When Apple Music launched in 2015, it was Apple’s ambitious leap into the fiercely competitive world of streaming. Fast forward today, and it’s no longer just another streaming service; it’s a global audio ecosystem influencing how we discover music, connect with artists, and personalize our soundtracks.

From hip-hop heads in New York to K-pop fans in Seoul, Apple Music has transformed the listening experience. This article explores the platform’s rise with fresh stats and trends, offering a full-spectrum view of its reach, revenue, and user behavior.

Editor’s Choice

- Apple Music hit 108 million paid subscribers globally, remaining the second-largest streaming platform after Spotify.

- More than 37% of Apple Music’s total user base is in the U.S., accounting for nearly 40 million subscribers in the region.

- Apple Music generated over $10.5 billion in revenue, crossing the $10 billion threshold.

- Nearly 1 in 5 iPhone users globally is also an Apple Music subscriber, showcasing strong ecosystem synergy.

- Apple Music Classical now has over 5 million monthly users, proving niche content strategies work.

- Over 65% of Apple Music users engage with curated playlists weekly, highlighting the value of human curation.

- Apple Music holds 21.5% market share in Japan, solidifying its position as the #2 streaming service.

Recent Developments

- In 2025, Apple Music rolled out “Collaborative Playlists,” allowing multiple users to curate shared mixes.

- Apple acquired Classical Archives, integrating its metadata for Apple Music Classical.

- AI-powered DJ Mixes now offer genre-specific transitions and personalization.

- The 2025 Grammy Awards were live-streamed exclusively on Apple Music.

- New subscription tiers tested in Canada and Australia, including an audio-only plan.

- Apple Music introduced 360-degree concert videos in Spatial Audio.

- Cross-app integration with Apple Fitness+ includes dynamic energy-based playlists.

- Beta feature lets artists release “audio merch” like exclusive intros and previews.

- Apple announced the “Voices Rising” program supporting emerging artists.

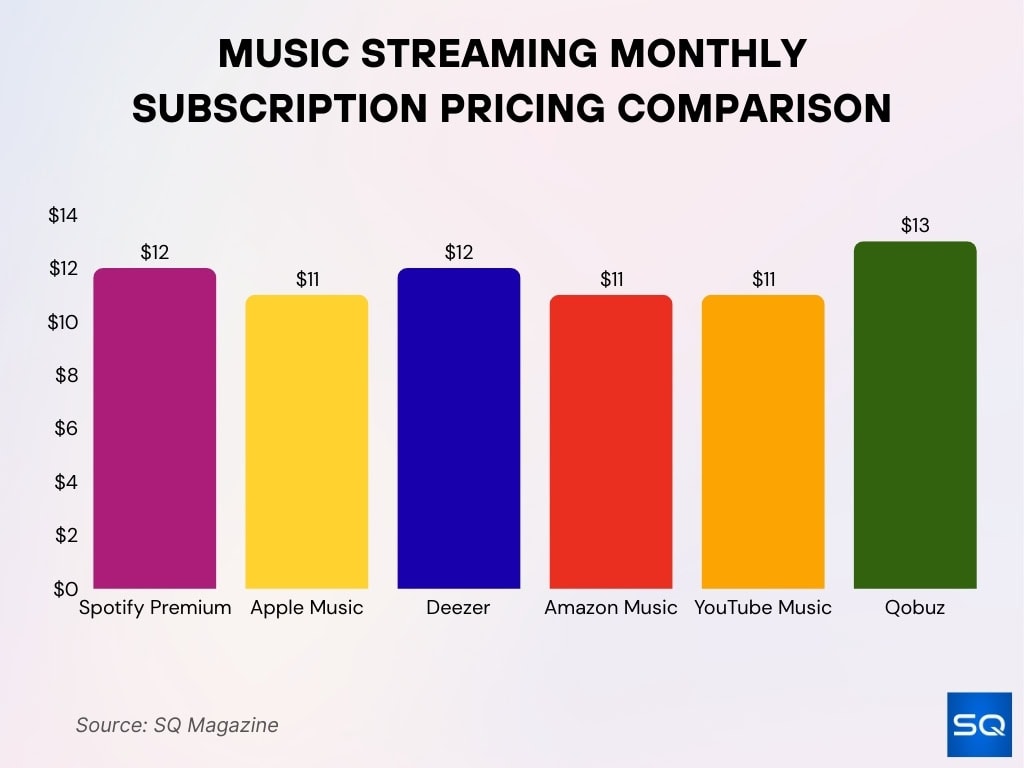

Music Streaming Monthly Subscription Pricing Comparison

- Qobuz is the most expensive major streaming service at $13 per month, positioning itself as a premium, audiophile-focused platform.

- Spotify Premium and Deezer are priced at $12 per month, sitting in the upper mid-range of the music streaming market.

- Apple Music, Amazon Music Unlimited, and YouTube Music offer more cost-efficient plans at $11 per month.

- The price gap between the cheapest and most expensive services is just $2 per month, highlighting strong pricing convergence across the industry.

- Mainstream platforms cluster tightly around the $11–$12 range, reinforcing price parity as a competitive strategy.

- Despite similar pricing, services differentiate through exclusive content, audio quality, ecosystem integration, and bundled benefits rather than cost alone.

Apple Music Global Subscribers

- Apple Music is now available in 173 countries, with high penetration rates in North America, Europe, and parts of Asia.

- India remains Apple Music’s fastest-growing market, with a 35% year-over-year increase in paid subscribers.

- In China, Apple Music has seen a 22% growth in monthly active users, largely driven by local content partnerships.

- The UK holds the third-highest subscriber base, with over 8.2 million Apple Music users.

- In Latin America, Brazil leads with 3.9 million subscribers, and Mexico follows closely at 3.2 million.

- Australia saw a 19% YoY increase, reaching over 2.5 million subscribers.

- Apple Music subscriptions in Africa grew by over 40%, with South Africa, Nigeria, and Kenya showing the most momentum.

- Japan now has 5.7 million users, positioning Apple Music ahead of Amazon Music for the first time in the region.

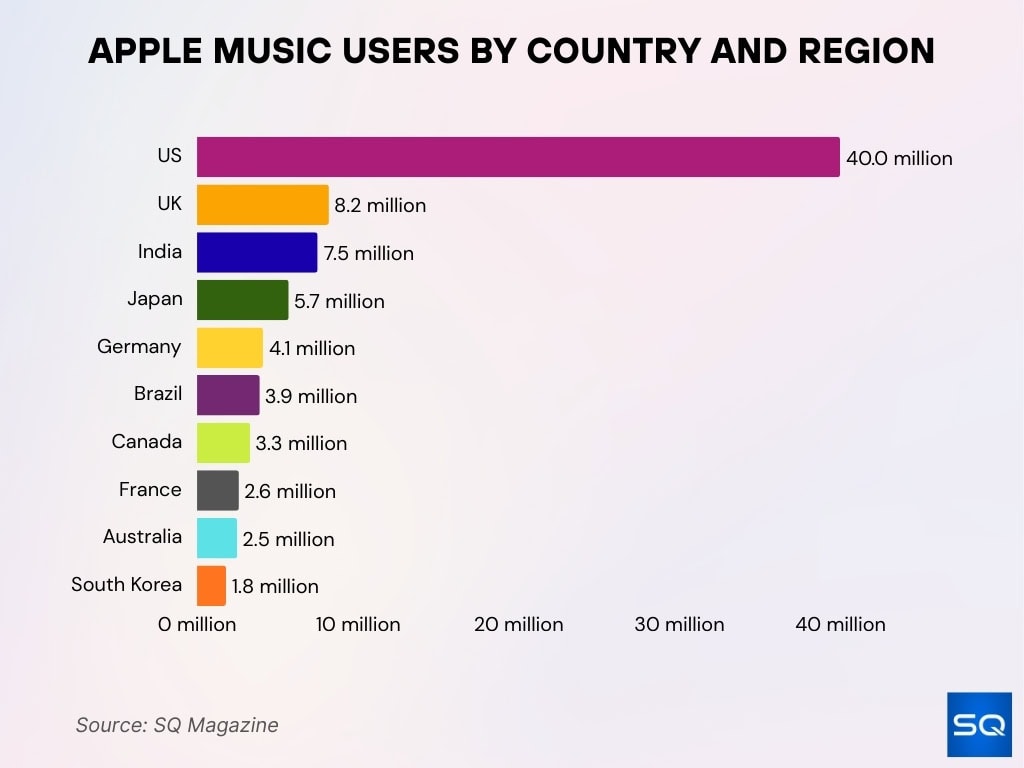

Users By Country & Region

- United States: 40 million subscribers (37% of the global total).

- United Kingdom: 8.2 million.

- India: 7.5 million subscribers with rapid double-digit growth.

- Japan: 5.7 million.

- Germany: 4.1 million.

- Canada: 3.3 million.

- Australia: 2.5 million.

- Brazil: 3.9 million.

- France: 2.6 million.

- South Korea: 1.8 million.

- Regional adoption rates show that Western markets are maturing while emerging markets are accelerating.

- Localized editorial playlists have boosted engagement by 26% in non-English-speaking countries.

- Apple’s student subscription plan, priced competitively, accounts for 12% of all new sign-ups in global university towns.

Apple Music Revenue

- Apple Music generated $11.3 billion in revenue, surpassing projections amid record services growth.

- Revenue has grown at a CAGR of 12.7% over the last five years.

- The U.S. remains the largest revenue contributor, followed by the UK and Japan.

- Bundled subscriptions (via Apple One) contribute 28% of Apple Music’s total revenue.

- Family plans account for nearly one-third of all subscriptions, contributing heavily to retention.

- Royalties paid to artists crossed $2.1 billion, up 18% from the previous year.

- Revenue from Apple Music for Business grew by 31% YoY.

- Apple Music Classical generated over $110 million in standalone revenue.

Most Streamed Songs and Artists on Apple Music

- The most-streamed song of 2025: “APT.” by ROSÉ & Bruno Mars.

- “Luther” by Kendrick Lamar & SZA holds second place globally.

- “Die With A Smile” by Lady Gaga & Bruno Mars ranks third.

- “Not Like Us” by Kendrick Lamar surged to the top of the charts.

- “BIRDS OF A FEATHER” by Billie Eilish is in the top 5 globally.

- “That’s So True” by Gracie Abrams broke into the top 10.

- Apple Music’s “Today’s Hits” playlist contributed to 31% of total streams for its top 10 tracks.

- Songs featured in Apple’s official ads saw a 2.5x spike in streaming activity.

- Regional hits like “Snooze” by SZA topped the North American charts.

- “Paint The Town Red” by Doja Cat saw an 18% increase after exclusives.

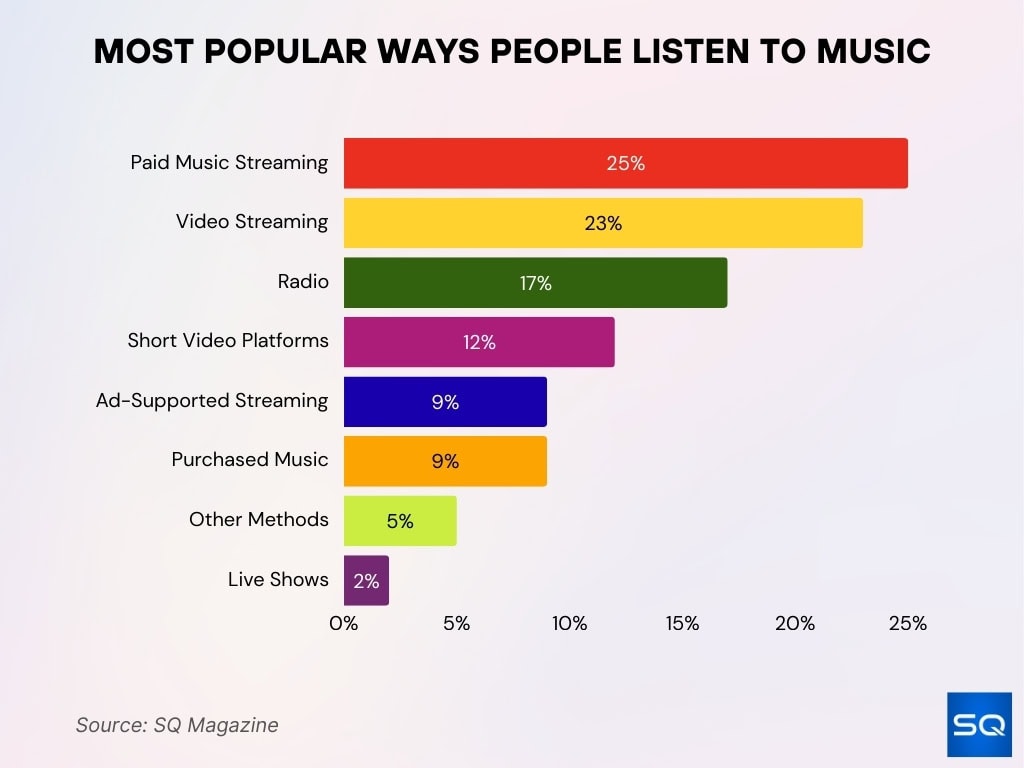

Most Popular Ways People Listen to Music

- Live shows contribute the smallest share at 2%, due to cost and accessibility limitations.

- Paid music streaming tops the list, with 25% of listeners choosing subscription-based platforms.

- Video streaming comes in close second at 23%, reflecting the popularity of platforms like YouTube.

- Radio remains strong, used by 17% of listeners despite digital competition.

- Short videos, such as on TikTok or Instagram Reels, account for 12% of music-listening habits.

- Ad-supported streaming services are used by 9% of users preferring free access with ads.

- Purchased music, including downloads and physical media, holds 9% of the market.

- Other listening methods make up 5%, including background use in apps.

Apple Music Integration Across Apple Devices and Services

- Over 95% of Apple Music subscribers use the service on an iPhone, but cross-device usage is rising fast.

- Apple CarPlay accounts for over 24% of all Apple Music listening sessions in North America.

- Apple Music is pre-installed on over 1.5 billion active Apple devices worldwide.

- HomePod streaming activity rose by 30% YoY, thanks to spatial audio and Siri integration improvements.

- Apple Watch users spend an average of 6.5 hours per week listening to music via the Apple Music app.

- Apple Music SharePlay usage grew by 43% in the past year.

- The platform is natively integrated into tvOS, macOS, iPadOS, and visionOS.

- iCloud sync and offline download support enable reliable use for traveling and commuting.

- Handoff functionality between devices increased usage time by 18%.

Apple Music’s Role in Podcasting and Original Content

- Apple Music hosts over 80,000 podcasts, separate from Apple Podcasts.

- Apple Music Originals saw a 29% increase in listens.

- Zane Lowe’s interviews remain flagship content with millions of monthly listens.

- Podcasts featuring music artist commentary see 2.2x longer listening sessions.

- “Essential Albums” documentary series gained over 18 million combined plays.

- Apple Music Radio includes 12 genre-focused stations.

- Time spent in Apple Music’s podcast tab grew 19% YoY.

- Integration with Shazam enables seamless music discovery-to-podcast transitions.

- Apple invests over $100 million into original audio content.

Demographics of Apple Music Users

- Users aged 18–34 make up 58% of Apple Music’s subscriber base, with a strong tilt toward urban areas.

- 72% of Apple Music users have a college degree or higher.

- 61% of users earn $75K or more annually.

- Urban-based users account for 68% of total subscribers.

- Hispanic and Black American users represent 29% of the U.S. user base.

- Among Gen Z users, Apple Music has NPS +37, higher than Spotify’s +21.

- Loyalty among Apple Music users is 1.8x stronger than rivals.

- 57% of global users say curated playlists are their favorite feature.

Artist Earnings and Royalties on Apple Music

- Apple Music paid out over $2.5 billion in royalties, marking an 18% increase YoY.

- Apple Music pays an average of $0.01 per stream.

- Over 75% of royalty payments went to independent artists and small labels.

- More than 5,000 artists earned over $100,000 from Apple Music.

- Apple Music for Artists dashboards have seen a 42% increase in log-ins.

- Female artists saw a 15% increase in revenue share.

- Direct-to-fan features appear on over 60% of artist profiles.

- Artists in emerging markets saw royalty increases of 28%–34%.

- Sync royalties for placements hit $150 million+.

Apple Music App Engagement and Listening Habits

- The average Apple Music user listens to 28 hours of content per week.

- Monthly active users (MAUs) crossed 140 million globally.

- The retention rate after three months of subscription is 79%.

- Top listening times are between 7–9 a.m. and 5–7 p.m.

- 70% of users use the offline download feature at least once a week.

- Daily app opens increased 11% YoY.

- 40% of listening happens through personalized playlists.

- Search-driven listening accounts for only 14% of sessions.

- Sleep timers and crossfade features boost listening durations among Gen Z.

Lossless and Spatial Audio Adoption Rates

- Over 57% of Apple Music users have enabled Lossless Audio.

- Spatial Audio adoption grew to 38%, due to AirPods compatibility.

- Listeners using Spatial Audio spend 19% more time on the app weekly.

- Hi-Res Lossless usage is highest in Japan, Germany, and the U.S.

- Apple’s catalog features over 100 million tracks in Lossless and 15 million+ in Dolby Atmos.

- “Spatial Audio with Dolby Atmos” is now a default setting on new iOS installs.

- User satisfaction ratings for audio quality exceed 91%.

- Spatial Audio exclusives increased subscriber sign-ups by 7.4% in Q1.

- Podcasts with Spatial Audio show 21% higher completion rates.

Conclusion

Apple Music has evolved into more than a streaming service; it’s a storytelling engine, a discovery platform, and a financial engine for artists worldwide. From AI-powered playlists to localized content strategies, Apple is doubling down on personalization and precision.

With a million subscribers, a renewed push into Spatial Audio, and strong artist support tools, Apple Music is clearly playing a long game. Whether you’re an artist, a curator, or a casual listener, this year shows there’s more to hear, and more ways to listen, than ever before.