Xbox Game Pass has become central to how gamers access high-quality content. Today, over 35 million subscribers enjoy access to hundreds of titles across console, PC, and cloud, a game‑changer in subscription gaming. In education, Xbox Game Pass supports game‑based learning for STEM concepts. In esports, teams leverage their vast library to train across genres. Read on to explore subscriber trends, growth full of insights, and why this matters now more than ever.

Editor’s Choice

- Over 35 million subscribers as of mid‑2025.

- Growth from 34 million in February 2024.

- Q1 2025 estimate: ~37 million subscribers.

- 68% on the Game Pass Ultimate tier.

- ARPU projected to rise 15.3% in 2025.

- 74% increase in indie game playtime in 2024.

- 78 new titles, including 23 day‑one releases, added in 2024.

Recent Developments

- Game Pass has surpassed 35 million subscribers following its last official update.

- Growth appears to be slowing, with only ~1 million added over 15 months to mid‑2025.

- Price raised to $19.99/month in 2024, yet 70–80% kept the Ultimate tier.

- Xbox is increasingly targeting mobile and PC audiences amid declining console sales.

- At Q4 2024, Xbox content and services revenue rose 61%, offsetting a 42% drop in hardware sales.

- Microsoft still expects Game Pass to hit 50 million subscribers in 2025 with new tiers.

- Major titles like Call of Duty at launch are driving renewed interest.

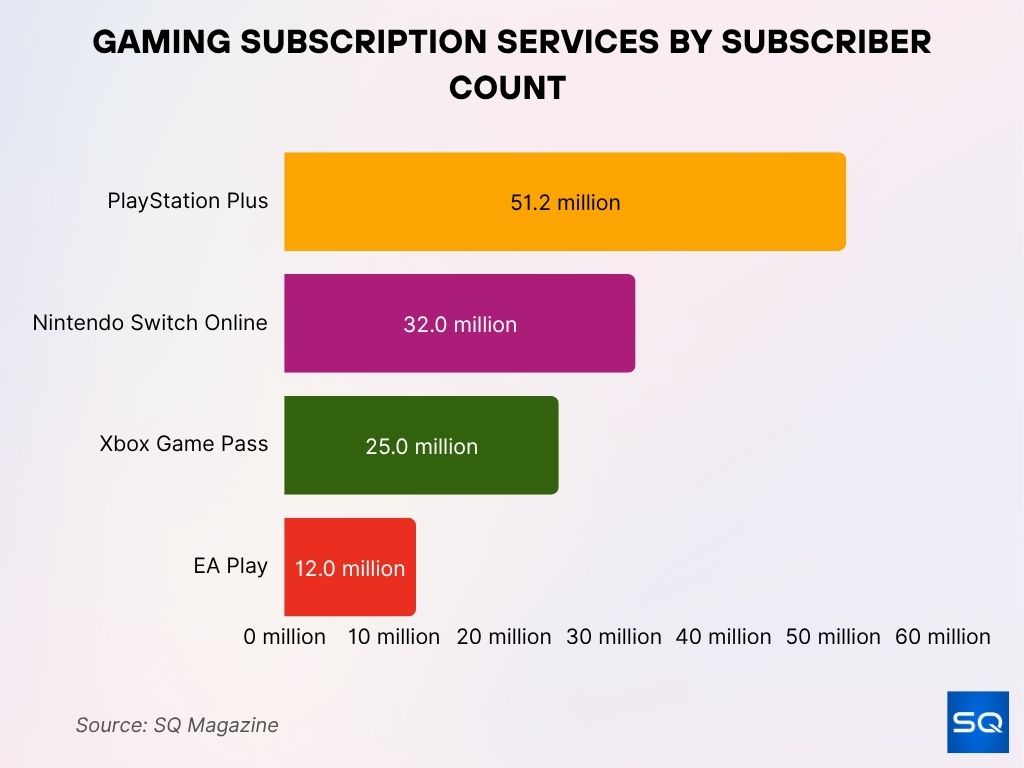

Gaming Subscription Services by Subscriber Count

- PlayStation Plus leads the market with 51.2 million subscribers, showcasing its dominance in online console gaming.

- Nintendo Switch Online holds second place with 32 million users, driven by family-friendly titles and the Switch’s global popularity.

- Xbox Game Pass follows with 25 million subscribers, offering access to a wide game library across console, PC, and cloud.

- EA Play rounds out the list with 12 million users, primarily attracted by EA’s sports franchises and bundled access with other services.

Total Subscriber Numbers

- 34 million subscribers official count in February 2024.

- Mid‑2025: estimates range from 35–37 million.

- Growth trajectory: 10M (2020), 15M (2020), 18M (2021), 25M (2022), 34M (2024), 35–37M (2025).

- The ultimate tier remains dominant with a 68% share.

- Subscriber additions slowed despite new content and pricing changes.

- Microsoft’s Q1 2025 estimate of 37M suggests small upward revisions.

- Still distant from the 50 million target being projected.

- Subscribers span console, PC, and cloud; game access across platforms remains key.

Subscriber Growth Over Time

- Fast early growth: from 10M in 2020 to 25M by 2022.

- Plateauing since: 34 M in early 2024 to ~35–37 M by mid‑2025.

- Ultimate tier’s dominance (68%) offsets declines in lower tiers.

- Indie playtime up 74% year‑over‑year in 2024.

- Game additions boosted to 78 new titles in 2024.

- Growth is tied to major studio releases like Activision titles.

- Future tiers and platforms are key to renewed growth.

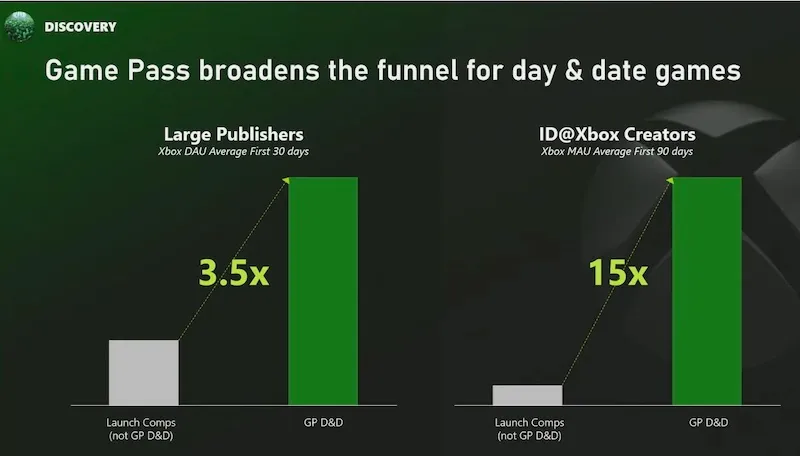

Game Pass Boosts Visibility for Day-One Game Launches

- Large publishers see a 3.5x increase in average daily active users (DAU) during the first 30 days when launching on Game Pass Day & Date (GP D&D).

- ID@Xbox creators experience an even bigger impact, with a 15x increase in monthly active users (MAU) over the first 90 days when launching on Game Pass.

- This shows that Game Pass significantly broadens discovery for both AAA and indie titles, especially when released on the platform at launch.

Ultimate Subscriber Stats

- Ultimate tier subscribers make up 68% of the total.

- Price increase in 2024 to $19.99/month validated by continued ultimate retention.

- Ultimate includes day‑one access and EA Play.

- Enjoyed the most demand with blockbuster releases like Call of Duty titles.

- ARPU to rise around 15.3% in 2025, driven by Ultimate subscriptions.

- This tier is the revenue backbone amid declining console sales.

- Strategic content additions to Ultimate are key drivers of continued loyalty.

Subscriber Demographics

- Specific demographic data remains limited in public reports.

- However, cloud/mobile usage grew 89% YoY, notably in India, South Korea, and Brazil.

- Console sales are slipping, pointing to more Game Pass users on PC and cloud platforms.

- 71% of Xbox Game Pass subscribers indicated the service influenced their decision to remain in the Xbox ecosystem.

- Indie game popularity suggests a younger, exploratory gaming demographic.

- During Microsoft’s trial of the Xbox Game Pass Friends & Family Plan in 2023, user satisfaction in pilot regions like Ireland and Colombia reached approximately 70%.

- Broader employment shifts and studio closures do not yet reflect in subscriber makeup.

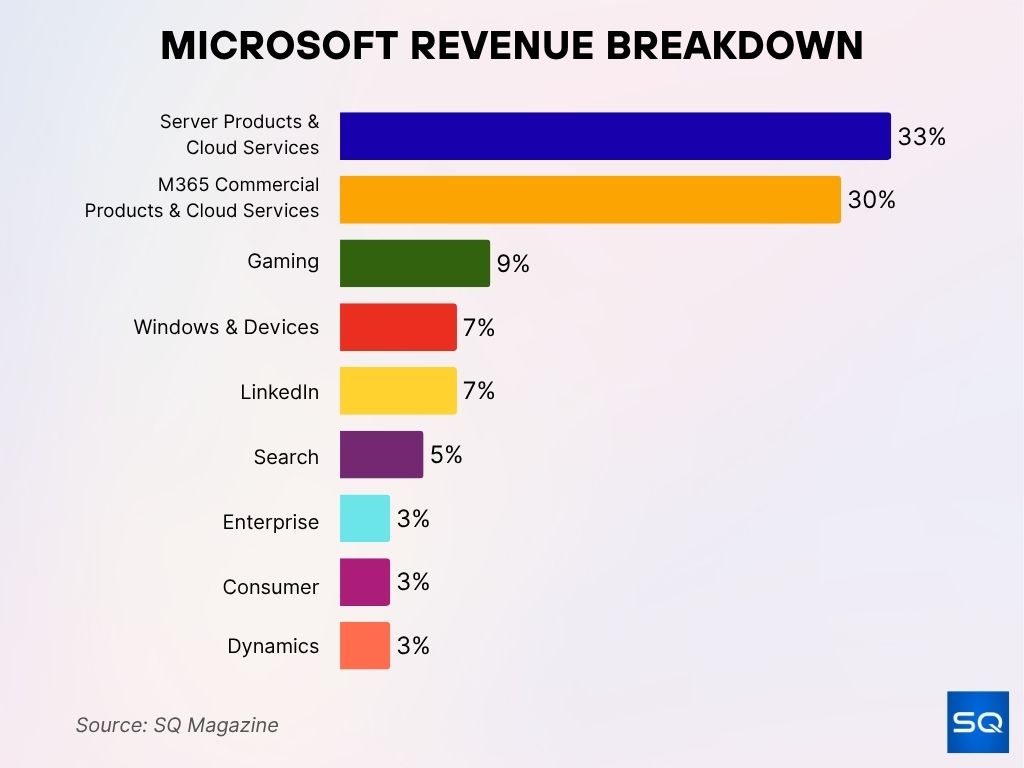

Microsoft Revenue Breakdown

- Server products & cloud services remain Microsoft’s largest revenue driver, contributing 33% of total earnings.

- Microsoft 365 commercial products & cloud services follow closely with 30%, reflecting strong enterprise demand.

- Gaming accounts for 9%, showcasing Xbox’s continued role in Microsoft’s ecosystem.

- Both Windows & Devices and LinkedIn each contribute 7%, highlighting the balance between hardware and professional networks.

- Search (e.g., Bing Ads) brings in 5%, underscoring Microsoft’s ad revenue stream.

- Enterprise, Consumer, and Dynamics segments each contribute 3%, indicating smaller but consistent roles in the revenue mix.

Regional Breakdown of Xbox Game Pass Subscribers

- Game Pass reached 37 million subscribers by Q1 2025, maintaining strength across regions.

- Southeast Asia saw a 31% year-over-year increase in Xbox users, driven in part by Game Pass Core adoption.

- Mobile access via cloud gaming grew significantly in India, South Korea, and Brazil, with an 89% increase in mobile gaming usage.

- North America remains core, the highest concentration of Ultimate-tier subscribers, though the exact split by region is undisclosed.

- Microsoft targets emerging markets to offset plateauing growth in mature regions.

- Game Pass’s flexibility supports adoption regardless of console availability.

- Cloud-centric regions (e.g., parts of Asia) see broader Game Pass uptake due to accessibility on low-end devices.

Subscriber Platform Distribution

- Game Pass offers tiers across console, PC, and cloud, with Ultimate covering all three.

- Console remains the dominant platform, though cloud (mobile) is growing fast, 89% YoY rise in mobile cloud usage.

- PC-only access (PC Game Pass) is priced around $12/month.

- Game Pass Core (formerly Live Gold) offers a curated console library at $9.99/month.

- 68% of subscribers now choose Ultimate, demonstrating multi-platform appeal.

- Cloud penetration is especially strong in regions with lower console ownership.

- Monthly active users across all Xbox platforms topped 500 million, a sign of platform-wide engagement.

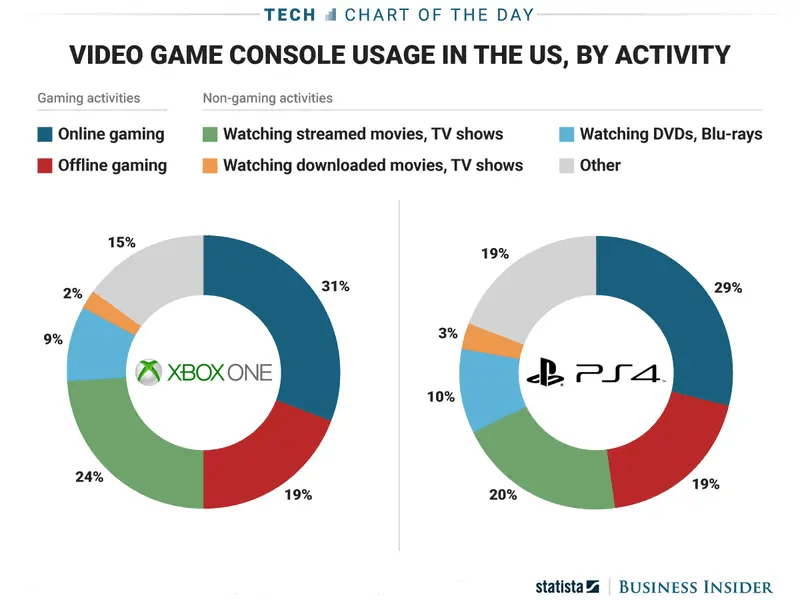

Video Game Console Usage in the US by Activity

Xbox One Usage Breakdown

- 31% of activity is online gaming, the most-used function.

- 24% is spent streaming movies and TV shows.

- 19% goes to offline gaming.

- 15% is classified as other activities.

- 9% is for watching DVDs/Blu-rays.

- 2% is spent on watching downloaded content.

PS4 Usage Breakdown

- 29% of activity is online gaming.

- 20% goes to streaming content.

- 19% is spent on offline gaming.

- 19% is categorized as other activities.

- 10% is for watching DVDs/Blu-rays.

- 3% is for watching downloaded content.

Monthly Active Users

- Microsoft reports 500 million monthly active users across its gaming platforms as of mid‑2025.

- That figure represents a 2.5× increase from early 2024, when active users were around 200 million.

- Cloud gaming set a new record with 140 million hours streamed in a single quarter.

- Game Pass users play 34% more hours compared to non‑subscribers.

- Subscribers averaged 18 different titles per year in 2024, up from 15 in 2023.

- Monthly engagement remains high despite subscriber growth slowing, suggesting strong retention.

Revenue Statistics

- Xbox Game Pass generated nearly $5 billion in annual revenue for FY 2025, a record milestone.

- Game Pass contributed about 65% of Xbox’s services revenue in 2024, estimated at $4.7 billion.

- Xbox content and services revenue rose 13–16% year-over-year.

- Hardware revenue declined by 22–25%, underscoring Game Pass’s growing importance.

- Microsoft’s overall gaming revenue rose 10% year-over-year, helped by Game Pass growth.

- Analysts forecast up to $5.5 billion in Game Pass revenue for 2025.

- Monthly revenue estimates hover around $340 million, largely from Ultimate-tier subscribers.

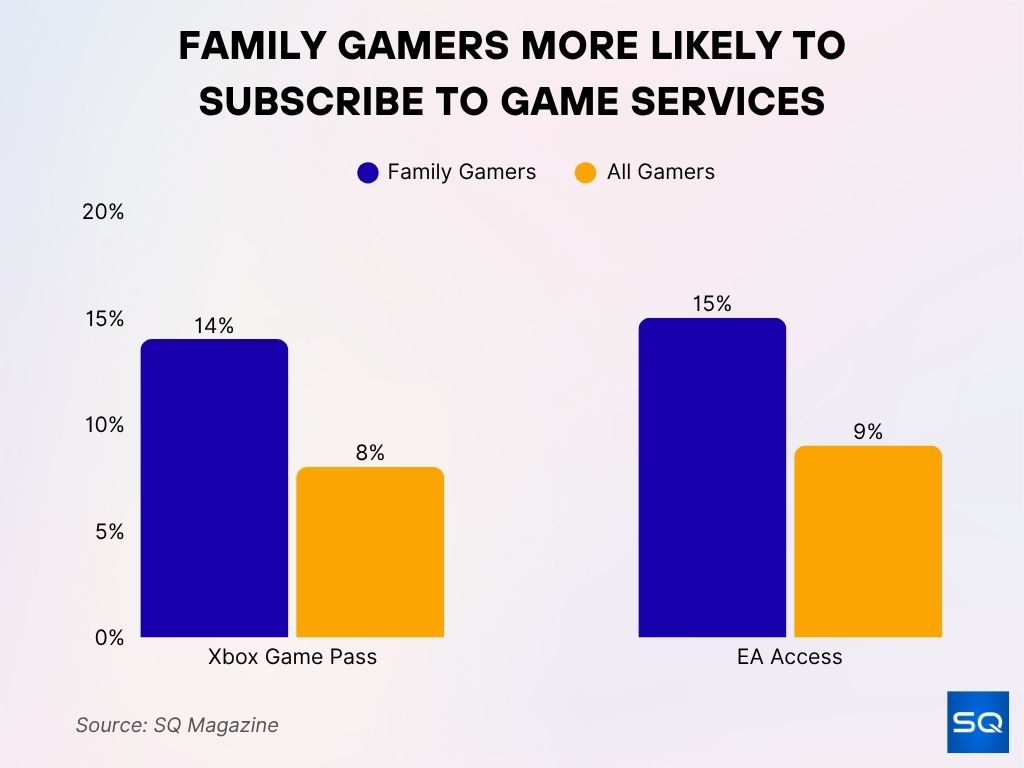

Family Gamers More Likely to Subscribe to Game Services

- Family gamers are significantly more likely to subscribe to gaming services than the general gamer population.

- 14% of family gamers subscribe to Xbox Game Pass, compared to just 8% of all gamers.

- 15% of family gamers use EA Access, versus 9% of all gamers.

- 29% of the total population live in households where children and adults play games together, highlighting the importance of family-focused gaming experiences.

Average Revenue Per User (ARPU)

- Global ARPU is expected to increase by 5.4% in 2024, with a bigger 15.3% jump in 2025.

- Rise in ARPU is tied to the shift toward premium ULTIMATE subscriptions and price hikes.

- With 68% of users on the Ultimate tier, the higher monthly price drives up per-user revenue.

- Bundled offerings, EA Play, cloud access, and day-one releases justify the premium tier price point.

Engagement and Usage Stats

- Subscribers averaged 18 distinct titles per year in 2024, up from 15 in 2023.

- Game Pass users log 34% more total gameplay hours than non‑subscribers.

- Indie titles on Game Pass saw a 74% increase in playtime in 2024.

- Cloud gaming surged with 500 million hours streamed over the year, plus 140 million hours in one quarter.

- Forza Horizon 5 alone had over 1.2 million unique players pre-launch, and reached 10 million within a week as a Game Pass title.

- High-tier content, like day-one AAA releases, continues to fuel engagement and retention.

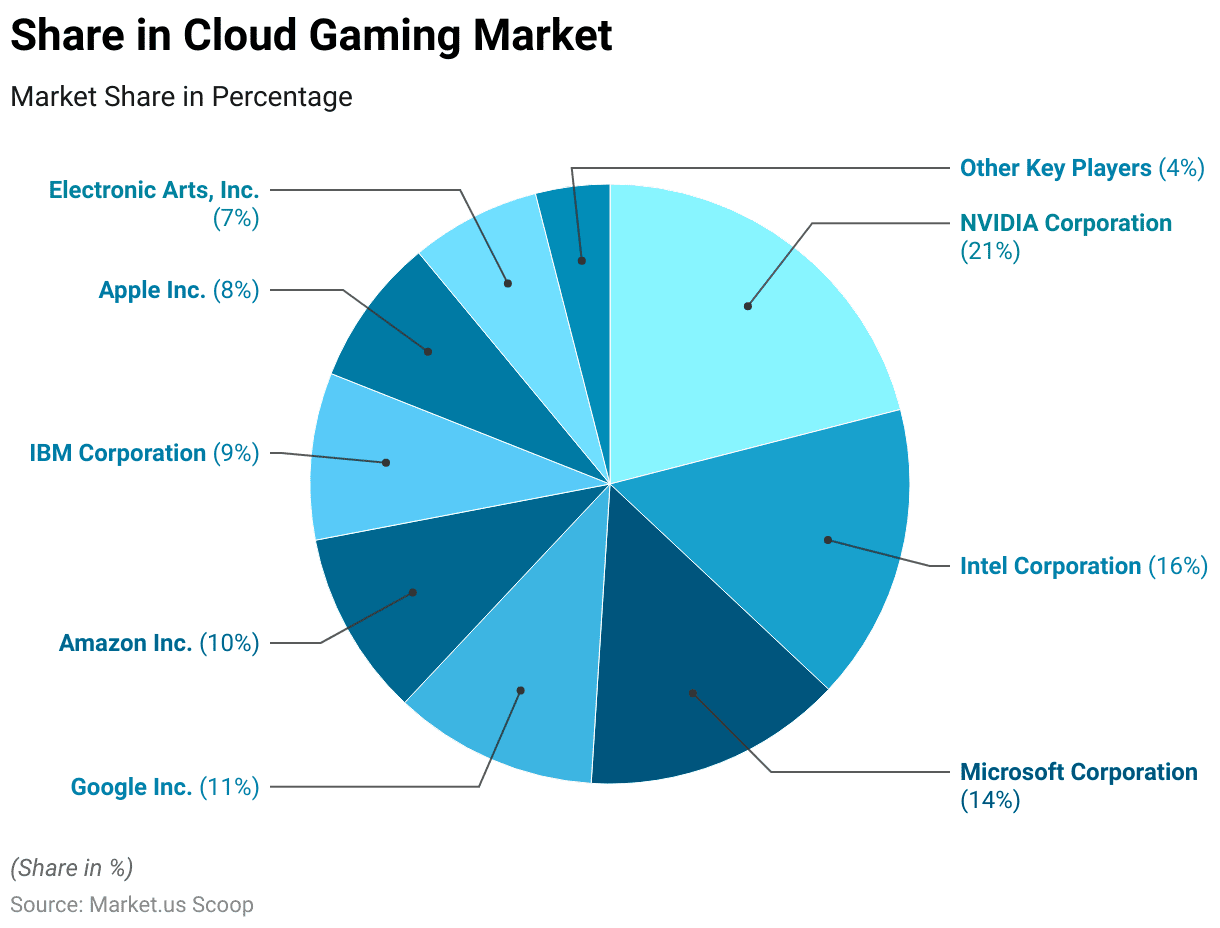

Cloud Gaming Market Share Breakdown

- NVIDIA leads the cloud gaming market with a 21% share, highlighting its dominance in GPU-powered services.

- Intel follows with 16%, leveraging its hardware ecosystem for streaming platforms.

- Microsoft secures 14%, driven by Xbox Cloud Gaming and Azure infrastructure.

- Google holds 11%, largely attributed to its Stadia legacy and cloud capabilities.

- Amazon captures 10% through Luna and AWS-powered services.

- IBM owns 9% of the market, reflecting its enterprise-focused cloud innovations.

- Apple contributes 8%, mainly via Arcade and device-based streaming integration.

- Electronic Arts holds 7%, emphasizing subscription-based and remote play services.

- Other key players collectively make up the remaining 4% of the market.

Notable Games and Downloads on Xbox Game Pass

- In August 2025, day‑one additions included Grounded 2, Wuchang: Fallen Feathers, and Tony Hawk’s Pro Skater 3+4.

- The curved catalog includes over 400 unique games on Ultimate, spanning console, PC, and cloud access.

- Day‑one flagship titles like Forza Horizon 5 reached 10 million players in its first week on Game Pass.

- Game Pass’s partnership with Antstream Arcade added retro games to the subscription in mid‑2025.

- Exclusive and first‑party releases continue to drive Game Pass value and retention.

Subscriber Satisfaction and Retention Rates

- Currently, detailed public-facing metrics on subscriber satisfaction or retention rates for Game Pass are lacking.

- However, the sustained investments in content, cloud accessibility, and day‑one releases suggest high retention intent.

- Analysts expect ongoing migration toward higher-value tiers (e.g., Ultimate) to enhance lifetime value and reduce churn.

- New revenue records and continued engagement provide positive indirect indicators of subscriber loyalty.

Future Growth Projections

- Analysts forecast $5.5 billion in Game Pass revenue for 2025, a roughly 15% increase driven by tier changes and price adjustments.

- As of FY25, Game Pass has already generated nearly $5 billion in annual revenue.

- Microsoft’s gaming segment posted record third-quarter revenue, $5.72 billion in Q3 FY25, driven by Game Pass and cloud, up 5% year over year.

- Predictive models suggest Game Pass may reach 50 million subscribers between late 2025 and early 2027, especially with new tiers such as ad-supported offerings.

- Expansion into handheld and portable gaming could offset hardware sales declines and broaden Game Pass’s use case.

- Continued platform expansion, AI integration, and content investments remain core to sustaining growth.

Conclusion

Xbox Game Pass continues to reshape how games are consumed. With its flexible tier system, strong day‑one content, and rising cloud engagement, Game Pass has proven to be more than a service; it’s a gaming ecosystem. It now outpaces traditional sales in revenue, offers unmatched accessibility across devices, and positions Microsoft as a content-first player. As 2025 unfolds, financial performance and industry shifts suggest Game Pass will remain central, not just to Microsoft’s strategy but to the future of gaming.

Alessandro Toglia

Hello,

I recently came across your excellent article on SQ Magazine about mobile gaming statistics, where you mentioned growth figures for Game Pass mobile usage in Brazil, India, and South Korea. The insights were fascinating and highly relevant to the market trends discussion.

Would you be so kind as to point me toward the original source of this data? Specifically, I’m curious whether these numbers derive from SQ Magazine’s own proprietary research or stem from an external report or dataset. The methodology and time frame would be particularly helpful as I’m comparing market dynamics in ongoing analysis.

Thank you for your time and the valuable insights you provide through your work.

Best regards,

Alessandro Toglia

Robert A. Lee

Hi Alessandro,

Thanks for your interest. The figures we cited draw on publicly available industry reports such as Statista, along with our own market research and, where relevant, interviews with industry leaders. Our articles aim to consolidate these insights for informational and educational purposes, and we always encourage readers to conduct their own research when comparing market dynamics.

Hope this helps.