.0% globally, up from previous years.

- Samsung increased diversity hiring by 17% in 2024, particularly boosting women in engineering and leadership.

- Training investment per employee rose to ₩1.919 million (~$1,400) in 2024, supporting development for new talent.

- Samsung delivered 66.8 average training hours per employee globally in 2024, up from 52.1 in 2022.

- Graduates and early-career hires benefit from leadership programs such as workshops for women leaders, mentoring, and networking.

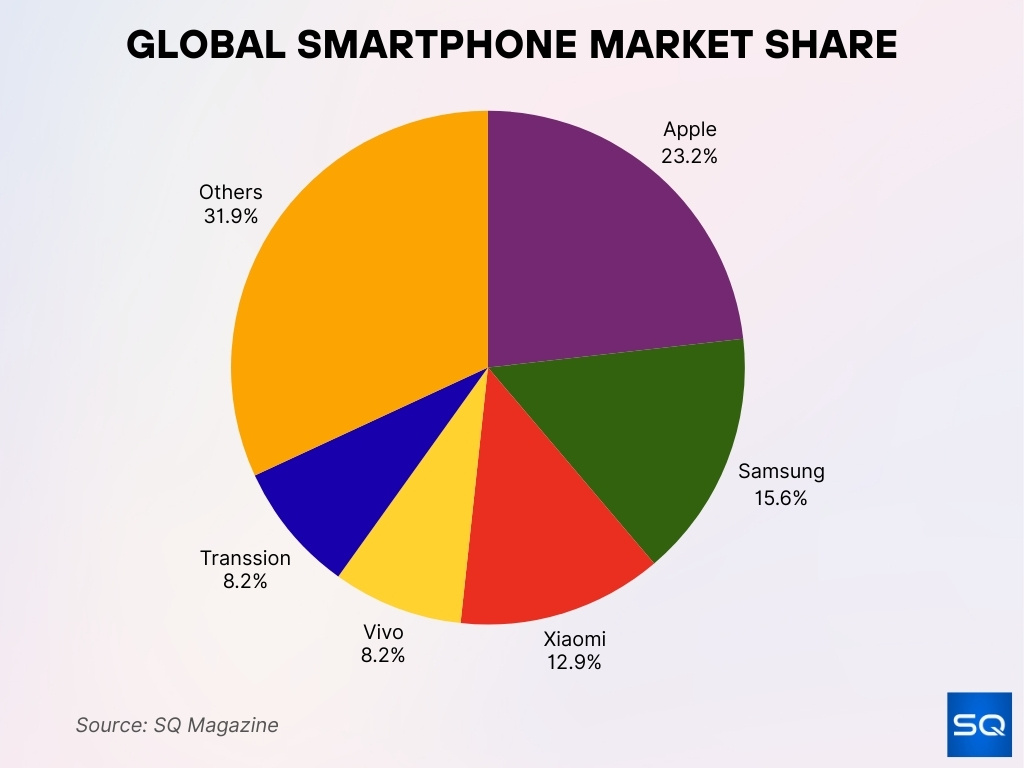

Global Smartphone Market Share

- Apple leads with a 23.2% share of the global smartphone market.

- Samsung holds the second spot with 15.6%, remaining a major Android player.

- Xiaomi captures 12.9%, strengthening its global presence.

- Vivo accounts for 8.2%, showing steady performance.

- Transsion also holds 8.2%, driven by strong growth in emerging markets.

- Others collectively make up the largest segment at 31.9%, highlighting market fragmentation.

Workforce Diversity and Inclusion

- In 2024, women made up 33.1% of Samsung’s workforce, down slightly from 35.1% in 2022.

- Female representation by job type (2024), Development: 19.7%, Manufacturing: 41.8%, QA & EHS: 38.8%, Sales & Marketing: 35.2%, Others: 37.0%.

- Regional female representation (2024), Korea: 25.8%, Asia ex‑Korea: 43.1%, Americas/Latin America: 33.6%, Europe: 33.3%, CIS: 36.0%, Middle East & Africa: 18.9%.

- At the managerial level, women rose to 18.2%, and at the executive level to 7.4% in 2024.

- Samsung’s 2024 pay equity initiative showed progress, domestic gender pay gap at 23.7%, improved from the previous year.

- 90% of employees reported feeling that their team values diverse perspectives in Samsung’s 2024 internal inclusion survey.

- Employee Resource Groups, such as UNIDOS, Galaxy of Black Professionals, and Pride, strengthen inclusion and cultural connection.

- Comparably diversity score, 66/100, placing Samsung in the top 50% among large companies. Among diverse employees, only 55% believe they are paid fairly compared to 67% of men.

Employees with Disabilities

- The number of employees with disabilities increased to 1,999 (1.9%) in 2024, up from 1,732 (1.6%) in 2022.

- This growth reflects Samsung’s expanded hiring at its standard workplace for people with disabilities in Korea.

Parental Leave and Return-to-Work Rates

- 4,892 employees took parental leave in 2024, including 1,510 men and 3,382 women.

- Return-to-work rates post-leave are high, 96.6% for men and 99.5% for women.

- Samsung operates 12 in-house daycare centers in Korea, with a capacity for 2,937 children, up from 11 centers and 2,628 capacity in 2022.

Retention and Retirement Rates

- The overall retirement rate declined from 12.9% in 2022 to 10.1% in 2024.

- Male retirement rate, 6.3% in 2024, up slightly from 5.9% in 2023. Female retirement rate decreased steadily to 3.8% in 2024.

- The average tenure of 11.2 years underscores strong retention in technical roles.

Conclusion

Samsung continues balancing global scale with strategic focus. While the workforce has slightly declined, hiring remains robust in innovation areas. Workforce diversity is advancing steadily, though challenges remain. Women now represent 33.1% company-wide, with growing representation in higher ranks and rising hiring of employees with disabilities. Parental leave and return-to-work rates point to strong support systems. As Samsung evolves toward innovation and inclusivity, these metrics reveal a resilient, adaptive workforce shaping its future.