In an era where digital asset exchanges shape financial markets, Coinbase stands out as a key player with measurable momentum. From retail investors trading bitcoin to institutions staking Ether, Coinbase’s platform supports real‑world activity such as crypto payments for merchants and institutional custody services. This article drills into the most recent data covering users, subscriptions and platform usage and invites you to explore the finer details in the sections below.

Editor’s Choice

- ~120 million total monthly users as of 2025.

- 8.7 million Monthly Transacting Users (MTUs) in Q2 2025.

- In Q3 2025, Coinbase posted $747 million in subscription/services revenue and $1 billion in transaction fees, with annual projections trending near $2.9 billion and $4.2 billion, respectively.

- Paid membership for Coinbase One reached over 600,000 members across 42 countries at one point.

- Coinbase held ~11% of staked Ether via its node‑operator role as of 2025.

- A cyberattack disclosed in May 2025 is expected to cost up to $400 million in remediation.

Recent Developments

- In May 2025, Coinbase announced its membership in the S&P 500 index, becoming the first major crypto platform to join.

- Coinbase disclosed in 2025 that it became the largest node operator on Ethereum, controlling ~11.42% of staked ETH.

- A cyberattack targeted overseas support agents in mid‑2025, affecting <1% of MTUs, with potential costs up to $400 million.

- Regulatory scrutiny, The U.S. Securities and Exchange Commission (SEC) investigated whether Coinbase inflated “verified users” metrics.

- Launch of Coinbase’s “Everything Exchange” ambition in 2025, expanding spot assets, derivatives, and a token sales platform.

- The surge of stablecoins, Coinbase noted that global stablecoin supply grew ~54% y‑o‑y, and their importance in payments increased in 2025.

- In August 2025, Coinbase’s subscription and services segment is flagged as a growing revenue pillar, shifting away from pure transaction fees.

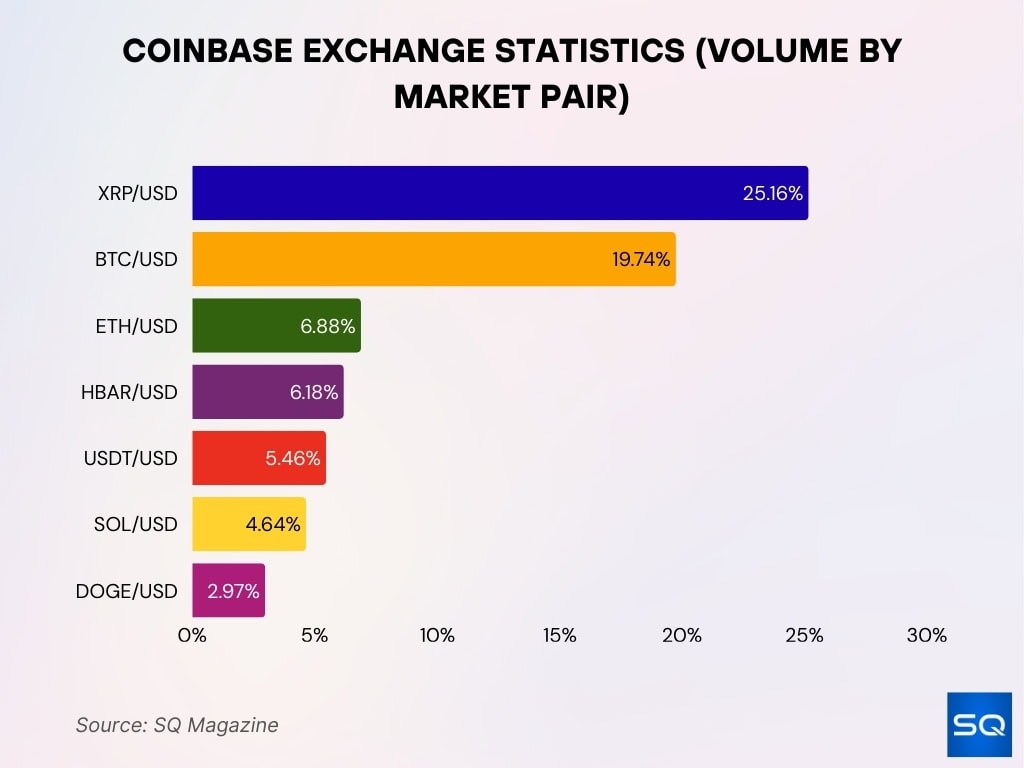

Coinbase Exchange Statistics by Trading Volume

- XRP/USD dominates with 25.16% of total trading volume.

- BTC/USD comes second, capturing 19.74% of market activity.

- ETH/USD holds 6.88%, reflecting consistent trader demand.

- HBAR/USD makes up 6.18%, showing rising Hedera interest.

- USDT/USD contributes 5.46%, underlining stablecoin utility.

- SOL/USD accounts for 4.64%, retaining a solid volume share.

- DOGE/USD maintains 2.97%, driven by meme-coin enthusiasm.

Monthly Transacting Users

- Q1 2025, ~9.7 million MTUs.

- Q2 2025, ~8.7 million MTUs.

- Q4 2024, ~7.0 million MTUs.

- Q3 2024, ~7.8 million MTUs.

- Q2 2024, ~8.2 million MTUs.

- Q1 2024, ~8.0 million MTUs.

- Peak late 2021, ~11.4 million MTUs.

- Q3 2023, ~6.7 million MTUs.

Total Verified Users

- By the end of 2024, ~108 million verified users.

- Estimated users in 2025: ~120 million.

- Q4 2022: 110 million verified users.

- Q3 2022: 108 million verified users.

- Q2 2022, 103 million verified users.

- Q1 2022: 98 million verified users.

- Q4 2021: 89 million verified users.

- Growth from Q4 2021 to Q4 2022, ~21 million new verified users.

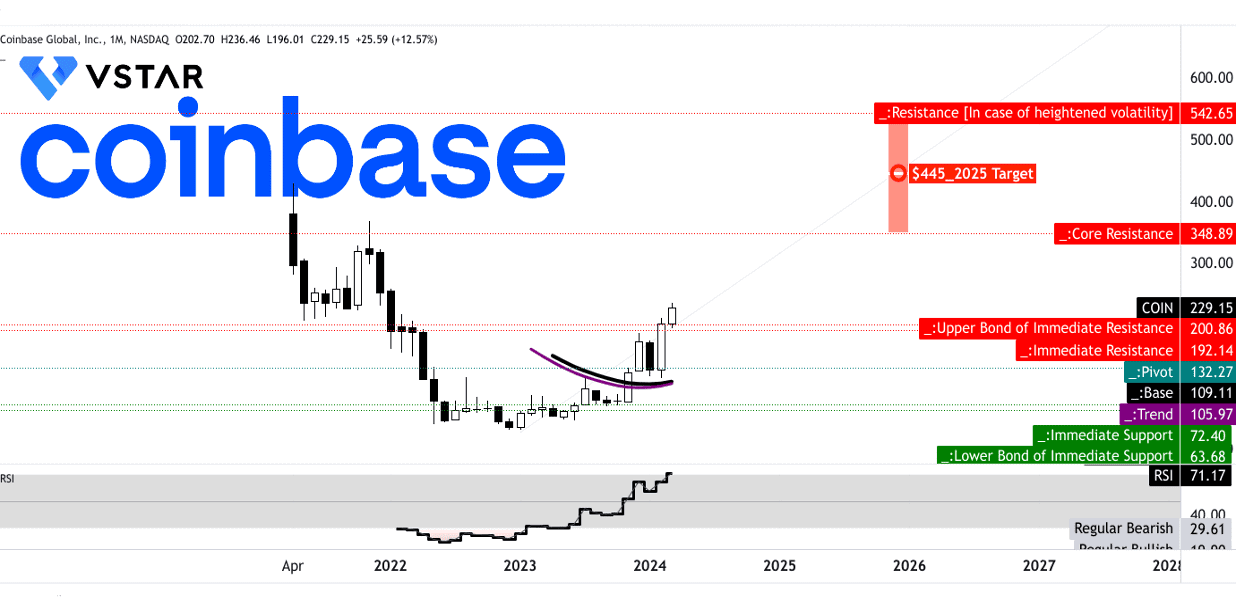

Coinbase Stock Price Levels and Targets

- Current price is $229.15, reflecting strong YTD growth.

- 2025 analyst target is $445, nearly double the current level.

- Core resistance sits at $348.89, a major breakout threshold.

- Upper immediate resistance is $200.86, with another at $192.14.

- Support levels are $72.40 (immediate) and $63.68 (lower bond).

- Pivot point is $132.27, with base at $109.11 and trend line at $105.97.

- High-volatility resistance could reach $542.65 in extreme upside cases.

- RSI is 71.17, signalling overbought conditions vs. bearish mark at 29.61.

Coinbase One Subscribers

- As of December 2024, Coinbase announced that the Coinbase One community had exceeded 600,000 members across 42 countries.

- In 2025, the estimate for Coinbase One subscribers rose to approximately 1 million.

- The Basic tier (introduced Q2 2025) launched at $4.99/month, making the service more accessible to more users.

- Earlier tiers included zero trading fees (for standard spot trading), staking reward boosts and free wires and card benefits.

- The service expanded geographically and in benefits over 2024–25, signalling Coinbase’s push from pure trading fees to recurring membership income.

- Membership growth remains a key diversification lever, especially as transaction volumes fluctuate.

- While exact churn and active‐usage metrics are not published, the approximate 1 million milestone suggests meaningful traction for a subscription product in a crypto exchange context.

Assets on the Coinbase Platform

- As of September 30, 2025, Coinbase reports $516 billion in assets on its platform.

- Earlier in 2025, another estimate put assets on the platform at $425 billion as of June 30.

- At the end of 2024, assets on the platform were around $404 billion.

- Changes in market valuations and cryptocurrency price movements can influence these figures significantly, even without changes in user counts.

- The growth in assets on the platform supports Coinbase’s scale in custody and staking, reinforcing its role as a major “crypto‑gateway” for retail and institutional users.

- High asset base positions Coinbase competitively as a custodian, for example, it is often cited as holding over 11% of all staked Ether.

- Platform assets growth also helps underpin other business lines (staking, lending, subscriptions) and gives credibility for institutional counterparties.

Transaction Revenue

- Q2 2025 transaction revenue totalled $764 million, down 39 percent quarter over quarter.

- Consumer trading revenue reached $650 million, marking a 41 percent Q/Q decline.

- Institutional transaction revenue fell to $61 million, also down 38 percent Q/Q.

Most Held Currencies on Coinbase

- On Coinbase’s platform, Bitcoin accounted for approximately 34% of total trading volume in Q2 2025.

- Ethereum (ETH) held about 12% of volume in the same period.

- XRP’s share was around 13% in Q2 2025.

- Solana represented roughly 10–11% of volume in parts of 2024 and early 2025.

- “Other crypto assets” (alt‑coins beyond the top few) accounted for about 26% of total volume.

- Among wallet holdings, Coinbase supports over 270 cryptocurrencies as of 2025.

- Within active wallets, Bitcoin remained the most common asset (~68% of surveyed wallets), Ethereum ~54%, and stablecoins ~49%.

- The distribution underlines that while mainstream assets dominate, there is meaningful diversification into alt‑coins and stablecoins on the Coinbase platform.

Retail Trading Volume

- In Q2 2025, Coinbase’s consumer (retail) trading volume was $43 billion, down 45% quarter‑over‑quarter.

- Consumer transaction revenue in the same quarter was $650 million, down about 41% Q/Q.

- In Q1 2025, total spot trading volume was reported at approximately $393.1 billion, down 10% Q/Q.

- Retail trading volume as a share of total Coinbase trading volume was around 6.6% in Q2 2025.

- For comparison, in Q1 2024, retail trading volume was ~$56 billion.

- The steep drop in retail volume reflects broader market softness, lower volatility and declining fee income.

- Retail volume remains a meaningful metric for assessing Coinbase’s exposure to everyday traders, which complements institutional activity.

- The shift toward subscription and services revenue is partly a response to declining retail trading volumes.

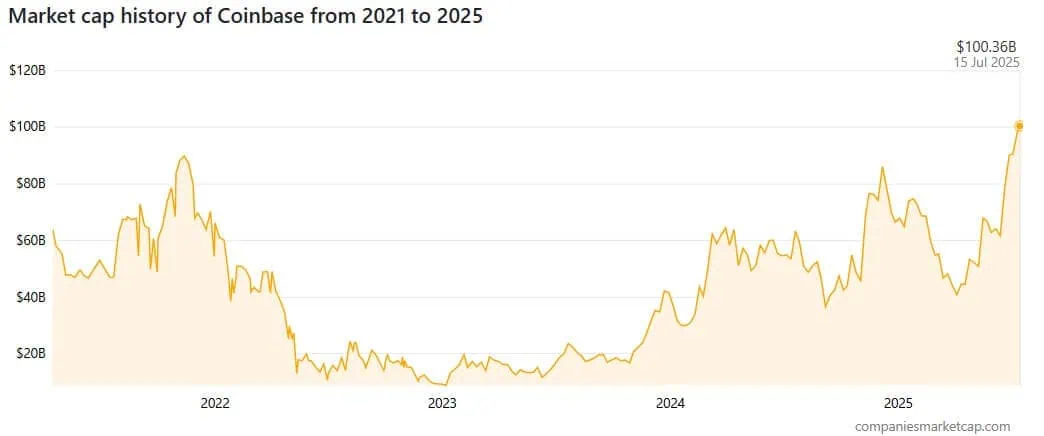

Coinbase Market Cap History

- 2021 market cap ranged between $40 billion–$80 billion, briefly topping $80 billion.

- Late 2022 saw a sharp drop below $20 billion.

- 2023 levels stayed low, fluctuating between $10 billion–$20 billion.

- 2024 recovery pushed values into the $40 billion–$60 billion range.

- July 15, 2025, marked a surge to $100.36 billion, a multi-year high.

Institutional Trading Volume

- In Q2 2025, institutional trading volume on Coinbase was $194 billion, down about 38% Q/Q.

- Institutional transaction revenue in Q2 2025 was $61 million, also down around 38% Q/Q.

- In Q3 2025, institutional trading volume rose to $236 billion, up 22% Q/Q.

- In Q3 2025, institutional transaction revenue was $135 million, up 122% Q/Q.

- The institutional segment is increasingly important for Coinbase because of higher potential ticket sizes, recurring product tie‑ins (custody, derivatives) and less sensitivity to retail volatility.

- The acquisition of derivatives exchange Deribit (closed August 14 , 2025) is expected to bolster institutional/derivatives volume.

- The institutional share of trading underscores Coinbase’s positioning as a regulated gateway for large‑scale digital asset participants.

Supported Cryptocurrency Assets

- As of 2025, Coinbase supports over 270 cryptocurrencies on its platform.

- On the institutional/custody side (Coinbase Prime), clients can custody over 420 assets across 52 chains.

- On the retail/trading Exchange side, Coinbase lists around 315 coins and 460 trading pairs as of the latest disclosure.

- In Q3 2025, Coinbase announced that via its DEX integration on Base, it added “more than 40,000 assets” to trade (though many are self‑custody/DEX) and claimed support for ~90% of total crypto‑market capitalization.

- Listing‑strategy trends, in 2024, Coinbase added 91 new assets to its institutional offering, expanding its derivatives/trading depth.

- The wide array of assets supports Coinbase’s goal of becoming an “everything exchange” (retail + institutional + DEX) rather than a single‑product platform.

- For users, this means access to emerging tokens, new networks, and niche markets, though with the usual risks of lower‑liquidity assets.

- From a business‑model perspective, listing a large number of assets helps attract a diverse user base and cross‑sell subscriptions and custody services beyond core Bitcoin/Ethereum-only customers.

Subscription and Services Revenue

- In Q2 2025, Coinbase reported $656 million in subscription and services revenue.

- In Q1 2025, subscription and services revenue was $698 million, representing a 9% increase quarter‑on‑quarter.

- For the full year 2024, subscription and services revenue reached $2.3 billion, up from $1.41 billion in 2023.

- Stablecoin‑related income (notably from USDC) drove a substantive part of this services growth, e.g., USDC balances on Coinbase averaged $13.8 billion in Q2 and grew ~13% Q/Q.

- The services segment now plays a key role in diversifying Coinbase’s income beyond transaction fees, which are more volatile.

- In Q2 2025, transaction (trading) revenue was $764 million, illustrating that subscription/services (~$656 m) are approaching parity with trading revenues.

- Coinbase forecasts subscription and services revenue for Q3 to lie between $665 million and $745 million.

- For investors and analysts, the uptick in subscription and services revenue signals a shift toward a platform offering rather than pure trading‑fee dependency.

Number of Coinbase Employees

- As of June 30, 2025, Coinbase employed over 4,200 people.

- In October 2025, reports show Coinbase employed approximately 4,300 people, a ~7% increase year‑on‑year.

- At the end of 2024, headcount stood at 3,772 employees, indicating rapid growth during 2025.

- Hiring is concentrated in compliance, customer support, and product functions, especially as Coinbase expands its global footprint and regulatory operations.

- The headcount growth contrasts with earlier crypto‑industry layoffs, signalling that Coinbase sees a sustained operational ramp‑up.

- For readers, this metric shows the back‑office and infrastructure scale required to support a major crypto platform and underpins services growth.

- Employee growth is also a proxy for investment in compliance, platform reliability and international expansion, areas critical in 2025.

- Workforce expansion can increase costs (capex / opex) in the short term, so the impact on profitability will depend on revenue growth from new services.

Global Website Traffic

- Although Coinbase does not publish exact monthly unique visitor figures, public disclosures and industry tracking suggest ~120 million monthly visits to the combined platform in 2025.

- In Q2 2025, Coinbase’s platform trading volume was $237 billion, which correlates with high user engagement and traffic.

- Traffic growth is supported by Coinbase’s inclusion in the S&P 500 index in May 2025, boosting institutional and retail visibility.

- Global market‑share estimates place Coinbase at 6.9% of worldwide crypto trading volume, giving it a significant web presence beyond the U.S. market.

- The large asset base on the platform (e.g., ~$425 billion as of mid‑2025) implies sustained traffic from users monitoring holdings, staking and asset‑management functions.

- User traffic is likely skewed toward the U.S., but international users (100+ countries) contribute meaningfully, especially via mobile app downloads and web visits.

Compliance and Security Statistics

- Coinbase states on its website that compliance is “rooted in best practices from traditional financial services” and includes KYC/AML, transaction‑screening and scaled investigation tools.

- The platform tracks and monitors all assets listed for “ongoing compliance” to ensure they meet listing standards and regulatory alignment.

- In May 2025, Coinbase disclosed a breach involving rogue support agents; the company estimated potential costs between $180 million‑$400 million to reimburse affected users.

- As of 9/30/25, Coinbase reported 4,700+ employees across the company, which includes compliance, security, and operational risk functions.

- Coinbase’s custody unit (Prime) supports over 420 assets and 52 chains, requiring advanced security and segregation of client funds.

Frequently Asked Questions (FAQs)

$1.87 billion.

~120 million monthly visits.

$801 million.

Conclusion

Coinbase continues to transform from a pure trading platform into a diversified digital‑asset services business. With support for hundreds of cryptocurrencies, rapidly growing subscription and services revenue, a workforce expanding into compliance and global operations, strong website and user traffic, and an emphasized focus on security and regulatory compliance, the company is positioning itself for the next phase of crypto adoption. That said, the growth of non‑trading revenue will be key as trading volumes fluctuate.