The digital wallet ecosystem continues to redefine financial transactions today. From fast in‑store checkouts to secure online purchases and peer‑to‑peer transfers, digital wallets have become a cornerstone of modern commerce. This article details current usage trends, consumer behaviors, and adoption patterns backed by the latest data.

Across retail and services sectors, businesses are redesigning checkout experiences to accept mobile wallet payments, and consumers increasingly depend on these tools for everyday purchases. Dive into this first part to understand the key indicators shaping digital wallet adoption today and what they mean for the future.

Editor’s Choice

- 5.2+ billion people globally are expected to use digital wallets by 2026, representing more than 60% of the world’s population.

- Global digital wallet users will grow from around 4.5 billion in 2025 toward 6 billion by 2030.

- Digital wallets now account for around 83% of global digital payment volume.

- 35% of online transactions are processed through mobile wallets in major global markets.

- Consumers under age 40 report ~70% wallet usage for purchases, highlighting generational trends.

Recent Developments

- 32% of global POS transactions use digital wallets.

- Digital wallets capture 53% of global online purchases.

- Contactless payments surge 221% from 2022 levels.

- QR code payments account for 48.6% of transactions.

- U.S. proximity mobile payments exceed $670.5 billion.

- GENIUS Act imposes bank-like oversight on providers.

- Market CAGR projected at 6.4% through 2033.

- 69% of U.S. adults used digital wallets recently.

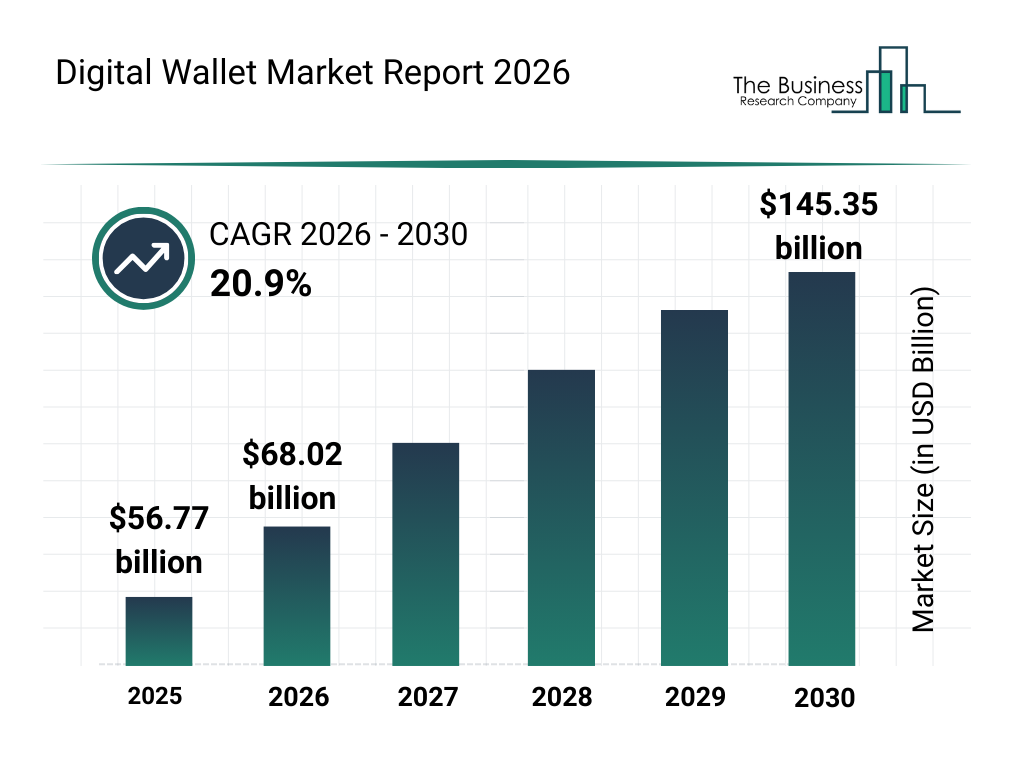

Digital Wallet Market Growth Overview

- The global digital wallet market was valued at $56.77 billion in 2025, highlighting the early scale of wallet-based payment infrastructure.

- Market size is projected to rise to $68.02 billion in 2026, reflecting accelerating adoption across retail, e-commerce, and peer-to-peer payments.

- From 2026 to 2030, the digital wallet market is expected to grow at a strong CAGR of 20.9%, signaling sustained long-term expansion.

- By 2030, the global digital wallet market is forecast to reach $145.35 billion, more than doubling its 2026 valuation.

- The growth trajectory indicates increasing reliance on mobile payments, contactless transactions, and digital financial ecosystems worldwide.

- Rapid expansion between 2027 and 2029, as illustrated in the forecast, suggests rising merchant acceptance and deeper consumer penetration.

- Overall, the data underscores digital wallets as a core pillar of modern financial infrastructure, driven by convenience, security, and global digitalization trends.

Digital Wallet Transaction Volume Trends

- Global digital wallet transaction value exceeds $12 trillion.

- QR code payments reach 380 billion transactions, 40% of the total volume.

- Digital wallets capture 53% of global e-commerce transactions.

- 32% of global POS transactions use digital wallets.

- Contactless payments grow 221% from 2022 to 2026.

- U.S. proximity mobile payments total $670.5 billion.

- Global digital wallet transaction volume CAGR 11.2% to 2029.

- QR code mobile payments hit $5.4 trillion.

- Digital wallets drive 73% transaction value growth over five years.

Popular Digital Wallets

- PayPal is used by 42% of Americans.

- Apple Pay is used by 34% of consumers, primary for 28%.

- Venmo is used by 33% of consumers.

- Cash App is used by 24% of consumers.

- Google Wallet is used by 17% of consumers.

- Alipay boasts 1.4 billion monthly active users worldwide.

- WeChat Pay has 1.38 billion monthly active users.

- Google Pay serves 820 million active users globally.

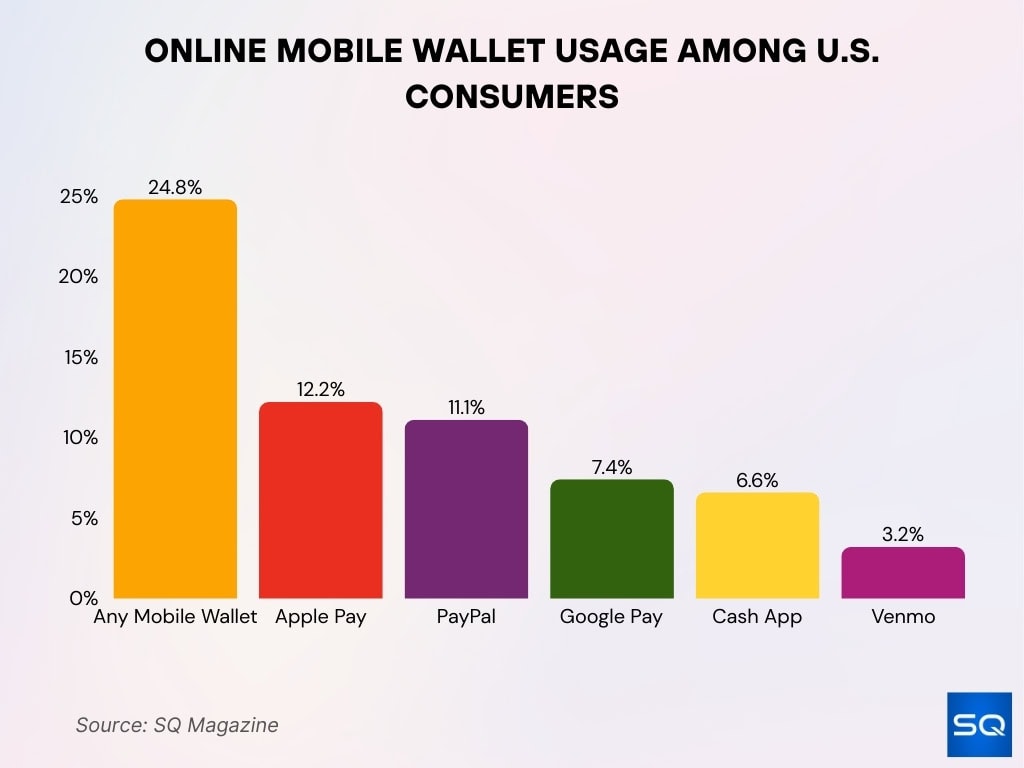

Online Mobile Wallet Usage Among U.S. Consumers

- Nearly one in four U.S. consumers (24.8%) use any mobile wallet as a weekly payment method, highlighting growing mainstream adoption.

- Apple Pay leads individual platforms, with 12.2% of U.S. consumers using it weekly for online payments.

- PayPal closely follows, recording 11.1% weekly usage, reinforcing its strong position in digital and mobile commerce.

- Google Pay is used weekly by 7.4% of U.S. consumers, reflecting steady adoption across Android ecosystems.

- Cash App accounts for 6.6% of weekly mobile wallet usage, driven by its popularity in peer-to-peer and online transactions.

- Venmo shows more limited weekly usage at 3.2%, despite strong brand recognition among younger users.

- Overall, the data shows that mobile wallet usage remains fragmented, with Apple Pay and PayPal capturing the largest shares of regular online payments.

Market Share Breakdown

- 69% of U.S. adults used digital wallets in the past 30 days.

- Apple Pay holds 38% U.S. digital wallet market share.

- PayPal commands 28% share of U.S. digital wallet market.

- Venmo is used by 33% of U.S. consumers.

- Cash App is utilized by 24% of U.S. consumers.

- Digital wallets account for 32% global POS transactions.

- APAC digital wallets 54% of POS payments.

- Europe’s digital wallets 33% of online payments.

Mobile Payment Insights

- Global digital wallet transactions surpass $10 trillion.

- Mobile payments market reaches $164.1 billion.

- QR code mobile payments total $5.4 trillion.

- QR transactions account for 48.6% of digital wallet volume.

- Digital wallet transaction volume CAGR 11.2% to 2029.

- APAC dominates with 66% of global digital wallet spending.

- Mobile wallet market grows at 26.3% CAGR.

- Digital wallet transaction growth 73% over five years.

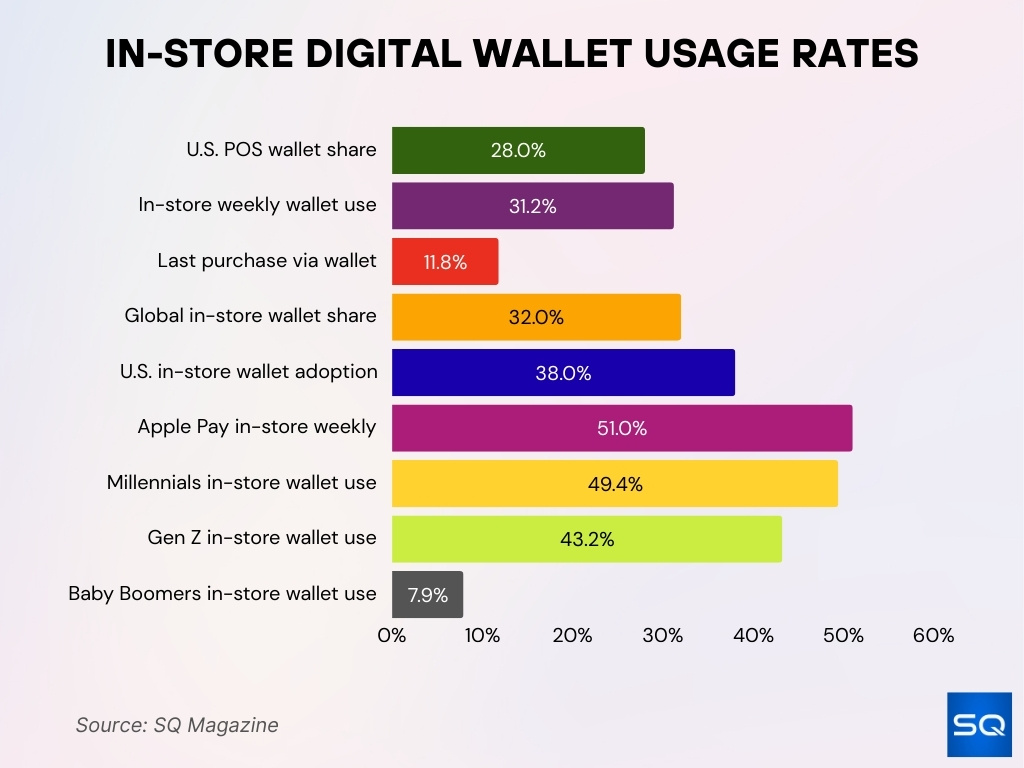

In-Store Usage Stats

- 28% of U.S. in-person POS payments use digital wallets.

- 31.2% of consumers use digital wallets in-store weekly.

- 11.8% used a mobile wallet for their most recent in-store purchase.

- 32% of global in-store transactions are via digital wallets.

- 38% of Americans use digital wallets at physical stores.

- 51.0% of U.S. digital wallet users use Apple Pay in-store weekly.

- 49.4% Millennials use digital wallets in-store weekly.

- 43.2% Gen Z use mobile wallets in-store weekly.

- 7.9% Baby Boomers use digital wallets in-store weekly.

User Demographics Data

- Global digital wallet users exceed 5.2 billion, over 50% of the population.

- 78.9% of Gen Z use digital wallets regularly.

- 66.7% of Millennials adopt digital wallets.

- 62.3% of Bridge Millennials use digital wallets.

- 43.7% of Gen X use digital wallets.

- 25.7% of Baby Boomers use digital wallets.

- 91% of Gen Z aged 18-26 actively use digital wallets.

- 49.4% Millennials use digital wallets weekly.

- 43.2% Gen Z use mobile wallets weekly.

Security Concerns Stats

- Digital wallet fraud cases projected to hit 34.56 million.

- 18.82% of digital wallet accounts compromised.

- 84% of consumers use biometric authentication.

- Fingerprint biometrics is adopted by 70% globally.

- Facial recognition is used by 43% of consumers.

- Biometrics reduces fraud by 15% for users.

- AI fraud detection reaches 95% accuracy.

- 45% of global fraud is from the Asia-Pacific region.

- Multi-biometric authentication becomes standard.

Online Shopping Stats

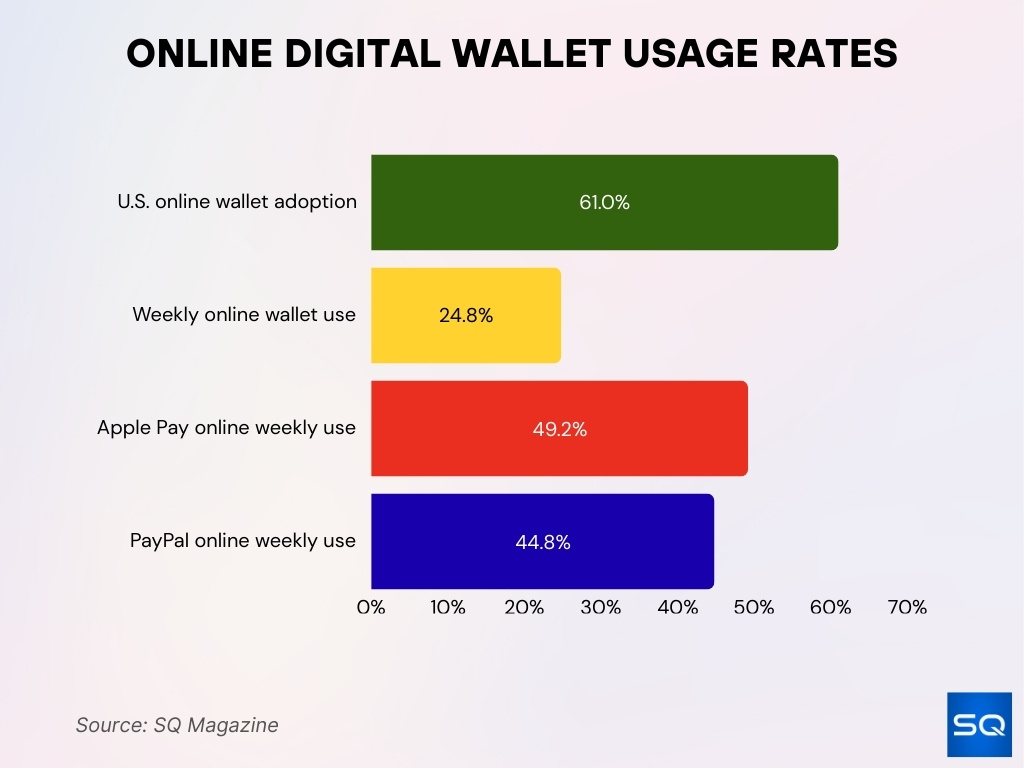

- 61% of Americans use digital wallets for online shopping.

- 24.8% of U.S. consumers use digital wallets online weekly.

- 49.2% of Apple Pay users use it online weekly.

- 44.8% of PayPal users use it online weekly.

- 75% of APAC e-commerce payments use digital wallets.

- Digital wallets capture 53% of global online purchases.

- Apple Pay processes 14.2% of U.S. online consumer payments.

- Digital wallets 165% more likely to be chosen for online payments globally.

Future Projections

- Global digital wallet users surpass 5.2 billion.

- The mobile wallet market is expected to grow to $784 billion by 2032.

- 46% of POS transactions will use digital wallets by 2027.

- Digital wallets 73% of global transaction value growth.

- Mobile payments market hits $2 trillion by 2035.

- 74% travelers use mobile wallets.

- Digital wallet CAGR 11.2% through 2029.

- 60% growth in wallet transaction value by 2026.

Frequently Asked Questions (FAQs)

QR code wallet transactions could constitute about 48.6% of all digital wallet transaction volume in 2026.

More than 70 million merchants worldwide now accept digital wallets.

Mobile wallets account for about 35% of online transactions across major economies, according to recent usage reports.

Conclusion

Digital wallets are no longer emerging tech; they are a mainstream payment method reshaping how consumers and businesses transact. With billions of users worldwide and projections showing continued expansion in both volume and value, wallets are influencing e‑commerce, in‑store experiences, mobile payments, and financial inclusion.

Younger demographics drive adoption, while advancements in security and authentication bolster trust. Looking ahead, digital wallets are set to integrate further into financial ecosystems, offering more than just payment convenience. As the digital wallet story continues to unfold, understanding these trends and statistics is essential for businesses, policymakers, and consumers alike.