Apple Pay’s growth marks a clear shift in how Americans pay. Its expanding user base, rising transaction volume, and wider acceptance by merchants underscore its impact on mobile payment habits. Across retail checkouts and online platforms alike, Apple Pay simplifies payments for consumers and helps businesses reduce friction. The following sections explore key numbers behind its recent rise and set the stage for deeper insights ahead.

Editor’s Choice

- In the U.S., Apple Pay is projected to reach around 60–65 million active users in 2025, nearly double Google Pay’s ~35 million.

- Apple Pay accounts for 54% of in-store mobile wallet transactions (2024).

- 63.9 million U.S. users in 2025, up 6.1% from 2024’s 60 million.

- Analysts estimate roughly 550–600 million global Apple Pay users in 2025, though projections vary.

- Apple Pay’s share of global card transactions remains below 5% in 2025, given Visa and Mastercard’s continued dominance.

- Apple Pay transaction volume is expected to reach about $1–2 trillion globally in 2025, showing strong double-digit growth, though not near $7.6 trillion.

Recent Developments

- U.S. user base in 2025 estimated at 65.6 million, up from 60 million in 2024 and a 63.9 million projection.

- Global user count reached an estimated 624–640 million in 2025.

- Apple Pay is expected to reach 10% of all global card transactions in 2025.

- Transactions processed soared to $7.6 trillion, a 21% increase.

- In-app purchases rose 26% in 2025.

- 14.3% of global e-commerce sales via Apple Pay in 2025.

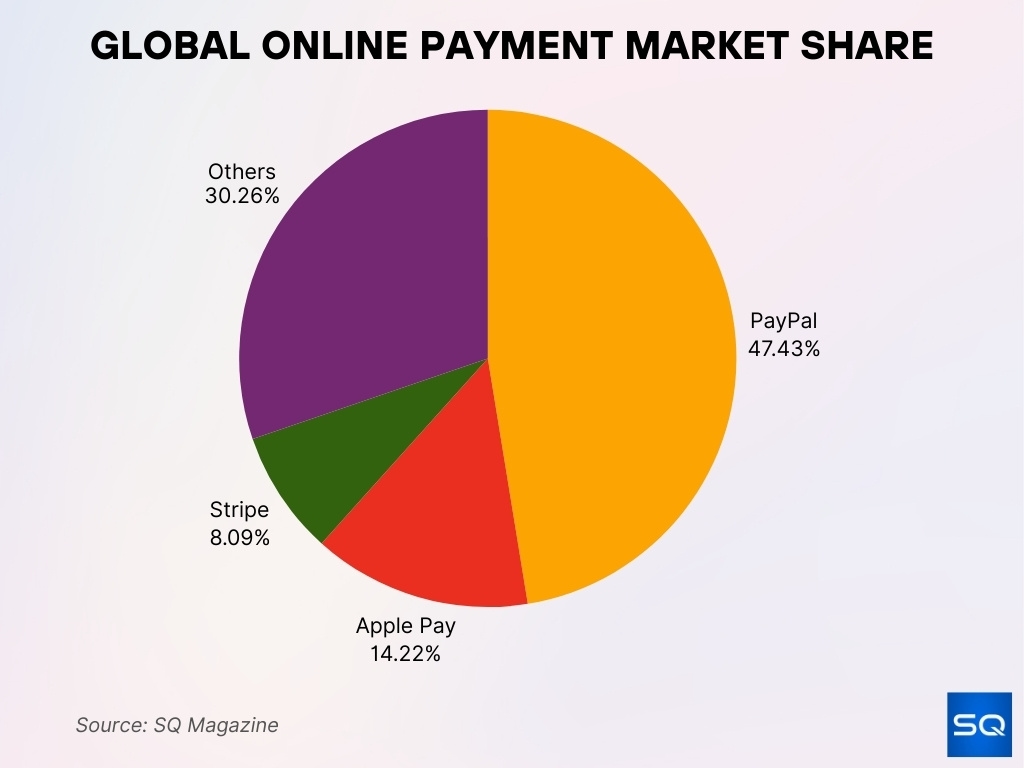

Market Share

- In the online payments market globally, Apple Pay held a 14.22% share in 2025, vs. PayPal’s 47.43% and Stripe’s 8.09%.

- In 2025 U.S., Apple Pay controls 49% of the mobile wallet user base.

- U.S. retailer acceptance, 85–90% of merchants.

- Apple Pay is used more than twice as often in stores as PayPal (8%) or Google Pay (4.2%).

- Globally, Apple Pay accounts for 35% of mobile wallet transactions.

Annual Transaction Volume

- Apple Pay handled $7.6 trillion in transactions globally in 2025 (up 21% YoY).

- In 2022, the global transaction total was $6 trillion.

- In-store U.S. orders via Apple Pay reached $199 billion in 2022.

- Apple Pay processed 12% of online card transactions globally in 2023.

- Apple Pay captured 14.2% of all online consumer payments in 2024.

- Apple Pay accounted for 5.6% of U.S. in-store purchases in 2024.

- Around 54.8% of U.S. mobile payment platform users chose Apple Pay in 2024.

- Digital wallet in-store adoption among U.S. consumers grew from 23% (2019) to 43% (2024).

Revenue Statistics

- In 2022, Apple Pay generated $1.9 billion.

- Apple applies a 0.15% fee per credit card transaction via Apple Pay.

- Apple Pay is part of the Services segment (24% of revenue in 2024), but its standalone contribution is undisclosed, and 3.4% is not an official figure.

- In-app purchases rose 26% in revenue-generating volume.

- Part of e-commerce share is at 14.3% globally.

- Average transaction size, $29.70 in 2025.

- 44% of subscription services offer Apple Pay as a preferred payment method.

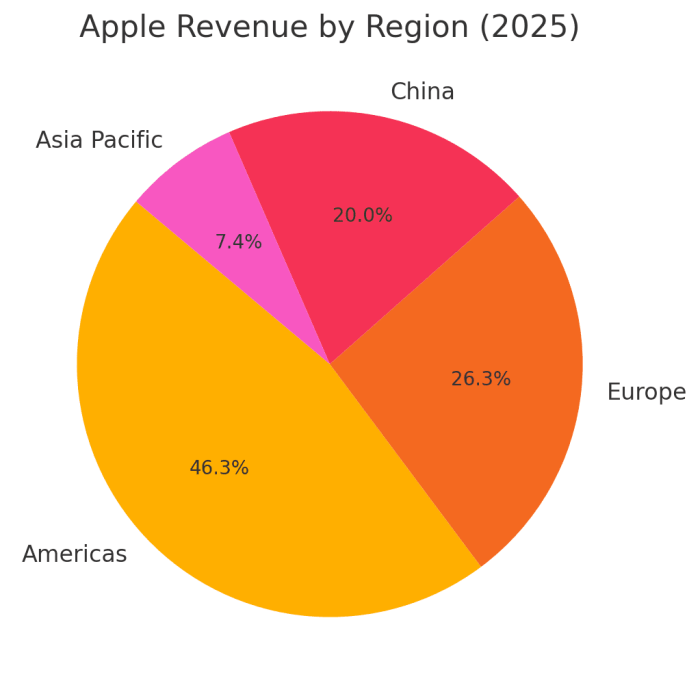

Apple Revenue by Region

- The Americas generated the largest share of Apple’s revenue, contributing 46.3% of the total.

- Europe followed as the second-largest market, accounting for 26.3% of Apple’s revenue.

- China represented a significant portion, with 20.0% of overall revenue.

- The Asia Pacific region contributed the smallest share at 7.4%.

User Demographics

- 22.3% of American consumers aged 14 and older are expected to use Apple Pay in 2025.

- 624 million global users in 2025.

- Since 2022, American Apple Pay users have grown 29.1% (CAGR around 8.9%).

- Surveys indicate that about half of Gen Z digital wallet users report using Apple Pay weekly, suggesting high but slightly lower adoption than 73%.

- Millennials, 51.1% of Millennial digital-wallet users use Apple Pay at least weekly.

- Gen X, 52.4% weekly Apple Pay users among wallet owners.

- Baby Boomers (65+) have low uptake, only 0.2% use Apple Pay, but 43.9% of those digital-wallet users do so weekly.

- Households earning over $100K annually account for 3.2% of consumers but 57% of wallet-user Apple Pay usage.

- Globally, 70% of users fall between 18 and 34 years old (Millennials & Gen Z).

- Gender split is modest, 55% male, 45% female globally.

In-Store vs. Online Usage

- Apple Pay accounts for 54% of all in-store mobile wallet transactions in the U.S. (2024).

- In-store orders hit $199 billion in 2022 in the U.S. (that’s ~3.1% of total U.S. merchant sales).

- Apple Pay accounted for 6–8% of U.S. online payments in 2024, depending on methodology, showing steady growth but below 14%.

- Globally, it represented 14.22% of online payments in 2025.

- During Black Friday/Cyber Monday 2022, 12.7% of both online and in-store shoppers used Apple Pay.

- In 2024, 5.6% of all U.S. in-store purchases used Apple Pay.

- Use for in-store purchases, 58% of U.S. consumers reported using Apple Pay for POS purchases.

- Online usage: 36% of consumers used Apple Pay for online purchases in a recent survey, up 21% since 2018.

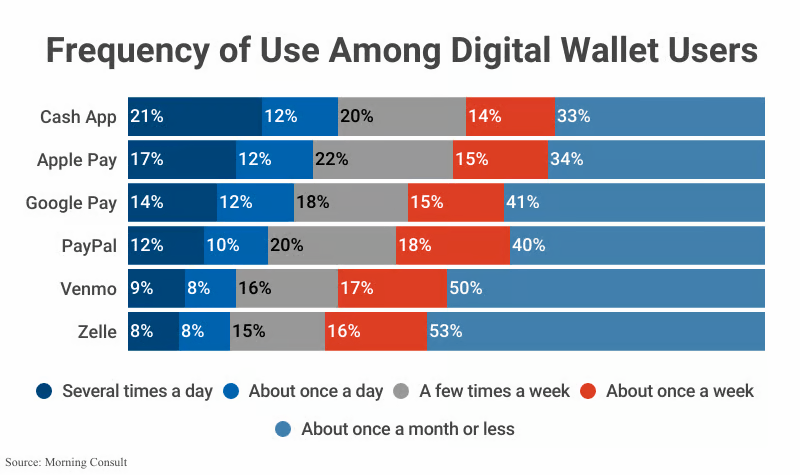

Frequency of Use Among Digital Wallet Users

- Cash App shows the highest frequency of usage, with 21% using it several times a day and 12% about once a day. Still, 33% use it only about once a month or less.

- Apple Pay has strong weekly engagement, with 22% using it a few times a week and 17% several times a day. 34% of users rely on it about once a month or less.

- Google Pay sees 14% using it several times daily, but a significant 41% only use it about once a month or less.

- PayPal remains widely adopted, though less frequently, with 12% daily users and 40% using it monthly or less.

- Venmo has lower frequency usage, with just 9% several times daily, while 50% use it only about once a month or less.

- Zelle ranks lowest in frequent engagement, with 8% using it several times daily, and the highest share (53%) relying on it monthly or less.

Merchant Acceptance

- Over 85% of U.S. retailers accept Apple Pay.

- Apple Pay is active on ~2.40 million live websites globally, while PayPal spans ~11.9 million.

- Nearly 574,200 companies accept Apple Pay worldwide, 80,140 are retailers.

- 41.5% of these accepting companies are based in the U.S., and 41.4% are small businesses (<10 employees).

- In the U.S., Apple Pay outpaces PayPal (8%) and Google Pay (4.2%) for in-store usage.

- Merchant adoption drove 58% part of Apple Pay’s growth.

- Global merchant support counts over 10 million merchants.

Competitor Comparison

- Apple Pay has close to 92% market share in U.S. mobile wallet usage (2020 data).

- For online payments, Apple Pay held 14.22% in 2025 vs. PayPal’s 47.43% and Stripe’s 8.09%.

- Google Wallet’s U.S. user base, about 35 million in 2025, compared with Apple Pay’s ~65.6 million.

- Market share: Apple holds ~49% of U.S. mobile wallet users.

- In some global mobile-wallet markets (like India), Google Pay leads, Apple lags.

- Among online merchants, Apple Pay appears on 2.4 million websites; PayPal leads significantly.

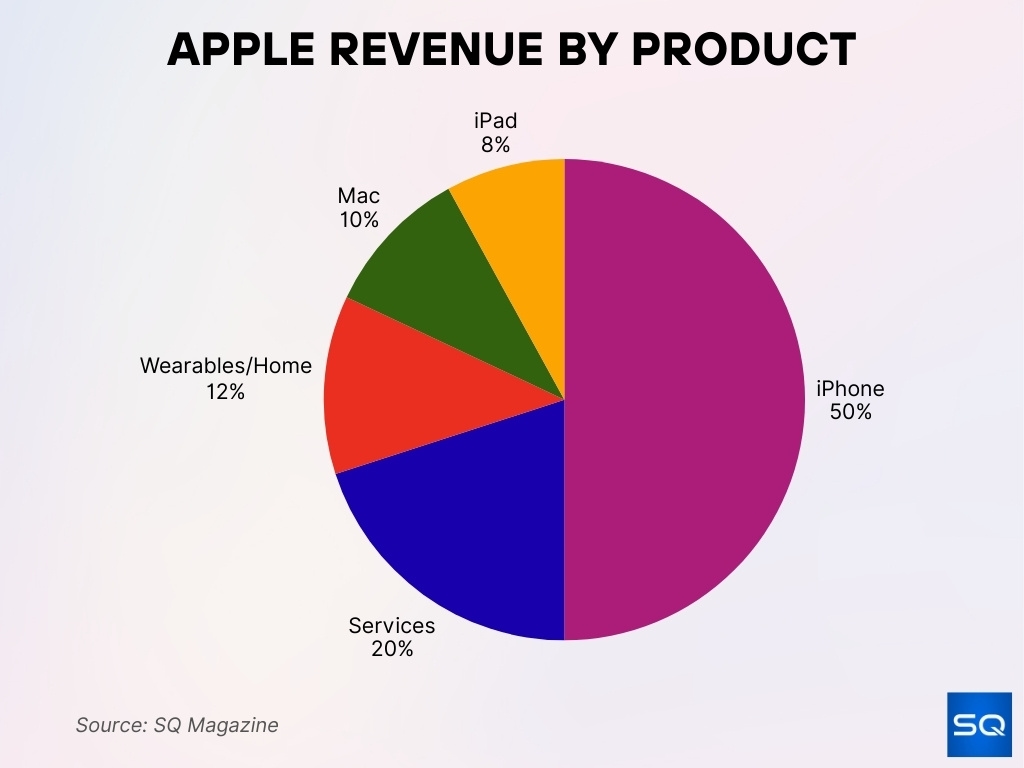

Apple Revenue by Product

- The iPhone remains Apple’s largest revenue driver, contributing 50% of total revenue.

- Services make up 20%, reflecting Apple’s growing focus on subscriptions and digital offerings.

- Wearables and Home products account for 12%, showing steady growth in Apple Watch, AirPods, and smart home devices.

- The Mac line contributes 10%, maintaining a stable share in Apple’s ecosystem.

- The iPad represents the smallest portion, at 8% of total revenue.

Security Features

- Apple Pay replaces card numbers with a tokenized Device Primary Account Number (DPAN) and uses a dynamic security code per transaction.

- Authentication is via Touch ID, Face ID, Optic ID, or passcode (a CDCVM).

- Apple Pay doesn’t store actual card numbers or retain transaction data tied to the user.

- Payments remain between the consumer, the merchant, and the bank; Apple has no visibility into purchase details.

- Users can remotely disable Apple Pay via Find My iPhone if a device is lost.

- In the UK, Apple Pay bypasses traditional contactless limits (e.g., £100) because of its secure authentication.

- Despite robust design, OTP-reliant setups remain vulnerable, especially where banks rely on SMS codes. A recent UK report flagged fraud risks in such systems.

- Biometric tokenization and end-to-end encryption help keep data secure on the device, reducing cloud-based vulnerability.

Technology and Innovations

- North American use of mobile wallets like Apple Pay is projected to double between 2020 and 2025.

- Apple introduced Tap to Pay on iPhone, which turns iPhones into contactless payment terminals.

- Siri integration enables voice-activated payments, now used by 22% of U.S. users in 2025.

- Apple Pay app navigation loads 2.3× faster than Google Pay across flagship devices.

- 68% of users in 2025 found Apple Pay faster for in-store transactions than other mobile wallets.

- 92% satisfaction rate among users, driven by seamless biometric authentication and tight ecosystem integration.

- NFC chip access is changing in Europe; Apple must allow third-party NFC services under new regulations (e.g., EU Digital Markets Act).

- CaixaBank in Spain now supports BNPL installments directly in Apple Wallet, enabling users to split purchases over 2–12 months.

Usage in E-commerce

- Apple Pay processes around 14.2% of all online consumer payments in the U.S. (2024).

- Worldwide, Apple Pay held a 14.22% share of online payments in 2025.

- Nearly 2.40 million live websites support Apple Pay online, compared to PayPal’s ~11.9 million.

- 27% of U.S. and UK respondents complete online payments using Apple Pay.

- About 51% of global iPhone users have activated Apple Pay.

- Virtual bank cards are set to make up half of online retail spending in the UK by 2027, underscoring the broader role of digital wallets.

- The general rise of mobile POS users aligns with Apple Pay’s growth, global mobile POS users expected to grow from 1.68 billion to 2.01 billion.

Recurring Transactions and Subscriptions

- 44% of subscription services now offer Apple Pay as the preferred payment method.

- In-app purchases through Apple Pay rose by 26%, contributing significantly to revenue growth.

- Recurring revenue via Apple Pay is part of wider Apple Services growth, which accounted for 24% of Apple’s total revenue in 2024.

- Biometric authentication (Face ID/Touch ID) reinforces recurring payments with secure, one-tap authorization.

- Deep integration in apps and subscription platforms drives seamless, repeat billing.

Partnerships and Ecosystem

- Apple Pay is supported by over 8,000 banks worldwide, with 72.5% of them serving U.S. customers.

- Partnerships include key U.S. banks like Citigroup, Synchrony, Discover, and Fiserv, enabling BNPL and reward integrations.

- Affirm integration allows U.S. shoppers to access BNPL options in Apple Pay via Affirm loans.

- CaixaBank launched Apple Pay installment payments (2–12 months) in Spain, expanding Apple’s BNPL ecosystem.

- The EU’s Digital Markets Act compels Apple to open NFC chip access, increasing interoperability across Europe.

Customer Satisfaction

- Satisfaction remains high, 92% of users report being pleased with Apple Pay.

- Apple Pay is perceived as faster in-store by 68% of users.

- With rapid app performance, 2.3× faster than Google Pay, it encourages repeat use.

- Integration with Siri adds convenience, used by 22% of U.S. users for hands-free payments.

- 98% of U.S. customers are likely to recommend Apple Pay.

Apple Pay Later and BNPL Adoption

- The BNPL market is booming, projected at $560.1 billion in 2025, growing at 13.7% annually.

- In the U.S., the BNPL market is forecast at $122.26 billion in 2025, with an 8.5% CAGR to 2030.

- About 9% of U.S. consumers were active BNPL users in late 2023 (up ~40% from 2021).

- Over 20% of American consumers with credit records had used BNPL by 2022.

- BNPL is mainstream during holidays, accounting for over 7% of e-commerce sales.

- Affirm has grown fast, with 22 million active users, partnerships with major merchants, a 13% BNPL market share (end of 2024), with GMV up sharply.

- CaixaBank’s new Apple Pay installment feature embeds BNPL options seamlessly during checkout for Spanish users.

Conclusion

Apple Pay’s evolution reflects a powerful blend of innovation, user trust, and ecosystem expansion. From faster performance and biometric ease to growing e-commerce adoption and embedded BNPL choices, Apple Pay has become a central payment tool for millions. Its strong bank and merchant partnerships further deepen its role across digital and physical commerce. As ecosystems evolve, especially under new regulations, Apple Pay’s momentum is set to continue. Dive into the full article for deeper insights into how Apple Pay is shaping the future of payments.