The rise of digital currencies is reshaping how consumers and businesses conduct transactions. From enabling faster cross-border payments to reducing merchant fees, crypto payments are making their mark in retail, e-commerce, and fintech ecosystems. Platforms like PayPal and Stripe have introduced crypto payment options, while SMEs and global marketplaces are embracing blockchain for seamless settlements. As crypto continues to integrate with real-world commerce, these statistics offer a clear picture of the industry’s momentum and future. Let’s explore the key numbers defining crypto payments in 2026.

Editor’s Choice

- The global crypto payments market is expected to exceed $3.5 billion by 2030, nearly doubling from its $1.8 billion valuation in 2024.

- Bitcoin and stablecoins remain the most commonly used digital currencies for payments worldwide in 2026.

- The average value of a cryptocurrency payment in retail settings is $112, reflecting wider adoption for small-ticket purchases.

- Over 75% of crypto users aged 18-35 have used cryptocurrency to pay for goods or services at least once in the past year.

- North America and the Asia-Pacific lead in crypto payment gateway integrations among e-commerce platforms.

- Approximately 61% of merchants that accept crypto offer instant conversion to fiat, minimizing volatility risks.

- The CAGR for the global crypto payment industry is estimated at 14.2% from 2024 through 2030.

Recent Developments

- In 2025, PayPal expanded its crypto checkout services to over 30 countries, allowing users to pay in Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

- Visa processed over $3 billion in crypto-linked card payments in 2025, supporting the growing trend of digital asset spending.

- Mastercard announced partnerships with over 90 crypto platforms to simplify merchant adoption of digital currencies.

- Coinbase Commerce reported over $300 million in crypto transaction volume in the first half of 2025, up 34% YoY.

- The European Union introduced the MiCA (Markets in Crypto-Assets) regulatory framework to improve transparency and compliance in crypto payments.

- Stripe relaunched crypto payments support in 2025, starting with USDC on Solana and Ethereum blockchains.

- El Salvador, the first country to adopt Bitcoin as legal tender, reported over 4 million wallet users as of 2025.

- Crypto.com launched its global pay service across 20 new markets, integrating with top retailers and travel portals.

- Apple Pay began exploring crypto wallet integration for in-app and NFC-based purchases.

- The number of crypto payment terminals worldwide surpassed 65,000 units, with a majority located in Latin America and Asia.

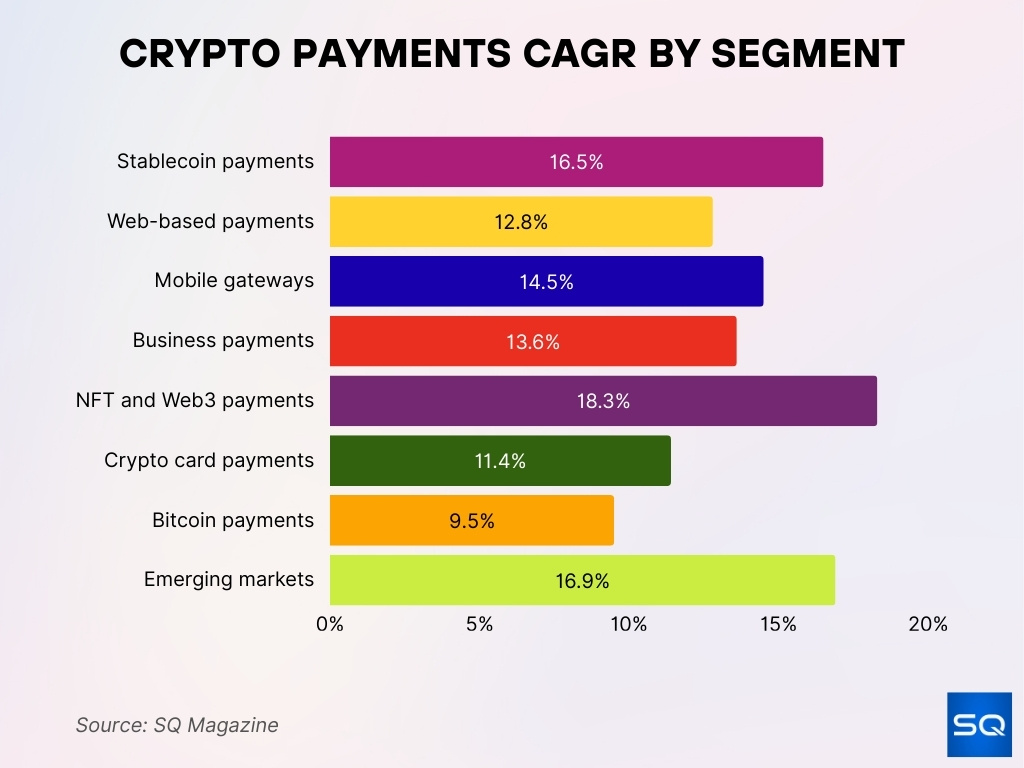

Compound Annual Growth Rate (CAGR)

- Stablecoin-related payments are expected to grow at a CAGR of 16.5%, driven by remittances and online shopping.

- Web-based crypto payment solutions are forecast to grow at a 12.8% CAGR through 2030.

- Mobile crypto gateways are anticipated to grow faster, at 14.5% CAGR, as mobile wallets gain popularity.

- The CAGR for business crypto payments is expected to reach 13.6%, as more enterprises adopt blockchain-based treasury tools.

- NFT and Web3 payment segments are projected to grow at 18.3% CAGR, particularly in gaming and digital goods.

- Cryptocurrency card payments (Visa, Mastercard linked) will grow at 11.4% CAGR through 2030.

- Bitcoin-specific payments are estimated to maintain a CAGR of 9.5%, as stablecoins outpace it in microtransactions.

- Emerging market growth in crypto payments is expected at a 16.9% CAGR, particularly in Africa and Southeast Asia.

Market Size and Growth

- The global crypto payment gateway market was valued at $1.69 billion in 2024 and is projected to reach $2.05 billion in 2025.

- The North American crypto payment market alone is expected to grow from $389 million in 2024 to over $700 million by 2030.

- Asia-Pacific is anticipated to register the fastest growth, with a projected CAGR of over 17% through 2030.

- Europe held approximately 26% of the global market share in 2025 due to strong regulatory infrastructure and fintech innovation.

- Latin America’s crypto transaction volume grew by 22% year-over-year in 2025, driven by stablecoin adoption in e-commerce.

- Over 65% of crypto transactions are currently processed via mobile or web-based payment gateways.

- Stablecoins represent more than 50% of crypto payments processed globally in 2025.

- Crypto payment volume in retail is projected to hit $600 billion globally by the end of 2026.

- Over 25 million merchants are expected to accept at least one form of cryptocurrency by the end of 2026.

- NFT marketplaces and metaverse platforms accounted for approximately 8% of crypto payment gateway revenue in 2025.

Global Crypto Payment Adoption Rates

- As of early 2026, over 430 million people globally own cryptocurrency, up from 420 million in late 2025.

- Nearly 1 in 4 crypto owners worldwide has used digital currency for payment in the past 12 months.

- In the U.S., 61% of crypto holders report having paid for goods or services with crypto at least once.

- South Asia led regional adoption growth, with crypto usage increasing by 20% year-over-year in early 2025.

- Nigeria and Vietnam rank in the top five countries globally for crypto payment adoption rates.

- Over 65% of stablecoin usage in Latin America in 2025 was tied to commerce rather than speculative activity.

- The number of cross-border crypto payments grew by 28% YoY in 2025 due to remittance and freelancing demand.

- In emerging markets, stablecoins like USDT and USDC are increasingly used for rent, food, and transport payments.

- The gender gap in crypto payment usage has narrowed, with 42% of female crypto owners reporting active usage.

- Merchant survey data indicates that over 53% of global e-commerce merchants plan to accept crypto by 2027.

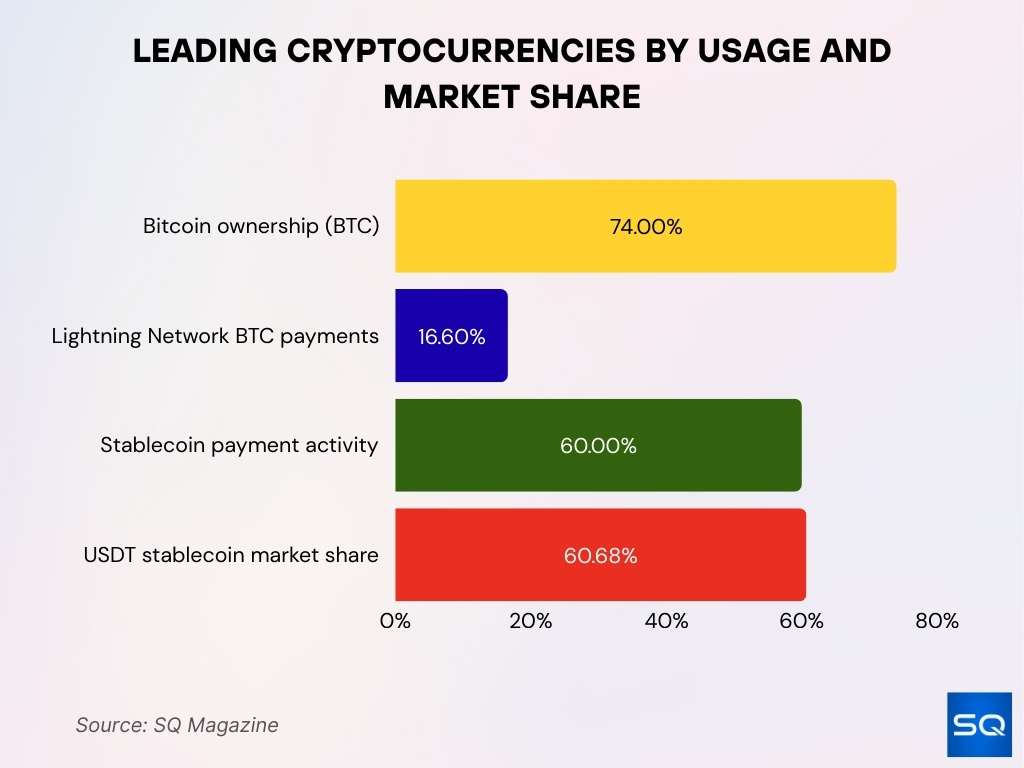

Leading Cryptocurrencies Used

- Bitcoin (BTC) is held by 74% of crypto owners.

- Lightning Network processes 16.6% of Bitcoin payments at CoinGate.

- Stablecoins account for nearly 60% of crypto payment activity.

- USDT holds 60.68% of the total stablecoin market share.

- Ethereum records 2.23 million daily on-chain transactions.

- Solana stablecoin supply reaches $17 billion.

- USDT circulation at $187 billion market cap.

- Global stablecoin market totals $318 billion.

Merchant Acceptance Statistics

- In 2025, over 25 million global merchants accepted cryptocurrency as a form of payment, up from 18 million in 2023.

- Roughly 61% of merchants convert crypto payments to fiat immediately to reduce volatility risk.

- About 39% of global crypto-accepting merchants operate exclusively online, while 21% are hybrid (online + in-store).

- Merchants in North America and Europe represent 58% of global crypto payment volume.

- Stablecoins like USDC and USDT are accepted by 43% of crypto-enabled merchants, compared to 36% for Bitcoin.

- Businesses in travel, gaming, luxury retail, and software industries show the highest crypto acceptance rates.

- Shopify and WooCommerce report a 23% YoY increase in merchants using crypto plugins and gateway APIs.

- Instant crypto-fiat settlement tools like those from BitPay and Coinbase Commerce have 40% higher merchant retention.

- PayPal’s crypto checkout feature now enables 100+ digital assets, boosting merchant checkout options.

- 76% of surveyed merchants believe crypto payments will reduce transaction costs over time.

Transaction Volume Data

- Visa reported over $3 billion in crypto-linked card transaction volume in 2025.

- Global daily crypto payment transactions surpassed 1.8 million in Q4 2025, according to blockchain analytics firms.

- Total crypto transaction volume for merchant payments was estimated at $640 billion in 2025.

- Bitcoin accounted for 28% of total crypto transaction volume, with stablecoins making up 52%.

- Ethereum-based payments (ETH and ERC-20 tokens) contributed to 16% of payment traffic.

- USDT was the most-used stablecoin for payments, facilitating over $290 billion in transactions in 2025.

- The average size of a crypto payment in retail fell to $112, indicating increased adoption for microtransactions.

- Cross-border payment volumes using stablecoins grew by 32% YoY in 2025.

- Payment volumes via DeFi protocols also rose, especially in gaming and metaverse applications.

- The percentage of recurring crypto payments (subscriptions, payrolls) increased by 18% in 2025.

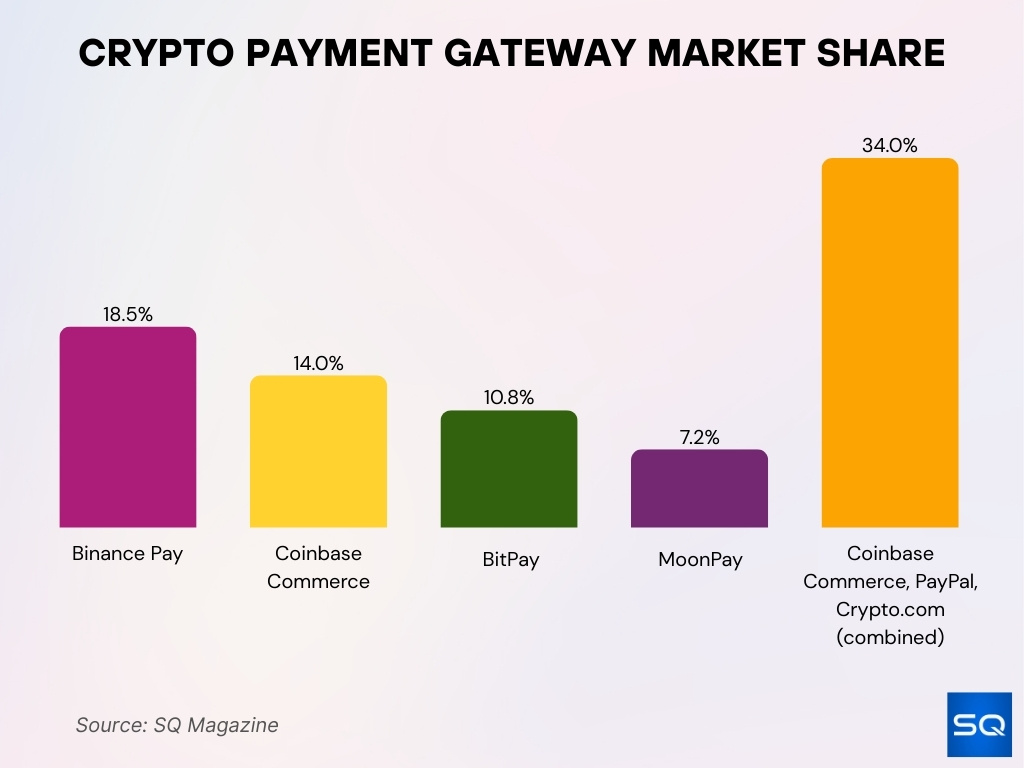

Popular Payment Gateways

- Coinbase Commerce, PayPal, and Crypto.com hold over 34% share.

- Binance Pay leads with 18.5% market share.

- Coinbase Commerce has a 14% market share.

- BitPay holds 10.8% market share.

- MoonPay has a 7.2% share.

- Web-based segment to hit $2.3 billion by 2030.

- Bitcoin accounts for 42% of gateway payments.

- North America commands 40% market share.

User Adoption Rates

- Over 430 million individuals globally owned crypto as of January 2026.

- About 74% of all U.S.-based crypto owners have made at least one payment using digital currency.

- In the EU, 1 in 3 crypto holders reported using it to pay for online services or goods in 2025.

- Gen Z and Millennials together accounted for over 65% of active crypto payers in 2025.

- Daily crypto users rose to 7.8 million globally, marking a 21% YoY increase.

- Crypto wallet downloads exceeded 2.1 billion globally by the end of 2025, many featuring payment support.

- Approximately 51% of crypto users cited transaction speed and fees as the top benefit for payments.

- User surveys show 62% of first-time crypto spenders preferred stablecoins over Bitcoin.

- 18% of users made recurring crypto payments, including subscriptions, salaries, and donations.

- 39% of users used QR code or NFC payments with crypto wallets in 2025, up from 27% the prior year.

In‑store vs Online Payments

- Online crypto payments hold 61% of the e-commerce share.

- Digital wallets 54% global e-commerce transactions.

- Retail crypto spending up 125% in 2025.

- Average crypto transaction value $800.

- Stablecoins process $5 trillion in transactions.

- In-store payment apps growing at 16.8% CAGR.

- Crypto cards enable 32% POS payments.

- Stablecoin fees under 1% for cross-border.

- North America 36.2% crypto apps market.

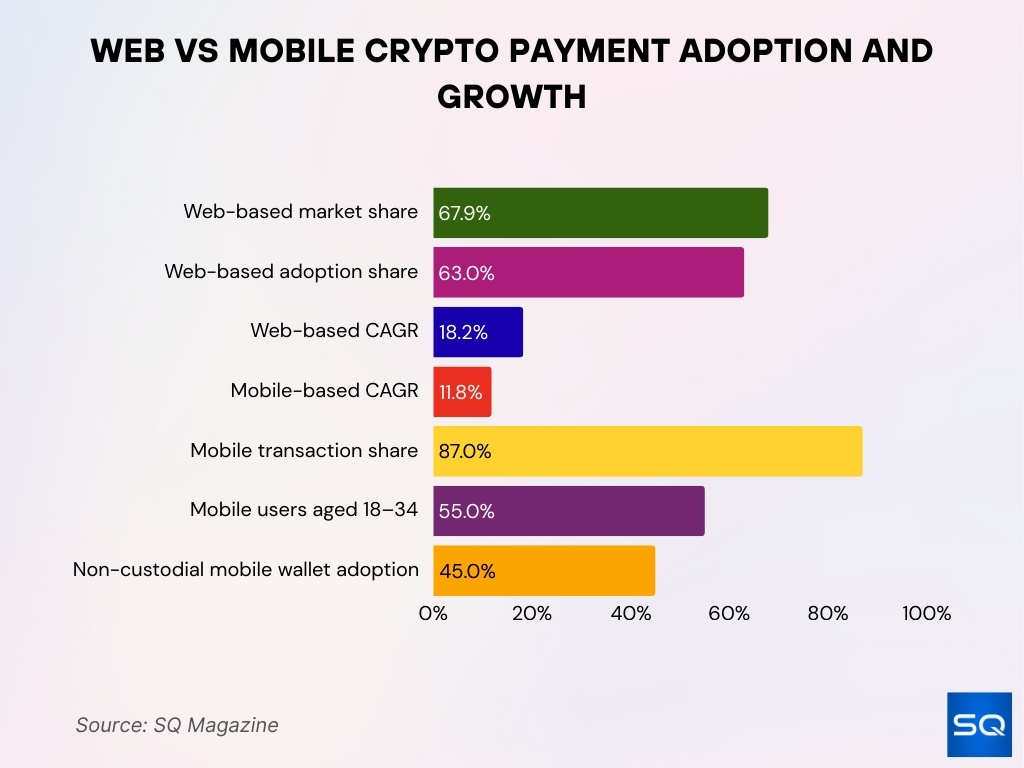

Web‑based vs Mobile Gateways

- Web-based gateways hold 67.9% market share.

- Web-based segment at 63% of total adoption.

- Web-based CAGR 18.2% through 2030.

- Mobile-based CAGR 11.8% through 2030.

- Mobile usage dominates 87% of transactions.

- Web solutions outpace mobile in transaction volume.

- Mobile gateways gain traction with 55% users aged 18-34.

- Non-custodial mobile wallets at 45% adoption.

Individual vs Business Users

- Global crypto users reach 800 million.

- Businesses drive 35% merchant growth.

- Stablecoins 90%+ of crypto payroll.

- 85% merchants cite new customers.

- 77% merchants note lower costs.

- 75% Millennials/Gen Z are open to crypto pay.

- 46% users adopt for speed.

- 41% for global access.

Regional Market Analysis

- North America has 37% of the global market share.

- Asia Pacific fastest-growing region.

- US gateway revenue $389 million.

- North America has $2.3 trillion crypto volume.

- Latin America’s 12.1% population holds crypto (57.7 million).

- Stablecoins 39% of LatAm crypto purchases.

- Sub-Saharan Africa adoption up 52%.

- APAC leads grassroots activity.

- Eastern Europe tops per capita adoption.

Frequently Asked Questions (FAQs)

The global crypto payment apps market is forecast to grow at a 16.8% CAGR between 2026 and 2035.

The global cryptocurrency payment apps market was valued at around $624 million in 2025.

Cryptocurrency payment adoption in the U.S. was forecast to grow by 82.1% over two years.

Conclusion

The crypto payments landscape continues to diversify and mature, with online gateways and mobile wallets driving mainstream use across individuals and businesses. Web‑based solutions dominate merchant adoption, while mobile crypto payments grow rapidly among tech‑savvy users. Real‑world innovations such as PayPal’s expanded crypto checkout options and POS integration reflect a world where digital asset payments are becoming more interoperable with legacy rails.

Regional trends show strong growth beyond North America, particularly in South Asia and emerging markets, where both retail and remittance use cases flourish. As regulatory clarity and infrastructure improve, expect broader acceptance and higher transaction volumes, reinforcing crypto’s role in the global payments ecosystem.