Buy Now, Pay Later (BNPL) has reshaped how consumers shop online and in-store by enabling people to split purchases into short-term payments without upfront interest. Over the past few years, this payment method has expanded rapidly, driven by fintech innovation and changing consumer expectations around credit flexibility.

In the U.S., BNPL has become a prominent option for Millennials and Gen Z, influencing purchasing behavior in sectors like fashion and travel, while globally it continues to expand across regions such as Latin America and the Asia Pacific. This article examines the latest Buy Now, Pay Later statistics today, offering insights into adoption, market growth, and usage trends that matter to both consumers and industry stakeholders.

Editor’s Choice

- The global BNPL market size is projected to reach about $28.44 billion in 2026, up from $23.37 billion in 2025, at a 15.18% growth rate.

- The U.S. is projected to reach 96.3 million BNPL users by late 2026, with average borrowing per user around $2,085.

- Between 17% and 35% of U.S. adults have used BNPL at least once in the past year, with higher usage among younger consumers

- More than half of Gen Z (51%) and millennials (54%) say they use BNPL more often than credit cards as of late 2025, a trend expected to deepen in 2026.

- Some proposed BNPL disclosure requirements were later relaxed amid concerns over overwhelming consumer information.

Recent Developments

- BNPL regulation is intensifying globally, with the UK’s Financial Conduct Authority introducing affordability checks for about 11 million users starting July 2026.

- Regulatory changes may exclude 10%–30% of current BNPL users due to affordability checks, especially among lower-income groups.

- FICO began including BNPL loan data in credit scores in late 2025, potentially affecting creditworthiness.

- Consumer advocacy highlights rising debt risks associated with BNPL late payments and defaults.

- Major providers like Affirm and Klarna are under increased regulatory scrutiny for lending practices.

- Broader financial literacy concerns have emerged, with many online credit users not fully understanding interest and fees.

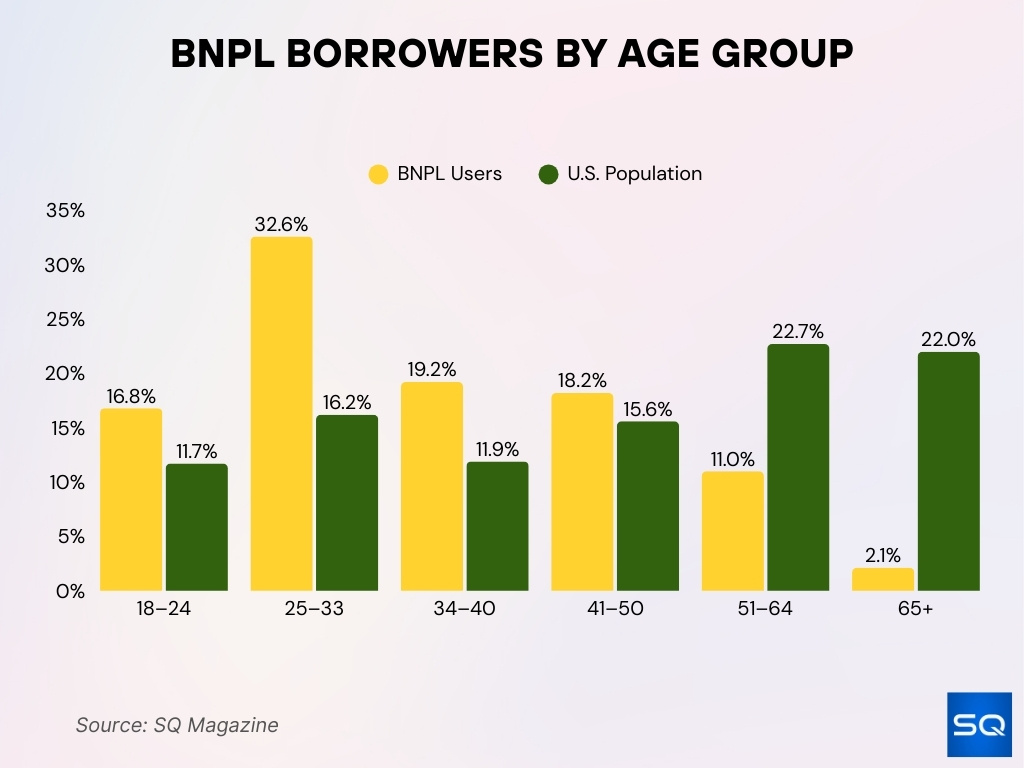

BNPL Borrowers by Age Group

- Ages 25–33: Dominate BNPL usage with 32.6% of users vs 16.2% of U.S. population.

- Ages 18–24: Make up 16.8% of users vs 11.7% population share, showing early adoption.

- Ages 34–40: Represent 19.2% of users vs 11.9% population, indicating mid-career engagement.

- Ages 41–50: Account for 18.2% of users vs 15.6% population, showing steady adoption.

- Ages 51–64: Underrepresented with 11.0% of users vs 22.7% population.

- Ages 65+: Only 2.1% of users vs 22.0% of the population, revealing minimal adoption.

- Summary: BNPL heavily skews toward younger age groups, with older adults largely untapped.

U.S. Buy Now, Pay Later Statistics

- About 18% of U.S. adults are expected to use BNPL in 2026.

- U.S. BNPL users are projected to reach 96.3 million.

- The U.S. BNPL payment market is forecast to grow 19.1% year over year to $127.94 billion in 2026.

- During the 2025 U.S. holiday season, BNPL spending reached about $20 billion, up 9.8% year over year.

- Around 72% of Americans said they planned to use BNPL in 2026, according to a 2025 survey.

- On average, U.S. BNPL users have borrowed about $2,085 across all their BNPL purchases.

- About 25% of BNPL users report using it to buy groceries, up from 14% the previous year.

- Roughly 41% of BNPL users say they have paid late on at least one loan in the past year, up from 34% a year earlier.

BNPL Use by Gender

- In the U.S., about 17.0% of women and 12.0% of men report using BNPL in the past year.

- Women are 41.7% more likely to have used BNPL than men, while men are 38.8% more likely to be heavy BNPL users.

- One survey finds women are more likely to use BNPL at 20% versus 14% of men.

- Another U.S. study shows men slightly ahead in lifetime BNPL use at 53% versus 46% for women.

- In the UK, 28% of female and 22% of male consumers used BNPL in 2024.

- In Britain, 68% of frequent BNPL users are female, with 51% being millennials and 16% Gen Z.

- BNPL use is significantly higher among women, Black, and Latino consumers compared with men and non‑Hispanic whites.

- Younger U.S. adults under 60 and women are more likely to use BNPL than older adults and men overall.

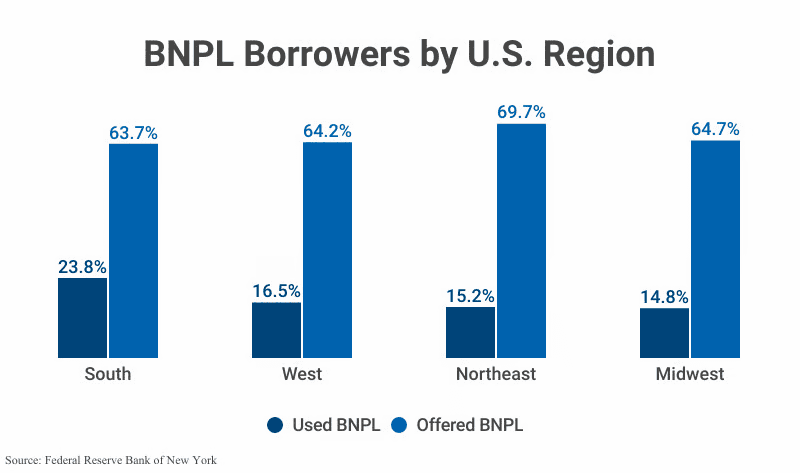

BNPL Borrowers by U.S. Region

- In the South, 23.8% of consumers have used BNPL, while 63.7% were offered BNPL options, making it the highest-usage region.

- In the West, 16.5% of consumers used BNPL despite 64.2% having access, reflecting a clear adoption gap.

- The Northeast records the widest access-to-usage gap, with 69.7% offered BNPL but only 15.2% using it.

- The Midwest shows the lowest usage rate at 14.8%, even though 64.7% of consumers were offered BNPL financing.

- Across all regions, BNPL availability exceeds 60%, yet usage remains under 25%, highlighting substantial untapped growth potential nationwide.

BNPL Use by Income Level

- In the U.S., about 25% of households earning under $50,000 report using BNPL, compared with roughly 18% of those above $100,000.

- High‑income households earning $100,000–$150,000 show BNPL adoption around 38%, versus 27% for those earning $25,000–$50,000.

- More than 3 in 10 cardholders with total credit limits under $5,000 used BNPL in the prior year, versus 11% among those with limits above $50,000.

- About 78% of BNPL users with family incomes below $50,000 say they used BNPL because it was the only way they could afford their purchase.

- Roughly 21% of BNPL users overall report using the loans to buy groceries, indicating heavier use among lower‑income households.

- Around 40% of BNPL users say they’ve paid late on a BNPL purchase, with late payment especially common among those facing financial constraints.

- Among late‑paying BNPL users, 96% show at least one financial vulnerability, such as low savings or high card balances.

- Nearly 60% of financially fragile households report using BNPL more than five times in the past year.

Popular Purchase Categories

- Apparel accounts for about 41% of BNPL purchases, making it the leading category.

- Electronics represent roughly 54% of BNPL users’ spending categories, up from 49% a year earlier.

- Furniture and appliances together make up about 36% of BNPL transactions.

- Groceries are financed by about 25% of BNPL users, up from 14% the prior year.

- Food delivery orders are paid with BNPL by around 27% of users.

- BNPL users are 61% more likely than non‑users to shop at fast‑fashion retailers like Shein.

- Roughly 63% of BNPL spending occurs in general online shopping channels.

- Clothing and fashion purchases via BNPL are reported by about 39%–41% of consumers in recent surveys.

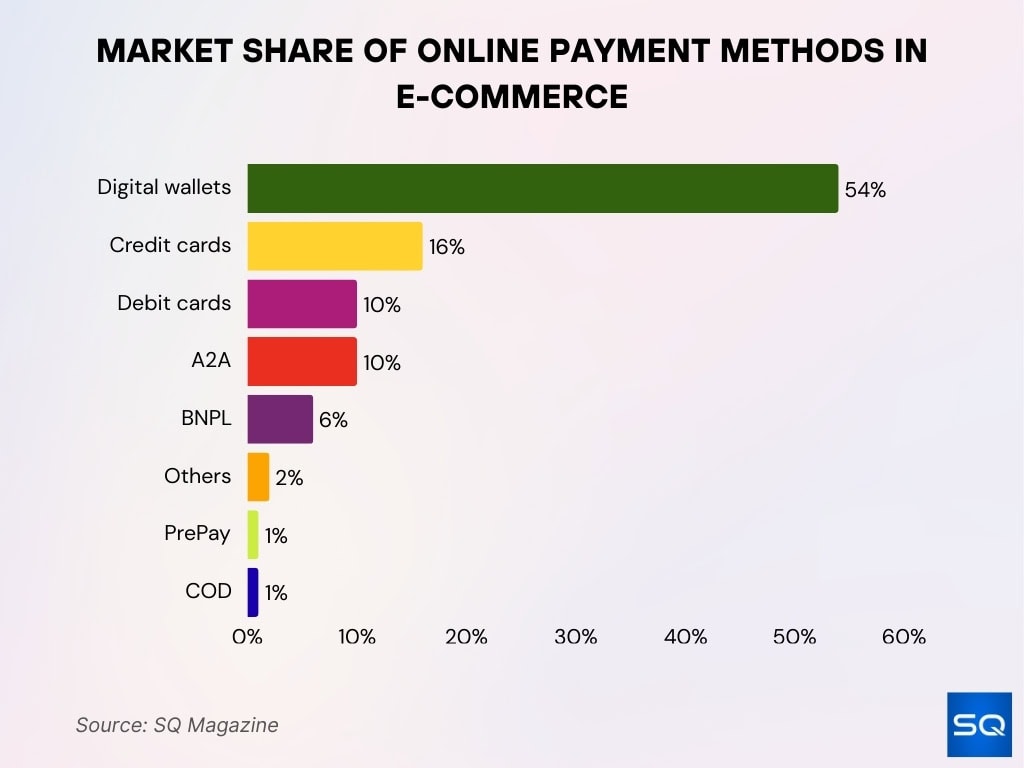

Market Share of Payment Methods for E-commerce Transactions

- Digital wallets lead the market with a 54% share of global e-commerce transactions.

- Credit cards contribute 16% of total online payment volume.

- Debit cards hold a 10% share of the e-commerce payments market.

- Account-to-account (A2A) transfers also account for 10% of transactions.

- Buy Now, Pay Later (BNPL) services represent 6% of online payment share.

- Other payment methods, including cryptocurrency and prepaid accounts, make up 2% of transactions.

- PrePay methods account for 1% of global e-commerce payments.

- Cash on delivery maintains a 1% share of total online transactions.

- Digital wallets are projected to remain dominant, sustaining a global share above 50%.

BNPL Holiday Shopping Stats

- U.S. shoppers are expected to spend about $20.2 billion using BNPL over the Nov–Dec holiday period, up 11% from $18.2 billion the prior season.

- BNPL spend on Black Friday is forecast at roughly $761.8 million, an 11% year‑over‑year increase.

- Cyber Monday BNPL transactions are projected to exceed $1.02–$1.06 billion, growing about 5% year over year.

- During the full 2025 holiday season, BNPL spend actually reached around $20 billion, up 9.8% and $1.8 billion higher than 2024.

- Smartphones are driving about 79–82.2% of BNPL holiday purchases, representing roughly $15.6 billion of spend.

- The 2025 holiday season saw total online spend of $257.8 billion, with BNPL contributing roughly $20 billion of that total.

- Roughly 50% of holiday shoppers say they plan to use BNPL to cover expenses, with 25% of Gen Z and millennials using it regularly.

BNPL Approval and Fees

- Around 76% of BNPL users report making all payments on time and in full, implying roughly 24% experience at least one issue or delay.

- Affirm’s monthly BNPL loans carry interest rates ranging from 0% to 36% APR, depending on credit profile.

- Average BNPL loan size is about $135 over a six‑week term, versus about $800 over 8–9 months for traditional installment loans.

- In 2023, BNPL lenders assessed about $135.9 million in late fees and collected $80.3 million, both down from 2021 levels.

- Loan‑level late fee rates among major BNPL lenders ranged from about 5.8% to 7.0% across recent years.

- Nearly 16% of surveyed BNPL users reported being charged a late or rescheduling fee or similar charge within six months.

- Roughly 37% of BNPL users incurred an overdraft fee in the last six months, highlighting compounding cost risks.

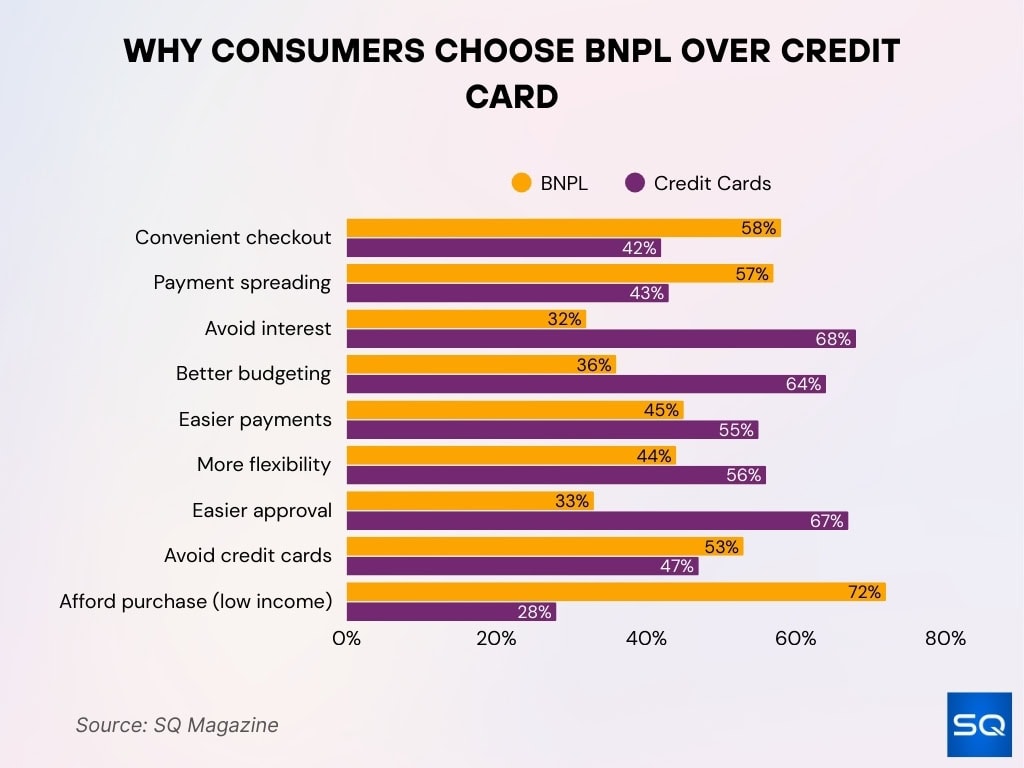

Reasons for Using Buy Now Pay Later (BNPL) and Credit Cards

- 57% of BNPL users rely on it to spread payments and better manage cash flow.

- 58% consider BNPL more convenient at checkout compared to credit cards.

- 36% prefer BNPL as a budgeting tool over traditional credit cards.

- 32% choose BNPL to avoid interest charges typically associated with credit cards.

- 53% actively avoid credit cards, favoring the simplicity of BNPL.

- 45% say BNPL offers easier payment structures than credit cards.

- 44% value the flexibility BNPL provides compared to credit card options.

- 36% select BNPL for its comparatively lower interest costs.

- 33% are attracted to BNPL due to its simpler approval process versus credit cards.

- 72% of low-income BNPL users report that it was the only way they could afford their purchase.

Risks and Late Payments

- 41% of BNPL users said they paid late on at least one loan in the past year, up from 34% a year earlier.

- About 49%–56% of U.S. BNPL users report experiencing at least one problem, with overspending cited by roughly 29%–30%.

- Roughly 25% of BNPL users have used loans to buy groceries, up from 14% the prior year, highlighting reliance on essentials.

- About 33% of BNPL users say they use the loans as a bridge to their next paycheck, up from 30% and 27% in earlier years.

- Around 27% of BNPL users report using the loans to make ends meet, with 21% saying they’ve used BNPL specifically for groceries.

- Nearly 32% of BNPL borrowers held simultaneous loans with at least two different BNPL firms, complicating repayment.

- One‑third of BNPL users have missed a payment in the past year, and about 47% have paid late at some point.

- About 56% of BNPL users say installment services encourage them to overspend compared with paying upfront.

Frequently Asked Questions (FAQs)

There are about 380 million BNPL users globally, with growth expected to continue thereafter.

BNPL accounted for approximately $20 billion in online spending during the 2025 holiday season.

About 41% of BNPL users reported missing at least one payment, according to recent trend data.

Conclusion

Buy Now, Pay Later has evolved from a niche checkout option into a mainstream payment method shaping retail, fintech, and consumer credit markets. Today, global transaction volumes continue to expand, holiday adoption keeps breaking records, and regulators are stepping in to address transparency and risk. At the same time, rising late-payment rates and the integration of BNPL into credit scoring models signal a more mature and scrutinized phase of growth.

For retailers, BNPL drives higher conversions and larger basket sizes. For consumers, it offers flexibility, but also demands disciplined repayment habits. As adoption climbs and oversight strengthens, understanding the numbers behind BNPL becomes essential for making informed financial decisions.