Chainlink (LINK) stands as the leading decentralized oracle network, connecting blockchains with real‑world data and powering smart contracts for DeFi, tokenized assets, and cross‑chain applications. Chainlink’s relevance continues to grow, from supporting macroeconomic data feeds to enabling complex cross‑chain infrastructure. Its reach affects both decentralized finance platforms and enterprise blockchain integrations. Below, we dive into key statistics that illustrate Chainlink’s current footprint.

Editor’s Choice

- LINK trades at ≈ $14.10 per token, with a circulating supply of ~696.85 million.

- Chainlink commands approximately 63–67% of the oracle market, according to various 2025 estimates, with dominance varying by blockchain and data provider.

- Its transaction value enabled (TVE), the value of smart contracts and protocols relying on its oracles, reached $26.42 trillion.

- Chainlink’s Cross‑Chain Interoperability Protocol (CCIP) now supports 50 blockchains after the Q1 2025 expansion.

- Over 2,000 price feeds and oracle integrations operate under Chainlink’s network.

Recent Developments

- Chainlink Network surpassed $20T in total value enabled (TVE) in Q1 2025.

- CCIP added 25 new blockchains in Q1 2025, totaling 50 connected chains.

- Data Streams achieved 777% growth in supported assets via the Multistream upgrade in 2025.

- Confirmed 14 new integrations across 11 blockchains, including Aptos, Arbitrum, and Solana, in 2025.

- U.S. Department of Commerce data, like GDP, PCE Price Index delivered on-chain across 10 networks in 2025.

- In 2025, Chainlink has **secured over $100 billion in Total Value Secured (TVS), up from earlier $93 billion+ milestones as DeFi and RWA usage accelerated.

- Data Streams expanded from 7 to 24 blockchains, a ~242% increase in Q1 2025.

- Deployed over 77 new Data Streams on mainnet in Q1 2025.

Chainlink Technical Snapshot

- Current price is $23.59, reflecting a 6.99% weekly gain.

- Weekly high was $24.20, while the low dipped to $20.85.

- Opening price was $22.02, showing strong mid-August momentum.

- Resistance levels stand at $23.59 and $26.46, signaling upside pressure.

- Support zones are at $21.68, $17.49, $15.48, and $12.75, forming the lower channel line.

- Weekly volume hit 498.44K, indicating healthy trading activity.

- Chaikin Money Flow (CMF 20) is +0.20, pointing to steady buying pressure.

- Price is inside a rising parallel channel, with a bullish breakout target near $36.

Historical Chainlink Price Performance

- Over the past year, LINK has seen a price decline of ≈ 43.08%, from the prior year’s peak to the current.

- Despite the yearly drop, recent weeks show signs of recovery, with LINK recording a weekly gain of ~7–8%.

- In the last 7 days, Chainlink has gained roughly 2.5%.

- Market trading volume remains robust, with 24‑hour volume around $700–710 million.

- Use of LINK remains strong, with a high circulating supply (~696.85M) providing deep liquidity.

- LINK’s rank among tradable assets remains within the top 15 by market capitalization, reflecting sustained investor interest.

- Some analyst projections for the end of 2025 place LINK between $22-$30, reflecting moderate optimism if adoption continues.

Chainlink Returns Versus Bitcoin and Ethereum

- As of late 2025, Chainlink (LINK) delivered a year‑to‑date return of +16.86%, while Bitcoin (BTC) posted +16.82%.

- LINK ranked among the top large‑cap tokens in a recent quarter, placing alongside major assets in performance‑adjusted returns.

- Chainlink’s quarterly returns in 2025 show volatility, with one quarter down ~32.5% and another nearly flat at –0.94%.

- Ethereum retains broader market dominance, and its market cap and network usage position it structurally above LINK in long‑term returns.

- LINK’s performance relative to BTC and ETH demonstrates that oracle‑linked tokens can outpace major cryptocurrencies in specific growth periods.

- LINK maintains higher volatility than BTC, with quarterly swings reflecting sensitivity to broader crypto market cycles.

- Analyst expectations suggest potential for LINK to reach $22–$32 by year‑end 2025 if network activity continues rising.

- Long‑term forecasts vary, with bullish sentiment tied to oracle adoption and pessimistic views tied to altcoin cycle risk.

Transaction Volume Statistics

- Market cap is $16.8 billion, with a fully diluted cap of $24.8 billion.

- Daily trading volume stands at $1.51 billion, reflecting strong liquidity.

On‑Chain Activity

- As of August 2025, active LINK addresses reached their highest level in 8 months, signaling renewed demand.

- Whale transactions involving LINK hit a 7‑month high, reflecting accumulation at larger wallet tiers.

- One daily movement registered ≈ 38.64 million LINK transferred, over 15 times higher than the previous week’s low.

- During a two‑week stretch, LINK surged nearly 50%, suggesting a correlation between heightened on‑chain activity and upward price movement.

- On‑chain analytics point to increased utility usage rather than purely speculative flows, aligning with growing oracle and CCIP adoption.

- Growth in unique addresses and transaction totals indicates rising participation from both retail and institutional entities.

- Expanding on‑chain metrics reinforce the argument that Chainlink’s value stems from network utility as much as from trading speculation.

Holder Distribution and Concentration

- Circulating supply is about 696.85 million LINK (~69.7% of the 1 billion max supply) as of late 2025, reflecting continued token unlocks and broader market distribution.

- Top 10 holders control 33.16% of the total LINK supply as of early 2025.

- The top 1% of addresses hold a record 81% of LINK tokens in 2025.

- 44% of the total supply was held in non-circulating wallets in 2025.

- Exchange reserves dropped 45 million tokens to 160 million since April 2025.

- 98.9% holder accumulation ratio shows nearly all active holders adding LINK in 2025.

- Active LINK addresses hit 10,000+, an 8-month high in Q3 2025.

- 87.5% of the circulating supply is in profit for holders in early 2025.

- Whale wallets accumulated over $116.7 million LINK post-October dip in 2025.

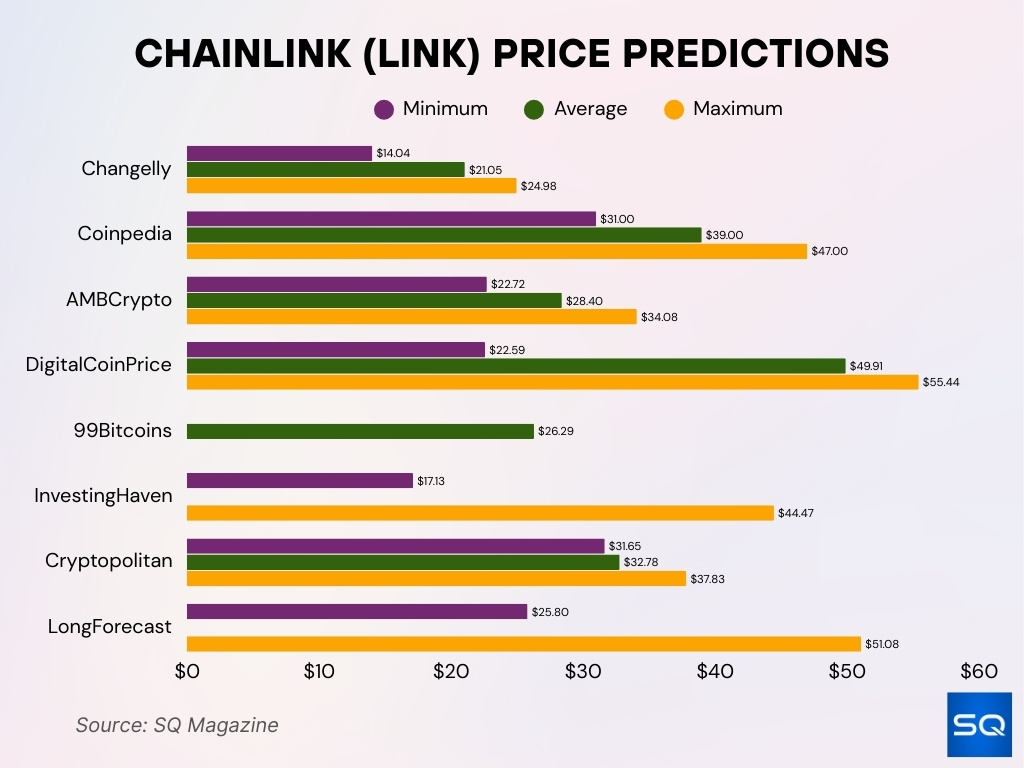

Chainlink (LINK) Price Predictions

- DigitalCoinPrice forecasts $55.44 max and $49.91 average, the highest among analysts.

- Coinpedia predicts $31 to $47, averaging $39 with a bullish outlook.

- LongForecast sees $51.08 max and $25.80 min, indicating a wide projected range.

- Cryptopolitan expects $31.65 to $37.83, pointing to likely consolidation.

- AMBCrypto estimates $22.72 min and $34.08 max, with an average of $28.40.

- Changelly gives $14.04 min and $24.98 max outlook.

- InvestingHaven targets $44.47 max with a $17.13 minimum, signaling upside potential.

- 99Bitcoins lists a single expected average price of $26.29, without high or low estimates.

Chainlink Oracle Network Metrics

- Chainlink’s Transaction Value Enabled (TVE) reached $25.24 trillion in 2025.

- Over 2,000 price feeds and oracle integrations now operate on Chainlink infrastructure.

- On Ethereum, Chainlink secures over 83% of all oracle‑supported value, and on Base, nearly 100%.

- In 2025, Chainlink integrated macroeconomic data from the United States Department of Commerce, including GDP and PCE Price Index.

- Institutional use cases expanded with Chainlink’s macroeconomic and traditional‑finance data integrations.

- Analysts estimate Chainlink’s dominance to be nearly nine times that of its nearest oracle competitor.

- Chainlink’s oracle network underpins tokenized assets, derivatives, automated smart contracts, and other institutional financial use cases.

DeFi and dApp Integrations

- In 2025, Chainlink powers oracle services for over 1,500 projects spanning DeFi, tokenization, derivatives, and prediction markets.

- On Ethereum‑based DeFi platforms, Chainlink serves more than 90% of lending and derivatives protocols.

- Chainlink Data Streams enable real‑time financial applications, including dynamic token pricing and inflation‑linked assets.

- Prediction‑market dApps rely on Chainlink’s low‑latency oracle solutions for accelerated settlement.

- As more DeFi and tokenization platforms emerge, Chainlink remains the default oracle for most new builds.

- Tokenized‑asset markets increasingly depend on Chainlink for pricing, verification, and interoperability functions.

- Chainlink’s deep dApp integration suggests that LINK’s value is tied more to infrastructure demand than speculative cycles.

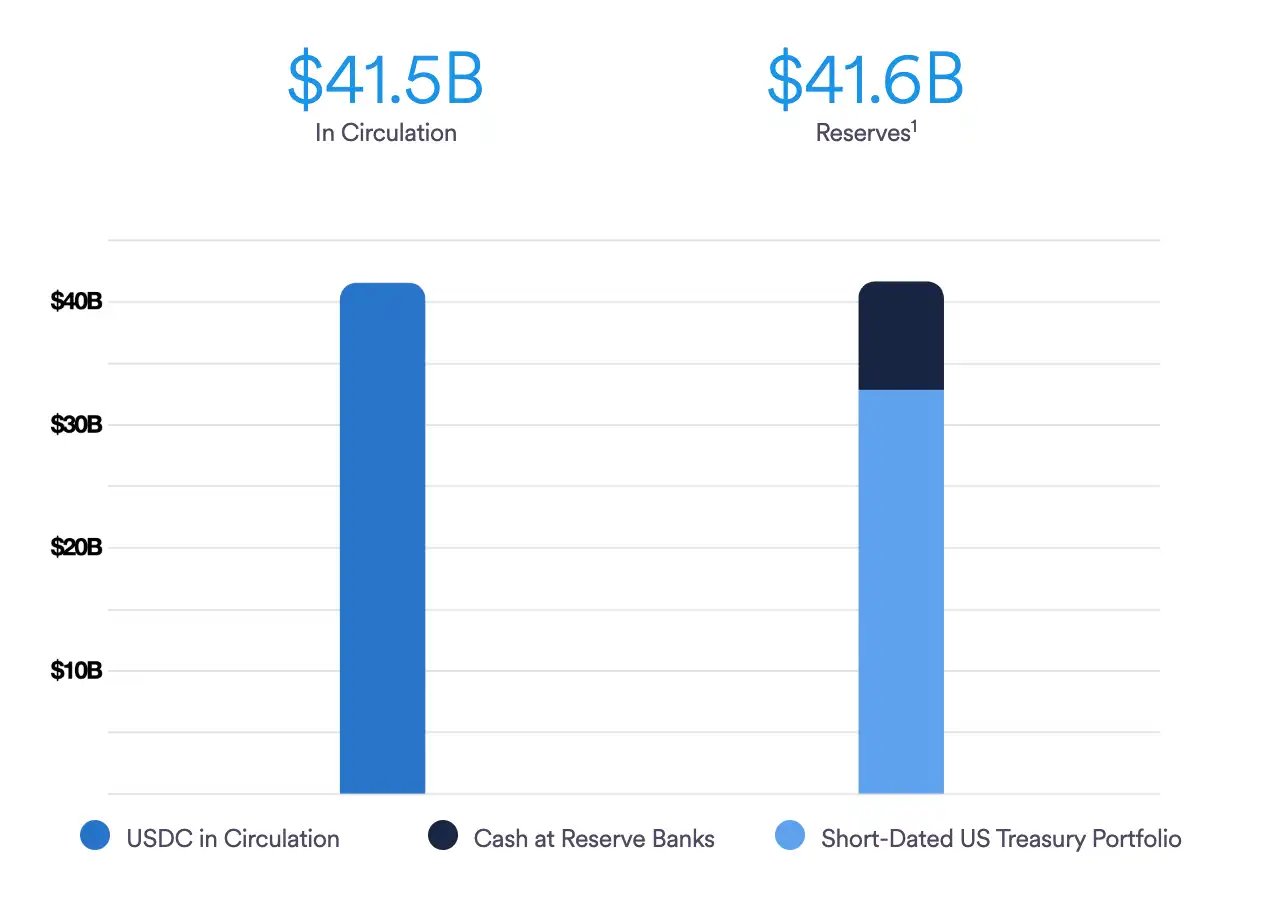

Chainlink’s USDC Integration and Reserve Transparency

- $41.5 billion USDC is in circulation, backed by real-world assets.

- $41.6 billion in reserves are verified by Chainlink oracles to back the USDC supply.

- Reserves include cash and short-dated U.S. Treasuries, boosting trust and liquidity.

- A $100 million surplus reflects overcollateralization and added stability.

- Chainlink enables transparent reserve reporting for DeFi and institutions.

- Most reserves are in short-dated Treasuries, ensuring a low-risk, government-backed approach.

Cross‑Chain and CCIP Growth

- As of mid‑2025, Chainlink’s CCIP supports 60+ public and private blockchains, enabling broad interoperability.

- In Q1 2025, CCIP added 25 new blockchains, raising the total supported chains to 50.

- CCIP upgrade v1.6 brought support for non‑EVM chains, making Solana the first non‑EVM mainnet to adopt CCIP.

- By May 2025, CCIP supported 59 networks and 388 cross‑chain lanes, according to third‑party analysis.

- CCIP and the Cross‑Chain Token (CCT) standard enabled assets like Toncoin to move across more than 60 blockchain networks.

- CCIP supports cross‑chain token transfers and data messaging, broadening liquidity and asset mobility.

- Analysts describe CCIP as enabling “global liquidity connectivity”, supporting seamless movement of tokenized assets.

- CCIP positions Chainlink as a foundational cross‑chain infrastructure rather than purely an oracle provider.

Ecosystem and Partnerships

- In 2025, Chainlink’s infrastructure secured over $100 billion in Total Value Secured (TVS), reaching an all‑time high.

- Aave v3 accounts for more than $70.9 billion of the TVS figure.

- Institutional and enterprise partnerships expanded significantly, signaling growing traditional‑finance adoption.

- Stellar joined Chainlink SCALE and adopted Data Feeds, Data Streams, and CCIP, broadening ecosystem reach.

- In 2025, Chainlink recorded 12 new integrations across 10 blockchains, strengthening multi‑chain support.

- Chainlink’s partnerships reflect its evolution into infrastructure for tokenized finance and enterprise‑grade blockchain services.

- Revenue models diversified, with fees from CCIP transfers and enterprise contracts enhancing sustainability.

- Analysts argue that growing partnerships may help stabilize LINK by tying its value more closely to real‑world infrastructure demand.

Chainlink Developer and Community Metrics

- 1,963 new addresses were added in a single day on October 1, 2025, the largest rise in weeks.

- 1,721 developers contributed to Chainlink repos over the past year through 2025.

- 4,947 commits across Chainlink repositories in the past year ending 2025.

- 21.9k developer actions recorded in 30 days on Ethereum in March 2025.

- 269 commits in the past 4 weeks versus the market average of 0 in late 2025.

- 924 commits in the past 12 weeks versus the market average of 3 in 2025.

- 80,430 Reddit subscribers and 1M Twitter followers reflect community growth in 2025.

- 27% YoY increase in on-chain activity for LINK wallets in Q2 2025.

Frequently Asked Questions (FAQs)

There are roughly 696.85 million LINK in circulation (~69.7% of the 1 billion max supply) as of late 2025.

The 24‑hour trading volume is about $1.51 billion.

Chainlink has surpassed $100 billion in Total Value Secured (TVS) as of 2025.

Conclusion

Chainlink stands at the intersection of decentralized finance, cross‑chain interoperability, and institutional‑grade blockchain infrastructure. Its CCIP network now spans 60+ blockchains and supports seamless token and data transfers across ecosystems, making Chainlink a backbone of multi‑chain liquidity and composability. Through growing enterprise partnerships, expanding Total Value Secured, and rising developer and on‑chain adoption, Chainlink is shifting from a niche oracle provider to a foundational infrastructure for tokenized assets, DeFi, and real‑world financial markets.