LinkedIn’s workforce has been evolving alongside corporate strategy shifts and global market changes. Today, the company’s employee numbers and structural trends offer a clear view into its trajectory. Industry professionals can see how LinkedIn’s growth affects recruitment strategy and competitive positioning in tech. Meanwhile, HR leaders can assess how workforce fluctuations ripple through hiring practices and employee experience. Read on to explore the detailed breakdown.

How Many People Work At LinkedIn?

- As of April 2025, LinkedIn employed over 18,500 full-time staff, based on estimates reported across LinkedIn’s Careers and Microsoft filings.

- LinkedIn reportedly grew its total workforce to 21,507 employees, marking a 7.2% increase year-over-year.

- As of 2024, LinkedIn operated over 36 international office locations, spanning major cities across North America, Europe, and Asia.

- In mid-2025, LinkedIn cut approximately 270 roles in San Francisco, Sunnyvale, and Mountain View, aligning with Microsoft’s company-wide layoffs announced earlier in the year.

- In 2023, LinkedIn cut approximately 668 roles, accounting for roughly 3% of its workforce, as part of a restructuring announced by Microsoft.

- Workforce diversity: 51.9% men, 47.6% women, 0.7% undisclosed.

- Ethnic breakdown: 40.5% Asian, 36.8% White, remainder Black, Latino, mixed races.

Recent Developments

- Laid off 270 employees across San Francisco, Sunnyvale, and Mountain View around May 15, 2025.

- Microsoft confirmed layoffs affecting over 6,000 employees, or around 3% of its global workforce, in a strategic cost-cutting move.

- Layoff sectors included engineering, product, talent, and finance teams.

- The wave of staff reduction continues, with over 62,000 tech jobs cut across 284 companies in the first five months of 2025.

- Despite this, LinkedIn launched stricter recruiter and executive job title verification, impacting over 80 million users who have verified since 2023.

- Expansion of company page verification to all Premium accounts aims to boost trust.

LinkedIn’s Current Team (Key People)

- Ryan Roslansky, Chief Executive Officer, also now oversees Microsoft’s Office products and Copilot initiatives, anchoring LinkedIn within Microsoft’s AI and productivity strategy.

- Dan Shapero, Chief Operating Officer, leads global operations, including sales, marketing, and customer experience across the platform.

- James Chuong, Chief Financial Officer, handles financial planning, strategy, and business operations, key to scaling recurring revenue streams.

- Mohak Shroff, Senior Vice President & Head of Engineering, heads engineering leadership across infrastructure, AI systems, and product development.

- Melissa Selcher, Senior Vice President and Chief Marketing & Communications Officer, shapes LinkedIn’s global brand, messaging, and communications initiatives.

- Aneesh Raman, Chief Economic Opportunity Officer, drives skills-based hiring strategy and economic opportunity programs through partnerships and public outreach.

- Karin Kimbrough, Chief Economist, leverages LinkedIn’s vast data to guide research and insights on labor market and economic trends.

- Daniel Roth, Vice President & Editor-in-Chief, leads content strategy, including editorial news, member stories, and original programming.

- Blake Lawit, Chief Global Affairs & Legal Officer, oversees legal affairs, compliance, and regulatory matters across LinkedIn’s global footprint.

- Tomer Cohen, Chief Product Officer, directs product strategy and development across the platform, from core features to innovation initiatives.

- Nicole Leverich, Chief Communications Officer, guides internal and external communications, helping articulate LinkedIn’s mission and narrative.

- Jessica Jensen, Chief Marketing & Strategy Officer, aligns marketing strategy with LinkedIn’s growth goals and user engagement objectives.

- Teuila Hanson, Chief People Officer, manages HR strategy, employee development, and cultural initiatives across the company.

- Caroline Gaffney, Chief of Staff to the CEO, supports executive operations and alignment between leadership and strategic priorities.

- Jeff Weiner, Executive Chairman, continues to offer strategic guidance and long-term vision at the board level.

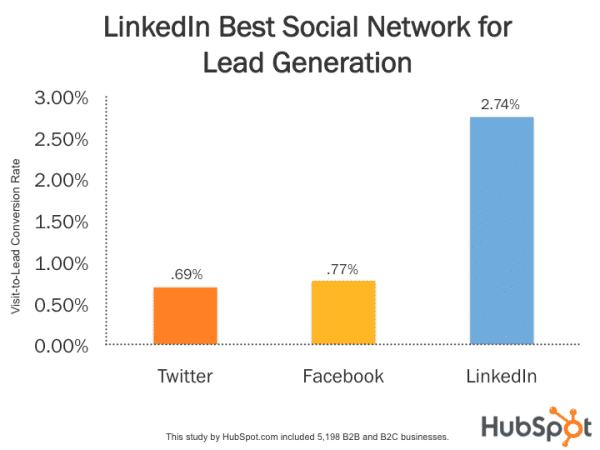

LinkedIn Dominates Lead Generation Among Social Networks

- LinkedIn leads all platforms with a 2.74% visit-to-lead conversion rate, the highest in the study.

- Facebook follows with a 0.77% conversion rate, significantly lower than LinkedIn.

- Twitter lags behind with only a 0.69% conversion rate.

- LinkedIn’s conversion performance is 3.5x higher than Twitter and 3.6x higher than Facebook.

- The data is based on a HubSpot study of 5,198 B2B and B2C businesses, highlighting real-world effectiveness.

- These findings reinforce LinkedIn’s role as the top platform for B2B lead generation in 2025.

Current LinkedIn Employee Count

- In April 2025, LinkedIn reported 18,500+ full-time employees worldwide.

- By August 2025, total employment rose to 21,507, a 7.2% increase from last year.

- Of those, 1,359 were newly hired year-to-date, about 5% of the total workforce.

- The count includes 19 departments, with 650 employees in engineering.

- Another source lists 18,500 employees in 2024, giving consistency to the April figure.

Historical Employee Growth

- Employee count rose from around 18,500 in early 2024 to 21,507 by August 2025.

- This reflects a year-over-year growth of approximately 7.2%.

- April 2025 saw more than 18,500 full-time staff, signaling a gradual scale-up.

- In contrast, earlier years experienced significant layoffs, a 3% reduction (~668 jobs) in 2023.

Workforce Reduction and Layoff Trends

- Roughly 668 employees (3% of LinkedIn’s workforce) were laid off in 2023.

- In May 2025, 270 roles were cut across Bay Area offices (SF, Sunnyvale, Mountain View).

- These layoffs are part of a broader Microsoft reduction exceeding 6,000 jobs.

- The tech industry faced 62,000 job cuts across 284 companies by May 2025.

- Layoff impact was felt across product, sales, talent, finance, and engineering functions.

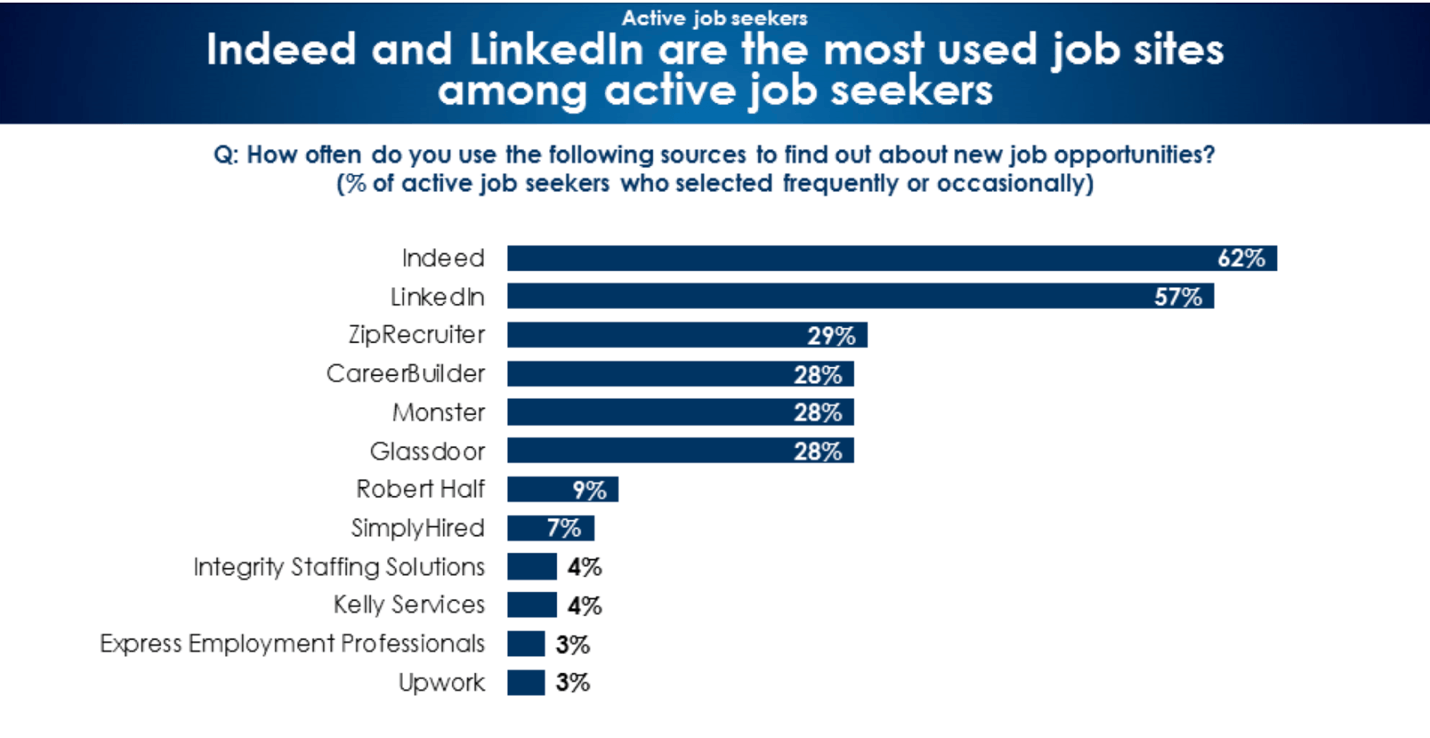

Most Used Job Sites Among Active Job Seekers

- Indeed is the top platform, used by 62% of active job seekers to find job opportunities.

- LinkedIn follows closely, with 57% of users relying on it frequently or occasionally.

- ZipRecruiter ranks third, attracting 29% of job seekers.

- CareerBuilder, Monster, and Glassdoor each have 28% usage among active seekers.

- Robert Half is used by 9% of respondents looking for new roles.

- SimplyHired sees engagement from 7% of job seekers.

- Integrity Staffing Solutions and Kelly Services are each used by 4%.

- Express Employment Professionals and Upwork trail at 3% each.

Global Office Locations

- As of early 2024, LinkedIn maintained 36 global offices, reflecting its widespread presence across regions.

- By April 2025, LinkedIn confirmed offices in 38+ cities, showing modest expansion.

- These locations span North America, Europe, Asia, and other strategic markets, promoting global connectivity.

- The addition of new offices suggests a focus on local hubs for product, talent, and growth.

- Office footprint aligns with coverage in 36 languages, boosting regional relevance and user support.

Workforce Distribution by Country

- LinkedIn’s workforce spans multiple countries, aligned with its global office presence, 38+ cities in 2025.

- English-language markets like the U.S., Europe, and India represent key talent pools, but company-specific breakdowns are not public.

- Despite employer distribution data being limited, broader user demographics show over 72% of members outside the U.S., hinting at diverse talent sourcing.

- The absence of country-level employee data may reflect internal confidentiality, even as hiring spans multiple continents.

- Still, LinkedIn maintains a strong presence in markets critical to user growth and platform development.

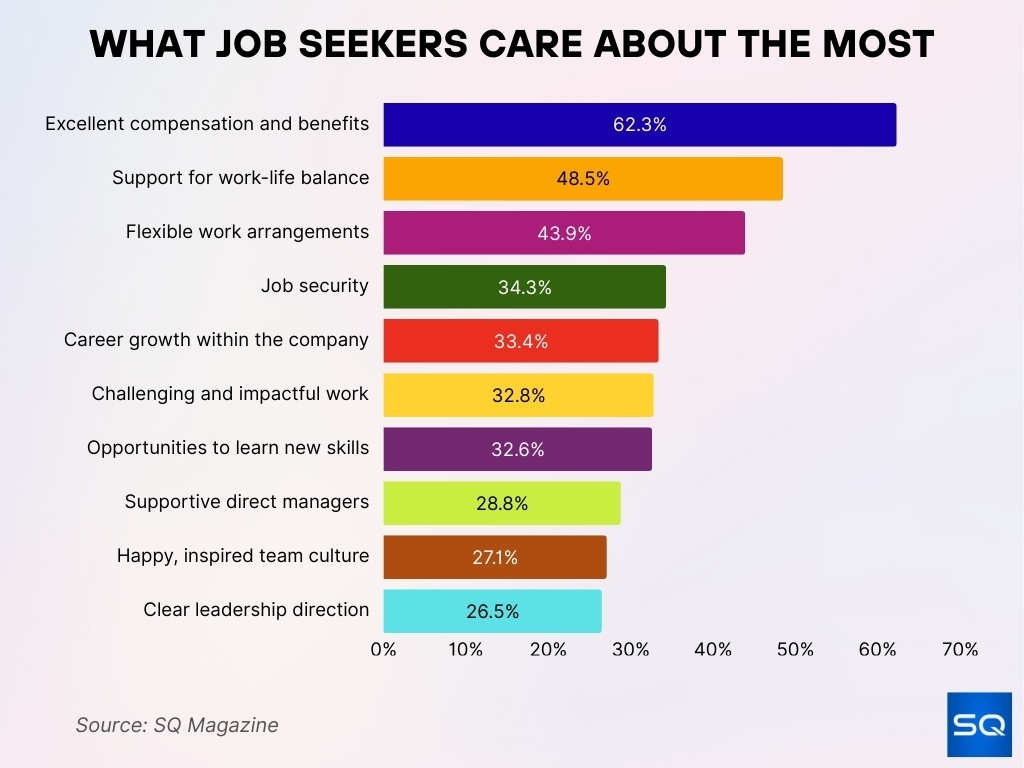

What Job Seekers Care About the Most

- 62.3% of candidates prioritize excellent compensation and benefits as their top job factor.

- 48.5% value support for work-life balance, emphasizing the need for flexibility and personal time.

- 43.9% consider flexible work arrangements essential in their job search.

- 34.3% rank job security as a critical consideration.

- 33.4% seek career growth opportunities within the company.

- 32.8% look for challenging and impactful work that offers purpose.

- 32.6% want opportunities to learn new skills for continuous development.

- 28.8% say having supportive direct managers influences their job decisions.

- 27.1% are drawn to a happy, inspired team culture.

- 26.5% emphasize the importance of clear leadership direction.

Employee Breakdown by Department

- In April 2025, open roles spanned product, marketing, engineering, sales, and design, suggesting active hiring across these divisions.

- A reported 19 departments cover core functions, including key technical and business operations.

- Engineering, given the company’s focus, likely hosts one of the largest employee groups, though exact figures aren’t public.

- Expansion in areas like LinkedIn Learning, AI content tools, and B2B sales solutions hints at departmental investment.

- Workforce allocation seems strategic, balancing technical innovation with growth-support functions like marketing and product development.

Full‑Time vs Contract Workforce

- As of April 2025, LinkedIn reported 18,500+ full-time employees, based on official press data.

- Contract or contingent workforce figures aren’t disclosed, but tech firms often supplement full-time staff with contractors.

- The emphasis on full-time hiring suggests LinkedIn prioritizes institutional knowledge and long-term development.

- Hybrid work trends may also influence the use of contract roles in certain functions, though data is not publicly available.

- Overall, the full-time workforce remains the cornerstone of LinkedIn’s internal operations.

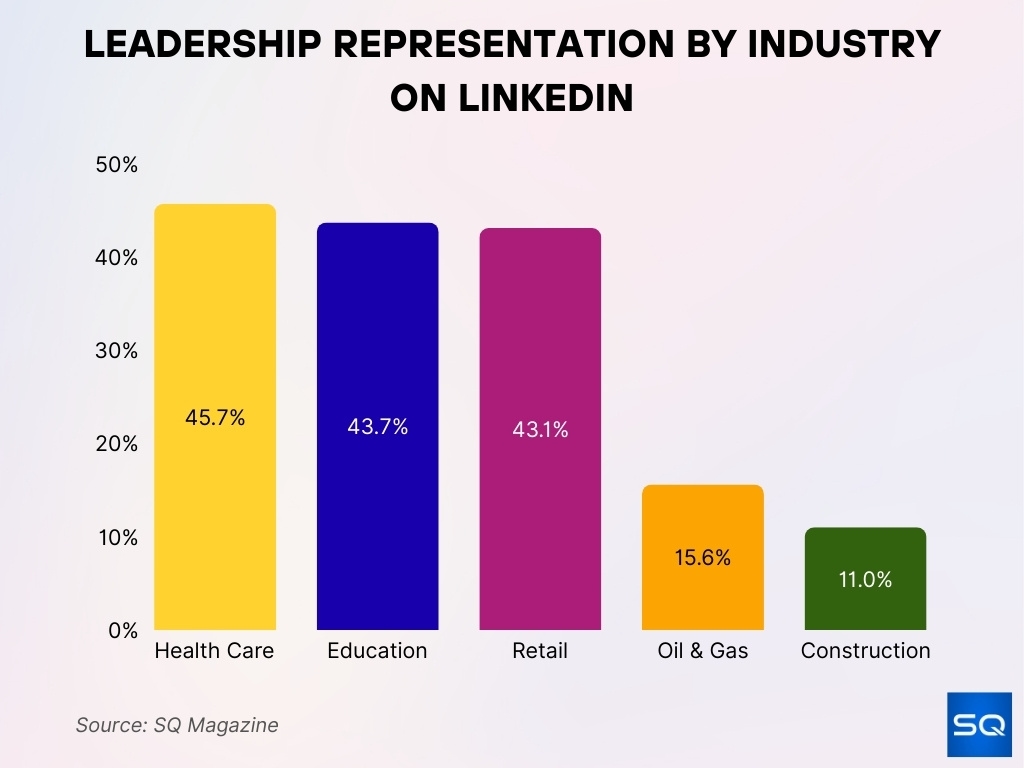

Leadership Demographics

- Women held ~46% of leadership roles at LinkedIn in 2023.

- Globally, across member data from 74 countries, women accounted for just 30.6% of leadership positions, compared to 43.4% of all roles.

- In the U.S., female leadership stood at 34.7%, higher than the global median.

- Representation gains plateaued, progress slowed from ~0.4 percentage points per year (2015 to 2022) to just 0.2 points combined over 2022 to 2024.

- The attrition of female representation is more pronounced at advanced career levels, especially among older generations.

- Industry-level insights show leadership representation varies, for example, Health Care (45.7%), Education (43.7%), and Retail (43.1%) are strong, but sectors like Construction (11.0%) and Oil & Gas (15.6%) lag.

Gender Diversity and Representation

- Women made up 47.3% of LinkedIn’s total workforce, while men made up 51.9%, and 0.8% did not disclose gender.

- In technical roles, women held only 29.3%, whereas men accounted for 69.4%, with 1.3% undeclared.

- Among leadership positions, approximately 46% were held by women, indicating relatively balanced representation at the top.

- Globally, women held just 30.6% of leadership roles, while comprising 43.4% of overall roles per LinkedIn’s Economic Graph data (end of 2024).

- Within leadership across 74 countries, the U.S. stood at 34.7% female representation, above the global average.

- Female representation in leadership remains low compared to total employment, showing room for growth.

- Recruitment data shows women are 16% less likely to apply to a job after viewing it, and 26% less likely to ask for a referral, yet they are 16% more likely to get hired when applying.

Ethnic and Racial Diversity

- 47.3% of LinkedIn’s leadership identified as White, 32.8% as Asian, and 6.5% as Black; 5.4% opted not to identify.

- Combined with gender data, these figures illustrate LinkedIn’s diverse leadership makeup while highlighting areas for improvement.

- Transparency in workforce diversity beyond leadership, such as overall ethnicity breakdown across all levels, remains limited.

Employee Satisfaction and Reviews

- LinkedIn employees rate the company 4.2 out of 5 stars on platforms like Glassdoor and Comparably, reflecting high overall satisfaction.

- This score reflects a generally positive sentiment toward LinkedIn’s work culture and benefits.

- Over 900 global leaders (around 25% of its leadership) completed a “Leading Others” academy, signaling investment in development.

- LinkedIn emphasizes career growth, and 73% of employees say they’d stay longer if more skill-building opportunities were offered.

- Globally, only about 56.7% of workers report being satisfied in their roles; LinkedIn likely surpasses this average.

- Key drivers of satisfaction include fair treatment (72%), growth opportunities (73.6%), and work-life balance (70.6%).

- LinkedIn’s learning tools and internal programs help sustain high satisfaction compared to general workforce trends.

Hybrid and Remote Work Policy

- Flexible work remains a strategic advantage; 20% of job postings were remote or hybrid, yet they attracted 60% of applications.

- Among new U.S. job postings in early 2025, fully remote rose from 10% (Q1 2023) to 13%, while hybrid climbed to 24%, and fully in-office dropped from 83% to 66%.

- Senior-level roles offered 31% hybrid and 15% remote options, mid-level saw 24% hybrid, 13% remote, entry-level had 18% hybrid, 10% remote.

- Most companies favor the “three in-office days per week” model, around 85% permit hybrid work, while 50% still emphasize office presence.

- Remote-capable employees in the U.S. are split: 52% hybrid, 28% fully remote, 20% fully on-site.

- Hybrid work correlates with notable benefits; industries with higher remote work saw a 0.09-point lift in labor productivity growth.

- Flexible policies significantly improve hiring reach and retention.

Open Roles and Hiring Trends

- LinkedIn’s “Jobs on the Rise” report highlights surging demand for AI roles; AI hiring is growing 30% faster than overall trends.

- Demand for green skills is accelerating; green talent demand rose 11.6%, while supply grew only 5.6%.

- Remote roles remain among the most competitive globally. For example, in the UK, 18% of applications were to remote roles, and 34% of postings were hybrid.

- 70% of marketers affirm that LinkedIn provides a positive ROI, underscoring ongoing platform adoption for hiring.

- Approximately 67 million companies and 139,000 schools are listed on LinkedIn, expanding content and hiring ecosystems.

- LinkedIn sees 7 hires every minute, while 11,000+ members apply for jobs every minute, highlighting intense hiring activity.

- 72% of recruiters use LinkedIn to fill jobs, reinforcing its central role in hiring strategies.

Key Benefits and HR Offerings

- LinkedIn supports a flexible hybrid model, enabling employees to choose remote or in-office work.

- The 4.2 employee satisfaction rating is tied to its comprehensive benefits package and work-life flexibility.

- Over 900 leaders completed professional development programs, representing a quarter of leadership capacity.

- Career development is emphasized, and learners stay longer if given more internal skill-building opportunities.

- Fair treatment, growth opportunities, and flexibility consistently underlie high satisfaction metrics.

- While not specific to LinkedIn, trends show internal learning programs and reskilling boost retention and culture.

- Offers likely include health care, retirement plans, wellness programs, and ongoing learning tools (MyGrowth, My Skills).

Future Workforce Projections

- AI roles are rising swiftly, 30% faster than overall trends, signaling continued demand for technical talent.

- By 2050, half of all jobs may lack sufficient green talent unless reskilling accelerates now.

- Reskilling needs are urgent, with estimates suggesting 59% of workers will need retraining by 2030.

- Demand for hybrid talent remains strong; flexible, remote-capable workers will likely dominate future hiring models.

- Learning culture and internal development tools will remain core to retaining talent.

- LinkedIn appears poised for continued growth in AI, green roles, and global workforce expansion.

Comparison with Other Tech Companies

- Dell’s decision to mandate full in-office attendance in March 2025 reportedly lowered its employee Net Promoter Score (eNPS) from 48 in 2024 to 32 in 2025.

- Unlike many firms, Citigroup retained hybrid flexibility; most employees work up to two days remotely, in contrast with banks enforcing stricter in-office models.

- A broader survey found 9% of businesses lost staff due to a lack of remote options, while 48% expect full-time office mandates soon.

- Flexible models clearly influence retention; LinkedIn’s approach stands out compared to companies forcing aggressive returns.

Conclusion

LinkedIn’s workforce today reflects a company evolving thoughtfully amid industry-wide shifts. With a high satisfaction rating of 4.2, strong hybrid flexibility, and growing demand for AI and green roles, it remains both dynamic and employee-centric. Its strategic benefits, leadership development, and learning infrastructure set it apart in a competitive tech landscape, where rigidity and harsh returns-to-office have cost others talent and morale. As LinkedIn continues adapting to future demands, from reskilling to sustainability, it’s well-positioned to retain its talent edge while scaling globally.