The tokenized commodities market is redefining how physical raw materials like gold, oil, and carbon credits are traded and held. Instead of traditional paperwork and settlement delays, tokens on blockchain offer 24/7 trading, fractional ownership, and global accessibility. In sectors from precious metals to energy credits, tokenization is not just a tech novelty; it’s reshaping liquidity models and democratizing access. Institutions and retail investors alike are increasingly participating in this evolving landscape. Explore the data below to understand how this emerging market is growing.

Editor’s Choice

- Tokenized commodities reached around $4.0 billion in valuation in late 2025, with precious metals and gold‑backed tokens driving most of the growth.

- Market size for tokenized assets expanded from $860 million in 2023 to $2.3 billion by mid‑2025.

- The estimated growth of real‑world asset tokenization could reach multi‑trillion levels by 2030.

- Tokenization enhances fractional ownership and liquidity for traditionally illiquid commodity markets.

- Active wallets in tokenized RWA markets exceeded 600,000+, indicating growing adoption.

- Stablecoin infrastructure (e.g., USDC) underpins much of commodity token trading.

Recent Developments

- Dubai Multi Commodities Centre partnered with Crypto.com to explore gold, energy, and agri‑commodity tokenization.

- JPMorgan’s Kinexys began blockchain testing to tokenize global carbon credits with S&P and ICR.

- Regulatory clarity and pilot frameworks for tokenized RWAs expanded in the US, UK, Singapore, and Hong Kong.

- Tokenized RWAs surpassed roughly $30–36 billion in total value by late 2025, supported by yield‑bearing assets and institutional adoption.

- Carbon credit tokenization efforts aim to enhance transparency and reduce fraud in voluntary markets.

- Tokenized commodity trading infrastructure saw increased integrations with DeFi platforms.

- Institutional players (banks, exchanges) are launching tokenized commodity products and platforms.

- Tokenized money‑market and RWA futures volumes exceeded $53 billion in 2025, indicating derivatives adoption.

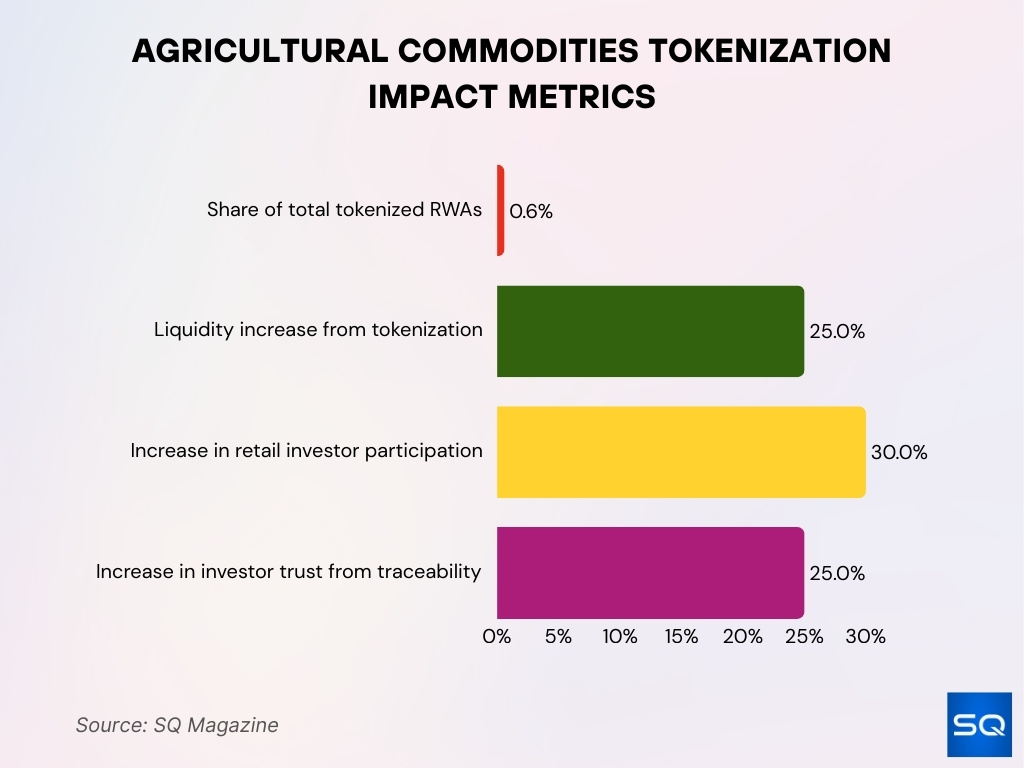

Agricultural Commodities Market Data

- The agricultural segment comprises 0.6% of total tokenized RWAs.

- Tokenization boosts commodities liquidity by 25%.

- Fractional ownership draws 30% more retail investors.

- Blockchain traceability increases investor trust by 25%.

- Tokenized agricultural commodities valued at $150 million.

- Wheat, corn, and soybeans’ tokenized assets total $150 million.

- Global RWA tokenization reaches between $18–36 billion by late 2025, depending on methodology, with one major estimate citing $35.9 billion by November 2025.

- AgriFoodTech startups raised $15.6 billion in 2023.

- RWA market is projected $100 billion by 2030.

- Blockchain in the agri supply chain hits $0.6 billion.

Market Breakdown by Commodity Type

- Precious metals (gold tokens) account for about 60% of the total commodity tokenization market value, with tokenized gold value rising to roughly $4.2 billion and growing more than 140% year‑on‑year.

- Energy commodities see early tokenization pilots, with oil and gas-linked tokens estimated at roughly 10–12% of commodity token volumes across major RWA platforms.

- Agricultural tokens remain small at under 5% of commodity tokenization, concentrated in pilot agri‑trade corridors in Brazil, India, and parts of Africa.

- Industrial metals, including future cobalt and base‑metal tokens, are projected to capture around 8–10% of new commodity token issuance pipelines on leading tokenization platforms.

- Market fragmentation persists, with more than 30 distinct token standards and protocol frameworks used across commodity issuers, limiting cross‑platform liquidity.

- Structures range from full‑reserve backing to fractional claims and futures‑style rights, with fractional and claim‑

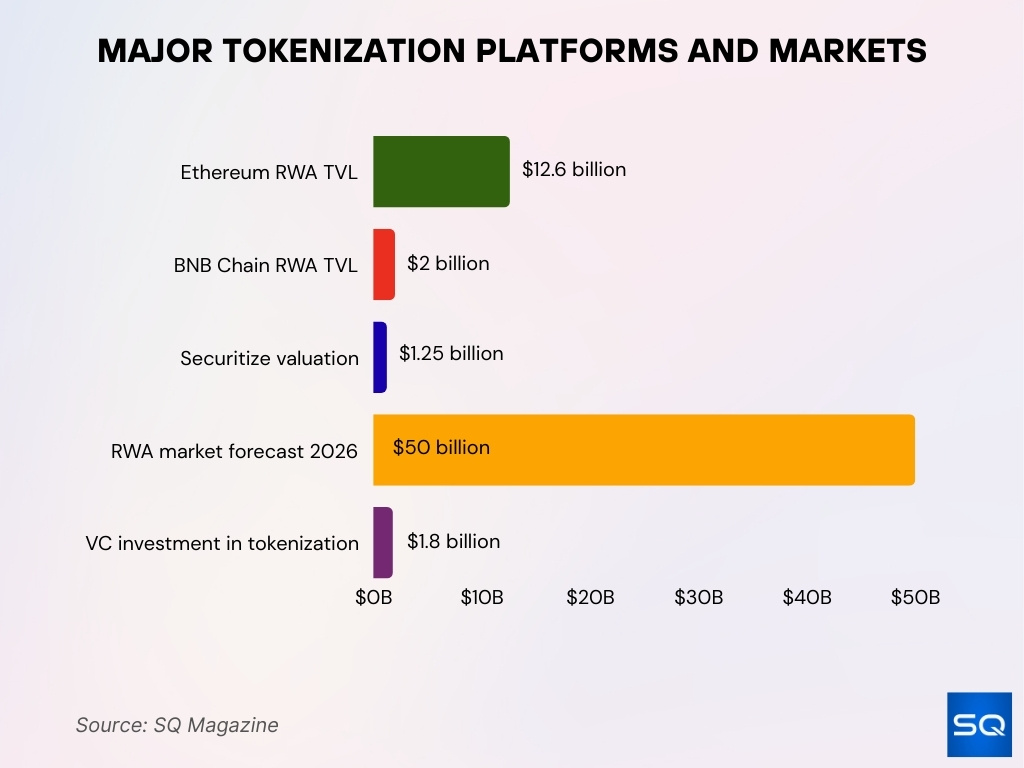

Major Platforms and Protocols for Commodity Tokenization

- Ethereum hosts 65% RWA market share at $12.6 billion TVL.

- BNB Chain captures 10.34% share with $2 billion TVL.

- Securitize tokenizes private equity and commodities for institutions.

- RWA tokenization funding is projected to be 25-28% of VC in 2026.

- Securitize is valued at $1.25 billion in a public merger.

- Platforms like Tokeny emphasize 100% regulatory compliance.

- RWA market forecast hits $50 billion by the end of 2026.

- VC investment in tokenization has exceeded $1.8 billion recently.

Precious Metals Market Statistics

- Tokenized commodities total around $4.7–4.8 billion, with gold‑backed tokens dominating roughly 85–90% of the segment.

- Tether Gold (XAUT) market cap is in the $1.4–1.6 billion range in late 2025, leading most individual gold‑backed tokens by size.

- Paxos Gold (PAXG) market cap stands at roughly $1.5–1.6 billion in late 2025.

- Tokenized gold grows 147% in six months to late 2025.

- Gold price projected $4,800/oz by Q4 2026.

- PAXG averages $4,700 per token in the 2026 forecast.

- XAUT and PAXG together hold close to 90% of the tokenized gold market by capitalization.

- Sector sees 300% YTD growth entering 2026.

- Gold tokens enable 24/7 trading versus exchange limits.

Tokenized Energy Commodities (Oil, Gas) Market Data

- The tokenized oil market is valued at $500 million entering 2026.

- Natural gas tokenization totals $100 million amid rising demand.

- Oil and gas comprise 18% of $2.3 billion tokenized assets in 2023.

- Tokenized energy offerings raised $500 million worldwide in 2024.

- 60% of energy token funding targets carbon reduction projects.

- Institutional pilots drive 20% projected growth for oil tokens in 2026.

- Liquidity for energy tokens trails precious metals by 95%.

- Fractional oil storage rights tokenized reach $50 million pilots.

- Regulatory clarity expected for 30% more energy token platforms.

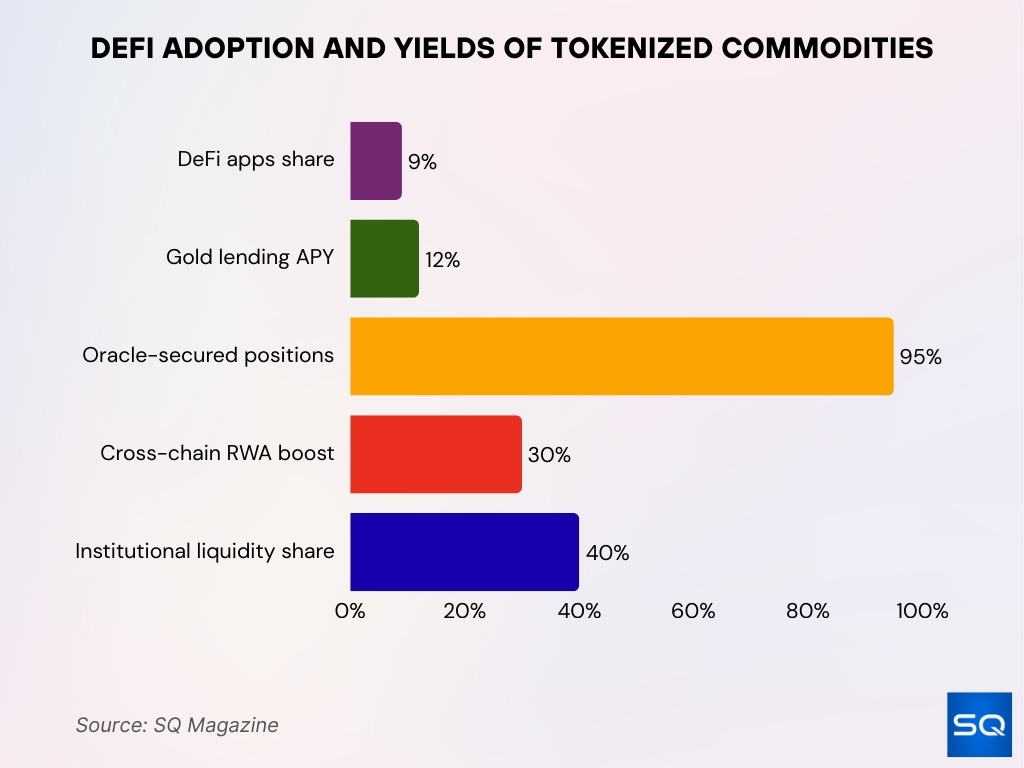

Use of Tokenized Commodities in DeFi

- 9% of DeFi apps focus on commodity tokenization.

- Tokenized commodities collateralize $1.2 billion DeFi loans.

- Gold tokens generate 12% APY in lending pools.

- RWA DeFi TVL reaches $2.5 billion across protocols.

- AMM pairs for metals hit $800 million in liquidity.

- Oracle feeds secure 95% of commodity-backed positions.

- Fractional tokens lower entry to $100 minimums.

- Cross-chain DeFi boosts RWA usage 30%.

- Yield strategies attract 40% institutional liquidity.

Industrial and Battery Metals Market Data

- Tokenized industrial metals hold $75 million value.

- Copper, lithium lead with $40 million combined.

- Silver tokens capture 15% of metal tokenization.

- The battery metals market reaches $13.67 billion.

- EV demand drives 25% growth in metal tokenization.

- The cobalt mining market hits $33.15 billion by 2034.

- Liquidity pools boost trading volume 40%.

- Pilot programs tokenized $20 million of lithium assets.

- ESG-linked metals tokens rise 30% YOY.

Tokenized Carbon Credits and Environmental Commodities

- Global carbon market hits $1.3 trillion.

- Voluntary carbon credits reach $1.7 billion.

- Market grows at 19.2% CAGR to 2035.

- North America holds a 5.3 billion market share.

- Tokenized credits surge 17.6% year-over-year.

- Blockchain enhances trading volume by 40%.

- Corporate offsets drive 45% of transactions.

- Projected to $13.4 billion by 2033.

- ESG mandates boost demand 35% annually.

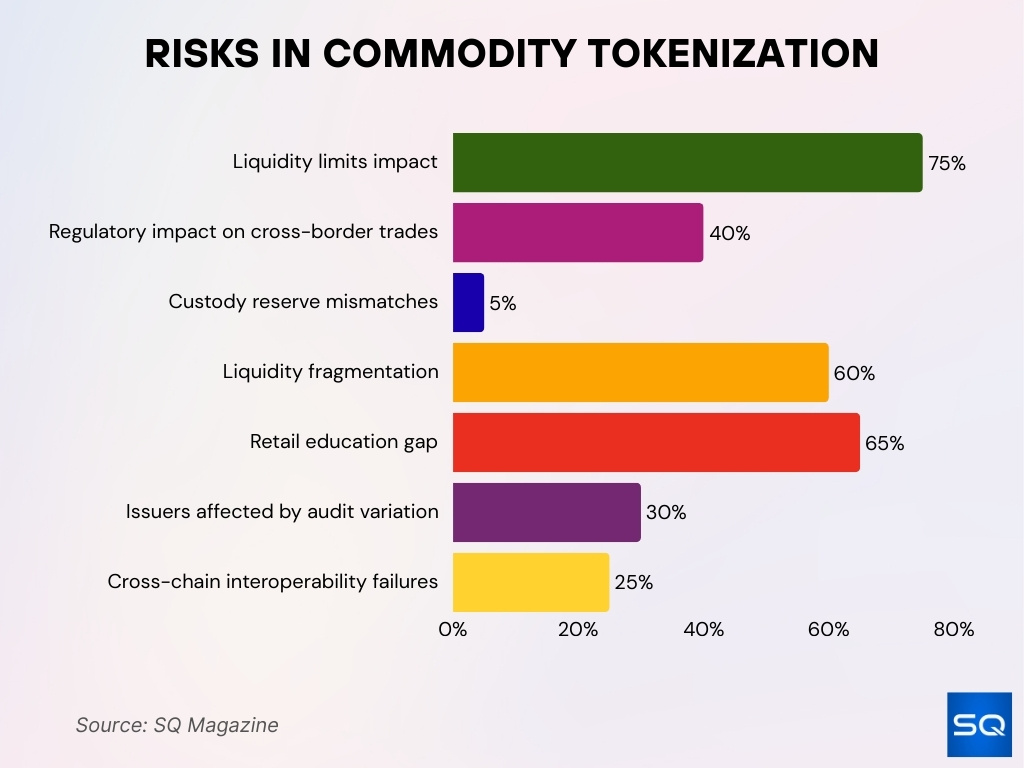

Main Challenges and Risks in Commodity Tokenization

- Liquidity limits affect 75% tokenized markets.

- Regulatory uncertainty impacts 40% cross-border trades.

- Custody risks expose 5% reserve mismatches.

- Smart contract hacks drain $300 million yearly.

- Blockchain fragmentation splits liquidity 60%.

- 65% retailers lack tokenization education.

- Audit variations erode trust in 30% issuers.

- Interoperability fails 25% of cross-chain attempts.

Distribution of Tokenized Commodities Across Blockchains

- Ethereum dominates with a 65% share of $12.6 billion RWA TVL.

- BNB Chain holds 10.34% of the total $2 billion TVL.

- Solana RWA TVL reaches $873 million with 18.4% growth.

- Polygon captures 8.2% market share in tokenized assets.

- Arbitrum L2 supports $1.5 billion in commodity tokens.

- Avalanche processes 5% of cross-chain tokenized trades.

- Bitcoin L2s host $200 million wrapped commodities.

- Base chain grows 150% in RWA deployments.

- Interoperability boosts liquidity 30% via bridges.

Liquidity and Depth of Tokenized Commodity Markets

- Tokenized commodities’ daily volume averages $150 million.

- Gold tokens account for 85% of $127 million volume.

- The average 24h RWA trading depth reaches $500 million.

- Gold token open interest hits $4.2 billion.

- Secondary markets trail traditional by 90% volume.

- Institutional liquidity boosts depth by 40% on platforms.

- DeFi pools incentivize 20% APY for providers.

- Cross-chain bridges increase liquidity by 25%.

- Market depth grows 150% YTD for top assets.

Institutional vs Retail Participation in Tokenized Commodities

- Institutions hold 70% of the tokenized commodities market.

- Retail participation rises 25% in fractional tokens.

- 55% institutions forecast rapid RWA demand growth.

- Retail accesses 30% via exchanges and brokerages.

- Corporate treasuries allocate 5% to tokenized commodities.

- 80% institutions prioritize audited custody.

- Retail yield strategies attract 40% new users.

- Liquidity deepens 35% from mixed participation.

- Education gaps limit retail to 20% potential.

Geographic Distribution of Tokenized Commodity Investors

- North America claims 45% of tokenized RWA TVL.

- Europe holds a 25% share post-MiCA implementation.

- Asia-Pacific captures 20% led by Singapore hubs.

- Middle East grows 8% with Dubai pilots.

- Latin America sees 2% nascent adoption.

- 30+ jurisdictions advance token regulations.

- Cross-border platforms boost access by 40%.

- US investors dominate 60% institutional flows.

- EU MiCA enables 15% retail growth.

- Emerging markets add 5% via local initiatives.

Performance of Tokenized Commodities vs Spot Prices

- Tokenized gold tracks spot with 0.1% average spread.

- PAXG correlates 99.8% with the gold spot price.

- Silver tokens deviate 0.5% from spot in low liquidity.

- Oil tokens align 98% with Brent crude benchmarks.

- Carbon credits match the voluntary market with 95% accuracy.

- 24/7 trading cuts discovery time 70% vs exchanges.

- Oracles update prices every 5 minutes for 99% uptime.

- Arbitrage narrows spreads 50% within hours.

- Volatility exceeds spot 20% in thin markets.

- Market makers reduce the bid-ask 0.3% average.

Custody and Reserve Management for Tokenized Commodities

- 95% issuers provide proof-of-reserve audits.

- Audited reserves cover 100% circulating gold tokens.

- Qualified custodians insure $5 billion in metals.

- Monthly PoR reports verify 99.9% backing accuracy.

- Blockchain trails cut settlement risk by 80%.

- 70% use multi-sig on-chain wallets.

- Inventory audits occur quarterly for 90% issuers.

- Regulatory compliance is met by 85% platforms.

- IoT verification boosts transparency by 40%.

Key Drivers of Tokenized Commodities Adoption

- Fractional ownership attracts 40% more retail investors.

- 24/7 settlement cuts friction 70% vs traditional.

- Regulatory clarity drives 60% institutional inflows.

- On-chain transparency boosts confidence by 85%.

- DeFi integration adds $2 billion in liquidity.

- Cross-border access grows participation 50%.

- Stablecoin rails slash costs 90%.

- ESG tokens surge 35% with a sustainability focus.

- Oracle’s accuracy hits 99.9% uptime.

- Smart contracts automate 95% settlements.

Frequently Asked Questions (FAQs)

Forecasts estimate tokenized assets could reach $13.55 trillion by 2030 at a ~45 % CAGR.

RWA dashboards showed a total distributed on‑chain value of $19.59 billion, indicating tokenized commodities’ broader inclusion in RWA ecosystems.

Commodities ranked among the top 10 tokenized RWA categories alongside real estate and U.S. Treasury bonds.

Conclusion

The tokenized commodities market is gaining traction as an integral part of broader real‑world asset tokenization trends. Institutional involvement and regulatory frameworks are strengthening market foundations, while retail access and DeFi integrations broaden participation and use cases. Commodity tokens increasingly track spot prices and deliver fractional ownership with transparent custody models underpinned by audits.

However, challenges such as liquidity depth, regulatory variation, and technological risks remain. As tokenization matures, it promises to reshape how commodities are traded, held, and financed, unlocking more inclusive and efficient markets for a global investor base.