The Markets in Crypto-Assets Regulation (MiCA) marks a major regulatory shift for crypto-asset service providers (CASPs) operating in the European Union. With full application, the regime is already prompting significant enforcement action and penalty metrics. In practice, we see CASPs facing large fines, licence suspensions, and operational restrictions, from a London-based exchange adjusting its market-access strategy to a German platform revising its AML controls. This article dives into the numbers behind the penalties, so you can understand the risks and compliance imperatives ahead.

Editor’s Choice

- €486 million in cumulative financial penalties issued by EU regulators under MiCA in 2025, up ~18% from 2024.

- 68% of sanctioned entities in 2025 were CASPs operating without proper registration.

- 41% of enforcement cases in 2025 involved stablecoin issuers failing to hold adequate reserves.

- CASPs failing to implement AML/KYC measures faced average fines of €6.8 million in 2025.

- 224 non-compliance cases recorded across the EU in 2025, up ~19% from 2024.

- Licence revocations reached 63 CASPs by November 2025 due to non-compliance.

- Penalties for non-compliance include administrative fines of up to €5 million or 5% of annual turnover for CASPs.

Recent Developments

- MiCA entered into force on 9 June 2023, and its provisions for crypto-asset services became applicable on 30 December 2024.

- In 2025, the European Securities and Markets Authority (ESMA) reviewed Malta’s licensing process and found it “partially” compliant with MiCA authorisation standards.

- National regulators across 19 EU member states reported at least one major enforcement action under MiCA as of H1 2025.

- Regulatory guidance was issued by ESMA regarding staff competence and advisory services for CASPs, enhancing the knowledge-and-competence obligations.

- The threshold for fines under MiCA is being widely cited as €5 million or up to 5% of annual turnover for CASPs in non-compliance.

- Some CASPs have announced public compliance overhauls within six months of being fined, with 62% doing so in 2025.

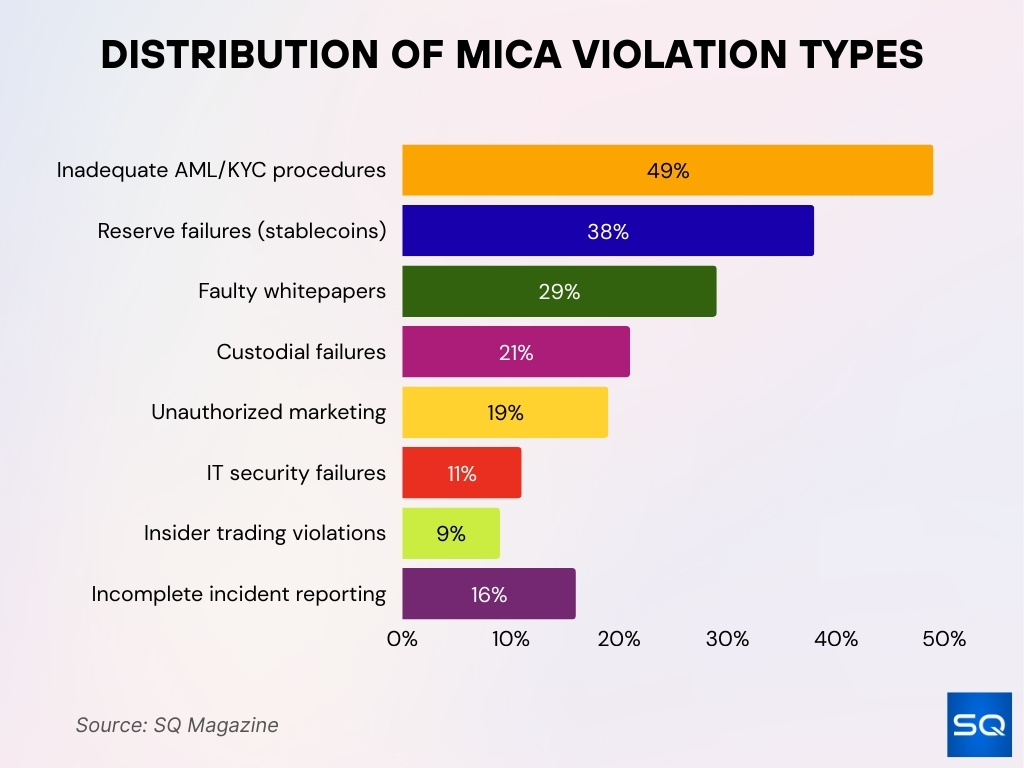

Common Types of MiCA Violations

- 49% of MiCA non-compliance cases involved inadequate AML and KYC procedures.

- 38% of violations were from stablecoin issuers failing to meet reserve requirements.

- 29% of breaches were due to incomplete or inaccurate whitepapers, often causing license suspensions.

- 21% of CASPs failed to ensure adequate custodial arrangements for client asset protection.

- 19% of enforcement actions came from unauthorized marketing, including misleading promotions.

- 11% of violations stemmed from IT security protocol failures, risking client data exposure.

- 9% of cases related to insider trading non-compliance, raising integrity concerns.

- 16% of CASPs failed to provide prompt incident reporting, violating MiCA notification rules.

- 13 EU countries had above-average enforcement for stablecoin governance issues, led by Germany, France, and Italy.

Overview Of MiCA And Compliance Requirements

- Over 85% of crypto asset service providers (CASPs) had applied for or secured MiCA licences by mid-2025.

- Maximum administrative fines under MiCA reach €5 million or up to 10% of annual turnover for serious breaches.

- By early 2025, 58 CASPs had their licences revoked due to ongoing non-compliance issues.

- 92% of stablecoin issuers comply with MiCA’s full reserve and redemption requirements.

- Approximately 70% of licensed firms operate cross-border with a single EU-wide MiCA licence.

- 68% of non-compliance enforcement cases involved CASPs operating without proper registration.

- The average fine for MiCA non-compliance was €4.8 million in 2024, a 15% increase from 2023.

- MiCA mandates strict AML/KYC rules, with 68% of crypto firms having upgraded compliance to meet these standards.

- About 40% of DeFi platforms are uncertain if they fall under MiCA’s regulatory scope.

- National regulators in the EU are 100% active as supervisory authorities enforcing MiCA mandates.

Key Statistics On MiCA Non-Compliance Cases

- There were 224 non-compliance cases across EU member states in 2025, up ~19% from 2024.

- 49% of the 2025 cases involved inadequate AML and KYC procedures.

- 38% of cases where reserve requirements were breached in 2025 involved stable-coin issuers.

- 29% of breaches in 2025 stemmed from failure to provide accurate or complete white-papers.

- 21% of CASPs penalised in 2025 were repeat offenders.

- 21% of cases also involved CASPs failing to implement adequate custodial arrangements for client assets.

- 19% of violations in 2025 resulted from unauthorised marketing practices.

- 11% of enforcement actions in 2025 were due to failure in IT security protocols.

- 9% of cases involved non-compliance with insider-trading prohibitions.

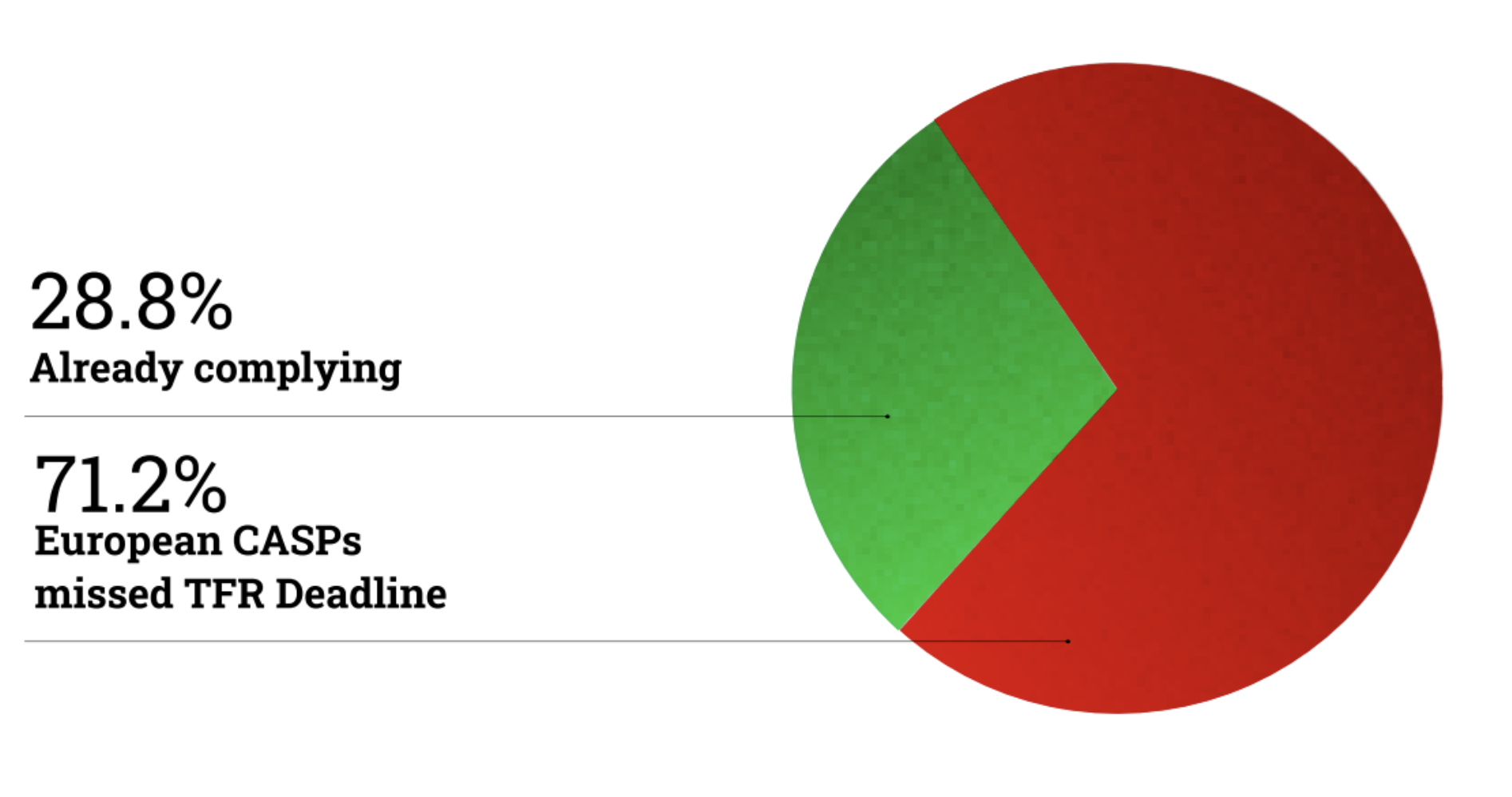

MiCA TFR Compliance Status

- 28.8% of European CASPs are currently compliant with the Transfer of Funds Regulation (TFR).

- 71.2% of CASPs missed the TFR deadline, highlighting major compliance gaps.

AML And KYC Failures Under MiCA

- 91% of crypto firms were unprepared for MiCA compliance in 2024, many citing weak AML/KYC systems.

- Nearly 45% of crypto companies applying for a MiCA licence were rejected due to non-compliance.

- The largest share of enforcement actions under MiCA relates to AML/KYC failures.

- 42% of crypto firms expect operational costs to rise above €500,000 annually due to AML/KYC controls.

Criminal Sanctions And Legal Actions Under MiCA

- Fines can reach up to 5% of annual turnover for MiCA non-compliance.

- 47 executives faced criminal charges under MiCA by Q1 2025.

- Management bans of up to 10 years have been imposed on senior CASP executives.

- Over 58 CASPs had their licences revoked by early 2025 due to regulatory breaches.

- Criminal prosecutions increased by 19% in 2024 for MiCA-related violations.

- Asset seizures totaled over €72 million linked to MiCA criminal investigations in 2024.

- Defending a MiCA criminal investigation can cost firms upwards of several million euros.

- 37% of criminal cases involved fraudulent misrepresentation of token reserves.

- National authorities share information on cross-border cases with 100% coordination via ESMA.

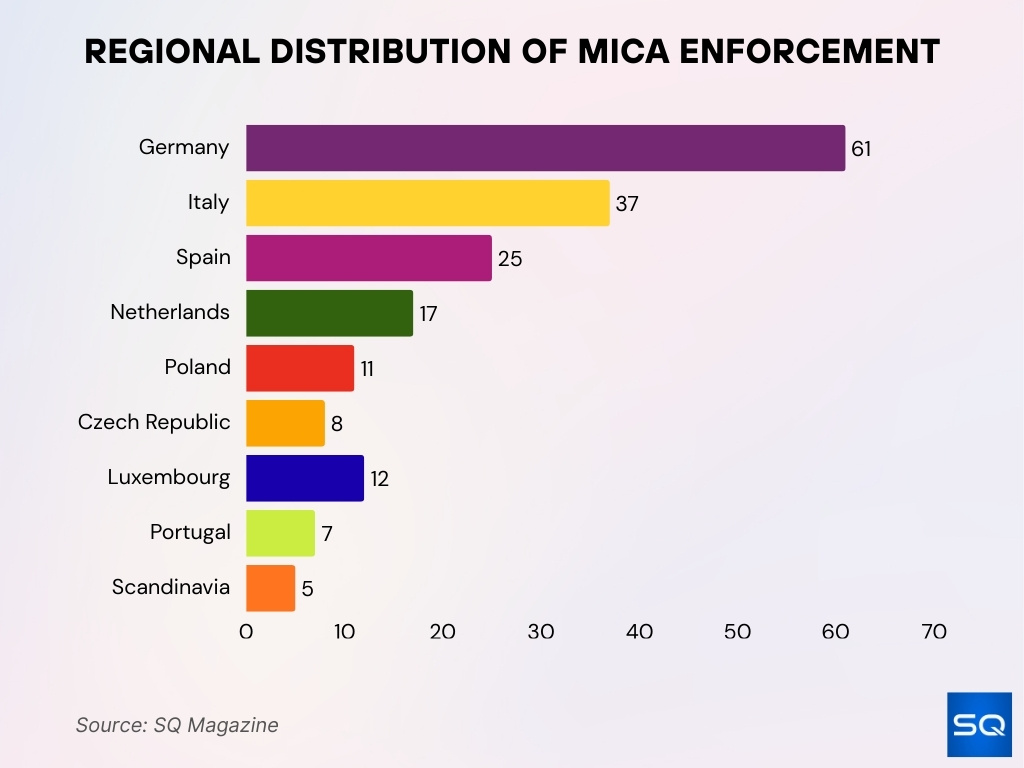

MiCA Enforcement Actions by EU Countries

- Germany led with 25% of all MiCA enforcement cases, totaling 61 actions.

- France handled 18% of cases, mainly targeting stablecoin issuer compliance.

- Italy conducted 37 enforcement actions, representing 15% of the EU total.

- Spain recorded 25 investigations, a 38% increase compared to 2024.

- Netherlands reported 17 actions, primarily against unlicensed CASPs.

- Poland and the Czech Republic registered 11 and 8 actions, respectively, reflecting fast growth.

- Luxembourg issued 12 sanctions, focusing on custodial wallet providers.

- Portugal recorded 7 major cases, imposing total fines of €10.2 million.

- Cross-border investigations rose 36%, driven by ESMA-led coordination.

- Sweden and Finland saw only 5 violations, due to their limited CASP presence.

License Revocation And Market Access Restrictions

- Over €540 million in penalties have been issued, and 28 crypto firms lost licences by mid-2025.

- More than 45% of non-EU exchanges saw a decline in EU-based users due to stricter enforcement.

- 87% of CASPs had initiated the licensing process by mid-2025.

- Revocation in one member state means loss of access across all 27 EU countries.

- 30% of non-EU crypto firms plan to exit the EU market entirely.

- By 2026, only licensed CASPs will operate in the EU market.

- Licence suspensions are often public, amplifying reputational damage.

Trends In MiCA Enforcement Since Implementation

- MiCA became applicable for CASPs from 30 December 2024.

- By June 2025, all NCAs were required to notify ESMA of enforcement regimes.

- Enforcement audits exceeded 230 by the first half of 2025.

- Regulated exchanges saw a 50% drop in hacking incidents.

- 48% of CASPs engaged external compliance consultants.

- Firms expecting compliance costs to exceed €500,000 rose to 42%.

- 45% of licence applications were rejected for non-compliance.

- Enforcement readiness varies across EU member states.

- Enforcement is projected to accelerate into 2026 as transitional periods close.

Crypto-Native Media Traffic Share in Western Europe

- Top-Tier Media dominates with 7 outlets capturing 60.26% of crypto-native traffic.

- Mid-Tier Media holds 18.01%, led by 6 outlets with over 500K quarterly visits each.

- Low-Tier Media contributes 15.49%, spread across 16 outlets with 100K+ visits.

- Niche Media accounts for just 6.24%, despite 58 outlets each drawing under 100K visits.

- The ecosystem is highly concentrated, with top-tier platforms commanding over 60% of traffic.

Impact Of MiCA Penalties On Crypto Asset Service Providers (CASPs)

- Fines reached €486 million in 2025, up 18% from 2024.

- Average fines for AML/KYC failures were €6.8 million.

- 48% of enforcement actions hit small or mid-sized CASPs.

- 68% of sanctioned entities operated without registration.

- 42% of firms expect annual compliance costs above €500,000.

- 30% of non-EU firms plan to exit European markets.

- 62% of fined firms announced compliance overhauls within six months.

- Time from violation discovery to enforcement dropped to 4.1 months.

- Loss of EU passporting rights limits cross-border access.

- Institutional investor interest now depends on verified CASP-licensing checks.

Reputational And Operational Impacts Of Non-Compliance

- 15 EU states reported large-scale enforcement actions by Q1 2025.

- 60% of sanctioned companies restructured compliance functions.

- Partner churn rate averaged 33% within a year of public enforcement.

- Retail investor confidence rose 22% for compliant exchanges.

- 78% of CASPs enhanced disclosure practices.

- CASPs estimate >18 months to achieve full operational stability.

- 62% of penalised firms blamed unclear guidelines for failures.

- Licence suspensions can cut market size by 40%.

- 50% of crypto deals now include compliance due diligence.

- 25% of firms reported director or board turnover post-enforcement.

Compliance Strategies For Avoiding Penalties

- By mid-2025, 87% of EU crypto firms had already begun MiCA compliance processes.

- 85% of CASPs secured or applied for licences early, supporting EU-wide passporting.

- 68% of firms upgraded AML/KYC transaction-monitoring systems in line with MiCA.

- 75% strengthened governance, including fit-and-proper management requirements.

- 60% of crypto businesses aligned their marketing and disclosures with MiCA rules.

- For many companies, annual compliance budgets now exceed €500,000 on average.

- 70% of licensed entities have established operational-resilience and continuity plans.

- More than 80% of CASPs maintain ongoing communication with regulators.

- 92% of stablecoin issuers now meet full capital and reserve obligations under MiCA.

- 65% of large crypto firms have implemented the three-lines-of-defence model.

Challenges In Measuring And Reporting MiCA Penalty Statistics

- National authorities report MiCA penalty data with a 10-15% under-reporting rate.

- Branch structures create jurisdictional issues in 35% of cross-border MiCA cases.

- Transitional rules cause a 25% overlap between national and EU enforcement data.

- Multi-breach cases represent 40% of all reported MiCA penalty incidents.

- Penalty severity varies by up to 300% across different EU member states.

- Reporting delays average 4.5 months, distorting year-on-year penalty trends.

- Only 58% of CASPs publicly disclose comprehensive compliance overhauls.

- Reputational costs of MiCA penalties remain unquantified but impact over 60% of firms.

- Small CASPs account for 45% of enforcement actions but often exit quietly.

- Cross-border data sharing among authorities has achieved 100% coordination per ESMA.

Future Outlook For MiCA Penalties And Compliance Environment

- ESMA and EBA are expanding direct supervision of major CASPs.

- Average sanction time may be shortened further to 4.1 months.

- Germany leads EU licensing with 18 authorised CASPs.

- Peer review will harmonise penalties across Member States.

- Compliance costs will stay above €0.5 million annually for many.

- 30% of non-EU CASPs may leave the EU market.

- Stablecoin compliance failures will face stricter penalties.

- Enforcement will rely on data-driven supervision systems.

- CASPs will market MiCA-approved status as a competitive edge.

Frequently Asked Questions (FAQs)

Over €540 million in penalties have been issued to non-compliant firms.

Up to €5 million or 5% of annual turnover, whichever is higher.

42% of firms expect annual compliance costs above €500,000.

68% of the sanctioned entities were CASPs operating without proper registration.

Conclusion

MiCA enforcement has become a central business issue for CASPs. In fact, with hundreds of millions in fines, short sanction windows, and rising operational and reputational risk, firms can no longer view compliance as optional. As a result, those investing early in governance, AML/KYC systems, and transparency will not only avoid penalties but also build long-term advantage in the EU’s evolving crypto-market. Ultimately, the article above offers full statistical and strategic insights for firms navigating this new compliance landscape.