NVIDIA emerged from rapid expansion to become a global employer, reflecting the company’s pivotal role in the AI and computing infrastructure revolution. This staffing scale supports applications ranging from autonomous-vehicle platforms and data-centre AI training to enterprise cloud graphics and gaming ecosystems. For instance, automotive OEMs use NVIDIA’s hardware/software stacks for self-driving pilots, and life sciences companies deploy NVIDIA-accelerated systems to analyse genomic data. Let’s explore the workforce numbers and underlying trends in detail.

How Many People Work At NVIDIA?

- NVIDIA employed around 36,000 people in fiscal year 2025, up about 21.6% from 2024.

- In fiscal 2024, NVIDIA’s headcount was approximately 29,600, a 12.99% year-on-year increase.

- The company’s revenue per employee is $3.6million-$4.59 million in recent data.

- Profit per employee for NVIDIA has reached over $2 million in more recent reporting.

- The gender split of the workforce is about 81% male / 19% female.

- Among U.S. race/ethnicity data, about 50% of U.S. employees identify as Asian/Indian, roughly 30% as White.

- The company reports a very low turnover rate of around 2.5%, significantly below the industry average.

Recent Developments

- The company’s headcount rose to 36,000 at year-end FY2025, a 21.62% increase from 2024.

- In FY2024, the employee count reached ~29,600, up from ~26,196 in 2023.

- NVIDIA published its FY2024 results with record revenue of $130.5 billion, up 114% year-over-year.

- The hiring surge has been driven largely by demand for AI and data-centre infrastructure roles.

- The company’s sustainability and diversity report for FY2025 mentions a strengthened focus on “diversity recruiting” and retention metrics.

- Operational costs have grown as productivity and scale ramp, for example, compensation and benefits expenses rose significantly due to workforce growth.

- There is increasing regional hiring in Asia and the Americas to support product development, sales, and global rollout.

- NVIDIA’s corporate filings indicate continued investment in R&D headcount to drive next-gen architectures.

How NVIDIA’s $5 Trillion Valuation Redefines Big Tech

- NVIDIA reached a historic $5 trillion market capitalization in November 2025, cementing its status as the world’s most valuable tech company.

- This valuation is equal to the combined worth of Meta and Alphabet, two of the biggest digital advertising and AI-driven firms.

- Apple’s market cap, around $4 trillion, trails NVIDIA by roughly $1 trillion, highlighting the semiconductor giant’s explosive growth.

- The combined retail powerhouses Amazon, Walmart, and Costco together also total about $4 trillion, matching Apple’s scale but still below NVIDIA’s.

- Microsoft, valued at $4 trillion, remains another close competitor but is outpaced by NVIDIA’s AI-fueled rise.

- The automotive sector, represented by Tesla, Ford, GM, and Stellantis, collectively sums to only $2 trillion, less than half of NVIDIA’s size.

- In the media and entertainment sector, Disney, Netflix, Warner Bros Discovery, and Comcast together hold roughly $1 trillion, showing NVIDIA’s dominance across industries.

- Even the globally recognized consumer brands McDonald’s, Coca-Cola, Starbucks, and Chipotle amount to just $500 billion, or 10% of NVIDIA’s valuation.

- The data underscores how NVIDIA’s leadership in AI and data-center chips has propelled it beyond traditional tech, retail, and automotive giants.

- As of late 2025, NVIDIA stands alone as the first semiconductor company to hit a $5 trillion valuation, reflecting both investor confidence and AI-driven market momentum.

NVIDIA’s Current Team (Key People)

- Jensen Huang: Founder, President & Chief Executive Officer. He co-founded NVIDIA in 1993 and has led the company since its inception.

- Colette Kress: Executive Vice President & Chief Financial Officer. She oversees financial planning, investor relations, and corporate development.

- Debora Shoquist: Executive Vice President, Operations. Responsible for global operations, supply chain, and manufacturing execution.

- Jay Puri: Executive Vice President, Worldwide Field Operations. Leading global sales, field operations, and customer engagement.

- Tim Teter: Executive Vice President, General Counsel & Secretary. Heads legal affairs, corporate governance, and regulatory compliance.

- Chris A. Malachowsky: Co-Founder & NVIDIA Fellow. While not part of day-to-day operations, he provides long-term strategic guidance on architecture and innovation.

- Michael Kagan: Chief Technology Officer (CTO). Drives technology strategy, oversees research, and leads high-performance computing and accelerated-compute initiatives.

- William Dally: Chief Scientist & Senior Vice President of Research. Heads deep in research on processors, architectures, and AI systems.

Top NVIDIA Employee Statistics

- Total global headcount: ~36,000 employees as of fiscal year 2025.

- Growth from 2024 to 2025: +6,400 employees (21.62% year-over-year).

- Growth from 2023 to 2024: from ~26,196 to ~29,600 (12.99%).

- Net profit per employee: over $2 million in recent years.

- Company ranking: Among the highest in the tech sector for revenue and profit per employee.

- Average headcount growth over recent years: ~18-20%+ in some years (e.g., 2022: ~18.43%).

- Global workforce distribution: data suggests talent is heavily weighted toward technical, engineering, and research functions.

- Headcount vs historical: In 2016, the employee count was ~9,227.

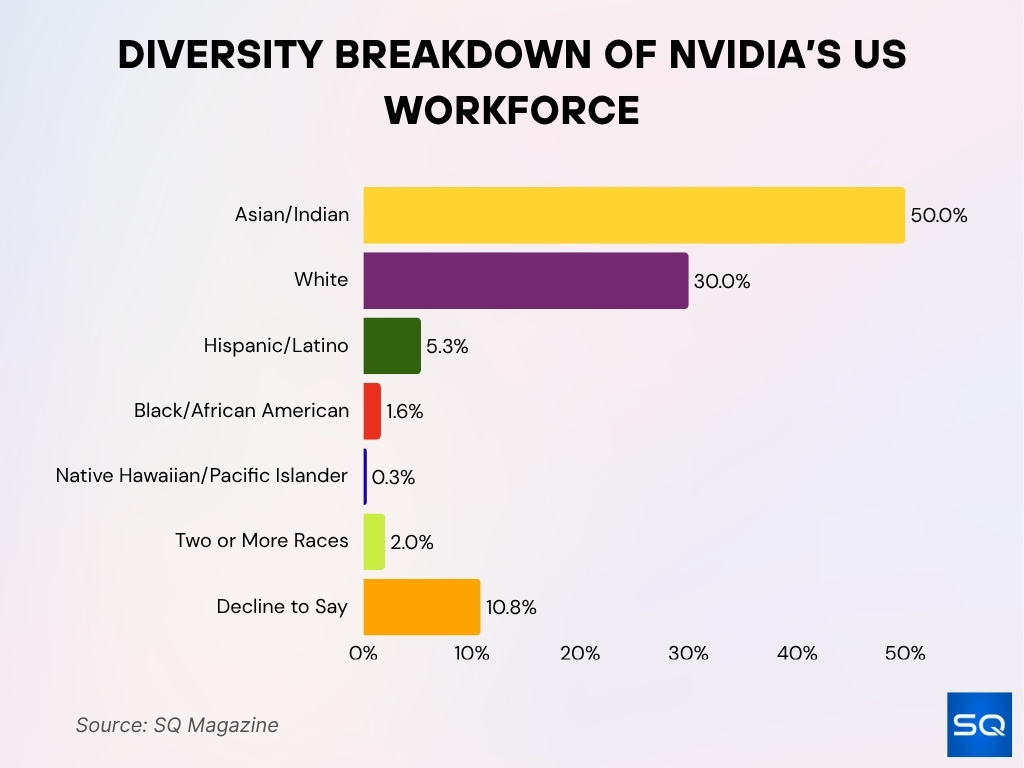

Ethnic Diversity Within NVIDIA

- As of 2024, about 50% of the U.S.-based workforce at NVIDIA Corporation is Asian/Indian.

- White employees represent roughly 30% of the U.S. workforce at NVIDIA in 2024.

- Hispanic/Latino representation rose to about 5.3% in 2024.

- Black/African American representation stood at approximately 1.6% in 2024.

- Native Hawaiian / Pacific Islander remain roughly 0.3% of the workforce.

- “Two or more races” accounted for about 2.0% in 2024.

- The “Decline to say” category (employees who do not report ethnicity) was roughly 10.8% in 2024.

Gender Representation at NVIDIA

- Female representation at NVIDIA is approximately 19%, with 81% male employees.

- Women make up 28.6% of NVIDIA’s board of directors as of recent data.

- Female participation in technical and engineering roles is lower than the overall female workforce share, below 19%.

- NVIDIA achieved near pay parity with women earning 99.5% of what men earn in baseline compensation.

- Women comprise about 15% of technical roles and 18% of managerial roles in NVIDIA’s U.S. workforce.

- External tech industry benchmarks target about 30-35% female representation, where NVIDIA remains below.

- NVIDIA’s female executive representation is roughly 15%, reflecting moderate room for growth

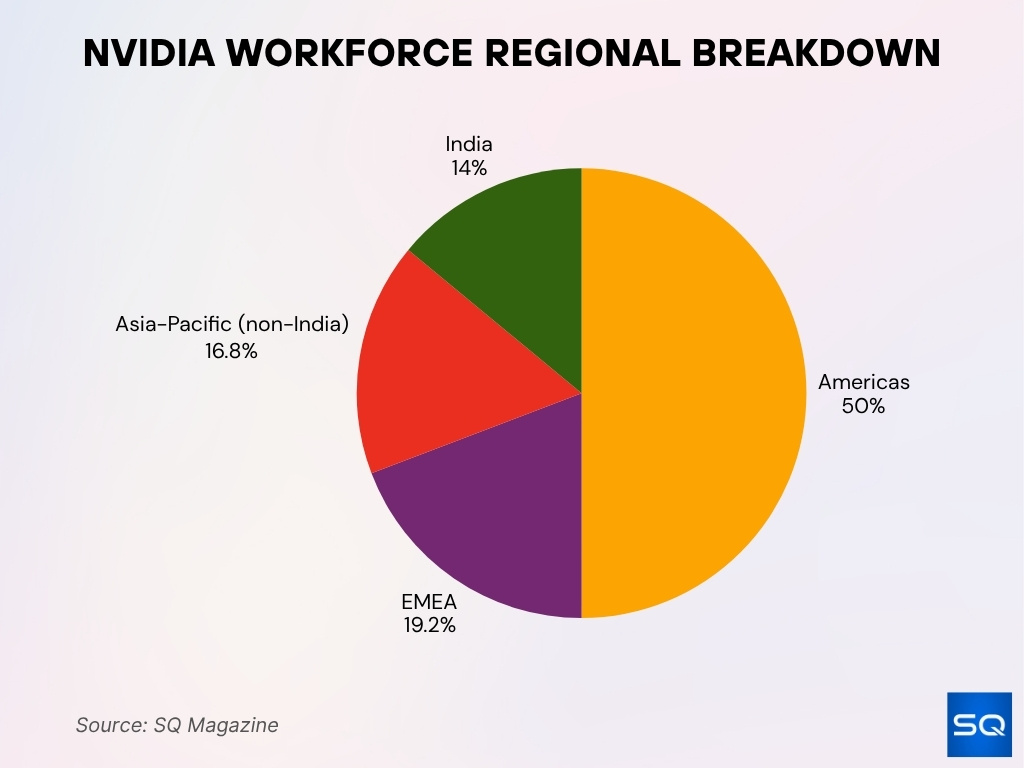

Regional Distribution of NVIDIA Employees

- Globally, as of 2025, NVIDIA’s total headcount is ~36,000 employees.

- Approximately 50% of NVIDIA employees were based in the Americas region.

- About 19.2% of the workforce was in the EMEA region (Europe, the Middle East & Africa).

- The Asia-Pacific (non-India) region accounted for about 16.8% of the workforce in one estimate.

- India alone comprised around 14% of the workforce.

- The Bay Area (San Francisco/Santa Clara/San Jose) hosts over 5,700 employees.

- India’s Bengaluru and Pune combined employ more than 2,300 staff.

- NVIDIA’s revenue-by-region breakdown for FY2025 shows the U.S. generating ~46.94% of revenue, suggesting a heavy concentration of business (and likely employees) in the U.S. region.

- Many of NVIDIA’s R&D and engineering roles are clustered in North America and India, aligning with the regional distribution of the workforce.

- The global spread implies that NVIDIA operates in multiple geographies but remains heavily U.S.-centric in staffing.

Revenue and Profit per Employee Metrics

- Revenue per employee at NVIDIA is estimated at $3.6million-$4.59 million.

- The company’s per-employee market valuation has been cited at $90-111 million per employee based on its ~36,000 employees and high market cap.

- The high revenue-per-employee metric suggests strong productivity and high-value roles within NVIDIA’s workforce.

- The 2025 headcount of ~36,000 followed revenue growth of ~114% in FY2025, meaning NVIDIA scaled revenue faster than headcount.

- Efficiency metrics like these support the notion that NVIDIA runs a relatively lean staffing model for an organization of its size in the tech sector.

NVIDIA Employee Comparison with Other Tech Companies

- As of mid-2025, NVIDIA’s global headcount (~36,000) is far lower than giants like Amazon.com Inc. (1.5 million+ employees) and Microsoft Corporation (221,000+).

- Despite its smaller workforce, NVIDIA’s revenue-per-employee outpaces many peers.

- Given NVIDIA’s specialization in high-margin GPU/AI infrastructure, the smaller headcount may reflect a focus on high-skill, high-value roles rather than large operational labour.

- For example, Apple’s ~164,000 employees generate ~$2.4 million in revenue per employee, and NVIDIA sits higher.

- The semiconductor sector (NVIDIA) differs from broad tech firms (cloud, retail) in workforce composition; NVIDIA leans more R&D/engineering rather than large retail/service staff.

- NVIDIA’s headcount growth is steep, rising from ~26,196 in 2023 to ~29,600 in 2024 and then ~36,000 in 2025.

NVIDIA’s Unrivaled Hold on the Data Center GPU Market

- NVIDIA controls between 92% and 94% of the global data center GPU market, underscoring its near-total dominance in AI computing infrastructure.

- AMD captures a modest 6% to 8% share, showing gradual progress but still far behind NVIDIA’s leadership position.

- Intel remains almost absent from this segment, with a 0% to 0.1% share, despite investments in data center GPU development.

- The figures reveal that NVIDIA powers nearly all major AI data centers, including those of Amazon, Google, Microsoft, and Meta.

Impact of Industry Trends (e.g., AI boom) on Headcount

- The rise of generative AI has significantly increased demand for hardware and infrastructure, directly driving growth in NVIDIA’s workforce.

- About 41% of CEOs expect AI to reduce staff numbers at various companies over the next five years, illustrating both opportunity and risk for headcounts.

- The semiconductor industry’s average turnover in recent years was around 16.4%, whereas NVIDIA’s reported turnover rate dropped to 2.5% in FY2025.

- NVIDIA’s headcount moved from ~26,196 in 2023 to ~29,600 in 2024 (12.99% growth) and then to ~36,000 in FY2025 per its report.

- Industry third-party data indicates NVIDIA had more than 3,000 open job postings in 2025, showing proactive hiring in key areas.

- The company states that the AI-driven demand for “accelerated computing” is a generational opportunity, implying sustained workforce growth.

Hiring Strategy and Talent Acquisition

- NVIDIA posted over 3,000 job openings in recent months, the highest among key industry peers.

- The company experienced a 21.62% increase in total employees, reaching around 36,000 in early 2025.

- North America hosts nearly 50% of NVIDIA’s workforce, with expanding R&D hubs in Europe and Asia-Pacific.

- NVIDIA’s stock-based compensation reached $4.74 billion in fiscal year 2025, a core part of retention for top talent.

- Approximately 85% of new hires from specialized recruitment campaigns come from diverse backgrounds.

- The firm’s software engineering and AI research roles constitute over 60% of new job postings.

- NVIDIA reports that its employees generate about $3.6million-$4.59 million in revenue per head annually.

- The company invested heavily in internal mobility and mentorship programs, supporting over 200 internal job transitions yearly.

Employee Retention and Turnover Rates

- NVIDIA’s overall turnover rate in FY2025 was reported at 2.5%, substantially below semiconductor-industry averages of ~16.4%.

- For FY2024, turnover was estimated at 2.7%, compared to ~17.7% industry average, confirming sustained low attrition.

- In FY2022, turnover at NVIDIA was 4.9%, already lower than the 13.8% industry figure that year.

- Approximately 20% of employees have tenure of ten years or more, indicating a stable core workforce.

- Retention is driven in part by large equity grants that vest over time; these “golden handcuffs” encourage longer stays.

- Employee satisfaction metrics are strong, and the company’s Glassdoor rating is around 4.6 out of 5, signaling high internal sentiment.

- Despite reports of high work intensity, employees stay, suggesting that compensation and growth opportunities outweigh stress factors.

- Low turnover helps NVIDIA maintain technical continuity and institutional knowledge in complex R&D environments.

Future Outlook for Workforce Growth

- NVIDIA’s workforce is projected to surpass 40,000 employees within the next 1-2 years.

- Skilled AI and machine learning roles are expected to grow by approximately 40% in the coming years.

- The company’s annual headcount growth reached 21.6% between 2024 and 2025.

- Around 50% of employees belong to Asian or Indian categories, reflecting geographic diversity.

- NVIDIA’s workforce remains male-heavy, with 80% male employees as of 2025.

- Hiring costs for AI engineers can exceed $400,000 total compensation per year, including equity and bonuses.

- Internal mobility programs facilitate over 200 job transitions annually within NVIDIA.

- AI-driven automation is expected to automate up to 80% of tasks, but increase employee productivity rather than reduce headcount.

- Expansion into emerging markets like China, India, and Southeast Asia is expected to increase regional headcount by 15-20% over the next two years.

Frequently Asked Questions (FAQs)

At $3.6million-$4.59 million revenue per employee, NVIDIA outpaces many peers whose revenue per employee metrics are often under $2.5 million.

The market value per employee exceeds $90 million (reported above $111 million in some sources).

Multiple sources state approximately 36,000 employees globally in FY 2025.

Conclusion

The workforce of NVIDIA reflects its transformation from a graphics-card maker into a global leader in AI infrastructure. Its hiring strategy prioritises high-value technical talent, global expansion, and strong retention mechanisms. Key industry trends such as the AI boom have both expanded and reshaped the workforce profile. Looking ahead, workforce growth is expected to continue, albeit with evolving role requirements and competitive talent dynamics.