The rollout of the Markets in Crypto-Assets Regulation (MiCA) is reshaping how digital assets cross borders within the European Securities and Markets Authority (ESMA)-regulated zone. With businesses in Germany receiving crypto payments from France, and multinational banks exploring stablecoin-based settlements across the EU, the implications are both operational and strategic.

Two real-world scenarios illustrate this: (1) a European exporter using a MiCA-compliant stablecoin to settle an international sale faster and cheaper than traditional wires, (2) a crypto-asset service provider (CASP) obtaining its EU licence and beginning to passport services across multiple member states, enabling wider cross-border coverage. Dive into the full article to understand the key stats, regulatory shifts, and market dynamics driving this transformation.

Editor’s Choice

- 65% of EU-based crypto businesses are MiCA compliant by Q1 2025.

- 80%+ of European crypto exchanges have adopted stricter AML/KYC measures under MiCA in 2025.

- While global stablecoin transaction volumes continue rising, projections for EU cross-border payment usage range from 20–30%, with potential growth depending on regulatory clarity and institutional adoption.

- 100% of CASPs must hold a valid EU CASP licence by mid-2025 (as a target) under MiCA’s framework.

- The number of EU crypto wallet users climbed to 33 million in 2025 (from 21 million in 2023) within MiCA-regulated segments.

- The EU captures 27% of global crypto transaction volume in 2025.

Recent Developments

- The MiCA Titles III & IV (covering stablecoins) became applicable on 30 June 2024.

- The remaining provisions (CASP authorisation, disclosures) applied from 30 December 2024.

- A transitional “grandfathering” clause allows existing providers until 1 July 2026 to apply for full authorisation.

- ESMA released supervisory guidelines in April 2025 to align national regulators under MiCA.

- The European Anti-Money Laundering Authority (AMLA) flagged crypto assets as a top money-laundering threat in mid-2025.

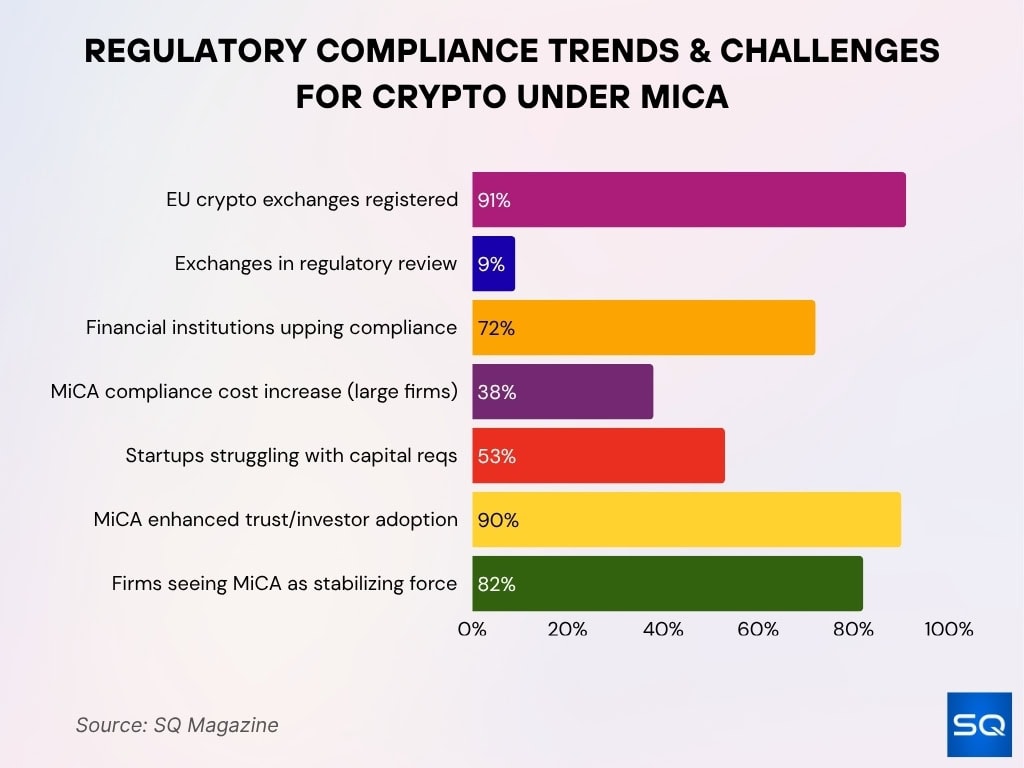

Regulatory Compliance Trends and Challenges

- 91% of EU crypto exchanges registered under MiCA in 2025, with 9% still under review.

- 72% of financial institutions boosted MiCA compliance staffing and technology in 2025.

- Compliance costs for large crypto firms rose 38% in 2025, driven by reporting and legal expansions.

- 53% of EU crypto startups struggled with MiCA capital requirements, especially stablecoin issuers.

- 90% of crypto businesses said MiCA improved institutional trust and adoption in 2025.

- Despite higher costs, 82% of firms viewed MiCA as a stabilizing force for the EU crypto market in 2025.

Key MiCA Requirements for Cross-Border Transactions

- Over 40 CASP licenses have been issued across the EU under MiCA as of mid-2025, enabling passporting across all 27 member states.

- Issuers of e-money tokens and asset-referenced tokens are required to hold 100% liquid reserves, with liquidity requirements ranging from 20%-60% for various asset maturities.

- MiCA mandates all cross-border crypto payment providers to comply with AML/KYC and the FATF “travel rule,” which 45 countries have implemented as of 2024 globally.

- About 32 CASPs are officially recognized under MiCA and undergo supervisory assessments as of mid-2025.

- Regulators imposed 26 withdrawals of authorisations and 615 administrative fines under MiCA across sectors in 2024, showing enforcement rigor.

- MiCA’s “passporting” regime replaces fragmented national registrations, reducing CASP numbers from thousands to around 40 licensed providers under EU harmonization.

EU Regulatory Framework and ESMA Guidelines

- Regulation (EU) 2023/1114 (MiCA) entered into force on June 29, 2023, becoming fully applicable on December 30, 2024.

- Over 65% of EU-based crypto businesses had achieved MiCA compliance by Q3 2025, with top countries reaching 90%+ compliance.

- ESMA’s April 2025 guidelines on market abuse under MiCA guide more than 27 national competent authorities (NCAs) across member states.

- Ireland set a transitional compliance period ending on December 29, 2025, with full MiCA enforcement required thereafter.

- Consumer complaints related to crypto transactions have dropped by 27% in 2025 after MiCA’s consumer protection measures took effect.

- Delegated acts under MiCA define supervisory fees expected to raise about €10 million annually from significant ART and EMT issuers.

- Despite MiCA, regulatory fragmentation persists, with 35% of member states showing inconsistent enforcement and rule interpretations as of 2025.

- Consumer protection, financial stability, and transparency are emphasized, with MiCA reducing crypto fraud losses by 32% in Q1 2025.

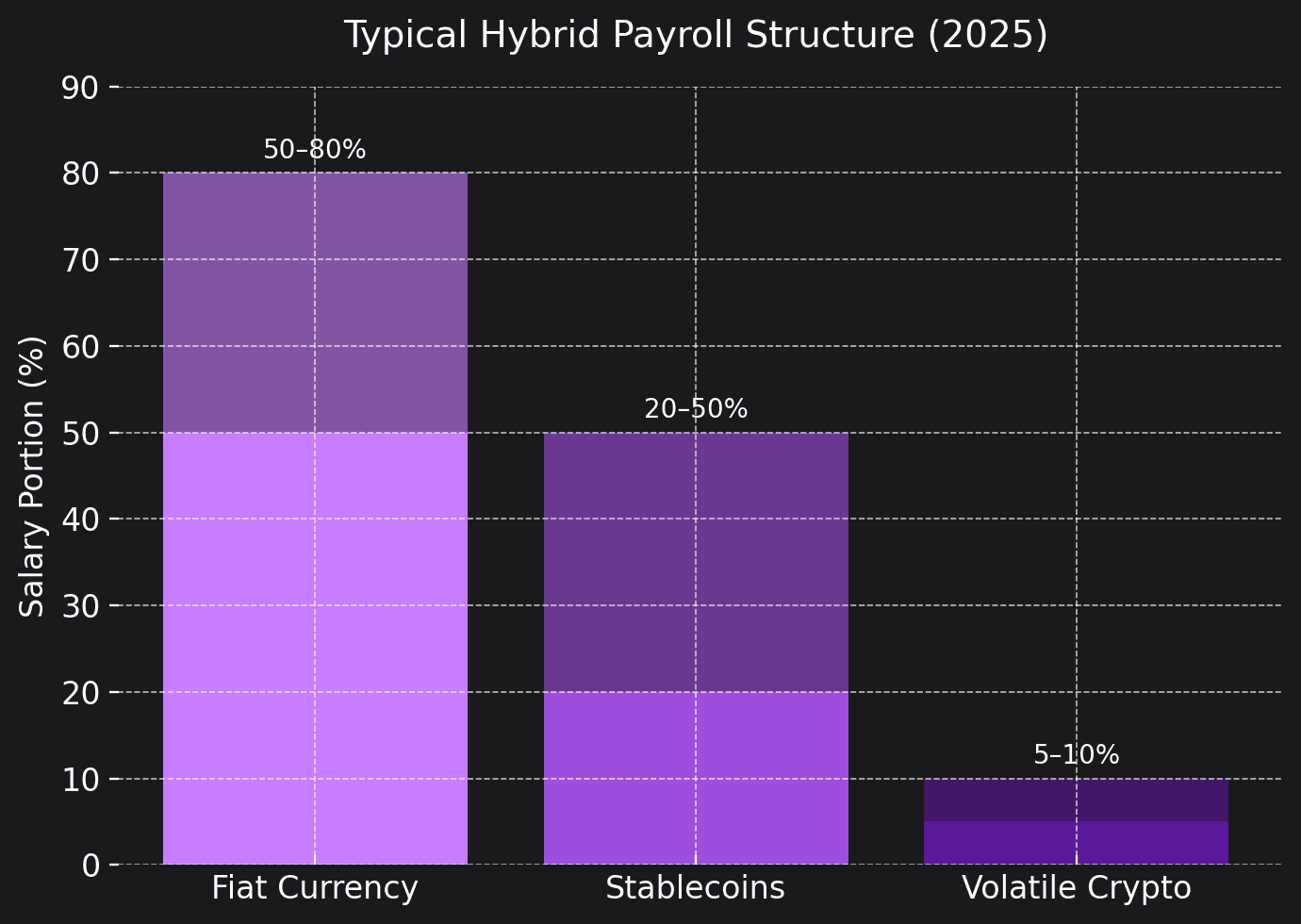

Typical Hybrid Payroll Structure

- Fiat currency makes up 50–80% of payroll, remaining the dominant component in hybrid systems.

- Stablecoins account for 20–50% of salaries, showing a move toward on-chain, low-volatility payments.

- Volatile crypto assets like Bitcoin or Ethereum form 5–10%, mainly used for bonuses or token incentives.

- Most firms still prioritize fiat stability while slowly adding crypto to attract digital-native talent.

- The fiat-crypto balance helps manage volatility risks and provides greater payment flexibility for employees.

Role of Crypto Asset Service Providers (CASPs)

- A CASP is defined by MiCA as an entity that professionally provides crypto-asset services (wallets, exchanges, custody) within the EU.

- The MiCA-compliance survey shows that over 4,000 CASPs had secured EU-wide licensing for cross-border services in 2025.

- CASPs must adopt stronger AML/KYC processes; for example, 97% of wallet/exchange/custodial firms passed MiCA-security audits in 2025.

- For cross-border capabilities, CASPs now face stricter transparency obligations and must ensure fee and settlement disclosures.

- National regulators have the authority to withdraw CASP authorisations, impose fines, or issue administrative sanctions under MiCA.

Growth and Adoption of MiCA-Compliant Transactions

- In 2025, more than 79% of European businesses accepting crypto now require MiCA-compliant transactions for cross-border sales.

- Over 74% of exchanges compliant with Markets in Crypto-Assets Regulation (MiCA) reported higher trading volumes in 2025 compared to non-compliant peers.

- Merchant crypto-adoption in the EU grew by 62% in 2025 as regulated payment options became more available.

- Cross-border lending activity on MiCA-compliant platforms increased by 57% in 2025.

- Traditional financial institutions processed 33% of crypto transactions using MiCA-compliant systems in 2025, reflecting integration of legacy finance.

- 48% of European consumers say that MiCA compliance boosted their trust in cross-border crypto payments in 2025.

- The number of MiCA-regulated wallet users in the EU reached 33 million in 2025, up from 21 million in 2023.

- EU custodians report safeguarding €520 billion in crypto assets in 2025 under MiCA reserve and security rules.

- Cross-border crypto payments by businesses using MiCA-approved gateways rose by 51% in 2025.

- 43% of freelancers and remote workers in Europe prefer crypto payments for speed and cost benefits in 2025.

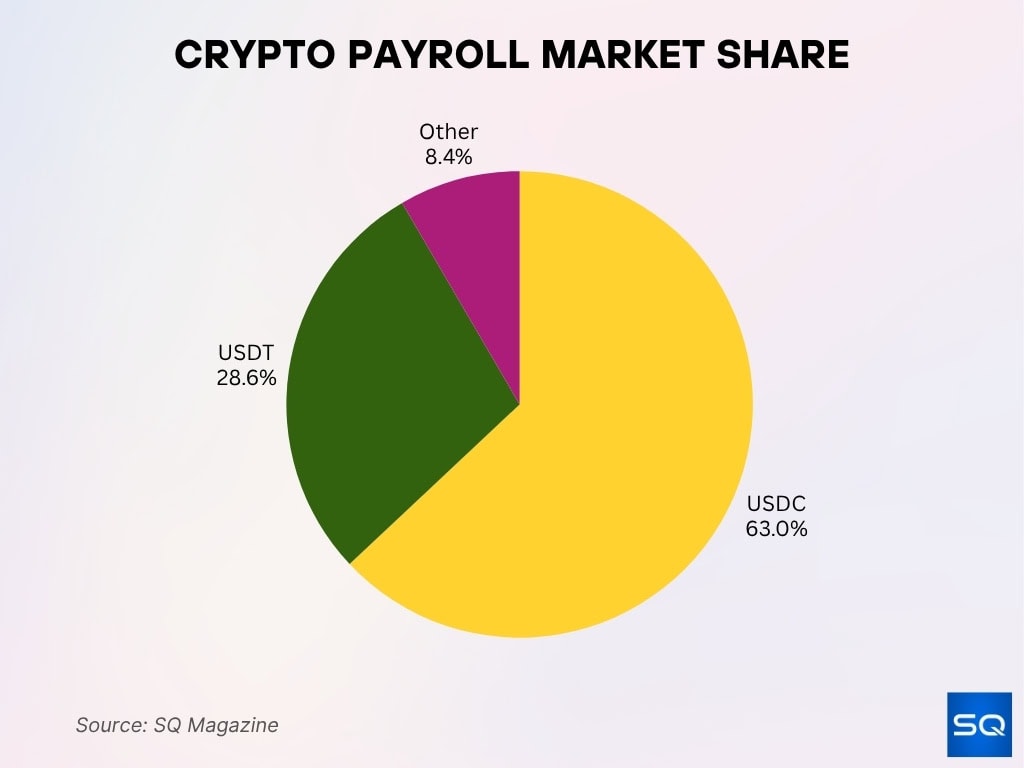

Crypto Payroll Market Share

- USDC leads the crypto payroll market with a 63% share, favored for compliance and transparency.

- USDT (Tether) holds 28.6%, driven by global liquidity but less used in regulated payrolls.

- Other stablecoins total just 8.4%, mainly for DAOs or regional payroll projects.

- Employers show a strong preference for regulated stablecoins, ensuring stability and legal clarity.

- Over 90% of crypto payrolls now use USDC or USDT, centralizing the market around two key tokens.

Transaction Volume and Market Size

- The European crypto transaction region recorded a peak monthly volume of $234 billion in December 2024 and maintained elevated levels into 2025.

- The overall EU crypto market was projected at €1.8 trillion by the end of 2025, up ~15% year-over-year under MiCA’s influence.

- MiCA-compliant exchanges saw volumes grow ~24% after its enforcement, per one source.

- Stablecoin payment-specific volumes globally were estimated at $5.7 trillion in 2024, underpinning the market’s scale.

- In 2025, stablecoin market capitalisation reached about $300 billion, representing roughly 7.5% the total crypto-asset market size.

- Despite growth, Europe’s share of stablecoin usage in payments remained low, about 22% of usage vs ~50% in the U.S. as of early 2025.

- The number of CASP licences issued in the EU had surpassed 40 by mid-2025, signalling increasing market participation.

- The EU claims approximately 27% of the global crypto transaction volume in 2025 to one estimate.

Stablecoins and E-Money Tokens in Cross-Border Payments

- As of 2025, stablecoins are underpinning a growing portion of cross-border payments in Europe and globally.

- Globally, stablecoin transactions surpassed $450 billion per month in 2024 and reached ~$710 billion per month by March 2025.

- The EU’s MiCA framework mandates that issuers of e-money tokens (EMTs) and asset-referenced tokens (ARTs) hold 100% reserves and meet strict disclosure standards.

- Institutional B2B use of stablecoins for cross-border settlement rose significantly in 2025, as per industry interviews.

- One study notes that stablecoins now account for 63% of all crypto transaction volume associated with illicit activity in 2024.

- European banks formed a consortium in late 2025 to issue a euro-stablecoin, though euro-denominated circulation remains small (~$66 million in one issuer’s case).

- Despite regulatory clarity, some industry voices believe that the need for stablecoins in intra-EU payments is limited given the existing instant-payment infrastructure (SEPA).

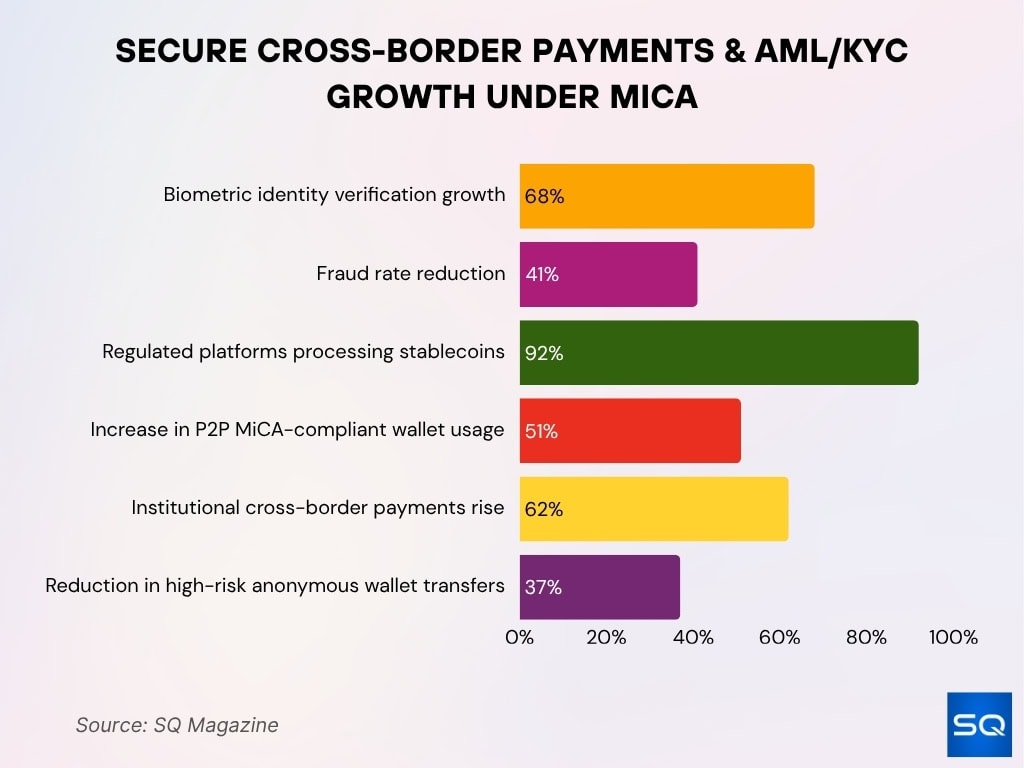

Cross-Border Payment Methods and AML/KYC Compliance

- Biometric identity verification for crypto payments surged 68%, reducing fraud by 41% in 2025.

- 92% of EU stablecoin transactions were processed via regulated platforms, ensuring full compliance in 2025.

- P2P transactions through MiCA-compliant wallets increased 51% in 2025, reflecting strong adoption.

- Institutional cross-border crypto payments climbed 62%, driven by MiCA’s legal clarity and reduced risk in 2025.

- MiCA disclosure rules led to a 37% drop in high-risk anonymous wallet transfers across the EU in 2025.

Impact on DeFi and Decentralized Platforms

- Within the EU, DeFi platform usage declined ~16% after MiCA’s initial enforcement phase, per one market-analysis data point.

- MiCA-compliant decentralized platforms that adapt to regulatory requirements saw active-user growth of ~33% in 2025.

- Peer-to-peer wallet usage on compliant platforms rose by 51% in 2025, signalling a user shift toward regulated DeFi options.

- Some DeFi-focused firms reported uncertainty over whether they fall under the MiCA scope, and about 40% said they lacked clarity.

- Institutional participation in DeFi-style services via regulated entities climbed ~51% in 2025 in the EU.

Risk Management and Consumer Protection

- Nearly 78% of EU exchanges reinforced consumer risk-disclosure protocols under MiCA by mid-2025.

- 82% of crypto transactions in the EU were subject to market-abuse rules (insider-trading and manipulation) in 2025 under MiCA mandates.

- Fraud incidents in cross-border crypto payments declined by 48% in 2025, attributed to enhanced AML/KYC and supervision.

- Security incident rates for crypto-wallets in the EU dropped by 41% as providers upgraded to MiCA-compliant cybersecurity frameworks.

- 92% of stablecoin transactions in the EU in 2025 were processed via regulated platforms with full compliance.

- Consumer trust surveys show 48% of users in Europe believe regulation like MiCA improves the safety of cross-border crypto payments.

- Fines for non-compliant crypto-firms under MiCA can reach up to €5.6 million or 10% of annual turnover.

- Among major crypto-firms, 87% had initiated licensing or compliance processes by mid-2025.

Anti-Money Laundering and Travel Rule Compliance

- Under MiCA, about 85% of crypto-asset service providers (CASPs) had applied for or secured their licence by mid-2025.

- Approximately 85% of CASPs upgraded AML/KYC protocols in 2025 to meet MiCA standards.

- About 10% of CASPs in the EU were flagged by regulators for failing AML/security standards in 2025.

- Biometric identity verification used in crypto payments grew by 68% in 2025, contributing to a 41% drop in fraud.

- National competent authorities across EU member states now supervise CASPs under MiCA, aligning AML supervision across the bloc.

- In one region, 30% of crypto firms cited difficulties meeting MiCA capital or reporting requirements that impact AML/travel-rule compliance.

- Institutional reporting frameworks for crypto transactions improved in 2025, with 78% of firms now able to generate MiCA-compatible audit-compliance data.

Taxation and Reporting Standards

- As of 2025, 65% of EU member states require crypto-asset service providers (CASPs) to submit transaction data for tax purposes under MiCA-aligned rules.

- Approximately 32% of institutional investors in the EU reported they increased their crypto holdings after MiCA’s investor-protection and reporting mandates.

- Around 42% of European blockchain startups estimate their annual compliance cost (including tax/reporting) will exceed €500,000 due to MiCA.

- By mid-2025, 70% of licensed crypto firms in the EU declared full readiness to submit MiCA-compatible regulatory and tax audit reports.

- Non-EU crypto firms, roughly 30% indicated plans to exit the EU market, citing burdensome tax and reporting standards under MiCA.

- More than 53 major crypto-firms had gained initial MiCA licences by 2025 (14 EMT issuers, 39 CASPs) and now face consistent tax-reporting obligations.

- In one survey, 78% of EU CASPs reported they have upgraded their data-reporting systems to meet MiCA’s disclosures and tax requirements.

- Smaller firms (≤ 10 employees) are especially impacted, ~40% say they lack internal resources to fully comply with MiCA tax-reporting by end-2025.

Technological and Infrastructure Developments

- The outstanding value of stablecoins in the EU rose 73% to approximately €240 billion by late 2024/early 2025, per the European Systemic Risk Board (ESRB).

- Some DeFi-platform infrastructure in Europe paused rollout due to uncertainty whether MiCA fully covers decentralized models, ~40% of DeFi platforms cited this.

- Upgrades, 78% of CASPs have enhanced cybersecurity and infrastructure risk frameworks in response to MiCA’s requirement for operational resilience.

- Some firms cite infrastructure implementation cost increases of up to 30% owing to new MiCA-driven technical compliance demands.

Impact on EU Financial Integration and Competition

- Cross-border crypto service activity increased by approximately 24% in markets with MiCA-compliant licenses in 2025.

- Smaller EU members risk losing crypto businesses as 54% of firms prefer hubs like Germany and the Netherlands due to faster licensing.

- Traditional banks now handle 33% of crypto transactions using MiCA-compliant systems in the EU (2025).

- Institutional investors in the EU increased crypto holdings by 32% after MiCA implementation (2025).

- Compliance costs for crypto startups have risen 6×, from about €10,000 to €60,000 by 2025, burdening smaller firms.

- Cross-border crypto payment offerings in the EU lag behind the US and Asia by about 15-20% in adoption rates.

- EU crypto lending services grew by 68% as firms adapted to MiCA regulations in 2025.

- MiCA licensing helped increase the number of registered crypto service providers by 47% across the EU in 2025.

- Larger enterprises dominate the post-MiCA market share, with about 75% of registrations held by firms from the top 5 EU countries with easier licensing.

Frequently Asked Questions (FAQs)

Approximately 79% of European businesses accepting crypto now require MiCA-compliant transactions for cross-border sales.

The EU captured approximately 27% of global crypto transaction volume in 2025.

About 92% of EU stablecoin transactions in 2025 were processed via regulated platforms for full compliance.

Around 85% of CASPs had applied for or secured MiCA licences by mid-2025.

Conclusion

The introduction and phased implementation of MiCA have significantly reshaped how cross-border crypto transactions operate within the EU. From tighter taxation and reporting norms to enhanced supervision, infrastructure development, and global regulatory alignment, the data highlight an ecosystem entering a new maturity phase.

Nonetheless, challenges remain, varying levels of licensing uptake, infrastructure bottlenecks, and the rising compliance costs for smaller firms could slow full integration. Overall, the EU is making clear strides toward creating a competitive and regulated crypto-asset market that supports seamless cross-border transactions under a unified framework.