Figma has firmly established itself as a leading collaborative design platform, redefining how designers, developers, and teams create interfaces together. Its reach now spans millions of users, from solo creators to major enterprises across industries. In sectors like tech and education, Figma has streamlined workflows, from live interface prototyping in startups to cross-functional design systems in universities. Read on to discover the most compelling statistics shaping Figma’s trajectory this year.

Editor’s Choice

- Figma’s revenue surged to $749 million in 2024, a 48% increase from 2023.

- The platform supported 13 million monthly active users as of March 2025.

- Nearly 95% of Fortune 500 companies leverage Figma in their workflows.

- As of 2025, over 10 million individual users use Figma, more than doubling from 2022.

- Figma’s market share in design tools stands at 40.65%, leading the category.

- The company’s LTM (last twelve months) revenue reached $821 million with a 49% growth rate.

- Figma’s annual user base growth hit 159%, highlighting the accelerating adoption of collaborative tools.

Recent Developments

- Figma filed for its IPO with the SEC, aiming to list as ticker FIG on the NYSE.

- Figma could reach a valuation of $56.3 billion, though the company has not yet officially gone public.

- If Figma proceeds with its IPO, analysts speculate the company could seek a valuation in the $16–20 billion range, though share quantity and capital raise details remain unconfirmed.

- At its IPO debut, Figma’s market cap neared $60 billion, approaching half of Adobe’s valuation.

- Figma is now recognized not just as a design tool, but as an AI-powered platform transforming product workflows.

- Q1 2025 saw $228 million in revenue, a 46% year-over-year increase.

- Operating margins improved, with Q1 2025 showing a 17% operating margin compared to a loss of 117% in 2024.

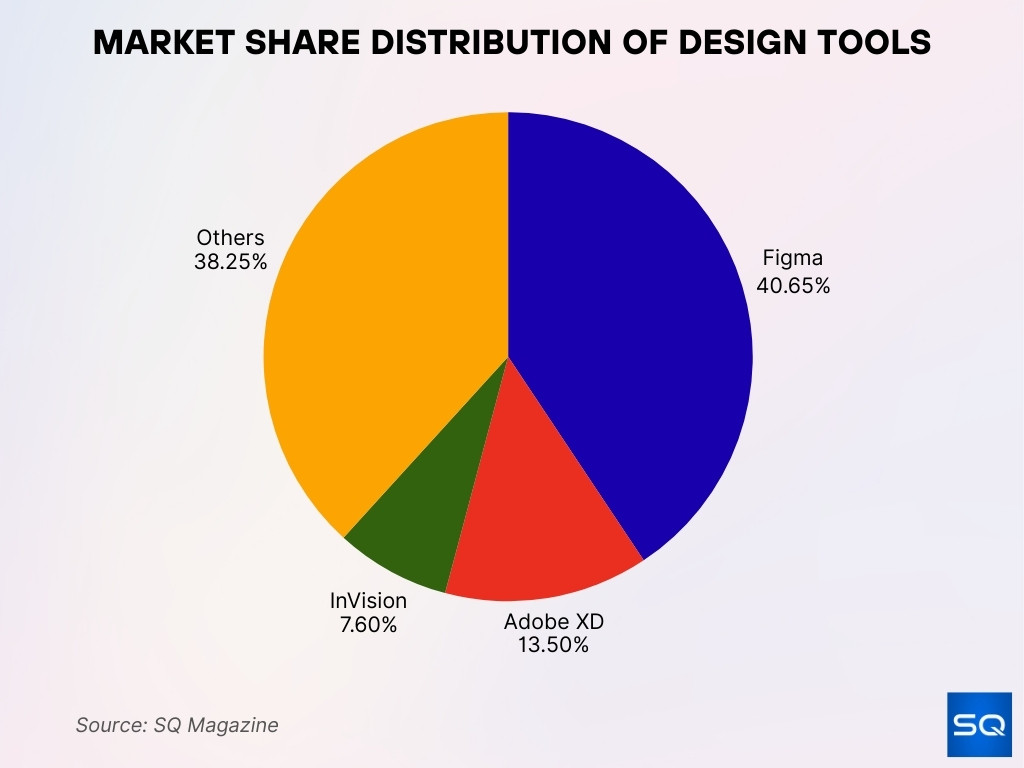

Market Share Statistics

- Figma holds a commanding 40.65% market share in the design tool category.

- Competitor stats, Adobe XD holds approximately 13.5%, and InVision around 7.6%.

- It leads over alternatives like Adobe XD and InVision.

- Figma’s dominance continues due to its cloud-based collaboration model, outpacing legacy desktop tools.

- Market trends favor browser-native platforms with real-time collaboration, areas where Figma excels.

- Figma continues to erode share from Adobe Creative Suite, despite Adobe’s entrenched presence.

- Its accessibility and collaborative features reinforce its leading position in market share.

Figma Platform Growth

- From 4 million users in 2022 to over 10 million in 2025, Figma’s user base more than doubled.

- The platform achieved monthly traffic of 6.69 million visits in January 2025, up from 4.68 million a year earlier, representing a CAGR of roughly 69%.

- Of those visits, 5.4 million came from branded search, indicating strong brand recognition.

- Search interest in “Figma” averaged 4.19 million global Google searches per month in 2024.

- The annual revenue growth trajectory shows explosive scaling, from $4 million in 2018 to $400 million in 2024, and beyond.

- Figma’s valuation climbed to $12.5 billion in 2024 after its Series F raise.

- By 2025, the employee count stood at around 2,300, supporting rapid product expansion.

Revenue Growth Statistics

- Revenue rose from $4 million in 2018 to $75 million in 2020, then $210 million in 2021.

- It reached $425 million in 2022, then $615 million in 2023, and hit $700 million by mid‑2024.

- As of year-end 2024, full revenue was confirmed at $749 million, with a 48% YoY increase.

- TTM revenue (last twelve months) was around $821 million with 49% growth.

- Q1 2025 alone generated $228 million, up 46% from Q1 2024.

- Subscriptions range from $12 to $45 per editor/month, enabling scalability from startups to enterprise.

- The product‑led freemium model has been key to turning organic adoption into paid conversions and revenue momentum.

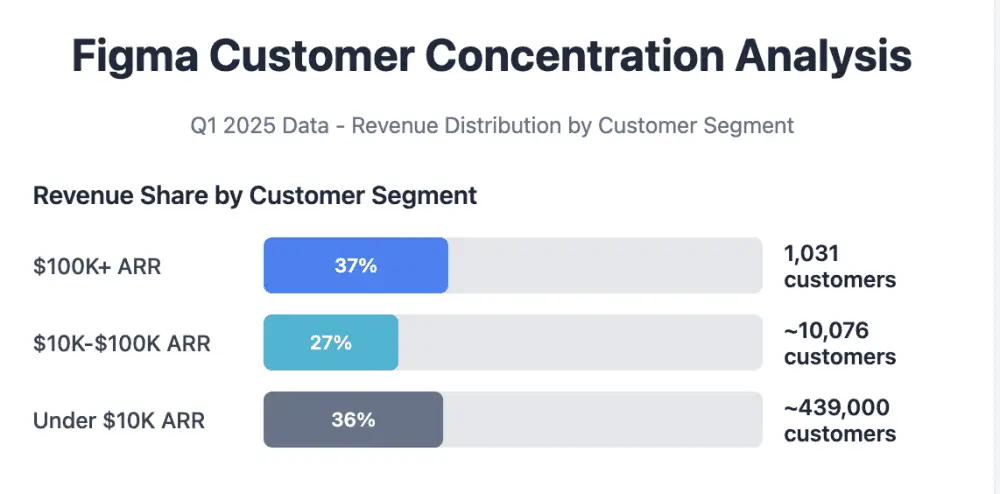

Figma Customer Concentration Analysis

- 37% of revenue comes from just 1,031 customers paying $100K+ ARR.

- 27% of revenue is contributed by around 10,076 customers in the $10K–$100K ARR segment.

- 36% of revenue is generated from Figma’s broad base of ~439,000 customers paying under $10K ARR.

Industry Adoption of Figma

- 95% of Fortune 500 companies use Figma in their design workflows.

- Among the Forbes Global 2000, 24% spend more than $100K annually on Figma.

- The tool is particularly strong in IT & Services, with over 12,800 companies using Figma, followed by Computer Software (10,097 companies).

- Other frequent industries include Marketing & Advertising (4,221), Internet (4,212), and Financial Services (3,164).

- Its appeal spans sectors, from retail to higher education, showing broad adoption.

- The flexibility of Figma’s platform has driven uptake across both creative agencies and enterprise engineering teams.

- Figma’s collaborative nature helps diverse teams, from marketers to product managers to developers, work seamlessly together.

Figma User Demographics

- 56.1% of Figma users are male, 43.9% female, showing a well‑balanced gender presence among visitors.

- The largest age bracket of users falls between 25 and 34 years old, reflecting Figma’s strong adoption by early-to-mid‑career professionals.

- Over 10 million users worldwide in 2025, more than double the 4 million in 2022, marking rapid expansion.

- Figma users report productivity and collaboration benefits, but specific ROI metrics like $3.28 per $1 invested are vendor estimates and should be interpreted cautiously.

- About 84% of designers report collaborating with developers weekly via Figma, a testament to its cross-functional impact.

- Around 38% of Figma users are based in the U.S., followed by 7% in India, indicating its global footprint.

- Small businesses (under 50 employees) make up 44% of Figma’s user base, showing its appeal to lean teams.

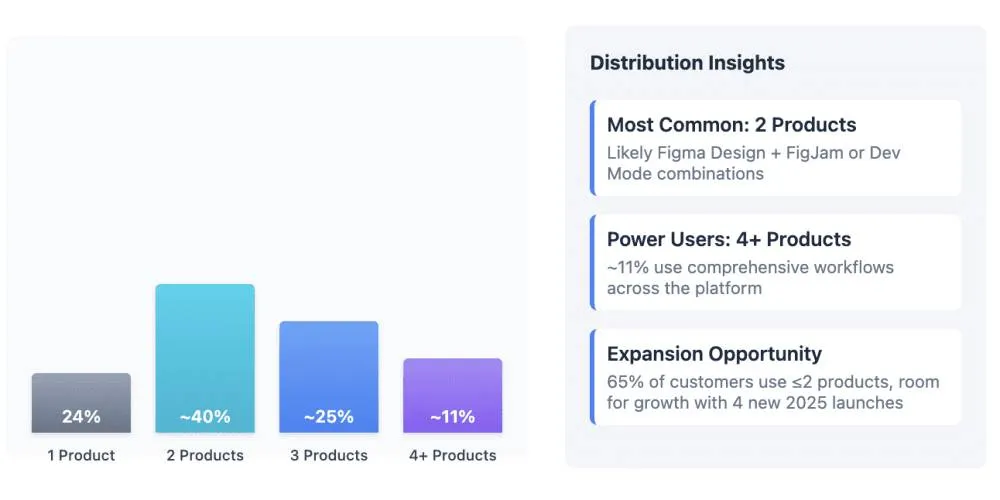

Figma Product Usage Distribution

- 24% of customers use only 1 product, showing single-tool adoption.

- The most common segment is 2 products (~40%), often combining Figma Design + FigJam or Dev Mode.

- Around 25% of users rely on 3 products, reflecting multi-tool workflows.

- 11% of power users leverage 4+ products for comprehensive platform use.

- 65% of customers use ≤2 products, highlighting a significant expansion opportunity with 4 new launches in 2025.

Company Size Breakdown

- 44% of Figma users work at small companies (1–50 employees), making them the most dominant group.

- Companies with 20–49 employees account for 15,035 organizations using Figma.

- Mid-sized companies (100–249 employees), 13,800 active Figma users.

- Very small teams (0–9 employees), 6,972 companies actively use Figma.

- Large enterprises (1,000+ employees) constitute only 13% of users, yet likely represent substantial revenue segments.

- Figma’s flexibility makes it a strong fit for both agile startups and select large-scale enterprises.

- Growth in engineering, product, marketing, and sales teams underlines Figma’s cross-domain reach and adaptability.

Geographic Distribution of Figma Users

- The U.S. accounts for 38% of Figma’s user base, the largest national share.

- India follows at 7%, signaling strong regional engagement.

- Figma’s usage spans across diverse global markets, though detailed country-by-country stats beyond these are not publicly available.

- Continued international adoption underscores Figma’s increasingly global design influence.

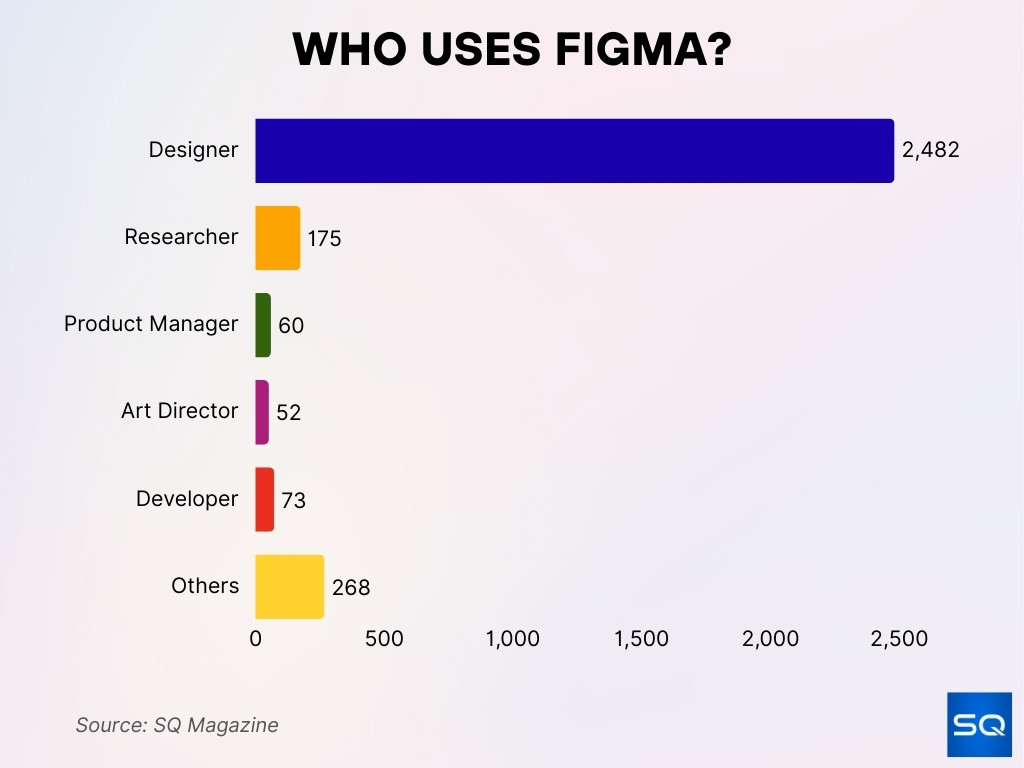

Who Uses Figma?

- Designers dominate with 2,482 users, making up the vast majority of Figma’s audience.

- Researchers account for 175 users, showing a smaller but valuable presence.

- Product Managers contribute 60 users, reflecting cross-functional adoption.

- Art Directors represent 52 users, highlighting leadership-level design involvement.

- Developers total 73 users, underscoring collaboration beyond design teams.

- Other roles make up 268 users, adding diversity to the Figma ecosystem.

Top Companies Using Figma

- As of early 2025, 95% of Fortune 500 companies rely on Figma for design workflows.

- 78% of Forbes 2000 companies also use Figma, reinforcing its presence within large enterprises.

- Major adopters include Microsoft, Airbnb, GitHub, Zoom, and Uber, all of which were early Figma adopters.

- Figma sees a strong footing in IT & Services, Computer Software, Marketing & Advertising, Internet, and Financial Services industries.

- The platform also gained traction in higher education, particularly following a Google for Education partnership.

- Its appeal spans startups to global enterprises, making Figma a universal design standard.

Figma Key Features Usage

- Figma supports design, prototype, and developer modes, bridging the gap between design and development.

- Real-time collaboration remains a defining feature, enabling simultaneous editing by multiple users.

- Built-in design systems and component libraries help teams maintain consistency and scale across files.

- As of February 2025, Library Analytics now includes data on components, styles, and variables for organization and enterprise customers.

- Figma introduced several new products in 2025: Figma Sites, Make, Buzz, and Draw, adding web publishing and AI-powered design features.

- The platform also offers vector editing, prototyping, and smooth design handoff, boosting team efficiency.

- Its WebAssembly‑based performance ensures a responsive experience even for complex files, setting it apart technically.

Figma AI Feature Adoption

- In firms with 1–10 employees, 61% of Figma users rated AI as very or critically important to achieving market share goals.

- 82% of developers report satisfaction with AI tools, compared to 69% of designers, suggesting deeper developer confidence.

- Regarding quality improvements, 67% of developers see AI enhancing their work, while only 54% of designers agree.

- Figma now positions itself as an AI-powered platform that helps teams go from ideas to shipped products.

- Its 2025 product launches, like Make and Buzz, incorporate AI-driven generation of prototypes and marketing assets.

- AI integration continues to deepen across Figma’s workflows and tooling.

- The company anticipates that AI will remain core to evolving design workflows, despite short-term efficiency trade-offs.

Plugin and Widget Statistics

- Figma hosts a broad plugin ecosystem, offering tools for accessibility, charts, editing, and more.

- By 2025, 20 essential plugins for UI/UX and web designers will be highlighted for boosting productivity and collaboration.

- At least 10 AI-powered Figma plugins, such as Builder.io and Magician, were identified as streamlining design processes in 2025.

- Plugin functions range from layer organization (Figma Autoname) to automated resizing (Automator) and content generation (Magician).

- AI plugins like Clueify support accessibility audits, flagging issues, and offering improvements.

- Figma’s Plugin community remains active and creative, driving ongoing feature expansion.

- Plugins consistently enhance real-time collaboration, streamline workflows, and foster design innovation.

Collaboration Metrics

- Figma’s Net Dollar Retention (NDR) stands at 132% in early 2025, showing strong expansion within existing accounts.

- Figma supports 13 million+ monthly active users, and notably, two-thirds are non-designers, highlighting widespread cross‑functional use.

- The platform scores a 40.65% share of the UI/UX market, driven by features like Dev Mode and Make 2.0 that support teamwork between designers and developers.

- 132% net dollar retention indicates customers consistently spend more over time, reflecting Figma’s collaborative stickiness.

- Figma’s Rule of 40 score is 63 (46% growth + 17% operating margin), well above the SaaS benchmark, showing healthy sustainability alongside teamwork‑boosting collaboration.

- Cross-functional workflows, from design to code, are strengthened through Dev Mode and AI tools like Make 2.0.

- Collaboration now reaches beyond core design teams to include developers, product managers, and marketers.

Design System Analytics in Figma

- In enterprise settings, Library Analytics now tracks usage of components, styles, and variables, helping teams monitor and refine design systems.

- These analytics support governance at scale, ensuring consistency across complex projects.

- Though granular stats (like adoption rates or activity trends) aren’t publicly disclosed, their release underscores Figma’s focus on systematizing enterprise workflows.

Figma Community Engagement Statistics

- Figma has built a community‑driven growth engine, turning early adopters into enterprise champions through peer influence and shared resources.

- Four stages of community engagement helped Figma scale, from grassroots user advocacy to structured enterprise adoption.

- Community programming continues to fuel self‑serve channels and contribute significantly to enterprise sales.

- The Figma Community, both files and forums, provides reusable templates, designs, and plugins, increasing engagement.

- Though hard numbers aren’t disclosed, this ecosystem underpins Figma’s viral growth and product-led expansion.

Figma Educational Usage

- Figma is free for educators and students, with features tailored for learning, real‑time collaboration, audio chat, voting, and feedback tools.

- Figma and FigJam integrate with Google Workspace for Education, enabling access across districts in the U.S., UK, and Japan.

- Templates, UI kits, and workflows support classroom use, while analytics help educators track participation and engagement.

- Figma’s tools align well with modern pedagogy, prototyping, mock‑ups, portfolios, and design literacy are all supported within classrooms.

- Although specific adoption figures (e.g., number of schools or users) aren’t public, educational integration remains a clear strategic focus.

Traffic and Audience Insights

- In July 2025, figma.com logged 121.94 million visits, a 22% monthly increase, with 13.35 pages per visit and an average session length of 16 minutes, 7 seconds.

- Visitor distribution by country shows the United States (12.95%), India (9.95%), and Russia (8.97%) as the top sources.

- Another source confirms 56.1% male and 43.9% female visitors, with the largest age group being 25–34 years old.

- A long‑term trend shows rising traffic; monthly visits hit 6.7 million in January 2025, with a CAGR of ~69% over prior years.

- Of that traffic, 5.4 million came from branded searches, a sign of strong brand awareness.

- Site engagement remains high, suggesting deep user interest and involvement.

Conclusion

Figma stands as a powerful force in collaborative design, combining rapid revenue growth, profitable expansion, and deep cross-functional adoption. It now accounts for over 40% of the UI/UX tool market, supports 13 million monthly users, two-thirds of whom aren’t designers, and consistently expands usage within companies (NDR of 132%). Its AI-enhanced tools like Make 2.0, Dev Mode, and Library Analytics elevate team productivity across disciplines.

Figma’s growth isn’t just financial; it’s cultivated through vibrant community participation, strong educational integration, and a platform built for real-world collaboration. High‑engagement website metrics and global user penetration underscore its relevance among the new generation of professionals.

As Figma continues to unify design workflows, from idea to deployment, in both organizations and classrooms, it sets a new benchmark for how tools can shape the creative ecosystem. For readers intrigued by how these numbers translate into tangible shifts in design work, the article as a whole offers a comprehensive, data-driven exploration of Figma’s evolving impact.