Video conferencing has quietly shifted from a pandemic necessity to a core business tool. Across sectors, it enables global teams to meet, educators to teach, and physicians to consult, all without physical travel. For example, a US-based legal firm cuts cross‑office travel costs by 40% via virtual depositions, while a rural hospital in India uses teleconsultations to extend care to remote communities. In this article, you’ll discover the latest data behind this transformation and why it matters.

Editor’s Choice

- The global video conferencing market is projected to reach $13,065.5 million in 2025 (from $11,653.1 million in 2024).

- Grand View Research estimates a CAGR of ~8.2% from 2025 to 2033 for the video conferencing market.

- In 2025, over 32.6 million Americans, or ~22% of the US workforce, will work remotely.

- Among global workers, 83% prefer hybrid work over fully remote or fully onsite.

- More than 300 million users worldwide use Zoom, giving it ~55.91% market share in video conferencing.

- Fifty‑two percent of fully remote leaders spend 3+ hours daily in virtual meetings.

- Sixty‑four percent of remote respondents favor hybrid video calls as their primary meeting style.

Recent Developments

- AI and automation are being embedded into video platforms to enable features like meeting summarization and real‑time translation.

- Zero‑touch room setups (rooms that configure themselves automatically) are gaining adoption in enterprise settings.

- Platforms are pushing cross‑vendor interoperability, allowing users on Teams, Zoom, Webex, or Google Meet to join one shared meeting.

- Security enhancements, including real‑time threat detection and end‑to‑end encryption, are now standard for many providers.

- Cloud deployment is overtaking on‑premises installations as organizations favor flexibility and scalability.

- There’s growing use of analytics dashboards that measure engagement, attention, and sentiment in video meetings.

- The shift to mobile-first meeting experiences is driving lighter apps optimized for smartphones.

- Investment in hardware refresh (like smart cameras, AI tracking cameras) is rising to support higher video quality.

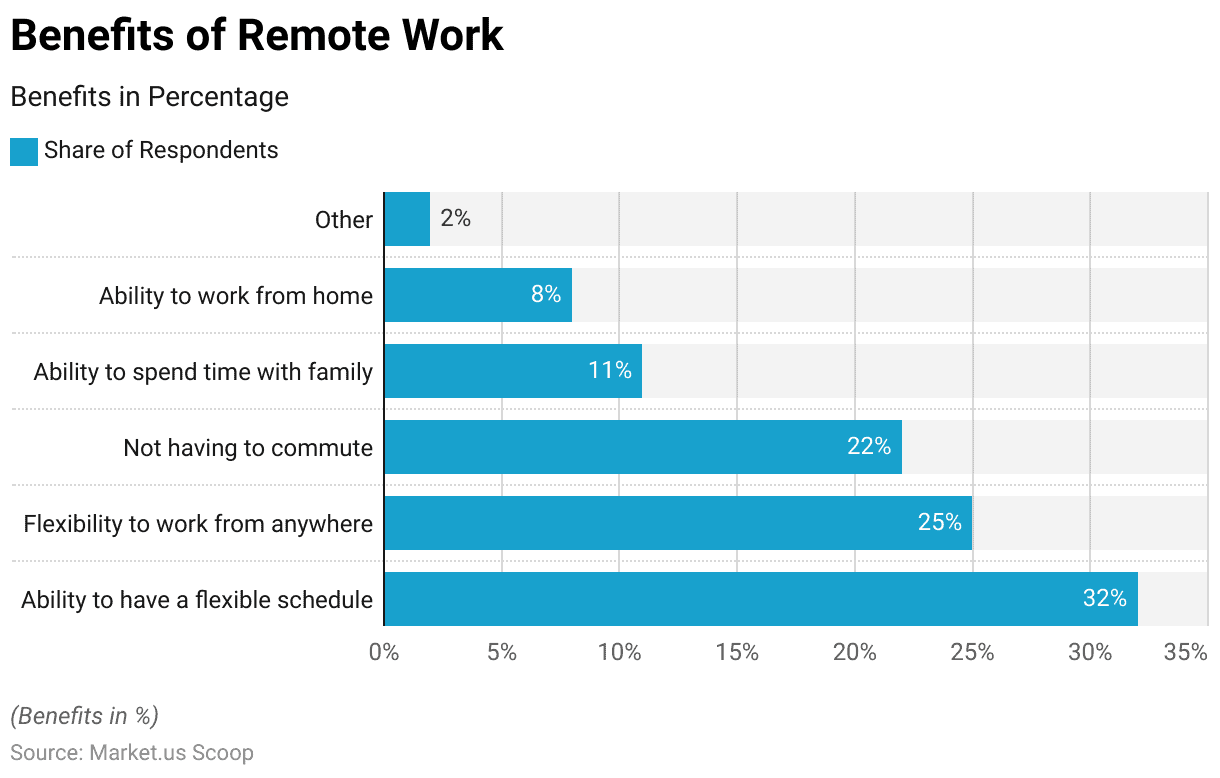

Benefits of Remote Work

- 32% of respondents said the ability to have a flexible schedule is the top benefit, allowing workers to better balance personal and professional demands. This flexibility is often the primary driver for employee satisfaction in remote setups.

- 25% value the flexibility to work from anywhere, highlighting the appeal of location independence. This freedom supports both lifestyle choices and global mobility.

- 22% cited not having to commute as a major advantage, reducing stress and saving significant time daily. The elimination of commuting also lowers transportation costs and environmental impact.

- 11% appreciate the ability to spend more time with family, strengthening work-life integration. Remote work creates opportunities to be more present at home without compromising productivity.

- 8% enjoy the ability to work from home itself, focusing on comfort and convenience. This provides employees with a personalized environment to perform better.

- 2% selected other benefits, reflecting individual preferences beyond the common categories. These may include health, lifestyle, or unique personal advantages.

Global Video Conferencing Market Size and Growth

- The global video conferencing market is expected to grow from $11,653.1 million in 2024 to $13,065.5 million in 2025.

- Some forecasts place the 2025 market value at $12.48 billion, with projections reaching $23.13 billion by 2032 (CAGR ~9.2%).

- Another estimate places it at $9.99 billion, with growth to $28.26 billion by 2034 (CAGR ~12%).

- One forecast suggests a jump from $26.22 billion in 2024 to $29.19 billion in 2025 (CAGR 11.31%) for a broader videoconferencing market.

- Between 2024 and 2029, the market will expand by $8.84 billion, with ~12.6% growth rates.

- Growth is predicted from $8.20 billion in 2023 to $19.17 billion by 2031 (CAGR ~11.2%).

- In the U.S., the video conferencing market in 2024 generated $3,781 million and is projected to grow at ~7.3% CAGR to 2033.

- The U.S. market was valued at $10.8 billion in 2024, with expectations to reach $26.14 billion by 2030 (CAGR ~15.7%).

Regional Market Statistics

- North America accounted for ~41–42% of the global market share in recent years.

- APAC’s share is growing; its video conferencing market is forecast to hit $6.8 billion by 2025.

- Europe often holds ~30%+ share in global forecasts.

- One estimate places Europe’s share in 2025 at ~$3,081 million (≈30%) of a 10,624.6 million global base.

- In APAC, China is projected to reach ~$1,070.96 million in 2025.

- India is forecasted to hit ~$254.99 million in 2025 in the video conferencing market value.

- South East Asia’s market is projected at $168.29 million in 2025.

- Latin America is estimated at ~5% of global volume, with Brazil’s 2025 figure ~$172.80 million.

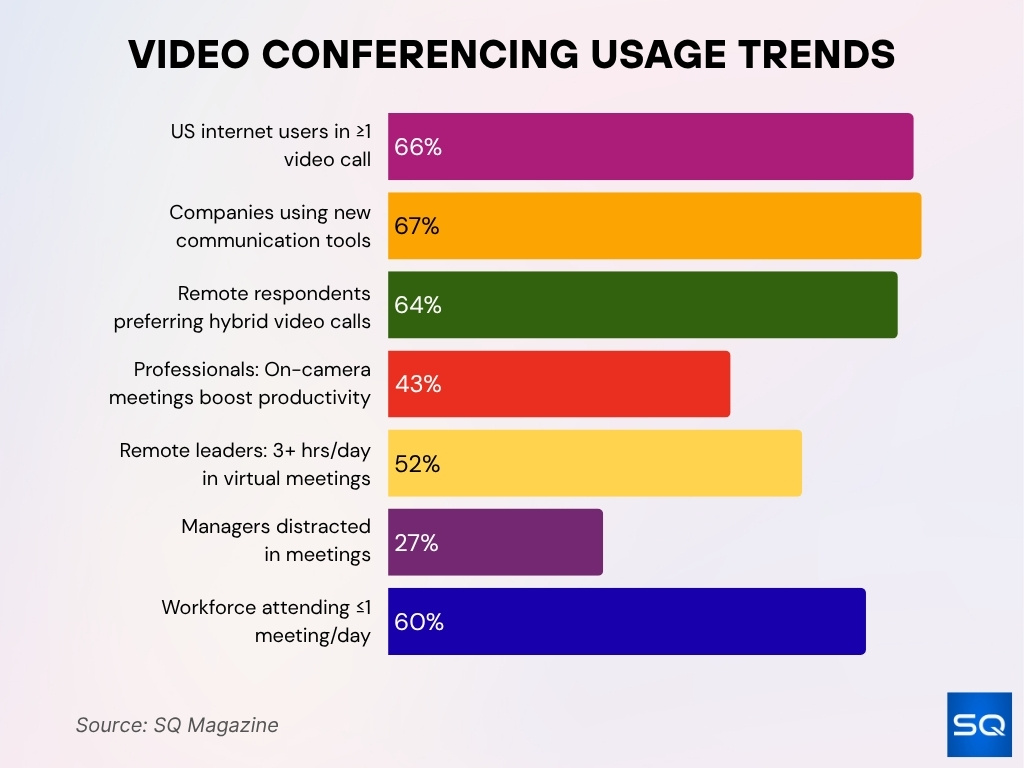

Video Conferencing Usage Trends

- As of late 2023, ~66% of U.S. internet users participated in at least one video call.

- In many organizations, 67% of companies report adopting new communication tools (including video) in recent years.

- Hybrid meeting styles dominate: 64% of remote respondents prefer hybrid video calls.

- 43% of professionals say on-camera meetings boost productivity vs audio-only.

- In remote leadership roles, 52% spend 3+ hours in virtual meetings daily.

- 27% of managers admit to being distracted in meetings.

- Among the general workforce, ~60% attend one meeting or fewer per day.

- In 2025, many vendors report increasing daily active users; for instance, Zoom continues to grow in user counts.

Remote and Hybrid Work Adoption

- As of early 2025, 22.8% of U.S. employees work remotely at least some hours (≈ 36.07 million people).

- 32.6 million Americans (~22% of the U.S. workforce) work remotely in 2025.

- Hybrid job postings rose from 15% in Q2 2023 to ~24% by Q2 2025.

- Fully in‑office job postings have declined from 83% in 2023 to ~66% in recent years.

- 29% of U.S. workdays are still performed from home in early 2025.

- Remote workers log ~51 more productive minutes per day compared to hybrid or office peers.

- 31.4% of job seekers are now searching exclusively for remote roles.

- Remote jobs have grown roughly threefold since 2020, now constituting over 15% of U.S. total job listings.

Cost Savings and Business Impact

- Firms adopting video conferencing reduce travel and lodging costs by as much as 30%–40%.

- Business travel cost reduction is a major driver of video conferencing’s growth.

- Businesses save on office space, commuting allowances, and utilities through remote meetings.

- Cloud video conferencing is expected to grow from $10.4 billion in 2024 to $11.79 billion in 2025.

- The 2024 U.S. video conferencing market was valued at $10.8 billion.

- Many organizations report ROI in 6 to 18 months after deploying video solutions.

- Video conferencing lowers carbon footprint by reducing travel.

- Offering remote/hybrid models via video helps employee retention and recruitment, lowering turnover costs by 10–15%.

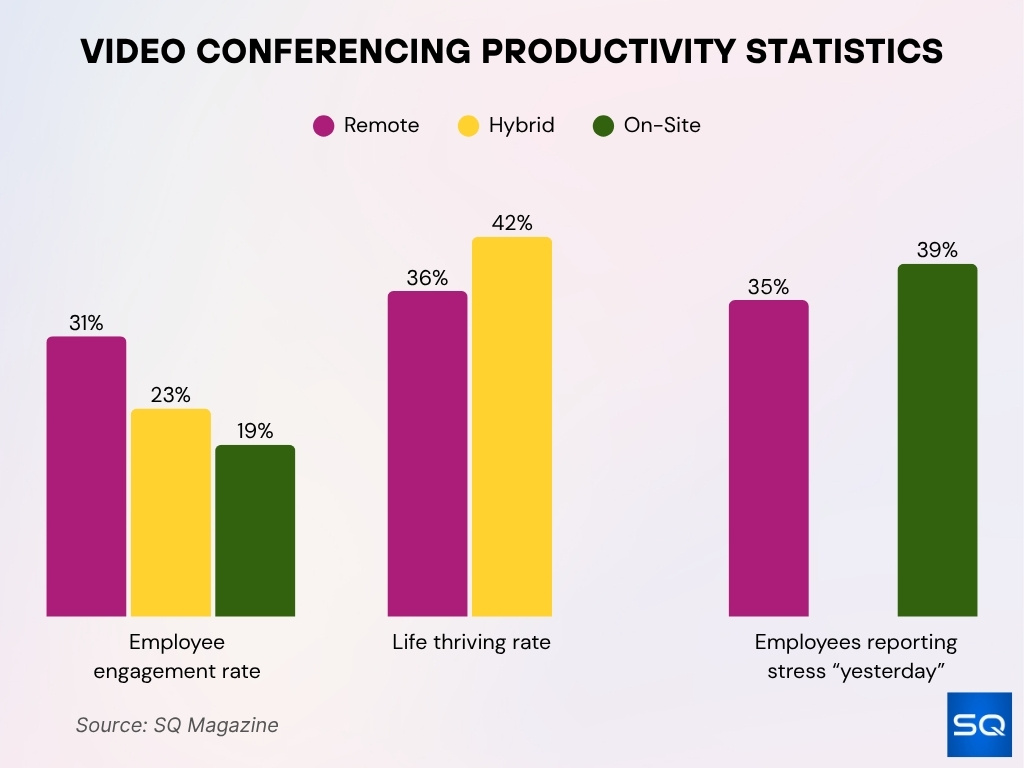

Video Conferencing Productivity Statistics

- Increased remote work percentages within industries correlate with positive gains in total factor productivity.

- Fully remote employees show 31% engagement rates, ahead of hybrid (23%) and on‑site workers (19%).

- Fully remote workers report lower overall life thriving (36%) versus hybrid (42%).

- Remote workers report higher stress levels, with 45% experiencing stress “yesterday” vs. 39% for on‑site.

- 86% of companies now conduct interviews online.

- 66% of applicants prefer video conferencing for interviews over other tools.

- Organizations embed analytics dashboards in video tools to measure attention, engagement, and sentiment.

- Remote job candidates maintain higher output per hour, due to fewer interruptions and better flow time.

Impact of COVID‑19 on Video Conferencing

- Daily Zoom participants jumped from 10 million in 2019 to 300 million by mid‑2020.

- Post‑pandemic, video conferencing became a standard part of infrastructure.

- Hybrid work adoption cemented video conferencing as essential.

- 73% of hybrid workers say they enjoy flexibility and prefer video tools.

- 25% of employees want to remain remote permanently.

- Platforms now embed AI and analytics to enhance virtual meetings.

- The global market is projected to $33.3 billion in 2025, boosted by pandemic momentum.

- Vendors have expanded into webinars, virtual events, telehealth, and education.

User Adoption and Demographics

- Zoom has over 300 million users, with ~55.91% market share.

- Microsoft Teams holds between 23% and 32.29% of the global market.

- Cisco Webex holds around 11% market share.

- 86% of companies use video tools for recruiting.

- 31.4% of job seekers prefer remote positions.

- Over 82% of remote workers began remote work within the past 5 years.

- Remote work is highest in North America, the UK, and Australia.

- In 2023, 13.8% of U.S. workers usually worked from home, up from 5.7% pre‑pandemic.

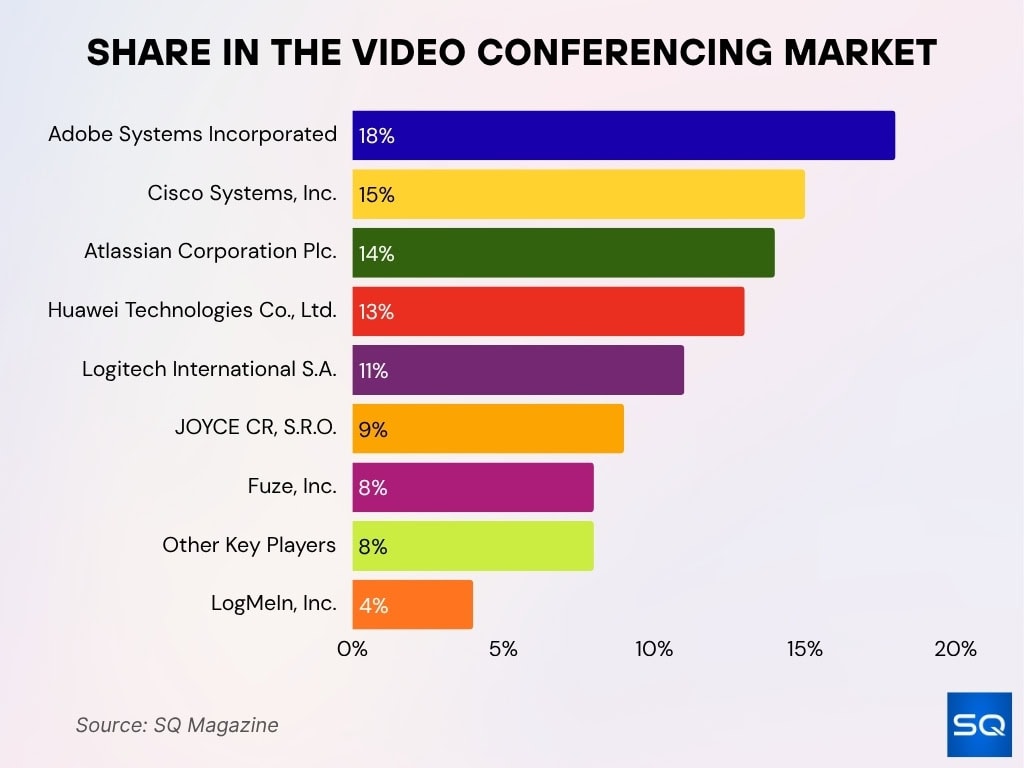

Share in the Video Conferencing Market

- Adobe Systems Incorporated holds 18% of the global video conferencing market, making it the largest single player in this space. Its wide suite of collaboration tools continues to dominate enterprise adoption.

- Cisco Systems, Inc. commands 15%, positioning it as a strong competitor with its Webex platform. The company leverages its enterprise networking leadership to maintain market influence.

- Atlassian Corporation Plc. has 14%, reflecting the strength of its integrated collaboration solutions. Its focus on workflow and project management tools complements its conferencing adoption.

- Huawei Technologies Co., Ltd. captures 13%, driven by rapid adoption in Asia and emerging markets. Its solutions are often bundled with its telecom infrastructure, giving it a competitive edge.

- Logitech International S.A. accounts for 11%, benefiting from its hardware-driven approach. Its webcams and conference equipment play a crucial role in powering remote and hybrid meetings.

- JOYCE CR, S.R.O. holds 9%, showcasing its growing role in niche regional markets. Despite being smaller, it has carved out steady adoption.

- Fuze, Inc. represents 8%, appealing to businesses seeking integrated communication platforms. Its focus on unified communications strengthens its standing.

- Other key players make up 8%, highlighting a competitive landscape with multiple smaller providers. This fragmentation shows ongoing innovation in the sector.

- LogMeIn, Inc. has 4%, reflecting a more modest share but still a notable presence with GoToMeeting. Its platform continues to serve a loyal base of business users.

Most Popular Video Conferencing Platforms

- Zoom leads with ~55.91% global market share.

- Microsoft Teams holds between 23% and 32.29%.

- Cisco Webex accounts for ~11%.

- Free-tier options from Webex, Google Meet, RingCentral, and Zoom are common.

- Many companies use multi-platform strategies, combining Teams and Zoom.

- Some vendors now integrate AR/VR capabilities to differentiate.

Mobile vs. Desktop Video Conferencing Usage

- Tools are being optimized for mobile-first meeting experiences.

- 30%–40% of participants attend video meetings via mobile.

- Desktop still dominates 70%–80% of the time in enterprise settings.

- Mobile is more common in sales, field services, and on‑site operations.

- Platforms support seamless switching between desktop and mobile.

- Mobile apps adjust video quality more aggressively for bandwidth savings.

- Video codecs are being optimized for mobile performance.

- Mobile users often join late or exit early, citing battery or connectivity issues.

Video Call Frequency and Duration

- The average video call lasts about 38 minutes, with business calls averaging 29 minutes.

- Remote workers attend ≈ 7.3 video calls per week, compared to 4.1 for hybrid and 2.6 for in‑office.

- 65% of users join at least one video call per weekday.

- The average employee spends ~11.3 hours/week in meetings.

- 46% of professionals attend 3 or more meetings a day.

- 86% of meetings include at least one virtual participant.

- 72% of workers lose time due to technical issues.

- 50% of meetings start late, by about 75 seconds.

- 45% of meetings are scheduled for 30 minutes.

Telehealth and Healthcare Video Conferencing

- The market is estimated to be around $102 million in 2025.

- HIPAA compliance is required for telehealth platforms.

- Security concerns include data leaks, identity spoofing, and weak encryption.

- One study identified 105 best practices for reducing telehealth barriers.

- Telehealth supports chronic care, mental health, and remote triage.

- Patients report benefits like lower costs and reduced travel.

- Barriers include bandwidth, device access, and EHR integration.

- In low‑connectivity areas, audio-first or asynchronous models are still used.

Frequently Asked Questions (FAQs)

It is estimated at $9.99 billion in 2025.

The CAGR is projected at ~12% over the 2025–2034 period

Zoom commands ~55.91% of the global videoconferencing software market.

Microsoft Teams holds about 32.29% share of the video conferencing market.

Conclusion

Video conferencing today is no longer a stopgap; it’s foundational. Meeting frequency, usage patterns, and expanding across sectors underscore its permanence. In education, healthcare, business, and government, it’s creating access, saving costs, and reshaping workflows. But with reach comes responsibility, privacy, security, and fairness must keep pace.

As you read through the full article, you’ll find deeper context, trend analysis, and actionable takeaways that illuminate where the video conferencing landscape is heading, and how your organization can stay ahead.