Facebook Messenger remains a core pillar in Meta’s communications ecosystem, shaping how more than a billion people connect daily. In business, brands use Messenger to power customer support chatbots and facilitate conversational commerce, in media, publishers embed share flows and in‑app messaging to improve retention and distribution. As usage evolves, fresh data reveals both steady growth and shifting patterns. Explore below to see how Messenger’s scale, reach, and dynamics are shaping the messaging landscape.

Editor’s Choice

- In January 2025, Messenger ads reached approximately 947 million users globally.

- That ad reach figure declined by about 32.5 million (–3.3%) from January 2024.

- In early 2025, Messenger’s ad audience represented 11.6% of the global population (age‑eligible).

- As of 2024, Messenger had over 1.04 billion active users across mobile platforms.

- In the United States, Messenger reached roughly 194 million users in early 2025.

- Messenger had about 302 million downloads in 2024, a notable drop from 2023 levels.

- In comparison with other messaging apps in 2025, Messenger ranked third globally by monthly active users, behind WhatsApp and WeChat.

Recent Developments

- Meta’s own ad planning tools show that Messenger’s advertising audience began shrinking in late 2024 into early 2025.

- The decline of 3.3% year over year in ad reach signals potential saturation or increased competition.

- Some strategic shifts, Meta has emphasized cross‑app messaging features linking Messenger, Instagram, and WhatsApp.

- The push for end-to-end encryption across messaging apps continues, impacting how Messenger evolves its privacy posture.

- The integration of AI assistants (e.g., Meta AI) into messaging interfaces has begun, hinting at future conversational extensions.

- Facebook Messenger’s API endpoints have expanded to allow richer media types and more interactive conversational flows.

- In Q4 2024, Meta reported that its Family of Apps (including Messenger) brought in $133 billion in revenue, underscoring how Messenger is part of a wider monetization engine.

- Messenger Rooms (video conferencing inside Messenger) continues to be enhanced, with support for up to 50 participants.

Usage Trends

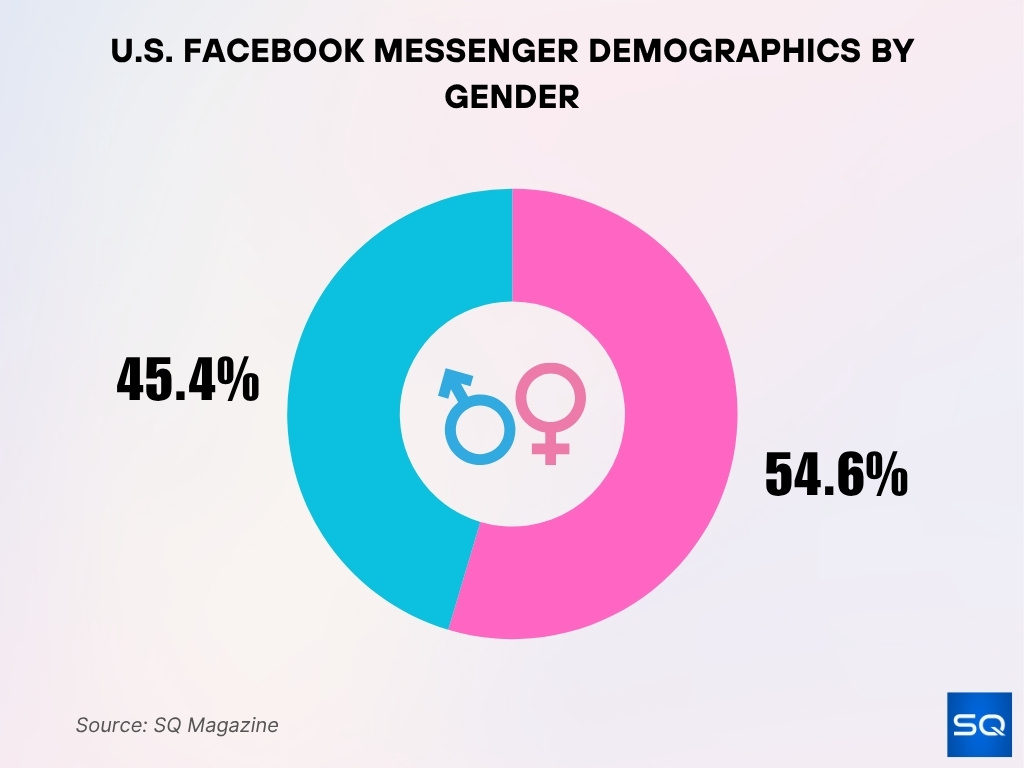

- According to demographic data, the majority of U.S. Messenger users are female, accounting for 54.6%, while 45.4% are male.

- According to BankMyCell, Messenger had 1.04+ billion active users in 2024.

- That accounts for roughly 30% of global mobile messaging app users in 2024.

- Usage growth in the U.S. from 2023 to 2024, from ~141 million to ~144 million (≈2.13% increase).

- Projections indicate U.S. Messenger users may reach 148 million by 2025.

- In February 2025, Messenger’s U.S. reach touched 56.6% of the U.S. population (≈ 194.8 million).

- The largest age group in the U.S. is 25–34 years old.

- Globally, Messenger’s ad reach is about 16.3% of adults (18+) in 2025.

- In markets excluding China, Messenger’s “eligible adoption rate” rises to 18.1%.

Geographic Breakdown

- In February 2025, the U.S. had about 194.8 million Messenger users (≈ 56.6% of the population).

- In February 2024, the U.S. user count was ~193.4 million (≈ 56.2%).

- Messenger is the #1 messaging app in 16 countries, including the U.S., Canada, Australia, Sweden, and the Philippines.

- Globally, WhatsApp leads in 63 countries, Messenger leads in 16.

- In Asia, Messenger lags behind apps like WeChat and LINE, except in select countries such as the Philippines.

- In North America and northern Europe, Messenger’s penetration is among the highest in messaging apps.

- China remains largely inaccessible to Messenger due to restrictions.

- In markets excluding China, Messenger’s adoption among eligible users reaches 18.1%.

Downloads and App Rankings

- In 2024, Messenger saw around 302 million downloads, marking a decline of nearly 30% compared to 2023.

- Messenger was among the top 3 most downloaded apps globally in 2024.

- On average, Messenger gained about 18.56 million monthly downloads in 2024.

- In 2023, Messenger’s global downloads numbered 262.53 million.

- Over the decade 2010–2019, Messenger ranked as the #2 most downloaded app, only behind Facebook itself.

- In 2025, among messaging apps, Messenger is ranked third globally by active users behind WhatsApp and WeChat.

- In monthly download charts for 2025, Messenger ranked below WhatsApp and Telegram in many markets.

- A relative drop in downloads suggests maturing adoption and potentially more focus on retention over acquisition.

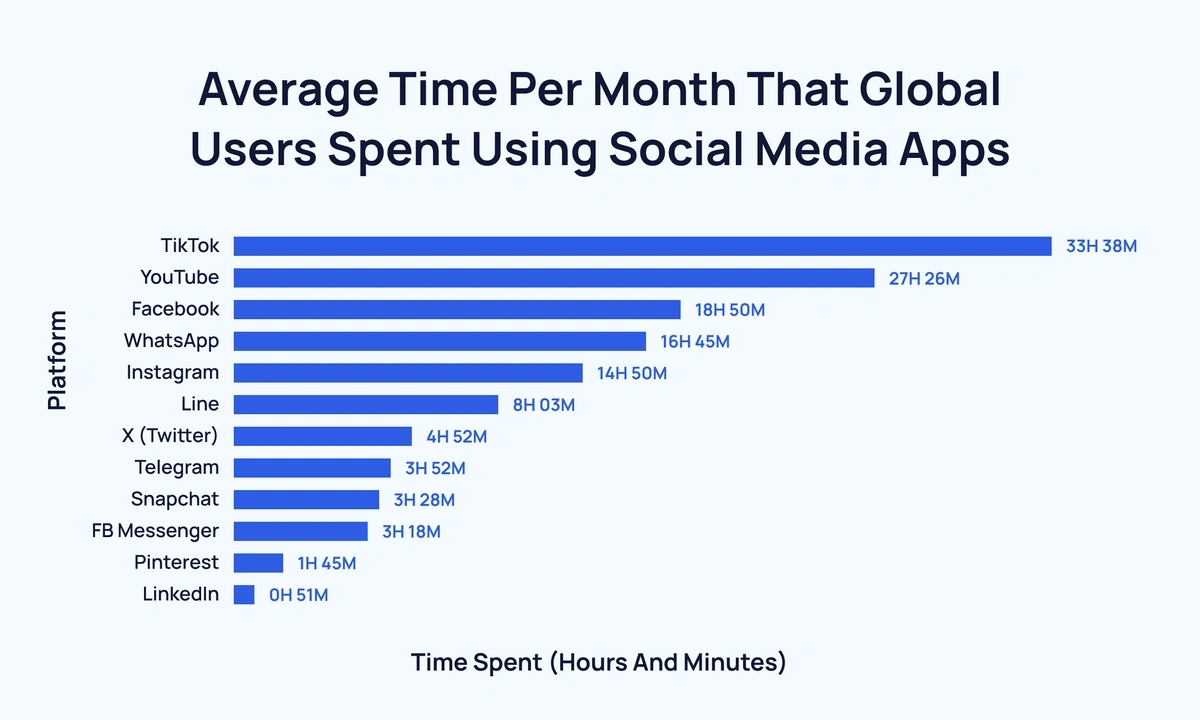

Time Spent on Social Media Apps

- TikTok users spent an average of 33 hours and 38 minutes per month, the highest across all platforms.

- YouTube ranked second, with users spending 27 hours and 26 minutes monthly.

- Facebook saw an average of 18 hours and 50 minutes of user time per month.

- WhatsApp users logged 16 hours and 45 minutes per month on average.

- Instagram users spent 14 hours and 50 minutes each month engaging on the platform.

- LINE users averaged 8 hours and 3 minutes monthly, showing strong regional loyalty.

- X (Twitter) captured 4 hours and 52 minutes of average user time per month.

- Telegram followed with 3 hours and 52 minutes of usage per user per month.

- Snapchat users spent 3 hours and 28 minutes monthly, slightly ahead of Messenger.

- Facebook Messenger saw 3 hours and 18 minutes of average user time each month.

- Pinterest users spent 1 hour and 45 minutes monthly, ranking near the bottom.

- LinkedIn had the lowest usage at just 51 minutes per month on average.

Activity Metrics

- In early 2025, Messenger ad reach stood at 947 million users globally.

- That reach accounted for 11.6% of the total global (age‑eligible) population.

- Yet from January 2024 to 2025, ad reach dropped by 32.5 million (–3.3%).

- Messenger remains a top destination in Meta’s ad network ranking, occupying 6th place (outside China) by audience size.

- In 2024, active users exceeded 1.04 billion across messenger platforms.

- U.S. users in early 2025, ~194.8 million (≈ 56.6% of the U.S. population).

- Female users in the U.S. made up 54.6% of that audience.

- The 25–34 age bracket forms the single largest share of U.S. users.

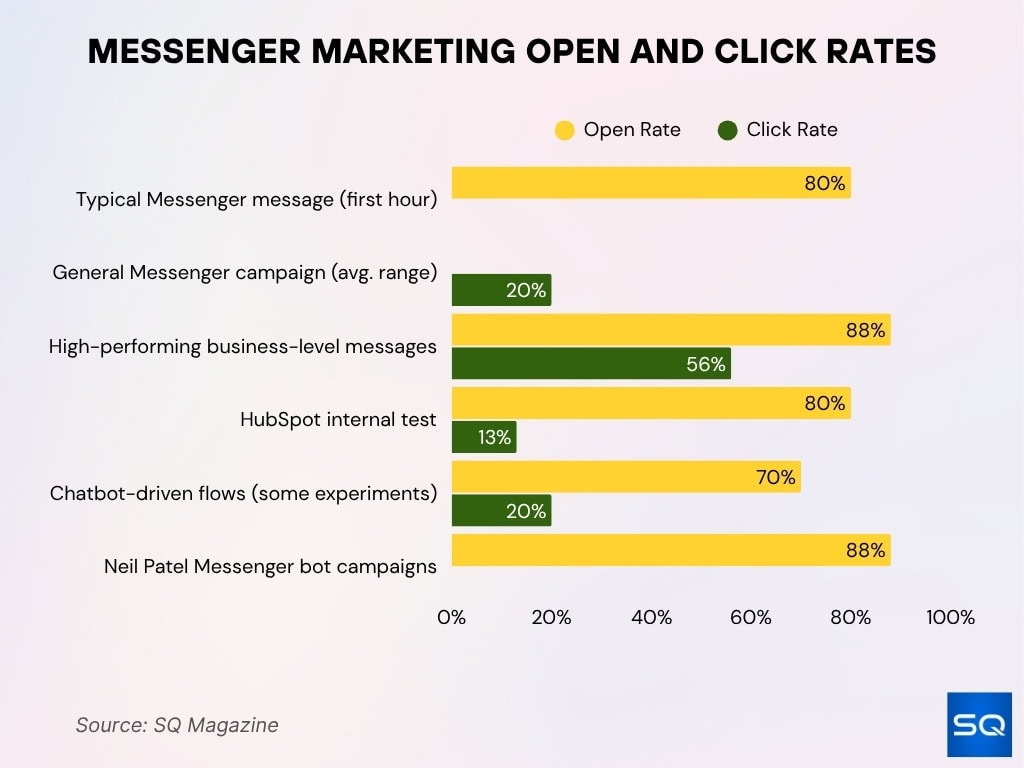

Engagement Rates

- Messenger marketing messages often achieve 70–80% open rates in the first hour, far above typical email opens.

- Messenger campaign CTRs may range between 10–20%, depending on targeting, message content, and industry, which is higher than standard email averages.

- Some business‑level messages report open rates up to 88% and CTRs as high as 56% under optimal conditions.

- HubSpot’s internal test, Messenger broadcasts generated an 80% open rate and 13% click rate, far outperforming their other content delivery methods.

- Chatbot‑driven flows on Messenger also maintain open rates above 70%, with some experiments claiming CTR above 20% or higher.

- In campaigns run by Neil Patel, Messenger bot messages reached open rates of 88%.

- Messenger marketing is said to deliver 10–80× greater engagement compared to email or social media channels.

- Across industries, average engagement per cost (on Facebook broadly) hovers around 0.046%, but Messenger’s conversational format offers a much higher return per message.

Business Statistics

- Over 40 million businesses actively use Facebook Messenger to communicate with customers and prospects.

- Monthly, more than 8 billion messages are exchanged between businesses and consumers on Messenger.

- There are more than 300,000 active chatbots deployed across the Messenger platform.

- Messenger bots can handle up to 80% of routine inquiries in customer support scenarios, though performance varies by industry and implementation.

- Meta claims Messenger’s advertising reach is nearly 979 million users monthly.

- Messenger bots can see open rates of 60–80% and CTR rates of 15–20%, especially in campaigns using personalization and timely responses.

Marketing Statistics

- Messenger marketing open rates far exceed email, where typical email open rates hover at 5–10%, Messenger averages 70–80% (or more).

- CTRs of ~20% are common for Messenger campaigns, much higher than many email benchmarks.

- Messenger marketing purportedly delivers 10–80× higher engagement than standard social posts or emails.

- Some click-to-message ads report 100% conversion (i.e., every click results in a user opening a chat).

- In Neil Patel’s experiments, bot‑based messages showed 88% open rates.

- Messenger broadcasts in one test drove 13% click rates, outperforming many content distribution channels.

- Many brands integrate Messenger with web chat, retargeting, and CRM to weave conversational marketing into multi-channel campaigns.

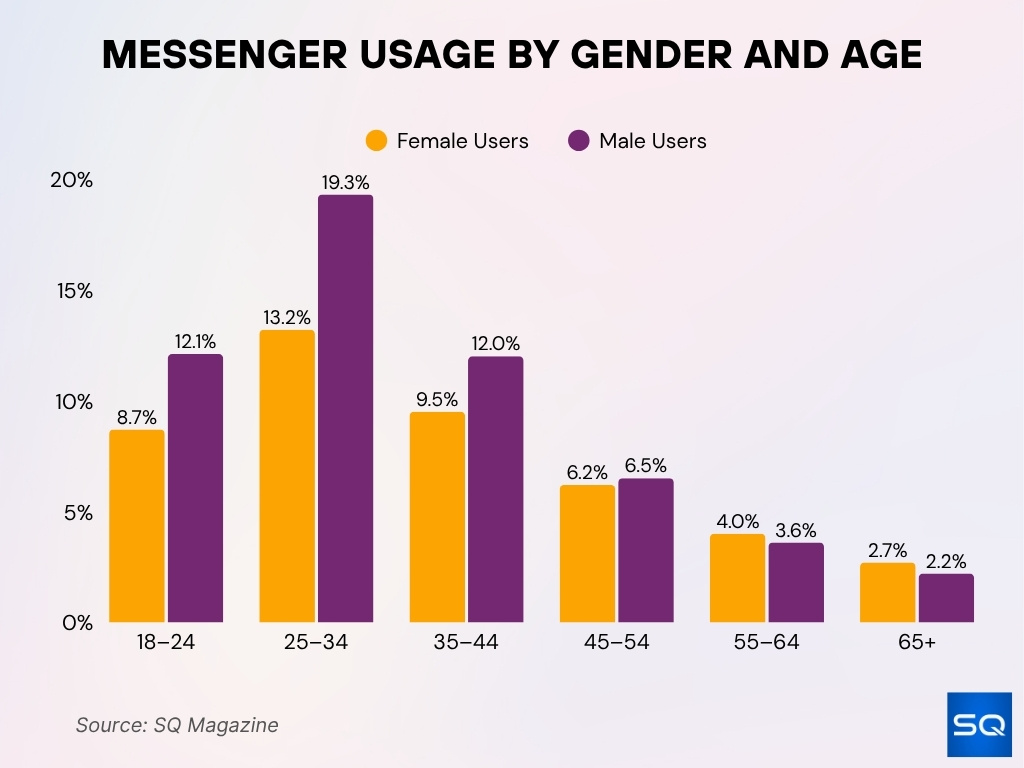

Messenger Usage by Gender and Age

- The 25–34 age group dominates Messenger usage, with 19.3% male and 13.2% female users.

- Among 18–24 year olds, 12.1% are male and 8.7% are female, showing strong early adult adoption.

- For users aged 35–44, 12.0% are male and 9.5% are female, indicating steady middle-aged engagement.

- The 45–54 demographic shows near parity, with 6.5% male and 6.2% female usage.

- In the 55–64 age group, females slightly lead at 4.0% versus 3.6% males.

- The 65+ group represents the smallest segment, with 2.7% female and 2.2% male users.

Revenue Statistics

- In 2024, Facebook’s total advertising revenue stood at $164.5 billion, up from $134 billion in 2023.

- Although Meta does not break out Messenger’s individual revenue, the messaging ecosystem (Messenger, WhatsApp, Instagram Direct) is viewed as a growth vertical.

- Meta’s non‑ad revenue, partly driven by messaging features (commerce, business APIs), grew 48% year over year in some reports.

- Messenger’s business messaging is often treated as a strategic monetization path in Meta’s roadmap for diversifying revenue.

- In Q3 2024, Meta reported that messaging-driven growth (especially in business messaging) boosted non‑ad income by hundreds of millions.

- Analysts estimate that messaging solutions may represent ~10% of Meta’s revenue, gradually growing faster than core ad channels.

- Messaging business in India alone has reached a $1 billion annual run rate, emphasizing regional monetization strengths.

- As of 2025, Facebook (excluding Instagram & WhatsApp) is projected to bring in $116.53 billion in ad revenue.

Facebook Messenger vs. Competing Messaging Apps

- In 2025, Messenger is often ranked as the third-largest messaging app, behind WhatsApp and WeChat.

- WhatsApp leads with 3 billion monthly active users.

- In many global markets, Telegram, QQ, and Snapchat also compete strongly; for example, Telegram boasts ~1 billion users.

- Messenger remains dominant in North America, Northern Europe, and markets like the Philippines, whereas WhatsApp leads in much of Latin America, Asia, and Africa.

- Messenger users open the app ~183.9 times per month (approx. six times per day).

- About 42.6% of Messenger users engage with the app daily.

- According to available analytics, Messenger sessions often last over a minute per open, but engagement varies based on user behavior and message context.

- Messenger boasts higher open/CTR performance than many competing messaging or email marketing platforms, which is a key differentiator in brand strategy.

Bots and Automation Statistics

- There are more than 300,000 active chatbots deployed across Messenger.

- Messenger bots often handle up to 80% of routine customer inquiries, reducing human workload.

- Open rates for bot‑triggered messages frequently exceed 70%, in some cases hitting 88%.

- CTRs for bot‑driven flows can range from 20% to 50+% under favorable conditions.

- In group contexts, bot privacy leak risks exist; bots may inadvertently collect message metadata or link identities across threads.

- Bot adoption in industries like e-commerce and hospitality has shown strong growth, with some markets reporting over 20% YoY increases in chatbot usage.

- Advanced bots now support rich templates, multimedia, quick replies, and natural language understanding, increasing user satisfaction and conversion.

- Some bot platforms integrate a fallback to human agents to handle edge cases or complex queries.

- Bot automation has enabled 24/7 customer responses for small businesses without hiring full‑time support staff.

Frequently Asked Questions (FAQs)

Messenger’s ad planning data shows it reaches approximately 947 million users globally as of January 2025.

In February 2025, Messenger had about 194.8 million users in the U.S., representing 56.6 % of the U.S. population.

Over 40 million businesses use Facebook Messenger to engage with customers and prospects.

Messenger bots are reported to handle up to 80% of routine customer inquiries in some deployments.

Conclusion

Facebook Messenger today remains a powerhouse in the messaging world, with more than 900 million reachable users, deep integration with business messaging, and evolving features across privacy, automation, and media. While performance, security, and bot risks remain challenges, Meta continues to invest heavily to stay ahead. For businesses, creators, and everyday users alike, these statistics offer a rich view of where Messenger is today, and where it’s headed.